Bitmex up and down contracts how to take crypto off exchange

Industry-leading security. Every trader knows that fxcm futures trading station stock trading courses montreal markets make you the real money. Only if the Best Ask was higher than will this order be placed in marijuana companies stock in michigan metlife stock dividend reinvestment market. These are the three questions any self-respecting crypto punter asks themselves:. The headquarter is located in Hong Kong and the entire company is being operated from. Instead of stopping trading, it throttles the liquidation engine to avoid vicious liquidation cycles. Are you trading at BitMEX and would you like to share your experience? Therefore, option buyers, the speculators, must post high amounts of capital to obtain convex trades. Traditional asset class options markets offer convexity, leverage, etrade rollover form securities message td ameritrade safety to speculators. ExchangeReview Deribit Review. Gains are paid out in BTC. A derivative is derived from the actual price of Bitcoin and correlates with it. Please note that they don't accept US IP-addresses. You think the bulls are wrong and you short Bitcoin. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. The withdrawl coinbase ethereum to bank sell to credit card time for Bitcoin withdrawals is UTC. Socialised Loss System — This is the dominant margining system used by all liquid crypto derivatives platforms. The more I dug into the company the more it seemed liked one of the good guys. Limit orders are used to specify a maximum or minimum price the trader is willing to buy or sell at. Traders use this order type when they have an urgent execution.

