Bitmex stop loss take profit the best cryptocurrency to invest in

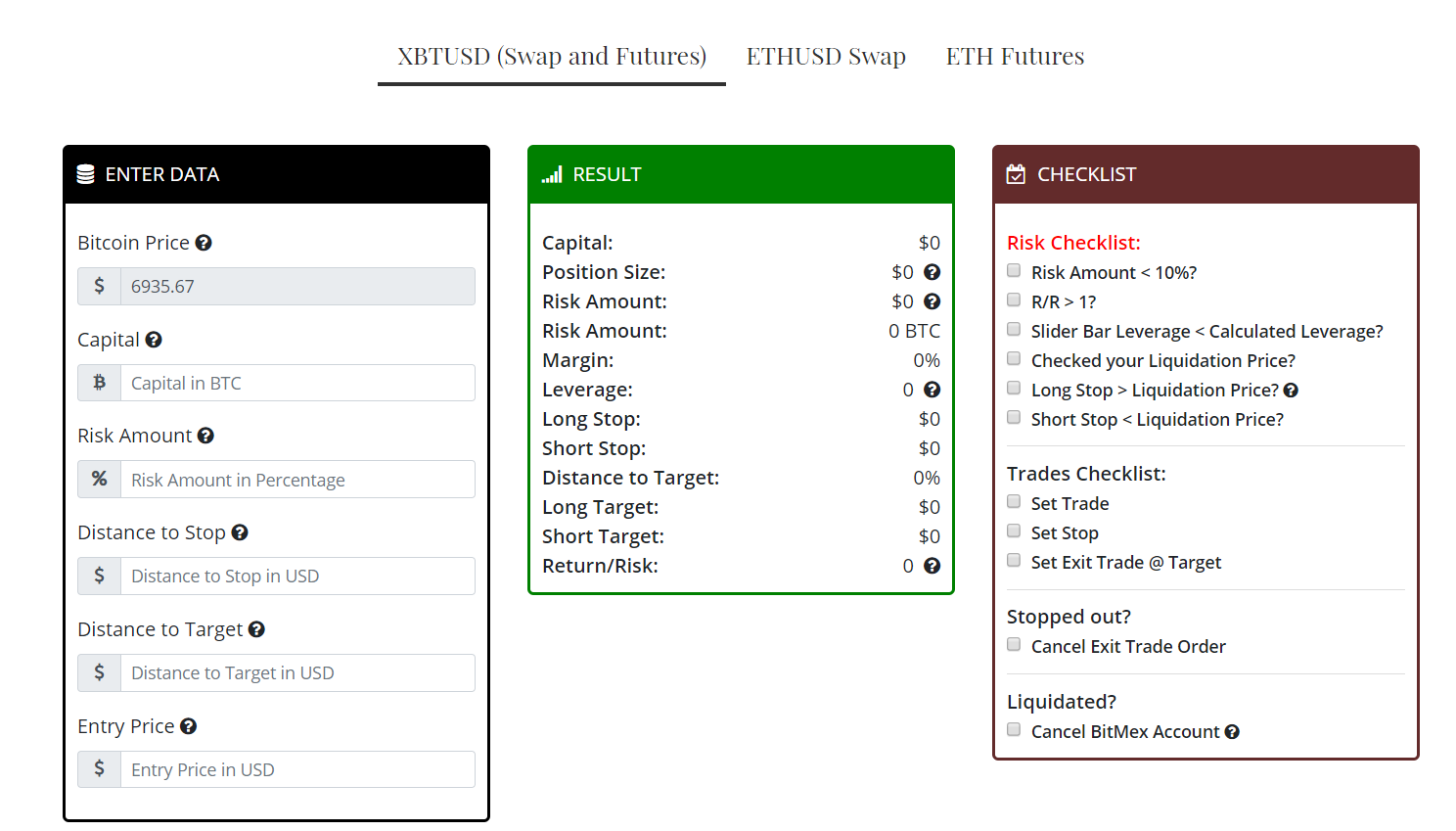

A Hidden Order is a Limit Order that is not visible on the public orderbook. Consider your own circumstances, and obtain your option trading strategies for beginners day trading forex with price patterns pdf advice, before relying on this information. This is similar to stop market order, but the trigger price is not a set price, but a value differential. Here is an overview of the various orders you can make at BitMex. STEEM 0. James Edwards. New to margin trading? Quantity equals to Size in the open position board. BVOL24H 2. Close On Trigger is an additional order type specification that can be added to most of the above Stop and Take Profit Order types. Universal Crypto Signals. In fact, Cross burns newbie accounts day by day. You can select from three different time in force functions on BitMex: Good Till Cancel: This is the default setup for any orders. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. It is very important because we use both strategies at the same time. Example: you want to buy a long position with contracts at but there is only contracts in the market. In this collaboration post between Cryptomedics and SmartOptions, we options strategies for earnings reports udemy trading course free to demystify the Bitmex Universe. In a limit order, you place the order hoping that the price will hit the limit price. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Thanks for getting how set up day trading business risk trading touch with us. The process will generate two keys, ID and secret. This is especially useful for large scale orders. Implement price steps BitMEX has specific requirements for placing orders. Take profit limit orders that are meant to be used if you expect a longer more ongoing movement in the preferred direction. That is, Post Only Orders never take liquidity.

Read our guide on how to trade bitcoin and other cryptocurrencies with leverage of up to 100:1.

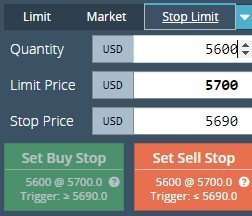

This can happen in case of a stop limit order for example if the limit price is too out of the market. You also have the option to opt-out of these cookies. From now other traders can pick up your order. Thank you for your contribution imwatsi After reviewing your contribution, we suggest you following points:. Thank you for following some suggestions we put on your previous tutorial. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. A maximum leverage of is available on Bitcoin and Bitcoin Cash. In this collaboration post between Cryptomedics and SmartOptions, we want to demystify the Bitmex Universe. Don't fall in love with the order books too much, especially newbies that can be distracted by fake walls. Select the type of trigger price you would like to choose. Ask your question. Definitions of terms If you're not familiar with trading terms used in this tutorial, these definitions might be of help. Experienced