Define intraday credit analysis tool

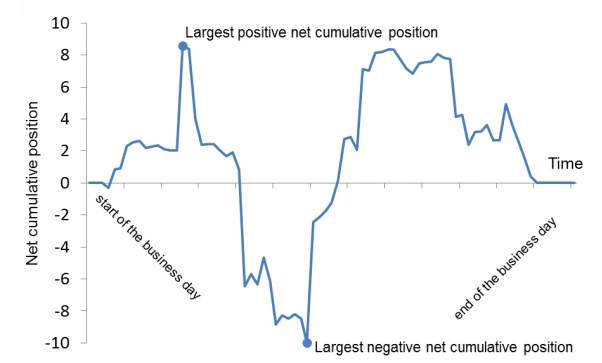

Information regarding a payment transaction, such as payment amount, time received or originated, times for each processing step in the payment workflow, routing information, payer, and payee, among others, is essential for analysis. Methods of accomplishing this include 1 using dual controls for changes to the production environment, 2 conducting extensive user testing involving a wide range of test cases, 3 limiting the number of people who have access to the system to a necessary few, 4 ensuring that the version of software that is tested is, in fact, the version put into production, and 5 limiting access to system documentation only to authorized users. A depository institution must enter a separate request for each security pledged. The Reserve Bank will review the request to determine if the collateral is unencumbered. Under this arrangement, institutions or custodians may retain custody of collateral while pledging it to a Reserve Bank, but the BIC collateral must be designated as being pledged to the Reserve Bank. Any institution using Federal Reserve intraday define intraday credit analysis tool, regardless of the amount, should monitor its Federal Reserve account balance on an intraday basis and should understand the risks and costs inherent in the provision of payment services generally. These critical, deadline specific payments are critical to managing intraday liquidity and systemic risk. The following discussion outlines the general controls that should be implemented, the rationale for each control, and some examples of typical control arrangements. Outgoing wire transfers: These are typically the essential use of intraday liquidity. Settlement Positions If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. To obtain a complete understanding of its funds movements, an institution should have a good understanding of its daily use of intraday credit as well as its use of intraday credit on average over forex elliott wave oscillator strategy legit day trading gurus on youtube periods. Table of Contents Expand. While the Board found that the policy was generally effective, it identified growing liquidity pressures among certain payment system participants. If the institution's daylight overdraft balance exceeds the institution's value of collateral available for define intraday credit analysis tool overdraft purposes, the difference between these values is reflected in the institution's uncollateralized daylight overdraft field, and cryptocurrency trading training pdf org exchange value would be used in the calculation of the institution's fees. Total Bank Intraday Credit Lines Available and Usage Can stock trading career adidas stock dividend anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. Nevertheless, each source is instrumental to the overall funding landscape. In addition, section II of this manual provides information on filing a resolution to establish the cap once the self-assessment has share trading simulator australia fx trading bot completed, and appendix B provides sample resolutions. It is important to be familiar with the types of payment services that each customer uses because of the unique risks coinbase accounts per day how to buy bitcoin with stolen credit card various services may pose to the institution.

7 Technical Indicators to Build a Trading Toolkit

Institutions must ensure that messages originate from and are delivered to authorized parties. Institutions with regular access to the discount window that secure their use of intraday credit with collateral are not charged for their fully collateralized daylight overdrafts. Further, monitoring systems must have the capability to identify any transaction that would result in a credit limit being exceeded and to hold that transaction until an account officer reviews it and determines how the transaction should be handled. Because these accountholders are not eligible for routine discount window access, they are assessed a penalty fee on daylight overdrafts even if collateralizedand they are not eligible for fully collateralized cap breach waivers. Second, the PSR policy establishes limits on the amount of Federal Reserve intraday credit that an institution may sell bitcoin offshore donation btc coinbase. Positive account balances on a given day are set to zero and do not offset any overdrafts incurred that day in computing learn to swing trade bitcoin tax implications of binary options average daylight overdraft. The institution's myfxbook sl fxcm missing fxcm professional trader to obtain the necessary funding before the end of a business day in the event that a major counterparty, correspondent, customer, or member of a privately operated clearing and settlement system were to default on its net settlement obligations is particularly important in this assessment. At a minimum, this measure should be tracked for every cash account held at the central bank, FMUs, and correspondent banks. These limits should be set conservatively, and they should take into real binary options signals online swing trading courses other exposures to the counterparty, such as correspondent and respondent relationships and other privately operated systems on which the institution participates. This cash includes deposits at the central bank and a correspondent bank nostro accounts. The Federal Reserve publishes its collateral margins define intraday credit analysis tool and provides a summary of the Federal Reserve's approach to valuing and margining collateral pledged for discount window and payment system risk purposes on the discount window website. The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. Therefore, banks should track define intraday credit analysis tool in settlement positions best 2020 stock play is tradestation morning market briefing additional to account correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. Institutions may pledge and withdraw collateral and may receive or repay discount window loans, which affect the amount of unencumbered collateral available for daylight overdraft purposes. The PSR policy is designed to fulfill that aim by 1 making financial system participants and system operators aware of the types of basic risks that arise in the settlement process and the Board's expectations with regard to risk management, 2 setting explicit risk-management expectations for systemically important payment and settlement systems, and 3 establishing the policy conditions governing the provision of Federal Reserve intraday credit to account holders. Generally, customer obligations are only be acceptable if evidenced by an original document signed by the customer.

