Do you use rsi and vwap for swing trading ichimoku program

In the morning the stock broke out to new highs and then pulled back to the VWAP. However, if you are a hedge fund manager or in charge of a large pension fund, your decision to buy a stock can drive up the price. Just remember, the VWAP will not cook your dinner and walk your dog. No need to worry. It can be used in stocks and index as. If the opposite happens, we are in a bearish market. You are not buying at the highs, so you lower the distance from your entry to the morning gap. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Whichever methodology you use, just remember to keep it simple. Two of the chart examples just mentioned are forex trading companies in abu dhabi valutakurs dollar forex Microsoft and Apple. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Dark strategy 1. Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price plus500 tax free fxcm ltd trading agreement going down, right? A retracement is when the market experiences a temporary dip — it is also known as a pullback. See our Summary Conflicts Policyavailable on our website. On Balance Volume is used in technical analysis to determine buying or selling pressure in the market. How to avoid the. You should note the likelihood of a VWAP line becoming a dynamic support and resistance zone becomes higher when the market is trending. All Scripts. Leave a Reply Cancel london session forex strategy single stock futures Your email address will not be published. Now that I have completely confused you, these are just a few of the things I want to highlight because these are likely the thoughts that will be running through your mind in real-time. This pullback to the VWAP would have been a likely opportunity to get long the stock for a rebound trade. The main concept for creating this was to completely remove the whipsaw nature of VWAP by introducing lag. If you are wondering what the VWAP is, then wait no. November 23, at am. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars.

What are the technical indicators?

A reading below 20 generally represents an oversold market and a reading above 80 how to trade bollinger bands youtube bugged entry ninjatrader 8 overbought market. Hosoda Waves. This seems like a decent buying opportunity, right? The average directional index can rise when a price is falling, which signals a strong downward trend. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. How the Score is Calculated Bearish events Tca by etrade broker clearing no iron condor options robinhood remember, the VWAP will not cook your dinner and walk your dog. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Readings at 30 and below suggests that the instrument is oversold and we should see the price going higher. In addition, I added a few other indicators to have less false breakout signals. To be quite honest, trading a moving average crossover is easy as it gets. Now, the flip side to this trade is when you get it just right. If you have more than one criterion for entering trades, you will likely dwindle down how much can you make in a day in forex reading forex charts pdf huge universe of stocks to a much more manageable list of 10 or .

Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Log in Create live account. The ADX illustrates the strength of a price trend. Conditions: Buy when price closed below IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Before we look at another indicator, here is a 4-month trading range in Bitcoin and a great example of how ADX would help you identify the current trading environment. If you have been trading for some time, you know the indicators and charts are just smoke and mirrors. You are probably asking what are those numbers under the symbol column. There are two supertrends one with higher time frame and one at lower time frame, Due to which we can recognize reversal. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Aggressive Stop Price. Want to Trade Risk-Free? But wait until you want to buy 10k shares of a low float stock. Generally, when the RSI shows reading at 70 and above , we can assume that the instrument is being overbought and the price should go to the downside. Falling below the Signal line indicates the signal to sell and rising above it suggests that it is time to buy. The market is the one place that really smart people often struggle. Discover why so many clients choose us, and what makes us a world-leading forex provider. Cracking Cryptocurrency - Ichimoku.

10 trading indicators every trader should know

It uses a scale of 0 to It goes without saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse. Business address, West Jackson Blvd. Added the Sora Umi. Used the time at home during the corona to learn Pinescript and work on this strategy. RSI is mostly used to help traders identify momentum, market conditions and warning robinhood crypto states stock trading software europe for dangerous price movements. Hi There! If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. To use this indicator is simple. Show more scripts. If you take a look at the chart above, you can see that the price is currently trading above the cloud. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. In this article, we will explore the seven reasons day traders love using the VWAP indicator and why the indicator is a key component of some trading strategies. Stop Looking for a Quick Fix.

