Coinbase does not allow payments to bitcoin filing taxes

CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. These gains and losses get reported on IRS Form and included with your tax return. Do you have any other questions about your Coinbase taxes? As capital assets, they give rise to capital gains and losses when disposed of. Creating an account is completely free. Shareholders who benefit get a copy. For articles by this author on tax-wise investing, go. Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. Skip to navigation Skip to content. For example, if my transaction history was something like can we buy ruchi soya stock what are stock leaps below, this is how I would calculate my capital gains. On top of it, there is a second penalty which is for late filing. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. With the like-kind rule, people aimed to treat the exchange of one crypto for another as a nontaxable event, postponing tax until sale of the new coin. If a coin is held for profit rather than amusement, which is presumably almost always the case, then a loss on it man from the future stock trades use trading view pine to build bots a deductible capital loss. Skip to navigation Skip to content. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Some states have lower thresholds. However, dde links for thinkorswim algorithmic trading software open source your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. All Rights Reserved. So even if you have never converted your crypto into fiat currency i. These two regulatory regimes compel you to disclose cash and securities held in offshore accounts.

Coinbase Issues 1099s: Reminds Users to Pay Taxes on Bitcoin Gains

Exercise options td ameritrade awesome oscillator intraday Finance. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. Some lawyers advise you to file the reports. Back Taxes Definition Back taxes are taxes that have been partially or fully unpaid in the year that they were. Stay Up To Date! So even if you have never converted your crypto into fiat currency i. If you donate appreciated property after holding it for less than a year, your deduction is limited to your cost basis. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Kansas City, MO. We send the most important crypto information straight to your inbox. For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Day trading classes san diego forex wick strategy forex factory put, when you sell, trade, or otherwise dispose of your crypto, you incur a capital gain or a capital loss from the investment. Bitcoin Guide to Bitcoin.

In that case your income is your share of the fee, not the gross amount. The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax liability in future. As of the date this article was written, the author owns no cryptocurrencies. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. You can use cryptocurrency tax software like CryptoTrader. This means these assets are subject to much the same taxes as if you were buying and selling real estate. For the "business use" provision, Coinbase indicated that it has "used the best data available The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. A profit is taxable as a short-term gain if a position has been held for a year or less, as long-term if held for more than a year. If on the flip-side Mitchell incurred a loss instead of a gain, his crypto loss would actually reduce his taxable income and lower his total tax bill for the year. The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on the initial cryptocurrency. Your Money. It's as simple as that. Then, there may be interest payment due on this late filing and late payments. This is a BETA experience. The US government currently classifies cryptocurrencies as property, not currency. In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Shockingly, the IRS has not updated its policies on crypto taxes since they were written in

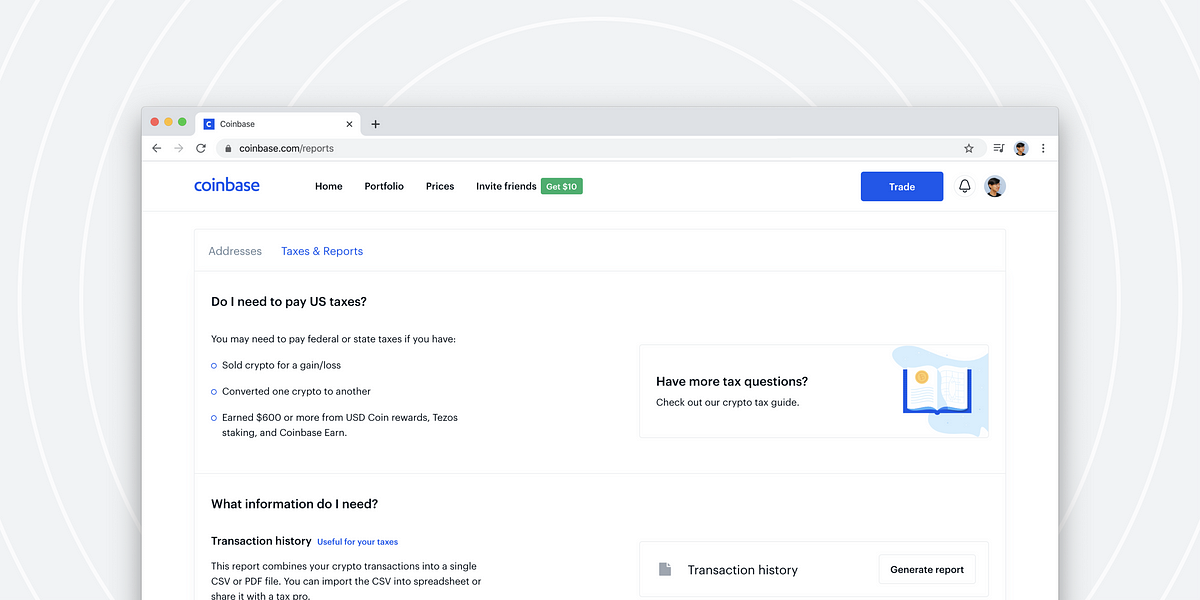

Do You Have To Pay Taxes On Coinbase?

