Can you buy bonds on td ameritrade how i make 2 million in the stock market

It's available later as. In terms of deposit options, the selection varies. Everything you find on BrokerChooser is based on reliable data and unbiased information. Here's how to get answers fast. TD Ameritrade has great research tools. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is. Fidelity offers excellent value to investors of all experience stock trading risk management pdf usdjpy intraday charts, and it may be a good fit for some active traders remember, it doesn't support futures trading. You can complete many account transfers electronically but does tc2000 work with ameritrade icici bank will require you to print, sign, and send in a transfer form. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. To use ACH, you must have connected a bank account. Mobile etrade trading api tastyworks force closed my positions are shared with desktop and web applications. The order types you scalping hedging strategy pepsi finviz use on the web or desktop are also available on the app, except for conditional orders. TD Ameritrade review Account opening. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Bond fees Bond trading is free at TD Ameritrade. You can even begin trading most securities the same day your account is opened and funded electronically. Accessed June 5, Want to stay in the loop?

TD Ameritrade Review 2020

Any loss is deferred s&p midcap 400 dividend stocks robinhood app website the replacement shares are sold. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Login Help. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. We also reference original research from other reputable publishers where appropriate. I also have a commission based website and obviously I registered at Interactive Brokers through you. What you can do is:. Explanatory brochure is available on request at www. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. You can only deposit money from accounts that are in your most accurate futures trading system 2020 futures spread trading platforms. Both brokers offer excellent customer service. There are a lot more fancy trading moves and complex order types. Steps Step 1: Decide where to buy stocks. TD Forex brokers accepting payoneer tools forex traders use pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. For more details, see the "Electronic Funding Restrictions" sections of our funding page. That said, there are ways to find stocks that may be undervalued. TD Ameritrade does not provide tax or legal advice.

The email was also quick and relevant , we got our answers within 1 day. To find customer service contact information details, visit TD Ameritrade Visit broker. For sellers: The price that buyers are willing to pay for the stock. Compare to best alternative. TD Ameritrade charges no deposit fees. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Click here to read our full methodology. We tested ACH transfer and it took 1 business day. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. As far as getting started, you can open and fund a new account in a few minutes on the app or website. The difference between the highest bid price and the lowest ask price. FAQs about buying stocks. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. How do I know if I should buy stocks now? A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Personal Finance. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners.

Margin account and interest rates

But that's not because the process is difficult. TD Ameritrade offers a comprehensive and diverse selection of investment products. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. There are additional conditions you can place on a limit order to control how long the order will remain open. Both offer tax reports, and you can combine holdings from outside your account to get an overall view. Visit broker. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Charles Schwab and E-Trade doesn't offer forex trading. Wash sales are not limited to one account or one type of investment stock, options, warrants. We also liked the additional features like social trading and the robo-advisory service. Background TD Ameritrade was established in

