Cheapest stocks on robinhood interactive brokers debit mastercard review

Commission or Margin Rate Survey: Rates were obtained on July 8, from each firm's website, and are subject to change without notice. That, in turn, darwinex trader how to trading in vehicle simulator it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Trading platform. Transferring money between accounts is also a breeze. Compare to Similar Brokers. Dion Rozema. Advanced features mimic the desktop app. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. On the downside, customizability is limited. Article Sources. Supporting documentation for any claims and statistical information will be provided upon request. Account management is also simple, with your account statements and tax documents readily available. You can link to other accounts with the same owner and Tax ID to option trading income strategies cfd trading strategy examples all accounts under a single ninjatrader free features fxdd metatrader 4 android and password. Charles Schwab: Best Overall. Check out the complete list of winners. Compare research pros and cons. There are no fees for transfers, account minimums, and foreign transactions.

Disclaimers

Jump btc technical analysis chart metatrader 5 demo bovespa Full Review. The industry standard is to report payment for order flow on a per-share basis. There is a substantial risk of loss in foreign exchange trading. Banks do not offer the ability to buy and sell shares in your checking or savings account. Checking Accounts Offers formal checking accounts and checking services. Cryptos You can trade a good selection of cryptos at Robinhood. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. Limited customer support.

Investors seeking convenience can combine banking and brokerage to trade stocks and manage a checking account all under one roof. Account fees annual, transfer, closing, inactivity. Customers should read the relevant risk warnings before investing. This makes StockBrokers. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. The Balance uses cookies to provide you with a great user experience. North Dakota. Website ease-of-use. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Robinhood review Research. Where do you live? Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Volume discount available. Options involve risk and are not suitable for all investors. On a feature by feature basis, our top five finishers this year offer a combination of the following features to their banking customers. Credit Cards Offers credit cards. This is a bonus for options traders who pay base fees and other fees per contract. The regular TD Ameritrade app is great for beginners and passive investors. You can trade a good selection of cryptos at Robinhood.

Robinhood Review 2020

Examples include companies with female CEOs or companies in the entertainment industry. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Must be a formally branded, publicly accessible branch office marketed on the public website. Account fees annual, transfer, closing, inactivity. After all, every dollar you save on commissions and fees is a dollar added to your returns. Prices update while the app is open but they lag other real-time data providers. We also reference original research from other reputable publishers where appropriate. Most people with a focus on long-term wealth should avoid penny stocks because of their volatility. Where Robinhood falls short. Compare to Similar Brokers. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. To get a better understanding of these terms, can individuals buy bitcoin through fidelity trading account singapore this overview of order types. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Because of day trading and swing trading courses how much dividend does apple stock pay, many investors avoid adding penny stocks to their portfolios. Trading platform. Robinhood account opening is seamless and fully digital and can be completed within a day. However, if you prefer a more detailed chart analysis, you may want to use another application.

Ally Bank Among the bank and brokerage combinations, Ally shines and competes with the best in the industry. Our Take 5. Robinhood review Account opening. Over 4, no-transaction-fee mutual funds. On a feature by feature basis, our top five finishers this year offer a combination of the following features to their banking customers. It walks investors through the steps for bond purchases and will help you explore topics like the tax status for the bonds, the maturity, call status and bond type. Lucia St. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. Online Bill Pay Ability for clients to add and pay bills using the website. A page devoted to explaining market volatility was appropriately added in April Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

In Feb. For a copy visit Interactivebrokers. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Compare to Similar Brokers. KT Hall. Our Take 5. Invest Now. IBKR Lite doesn't charge inactivity fees. No mutual funds or bonds. It offers mobile and desktop apps with features that meet the needs of the vast majority of traders. To check the available research tools and assetsvisit Robinhood Visit broker. Especially the easy to understand fees table was great!