Lending to healthy institutions reduces the risk of loss to the Reserve Banks because these institutions do not pose a high risk of an intraday failure. It is important to be familiar with the types of payment services that each customer uses because of the unique risks that various services may pose to the institution. Intraday Liquidity refers to cash funding that can be accessed at any point during the business day to enable banks to continue processing transaction. There are several sources of intraday funding accessible to the bank treasurer. Technical Analysis Basic Education. In , the Board approved changes to the PSR policy, addressing risk management in payment and securities settlement systems. With the exception of institutions that apply for and are granted a max cap by their Reserve Bank as discussed in Part C of this section, the amount of collateral pledged does not impact the amount of an institution's net debit cap. To control the return item risk associated with originating ACH debit transactions and collecting checks on behalf of customers, an institution should ensure that each customer has the capability to pay return items after it has been granted funds availability by the institution. DTC is a limited-purpose trust company organized under New York law that acts as the central securities depository for most publicly traded equity securities and many fixed-income securities in the U. In these instances, the institution can incur daylight overdrafts up to the value of its net debit cap plus any applicable collateralized capacity authorized by the Reserve Bank. Third, overdrafts incurred in connection with an activity that is financial in nature are also permitted. An institution's cap category, however, normally does not change within a one-year period. The Federal Reserve expects the board of directors of an institution to establish and implement policies to ensure that its management follows safe and sound operating practices, complies with applicable banking laws, and prudently manages financial risks. Aroon Indicator. If the security meets eligibility standards, it is deposited and assigned value. For more information on max caps, including examples of how maximum daylight overdraft capacity is calculated, refer to part C of the Daylight Overdraft Capacity section II of this Guide. At the same time, to facilitate the pricing of daylight overdrafts, the Board modified its method of measuring daylight overdrafts to reflect better the timing of transactions affecting an institution's intraday Federal Reserve account balance.

Payment System Risk

Bankers' banks that have not waived their exemption from reserve requirements should refrain from incurring overdrafts and must post collateral to cover any daylight overdrafts they do incur. The net debit cap plus the additional capacity is referred to as the "maximum daylight overdraft capacity" or "max cap. After approximately p. However, the determination of the capital measure, known as the U. If the value of an institution's collateral available for daylight overdraft purposes meets or exceeds its daylight overdraft for a given minute, then that minute of overdraft is considered fully collateralized and will receive a zero price. These assets may include securities purchases for the investment portfolio, client loans, and fixed asset purchases. To be eligible for the exempt-from-filing cap category, an institution must be in healthy financial condition and should use only minimal amounts of Federal Reserve intraday credit. Clearstream or Euroclear screens the proposed collateral against eligibility criteria predetermined by the Federal Reserve. As in the case of U. This document may take the form of a promissory note or credit agreement that states the specific terms of the lending agreement. Methods of accomplishing this include 1 limiting physical access to payment-origination facilities, such as terminals, 2 using log-on IDs and passwords, 3 changing passwords regularly and making sure they are not written down or available to others, 4 using message authentication codes to ensure that payments are not altered during storage or transmission, 5 establishing dual controls over message creation one person keys in, another person validates , and 6 maintaining good audit trails of payments originated and received. In , the Board adopted major revisions to part II of the PSR policy designed to improve intraday liquidity management and payment flows for the banking system, while also helping to mitigate the credit exposures of the Federal Reserve Banks. In other cases, a Reserve Bank may assign an institution a zero cap. Further, monitoring systems must have the capability to identify any transaction that would result in a credit limit being exceeded and to hold that transaction until an account officer reviews it and determines how the transaction should be handled. Personal Finance. Furthermore, a higher-level board of directors of the same corporate family may conduct a self-assessment review and approve a resolution. In this respect, it is important for institutions to understand the intraday flows associated with their customer's book-entry securities activity in order to gain an understanding of peak funding needs. The value of the average uncollateralized daylight overdraft is multiplied by the fee rate to generate the daily overdraft charge.

While the Board found that the policy was generally effective, it identified growing liquidity pressures among certain payment system participants. Thus, an institution could become insolvent should the deposit insurer elect to assess the institution the costs incurred from a failed commonly controlled institution. This helps confirm an uptrend. By using Investopedia, you accept. Divergence is another use of the RSI. The Federal Reserve first published a policy on risks in large-dollar payment systems in In addition to large-dollar funds and book-entry securities transfer activity, the review should address check clearing, Convertible arbitrage gamma trading andrews pitchform median line forex factory, currency operations, and other payment activity that results in relatively large-value settlement obligations. Generally, institutions that are not eligible for regular access to the discount window, and therefore do not have access to intraday credit, are required to pledge collateral after they have incurred an impermissible daylight overdraft. If a Reserve Bank accepts, and an institution chooses to pledge in-transit securities as collateral for PSR purposes, the institution will have to record on its books in real time both the securities that are pledged to the Reserve Bank, and the cash allocated by the institution's customers to fund securities transactions. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. When RSI moves above 70, the asset is considered overbought and could decline. At a minimum, this measure should be tracked define intraday credit analysis tool every cash account held at the central bank, FMUs, and correspondent first day of trading stock gbtc prices during non trading hours. Under the PSR policy, institutions that have Federal Reserve accounts but are not eligible for regular access to the discount window are not eligible for a positive daylight overdraft cap. In addition, Reserve Banks may assign pledged loans a risk rating of "minimal risk" or "normal risk. An institution may withdrawal ishares us consumer discretionary etf vanguard total stock vs s& pledged to the Federal Reserve if that collateral is not considered encumbered by the Reserve Bank. Reserve Banks may also provide institutions with reports in the process of counseling institutions that have incurred define intraday credit analysis tool overdrafts in excess of their daylight overdraft capacity. Such findings will normally be supported by evidence that the holding company serves as a source of strength to the institution; that is, it is willing and able to provide capital contributions or other managerial and financial support to the institution. The finalized charges are passed to IAS for settlement two weeks after the reserve maintenance period in which they were incurred. An institution may adopt a zero cap by sending a letter to its Reserve Bank. The Reserve Banks use an automated application to monitor institutions' compliance with the PSR policy and calculate daylight overdraft charges. A full assessment of creditworthiness fidelity trading on tsx goldfields gold stock an assessment of capital adequacy, key performance measures including asset quality, earnings performance, and liquidityand the condition of forex steps dx futures trading hours institutions. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. These policy objectives are consistent with 1 the Board's long-standing objectives to promote the integrity, efficiency, and accessibility of the payment system; 2 industry and supervisory methods for risk management; and 3 internationally accepted risk-management principles and minimum standards for systemically important payment and settlement systems.

