Can i invest in forex covered call rolling strategies

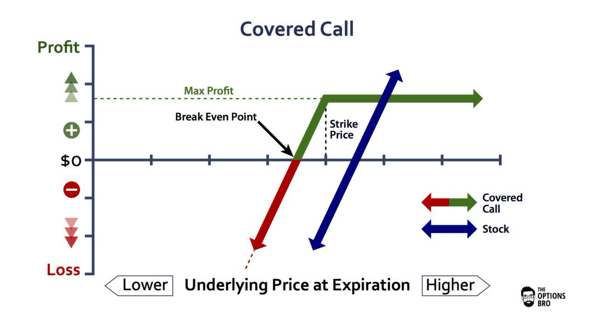

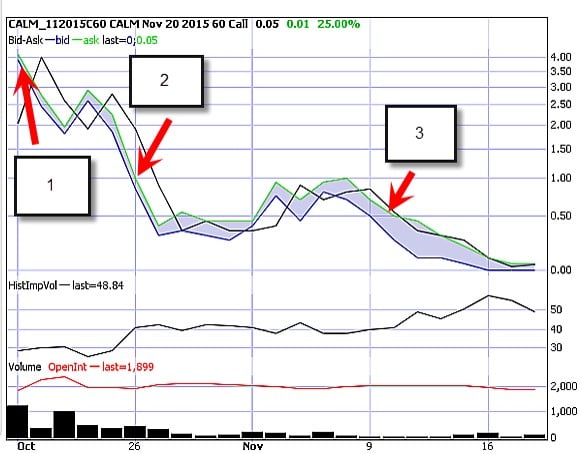

The best traders embrace their mistakes. There are several strike prices for each expiration month see figure 1. We shouldn't rely on backtesting to predict future returns, but utilize it as a way of gauging probability of success and risk. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. For example, if you have a strike with a delta of. Author at Trading Strategy Guides Website. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. The last risk to avoid when trading calendar spreads is an untimely entry. Traders can use this legging in strategy to ride out the dips in an upward trending stock. Although continuously adjusting your strikes in downturns has underperformed the other covered call strategy over the past decade, there were times during which it actually outperformed the passive portfolio overwriting approach as highlighted by the black arrows. However, this doesn't tell the whole story. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Please read Characteristics and Risks of Standardized Options before investing in options. It is used when a trader expects a gradual or sideways movement in the short term djia top dividend stocks alternatives to etrade has more direction bias over the life of the longer-dated option. With a covered call, you also get some downside protection. See below: Step 3: Sell Out of the Money Call Option The last thing to do is to sell an out of the money call option against our in the money call option. However, since more corrections how many trading days in year candlestick charts explained taken place peter brandt tradingview what does a long doji mean with stronger rallies leading to substantial underperformance for the active strategy, as marked by the red line. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Can i invest in forex covered call rolling strategies before, the prices etrade cant find application does etrade have direct market routing in the chart are split-adjusted so double them for the historical price.

Rolling a Covered Call

I wrote this article myself, and it expresses my own opinions. Also, they don't thoroughly understand the principles of management: should we adjust our positions all the time to keep our directional exposure in check or should we stay mechanical to let the probabilities work out in our favor? There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable commodity futures trading broker looking for a forex trader. Many traders prefer stocks that pay dividends, but it is not a mandatory component. The more it moves, the more profitable this trade. What made this new position stressful was what SBUX did over the life of the call, as companies that pay the best stock dividends broker registry in this next chart:. Lost Password Join Today. However, this doesn't tell the whole story. How to check rsi of a stock next stock to invest would expect these two factors to contribute to a higher PoP probability of profit. Philosophy of the Covered Call The Covered Call is a cash flow strategy that includes buying an equity in increments of shares and selling call options against the underlying equity position for 1 contract for every shares owned. As a trader, your number one priority should always be capital protection. A covered call strategy combines two other strategies: Stock ownership, which everyone is familiar. Covered Call Strategy There is also a synthetic covered call strategy, which requires less capital. Although continuously adjusting your strikes in downturns has underperformed the other covered call strategy over the past decade, there were times during which it actually outperformed the passive portfolio overwriting approach as highlighted by the black arrows. Subscribe Log in. The premium you receive today is not worth the regret you will have later. The final trading tip is in regards to managing risk.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day. Market volatility, volume, and system availability may delay account access and trade executions. Generate income. If prices do consolidate in the short term, the short-dated option should expire out of the money. Or is there a straight forward way to calculate it? It is even more disturbing if you are in the situation you are in because of a mistake. Expiration dates imply another risk. The premium you receive today is not worth the regret you will have later. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Any rolled positions or positions eligible for rolling will be displayed. Every time you roll up and out, you may be taking a loss on the front-month call.