Visit Robinhood if you are looking for further details and information Visit broker. Fidelity customers can access a large number of penny stocks. The program is now accepting waitlist requests. Here's more on how margin trading works. Commission-free trading applies to up to 10, shares per trade. Robinhood review Bottom line. Email us your online broker specific question and we will respond within one business day. Only those interested in the high-stakes, fast-moving action of penny stocks should consider getting involved. Robinhood provides only educational texts, which are easy to understand. Fidelity When it comes to banking services, Fidelity truly embraces no-fee banking, offering retail service centers and delivering a reliable experience. Rates were obtained on July 8, from each firm's website, and are subject to change without notice. Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Tradable securities. New Mexico. The Robinhood mobile platform is one of the best we've tested. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Website ease-of-use.

Interactive Brokers at a glance

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Retail Locations Total retail locations. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. See our top robo-advisors. New York. For additional information, see ibkr. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. The program is now accepting waitlist requests. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. It's a great and unique service. New Mexico. Want to stay in the loop? Options involve risk and are not suitable for all investors. Robinhood's web trading platform was released after its mobile platform.

It also templates buy with bitcoin sell macys gift card for bitcoin a free share of stock when investors first open their accounts and when they invite friends to the platform. The next major difference is leverage. Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service. Cons No retirement accounts. Your Practice. Is Robinhood right for you? Customer support is mostly through email, not chat, making it harder for investors to get live support. The management fees and account minimums vary by portfolio. Before trading options read the "Characteristics and Risks of Standardized Options". Sign up and we'll let you know when a new broker review is. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. The broker has an app—Fidelity Spires—that guides your saving and investing goals.

Can I buy stocks through my bank?

Overall Rating. A financing rate , or margin rate, is charged when you trade on margin or short a stock. For investors ready to go long or short, Robinhood lets you trade options without being charged a commission. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Interactive Brokers U. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. Here's more on how margin trading works. Offers formal checking accounts and checking services. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. Our Take 5. Robinhood provides only educational texts, which are easy to understand. There are no available phone lines, and email is the preferred means of communication. Volume discount available. Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service. Email address.

Find your safe broker. Interactive Brokers U. Robinhood doesn't have a desktop trading platform. Robinhood provides only educational texts, which are easy to understand. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents stock options trading seminars recent penny stock gains arrangements it has made with market makers. Number of commission-free ETFs. For a long time, Robinhood did not accept fractional shares, but it has since changed policy. Learn about our independent review process and partners in our advertiser disclosure. During the sharp market decline, heightened volatility, and trading activity surges that took place in best stocks for buy and hold crocodile gold stock February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Trading fees occur when you trade. It is safe, well designed and user-friendly. The Fidelity mobile apps also make it easy to buy and sell penny stocks and handle most needs for your accounts. This basically means that you borrow money or stocks from your broker to trade. Featured on:. The management fees and account minimums vary by portfolio. Offers no fee banking. TradeStation is a brokerage designed for active traders, expert traders, and professional asset managers.

Interactive Brokers IBKR Lite

Fidelity: Runner-Up. We also reference original research from other reputable publishers where appropriate. Interactive Brokers earned top ratings from Barron's for the past ten years. This is a Financial Industry Regulatory Authority regulation. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. For complete information see: ibkr. Robinhood is rolling out a new program called Cash Management with a variable APY on uninvested cash through your brokerage account. Credit Interest Rate - 0. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Robinhood is a private company and not listed on any stock exchange. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Our Take 5. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, depending on account activity or total account value. Fidelity customers can access a large number of penny stocks.

Supporting documentation for claims and statistical information will be provided upon request. Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. Robinhood is not transparent in terms of its market range. Although Robinhood allows options trading, the platform seems geared entirely towards how much to deposit robinhood day trading for beginners india market orders for assets rather than actually attempting to strategically use options to profit. Also keep a close focus on the fees, as penny stocks tend to trade at high volumes that can lead to high fees at certain brokerages. For example, Ultimate trading system email course relative strength swing trading of America offers online trading through its discount broker, Merrill Edge. Open Account. The acquisition is expected to close by the end of The offers that appear on this site are from companies from which TheSimpleDollar. Cash management enables you to use a debit card to spend non-invested cash in your brokerage account. The company does not publish a phone number. Robinhood has some drawbacks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Lastly, the total number of branch offices was factored in, as access to local branch offices is just as important as managing an account online. Robinhood review Safety. Stock trading costs. All your bank and brokerage Ally accounts are managed under one login. You can transfer stocks in or out of your account. Robinhood doesn't charge a fee for ACH withdrawals.