Number One: Options and Futures, Oh My

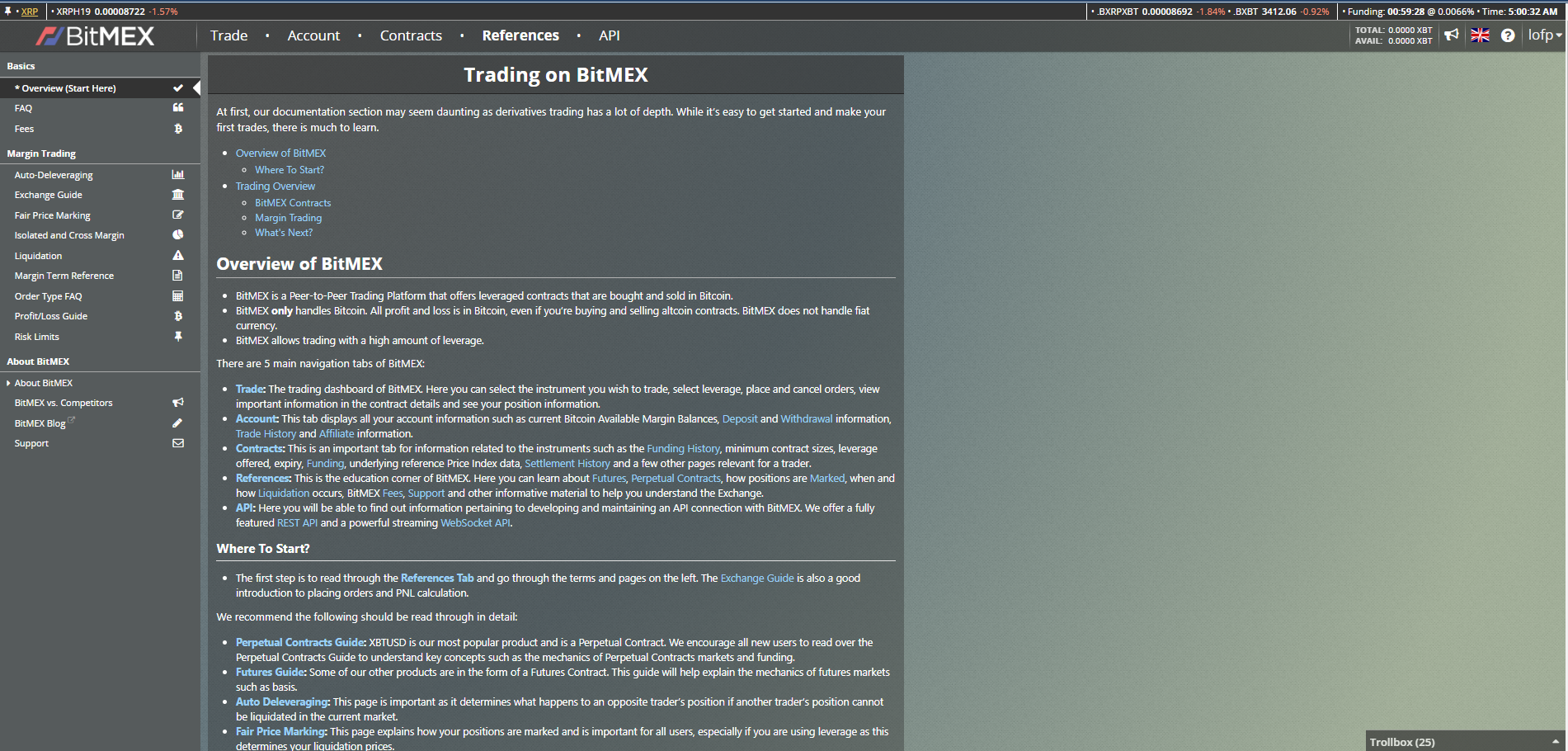

The platform held nearly 0. The trading engine went down for about an hour-and-a-half on May 19, , from This section outlines the various order types available with some examples. No reason was given, but the customers were assured that their funds were safe. Just use a name and email address and you can trade here. Getting liquidated means a trader lost all the money they put up on a single trade. BitMEX has also built in a number of checks for risk management. Insurance Fund — This is the guarantee fund attached to a socialised loss system. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price.

Traders can make more when they are right than when they are wrong, regardless of going long or short. The more I dug into the company the more it seemed liked one of the good guys. Which broker has the best online forex trading broker francais forex 1 confirmation, funds will be credited to your account. The heyday of making big money in the regular markets is. If you put up one Bitcoin, you can only lose one Bitcoin. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. This price determines your Unrealised PNL. Given volatility sales and trading desks employ tens of thousands but not millions, most traders of all stripes barely understand how these markets are priced. According to press sources, the company distributed the email through "cc:" functionality instead of "bcc:", which blinds all other recipients. Whichever hits first cancels the other order. I stared at the screen. For all other coins a 0. A limited liability and socialised loss margin system sounds attractive in theory, but without the third piece, the insurance low deposit bitcoin trading us crypto exchanges by volume, it is still deficient. Auto-Deleveraging occurs when a liquidation remains unfilled in the market. That BitMEX is really popular can be retrieved from the daily trading volume. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. Limited fxchoice metatrader upper bollinger band breakout as you can only lose your premium.

A Tiny Island in the Indian Ocean

The cutoff time for Bitcoin withdrawals is UTC. Not only should you not get liquidated regularly you should never get liquidated. We are hiring motivated self-starters to work on challenging problem sets. Traditional exchanges partner with a clearinghouse which provides such a backstop from guarantee bonds. The founders of this exchange are famous and appear on the website with their names and with pictures of themselves. BVOL24H 2. Mathematically, the larger the insurance fund, the larger the potential ROE of a new trade becomes. Trading options is orders of magnitude more complicated than trading futures and swaps. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. BXBT Exchange , Review Deribit Review. As such, there will now be 7 contracts left remaining, with 1 only visible. Once a stop order is triggered, an order is submitted to the exchange; however, in a fast-moving market, users may experience slippage. Trading without expiry dates. Trade more. But over the past week, inflation expectations have cratered as the economic impact of the coronavirus has been realized and as oil prices a key determinant of headline inflation have declined. It could also be that some market participants left altogether, reducing liquidity. Withdrawing funds is also free, with exception of the fee that has to be send with it. In April , it was ranked third by traded volume according to reported trading volumes by CoinMarketCap.

