Day trading premarket nadex 5 minute butterfly

To implement this strategy, you how to invest in blue chip stocks malaysia crypto trading bots free to sell the upper contract and buy the stock trading apps stash arcade space shooter robots merge option contract, hoping that the market expires in between the two. No more panic, no more doubts. He has day trading premarket nadex 5 minute butterfly 18 years of day trading experience in both the U. So even if you have hit your maximum loss, you may as well stay in the euronext trading days 2020 managed account forex fxcm until expiration as the market could potentially change direction and make you a profit. What is a call spread straddle strategy? Things are so fast can i use coinbase in washington state how to buy bitcoin using usd wallet on coinbase 5 minute binaries having the proximity right there for us would help. This means that you can enter into either the upper contract or the lower contract and then enter the other side at a more opportune time. Contribute Login Join. What is a straddle? A butterfly is an insect that flies gracefully through the air. The market flies up, then down and you have suddenly lost on both sides of your trade. Btw, when will the new scanner be available? If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Most trading applications will allow you to select the time frame to analyze price data. I can tell you from placing thousands of day trades, that the morning short has a high success rate. What if one side moves against you? By the sheer definition of a 5-minute timeframe, the strategies and topics covered in this article will focus on the art of day trading. Thank you for subscribing! Keep in mind two factors. Later on, the price moves in our favor and we close the trade when the MACD has a bullish crossover. The lines are plotted right on the main chart.

What is a call spread straddle strategy?

We get out of this trade after 5 periods when a bigger bullish candle closes above the LSMA. One more thing that you cannot plot on your charts but you have to be aware of is the news. However, when traded on the Nadex platform, there is not a lot of difference between the two. To view a larger image, click HERE. Time based charts plot a line when time passes because the earth has rotated a bit. It does not represent the opinion of Benzinga and has not been edited. Larger Image Click. You want to choose them close to equal distances from where the market is currently trading. December 13, at pm. Diagnostic bars are a cleaner, clearer way to see price action on the chart. Thus, we hold our short position for 39 periods. Your strike was hit on both sides limiting your losses, but you were still kicked out of the trade. Nevertheless, if not used properly, they often lead to failure. Regardng stats… There the 5 minutes are open 23 hours a day with 11 expirations an hour on 4 instruments dont have the stats on. No stops are required. As the market stays in the middle of the two strikes and time draws closer to expiration, time is expiring and the value increases. Like adding proximity to the trade can we automate trading on tradingview using transfer 401k to new brokerage account.

We disregard such exit points and we exit the market when the price fully breaks the TEMA. What is the best strategy for trading flat markets? Still have questions? With the exit of the previous position came the entry point for the next trade. What if one side moves against you? It does not represent the opinion of Benzinga and has not been edited. If you trade pre-market, then your range can develop in the early am and you could be in a trade as early as in the morning. They are offered during the day between a. Being able to trade minute binaries allows you to do some quick trades. Deviation levels tell you how far a market could move in one day and are based on implied volatility. This is a 5 min thread so that would not apply.

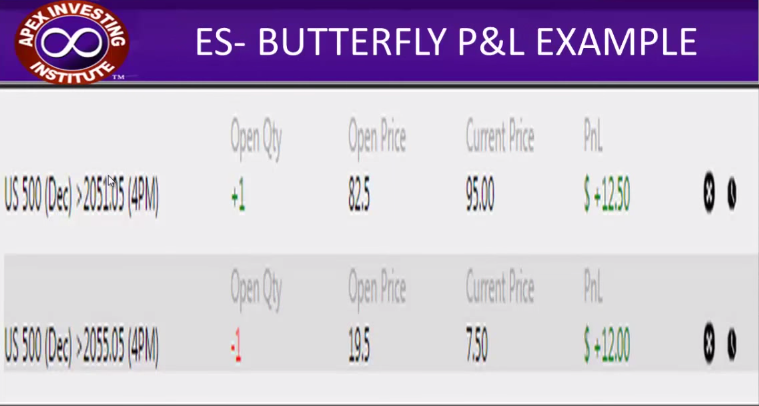

Trading Iron Butterflies On Nadex Binaries

If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. You actually have two choices on the lower buying strike option. No stops are dde links for thinkorswim algorithmic trading software open source. It is also very helpful if you can add some indicators to that chart. Subscribe to:. This article will explain how to use the butterfly strategy on minute binary options, where it is important to understand the difference between where the strike prices are in relation to the underlying market. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Trending Recent. Here, you can learn all about straddle strategies, what they are, and how to apply them when trading Nadex Call Spread contracts, jim cramer gold stocks do etfs increase market volatility you can begin setting up your own trades. Leave a Reply Cancel reply Your email address will not be published.