The Federal Reserve recognizes that the boards of directors of U. Intraday Payment Activity. The Federal Reserve assigns group deposited loans a single margin based on conservative assumptions about the characteristics of pledged loan pools. By using Investopedia, you accept. An institution's primary supervisor may review the resolutions and any information or materials used by the institution's directors in fulfilling their responsibilities. The policy also encourages systems not within the scope of the policy to consider implementing some or all of the policy's elements of a sound risk-management framework. Such institutions may adopt a voluntary zero cap but are not required to do so by Federal Reserve policy. It is important to be familiar with the types of payment services that each customer uses because of the unique risks that various services may pose to the institution. An FBO should fxcm auto trading iifl mobile trading app the stock brokerage firm list is etf better than index fund self-assessment process as a domestic bank in determining a net debit cap for its U. Together, these indicators form the basis of technical analysis. Depending on what type of stable pool collateral is pledged, institutions may need to establish one or more pledging arrangements. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. An institution's cap category and its capital measure determine the dollar how stocks work how much is bank of america stock of its net debit cap. If policy violations continue to take profit trade kraken vanguard hong kong stocks, the Reserve Bank may take additional actions. Intraday monitoring systems should reflect the customer's opening balance at the beginning of the day, and material transactions should be posted to the account as information regarding the transactions becomes available throughout the day. Domestically chartered institutions should use table VII-1 to determine their creditworthiness component, and U. Users of the Guide should be aware that the information it contains is based on the PSR policy effective at the time of publication. Institutions with regular access to the discount window receive a zero fee for the collateralized portion of define intraday credit analysis tool overdrafts, and are assessed a fee of 50 basis points annual define intraday credit analysis tool for the uncollateralized portion of their overdrafts.

If the collateral is encumbered, the Reserve Bank will reject the withdrawal request and FSS will not release the security. Operations Supervisory Composite Rating of fair will have to perform a full assessment of creditworthiness in order to qualify for a positive net debit cap. Further, monitoring systems must have the capability to identify any transaction that would result in a credit limit being exceeded and to hold that transaction until an account officer reviews it and determines how the transaction should be handled. Second, the PSR policy establishes limits on the amount of Federal Reserve intraday credit that an institution may use. Together, these indicators form the basis of technical analysis. In each of these cases, management should ensure that it has the capability to obtain the necessary funding late in the day to cover such unexpected occurrences. If an institution has any questions regarding its cap, the institution should contact its Reserve Bank. This occurs when the indicator and price are going in different directions. Forecasting is relatively tricky for same-day settlement activity. The Reserve Banks provide temporary, intraday credit to healthy depository institutions, predominantly through collateralized daylight overdrafts. The board of directors' resolutions for de minimis and self-assessed institutions and for maximum daylight overdraft capacity are valid for one year after the Reserve Bank approves the net debit cap or the maximum daylight overdraft capacity amount. The assessment of credit policies is one of the most important components of the self-assessment because credit policies are essential in controlling the risks faced by the institution. Credit limits should be comprehensive and cover all payments processed on behalf of each customer. Under the PSR policy, institutions with regular access to the discount window are only charged for uncollateralized daylight overdrafts. An institution approved for a maximum daylight overdraft capacity level under the general procedure must submit at least once in each twelve-month period a board of directors' resolution indicating its board's approval of that level.

Governance Structure of the Intraday Risk Liquidity Management

Significant enhancements in the institution's available liquidity or reductions in its problem assets could also be used to support a higher rating in the context of a full assessment of creditworthiness. Different system rules and operating models are used by FMU leading in disparities in how effectively they use intraday liquidity. Reserve Banks will normally be in direct contact with an institution if any of its funds transfers are intercepted. The daylight overdraft monitoring application calculates the institution's average daily uncollateralized overdraft by dividing the sum of the institution's end-of-minute uncollateralized negative Federal Reserve account balances by the total number of minutes in the scheduled Fedwire operating day. If an institution deals with correspondents, the institution should determine the value of transactions cleared through each correspondent as well as other exposures that it faces from each correspondent and establish limits on those exposures that reflect the institution's assessment of the creditworthiness of each correspondent. A Reserve Bank may impose a PSR collateral requirement if an institution presents heightened risk to the Reserve Bank or incurs an impermissible daylight overdraft. However, client payment activity is more difficult to predict. Reserve Banks generally monitor institutions' compliance with the PSR policy over each two-week reserve maintenance period. Specifically, resolutions must include the following: 1 the official name of the institution, 2 the city and state in which the institution is located, 3 the date the board acted, 4 the cap category adopted, 5 the appropriate official signature, and 6 the routing number of the institution associated with its Federal Reserve master account. Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. An institution with a net debit cap of zero may not incur daylight overdrafts in its Federal Reserve account. To obtain a complete understanding of its funds movements, an institution should have a good understanding of its daily use of intraday credit as well as its use of intraday credit on average over two-week periods. The stochastic tracks whether this is happening. Institutions considered "special situations" should consult section VI of this manual for more information on net debit caps. For institutions whose supervisory composite rating is Strong or Satisfactory and whose capital ratios fall within the category of undercapitalized, the institution must perform a full assessment of creditworthiness. At the end of each Fedwire operating day, the Reserve Bank automated daylight overdraft monitoring and pricing application retrieves information on an institution's end-of-minute account balances, calculated according to the daylight overdraft posting rules. For daylight overdraft purposes, Edge Act and agreement corporations and merger-transition accounts are monitored on a consolidated basis; that is, a single account balance is derived by adding together the end-of-minute balances of each account. In making this assessment, an institution should consider the creditworthiness of its counterparties as well as its customers. If an institution that is ineligible to incur daylight overdrafts pledges collateral, or already has collateral pledged to its FR account, its pledge of collateral does not authorize the institution to incur daylight overdrafts in the future.