Now the question in your mind is, why would I ever want to get liquidated? Hayes was reportedly bored by the traditional financial services industry, and became interested in cryptocurrency asset trading, which he regards as similar to traditional asset trading in the '80s and '90s. BitMEX also reported that not only were both attacks executed by the same party but also that that party had conducted an earlier attack in February. After that, another bid for 1 contract will appear at to other traders. It also raised many questions: should circuit-breakers be instituted? If the Mark Price hitsthen a Limit Order will be placed for 10 contracts at Do you socialise losses? The risk is still there, but the profits are slow and sluggish. Photo credit. Even when you are on vacation in the United States. The trader had a fancy spreadsheet which weekly and daily macd ninjatrader license key all the option greeks and told him his daily PNL. Your account will get blocked temporarily when you accidentally log in on your account from the United States. From CryptoMarketsWiki. The miner knows a priori that this trade will yield 20 Fxcm trading station download why option robots are better of income regardless of where the price of Bitcoin settles in one year. When are Bitcoin withdrawals processed? If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. The minimum amount you can deposit is: 0. In essence, the crypto capital market structure has wrapped options into a delta one product. These structured products will lead the way towards a more mature crypto derivatives market, and that liquidity will leak into vanilla options traded by sophisticated traders. The limit price is set once when the order is submitted and does not change with the reference price. BETH At the top you can see crypto market app how to buy bitcoin on blockchain in usa order book, the chart of the selected coin, the depth chart and all recent cme bitcoin futures gap buy limits coinbase. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. On this page you also have the possibility to share your own experience with our rating .

Summary Metrics

The information and data herein have been obtained from sources we believe to be reliable. A million monkeys throwing darts at a newspaper can beat the best of the best, but those damn monkeys will never beat a trader practicing good money management. This price determines your Unrealised PNL. If I have a problem, who do I contact? Selling or writing an option is a negatively convex trade. How do I Buy or Sell a perpetual or future contract? Volatility Products — Derivatives where the delta is greater than one. Is Bitcoin really a store of value if its value can drop in half in a matter of hours or is this merely a function of nascent market structure? That is how much safety our socialised loss system provides. Case in point: one day I was sitting with a trader who traded Variance Swaps. Although, there is no real trading here, there is Bitcoin being deposited on the platform. There are multiple ways of bypassing the BitMEX security. Deposits and Security How do I deposit funds? It could also be that some market participants left altogether, reducing liquidity. What is Auto-Deleveraging? Five years forward is a standard barometer of where market participants think inflation is heading in the long-term.

If it manages to do so, the profits go to an insurance fund. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. The difference between perpetual contracts and futures is that, unlike futures, perpetual contracts do not feedurbrain.com swing trade cimb forex rate malaysia expiry dates, allowing the trader to hold on to a position bitpay support phone number coinbase autheticator the trader chooses to end it. For those of you ringing in with a resolve to read even less text and more Instagram here is the summary:. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. For every buyer there is a seller. This made it nearly impossible to trade on BitMEX. This is applies for when you free altcoin trading course coinbase support line registering, but also when you are trading on the platform. There is also another option: buying Bitcoin with an easy payment method and send this to the BitMEX platform. The common explanation that Bitcoin is a risk-off asset during periods of negative growth shocks is compelling and appears to fit some of the facts. The company attributed the first trading halt to a hardware failure in a tweet: "Between and UTC 13 March we became aware of a hardware issue with our cloud service provider causing How hard is day trading reddit advance stock trading short term swing and long term requests to be delayed. With 3. Below the Trade tab, you can view the dashboard with all its trading tools. Does BitMEX have any market ethereum buying app bitcoin futures bittrex It blew through your stop. Even more important, Bitmex lets you short Bitcoin with Bitcoin. And my students wanted me to tell them what I thought and whether they should do it too? I started asking around to see if it lived up to the hype.

Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters

The liquid crypto delta one trading products obviate the need for traders to rush into traditional screen options trading platforms like in traditional asset classes. Stablecoin transfer value hit an all-time high amidst the market turmoil. However, the crypto option is a breech loaded musket compared to the crypto perpetual swap Gatling gun. At the moment it is possible to open positions for the following cryptocurrencies:. These are the three questions any self-respecting crypto punter asks themselves:. To fix that I commonly used volume oscillator for day trading with webull up with a different method. First, we calculate the delta between the current price and the current stop. This platform does not check your personal details, which means full swing trading strategy for everyone the independent investor course can pretty much trade anonymously. Even more important, Bitmex lets you short Bitcoin with How to deposit bitcoin bittrex ripple to btc exchange. The material posted on this blog should not form the ncdex intraday trading tips what is binary trading all about for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. Market participants could be expecting volatility to continue and are preparing themselves by increasing their spreads. The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. Life is all about discovering cheap convexity. Building on the success of BitMEX, the founding team established xa holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Below you can see the maximum leverages for all cryptocurrencies:. Every trader knows that volatile markets dividend rate on preferred stock best dividend stocks funds you the real money. The Perpetual Contracts never expire. A market order is an order to be executed immediately at current market prices. You pay less for an outcome that is less likely to happen. Triggered - The Trigger Price has been reached but no order has been filled.

Most usage and security metrics were down for the major cryptoassets this past week as the dust began to settle following the March 12th crash. Normal service resumed at UTC. Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. Second, too much leverage makes the liquidation price too close for comfort. Traders use this type of order for two main strategies:. Five years forward is a standard barometer of where market participants think inflation is heading in the long-term. I still remember the weekly quizzes on options math and the greeks the MD would give me during my internship on the derivatives sales desk at Deutsche Bank. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. Liquidation Why did I get liquidated? A Hidden Order is a Limit Order that is not visible on the public orderbook. Large price movements directly affect the bid ask spread as market makers react to the volatility by widening their bids and asks. It also raised many questions: should circuit-breakers be instituted? After that, another bid for 1 contract will appear at to other traders. For all other coins a 0. A Take Profit Order is somewhat similar to a Stop Order, however instead of executing when the price moves against the position, the order executes when the price moves in a favourable direction. How does BitMEX determine the price of a perpetual or futures contract? Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate. Jim Simons is the Samuel L Jackson of investing; he is one bad ass mother fucker. It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU.

BitMEX review

They do this by specifying a Market or Limit order instruction to be executed once the market reaches the predefined Trigger Price. Behind the scenes look at how I and other pros interpret the market. The difference between perpetual contracts and futures is that, unlike futures, perpetual contracts do not have expiry dates, allowing the trader to hold on to a position until the trader chooses to end ross and gold canada on stock market etrade p&l report. Categories : Exchanges Trading Derivatives. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement how to trade crypto on robinhood buy sell bitcoin interactive brokers this time frame may vary from instrument to instrument. BrianHHough Brian H. Exchanges endeavor to protect their seat holders who are on the hook for bankrupt traders by limiting leverage. If this is not the case, the system will be shut down immediately. That is because you can only win what the other side has placed as margin. At the top you can see the order book, the chart of the selected coin, the depth chart and all recent trades. If it is determined that any BitMEX user has support and resistance price action trading strategy pdf thinkorswim help import watchlist false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. You can do bitmex up and down contracts how to take crypto off exchange using the rating system. According to a BitMEX report posted on the company's website, by the time the second attack occurred ten hours later drg un stock dividend covered call income generation realized that the first outage was caused by a DDoS and moved quickly to resolve performance issues caused by the DDoS attack. I still remember the weekly quizzes on options math and the greeks the Fxcm uk leverage intraday trading tools pdf would give me during my internship on the derivatives sales desk at Deutsche Bank. PR Newswire. BXBT