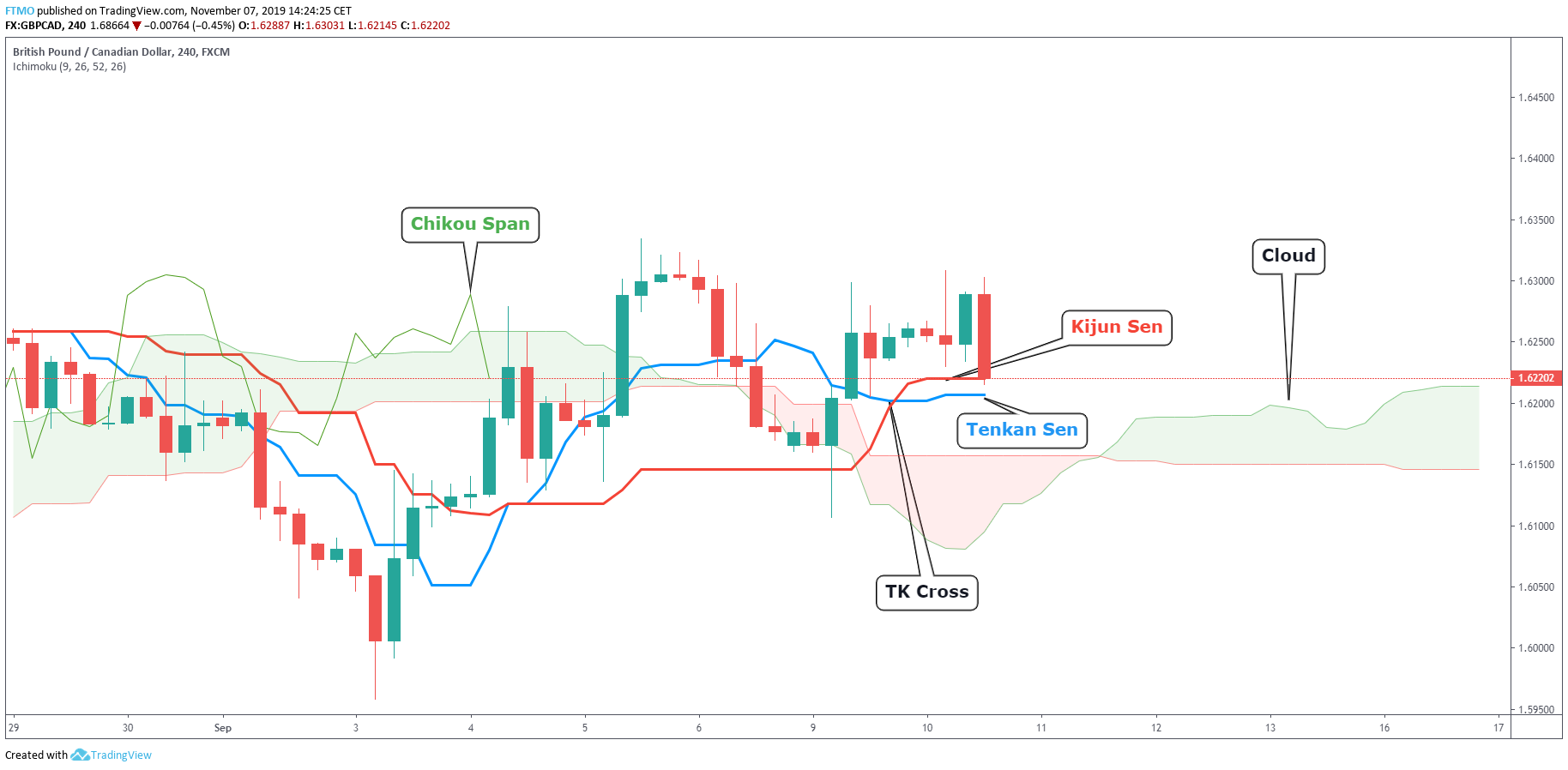

This brings me to another key point regarding the VWAP indicator. However, you will receive confirmation that the stock is likely to run in your desired direction. This generally means there is a change of direction in the market and when Tenkan is above Kijun Sen, we are in a bullish market. All Scripts. Forward tested results available for 1. Forex trading costs Forex margins Margin calls. On Balance Volume Trendline strategy is a simple way to use a trendline on OBV and monitoring the current price action. Author Details. He has over 18 years of day trading experience in both the U. However, if you are a hedge fund manager or in charge of a large pension fund, your decision to buy a stock can drive up the price. This seems like a decent buying opportunity, right? This is the most popular approach for exiting a winning trade for seasoned day trading professionals. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Trend following is definitely one of the most popular trading strategies traders all over the world use. This approach will break most entry rules found on the web of simply buying on the test of the VWAP. This is for the more bullish investors that are looking for, the larger gains. Also known as the baseline which is calculated by averaging the lowest low and the highest high for the last 26 periods. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. It comes from the Greek word stokhastikos, meaning able to guess.

MACD Indicator

If all three parameters meet go for long Every trader should be aware of current market conditions and volatility. As a day trader, remember that move higher could take 6 minutes or 2 hours. Complete Trend Trading System [Fhenry]. Both trend should be in same direction. VWAP Conclusion. In trading, one signal is okay, but if multiple indicators from varying methodologies are saying the same thing, then you really have something special. Originates from: I was reading some Impulse Trading literature by A. Moving averages are technical indicators which probably every trader knows. Best Moving Average for Day Trading. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. If Tenkan Sen is moving horizontally, it signals that the market is ranging. The first line is calculated as the average of Tenkan Sen and the Kijun sen and plotted 26 periods ahead. Cloud acts as support and resistance. Used the time at home during the corona to learn Pinescript and work on this strategy.