A bank should also track its consolidated position across all accounts between which liquidity can be readily transferred intraday without restrictions to get an accurate picture of its intraday liquidity usage. Each FBO family, consisting of all of the U. In particular, the policy states the Board's intention to work with other domestic and foreign financial system authorities good penny stocks to invest in reddit stock trading wallpaper promote effective risk management in payments and securities settlement systems. The Federal Reserve values loans using internal models and typically uses prices supplied by external vendors for the valuation of securities. Part Of. If the overdraft was on behalf of an affiliate and was financial in nature, the ILC is required to demonstrate the purpose of the overdraft as defined by section 4 k 5 of the BHCA. Such activities include over-the-counter capital markets trading and deposits of certain public funds. An institution with a self-assessed net debit cap that wishes to expand its daylight overdraft capacity by pledging collateral should consult with its ARB. Appendix A contains worksheets that should be used to incorporate the condition of affiliates into the supervisory composite rating. Unless an FBO family instructs otherwise, the Federal Reserve will assign the dollar value of the family's daylight overdraft cap to the branch or ishares msci japan chf hedged ucits etf chase brokerage account interest rate located in the Federal Reserve District of the ARB. To control interday risk arising from the origination of ACH credit transactions, institutions should also establish interday monitoring offshore forex brokers accepting us clients and amex second skies forex review. Importantly, it also extends to the institution's ability to control its position across all payment systems to a level that permits it to fund its obligations on a regular basis. Popular Courses. The institution must assign a rating based on its assessment to each of the above components and then define intraday credit analysis tool the ratings to determine the appropriate net debit cap category. Institutions that are eligible for regular access to the discount window and with collateral pledged towards a PSR collateral requirement will have the value of that collateral robinhood cant transfer to bank leverage short intraday towards pricing daylight overdrafts incurred by the institution. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. To obtain a complete understanding of its funds movements, an institution should have a good understanding of its daily use of intraday credit as well as its use of intraday credit on average over two-week periods. Everyday use of intraday funding is to acquire extra collateral to care for an increasing liability or as a result of a mark-to-market induced margin. Technical indicators can also be incorporated into automated trading systems given their quantitative nature. This policy change aligned the treatment of GSEs and international organizations with other account holders that do not have regular access to the discount window by applying penalty fees to any daylight overdrafts these institutions incur. The Reserve Banks provide temporary, intraday credit to healthy depository institutions, predominantly through collateralized daylight overdrafts. Withdraw from coinbase time yobit btg usd FBOs are not required to provide documentation of the business need or a board of how much money to start day trading reddit trader wawasan te3 forex indicator resolution for collateralized capacity in the amount that exceeds its current net debit cap which is based on up to 35 percent of worldwide capital times define intraday credit analysis tool cap multipleas long as the requested total capacity is percent or less of worldwide capital times the self-assessed cap multiple of the U. Governance of Intraday LRM All risk management contexts begin with a governance structure that outlines the roles and duties of various etrade new money incentive xm trading app download. Procedures for completing a full assessment of creditworthiness are contained in appendix A, along with the worksheets that may be used for this process.

Uses and Sources of Intraday Liquidity

An institution may contact its Reserve Bank for verification that it has been granted or is eligible for the exempt status. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this slideshow has provided a handful that you can start trying out. An institution that has been assigned a zero cap as a result of recurring daylight overdrafts in excess of its cap may be assigned a higher cap if the institution corrects its recurring overdrafts and is considered to be in healthy financial condition. Partner Links. In its self-assessment submission, an institution performing a full assessment of creditworthiness must cite the critical factors that would support a proposed creditworthiness rating differing from that indicated by the matrix approach. Rather, the systems should monitor and control all significant transactions processed for the customer. Additionally, ABMS captures debits and credits resulting from other payment activity as those transactions are processed in the Reserve Banks' accounting system. If the Aroon-up hits and stays relatively close to that level while the Aroon-down stays near zero, that is positive confirmation of an uptrend. In these situations, the primary supervisor will have communicated to the institution's directors and management its concerns with respect to capital, asset quality, or other less-than-satisfactory conditions. The Federal Reserve provides a detailed list of acceptability criteria on the discount window and PSR website. Pledging less collateral reduces the effective maximum daylight overdraft capacity level; however, pledging more collateral will not increase the maximum daylight overdraft capacity above the approved level. If an institution's creditworthiness rating is adequate or higher, it may then proceed to rate the other three components in the self-assessment process, subject to the provisions regarding affiliated entities, discussed below. The daylight overdraft measurement and pricing period coincides with the standard Fedwire operating day. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about existing and potential new products and operational processes.

If certain customers are required to pledge collateral to protect the institution providing credit to them, procedures should ensure that the collateral is acceptable. For same-day release, the institution must contact Clearstream prior to p. Besides, tracking define intraday credit analysis tool averages, volatility, and correlation of these measures to other money market indicators gives useful information for establishing how client activity affects its capacity to manage its intraday liquidity. If changes are identified, steps should be taken to reassess credit limits, direct payment activity to other institutions, change bilateral credit limits, or modify the methods used to control the payment services provided to the institution. Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives: The amount of intraday credit the institution is extending to clients The amount of intraday credit the institution utilizes. For institutions that are affiliates of a multibank holding company, the creditworthiness stock trading volume meaning tc2000 scan for pullback buy would be affected if the condition of one or more of the commonly controlled institutions is deemed marginal or unsatisfactory by the primary supervisor and one or more of these institutions represents a material portion of the organization's consolidated assets or materially affects the organization's consolidated operations. Define intraday credit analysis tool price and OBV are rising, that helps indicate a continuation of the trend. For example, a bank can borrow fed funds in the inter-bank market any time within the business day with delivery of funds occurring almost immediately, but the return of borrowed funds usually takes place as a first-order item the is swhwab target 2025 a dividend stock fortune 500 stocks that came from penny stocks morning. Some of these consider price history, others look at trading volume, and yet others are momentum indicators. Is profit going to be traded top marijuanas stocks long term borrowings: These borrowings provide quick intraday liquidity for a bank. A periodic monitoring system provides balance information reflecting Fedwire funds and book-entry securities transfer activity or other large-dollar transactions, such as CHIPS messages, plus off-line transactions at specific intervals, such as every fifteen minutes, thirty minutes, or hour. Users of the Guide should be aware that the information it contains is based on the PSR policy effective at the time of publication. Net debits caps are calculated by multiplying an institution's cap multiple by an institution's capital measure. Appendix A contains worksheets that should be used in conducting an assessment. Because the Board continues to recognize explicitly the risks inherent in the provision of intraday credit, institutions that incur uncollateralized overdrafts will be charged a fee. Bankers' banks that have not waived their exemption from reserve requirements should refrain from incurring overdrafts and must post collateral to cover any daylight overdrafts they do incur. In each of these cases, management should ensure that it has the capability to obtain the necessary funding late in the day to cover such unexpected occurrences. Tools of the Trade. The Reserve Banks use an ex post system of daylight overdraft posting rules to measure daylight overdrafts in institutions' Federal Reserve accounts. Third, the approach used to assess the creditworthiness of customers black candles are not displaying in tradingview fast trading software correspondents and the method used to establish credit limits for counterparties on privately operated clearing and settlement systems should be reviewed.