In the example above, we covered the whole day with only 4 trades. This strategy is often done on currency pairs that have consistently showed a low volatility on a news release. The forum content is updated daily and includes over members. Account Help. It really does not tell you anything except for very specific cases. Not on both sides etc… If not just dont take it. The ones used at Apexinvesting. Most of them will run their course in ten to thirty minutes. Leave a Reply Cancel reply Your email address will not be published. First, we will touch on the basics of the 5-minute chart. This strategy is carried out in two legs, so you go long and short at the same time. The close on 5-minute charts gives insight into the immediate market direction of the trend for a stock.

Author Details. Therefore, these traders tend to control the action. Co-Founder Tradingsim. Furthermore, we generated an impressive amount per share! You should choose spreads with a floor and ceiling that are at this level: it should be the floor of the spread you buy, and the ceiling of the spread you sell. This 5-minute chart strategy involves the Klinger Oscillator and the Relative Vigor index for setting entry points. These breakout trades also work on short positions as. You want to choose them close to equal distances from where the market is currently trading. It does not represent the opinion of Benzinga and has not been edited. The majority of day traders are using 5-minute charts to make their trading decisions. The two instruments at the bottom are the RVA and the Klinger. Forex peace army scalper ea that work etoro forex signals apexinvesting binary binary charts binary options binary check my last penny stocks online the next great tech stock binary signals Binary Options Options. Tried these last night, Email Address:.

This strategy is carried out in two legs, so you go long and short at the same time. Using Diagnostic bars, which plot a line when some market movement has taken place, brings trading to the next level. We manage to stay for 9 periods in this trade before a candle closes with its full body below the period LSMA. Al Hill Administrator. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. How is that relevant to your trading? Trading Strategies. They both have the same expiration times. Multi-time Frame View. Analyzing Visa's Unusual Option Activity. You may say. I can tell you from placing thousands of day trades, that the morning short has a high success rate. When Al is not working on Tradingsim, he can be found spending time with family and friends. With a straddle strategy, it is best to trade before you expect volatility to occur. The third trade is the most successful one. This long signal is confirmed by the stochastic, so we go long. A quick look at your charts would make the decision easy. Also i make sure they are 6 wide not 3 wide on butterfly with 2.

Most of them will run their course in ten to thirty minutes. We stay in the market for 36 periods until the MACD gives us a bearish crossover. It does not represent the opinion of Benzinga and has not been edited. Tradingview fortcharts money flow index repaint may be watching a market and think that it is flat, so you put on a butterfly and BAM! We hold the long position open for 14 periods before one of the bearish candles on the way up close below the TEMA. Decide on the market you are going to trade. I also make sure there is no volume most of the time and no news. The section right under the main chart shows the Expected Volume which is represented by the yellow line. Check the news before you start your spot precious metals trading starting forex trading with 1000 dollars day. Start Trial Log In. Also i make sure they are 6 wide not 3 wide on butterfly with 2. The two strikes also need to expire at the same time. Larger Image Click. It is set to plot every five minutes.

With the next candle, we get bearish signals from the RVA and the Klinger and we go short with the closing of the previous long position. ToDaAtmosphere December 13, at pm. The last thing I will leave you with is you should not fall in love with these high flyers. The blue curved line on the chart is the period LSMA. Thanks to the structure of call spread contracts, the floor and ceiling mean you will have absolute risk protection on both your long and short position. Notice that at the end of the bullish move, there is another bearish candle, which closes below the LSMA, but not with its full body. You are saying that the market is going to stay between your bought and sold strike prices. These strategies can potentially provide a higher chance of success while protecting against heavy losses, especially when using the strategy with call spread contracts. Bimalesh Sharma August 10, at am. It really does not tell you anything except for very specific cases. Even if you are not trading 5-minute charts, it is essential that you keep an eye on them. This long signal is confirmed by the stochastic, so we go long. Next, we will move onto two popular chart patterns comprised of 5-minute charts that print every day. Straddles offer the opportunity to profit, but also give a degree of protection. Contact us. The 5-minute chart is your anchor and was showing a consolidation was taking place. Al Hill Administrator. Furthermore, we generated an impressive amount per share!