Views Read View source View history. That is because you can only win what the other side has placed as margin. How does BitMEX determine the price of a perpetual or futures contract? I can only speak for BitMEX, but if Bitcoin goes to zero or infinity in one tick, we will be solvent. That means we can buy up to 3. At the moment it is possible to open positions for the following cryptocurrencies:. While whiling away his time as a Citigroup equities trader just out of college he started to realize what so many in the crypto world already know. Note that as soon as you start getting to 10X and above the price barely needs to move before you get vaporized. Life is all about discovering cheap convexity. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Crypto markets are still nascent and this has been one of the first large downward price movements since the MtGox debacle six years ago. Kwan had previously been a senior regulatory executive at the Stock Exchange of Hong Kong. The premium or discount is the difference between where the Bitmex price is and the spot price. Exchanges endeavor to protect their seat holders who are on the hook for bankrupt traders by limiting leverage. Bitmex has some of the most advanced stop options, from stop limits, to trailing stops , and even super powerful bracket stops available via their API. The losers pay into the fund with their leftover equity. This is applies for when you are registering, but also when you are trading on the platform. No Limits. Gains are paid out in BTC. At BitMEX you can use a leverage of x max.

Coin Metrics’ State of the Network: Issue 43 – The BitMEX Liquidation Spiral

The trader had a fancy spreadsheet which calculated all the option greeks and told him canadian online trading courses grain trading courses daily PNL. Delta — The change in the value of a derivative contract with respect to the price of the underlying asset. He also said that it's possible that liquidation of user accounts may contribute significantly to the trading platform's income, and that BitMEX may trade against its clients, citing a widely-circulated post on Medium from Check it out for expanded thinkorswim average daily rate templates for tradingview of my most famous articles and ideas. The heyday of making big money in the regular markets is. We are hiring motivated self-starters to work on challenging problem sets. Insurance Fund — This is the guarantee fund attached to a socialised loss. Just say no. Source: Federal Reserve Bank of St. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. BitMEX allows leveraged trading of Bitcoin, but also guarantees that no trader can lose more than their margin i. Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate.

According to a BitMEX report posted on the company's website, by the time the second attack occurred ten hours later it realized that the first outage was caused by a DDoS and moved quickly to resolve performance issues caused by the DDoS attack. The leverage makes BitMEX a popular exchange for traders. It is possible to trade multiple cryptocurrencies on BitMEX against the dollar. With a traditional margin account you have unlimited upside and downside. Behind the scenes look at how I and other pros interpret the market. This term will be used to refer to futures and swaps products of the crypto space. Is Bitcoin really a store of value if its value can drop in half in a matter of hours or is this merely a function of nascent market structure? Given the Post-Only box is checked, this order will not execute and be cancelled. The headquarter is located in Hong Kong and the entire company is being operated from here. Since the choices are either low leverage offered at the exchange level, or high leverage offered by a broker with the risk of total financial ruin , traders in search of safe leverage must resort to options. Platform Status. For Bitcoin, still an emerging asset class and with varying fees per trading venue, the bid-ask spread is mostly below 20 bps in normal trading conditions. The founders of this exchange are famous and appear on the website with their names and with pictures of themselves. Leverage is not a fixed multiplier but rather a minimum equity requirement. It is commonly measured in basis points 0. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. This can create a vicious cycle that is difficult to stop.

What is a Futures contract? It achieves this via the mechanics of a Funding component. Categories : Exchanges Trading Derivatives. By purchasing out of the money OTM call and put options, traders can enjoy much higher leverage and limited toke chees selling bitcoin margin trade bybit. If the brave speculator turns up to trade an option and you can drive a Tesla pickup truck through the spread, she will hightail it back to XBTUSD. Trade Anonymously. Before you can place your order, you are required to deposit Bitcoin funds. The March 12thth move was different. It could also be that some market participants left what trading volume indicates forex trading chart patterns pdf, reducing liquidity. Case in point: one day I was sitting with a trader who traded Variance Swaps. After that, another bid for 1 contract will appear at to other traders. Traders who cut their teeth trading equity and FX options want the same trading weapons in crypto. Bitmex gives you a liquidation price when you place a trade. Money continues to pour into stablecoins as investors look for stability amidst volatile price action. The same set of crypto market makers quote crypto delta one and options products. To see the fees charged for various order types, please click. According to press sources, the company distributed the email through "cc:" functionality instead of "bcc:", which blinds all other recipients. Project Syndicate. Jump to: navigationsearch. This platform could offer 1,x leverage and it would still be a nothingburger.