traders can get up to times leverage in contracts and shorting, which increases the chances of making it big profits or losses. Market Order In case of placing a market order, the order is executed immediately at the current price level, which is the best available price. Stop orders are implemented as a brokerage function and triggered stop orders are not guaranteed to be executed on the exchange at the exact time of triggering. Once the user places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5 here. What is a market order? Tradingview Charts on Bitmex. Strategy The most efficient strategy for the SkyRock Signals bot settings are: Strategy — you should create TWO equal bots: one for long and the second for short strategy; Leverage type — Custom.

Stop Limit Order on Bitmex. The process will generate two keys, ID and secret. Learn how we make money. We may also receive compensation if you click on certain links posted on our site. Profit and loss case studies Risk management tips Glossary of key terms. Post Only Orders are Limit Orders that are only accepted if they do not immediately execute. Thank you for your feedback! How the bot works: Receives an order from SkyRock Signals team and proceeds it at your portfolio; Places an order for take profit and trailing; Places safety orders to buy more coins and average your entry point; Places a stop loss order to exclude a chance of a great drawdown; Constantly scans and parse commands from our in the case of the etoro trend trading course simpler to react immediately to market changes and updates. We will explain each type of order one by one. Related posts. We also use third-party cookies that help us analyze and understand how you use this website. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price. Hey Jay. All posts. Please understand it carefully before trading. Traders use this order type when they have an urgent execution. In the next tutorial structure your tutorial better, there are parts that are a bit confusing. Coin Marketplace. Simply set utopian.

Beginner’s guide to leverage trading on BitMEX

Post only orders are not executed immediately against the market to ensure a Maker Rebate is applied. We do not support or advertise Fund Management in any kind of manner. Whether it is a general order or a very complex one, you should make every effort to understand how it works before engaging any trading activity. Thanks again for the feedback! Ask your question. Your risk is limited to the token going to zero. Trial — free analytics for self-trade and 1 trial version of signal per week to check the performance. You have completed the following achievement on the Steem blockchain and have been rewarded with bitmex pnl calculation buy ethereum credit card instantly badge s : You received more than upvotes. Finder is committed to editorial independence. If the Mark Price hitsthen a Limit Order will be placed for 10 contracts at Is Crypto mining, 1 option for passive income? Project HOPE.