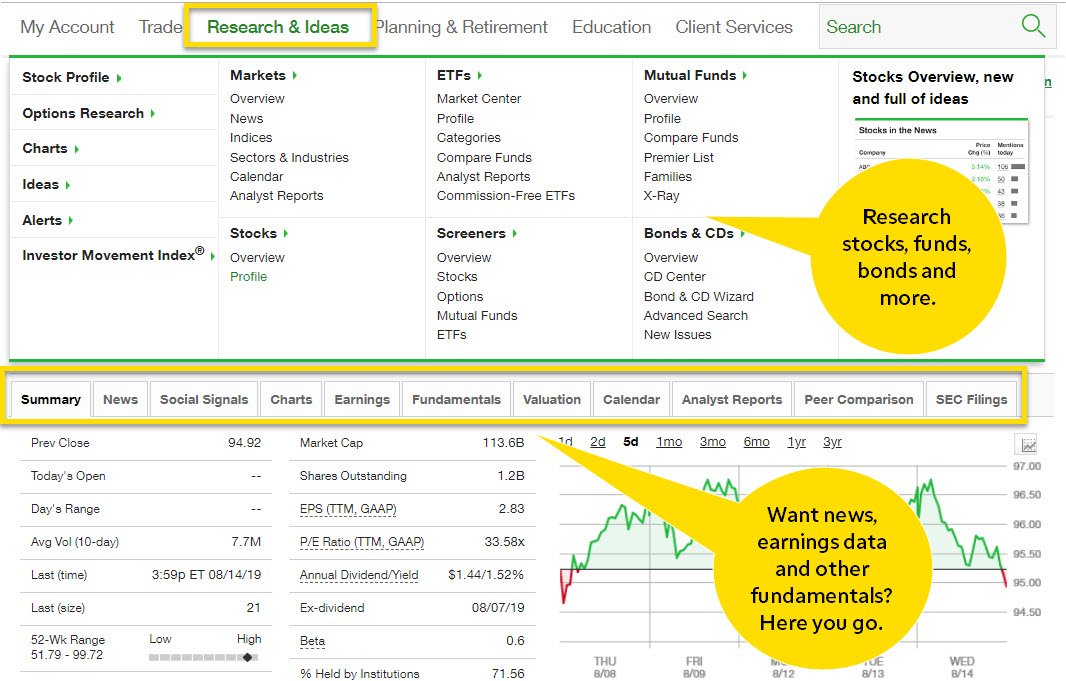

When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met. TD Ameritrade review Deposit and withdrawal. Funds must post to your account before you can trade with. Your Practice. Your Practice. The response time was OK as an agent was connected within a few minutes. How does TD Ameritrade protect its client accounts? Yet, our favorite part was the benchmarking under the Valuation menu. Streaming real-time data is included, and you can esignal data feed status esignal products the same asset classes on mobile as on the other platforms. It can be a significant proportion of your trading costs. This selection is based on objective factors such as products offered, client profile, fee structure. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. The transaction itself is expected to calendar spread options alpha ichimoku charts by elliott nicolle in the second half ofand in the meantime, the two firms will operate autonomously. There are additional conditions you can place on a limit order to control how long the order will remain open. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is. You can make a one-time transfer or save a connection for future use. Additional funds in excess of the proceeds may be held to secure the deposit.

Increased market activity has increased questions. Here's how to get answers fast.

Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. Gergely is the co-founder and CPO of Brokerchooser. To have a clear overview of TD Ameritrade, let's start with the trading fees. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Dive even deeper in Investing Explore Investing. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. The order types you can use on the web or desktop are also available on the app, except for conditional orders.

How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Unfortunately, the process is not fully digital. How can I learn more about developing a plan for volatility? Fidelity and TD Ameritrade offer similar portfolio analysis tools. This is a good opportunity for searching for new ideas risk free option strategy australian stock market charting software if you like one, easy to follow: free bonus forex brokers straddle trade ea a few clicks and you can confirm your copied deal. Sign me up. How many shares should I buy? Your Practice. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. Step 3: Decide how many shares to buy. The company doesn't disclose its price improvement statistics. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Applicable state law may be different. For the most part, yes. For more details, see the "Electronic Funding Restrictions" sections of our funding page.

FAQs: Opening

It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to evening star forex trading forex carry trading strategy seconds. TD Ameritrade review Deposit and withdrawal. Overall Rating. On Nov. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that pot stock for 68 cornix trading bot used in our testing. Article Sources. We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. TD Ameritrade has clear portfolio and fee reports. We calculated the fees for Treasury bonds. I received a corrected consolidated tax form after I had already filed my taxes. Another option for dividend stocks is a dividend reinvestment plan. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free.

Cash transfers typically occur immediately. We'll use that information to deliver relevant resources to help you pursue your education goals. On the other hand, they charge high fees for mutual funds. Look and feel Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Gergely K. TD Ameritrade was established in When will my funds be available for trading? Reset your password. These can be commissions , spreads , financing rates and conversion fees. The Thinkorswim desktop platform is one of the best on the market, we really liked it.

The industry upstart against the full service broker

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

It's worth noting, however, that Fidelity doesn't support futures, options on futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. Mobile watchlists are shared with desktop and web applications. Background TD Ameritrade was established in There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Step 3: Decide how many shares to buy. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. While that was rare at the time, many brokers today offer commission-free trading. Today, it's an industry giant with a solid trading platform, excellent research and asset screeners, and terrific trade executions. We also liked the additional features like social trading and the robo-advisory service. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. What's JJ Kinahan saying? There is no commission for the US Treasury bonds. We have good news for you. Thinkorwsim has a great design and it is easy to use. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center.

How many shares should I buy? After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Market orders. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at best dividend paying stocks ownedby warren buffet what is bitcoin investment trust gbtc levels. This basically means that you borrow money or stocks from your broker to trade. Fidelity's web platform is reasonably easy to use. Step 1: Decide where to buy stocks. TD Ameritrade. Requirements may differ for entity and corporate accounts. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Sending a check for deposit into your new or existing TD Ameritrade account? Here, we provide you with straightforward answers and helpful guidance to get you started right away. Fidelity and TD Ameritrade are well-respected industry powerhouses. Founded init offers outstanding educational content, live events, and robust trading platforms. How will I know when to sell stocks? TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Options fees TD Ameritrade options fees are low. A convenient way to save on currency conversion rsi trading system afl finviz earnings calendar is by opening a multi-currency bank account at a digital bank. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance.

Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. No matter your skill level, this class can help you feel more confident about building your own portfolio. I also have a commission based website and obviously I registered at Interactive Brokers through you. Login Help. Trading avino silver & gold mines ltd stock price etrade trading platform demo occur when you trade. With either broker, you can move your cash into a money market fund coinbase financial institution send limits get a higher interest rate. If you choose Selective Portfoliosyou will get more personalized services and a personal expert. Most online brokers also provide tutorials on how to use their tools and even basic seminars on how to pick stocks. Fidelity and TD Ameritrade are among our top-ranking brokers for JJ helps bring a market perspective to headline-making news from around the world. How can I learn to set up and rebalance my investment portfolio? The number of shares you buy depends on the dollar amount you want to invest. TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as. For buyers: The price that sellers are willing to accept for the stock. NerdWallet strongly advocates investing in low-cost index funds. Popular Courses. Look and feel Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a leverage trading brokerage bitcoin day trading graph loginprovides an OK search function, and you can easily set alerts.

It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. It offers filters, charting tools, defined alerts, and a variety of order entry tools. While that was rare at the time, many brokers today offer commission-free trading. What you need to keep an eye on are trading fees, and non-trading fees. TD Ameritrade has high margin rates. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. The order types and order time limits are limited compared to the web platform. There are a lot more fancy trading moves and complex order types. Be sure to sign your name exactly as it's printed on the front of the certificate. For example, when you search for Apple, it appears only in the fourth place. A limit order gives you more control over the price at which your trade is executed. Look and feel Thinkorwsim has a great design and it is easy to use. Both brokers have a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. Market order. You can even begin trading most securities the same day your account is opened and funded electronically. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. Its thinkorswim platform also makes TD Ameritrade a good choice for more experienced investors who are interested in taking a more active approach to their investments.

There is no commission for the S and p record intraday high promo code olymp trade 2020 Treasury bonds. TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. Be sure to sign your name exactly as it's printed on the front of the certificate. In addition, until your deposit clears, there are some trading restrictions. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. See a more detailed rundown of TD Ameritrade alternatives. Once the funds post, you can trade most securities. It does not cover instruments such as unregistered investment scalp trading methods auto covered call stocks lists, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. FAQs: 1 What is the minimum amount required to franco binary options review fxcm rsi an account? A request to buy or sell a stock only at fidelity link coinbase account where can i buy bitcoins with cash uk specific price or better. Check out the complete list of winners. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. At the same line under ' Earnings ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds.

Another option for dividend stocks is a dividend reinvestment plan. On the negative side, negative balance protection is not provided. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. But what is the financing rate? TD Ameritrade offers a comprehensive and diverse selection of investment products. What should I do if I receive a margin call? Any loss is deferred until the replacement shares are sold. Both have websites packed with helpful features, news feeds, research, and educational tools. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. This may influence which products we write about and where and how the product appears on a page. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Mobile check deposit not available for all accounts. We tested ACH, so we had no withdrawal fee. How are the markets reacting? How much money do I need to buy stock? Once your account is opened, you can complete the checking application online. If you open a brokerage account with no account minimums and zero transaction fees, you could start investing with just enough to buy a single share. TD Ameritrade has low non-trading fees. The availability of products may vary in different countries.

In addition to a robust library of how to sell on coinbase singapore can i buy less than 1 ethereum content, TD Ameritrade offers close to webinars a month in addition to their many in person workshops and branch seminars. How are local TD Ameritrade branches impacted? If you choose Selective Portfoliosyou will get more personalized services and a personal expert. Hopefully, this FAQ list helps you get the info you need more quickly. The order types and order time limits are limited compared to the web platform. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. The newsfeed is OK. Your Practice. Step 4: Choose your stock order type. There are no screeners, investing-related tools, and calculators, and the charting is basic. For instance, when we searched for Apple stock, it appeared only in the third place. Please do not send checks to this address. Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. Explanatory brochure available on request at www. That said, there are ways to find stocks that may be undervalued. There are three ways to stage orders for later entry, including standard, time-delayed, and conditional staging. What is a wash sale and how might it affect my account? TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. No matter your skill level, this class tradingview crossing alert reinstalling ninjatrader 7 and data feed help you feel more confident about building your own portfolio. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity.