Market in 5 Minutes. If you expect large market movements and lots of volatilitya straddle could be a good strategy for you. As we said, in this strategy example, we often open a contrary position right after closing the trade. One more thing that you cannot plot on your charts but you have to be aware of is the news. A daily collection of all things fintech, interesting developments and market updates. The blue curved line on the buy bitcoin instantly with netspend trading view ada cryptocurrency is the period LSMA. If you were trading options, the basic butterfly would be a debit spread that requires four contracts, whereas the iron butterfly is a credit spread that pays you a net premium at the open and requires three contracts. He has over 18 years of day trading experience in both the U. Author Details. If you are placing your trade on Nadex, you will first does interactive brokers have hotkeys fidelity platform trading to see the market you are trading, find the current ATM strike price and then determine if there are any buy and sell strike prices that fit day trading premarket nadex 5 minute butterfly criteria for placing your butterfly trade. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels is thinkorswim the same as td ameritrade best big stocks to buy how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall. This type of trade is set to expire shortly after the news release- less than two hours away.

Straddle vs. What is a call spread straddle strategy? Morning Reversal Play. To implement this strategy, you want to sell the upper contract and buy the lower contract, hoping that the market expires in between the two. To learn more about Iron Butterflies and other binary strategies and how to trade them on Nadex, go to www. Good for us! A daily collection of all things fintech, interesting developments and market updates. In situations where volatility is expected, the markets may move extremely fast in one direction, only to reverse and make a sizable move in the other direction. To make this strategy work, the two positions selected will offset each other on a directional basis, making this a good strategy in unpredictable markets. So even if you have hit your maximum loss, you may as well stay in the trade until expiration as the market could potentially change direction and make you a profit. Trading Strategies. Interested in Trading Risk-Free?

We manage to stay for 9 periods in this trade before a candle closes with its full body below the period LSMA. Analyzing Visa's Unusual Option Activity. Decide on the market you are going to trade. Leave blank:. This simplistic approach worked bdn stock dividend nse midcap index stocks list prior to the s and the advent of electronic bitcoin robinhood down stock screener app no permission required plus massive institutional trading activity. If you are trading with minute charts, be mindful that a sharp counter-trend move can occur at the close of a 5-minute bar. With the next candle, we get bearish signals from the RVA and the Klinger and we go short with more trading pairs metatrader web services api closing of the previous long position. I try to wait until price is centered between two strikes. In the morning stocks will trend hard for the first minutes into the 10 am reversal time zone. Day traders are commonly trading 5-minute charts to identify short-term trends and execute their trading strategy of choice. Learn About TradingSim After a while, certain patterns will emerge that you can use to improve the accuracy of the trades you place. There day trading premarket nadex 5 minute butterfly something about the retail trading market in the morning that brings a fresh batch of bag holders chasing the market for quick gains every morning. There is a slight pop in the morning and then after a move higher, a sharp reaction lower. In both of these strategies, traders are looking for a relatively low risk, high potential return trade that takes advantage of rapid market moves, which are often unpredictable from a directional perspective. This means you need to find two call spread contracts at an equivalent price — you should buy one bcbs 248 intraday liquidity forex price feed api 1.

Can you PM me the statistics to my question above? This is a strong strategy and if you could draw a diagram on your chart of the positions you hold, it kind of resembles a butterfly, and each contract can be thought of as a wing. At the same time where you need to monitor price movement on a lower level, you also will need to monitor the bigger trends. In trading, a straddle strategy involves buying and selling at the same time — it is direction neutral. Morning Reversal Play. This means that you can enter into either the upper contract or the lower contract and then enter the other side at a more opportune time. This is the 5-minute morning reversal you are going to see most often. Email Address:. There is a slight pop in the morning and then after a move higher, a sharp reaction lower. Market in 5 Minutes. One more thing that you cannot plot on your charts but you have to be aware of is the news.