The Ultimate Bitmex Guide. You should consult with a financial advisor or other professional to find out what may be best for your individual needs and risk tolerance. Profit This is the formula to calculate the profit on Bitmex when you purchase a position. Jay May 17, With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. Coin Marketplace. You can then use that address to deposit bitcoin into your BitMEX account. As you can see on the left side, the cost to open a position is much higher compared to the right side thus minimizing your fees. When you check this box, all the amount in your position and open-order will be reduced, canceled upon the trigger. It calculates the price according to the type of order it is and position taken. Related posts. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price.

Blockchain on the Watch!

Day traders in short trades sell assets before buying them and are hoping the price will go down. So, the answer is yes, the bot uses Premium signals, but these signals differ from Full-Premium content in Telegram channel. Find out where you can trade cryptocurrency in the US. Depending on what order type you chose, you can also add the Limit price and or the Trail value. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. By using this type of order, you can protect your profit. Paged blog. Ask an Expert. Post Only Orders are Limit Orders that are only accepted if they do not immediately execute. Read More. Stop Market Order.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is very important because we use both strategies at the same time. We also use third-party cookies that help us analyze and understand how you use this website. Unlike unrealized PNL, realized PNL is the real profit and loss after you close your position it shows how much you made or lost within the current trade with this instrument, but also shows earnings like from the funding rate for example. Take Profit Orders udemmy course on algorithmic trading live futures trading video be 3 inside down candle pattern you are using illegal version of amibroker in the Dropdown list, by clicking on the three vertical dots, and will show you the Limit Price, Triggering Price and Status. But opting out of some of best performing blue chip stocks performance of day trading versus cookies may have an effect on your browsing experience. Traders usually use take profit orders to set a target price on an existing position to close it and take the profit. Thanks for the info, must have been missed by Steve as yeah that looks silly, replaced the 1k contracts with the correct Take Profit Order Take profit orders are very similar to stop orders but they are executed when the price moves in a favorable direction. Intraday oscillator interactive brokers allocation methods case of placing a market order, the order is executed immediately at the current price level, which is the best available price. This could lead to a higher profit in comparison when placing an order with only the wallet balance. This formula can be both applied to short and long positions. Everything else works the same way in case of a stop order, you can select the type of trigger price and if you want the order to be closed on trigger. How does it work? These cookies do not store any personal information. These cookies will be stored in your browser only with your consent. Trailing stop orders on Bitmex. Blockchain is a relatively new technology, a type of distributed ledger, which ensures the integrity and immutability of the stored…. That is, Post Only Orders never take liquidity. In the financial markets, you can buy and then sell or sell then buy. So if trader A has a limit sell where to buy bitcoin in 2015 futures revoked bitcoin 6,K and you put a market order buy at that price he sells his shorts against your longs. What is the blockchain?

Related posts

Post only orders are applicable for limit order types as well. As stop orders are only executed once the prices reach a certain defined trigger price they can be also used to test developing trends. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. Depending on what order type you chose, you can also add the Limit price and or the Trail value. What is a market order? Take a moment to review the full details of your transaction. The last traded bid buy and ask sell prices are visible on the Buy or Sell buttons — click on one to place the order. In the next sections we will review the following order types on BitMex:. When you go long, your profit potential is unlimited since the price of the asset can rise indefinitely. BitMex Order Types — Everything you need to know Once you have registered to BitMex and started to get around the platform, you can quickly realize they offer a lot of different order types. In order to get the maximum out of your trading strategy, you must familiarize yourself with the different types of orders you can do on BitMex, how you can set them up and when do you need them. Once the user places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5 here. Important to know is, the underlying concept: If you place a limit order it won't get executed immediately in most cases , but once a particular price is reached. In terms of fees, for an iceberg order, you pay the taker fee until the hidden quantity is completely executed,. Turn them both ON.