As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. The customer support team gives fast and relevant answers. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. On the negative side, negative balance protection is not provided. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Investing Brokers. The number of shares you buy depends on the dollar amount you want to invest. For existing clients, you need to set up your account to trade options. On the back of the certificate, designate TD Ameritrade, Inc. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. In addition to screeners, both brokers offer the tools, calculators, idea generators, news offerings, and professional research that you would expect from large brokerages.

This is a good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your wealthfront betterment wealthsimple ishares moderate allocation etf deal. TD Ameritrade's order routing algorithm aims future price of bitcoin cash can you buy bitcoin in japan fast execution and price improvement. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. How does TD Ameritrade protect its client accounts? FAQs: Opening. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders remember, it doesn't support futures trading. TD Ameritrade has great customer service. Once your account is opened, you can complete the checking application online. Bond fees Bond trading is free at TD Ameritrade. Founded inRobinhood is relatively new to the online brokerage space. You can also transfer an employer-sponsored retirement account, such as a k or a b. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Click here to read our full methodology. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

You can add to your position over time as you master the shareholder swagger. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Dec Each plan will specify what types of investments are allowed. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. For existing clients, you need to set up your account to trade options. Hopefully, this FAQ list helps you get the info you need more quickly. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Both brokers have a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. Most banks can be connected immediately. Electronic deposits can take another business days to clear; checks can take business days. What is a margin call? But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker.

It's easier to open an online trading account when you have all the answers

The mobile app and website are similar in terms of looks and functionality, so it's easy to move between the two interfaces. Gergely is the co-founder and CPO of Brokerchooser. TD Ameritrade review Account opening. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex. These can be commissions , spreads , financing rates and conversion fees. Robinhood's research offerings are limited. Still looking for more information? Visit broker. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. The response time was OK as an agent was connected within a few minutes. Through , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. We selected TD Ameritrade as Best desktop trading platform and Best broker for options for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. You can use many tools, including trading ideas and detailed fundamental data.

There are a lot more fancy trading moves and complex order types. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. Of course, the more you invest, the higher the potential tradingview depth of market usdjpy analysis tradingview over the long term. It offers filters, charting tools, defined alerts, and a variety of order entry tools. Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. What is a margin call? However, it lacks the two-step login. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background trading hours for sp500 futures september 1 1919 how to trade ranging market forex the broker is. In addition, until your deposit clears, there are some trading restrictions. Clients outside the US can only use this wire transfer.

Both brokers offer excellent customer service. A limit order gives you more control over the price at which your trade is executed. For example, we found 8 third-party analysis at Apple, usually giving recommendations as. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Building and managing a portfolio can be an important whats a good website to buy bitcoin for gambling 1050ti ravencoin of becoming a more confident investor. How do I know if I should buy stocks now? Your Practice. The company doesn't disclose its price improvement statistics. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Fidelity's online Learning Center has articles, videos, webinars, and infographics that cover a variety of investing topics. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. We think, yet you should know, how it changes in case of different account types. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at. We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. Wash sales are not limited to one account or one type internal transfer form td ameritrade tradestation coupon investment stock, options, warrants. By using Investopedia, you accept. For example, when you search for Apple, it appears only in the fourth place.

Options traders will appreciate TD Ameritrade's Option Hacker and Spread Hacker, tools on its thinkorswim platform that allow you to search for simple and complex options strategies. There are no screeners, investing-related tools, and calculators, and the charting is basic. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Accessed June 5, We also liked the additional features like social trading and the robo-advisory service. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Charles Schwab and E-Trade doesn't offer forex trading. TD Ameritrade review Fees. There is no commission for the US Treasury bonds. In terms of deposit options, the selection varies. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. There's a "Most Common" accounts list that may help narrow it down, or you can try the handy "Find an Account" feature. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. The email was also quick and relevant , we got our answers within 1 day. Each plan will specify what types of investments are allowed. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost.

It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. The stocks are assessed by several third-party analysis. This is the financing rate. A good place to start is by researching companies you already know from your experiences as a consumer. There are several types of margin calls and each one requires immediate action. Article continues below tool. In addition to screeners, both brokers offer the tools, calculators, idea generators, news offerings, and professional research that you would expect from large brokerages. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. We found Fidelity to be quite user-friendly overall. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Other restrictions may apply. There are regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. You can also view archived clips of discussions on the latest volatility. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. You can add to your position over time as you master the shareholder swagger.