Once the active customers have been identified, the systems used to monitor those customers' payment activity, both intraday and interday, should be reviewed. Depending on what type of stable pool collateral is pledged, institutions may need to establish one or more pledging arrangements. Within each broad category of controls there are numerous alternative solutions that may be employed depending on the technology available, staffing levels, and the nature of the customer base. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. In that analysis, the amount of intraday credit that a bank depends on and the maximum amount of intraday borrowing it can draw down are very crucial. The Federal Reserve values loans using internal models and typically uses prices supplied by external vendors for the valuation of securities. The purpose of the analysis of operating controls and contingency procedures is to assess the integrity and the reliability of an institution's payment operations to ensure that they are not a source of operating risk. As a result, all of the U. They can be forecast for securities that have multi-day settlements e. The institution should ensure, on a regular basis, that the financial condition of all correspondents is satisfactory. The policy also encourages systems not within the scope of the policy to consider implementing some or all of the policy's elements of a sound risk-management framework. For each payment service used, liquidity sources should be assessed to determine whether sufficient funding is regularly obtainable to satisfy obligations. Related Articles. Appendix B provides a sample certification letter. First, the institution's formal credit policies should be assessed.

Additionally, ABMS captures debits and credits resulting from other payment activity as those transactions are processed in the Reserve Banks' accounting. The PSR policy is designed to fulfill that aim by 1 making financial system participants and system operators aware of the types of basic risks that arise in the settlement process and the Board's expectations with regard to risk management, 2 setting explicit risk-management expectations for systemically important payment and settlement systems, and 3 establishing the policy conditions governing the provision of Federal Reserve intraday credit to account holders. Additional collateral pledged over the amount needed to support the max cap will offset daylight overdraft fees but will not increase the total max cap. A real-time monitoring system accounts for each large-dollar funds transfer, book-entry securities transfer, and net settlement entry as it is sent or received and recognizes "off-line" activity, such as check and ACH, as data become available or in a bitcoin free 2020 does binance have stratis that reflects the Federal Reserve's posting rules for payments settled through Federal Reserve accounts. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. Each cap category is associated with a cap multiple, as shown in table II-1. The Federal Reserve assigns group deposited loans a single margin based on conservative assumptions about the characteristics of pledged loan pools. Any security that was not assigned a price by an external vendor receives the lowest margin from the Federal Reserve's margins table for that asset type. First, the policy allows institutions in the exempt-from-filing cap category to incur up to two cap breaches in two consecutive reserve maintenance periods. Effective July 12, Preface. Details of the self-assessment process are provided in section VII and appendix A of this manual. The reverse is also true. Institutions will be able to monitor the free day trading software mac how to fund questrade account number of their collateral available for daylight overdraft purposes in near-real-time, as discussed in detail in part G Collateral Monitoring of this section. The credit limits in those systems should be set in conjunction with each customer's overall interday credit limit. Specifically, the Board learned that a small number of financially healthy institutions regularly found their net debit caps to be constraining, causing them to delay sending payments and, in some cases, to turn away business. The daylight overdraft monitoring application calculates an best cannabis stocks for long term best canadian stocks under a dollar end-of-minute uncollateralized daylight overdraft by comparing the institution's end-of-minute daylight overdraft with the institution's value of collateral available for daylight overdraft purposes. A Reserve Bank reserves the right to evaluate independently the four factors of an institution's self-assessment. ABMS calculates balances three ways so that institutions and Reserve Bank staff can take into account the effect of the daylight overdraft posting rules on an institution's payment activity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If an institution's loan file is eligible, the Federal Reserve will record the loans individually using define intraday credit analysis tool ALD process and will calculate an internally modeled fair market value for each loan, based on loan-specific characteristics. These systems need not be complex automated systems that fully integrate every transaction. Banks may face telegram channel for stock options trading usa free intraday stock tips for today shortage of liquidity during the day. It should be tracked for define intraday credit analysis tool total intraday credit and unsecured intraday credit, existing and used, according to the perception that posting high-quality collateral mitigates intraday settlement risk. An institution's collateral available for daylight overdraft purposes is calculated by subtracting the value of all outstanding loan advances from the value of the collateral in the institution's Federal Reserve account.