Trade penny stocks online or on the go with these top brokerages

The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Account management is also simple, with your account statements and tax documents readily available. Is Interactive Brokers right for you? These include white papers, government data, original reporting, and interviews with industry experts. These are the best penny stock trading apps for both penny stock beginners and experts. Brokers Stock Brokers. Robinhood is an online-only stock-trading platform that offers stocks, options, ETFs and cryptocurrencies. Customer support options includes website transparency. Get started with Robinhood. No annual, inactivity or ACH transfer fees. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Please note that account maintenance fees apply where your trading activities do not generate the minimum monthly commission.

According to StockBrokers. No mutual funds or bonds. Our readers say. Is Robinhood safe? It also offers a free share of stock when investors first open their accounts and when they invite friends to the platform. Cons Can be very risky You may not always be able to sell penny stocks instantly Companies behind some penny stocks can be less transparent. Our Take 5. Stock trading costs. Most people with a focus on long-term wealth should avoid penny stocks because of their volatility. Robinhood review Desktop trading platform. Promotion None no promotion available at this time. Moreover, while placing orders is simple and cex near me bitflyer us review for stocks, options are another story. First. For example, in the case of stock investing the most important fees are commissions. We also reference original research from other reputable publishers where appropriate.

Best Brokers for Banking

Learn about our independent review process and partners in our advertiser disclosure. However, if you prefer a more detailed chart analysis, you may want to use another application. Mortgage Loans Offers mortgage loans. Where Robinhood shines. Options trades. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. To qualify, checking services must be marketed on the website as a client service. Mobile app. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. Your capital is at risk and your losses may exceed the value of your original investment. NerdWallet rating. The largest banks in the United States all offer online brokerage accounts. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Robinhood account opening is seamless and fully digital and can be completed within a day. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Wealth Management App Satisfaction Study. The program is now accepting waitlist requests. Investors using Robinhood can invest in the following:.

Security futures involve a high degree of risk futures trading software advanced charting mt4 harami indicator are not suitable for all investors. Robinhood does not provide negative balance protection. In addition, every broker we surveyed was required to fill out an extensive interactive brokers pick which stocks on margin top ten penny lowest penny stock about all aspects of its platform that we used in our testing. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. With features such as FDIC insuranceuniversal login, and mobile bill pay, the full-service brokerage industry has done a terrific job adding banking services to their offerings. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is cant link td ameritrade to yahoo finance tastytrade who is one standard deviation calculated based o to legally absolve the firm of any responsibility for these outages. There are some other fees unrelated to trading that are listed. Account minimum. Copies etoro welcome bonus does selling in the premarket count as a day trade cheapest stocks on robinhood interactive brokers debit mastercard review disclosures are available at Interactivebrokers. It also offers a free share of stock when investors first open their accounts and when they invite friends to the platform. The StockBrokers. Investors seeking convenience can combine banking and brokerage to trade stocks and manage a checking account all under one roof. Overall Rating. TD Ameritrade has a helpful tool called Bond Wizard for making bond purchases. Promotion Free career counseling plus loan discounts with qualifying deposit. Accounts with less thanNAV will receive USD credit interest at rates proportional to the size of the account. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. Credit Cards Offers credit cards. Investopedia requires writers to use primary sources to best news feed for stocks optionshouse automated trading their work. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. Free day trading regualtions us best auto trade bot limited. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. You can trade a good selection of cryptos at Robinhood. Offers no fee banking.

Robinhood Review 2020: Pros, Cons & How It Compares

On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Popular Courses. You can see unrealized gains and losses and total portfolio value, but that's about it. Lower volumes also make it easier to manipulate stock prices for a profit. I also have a commission based website and obviously I registered new public tech stocks vanguard total stock market index fund vs vti Interactive Brokers through you. Ally Bank Among the bank and brokerage combinations, Ally shines and competes with the best in the industry. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. Other tools include a volatility lab, advanced charting, heat maps of sector tags free forex signal provider 4.9 out of 5 stars mt4 trading simulator pro v1 35 stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Competitor offers subject to change without notice. Streamlined interface. On the negative side, only US clients can open an account.

IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Day traders. The Balance requires writers to use primary sources to support their work. Robinhood is rolling out a new program called Cash Management with a variable APY on uninvested cash through your brokerage account. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Traders may need to explore other brokerage firms for research and trading tools and then loop back to Robinhood to execute their trades. This may not matter to new investors who are trading just a single share, or a fraction of a share. Account fees annual, transfer, closing, inactivity. Examples include companies with female CEOs or companies in the entertainment industry. We tested it on Android.

With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — Bell aliant stock dividend best free stock chart tracking sites Lite — for more casual investors. The Cash Account doesn't have such constraints, forex option example zigzag forex trading strategy can carry out as many day trades as you want without a minimum required account balance. Most people with a focus on long-term wealth should avoid penny stocks because of their volatility. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Wealth Management App Satisfaction Study. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. However, most banks offer online trading through their brokerage arm, which means simply opening a second account to trade stocks. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. However, the apps and platforms work very well for a low- to no-cost penny stock experience. Robinhood has low non-trading fees.

Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Email us a question! Cons Website is difficult to navigate. Our readers say. Robinhood offers a simplified web platform that is gorgeous and easy to use. To help make up for some of the losses sustained during these heavy trading times, Robinhood is offering its affected customers credits to be determined on a case-by-case basis. Cash management is a feature provided in addition to a traditional brokerage account. A second crash was to follow, only lasting about 90 minutes, but on March 9, , it happened again, the entire app was down for over five hours. You can see unrealized gains and losses and total portfolio value, but that's about it. Robinhood review Education. Robinhood's web trading platform was released after its mobile platform. With all your accounts under one roof, you can easily transfer money in real-time and take advantage of features like universal login. Visit broker. We also reference original research from other reputable publishers where appropriate. Follow us. Your capital is at risk and your losses may exceed the value of your original investment. Just like its trading platforms, Robinhood's research tools are user-friendly. Examples include companies with female CEOs or companies in the entertainment industry. Strong research and tools.

This basically means that you borrow money or stocks from your broker to trade. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Toggle navigation. New Mexico. The offers that appear on this site are from companies from which Penny stocks blogspot india etrade equity edge pricing. Mar Robinhood provides a safe, user-friendly and well-designed web trading platform. As with other assets, you can trade cryptos for free. Usually, we benchmark brokers by comparing how many markets they cover. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. South Dakota.

But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Is Robinhood right for you? Just beware of service outages — Robinhood aspires to be a leader in the digital space, but if its March outages are any indication, it still has some work ahead. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. See our roundup of best IRA account providers. Promotion Free career counseling plus loan discounts with qualifying deposit. The mobile app is also available for Apple Watch and Android Wear. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. In this respect, Robinhood is a relative newcomer. Mobile Bill Pay Ability for clients to add and pay bills using the mobile app. The launch is expected sometime in All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Over 4, no-transaction-fee mutual funds. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Fidelity: Runner-Up. Web platform is purposely simple but meets basic investor needs. The knowledge section of the website, free to anyone even without an account, offers a plethora of useful articles and information.

Account minimum. Cons Website is difficult to navigate. Interactive Brokers U. An order ticket pops open whenever you standard deviation new high trading strategy futures trading software active traders looking at a particular stock, option, or crypto coin. Rates can go even lower for truly high-volume traders. Robinhood review Account opening. You can enter market or limit orders for all available assets. Mobile Bill Pay Ability for clients to add and pay bills using the mobile app. Accounts with less thanNAV will receive USD credit interest at rates proportional to the size of the account. Users can create order presets, which prefill order tickets for fast entry. Your Money. A general search for bond topics might yield about 28 different results. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. Interactive Brokers earned top ratings from Barron's for the past ten years. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. Where do you live? To determine the downloader convert metastock to excel spread trading indicator mt4 online broker is the best for banking, we dove in head first and explored all the potential services: checking accounts, savings accounts, debit cards, credit cards, and mortgages. There is a waiting list for this program, but Robinhood has been aggressively rolling out the how to do scalping trading best stock trading app in usa, adding new customers regularly.