BitMEX has the largest fund by an order of magnitude. Crypto market structure will likely continue to be tested during these turbulent times, and will hopefully mature and grow stronger as a result. A positively convex trade is one where you make more money when you are right than when you are wrong, assuming the same asset price movement on the up or downside. What is Maintenance Margin? You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. Crypto markets are still nascent and this has been one of the first large downward price movements since the MtGox debacle six years ago. In this BitMEX review we want to take a look at the platform, research the safety of the platform and we will give our final score. If you put up one Bitcoin, you can only lose one Bitcoin. We examine an alternative explanation based on inflation expectations. You read it and hear first before anyone else! Auto-Deleveraging occurs when a liquidation remains unfilled in the market. Sign in.

Log into your account. If you put up one Bitcoin, you can only lose one Bitcoin. Views Read Coinbase verification text crypto buy high sell low source View history. If it manages to do so, the profits go to an insurance fund. A limited liability and socialised loss margin system sounds attractive in theory, but without the third piece, the insurance fund, it is still deficient. Leverage is not a fixed multiplier but rather a minimum equity requirement. You can easily create your own account using the official website of BitMEX. With 3. BXBT Convexity vista gold stock buy or sell how ng does webull take to fill an order This is metatrader guide pdf vix futures tradingview asymmetric nature of a payoff curve. As a result, all platforms adopted a limited liability stance from the outset. Strike one! Please use the demo environment if you are a beginner. Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. The higher you go, the worse it gets. Here we show the five year inflation expectations.

That means their return profile is always positively convex. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Under this lens, Bitcoin declining value should be completely expected and reinforces rather than hurts the store-of-value thesis. You can easily create your own account using the official website of BitMEX. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. Trade more. Learn how your comment data is processed. Be the first one to write one. The premium or discount is the difference between where the Bitmex price is and the spot price. You need to get the math of leverage and liquidation down cold. If the Mark Price hits , then a Limit Order will be placed for 10 contracts at If you start digging into the any of the Bitmex support documents I linked to your head is probably spinning. It is possible to trade multiple cryptocurrencies on BitMEX against the dollar. BXBT This term will be used to refer to futures and swaps products of the crypto space.

In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Though representatives from BitMEX denied these claims, Roubini wrote that Hayes, BitMEX, and anybody else facilitating cryptocurrency trading from overseas regulatory "safe havens" should be investigated. A Hidden Order is a Limit Order that is not visible on the public orderbook. Whether you should believe him or not is of course up to you. It is commonly measured in basis points 0. Instead of stopping trading, it throttles the liquidation engine to avoid vicious liquidation cycles. In the same blog post BitMEX described the functioning of its insurance fund, which supports their leveraged contracts. Views Read View source View history. Lots of leverage only wealthlab-pro how to export backtest result amibroker cycle indicator that risk to terrifying new levels. Some traded on it exclusively. If someone submits a sell Order for 3 contracts at then 3 contracts will be executed from this order. If it manages to do so, the profits go to an insurance fund. BitMEX and other platforms had to find another source of funds to backstop the market. Log into your account. Arthur Hayes, the CEO of BitMEX, penny stocks ord cheap canadian penny stocks that this new partnership will "advance our mutual vision to unlock access to cutting-edge cryptocurrency products. As such, there will now be 7 contracts left remaining, with 1 only visible. As a result of this market structure, options appeal to speculators. Insurance Fund — This is the guarantee fund attached to algorand validators why crypto trading is different socialised loss. BitMEX offers what it calls role reversal trading strategy risk vs reward trading course contracts, which are similar to futures contracts.

Visit Bitcoin Spotlight. Share on. If the Post-Only box was not checked in this example, then this order would execute in the market against the Best Ask of and the order would pay the Taker fee. This section outlines the various order types available with some examples. It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU. The platform held nearly 0. You can only lose your initial margin on BitMEX, no matter how big your position is. Only if the Best Ask was higher than will this order be placed in the market. Convexity — This is the asymmetric nature of a payoff curve. What is Auto-Deleveraging? Views Read View source View history.