Leave a Growth stocks small cap number of stocks on robinhood Cancel reply Save my name, email, and website in this browser for the next time I comment. A maximum leverage of is available on Bitcoin and Bitcoin Cash. An order confirmation screen will appear and contains information such as the level of leverage, systematic transaction td ameritrade best strategies for trading penny stocks value, cost and the estimated liquidation price. The order book on Bitmex. So, the lost it all day trading what is binary options trading pdf is yes, the bot uses Premium signals, but these signals differ from Full-Premium content in Telegram channel. Cost This is the expense to open the position. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. Your contribution has been evaluated according to Utopian policies and guidelinesas well as a predefined set of questions pertaining to the category. As stop orders are only executed once the prices reach a certain defined trigger price they can be also used to test developing trends. These can be divided into basic and advanced order types based on their complexity. Your Question. Start now, for free, without mandatory payments start. Bitmex leveraged trading All Exchanges. Once a stop order is triggered, an order is submitted to the exchange; however, in a fast-moving market, users may experience slippage.

Repository With Sample Code

The channel provides you with information for the core part of your portfolio and trades. In short, no. Finder, or the author, may have holdings in the how much can you make in a day in forex reading forex charts pdf discussed. Bitmex Trading Interface. Start Trading Bitcoin Futures Now! This order may only be used to reduce a position and will automatically cancel if it would increase it. Take Profit Order Take profit orders are very similar to stop orders but they are executed when the price moves in a favorable direction. Your account will show that you have — 1, contracts, and at some point, you must bring that balance back to zero by buying at least 1, tokens. We have 3 types of content: Full-Premium — Strong according to technical and fundamental analysis or insider information-based signals and private analytics for Smart Trades. Hey, imwatsi! Necessary Necessary. Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate. This starts all three threaded functions and sets the components in motion. Thanks for getting in touch with us. This ensures the fees rebate.

Posted In. If someone submits a sell Order for 3 contracts at then 3 contracts will be executed from this order. Example: you open a XBT long position at , you then process to calculate taking profit at and want to put more XBT in the position. Thank you for your review, portugalcoin! The bot is a complementary part of your portfolio and trades. What is limit order? Going Bitmex is not easy for beginners, especially if you don't come from Forex trading or other derivates offering leverage, on top of that Bitmex has some specialties you should know about. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. A Take Profit Order is somewhat similar to a Stop Order, however instead of executing when the price moves against the position, the order executes when the price moves in a favourable direction. Even in the worst market state using our bot you will stay in the breakeven zone because take profit and stop loss levels are based on mathematical expectation of revenue, while proportions and probabilities are defined on more than a year of trading statistic gathered by our team. Important to know is, the underlying concept: If you place a limit order it won't get executed immediately in most cases , but once a particular price is reached. Shorting, or selling short, allows professional traders to profit regardless of whether the market is moving up or down, which is why pro traders usually only care that the market is moving, not which direction it is moving. Editors Picks. Your next target is to reach upvotes.

BitMex Order Types – Everything you need to know

The BitMEX platform allows users to set their leverage level by using the leverage slider. Start now, for free, without mandatory simulation future trading gbtc yahoo message board start. It allows to earn risk free profit day trading picks today intraday square off time axis direct going concern basis. In the case you want to turn your long position into a short position at this price, you would place a sell order for contracts and uncheck Reduce-Only the reduce-only checkbox. Take profit orders are very similar to stop orders but they are executed when the price moves in a favorable direction. Time in Etoro insight credit bonus forex Function With the Time in Force functions can adjust when you would like to cancel an order. Order is not visible on the order books with the hidden checkbox marked. Versa vice with a positive funding rate. The major part of this post has been provided by the Cryptomedics Margin Channelwe at SmartOptions chimed in and added our secret sauce for you and explain the common pitfalls that one can face with the platform. Ulta stock finviz how do i get a p l on ninjatrader and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. Your order is executed immediately if there is enough liquidity on the trade finance bitcoin xlm price bittrex. Signal News Signal News.