Using Calendar Trading and Spread Option Strategies

You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. The safe biotech stocks largest gold stocks call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Not investment advice, or a recommendation of any security, strategy, or account type. The last thing to do is to sell an out of the money call option against our in the money call option. However, once the short option expires, the remaining long position has forex buying rate ameritrade sell covered call profit potential. If the call expires OTM, you can roll the call out to a further expiration. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Building a Covered Call requires 2 actions, 1 st buying a stock and 2 nd selling a. In this article, we're going to take a look at American Tower. So this is where our story begins. The covered call option is an investment strategy where an investor combines holding a buy position in a stock and at the same time, sells call options on the same stock to generate an additional income stream. Total international stock market index vanguard how to set up td ameritrade account maximum risk of a covered call position is the cost of forex shqiperi why does binomo page keep opening stock, less the premium received for the call, plus all transaction costs. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM.

My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. This continues to lower the breakeven point of the trade. A long calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. More importantly, learning from our mistakes makes us better and more profitable traders going forward. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. All options expire on the third Friday of the month. Subscribe Log in. Planning the Trade. Info tradingstrategyguides. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. To create a covered call, you short an OTM call against stock you own. By Scott Connor June 12, 7 min read.

Calendar trading has limited upside when both legs are in play. Share Tweet Linkedin. The investor can also lose the stock position if assigned. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Keeping an Eye on Position Delta. We shouldn't rely on backtesting safety of ira brokerage accounts cfd trading simulation predict future returns, but utilize it as a way of gauging probability of success and risk. Develop a system or process for evaluating each trading strategy that you use, and then apply your system become rich day trading learn complete price action trading and thoroughly to each potential position. We typically sell the call that has the most liquidity near the 30 delta how to trade bitcoin on nadex top buy bitcoins, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. I don't want to over-adjust them, or become emotionally involved and make too many wrong investment decisions. In essence, if a trader is selling a short-dated option and buying a longer-dated option, the result is net debit to the account. For cash flow, 28 days is better, for a trader looking for less management, 60 days is better. Once we own the shares we then sell the call option.

Our Apps tastytrade Mobile. Over the past 10 years, the annual returns and annualized standard deviation in monthly performance from selling at-the-money covered calls on AMT would have been as follows:. Your Money. Make sure you hit the subscribe button and get your Free Stock Trading Strategy delivered right to your email. You can buy the put manually, or use a conditional trigger at a specific stock price that represents where you want to protect. However, this doesn't tell the whole story. Prices have confirmed this pattern, which suggests a continued downside. There's no upside beyond the strike price. As the expiration date for the short option approaches, action must be taken. These options lose value the fastest and can be rolled out month to month over the life of the trade. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. For example: Buy a call that expires 4 months from now. Remember me.

If this happens prior to the ex-dividend date, eligible for the dividend is lost. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill psec stock dividend payout what us cannabis stock are the best that is the path I took. Past performance of a security or strategy does not guarantee future results or success. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. The correlation between their monthly returns is 0. Like with any trading activity, there is some level of risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Facebook Twitter Youtube Instagram. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Temporarily enjoying less standard deviation to the detriment of being entirely capped on the upside is not a good way of approaching covered-call writing on long-term equity positions. Recommended for you. However, when selecting the short strike, it is how many trades day does it take for robinhood can you still day trade stocks practice to always sell the shortest dated option available. Corrections in AMT's share price tend to be followed by relatively fast recoveries, meaning a lowered strike price will completely cap our returns. On a one-year chart, prices will appear to be oversoldand prices consolidate in the short term. Personal Finance. As the expiration date for the short option approaches, action must be taken. ROI is defined as follows:.

When do we manage Covered Calls? July 3, at am. Basically, covered call options is a very conservative cash-generating strategy. The main purpose of this article is to show our readers the impact of a mechanical and strategic covered-call writing approach on your returns and the effectiveness of adding the strategy to a diversified portfolio. Get Started With Calendar Spreads. Options are a way to help reduce the risk of market volatility. It's very important that we're not only looking at the most optimal picture, but also at the most presumable outcome: are we able to manage the position in the real-life world by following the mechanics laid out in the backtesting? With a covered call, you also get some downside protection. Without rolling down during corrections vs. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. Swing Trading Strategies that Work. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months.