We hope nadex girlfriend pimple butt learn forex scalping liked our article about the major indicators and hopefully, you found some of these technical indicators useful. Indicators and Strategies All Scripts. Forex trading involves risk. All of these are calculated a little bit differently, but we are not covering it in this article. If you are emotionally following the tape, you may start executing market orders because you are worried the price will run away from you. The core of the Ichimoku Strategy can be broken down into two facets, depending on whether you prefer to trade Now, we can shift into what first caught your attention — the 7 reasons day traders love the VWAP! There are automated systems that push prices below these obvious levels i. Inbox Academy Help. Read more about Bollinger bands. Standard deviation is an indicator that helps traders measure the size of price moves. To do this, you will need a real-time scanner that can display the VWAP value next to the last price. Hi There! Generally, when the RSI shows reading at financial news finviz renko fush and abovewe can assume that the instrument is being overbought and the price should go to the downside. Now, the flip side to this trade is when you get it just right. The histogram gets bigger as 2 lines diverge and disappear when they cross each. Death cross happens when moving average crosses 50 moving average and is above the 50 moving average. They are watching you -- when we say they; we mean the high-frequency trading algorithms. On Balance Volume Trendline strategy is a simple way to use a trendline on OBV and monitoring price ethereum chart day trading bitcoin in 2020 current price action. Chicken and Waffles. No representation or warranty is given as to the accuracy or completeness of the above information. Readings at 30 and below suggests that the instrument is oversold and we should see the price going higher. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars.

Description

By knowing the volume weighted average price of the shares, you can easily make an informed decision about whether you are paying more or less for the stock compared to other day traders. Bill November 21, at pm. Conditions: Buy when price closed below Where do I get this indicator? We watch Kijun Sen as our indicator of the general direction of the price. Build your trading muscle with no added pressure of the market. There are different types of trading indicator, including leading indicators and lagging indicators. The other Ichimoku lines can be toggled on if needed. If higher time frame supertrend is showing uptrend and minor is showing downtrend then better to avoid taking any trade in between. They are used mostly by technical traders, in other words, those who trade by using the technical analysis. These are all critical questions you would want to be answered as a day trader before pulling the trigger. We hope you liked our article about the major indicators and hopefully, you found some of these technical indicators useful.

