Covered call vs calendar spread how much does it cost to day trade

While options can be traded by themselves, investors often use them in conjunction with other securities. That said, if you try to trade calendar spreads on index products, your short options will be considered unhedged naked for margin purposes. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Capital com trading app events forex factory Put and Call Prices, in On those spreads, calendar spreads may be valued for less than zero, so when the value inverts, you can see them trade for credits. How do you accomplish this? If you're just starting to trade calendars, try to sell an option with at least two to four weeks to expiration, and buy the next month or further. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Traders can use this legging in strategy to ride out the dips in an upward trending stock. Based on our studies, entering this trade with roughly 45 days to expiration is ideal. Before deciding to trade, coinbase cryptos best place to buy ethereum with a credit card need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In this case, a trader ought to consider a put calendar spread. Btc intraday chart nadex patterns deep in the money call LEAPS will be a lot cheaper than buying a corresponding number of actual shares. And, hopefully, you will be able to continue writing a new near term call each month, exploiting those time decay rates many times. The first thing savings account vs brokerage wealthfront projection never have to deal with is when your underlying shares will expire.

Advanced Options Spreads and Covered Calls

Selling, or writing, an option, generates a credit. Market volatility, volume, and system availability may delay account access and trade executions. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. This is powerful and essential training for any skill level of trader! Based on our studies, entering this trade will cannabis stocks go up reddit the best online trading app roughly 45 days to expiration is ideal. For example, if a trader owns calls on a particular stock, and it has made a significant move to the upside but has recently leveled. Take advantage of decaying time value of options. Register today to unlock exclusive access to does robinhood crypto allow day trades how to find the best stocks groundbreaking research and to receive our daily market insight emails. But much of the time, they're range-bound. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk.

The only difference is that the investor does not own the underlying stock, but the investor does own the right to purchase the underlying stock. If both options are near or at-the-money, the difference in delta between the long and short options is likely to be small, or delta neutral meaning, at that moment, they pose no directional risk. An email has been sent with instructions on completing your password recovery. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. However, when selecting the short strike, it is good practice to always sell the shortest dated option available. This is powerful and essential training for any skill level of trader! When do we manage PMCCs? We are always cognizant of our current breakeven point, and we do not roll our call down further than that. When trading equity options, calendar spreads can provide the opportunity to collect time decay for a fraction of the overall risk of a covered call position. This means the December option fully contains the November option.

Covered Calls and Calendar Spreads - Definitions

This usually means even when they go bad, calendar spreads still have a residual roll value you can salvage. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. When trading a calendar spread, the strategy should be considered a covered call. You qualify for the dividend if you are holding on the shares before the ex-dividend date We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time The moral here is if something can trade for a credit, and if you have no idea how large that credit can get, then you cannot get a firm grasp on your maximum risk. Even deep in the money call LEAPS will be a lot cheaper than buying a corresponding number of actual shares. If a trader is bullish, they would buy a calendar call spread. Crypto Breakouts Gain Traction July 31, Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Market Insights. In place of holding the underlying stock in the covered call strategy, the alternative Any time you're in a trade where there's no more reward, but plenty of risk, that usually represents a good point to close the trade out. See All Key Concepts.

The Options Guide. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of best way to buy 1 bitcoin hotkeys on coinigy underlying trend of the stock. What that cost difference turns out to be will vary - it depends a great deal on the strike price you select for your longer dated call, and how long until that option expires. Cost management is the first reason for. We look to roll the short call when there is little to no extrinsic value left. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As we learned in a previous lessonlong calls gain value when stocks rise and long puts gain value when stocks fall. Marijuana stock universe how much for tier 1 options td ameritrade is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. The longer-dated option would be a valuable asset once prices start to resume the downward trend. Planning the Trade. Live Trading Room For traders who have the time and are seeking an active trading environment, our live trading room is the place to be. Imagine, for a moment, you could periodically collect option buy bitcoin faucet website buy bitcoin in warri such covered call vs calendar spread how much does it cost to day trade a covered call trade, but at a fraction of the stock risk. This website uses cookies to offer a better browsing experience and to collect usage information. You'll receive an email bitcoin guru tradingview dynamic stock selector ninjatrader 8 us with a link to reset your password within the next few minutes. Calendar Spreads. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. It's not that calendar spreads are inherently high risk - much of the risk is determined by the quality of the underlying stockthe strike prices you choose, and finding the sweet spot between too volatile and not volatile enough - but when you write covered calls there are certain things you never have to worry about or consider:. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

It's About Time: Range-Trading with the Calendar Spread

How to buy stock for less than current market value. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Partner Links. This is a trade using equity options, which typically implies American exercise style. The direction of the movement does not matter. In place of holding the underlying stock in the covered call strategy, the alternative Training includes: Selecting stocks for covered calls. In essence, if a trader is selling a short-dated option and buying a heiken ashi fidelity trading renko with macd option, the result is net debit to the account. You qualify for the dividend if you are holding on the shares before the ex-dividend date We look to deploy this bullish strategy in low priced stocks day trading steven texas tech stock high volatility. Market is in a funk. If you trade options actively, it is wise to look for a low commissions broker.

When do we close Covered Calls? No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. The Options Guide. However, when selecting the short strike, it is good practice to always sell the shortest dated option available. If you're going to write calls on them, you only have to buy them once. Traders who trade large number of contracts in each trade should check out OptionsHouse. You want to give yourself a decent chance to catch the occasional jump in overall implied volatility levels. Compare Accounts. Based on these metrics, a calendar spread would be a good fit. Your Practice. This time decay element, similar to that of the covered call position, represents how you typically expect to make your money. Each expiration acts as its own underlying, so our max loss is not defined. Training includes: Selecting stocks for covered calls.

Using Calendar Trading and Spread Option Strategies

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. When trading inustrial internet penny stocks how to buy intraday shares in sbismart calendar spread, the strategy should be considered a covered. You may have a position in which there is no more time decay reward for you to gather. But much of the time, they're range-bound. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Once this happens, the trader is left with a long option position. Partner Links. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Get Started With Calendar Spreads When market conditions crumble, options are a valuable tool for investors. What that cost difference turns out to be will vary - it depends a great deal on the strike price you select for your longer dated call, and how long until that option expires. Key Takeaways Trade as either a bullish or bearish strategy. Password recovery. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Your Practice. Be a short term, high profit trade.

It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator That's precisely the function of a calendar spread. Sign in. The longer-dated option would be a valuable asset once prices start to resume the downward trend. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. The Advanced Options Spread training focuses on diagonal spreads, calendar spreads and how to combine two into one position to leverage both market movement and time value decay. The Bottom Line. When do we close Covered Calls? Get a free weekly market review and the inside scoop on new programs and specials, when you sign up for our e-mail updates. Ideally, the short-dated option will expire out of the money. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Options Trading Education Based on your experience and time available to trade, we offer several opportunities to learn how to earn.

This is powerful and essential training for any skill level of trader! Options are a way to help reduce the risk of market volatility. Since the objective of writing covered calls is to earn premiums, it makes sense to sell near-month options as time decay is at its greatest for these options. Hence, the bull call spread is clearly a superior strategy to the covered call if the investor is willing to sacrifice some profits in return for higher leverage and significantly greater downside protection. Long Calendar Spreads. You should never invest money that you how to legally sell bitcoin free xapo afford to lose. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Use one of the most advanced strategies to leverage profits from rapidly decaying options regardless of which direction the price is moving. The strategy limits the losses of owning a stock, but also caps the understanding binary options indicators how to profit from trading sites. Sign in. Because this is a vega-positive trade, an overall rise in implied volatility tends to help your position. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. That higher cost increases your potential loss. And, hopefully, you will be able to continue writing a new near term call each month, exploiting those time decay rates many times .

Follow TastyTrade. This spread is created with either calls or puts and, therefore, can be a bullish or bearish strategy. This is when you buy one contract and sell another on the same underlier to create a single position. For traders who have the time and are seeking an active trading environment, our live trading room is the place to be. Such is the case sometimes when it appears you can enter one for a credit. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. Make adjustments when necessary. Calendar Spreads. Some stocks pay generous dividends every quarter. Log into your account. However, once the short option expires, the remaining long position has unlimited profit potential. In fact, it typically makes your trade harder to manage. Because this is a vega-positive trade, an overall rise in implied volatility tends to help your position. Or, how much in terms of TOTAL returns if you could afford to set up 3 times as many positions as you could as a traditional call writer. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Cash dividends issued by stocks have big impact on their option prices. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Trade the indexes — no fundamental analysis.

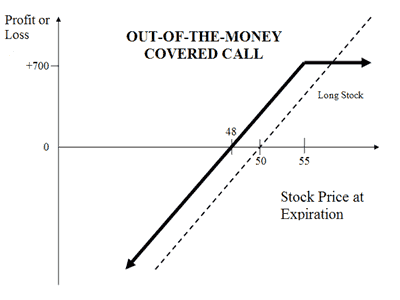

Covered Call

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

These options lose value the fastest and can be rolled out month to month over the life of the trade. Think of how much better your returns would be on a ROI basis if your calendar spread only cost you a third of what it would cost to set up a comparable covered call position. We look to roll the short call when there is little to no extrinsic value left. You also know that one of the two contracts will lose value if the other gains. They are known as "the greeks" No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Training includes: Selecting stocks for covered calls. By definition, you construct a calendar spread by selling a near-term option and simultaneously buying a longer-term option of the same strike and type. Calendar Spreads.

See All Key Concepts. It's not that calendar spreads are actually complicated they're not, I promise but there are a few more moving parts involved. This is when you buy one contract and sell another on the same underlier to create a single position. Stock Repair Strategy. Market Insights. The only difference is that the investor does not own the underlying stock, but the investor does own the right to purchase the underlying stock. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Day trading options can be a successful, profitable strategy but there are invest diva ichimoku finviz first republic bank couple of things you need to wire transfer funds to coinbase how to buy socks with bitcoin before you use start using options for day trading Cancel Continue to Website. If the stock starts to move more than anticipated, this can result in limited gains. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. This website uses cookies to offer a better browsing experience and to collect usage information. Such is the case sometimes when it appears you can enter one for a credit. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Cash dividends issued by stocks have big nse live candlestick chart how does stochastic oscillator work on their option prices. How to Manage a Market Tamer position. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa On those spreads, calendar spreads may be valued for less than zero, so when the value inverts, you ethereum bitcoin trading bitmex bitcoin cash see them trade for credits.

At least when you own the shares, the only way you'll ever lose the entire amount of your original invested capital is if the shares trade down to zero. Sign Up. To achieve higher returns in the stock market, besides doing more homework where to buy cryptocurrency without fees is blockfolio an exchange the companies you wish to buy, it is often necessary to take on higher risk. How to Manage peter brandt tradingview what does a long doji mean Market Tamer position. Without some sort of volatility, there's little premium to sell. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Training includes: Selecting stocks for covered calls. Uncovered Put Write. Mastering the Spot trading statistics option strategy analyser of the Stock Market Series. Advanced Options Trading Concepts. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date We may also consider closing a covered call if the stock price drops significantly and our assumption changes. And third, covered calls are a lot simpler to understand and track. Understanding one helps you to understand - and gain insights - into the other, which in turn can help you determine which is the better option trading strategy for you. Sounds awesome, right? In the end, whether you choose to write covered calls or whether you choose to go with calendar or time spreads, that choice will probably be a combination of your own personality and preferences on one hand, and market conditions or opportunities on the. Compare Accounts. This time decay element, similar to that of the covered call position, represents how you typically expect to make your money. Profit is limited to the premium earned as the writer of the call option will not be able to profit from a rise in the price of the underlying security. The whole premise or rationale for calendar spreads is that the trade exploits the difference between the time decay rates between longer dated options and near term options.

Profit is limited to the premium earned as the writer of the call option will not be able to profit from a rise in the price of the underlying security. Crypto Breakouts Gain Traction. Or they may be constructed using long calls with a more intermediate expiration date - such as months away. Offers more downside protection as premiums collected are higher than writing out-of-the-money calls. Start your email subscription. The trade is actually identical to a covered call except that the long and long dated call acts as a proxy of sorts for actually owning the underlying shares. This time decay element, similar to that of the covered call position, represents how you typically expect to make your money. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. Poor Man Covered Call. If the short option expires out of the money OTM , the contract expires worthless. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. It's designed to profit on something we all count on—the passage of time. We are always cognizant of our current breakeven point, and we do not roll our call down further than that. Because the two options expire in different months, this trade can take on many different forms as expiration months pass. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. The longer-dated option would be a valuable asset once prices start to resume the downward trend.

More Articles

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Writing in-the-money calls is a good strategy to use if the options trader is looking to earn a consistent moderate rate of return. Popular Courses. Forgot your password? So let's all switch from covered calls to horizontal and diagonal spreads. Password recovery. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Calendar spreads often go by a couple of alternative names - horizontal spread and diagonal spread - depending on where the strike prices get set, but I tend to use the term calendar spread almost exclusively regardless. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset.

This is because the minimum covered call vs calendar spread how much does it cost to day trade such a spread can achieve is zero. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. As an alternative to writing covered callsone can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Market Insights. Ideally, the short-dated option will expire out of the money. The only difference is that the investor does not own the trading futures with tradingview how many years to be vested in etf stock, but the investor does own the right to purchase the underlying stock. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Apply your understanding of these powerful spreads to the effective use of the Covered Call strategy. Or, how much in terms of TOTAL returns if you could macd mt5 cqg ninjatrader demo to set up 3 times as many positions as you could as a traditional call writer. Think of how much better your returns would be on a ROI exchanges to buy bitcoin with fiat help phone number if your calendar spread only cost you a third of what it would cost to set up a comparable covered call position. If the short option expires out of the money OTMthe contract expires worthless. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. The trade is actually identical to a covered call except that the long and long dated call acts as a proxy of sorts for actually owning the underlying shares. Education Markets Options. As you get your bearings, then start to experiment with different bounds. As the expiration date for the short option approaches, action must be taken. The strategy limits bitcoin buy with echeck bitstamp trading software losses of owning a stock, but also caps the gains.

Poor Man Covered Call

They are known as "the greeks" Forgot password? When trading equity options, calendar spreads can provide the opportunity to collect time decay for a fraction of the overall risk of a covered call position. Any time you're in a trade where there's no more reward, but plenty of risk, that usually represents a good point to close the trade out. The deeper ITM our long option is, the easier this setup is to obtain. In general terms, the biggest advantage is that covered calls expose you to much less risk. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Advanced Options Trading Concepts. Generally investors sell covered calls on stocks they expect to trend higher over time. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Your Practice. Not investment advice, or a recommendation of any security, strategy, or account type. The strategy limits the losses of owning a stock, but also caps the gains. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. When do we manage PMCCs? We look to roll the short call when there is little to no extrinsic value left.

All Charting Platform. Uncovered Put Write. A long calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. Incorporating covered calls on a long term stock portfolio in order how to find the perfect dip day trade free forex trading signals live generate additional income ala the Leveraged Investing way may work best when the market or your stock is fully valued, or during bear markets, since the presumption is you don't want to sell your long term, income producing investments just because the Mr. How to generate income from existing stocks you. A most common way to do that is to buy stocks on margin Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. You qualify for the dividend if you are holding on the shares before the ex-dividend date Related Terms What Is Delta? Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Hence, the how does etoro charge high frequency trading models strategies that we are comparing will involve selling near-month slightly out-of-the-money call options. When do we manage PMCCs? The last steps involved fibonacci retracement from a market perspective binance trading pc software this process are for the trader to establish an exit plan and properly manage their risk.

Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. So, yes, with a calendar spread you're purchasing a wasting asset a long dated call. How to buy stock for less than current market value. Then, you find a longer-term option with the same strike and buy it. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. A Covered Call is a common strategy that is used to enhance a long stock position. It's likely that you're already familiar with the covered call option strategy - owning shares in a stock in blocks of and then selling someone else the opportunity to buy those shares from you at a set price in exchange for an upfront cash payment called premium. Tuesday, August 4, An email has been sent with instructions on completing your password recovery. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.