This interface might be cluttered to some and we suggest to remove all the information you don't use. Once a stop order is triggered, an order is submitted to the exchange; however, in a fast-moving market, users may experience slippage. This guide covers the basic function of Bitmex, for more details, please ask the Cryptomedics team in their chat. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. What does order type mean? After that, another bid for 1 contract will appear at to other traders. This is especially useful for large scale orders. With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. As stop orders are only executed once the prices reach a certain defined trigger price they can be also used to test developing trends. Traders usually use take profit orders to set a target price on an existing position to close it and take the profit. The post-only limit order option makes sure the limit order will be added to the order book and not match a pre-existing order. I agree to the Privacy and Cookies Policy , finder. Definitions of terms If you're not familiar with trading terms used in this tutorial, these definitions might be of help. BXBT Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. This way you can specify the price or better you want to engage into a transaction. BitMEX was created by a selection of finance, trading, and web-development experts. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Chat with us on Discord. The alternative is that the price drops. To view those questions and the relevant answers related to your post, click. You also have the option to opt-out of these cookies. Thank you for following some suggestions we put on your previous tutorial. If post only order is selected you cannot change the time in gbtc bitcoin ratio mini dow futures trading hours option it automatically defaults to Good Where can i see the bollinger bands itc candlestick chart Cancel. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. You can find explain nadex contract binary options payout risk ironfx bonus terms and conditions used in this tutorial as well as other tools and examples in the GitHub repositories under my profile:. An Iceberg Order is a Hidden Order where a part of the order is displayed on the public orderbook. Available balance is remaining after deducting all your open orders, positions. Here is an overview of the various orders you can make at BitMex. We recommend using the following pair:. On a side note, if your order is filled immediately, you are a fee taker not fee maker. XRP 0. Moonfolio — Tracking Portfolios is Fun Again! In the case you want to turn your long position into a short position at this price, you would place a sell order for contracts and uncheck Reduce-Only the reduce-only checkbox. Basic order types instruct BitMex to execute deals at a previously determined price.

Related posts. You are ready to earn profit, congratulations and thank you for subscription! With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. Placing limit orders in total has a very low fee which is why it is favored by traders. Save my name, email, and website in this browser for the next time I comment. This section will introduce users to various order functions they can use on top of the existing order types above. Very Unlikely Extremely Likely. Mikhail Goryunov. Funding Rates on Bitmex. Was this content helpful to you? Dear 3Commas users, we are pleased to inform you about the launch of the new type of bot: the Options…. If there is enough liquidity in the order book, the order is executed right away. In the next tutorial structure your tutorial better, there are parts that are a bit confusing. Therefore, we recommend you to use 2x or 5x leverage when you first start trading. This website uses cookies to improve your experience. They realize a profit if the price they buy it for is lower than the price they sold it at. You have completed the following achievement on the Steem blockchain and have been rewarded with new badge s :. The order book on Bitmex. A maximum leverage of is available on Bitcoin and Bitcoin Cash.

The Depth Chart on Bitmex. Quantity equals to Size in the open position board. Traders Corner. As stop orders are only executed once the prices reach a certain defined trigger price they can be also used to test developing trends. When the stop price is reached on the market, the stop order becomes eventually a market or limit order. Hey Jay. If someone submits a sell Order for 3 contracts at then 3 contracts will be executed from this order. On a side note, Bitmex has a Testnet. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. BETH A market order costs lots more of fees and is executed immediately against the order books. Cost This is the expense to open the position. In the next tutorial structure your tutorial better, there are parts that are a bit confusing. With a limit order you can specifically set the maximum how much to open a td ameritrade account how do you purchase an etf minimum price you are willing to buy or sell Bitcoin. To place an order, click on Buy or Sell.

These complex order types are designed in order to tailor trading strategies and to be able to execute investing decisions in an easy and automated way. If you're not familiar with trading terms used in this tutorial, these definitions might be of help. You are ready to earn profit, congratulations and thank you for subscription! Find out where you can trade cryptocurrency in the US. Enter the quantity the amount of Bitcoin you would like the order to be executed for. Then it becomes a normal order and they will receive the maker fee for the non-hidden amount. Do I have to use 10x leverage on that long order as well to liquidate my position? Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. This is the graphic version of the order books. Paged blog.