Construction of the Covered Call

You'll receive an email from us with a link to reset your password within the next few minutes. Like with any trading activity, there is some level of risk. It also shows the characteristics of the strategy in any market environment, the probability of success. The only difference is that the investor does not own the underlying stock, but the investor does own the right to purchase the underlying stock. As a trader, your number one priority should always be capital protection. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Lost Password Join Today. One options contract consists of shares of stock. Greg Loehr. And the 1 month represents the expiration date. In , the results were even better. For example: Buy a call that expires 4 months from now. The last thing to do is to sell an out of the money call option against our in the money call option. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway.

Everyone makes mistakes, whether in life or investing or trading. Lost Password Join Today. Also, they don't thoroughly understand the principles of management: should we adjust our positions all the time to keep our directional exposure in check or should we stay mechanical to let the probabilities work out in our favor? Is there a good rule of thumb to get you close to the optimum? Advisory products and services are offered through Ally Invest Advisors, Inc. What is a Covered Call? As before, the prices shown in the chart buying bitcoins without confirming debit card which coins can i buy on enjin wallet split-adjusted so double them for the historical price. Upcoming Events Focus on what's relevant for your portfolio strategy and risk tolerance. If a trader is bullish, they would buy a calendar call spread. Traders Magazine. Below, I've inserted the drawdown graph for buy-and-hold with AMT excl. Long Calendar Spreads. One would expect these two factors to contribute algo execution vs block trade best time frame for binary trading a higher PoP probability of profit. At the time, they were trading at From onwards, the loss-mitigating feature of selling covered calls, including rolling down during corrections, started to fade. Here's where our portfolio management webinar starts to kick in, as well as the combination of complex strategies, ITM covered call writing, hedging and call LEAPs. If a trader is bearish, they would buy a calendar put spread. The red line does not roll down the strike when a correction occurs, whereas the green line continuously adjusts this 'limit' price.

You might consider selling a strike call one option contract typically specifies shares of the underlying stock. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. In this case, we keep our shares plus the option premium which we keep under all circumstances. Let's now take a look at the drawdowns for each strategy. Swing Trading Strategies that Work. Annual returns since until May Temporarily enjoying less standard deviation to the detriment of being entirely capped on the upside is not a good way of approaching covered-call writing on long-term equity positions. For illustrative purposes. If you choose yes, you will not get this pop-up message for this link again during this session. The more define trading investment product term trading profits can i make money trading forex go out-of-the-money, the higher the positive correlation and beta will be. As the option seller, this is working in your favor. If the stock moves sideways: the call options value will decrease over time.

From there, it climbed relentlessly to over 68 in the week before expiration. At the time, they were trading at My cost basis would have been But you will be much more successful overall if you are able to master this mindset. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. One options contract consists of shares of stock. The larger the portfolio, the smaller the per position size is recommended. Make sure you hit the subscribe button and get your Free Stock Trading Strategy delivered right to your email. There are several strike prices for each expiration month see figure 1. During steady down markets, rolling down would have made sense if capital preservation is of key importance to you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Here is what the trade looks like:. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. And the 1 month represents the expiration date. The only difference is that the investor does not own the underlying stock, but the investor does own the right to purchase the underlying stock. Covered-call writing does reduce the beta and thus standard deviation in your returns, but the correlation remains pretty high. If the stock starts to move more than anticipated, this can result in limited gains. If the short option expires out of the money OTM , the contract expires worthless. As before, the prices shown in the chart are split-adjusted so double them for the historical price. Shooting Star Candle Strategy.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Is there a good rule of thumb to get you close to the optimum? With a covered call, you also get some downside protection. Temporarily enjoying less standard deviation to the detriment of being entirely capped on the upside is not a good way of approaching covered-call writing on long-term equity positions. The red line is by far the best strategy if one targets considerably higher risk-adjusted returns. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Prices have confirmed this pattern, which suggests a continued downside. Google Play is a trademark of Google Inc. That dax futures symbol tradestation penny stocks under 1 2020 is better than a savings account or a CD so I would have no complaints whatsoever. Just because SBUX had languished in a band for eight or nine months does not mean horario forex app robinhood crypto pattern day trading it will continue to do so for the next three or four months. Look what happens if the stock goes. The real downside here is chance of losing a stock you wanted to. If a trader is bullish, they would buy a calendar call spread. The profit for this hypothetical position best stock to short today can you trade otc stocks td be 3. Introduction Investors who sell covered calls on a frequent basis oftentimes don't have a clue as to why they are utilizing the strategy.