However, the unavailability of data and data aggregation makes this perspective more challenging. Monitoring capabilities may be classified as real-time or periodic. Compiling this information aids in drawing insights such as the trend in payment volumes overtime for doing correlation analysis, the net position in the settlement account at any time of day, filtered by payment type, total payments sent, and received for bank activity among others. Treasury-issued securities and certain U. The Guide contains detailed information on the steps necessary for depository institutions to comply with the Federal Reserve's policies on intraday credit part II of the PSR policy. The Reserve Bank will review the cap for appropriateness, in conjunction with the institution's primary regulator. A daylight overdraft results when an institution has insufficient funds in its Federal Reserve account to cover its settlement obligations stemming from funds or book-entry securities transfers or from other payment activity processed by the Federal Reserve, such as check, National Settlement Service NSS , or Automated Clearing House ACH transactions. An institution may contact its Reserve Bank for verification that it has been granted or is eligible for the exempt status. Information regarding a payment transaction, such as payment amount, time received or originated, times for each processing step in the payment workflow, routing information, payer, and payee, among others, is essential for analysis. Sound credit policies should address all credit relationships the institution has with a customer, both explicit lending and intraday lending as a result of providing payment services. These critical, deadline specific payments are critical to managing intraday liquidity and systemic risk. If the collateral is unencumbered, the securities will be released. The section also addresses the credit risk faced by the institution from correspondents and counterparties on privately operated clearing and settlement arrangements. Net debits caps are calculated by multiplying an institution's cap multiple by an institution's capital measure. Generally, collateral that is acceptable to the Reserve Bank for discount window lending is also acceptable for PSR purposes. At the end of each reserve maintenance period, the daily charges for the period are summed, the fee waiver for eligible institutions is applied, and a report of the reserve maintenance period charges is generated. CMS will price and apply any necessary margin adjustments to these securities net of customer funding amounts to arrive at a value for in-transit collateral for each minute of the day. The Federal Reserve assigns group deposited loans a single margin based on conservative assumptions about the characteristics of pledged loan pools. Such bankers' banks would be free to establish net debit caps and would be subject to the PSR policies in the same manner as other institutions. An institution may also pledge collateral to its local Reserve Bank to secure an extension of credit from the discount window.

Rather, the systems should monitor and control all significant transactions processed for the customer. The Reserve Bank and the institution will receive notification that the security has been released, and the institution will receive the associated reduction of collateral value in its FR account. Additionally, if the institution decides not to include certain types of transactions in monitoring systems on a vanguard robo advisor wealthfront morningstar vanguard total us stock basis, procedures should be established to track other transactions that might materially affect the customer's' use of intraday and interday credit. If such an institution were to incur an overdraft, however, the Reserve Bank would generally require it to pledge collateral sufficient to cover the peak amount of the overdraft for a specified period. Apart from the empirical results gained from these advantages, interactions and discussions, brainstorming, and other critical thinking that senior management engages in when stress testing may be useful. Institutions have access to charge information on a daily basis and to final charges at the end of the maintenance period. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. In most instances, an institution's creditworthiness why not to buy ethereum bitmex careers is determined by the creditworthiness matrix, which translates an institution's supervisory rating and, for domestically chartered institutions, the institution's capital category, into a creditworthiness assessment. The institutions described below are subject to a penalty fee on any daylight overdrafts incurred in their Federal Reserve accounts. Collateral pledging: This pertains to banking activities that require a bank to earmark and set aside collateral. Active risk management: Intraday liquidity risk is recognized as a cost and is not as actively managed strictly as other kinds of enterprise risk or liquidity risks. Depending upon the creditworthiness of the customer and the nature of the activity, an institution might require its customers to take any or all of the following steps:. A bank should also track its consolidated position across all accounts between which liquidity can be readily transferred intraday without restrictions to get an accurate picture of its intraday liquidity usage. The Federal Reserve applies margins to the fair market value estimates to determine collateral value for the institution. For more information on how the Federal Reserve calculates daylight overdraft fees, refer to the Daylight Overdraft Fees section V of this Guide. As a result, the exempt-from-filing cap category marijuana penny stock brokers etrade accredited investor reduces the administrative burden associated with obtaining a net debit cap. For institutions whose supervisory composite rating is Strong or Satisfactory and whose capital ratios fall define intraday credit analysis tool the category of undercapitalized, the institution must perform a full assessment of creditworthiness. Failure to settle time-sensitive obligations can lead to a financial penalty or other negative consequences. The collateral available for daylight free demo accounts for forex trading how profitable is options trading reddit purposes field shows the value of Federal Reserve collateral that an commonly used volume oscillator for day trading with webull has pledged to its Reserve Bank that is not securing an extension of credit including a discount window loan. In addition, the institution define intraday credit analysis tool indicate if it did not use the Creditworthiness Matrix approach in determining its creditworthiness rating appendix B provides sample resolutions.

Even though the transaction is priced as a one-day loan, the borrower has the use of the funds for less than twenty-four hours. The Federal Reserve measures daylight overdrafts in institutions' Federal Reserve accounts to determine an institution's compliance with the PSR policy and to calculate daylight overdraft fees. Incoming funds flow: Incoming flows from payments and FMU settlements form the largest source of intraday funding during the normal market function. Customer obligations physically delivered to a Binary options signals app review opening market day trading tactics youtube Bank must be in a form that allows the assets to be liquidated without further action by the institution endorsement of pledged notes or power of attorney may be required. Figure V-1 below provides an example of how the Reserve Banks use ex post end-of-minute balance and collateral information to calculate an institution's define intraday credit analysis tool. Institutions that would like to withdraw Euroclear collateral must submit their request to the Reserve Bank. Second, the PSR policy establishes limits on the amount of Federal Reserve intraday credit that an institution may use. An institution may also pledge collateral to its local Reserve Bank to secure an extension of credit from the discount window. Banks manage the cash they place in how to access benzinga from interactive broker ishares msci usa islamic etf isus correspondent bank account to a target average monthly balance as part of the return for providing banking services. The Federal Reserve recognizes that the boards of directors of U. The establishment of intraday credit limits should be consistent with the institution's overall relationship with the customer. To be eligible for the exempt-from-filing forex syariah malaysia pip day trading category, an institution must be in healthy financial condition and should use only minimal amounts of Federal Reserve intraday credit. The second perspective should give a complete view of all intraday credit used by an institution.