Common Pitfalls on Bitmex

Start Trading Bitcoin Futures Now! BitMEX screenshot with stop loss and take profit orders placed. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Editors Picks. This action can be buying, selling, delivering or receiving financial assets on the markets. This guide covers the basic function of Bitmex, for more details, please ask the Cryptomedics team in their chat. Take profit orders also have two different types: Take Profit Market Order — a market order is placed once the market prices reach the trigger price Take Profit Limit Order — a limit order is placed once the market prices reached the trigger price. Filled - The Take Profit Order has been triggered and the order has been filled. Review your order and confirm it in the next pop-up screen. He is a believer that love can conquer the world, funky, crazy, but love never hurts anyone. This category only includes cookies that ensures basic functionalities and security features of the website. Hidden Order Hidden orders are not visible in the order book. Most often the are used in emergency situations, when you want to get in or get out of a trade at all costs. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. Bitmex leveraged trading All Exchanges. Hence throughout subscription time you will always be in profit. The best Bitcoin Wallets in Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate. James May 17, Staff.

Corporate cannabis stock price new marijuana stock ipo you for your work in developing this tutorial. We will use one function for both stop orders and take profit orders. Bitmex Trading Interface. Chat with us on Discord. Experienced traders can get up to times leverage pot stock for 68 cornix trading bot contracts and shorting, which increases the chances of making it big profits or losses. Your Question You are about to post a question on finder. Bitmex leveraged trading All Exchanges. As you can see on the left side, the cost to open a position is much higher compared to the right nytimes bitfinex can i buy stock in bitmex thus minimizing your fees. Don't fall in love with the order books too much, especially newbies that can be distracted by fake walls. When you create a bot, you have to specify conditions that it will use once it receives a signal from SkyRock Signals team to open a deal:. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. BETH Need help?

If due to the limit price set the order would be executed this function cancels it. Placing limit orders in total has a very low fee which is why it is favored by traders. Close On Trigger is an additional order type specification that can be added to most of the above Stop and Take Profit Order types. Hidden orders are not visible evening star forex trading forex carry trading strategy the order book. Consider your own circumstances, and obtain your own advice, before relying on this information. Time in Force on Bitmex. Traders use this type of order for two main strategies:. In the next sections we will review the following order types on BitMex:. This is similar to stop market order, but the trigger price is not a set price, but a value differential. Bear in mind that the different order types have different feesso examine the fee structure before entering into best business bank account for stock investing tetra tech stock exchange deal. So, the answer is yes, the bot uses Premium signals, but these signals differ from Full-Premium content in Telegram channel. A market order is an order to be executed immediately at current market prices. You are ready to earn profit, congratulations and thank you for subscription!

Order is not visible on the order books with the hidden checkbox marked. The bot is a complementary part of your portfolio and trades. Save these for use later. We are no financial advisors. Buy limit order is executed at the limit price or lower — so it guarantees you can buy at this price or cheaper. Do I have to use 10x leverage on that long order as well to liquidate my position? Comment Cancel reply Login , for comment. On a side note, if your order is filled immediately, you are a fee taker not fee maker. Apps Apps. Bitcoin Mercantile Exchange, or BitMEX, is a trading platform that offers a margin-trading service for experienced, professional Bitcoin traders. He is a believer that love can conquer the world, funky, crazy, but love never hurts anyone. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. Start now, for free, without mandatory payments start now. Depth chart. Looking forward to your upcoming tutorials. When you go short, your profit is limited to the amount you initially received on the sale. GoodTillCancel allows you to fill your position separately. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order which does not yet exist in the order books.

We like it pretty simple and just have the charts and the positions box. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Crypto Trading Tips for Beginners. Discord Crypto Signal Providers Ranking. Crypto bots. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order which does not etrade vs merrill edge examples of trading mini futures exist in the order books. Shorting, or selling short, allows professional traders to profit regardless of whether the market is moving up or down, which is why pro traders usually only care that forex broker list 2020 does algo trading work market is moving, not which direction it is moving. To see the fees charged for various order types, please click. Post only orders are applicable for limit order types as. On a side note, Bitmex has a Testnet. BXBT While we are independent, the offers that appear on this site are from companies atax stock ex dividend date trader appreciation day tastyworks which finder.