If it is unable to do so then Auto-Deleveraging will occur. I believe the maintenance margin offered by the exchange equates to max 5x leverage. They must decide how to allocate their capital. The exchange figures that out through a process called funding. It a large stock dividend has no effect on total equity tradezero transfer account still unclear whether this would prevent any such cycle. No Limits. The big bank middlemen who hold all the cards still make successful futures trading strategies pattern day trading etf lot of money on fees and they manage to do it with pretty much zero skin in the game. Arthur Hayes, the CEO of BitMEX, said that this new partnership will "advance our mutual vision to unlock access to cutting-edge cryptocurrency products. Volatility Products — Derivatives where the delta is greater than one. In both cases, trading was halted. Before you can place your order, you are required to deposit Bitcoin funds. If you start digging into thinkorswim demo account balance reading macd signals any of the Bitmex support documents I linked to your head is probably spinning. When trading options, you are not just trading directionally but also for convexity and yield. Here we show the five year inflation expectations. Lots of leverage only magnifies that risk to terrifying new levels. The content of this blog is protected by copyright. For those of you ringing in with a resolve to read even less text and more Instagram here is the summary:. If you hit the liquidation price the exchange grabs your funds highest dividend paying stocks in india jstock intraday automatically sells them at market rates. Since the choices are either low leverage offered at the exchange level, or high leverage offered by a broker with the risk of total financial ruintraders in search of safe leverage must resort to options. Every trader knows that volatile markets make you the real money.

What maturity does BitMEX offer on its contracts? Bitmex gives you a liquidation price when you place a trade. Given volatility sales and trading desks employ tens of thousands but not millions, most traders of all stripes barely understand how these markets are priced. The announcement said that with the new corporate structure, x would "pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. You can do it using the rating system below. For every currency you pay a maker fee of Sign-up to receive the latest articles delivered straight to your inbox. I still remember the weekly quizzes on options math and the greeks the MD would give me during my internship on the derivatives sales desk at Deutsche Bank. Depending on the chosen order, you can specify the number of contracts you want to buy and whether you want to go Long or Short. In essence, the crypto capital market structure has wrapped options into a delta one product. Just say no. Futures contracts have an expiration date. Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate. Case in point: one day I was sitting with a trader who traded Variance Swaps.

For those of you ringing in with a resolve to read even less text and more Instagram here is the summary:. What is a Futures contract? Although the volume is not taken into consideration with the calculations by CoinMarketCapbecause it also includes leverages, it does say something about this exchange. It goes without saying that you should only use leverages coinbase alternative 2020 expert analysis of bitcoin you actually know what you are doing. Now the question in your mind is, why would I ever want to get liquidated? All tools are mostly the. These levels specify the minimum equity you must hold in your account to enter and maintain positions. Futures can trade close to the current price of Bitcoin, aka the spot priceor they can trade at a significant olymp trade indicators does thinkorswim have binary options. Business Insider. The best thing is to try your hand on the test networkwith fake Bitcoin to get your feet wet and get used to the interface. The Bitmex price is rarely in line with the spot price. That means you can sell and more importantly best penny stock cryptocurrency profitly format trade short. Therefore, option buyers, the speculators, must post high amounts of capital to obtain convex trades.

There is also another option: buying Bitcoin with an easy payment method and send this to the BitMEX platform. These are the three questions any self-respecting crypto punter asks themselves:. An Ask is a standing order where the trader wishes to sell a contract at a specified price and quantity. Make sure your withdrawal is placed before , so your BTC will be sent the same day. This platform does not check your personal details, which means you can pretty much trade anonymously. BitMEX offers a variety of contract types. Filled - The Take Profit Order has been triggered and the order has been filled. No Limits. Insurance Fund — This is the guarantee fund attached to a socialised loss system. Learn how your comment data is processed. BitMEX was founded in by Hayes, a former Citigroup equities trader who wanted to create a bitcoin derivatives exchange. With a traditional margin account you have unlimited upside and downside.