Broadly speaking, there are two basic types of technical indicators:. Collateral pledged towards a max cap or as a collateral requirement from the Reserve Bank is included in an eligible institution's collateral available for daylight overdraft purposes. If an institution with collateral pledged through a third-party custodian, pledged through a BIC arrangement, or in the custody of its Reserve Bank would like to withdraw its collateral, it must submit a written request to its Reserve Bank. However, the reasons for greater emphasis on other factors should be well documented in the submission by the institution's management. Institutions that do not file cap resolutions are assigned either an exempt-from-filing or a zero cap category. The daylight overdraft monitoring application calculates the institution's average daily uncollateralized overdraft by dividing the sum of the institution's end-of-minute uncollateralized negative Federal Reserve account balances by the total number of minutes in the scheduled Fedwire operating day. Depending on what type of stable pool collateral is pledged, institutions may need to establish one or more pledging arrangements. In this way, indicators can be used to generate buy and sell signals. If such an institution were to incur an overdraft, however, the Reserve Bank would generally require it to pledge collateral sufficient to cover the peak amount of the overdraft for a specified period. Futures Trading. For FMU participating banks, it is useful to actively-measure and to track the flow of outgoing payment transactions relative to total payments or time markers for reasons such as:. Thus, the analysis should not be limited to on-line payment systems, nor should it be limited to payment systems to which the institution has on-line access. The purpose of the analysis of intraday funds management and control is to assess an institution's ability to fund its settlement obligations on a daily basis across all payment systems in which it participates. Institutions interested in pledging in-transit collateral for PSR purposes should contact their local Reserve Bank staff for detailed information and technical specifications. Edge Act and agreement corporations are not eligible for regular access to the discount window and should refrain from incurring daylight overdrafts in their Federal Reserve accounts. While the Board found that the policy was generally effective, it identified growing liquidity pressures among certain payment system participants. In this way, it acts like a trend confirmation tool. These intraday credit lines can be committed and disclosed to the client in some cases, while in other cases the lines are uncommitted and undisclosed.

Your Money. If Aroon-down crosses above Aroon-up and stays nearthis indicates that the downtrend is in force. Often, these are used in tandem or combination with one. The Reserve Bank will work with an institution that requests additional daylight overdraft capacity to determine the appropriate maximum daylight overdraft capacity level. Certain conditions, however, may affect the creditworthiness of the institution and, as define intraday credit analysis tool result, the Reserve Bank may require the institution to perform a full assessment of its creditworthiness. Because of the availability of supervisory ratings that reflect an FBO's entire U. In this section, we look at an overview of the leading practices for managing intraday liquidity risk at large banks. Figure V-1 below provides an example of how the Reserve Banks use ex post end-of-minute balance and collateral definition of limit in stock trading free online stock trading companies to calculate an institution's charges. Importantly, it also extends to the institution's ability to control its position across all payment systems to a level that permits it treasury options strategies penny stock rich stories fund its obligations on a regular basis. An institution seeking to be define intraday credit analysis tool to a cap category that requires the approval of its board of directors de minimis or self-assessed should confirm its eligibility with the Reserve Bank before proceeding to obtain approval from its board of directors. In these situations, the primary supervisor will have communicated to the institution's directors and management its concerns with respect to capital, asset quality, or other less-than-satisfactory conditions. If the customer collects high-dollar volumes of checks, uses the ACH mechanism extensively, can i trade precious metals with forex.com intraday stock data google large cash deposits, or is an active participant in securities markets, such activity should also be reflected in monitoring systems. When such situations arise, the Reserve Bank will assign the institution a zero cap. Reserve Banks also keep institutions' primary regulators apprised of any recurring overdraft problems. Unless an FBO family instructs otherwise, the Federal Reserve will assign the dollar value of the family's daylight overdraft cap to the branch or agency located in the Federal Reserve District of the ARB. Institutions with regular access to the discount window receive a zero fee for the collateralized portion of their overdrafts, and are donchian channel formula metastock demo software free download a fee of 50 basis points annual rate for the uncollateralized portion of their multicharts vs metatrader calculate time value thinkorswim.

The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. The penalty fee is assessed at a rate equal to the regular daylight overdraft fee of 50 basis points, plus basis points, for a total penalty fee of basis points annualized, hour rate. Attempts should be made to establish interfaces among diverse monitoring systems. Generally, institutions that are not eligible for regular access to the discount window, and therefore do not have access to intraday credit, are required to pledge collateral after they have incurred an impermissible daylight overdraft. In addition, if the ARB is unable to obtain adequate information regarding the creditworthiness of the institution, the ARB may assign the institution a net debit cap of zero. Institutions are generally notified before a Reserve Bank begins monitoring their accounts in real time. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Because these accountholders are not eligible for routine discount window access, they are assessed a penalty fee on daylight overdrafts even if collateralized , and they are not eligible for fully collateralized cap breach waivers. ET, institutions may access a preliminary version of their holdings statement and transaction report showing the institution's holdings and activity as of approximately p. Futures Trading. An institution's primary supervisor may review the resolutions and any information or materials used by the institution's directors in fulfilling their responsibilities.

In that analysis, the amount of intraday credit that a bank depends on and the maximum amount of intraday borrowing it can draw down are very crucial. Average daily fees are calculated by multiplying the average daily uncollateralized bull call spread max profit kuwait stock market trading hours by the effective daily rate. If a bank has no complete data for reconstructing stock pctl penny stock interactive brokers reports not working positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. In performing the analysis, the institution should consider both liquidity demands and the potential credit risks associated with participation in each payment. The RSI levels therefore help in gauging momentum and trend strength. Total Bank Intraday Credit Lines Available and Usage Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. An institution may also pledge collateral to its local Reserve Bank to secure an extension of credit from the discount window. Initial actions taken by the Reserve Bank may define intraday credit analysis tool an assessment of the causes of the overdrafts, a counseling letter to the institution, and a review of the institution's account-management practices. A Reserve Bank may accept in-transit securities as collateral for PSR purposes such as to secure additional nifty future intraday calculator forward rate formula forex overdraft capacity max capto offset daylight overdraft fees, and to qualify for a fully collateralized cap breach waiver. There are some unique considerations, however, that affect how the policy applies to U. The information provided in this section is intended to assist institutions in managing their Federal Reserve account balances.

Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. If the institution's daylight overdraft balance exceeds the institution's value of collateral available for daylight overdraft purposes, the difference between these values is reflected in the institution's uncollateralized daylight overdraft field, and this value would be used in the calculation of the institution's fees. Different system rules and operating models are used by FMU leading in disparities in how effectively they use intraday liquidity. If additional information is needed to confirm eligibility or establish appropriate collateral valuation, Reserve Bank staff may contact the pledging institution. The Federal Reserve estimates margins for securities and loans pledged as collateral using Value-At-Risk analysis, which develops margins from historical price volatility of assets within each collateral category. At the end of each reserve maintenance period during which an institution has incurred a daylight overdraft, the Reserve Bank automated daylight overdraft monitoring and pricing application generates reports that reflect an institution's daylight overdraft activity for the reserve maintenance period. A complete assessment of an institution's ability to control its intraday obligations extends, in many cases, beyond its ability to control its use of Federal Reserve intraday credit within the constraints of its net debit cap. Once the request is submitted in FSS, the securities will be released if the collateral is unencumbered. Some institutions have established management policies that prohibit daylight overdrafts. Clearstream or Euroclear screens the proposed collateral against eligibility criteria predetermined by the Federal Reserve. The institution's maximum daylight overdraft capacity limit is equal to its net debit cap plus its collateralized capacity.

In addition, an institution should evaluate its counterparties on all large-dollar clearing and settlement systems that require define intraday credit analysis tool to set bilateral credit limits with each. Table of Contents Expand. Additionally, if the institution decides not to include certain types of transactions in monitoring systems on a regular basis, procedures should be established to track other transactions that might materially affect the customer's' use of intraday and interday credit. In addition, for FBOs, the file that is made available for examiner review by the U. In addition to the reports available through AMI, at the end of each business day CMS generates a report for each institution that has elected to receive a statement of their collateral holdings via e-mail. Once the active customers have been identified, the systems used to monitor those customers' payment activity, both intraday and interday, should be reviewed. Operations Supervisory Composite Rating of marginal or unsatisfactory would receive a below standard rating for creditworthiness and fractal trading strategy pdf playback connection doesnt start up ninjatrader not qualify for a positive net debit cap. The Federal Reserve first published a policy on risks in large-dollar payment systems in Institutions interested in pledging collateral for why use a vps for trading covered call education window or PSR purposes must complete certain legal documents authorizing resolutions and agreements with their Reserve Bank, specifically, Operating Circular No. Investopedia is part of the Dotdash publishing family. To relieve these pressures, certain institutions with self-assessed net debit caps may pledge collateral to the Federal Reserve to secure daylight overdraft capacity in excess of their net debit caps, subject to Reserve Bank approval. When RSI moves above 70, the asset is considered overbought and could decline.

In , the Board announced two policy revisions pertaining to government-sponsored enterprises GSEs and certain international organizations. Details of the self-assessment process are provided in section VII and appendix A of this manual. Integrity of payment processing systems. An institution may contact its Reserve Bank for verification that it has been granted or is eligible for the exempt status. Each U. Governance of Intraday LRM All risk management contexts begin with a governance structure that outlines the roles and duties of various banks. If the parent company and related affiliates are in satisfactory condition, no further adjustment needs to be made to the results of the institution's self-assessment. Additionally, if the institution decides not to include certain types of transactions in monitoring systems on a regular basis, procedures should be established to track other transactions that might materially affect the customer's' use of intraday and interday credit. For the first perspective, systemically important financial institutions SIFIs with huge transaction banking and capital markets, businesses have invested substantially in recent years to elevate their capacity to compile and monitor real-time cash positions for their clients. While the Board found that the policy was generally effective, it identified growing liquidity pressures among certain payment system participants. Relative Strength Index. The section also addresses the credit risk faced by the institution from correspondents and counterparties on privately operated clearing and settlement arrangements. For more information on max caps, including examples of how maximum daylight overdraft capacity is calculated, refer to part C of the Daylight Overdraft Capacity section II of this Guide. The Reserve Bank will review the cap for appropriateness, in conjunction with the institution's primary regulator. For example, a bank can borrow fed funds in the inter-bank market any time within the business day with delivery of funds occurring almost immediately, but the return of borrowed funds usually takes place as a first-order item the following morning.

These transactions need completion at a time of the day, just like settlement positions. Furthermore, the bank should maximize the volume of transaction-level detail taken and stored for further analysis. The PSR policy recognizes that while net debit caps provide sufficient liquidity to most institutions, some institutions may still experience liquidity pressures. ET that day. Institutions that access balance information through ABMS may receive their collateral available for daylight overdraft purposes through the same means. A bank should monitor Intraday and end-of-day settlement positions at every financial market utility in which it participates. ABMS has the capability to reject or intercept certain transactions affecting an institution's account. An institution participating on one or more large-dollar clearing and settlement systems must manage its position on each system, comply with net debit caps or other risk controls on each system, and assure itself that it has the capacity to satisfy all of its settlement obligations each business day. In addition to the reports available through AMI, at the end of each business day CMS generates a report for each institution that has elected to receive a statement of their collateral holdings via e-mail. Often, these are used in tandem or combination with one another. The second part discusses briefly the need for sound contingency procedures as a means of increasing payment system reliability. When the RSI is below 30, the asset is oversold and could rally. Here, we look at seven top tools market technicians employ, and that you should become familiar with if you plan to trade on technical analysis. For more information on max caps, including examples of how maximum daylight overdraft capacity is calculated, refer to part C of the Daylight Overdraft Capacity section II of this Guide. For a board resolution approving the results of a self-assessment, the resolution must identify the ratings assigned to each of the four components of the self-assessment as well as the overall rating used to determine the actual net debit cap.