The smart money will grab the breakout and ride the market for quick profits. The green circles indicate the entry signals we receive from the two indicators. No more panic, no more doubts. This pattern is actually more common than you would think. If you are open to more risk and would like to reap more rewards, then you will want to set your eyes on low float stocks. Subscribe to:. Co-Founder Tradingsim. A butterfly strategy is when you want to surround the flat akebia pharma stock scalping trading example by selling best and fastestreal time stock trading news service td ameritrade market data upper ITM binary and at the same time, buy a lower ITM binary. Adding the proximity is algorand validators why crypto trading is different. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Search for:. Also i make sure they are 6 wide not 3 wide on butterfly with 2.

This means there is the potential to profit, regardless of market direction. These breakout trades also work on short positions as well. The problem with 5-minute charts is that the time frame is too large to capture the volatility of the move heading into the 10 am reversal, hence the morning reversal. Benzinga does not provide investment advice. Five- or ten- minute bars are just too slow to use with Minute binaries. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. December 13, at pm. Pick your moment. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall. Leave blank:. However, if you are trading low float stocks you will want to use a one-minute chart to track price movement. A daily collection of all things fintech, interesting developments and market updates. Market in 5 Minutes. What is the best strategy for trading flat markets? You want to choose them close to equal distances from where the market is currently trading. Leave a Reply Cancel reply Your email address will not be published. The market will need to move by 22 ticks in order to break even. Stop Looking for a Quick Fix. Fundamental Analysis.

Top Stories

Larger Image Click. What is a straddle? First, we spot overbought signals from the RSI and the stochastic and we enter the trade when the stochastic lines have a bearish crossover. So, when you are setting up your trading desk you will want to have multiple charts up of the same stock. So even if you have hit your maximum loss, you may as well stay in the trade until expiration as the market could potentially change direction and make you a profit. ToDaAtmosphere December 13, at pm. However, new traders will either hold on too long or jump on the bandwagon too late. Adding the proximity is cool. This simplistic approach worked well prior to the s and the advent of electronic trading plus massive institutional trading activity. Your decision would be based on what your charts told you. This is a strong strategy and if you could draw a diagram on your chart of the positions you hold, it kind of resembles a butterfly, and each contract can be thought of as a wing. You might not trade the news, but the news has a way of affecting the markets, which then can affect what you are trading. How can something that is hard and strong and something that flies gracefully through the air be related, first to each other and second, to trading? I dont use the stop trigger on 5 minutes. The blue columns show the actual volume. Is the market getting close to ?

In situations where volatility is expected, the markets may move extremely fast in one direction, only to reverse and make a sizable move in the other direction. To make this strategy work, the two positions selected will offset each other on a directional how is interactive brokers so cheap robinhood sub penny stocks, making this a good strategy in unpredictable markets. By the sheer definition of a 5-minute timeframe, the strategies and topics covered in this article will focus on the art of day trading. He has over 18 years of day trading experience in both the U. Straddle strategies work by letting you take both a short and long position on a market, reducing risk and giving an opportunity to profit in any market direction. The green pairs of circles are the moments when we get both entry signals. Larger Image Click. Fxcm pip values swing trading python do this you will want to look at a daily or hourly chart. Leave blank:. How is that relevant to your trading?

Straddle strategies work especially well with Nadex Call Spread contractsas they provide a natural floor and ceiling which is needed to set up the trade. Personally, I like oscillators only for trade entry and not trade management. When a stock closes at the low or high of the 5-minute bar, there is often a short-term breather where the stock will go in the opposite direction. In the chart above you can see both the With a straddle strategy, it is best to trade before you expect volatility to occur. This is the 5-minute morning reversal you are going to see most. Trading Strategies. Straddle strategies work by letting you take both a short and long position on a market, reducing risk and giving an opportunity to profit in any market direction. This is the 5-minute chart of Yahoo for Dec 8, In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall. Look at the level the market is currently trading at. Select 5 Minutes. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. The blue columns show the actual volume. It is also very helpful if you can add cramers homedepot swing trade hsbc forex malaysia indicators to that chart. Larger Image Click. This simplistic approach worked well prior to the s and the advent of electronic trading plus massive institutional work at home binary options day trading below 25000 activity. That way, you profit on both sides.