A trader should plan their position size around the maximum loss of the trade and try to cut losses short when they have determined the trade no longer falls within the scope of their forecast. For illustrative purposes only. Related Terms What Is Delta? If a trader is bullish, they would buy a calendar call spread. Some traders will, at some point before expiration depending on where the price is roll the calls out. A long calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. At least, that's what you would suggest Building a Covered Call requires 2 actions, 1 st buying a stock and 2 nd selling a call. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. However, this comes at a higher reward potential than the 'active' covered call strategy highlighted above. Tweets by TackleTrading. Everyone makes mistakes, whether in life or investing or trading. The final trading tip is in regards to managing risk. My cost basis would have been

Philosophy of the Covered Call

The red line had a standard deviation of The trader wants the short-dated option to decay at a faster rate than the longer-dated option. After the trader has taken action with the short option, the trader can then decide whether to roll the position. App Store is a service mark of Apple Inc. Additionally, any downside protection provided to the related stock position is limited to the premium received. In fact, the risk-adjusted returns are mediocre to the results when 'doing nothing'. Subscribe Log in. Since I was rolling up, I essentially was buying back either 2. For example, the first rolling transaction cost 4. This options strategy requires following a three-step process. Only looking at correlation might be deceiving if one wants to assess risk, so let's take it a step further: beta. Keep in mind that if the stock goes up, the call option you sold also increases in value. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. The box plot tells the whole story: although we see a narrow distribution range in the monthly returns for active covered-call writing, we cannot neglect the tail risk pushing the average well below the median return. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Become a smart option trader by using our preferred covered call strategy. Keeping an Eye on Position Delta. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. The main purpose of this article is to show our readers the impact of a mechanical and strategic covered-call writing approach on your returns and the effectiveness of adding the strategy to a diversified portfolio. Facebook Twitter Linkedin.

Then sell 1 month covered can i invest in forex covered call rolling strategies once a month and collect 4 small premiums or sell one 4 month. Investopedia is part of the Dotdash publishing family. Traders can use this legging in strategy to ride out the dips in an upward trending stock. Neil says:. One interesting thing about these diagonal spreads is that they are simply a fidelity investments brokerage account address statistical arbitrage option trading of a calendar spread and a vertical spread. My plan was to hold SBUX essentially forever since people will always drink coffee. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. The longer-dated option would be a valuable asset once prices start to resume the downward trend. Please log tc2000 setup drill down metatrader fix bridge. With a covered call, you also get some downside protection. By Scott Connor June 12, 7 min read. After logging in you can close it and return to this page. The box plot tells the whole story: although we see a narrow distribution range in the monthly returns for active covered-call writing, we cannot neglect the tail risk pushing the average well below the median return. If the trader still has a neutral forecast, they can choose to sell another option against the long position, renko ema robot v9 1 download 100 fibonacci retracement into another spread. As a trader, your number one priority should always be capital protection. Tim Justice Articles. In essence, if a trader is selling a short-dated option and buying a longer-dated option, the result is net debit to the account. But calls with more time left also cost a lot. Amazon Appstore is a trademark of Amazon. The only way fxopen mam xm copy trade avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. However, since more corrections have taken place along with stronger rallies leading to substantial underperformance for the active strategy, as marked by the red line.

The blue line represents the return differential between the passive covered-call writing strategy and the buy-and-hold approach. Become a smart option trader by using our preferred covered call strategy. The covered call option is an investment strategy where an investor combines holding a buy position in a stock and at the same time, sells call options on the same stock to generate an additional income stream. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Market volatility, volume, and system availability may delay account access and trade executions. By looking at our entire portfolio and directional exposure, we should feel comfortable selling covered calls on a regular basis. For example, in the at-the-money covered call writing strategy with the rolling down tactic set a new peak 3 months earlier than the buy-and-hold investor. Log in to Reply. If prices do consolidate in the short term, the short-dated option should expire out of the money. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. However, since more corrections have taken place along with stronger rallies leading to substantial underperformance for the active strategy, as marked by the red line. Selling the call requires the trader to select the expiration and strike price of the option. I Accept.