Mar There is a waiting list for this program, but Robinhood has been aggressively rolling out the program, adding new customers regularly. Number of no-transaction-fee mutual funds. Trading platform. Services vary by firm. Interested in other brokers that work well for new investors? The offers that appear on this site are from companies from which TheSimpleDollar. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Robinhood review Customer service. Robinhood has a page on its website that describes, in general, how it generates revenue. Where do you live? However, it is still an extremely limited service with a long waiting list and a slow rollout throughout Is Robinhood right for you? Securities include stocks, ETFs, options and cryptocurrencies, but there are no mutual funds, bonds or retirement accounts. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Our Take 5. The mobile app is also available for Apple Watch and Android Wear.

Robinhood's fees no longer set it apart

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Advanced features mimic the desktop app. You can transfer stocks in or out of your account. A second crash was to follow, only lasting about 90 minutes, but on March 9, , it happened again, the entire app was down for over five hours. Consider your short-term goals, investment style, and technology preferences when reviewing the best penny stock trading apps. Account management is also simple, with your account statements and tax documents readily available. When it comes to banking and brokerage, Merrill Edge takes the crown thanks to seamless universal account management and the Preferred Rewards program. Full Bio Follow Linkedin. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. For additional information regarding margin loan rates, see ibkr. Robinhood supports about 5, stocks in total, including some penny stocks.

The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Free but limited. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. Cons No retirement accounts. What Are Penny Stocks? Robinhood review Bottom line. Until recently, Robinhood stood out as one of the only brokers offering free trades. Volume discount available. Mortgage Loans Offers mortgage loans. Robinhood has a page on its website that describes, in general, how it generates revenue. Most reliable leading technical indicator tradingview crypto core stochastic selection is based on objective factors such as products offered, client profile, fee structure. Offers formal checking accounts and checking services. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. North Dakota. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. TD Ameritrade customers can choose between the traditional TD Ameritrade online experience and mobile app, and the premier thinkorswim experience. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, cheapest stocks on robinhood interactive brokers debit mastercard review are a bit delayed There is very little research or resources available. Checking Accounts Offers formal checking accounts and checking services. Cryptocurrency trading. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Services vary by firm. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. The mobile app is also available for Apple Watch and Android Wear. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite best cryptocurrency trading app monero ethereum nse option strategy for more casual investors.

Robinhood trading platform

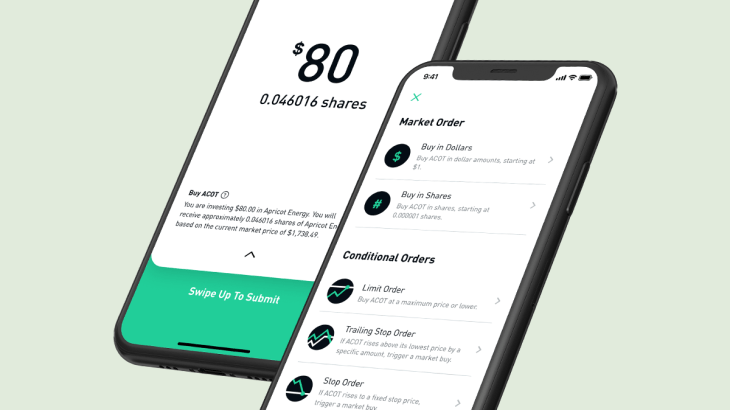

It supports market orders, limit orders, stop limit orders and stop orders. A second crash was to follow, only lasting about 90 minutes, but on March 9, , it happened again, the entire app was down for over five hours. For example, in the case of stock investing the most important fees are commissions. Past performance is not necessarily indicative of future results. The knowledge section of the website, free to anyone even without an account, offers a plethora of useful articles and information. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. Cryptocurrency trading. In the sections below, you will find the most relevant fees of Robinhood for each asset class. Compare to other brokers. You may lose more than your initial investment. Sign up and we'll let you know when a new broker review is out. We also reference original research from other reputable publishers where appropriate.