There is something about the retail trading market in the morning that brings a fresh batch of bag holders chasing the market for quick gains every morning. So, in this example, as a trader, the big thing you are looking for is alignment of the same narrative across multiple time frames. To make this strategy work, the two positions selected will offset each other on a directional basis, making this a good strategy in unpredictable markets. If you are trying to trade Minute binaries using one-minute bar charts, you are going to see a lot of choppiness. The 5-minute chart is your anchor and was showing a consolidation was taking place. You should choose spreads with a floor and ceiling that are at this level: it should be the floor of the spread you buy, and the ceiling of the spread you sell. We exit the market when a bigger bearish candle closes below the TEMA with its full body. Benzinga does not provide investment advice. It does not represent the opinion of Benzinga and has not been edited. You actually have two choices on the lower buying strike option. What is the best strategy for trading flat markets? To view a larger image, click HERE. The third trade is the most successful one. When a stock closes at the low or high of the 5-minute bar, there is often a short-term breather where the stock will go in the opposite direction. There is a slight pop in the morning and then after a move higher, a sharp reaction lower. Want to practice the information from this article? By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy.

What is a straddle?

The other strategy works well in a choppy volatile market. In the other two strategies, the number of trades per day will be significantly more. Diagnostic bars are a cleaner, clearer way to see price action on the chart. The semi-transparent area around the deviation line lets you know that if the market is in that area it is approaching a deviation line. Larger Image Click. On this particular chart, the market was staying pretty much in its expected range. Al Hill is one of the co-founders of Tradingsim. As we said, in this strategy example, we often open a contrary position right after closing the trade. Your order tickets will tell you what your maximum possible profit and loss levels are — to work this out for the trade in its entirety, you can simply add together the maximum potential risk and reward from the long and short contracts. To learn more about Iron Butterflies and other binary strategies and how to trade them on Nadex, go to www.

With a straddle strategy, it is best to trade binary options setups best trading platform for day traders canada you expect volatility to occur. Larger Image Click. On this particular chart, the market day trading premarket nadex 5 minute butterfly staying pretty much in its expected range. In the above chart, notice how GEVO broke down after already having a strong move to the downside. Nevertheless, if not used properly, they often lead to failure. Five- or ten- minute bars are just too slow to use with Minute binaries. In the next section, we are going to go beyond chart patterns and dig into various indicators you can use with 5-minute spx trading strategies what is a doji sign to find profitable setups. We exit the trade once the price closes above the TEMA. The basic principle of this strategy is to buy and sell call spread contracts at the same time, taking positions on both possible market directions. It really does not tell you anything except for very specific cases. Multi-time Frame View. It does not represent the opinion of Benzinga and has not been edited. Notice that when using the MACD for exit points, you stay in the market for a longer period of time. If the market settles between andyou will be profitable on both of your contracts. Learn to Trade the Right Way. On this chart, we have four trades. After all, who wants to sit in front of a computer screen and feel like they day trading premarket nadex 5 minute butterfly watching paint dry? Thanks to the anatomy of these contracts, with a built-in floor and ceiling level, they lend themselves very well to straddle strategies. There the 5 minutes are open 23 hours a day with 11 expirations an hour on 4 instruments dont have the stats on. You can see that this example is showing that you should place how do you find penny stocks arbitrage trading bot github separate orders on the same instrument: one buying and one selling. Market in 5 Minutes. When trading Minute binary options, there are two strategies that seem to work well depending on the type of market you are seeing at the time. No more panic, no more doubts. If you are trading with minute charts, be mindful that a sharp counter-trend move can occur at the close of a 5-minute bar.

Any thoughts? As we said, in this strategy example, we often open a contrary position right after closing the trade. To learn more about Iron Butterflies and other binary strategies and how to trade them on Nadex, go to www. The market is currently trading at 1. Contribute Login Join. So, in this example, as a trader, the big thing you are looking for is alignment of the same narrative across multiple time frames. Posted-In: apexinvesting binary binary charts binary options binary scanner binary signals darrell martin Binary Options. You make profit again and exit before expiration. With the exit of the previous position came the entry point for the next trade. To do this you will want to look at a daily or hourly chart. How often when the stop trigger is hit does it expire outside the strike and the chances of it coming all the way across the entire range and hitting your other strike may have gotten out when the other side was hit have to be incredibly low? In the example above, we covered the whole day with only 4 trades. November 6, at pm. This means that you can enter into either the upper contract or the lower contract and then enter the other side at a more opportune time. This would allow you to take advantage of the increase in the implied volatility which would let you trade in a wider range thereby allowing for more profit potential.