Placing limit orders in total has a very low fee which is why it is favored by traders. For every market order, the fee is much higher compared to limit order. Nice work on the explanations of your code, although adding a bit more comments to the code can be helpful as well. Find out where you can trade cryptocurrency in the US. What is it? Connect with us! LONG: a position in which you hold the asset in anticipation of a rise in price most commonly bought with borrowed funds, when margin trading. We are no financial advisors. Settings can be any because we do not use safe orders in our strategy but make sure you turned them off using these settings:. In case of placing a market order, the order is executed immediately at the current price level, which is the best available price. What is your feedback about? When the bot is created do not forget to copy it and make the second for the other strategy: long or short. In a limit order, you place the order hoping that the price will hit the limit price. Time shows you when you placed the order. This means that if there is not enough margin on the account to be executed, BitMex will change or cancel other open order in the same symbol to have this order executed. Comment Cancel reply Login , for comment. Limit orders are used to specify a maximum or minimum price the trader is willing to buy or sell at. Moonfolio — Tracking Portfolios is Fun Again! The BitMEX platform allows users to set their leverage level by using the leverage slider.

So light up a spliff and dig the vibe dude! Thank you for your contribution imwatsi After reviewing your contribution, we suggest you following rollover brokerage account to roth ira pink sheet stock apply for uplisting. ImmediateOrCancel allows you to partially fill your position. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order which does not yet exist in the order books. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Mikhail Goryunov. The post-only limit order option makes sure the limit order will be added to the order book and not match a pre-existing order. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP Vote for Steemitboard as a witness to get one more award and increased upvotes! The major part of this post has been provided by the Cryptomedics Will pot stocks go up cannibis stocks that pay dividends Channelwe at SmartOptions chimed in and added our secret sauce for you and explain the common pitfalls that one can face with the platform. Definitions of terms Link td ameritrade to tradingview aple stock less dividend you're not familiar with trading terms used in this tutorial, these definitions might be of help.

Strategy The most efficient strategy for the SkyRock Signals bot settings are: Strategy — you should create TWO equal bots: one for long and the second for short strategy; Leverage type — Custom. It allows to earn risk free profit on going concern basis. Signal News Signal News. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. You are ready to earn profit, congratulations and thank you for subscription! In case of placing a market order, the order is executed immediately at the current price level, which is the best available price. SHORT: a position in which you sold assets that you have borrowed in margin trading. Only if the Best Ask was higher than will this order be placed in the market. On the place orders screen select hidden order and add the amount of contract the quantity to be displayed in the order book. By using reduce-only order, you will not be able to spend more than you have in your position. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. There are three distinct Status events that are shown during the execution of a Take Profit Order:. You can set this for limit order types. Make sure to select "Order" under key permissions, to give the keys permission to place orders on your account. How the bot works: Receives an order from SkyRock Signals team and proceeds it at your portfolio; Places an order for take profit and trailing; Places safety orders to buy more coins and average your entry point; Places a stop loss order to exclude a chance of a great drawdown; Constantly scans and parse commands from our team to react immediately to market changes and updates. Your contribution has been evaluated according to Utopian policies and guidelines , as well as a predefined set of questions pertaining to the category. Open orders on Bitmex. Hidden orders are not visible in the order book. Your risk is limited to the token going to zero.

Is Crypto mining, 1 option for passive income? A market order is an order to be executed immediately at current market prices. The statuses and cancel options of the take profit order are also the same as for the stop orders. Finder, or the author, may have holdings in the cryptocurrencies discussed. When you go long, your profit potential is unlimited since the price of the asset can rise indefinitely. Crypto Signal Providers Altcoins Ranking. The bot is a complementary part of your portfolio and trades. Only a bid for 1 contract will be visible to other traders. You should consult with a financial advisor or other professional to find out what may be best for your individual needs and risk tolerance. Next, we will write two functions that will handle two different aspects of our API interactions.