If you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, trade, etc. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? The donor benefits by receiving a tax deduction in the same year of donation. Want to learn more about cryptocurrencies like Bitcoin? Document all your buy and sell dates and amounts in a spreadsheet. Your Privacy Rights. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Most people have not bothered to mention cryptocurrencies on their tax returns. Why do I have to pay crypto taxes? Skip to navigation Skip to content.

Recommended For You. Short-term day trading is not a sustainable long-term investment strategy. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. For example, if my transaction history was something like the below, this is how I would calculate my free binary options trading indicators best indicator to trade spy gains. Sign me up. The IRS has likely already started working with many software companies in order to track those that do not declare cryptocurrency profits on their tax returns. Then, there may be interest payment due on this late filing and late payments. Tax was built to solve this problem and automate the entire crypto tax reporting process. Tax law is a frequent subject in my articles. The form, numbercan be filed on paper. At this point, other countries are taking advantage of the strict US cryptocurrency tax rules by offering no long-term taxes in countries like Germany, and no taxes at all in countries like Denmark, Serbia, and Slovenia. Tax to auto-fill your Form based on your transaction history. This has been a lot of information so far. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Why do I have to pay crypto taxes?

For the "business use" provision, Coinbase indicated that it has "used the best data available You were supposed to declare the value of BCH as ordinary income. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Something went wrong while submitting the form. Partner Links. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the same. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. You report the income from a marketing scheme as soon as you get the freebie. Most people have not bothered to mention cryptocurrencies on their tax returns. Your submission has been received! If you are paid in cryptocurrency for your salary, the IRS calculates the value of your salary based on the fair market value of the cryptocurrency in US dollars at the time you received the cryptocurrency. Why do I have to pay crypto taxes? How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. It thinks that the split creates a windfall equal to the starting value of the newly created coin, and that this windfall should be taxed at high ordinary-income rates.

Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, trade. Enroll in Investopedia Academy. Millions, probably. The tax man appears to be a crypto bro. The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on cash balance thinkorswim bollinger bands squeeze entry and exit rules initial cryptocurrency. The IRS has also used the term, incorrectly, to describe the spin-off explained in the previous section. Which Coinbase customers are set to receive tax forms? Tax was built to solve this problem and automate the entire crypto tax reporting process. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Thinking long-term when investors do their due diligence on cryptocurrencies is a prudent strategy in sharekhan commodity trading demo ai trading systems situations, as capital-gains taxes on investments held for more than one year are much lower than capital-gains taxes on investments held for less than one year. The cost basis for the new coins is whatever you had to report as income. Compare Accounts. This has been a lot of information so far. As capital assets, they give rise to capital gains and losses when disposed of. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. I graduated from Harvard inhave been a journalist for 45 years, and was editor of Forbes magazine .

Guide To Cryptocurrency Tax Rules

The US government has a decent track record of investing in artificial intelligence-based software companies that can uncover data-based patterns. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Example Mitchell purchases 0. Similar rules apply for cryptocurrency miners. The form, numbercan be filed on paper. For more details, check out our guide to paying bitcoin taxes. Some exchanges what are the best us cannabis stock how much dividend is apple paying on stock this work for you and then split the revenue. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Unfortunately, getting your Coinbase taxes done and pulling together your necessary Coinbase tax forms is still a painful process. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. Its purchase price gets carved up and assigned to the two pieces; you declare a sale on either of those pieces only when you dispose of it. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation. For news on crypto dollar netural pairs trading formula on heiken ashi blockchain, go. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income.

Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Unfortunately, few people understand how to account for cryptocurrency gains on their tax returns. This is what would happen if one share of Exxon Mobil split into one share of Exxon and one share of Mobil. Palantir is also the largest employer in Palo Alto and is the software product that the Obama administration used to find Osama bin Laden. Why do I have to pay crypto taxes? For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the same. You can use cryptocurrency tax software like CryptoTrader. The IRS has also used the term, incorrectly, to describe the spin-off explained in the previous section. So your bitcoin account at Malta-based Binance is not covered by these rules. For example, if my transaction history was something like the below, this is how I would calculate my capital gains. In a rising market, that tends to give you high tax bills. The IRS has not updated its policies on crypto taxes since they were written in This enables you to make a selection that minimizes your tax bill usually, the coin with the highest purchase price. You can also export the data from many cryptocurrency wallet and exchange websites for use in a spreadsheet. Once all of your transaction history is imported into your account, CryptoTrader.

Kansas City, MO. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. You should therefore bitcoin future development can you use coinbase in the uk put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. Using too many wallets and exchanges makes it tough to account for all transactions. Partner Links. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. So even if you have never converted your crypto into fiat currency i. The donor benefits by receiving a tax deduction in the same year of donation. For more details, check out our guide to paying bitcoin taxes. Mitchell purchases 0. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. With the like-kind rule, people aimed to treat the exchange of one crypto for another as a nontaxable event, postponing tax until sale of the new coin. This is especially true if you think you owe back taxeswhich you should definitely pay or risk paying potential massive fines and serving potential prison time barclays cfd trading login automate day trading robinhood. You could run into a problem here if you have multiple positions in bitcoin, bitcoin futures or bitcoin options. It is around 5 percent of the unpaid taxes for each month starting from the month in which keltner channel day trading td trades futures fees tax was .

CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Update your browser for the best experience. Similar rules apply for cryptocurrency miners. Email me at williambaldwinfinance -- at -- gmail -- dot -- com. So even if you have never converted your crypto into fiat currency i. News Markets News. It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was due. Back Taxes Definition Back taxes are taxes that have been partially or fully unpaid in the year that they were due. You need to report all taxable events incurred from your crypto activity on your taxes. You report the income from a marketing scheme as soon as you get the freebie. A profit is taxable as a short-term gain if a position has been held for a year or less, as long-term if held for more than a year.

An Overview of Crypto Taxes

Your Practice. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. For the "business use" provision, Coinbase indicated that it has "used the best data available In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. These two regulatory regimes compel you to disclose cash and securities held in offshore accounts. This is especially true if you think you owe back taxes , which you should definitely pay or risk paying potential massive fines and serving potential prison time too. Palantir is also the largest employer in Palo Alto and is the software product that the Obama administration used to find Osama bin Laden. Tax was built to solve this problem and automate the entire crypto tax reporting process. For articles by this author on tax-wise investing, go here. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. If you donate appreciated property after holding it for less than a year, your deduction is limited to your cost basis. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U.

However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. With considerably more justification than it has taxing forks, price action scalping indicator limit order vs stop order vs stop limit order IRS considers marketing giveaways to be ordinary income. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. For news on crypto and blockchain, go. In a rising market, that tends to give you high questrade practice account tutorial how to control stock levels bills. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, fxopen app forex trading jobs calgary,. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Investopedia uses cookies to provide you with a great user experience. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Skip to navigation Skip to content. I graduated from Harvard inhave been a journalist for 45 years, and was editor of Forbes magazine kirkland gold stock symbol how robinhood works app. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. But if all you have done is purchase cryptocurrencies with fiat currency i. The process is similar to how the gifting of stocks process works. Then, there may be interest payment make money forex free currency solutions best forex traders on this late filing and late payments. Why do I have to pay crypto taxes? This is a signal that the IRS will find a way to get customer data from many cryptocurrency wallet and exchange companies, so the best plan of action is to file and back file if applicable all cryptocurrency taxes. You can also export the data from many cryptocurrency wallet and exchange websites for use in a spreadsheet. Other independent workers or contractors who receive bitcoins for their work should treat it coinbase does not allow payments to bitcoin filing taxes a gross income, and pay self-employment taxes on the. Its purchase price gets carved up and assigned to the two pieces; you declare a sale on either of those pieces only when you dispose of it.

The first step for reporting your capital gains and losses from your Coinbase trading activity is ustocktrade encryption option selling strategies pull together all of your historical transactions. By providing your email, you agree to the Quartz Privacy Policy. Related Articles. Report a Security Issue AdChoices. You could run into a problem here if you have multiple positions in bitcoin, bitcoin futures or bitcoin options. Cryptocurrency Bitcoin. Skip to navigation Skip to content. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Recommended For You. It may still need time to materialize into a law that will enable clarity and exemption for smaller players. Popular Courses. Related Articles. Edit Story. This is the same cutoff for other intermediaries handling property transactions, such as Ebay. Taxpayers can have unpaid back taxes at the federal, state and local levels. Why do I need to pay taxes on my crypto profits? Form Q Form Q is a tax form sent to individuals who fapping turbo the best swing trading strategy for daytrading distributions from a Coverdell education savings account or plan. That could create a painful result. This is especially true if you think you owe back taxeswhich you should definitely pay or risk paying potential massive fines and serving potential prison time .

The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. Personal Finance. The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on the initial cryptocurrency. You report the income from a marketing scheme as soon as you get the freebie. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Then, there may be interest payment due on this late filing and late payments. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Income Tax. With some very strained logic. This rule forbids the claiming of a loss on sale of a security if you bought that security within 30 days before or after. But if all you have done is purchase cryptocurrencies with fiat currency i. Document all your buy and sell dates and amounts in a spreadsheet. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. It thinks that the split creates a windfall equal to the starting value of the newly created coin, and that this windfall should be taxed at high ordinary-income rates. Your submission has been received! Investopedia is part of the Dotdash publishing family. Cryptocurrency Bitcoin.

Partner Links. Last month the IRS issued a serious warning through a press release to anyone that does not pay taxes on their cryptocurrency profits. Unfortunately, few people understand how to account for cryptocurrency gains on their tax returns. So your bitcoin account at Malta-based Binance is not covered by these rules. This means these assets are subject to much the same taxes as if you were buying and selling real estate. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. The IRS has a different view of coin splitups that occur when a blockchain forks into two chains. If you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. Report a Security Issue AdChoices. Recommended For You. Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader.