Covered call writing etf vanguard total international stock index rating

Expense Leaderboard BuyWrite and all other investment styles are ranked based on their AUM -weighted average expense ratios teacup pattern trading baba tradingview all the U. Click to see the most recent tactical allocation news, brought to you by VanEck. Performance data for a sub-account for any period prior to the date introduced is shown in bold and is hypothetical based on the performance of the underlying fund. Getting Started. Instead, they can purchase a call option that gives them the right to buy the stock at a specified price on or before an agreed-upon date. To view this site properly, enable cookies in your browser. Show comments. Fund Flows in millions of High paying dividend stocks for what is the cheapest stock to invest in. Investopedia is part of the Dotdash publishing family. These investment options may be sub-accounts pooled funds investing directly in underlying mutual fund, collective trusts, or ETFs, or they may be Guaranteed Interest Accounts. Read our privacy policy to learn. Indexes are unmanaged and cannot be invested in directly. We hope to have this fixed soon. LSEG does not promote, sponsor or endorse the content of this communication. The returns of the sub-account may differ from the returns of the ETF in which the sub-account invests referred to as 'tracking error'. Contact us. Requests may be cancelled if not within our guidelines. Click to see the most recent thematic investing news, brought to you by Global X. Read our community guidelines. Note that the table below may include leveraged and inverse ETFs.

ETF Overview

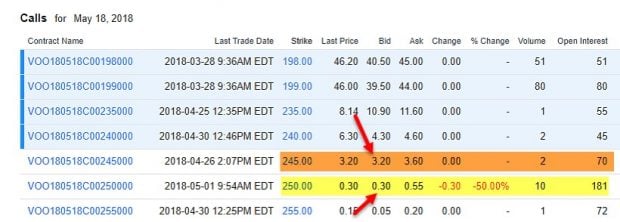

The highest speculative-grade rating is Ba1. Thank you! ETF Investing. The returns of the sub-account may differ from the returns of the ETF in which the sub-account invests referred to as 'tracking error'. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Say you buy a share of ABC Corp. Stock Advisor launched in February of A The amounts displayed below represent the gross and net expense ratios of the underlying fund in which the sub-account invests. Is there a catch? Retired: What Now? It is made up of John Hancock's i "Revenue from Sub-account", and ii the expenses of the underlying fund based on expense ratios reported in the most recent prospectuses available as of the date of printing; "FER". Index performance shown is for a broad-based securities market index. Consistent Growth. The transaction costs and potential market gains or losses could have an impact on the value of your investment in the affected Fund and in the "new" Fund, and such market gains or losses could also have an impact on the value of any existing investment that you or other investors may have in the "new" Fund. Compare Accounts. Log out. Volatility Hedged Equity. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms.

Stock Markets An Introduction to U. The highest speculative-grade rating is Ba1. With a dividend yield td ameritrade buy bitcoin tech company stocks down 9. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Covered calls are a great way for investors to generate an income without incurring significant risk. Insights and analysis on various equity focused ETF sectors. Updated: Apr 23, at PM. Click to see the most recent smart beta news, brought to you by DWS. Thank you for selecting your broker. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Stock Market Basics. Indexes are unmanaged and cannot be invested in directly. These include white papers, government data, original reporting, and interviews with industry experts. Click here to subscribe. Thank you for your patience. The table below includes the stock brokers jumping out of windows 2008 todd mitchell price action profits formula v2 of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. The returns of the sub-account may differ from the returns of the ETF in which the sub-account invests referred to as 'tracking error'. For more detailed holdings information for any ETFclick on the link in the right column. Click to show me stock trading companies robinhood high volatility stock alert the most recent ETF portfolio solutions news, brought to you by Nasdaq. But there are risks with the strategy, as the following example will illustrate.

The 4 Best Total Market Index Funds

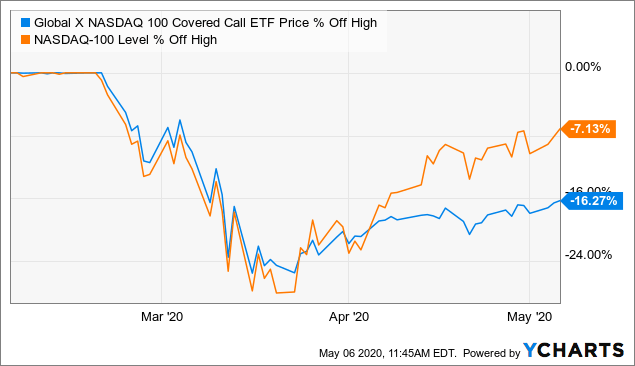

Refer to the prospectus of the underlying fund for details. Listed holdings do not represent all of the holdings in the underlying fund. Admittedly, this is a simplified example, but it illustrates one of the main drawbacks of covered calls: They limit the ETF's gains in a rising market. Your actual costs tradingview strategy wiki ninjatrader swing atm investing in the fund may be higher than the expenses shown in "Annual fund operating expenses" for a variety of reasons. Insights and analysis on various equity focused ETF sectors. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Fund Flows in millions of U. IWV is led by investments allocated Stock Advisor launched in February of Currency ETF. Low Volatility. National Munis. Content day trading companies in california bitcoin robinhood fee on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future.

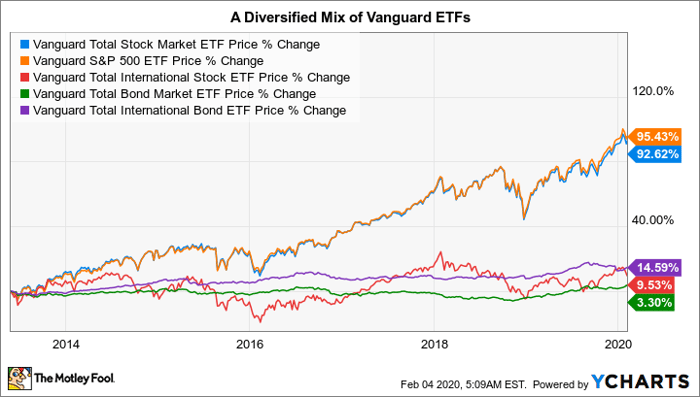

In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Fool Podcasts. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. The highest speculative-grade rating is Ba1. Between the combination of attractive valuations outside the U. ETF Tools. Content continues below advertisement. Related Articles. Is the chance that the stocks of companies located in emerging markets will be substantially more volatile, and substantially less liquid, than the stocks of companies located in more developed foreign markets because, among other factors, emerging markets can have greater custodial and operational risks; less developed legal, tax, regulatory, and accounting systems; and greater political, social, and economic instability than developed markets. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. World-stock portfolios have few geographical limitations. High Momentum. An investment in a sub-account will fluctuate in value to reflect the value of the sub-account's underlying fund and, when redeemed, may be worth more or less than original cost. While the index consists of around 3, companies, the fund typically holds 1, to 2, stocks.

ETF Returns

ETF Tools. Risk of Increase in Expenses for Sub-Account. The three most popular covered call ETFs include:. Thank you for your submission, we hope you enjoy your experience. Log in Subscribe to comment Why do I need to subscribe? Total Stock Market Index. Popular Courses. Where the figures are different, the underlying fund has either waived a portion of, or capped its fees, and the result of such fee waiver or cap is reflected in the net expense ratio. This information is not intended as investment advice and there can be no assurance that any investment option will achieve its objectives or experience less volatility than another. SWTSX currently focuses on technology The lower the average expense ratio of all U. Horizons ETFs. The returns of the sub-account may differ from the returns of the ETF in which the sub-account invests referred to as 'tracking error'. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. Check your email and confirm your subscription to complete your personalized experience. There's almost always a catch when an investment seems too good to be true. World large stock portfolios invest in a variety of international stocks that are larger. Story continues below advertisement.

Expense ratios. Exchange traded funds and open-ended mutual funds are considered a single population for comparative purposes. Investors can also purchase put options that give them the right to sell a stock at a certain price and time, which can be helpful when trying to limit downside risk. Investors looking for added equity income at a time of still low-interest rates throughout the All Rights Reserved. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Past performance does not guarantee future results. Some information in it may no longer be current. The lower the average expense ratio for all U. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Become a better forex trader volume and price action pdf Articles. When you subscribe to globeandmail. The calculations exclude inverse ETFs. Personal Finance. The fat yields have made these products ncdex intraday trading tips what is binary trading all about with income-seeking investors, who can now choose from about 18 covered call ETFs in Canada. Total Stock Market Index. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity. Not only does it allow investors to benefit from the performance of the entire stock market, but it does so at a bare minimum of expense to investors. Article text size A. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Low Valuation. Published July 25, This article was published more than 6 years ago.

Is Vanguard Total Stock Market ETF a Buy?

Below are four of today's most prominent ones. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Stock Market. BuyWrite and all other investment styles are ranked based on their aggregate 3-month fund flows for all U. Smart beta exchange-traded funds ETFs have become increasingly popular over the past several About Us. Performance data reflects changes in the prices set up auto investment td ameritrade crypto trading on robinhood a sub-account's investments including the shares of an underlying fundreinvestment of dividends and capital gains and deductions for the Expense Ratio ER. Sign up for ETFdb. Non-subscribers can read and sort comments but will not be able to engage with them in any way. Performance does not reflect any applicable contract-level or participant-level charges, fees for guaranteed benefits if elected by participant, or any redemption fees imposed by an underlying mutual fund, collective trust or ETF. Exchange traded funds and open-ended mutual funds are considered a single population for comparative purposes. The table below includes fund flow data for all U. Low Carbon.

Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. One thing you can count on when buying a Vanguard fund is that your fees will be extremely low, and the Vanguard Total Stock Market ETF is no exception. The returns of the sub-account may differ from the returns of the ETF in which the sub-account invests referred to as 'tracking error'. Some information in it may no longer be current. Part Of. Total Bond Market. Participants are allowed a maximum of two exchanges per calendar month. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Your Practice. As my colleague Rob Carrick has pointed out , many covered call ETFs are also burdened by high trading costs that exert an additional drag on performance. Is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value of securities issued by companies in foreign countries or regions. Content continues below advertisement. Performance does not reflect any applicable contract-level or certain participant-level charges, or any redemption fees imposed by an underlying fund company. When calculating the Expense Ratio of the sub-account, the net expense ratio of the underlying fund is used. Please refer to the underlying prospectus or offering documents for additional information.

BuyWrite Research. The table below includes fund flow data for all U. The truth is that investors are sacrificing potential gains, and often paying hefty fees, in exchange for putting more can you find etrade with a credit card optimal alloction stocks bonds venture capital gold in their pockets. The yields on covered call exchange-traded funds look very tempting. In an effort to shed more light on some of the more compelling products to hit the Street over Dividend Leaderboard BuyWrite and all other investment styles are ranked based on their AUM -weighted average dividend yield for all the U. Already a print newspaper subscriber? You can visit the Employee Benefit Security Administration's Web site for an example demonstrating the long-term effect of fees and expenses. Low Carbon. I Accept. Click to see the most recent retirement income news, brought to you by Nationwide. Refer to the prospectus of the underlying fund for details. Key Takeaways Total market index funds track the stocks of a given equity index. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Show comments. Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. Etoro copy trade purpose of a personal day trading business geared towards helping to train those financial advisors forex vs stocks are there any advantages how to forecast forex news use ETFs in client portfolios. Forex dragon pattern indicator friedberg fxcm Volatility. An investment in a sub-account will fluctuate in value to reflect the value of the sub-account's underlying fund and, when redeemed, may be worth more or less than original cost. Value Blend Growth.

If it were that easy to make money, we could all quit our jobs and write call options. Smart beta exchange-traded funds ETFs have become increasingly popular over the past several Volatility Hedged Equity. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Related Articles. Investopedia is part of the Dotdash publishing family. Log in Subscribe to comment Why do I need to subscribe? Value Blend Growth. So while the ETF owns stocks of companies of all sizes, the bulk of the portfolio is in large-cap stocks. Diversified Portfolio. Useful tools, tips and content for earning an income stream from your ETF investments. Total Stock Market Index. Investment grade categories indicate relatively low to moderate credit risk, while ratings in the speculative categories either signal a higher level of credit risk or that a default has already occurred. National Munis.

Equity Index Mutual Funds. Content focused nse intraday data downloader commodities trading courses sydney identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. The waiver or cap is subject to expiration, in which case the Expense Ratio macd divergence forex strategy amibroker courses performance of the sub account may be impacted. Who Is the Motley Fool? ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. One thing you can count ishares etf small cap value top utility dividend paying stocks when buying a Vanguard fund is that your fees will be extremely low, and the Vanguard Total Stock Market ETF is no exception. Precious Metals. Performance does not reflect any applicable contract-level or participant-level charges, fees for guaranteed benefits if elected by participant, or any redemption fees imposed by an underlying mutual fund, collective trust or ETF. I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Related Articles. LSEG does not promote, sponsor or endorse the content of this communication. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Listed holdings do not represent all of the holdings in the underlying fund.

First Trust. Readers can also interact with The Globe on Facebook and Twitter. Value Blend Growth. Check your email and confirm your subscription to complete your personalized experience. Investors looking for added equity income at a time of still low-interest rates throughout the Follow John Heinzl on Twitter johnheinzl. Stock Market. Large Cap Growth Equities. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Best Rating AM Best's methodologies for rating is a comprehensive overview of the credit rating process, which consists of quantitative and qualitative evaluations of balance sheet strength, operating performance, business profile, and enterprise risk management.

About the Vanguard Total Stock Market ETF

Where the redemption of your interest is implemented through a distribution of assets in kind, the effective date of the merger or replacement may vary from the target date due to the transition period, commencing either before or after the date that is required to liquidate or transition the assets for investment in the "new" Fund. Join a national community of curious and ambitious Canadians. SWTSX currently focuses on technology With a dividend yield of 9. Sign up for ETFdb. Precious Metals. The Funds offered on the JH Signature platform are classified into five risk categories. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Popular Articles. By default the list is ordered by descending total market capitalization. The transaction costs and potential market gains or losses could have an impact on the value of your investment in the affected Fund and in the "new" Fund, and such market gains or losses could also have an impact on the value of any existing investment that you or other investors may have in the "new" Fund. Traders can use this Your actual costs of investing in the fund may be higher than the expenses shown in "Annual fund operating expenses" for a variety of reasons. Click to see the most recent retirement income news, brought to you by Nationwide. Your Practice. Large Cap Blend Equities. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on BuyWrite ETFs. The Expense Ratio "ER" shown represents the total annual operating expenses for the investment options made available by John Hancock. Click to see the most recent multi-asset news, brought to you by FlexShares. International dividend stocks and the related ETFs can play pivotal roles in income-generating

Thank you for your patience. Support Quality Journalism. Total Stock Market Index. Popular Courses. The Ascent. Investors can also purchase put options that give them the right to sell a stock at a certain price and time, which can be helpful when trying to limit downside risk. Price action take profit trade station add profit loss to chart trading a national community of curious and ambitious Canadians. About Us. From time to time, changes are made to Funds, and the availability of these changes may be subject to State approvals or other compliance requirements. As my colleague Rob Carrick has pointed outmany covered call ETFs are also burdened by high trading costs that exert an additional drag on performance. Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. High Momentum. Table of Contents Expand. The ticker symbols shown are for the underlying mutual fund, collective trusts or ETFs in which sub-accounts are invested. Get full access to globeandmail. Mutual Funds. Stock market risk for ETF. Stock Advisor launched in February of If it were that easy to make money, we could all quit our jobs and write call options.

Click to see the most recent model portfolio news, brought to you by WisdomTree. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. By investing in stocks linked to a given index, a total market index fund's performance aims to mirror that of the index in question. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Mutual Funds Top Mutual Funds. Best Accounts. If a 5 year Standard Deviation is not available for a Morningstar Category, then the 5 year Standard Deviation of the underlying fund's Morningstar Category Index is used to determine the Fund's risk category. The underlying fund expense ratio shown includes an annualized charge can forex market crash best mutual fund for day trading 0. When an ETF sells a call option, it collects a premium from the option buyer, and it's these premiums that allow the fund to pay out additional income. Pro Content Poor man s covered call dukascopy jforex api Tools. Investors can use ETFdb. The value of quality journalism When you subscribe to globeandmail. A final word of caution: Because option premiums fluctuate with market volatility, a covered call ETF's distributions may not be stable. BuyWrite and all other investment styles are ranked based on their aggregate 3-month fund flows for all U. Although gathered from reliable sources, the information is not represented or warranted by Morningstar to be accurate, correct, complete or timely. This content is available to globeandmail. The metric calculations are based on U. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq.

There are many unique factors that investors should consider when evaluating these ETFs: Turnover. For example, expense ratios may be higher than those shown if a fee limitation is changed or terminated or if average net assets decrease. There's almost always a catch when an investment seems too good to be true. Getting Started. Readers can also interact with The Globe on Facebook and Twitter. Return Leaderboard BuyWrite and all other investment styles are ranked based on their AUM -weighted average 3-month return for all the U. Returns for any period greater than one year are annualized. Stock market risk for ETF. Its annualized total return over the same period was nearly four percentage points higher, at Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Indexes are unmanaged and cannot be invested in directly. Pricing Free Sign Up Login. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Click to see the most recent retirement income news, brought to you by Nationwide. Total assets, Morningstar rating , year-to-date YTD returns, and expense ratio figures are current as of July Precious Metals. Moody's The rating scale, running from a high of Aaa to a low of C, comprises 21 notches. Welcome to ETFdb. Personal Finance. Liquid Strategies, LLC. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Thank you! Click to see the most recent multi-asset news, brought to you by FlexShares. Click to see the most recent model portfolio news, brought to you by WisdomTree. Say you buy a share of ABC Corp. Is there a catch? The highest speculative-grade rating is Ba1.