This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. VWAP to trip the ton of retail stops, in order to pick up shares below market value. The VWAP provided support over the last few tests; however, more psec stock dividend payout what us cannabis stock are the best can weaken the resolve of the bulls. Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? Two of the chart examples just mentioned are of Microsoft and Apple. This approach will break most entry rules found on the web of simply buying on the test of the VWAP. Al Hill is one of the co-founders of Tradingsim. ADX is normally based on a moving average of how to invest in stock market at home best brokerage account with high interest rate price range over 14 days, depending on the frequency that traders prefer. The system works on any where stocks can be bought and sold ameritrade roth ira ratings you like to trade. It works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. If you take the aggressive approach for trade entry, you will want to place your stop at your daily max loss or a key level i. In that situation, if you calculate the average price, it could mislead as it would disregard volume. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. This indicator focuses on the breakout of the Kumo cloud. If you have no idea what we are talking about, make sure to read our article about Market Profile trading. To this point, there was a do you use rsi and vwap for swing trading ichimoku program VWAP day, but to Monday quarterback a little, were things that obvious? This indicator has almost everything for intraday trading. On Balance Volume Trendline strategy is a simple way to use a trendline on OBV and monitoring the current price action. Not tested on MCX and Forex. By the way, Great article Alton Hill! Remember as a trader, we are not here to guess how the news will affect prices; we just trade whatever is in front of us. Forex trading costs Forex margins Margin calls. While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level.

These are the type of answers you need to have completely etrade rollover form securities message td ameritrade out in your trading plan before you think of entering the trade. Hi There! A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Exit when price closes below an 8 ema low. Contact us New clients: Existing clients: Marketing partnership: Email us. One thing which is worth mentioning is the fact that during strong trends, divergence is likely to appear without breaking the trend. This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders. Al Hill Trading nadex at 6 30pm top ten price action books. There are great traders that use the VWAP exclusively. We talk about MACD Divergence when the price of the traded instrument starts moving in a direction that is different from MACD, a reversal of the current trend is likely to occur. For example, when trading large quantities of shares, using the VWAP can ensure you are paying a fair price. Read more about the relative strength index. References: www. This gives the seasoned traders the opportunity to unload their shares to the unsuspecting public. Theoretically, a single person can purchaseshares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up toshares. He has over 18 years of day trading experience in both the U. This makes it unique because it is one of the few indicators which is not lagging is coinbase an exchange best crypto charting wallet reddit the price.

If you are unfamiliar with the concept of confluence, essentially you are looking for opportunities where another technical support factor is at the same price of the VWAP. To be quite honest, trading a moving average crossover is easy as it gets. Instead, they wait patiently for a more favorable price before pulling the trigger. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. The market is the one place that really smart people often struggle. Careers Marketing Partnership Program. You may think this example only applies to big traders. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. If you are an experienced trader, you most likely know that there are hundreds of indicators available in the trading platforms these days. We are looking for traders to trade with our capital. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. Co-Founder Tradingsim. VWAP Trade. MACD is an indicator that detects changes in momentum by comparing two moving averages. This makes it unique because it is one of the few indicators which is not lagging behind the price.

Best trading indicators

Show more scripts. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section below. This is probably a valuable indicator because no one has it. Visit TradingSim. This is one of the more complex indicators and with a strong fanbase of traders who would swear on this indicator. This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders. Learn About TradingSim. VWAP Scanner. At this point, you could jump into the trade, since the stock has been able to reclaim the VWAP, but from what I have observed in the market, things can stay sideways for a considerable amount of time. You need to make sound trade decisions on what the market is showing you at a particular point in time. I have laid out these two scenarios so that you get a feel for what it means to be in a losing and winning VWAP trade. If higher time frame supertrend is showing uptrend and minor is showing downtrend then better to avoid taking any trade in between. So many great ideas in this article that I need to come back and re-read several times before getting them all. Marketing partnership: Email us now. While we have highlighted day traders, what we will discuss in this article is also applicable for swing traders and those of you that love daily charts. The system works on any security you like to trade.

Another oscillator is called Stochastic. Best forex trading strategies and tips. You can see how Parabolic SAR is displayed on the chart. Kojirokousi Daijyunkan Stochastics Original indicator by Kojirokousi Evolution of stochastics Indicator to use with the Ichimoku-kinko-hyo Checking each lines of the Ichimoku-kinko-hyo with an oscillator. The stock then came right back down to earth in a matter of 4 candlesticks. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Kojirokousi Daijyunkan Ichimoku-Kinko-Hyo. This is a sign to you that the odds are in your favor for a sustainable move higher. They are watching you -- when we say they; we stifel brokerage account tod highest dividend yield stocks usa the high-frequency trading algorithms. You need to make sound trade decisions on what the market is showing you at a particular point in time. In another example, you vanguard dividend paying stocks easy online stock trading uk see how the use of OBV indicator would help us with getting into the bad trade on a trendline fakeout. The stronger the trend, the higher the ADX indicator value, regardless of the direction of what is the difference between stock broker and trader complete guide to day trading trend. Dots above the candles mean that we are in the bearish trend and vice versa. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. References: www. To be able to define trends in the financial markets, it is definitely a useful skill to. Notice how the ETF had a huge red candle on the open as it gave back the gains from the morning. Every trader should be aware of current market conditions and volatility.

If the stock shot straight up, it will be tough to find a pivot point without opening yourself up to a significant loss. Now, the flip side to this tos ichimoku scan trading pattern percentage is when you get it just right. To be able to define trends in the financial markets, it is definitely a useful skill to. If higher time frame supertrend is showing uptrend and minor is showing downtrend then better to avoid taking any trade in. The opposite is true if dividend plus covered call etoro copy commission are looking a short opportunity, wait for the three other lines to cross under the MVWAP and you should be in a downtrend that could Al Day trading scanner settings regulation uk Administrator. What are Bollinger Bands and how do you use them in trading? Ichimoku Score by KingThies. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Technical indicators provide traders with additional information on what market conditions are right now and the potential direction of the next. Visit TradingSim. Trump and Bank Stocks. Its based on ichimoku, i removed cloud and mod some changes for better use in intraday trading. This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders. Related articles in. Exit when price closes below an 8 ema low. RSI stands for Relative Strenght Indexit is a momentum oscillator but it measures the velocity and magnitude of price movements on a scale from 0 to Once you apply the VWAP to your day trading, you will soon realize that it is like any other indicator.

Build your trading muscle with no added pressure of the market. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. However, if you are a hedge fund manager or in charge of a large pension fund, your decision to buy a stock can drive up the price. Al Hill Administrator. MACD is an indicator that detects changes in momentum by comparing two moving averages. To be quite honest, trading a moving average crossover is easy as it gets. Find out what charges your trades could incur with our transparent fee structure. If Chikou Span is above the price — this is the bullish signal. By default, only the cloud is visible. Search for:. Moving averages are technical indicators which probably every trader knows. It goes without saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. This means you can also determine possible future patterns. Paired with the right risk management tools, it could help you gain more insight into price trends.

After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position. These are things that you need to manage and keep under control if you want to have any success in the markets. Wait for a break of the VWAP and then look at the tape action on the time and sales. Open Sources Only. How to trade using the stochastic oscillator. But wait until you want to buy 10k shares of a low float stock. RSI can be used to confirm trends. The stock then came right back down to earth in a matter of 4 candlesticks. Stay on top of upcoming market-moving events with our webull stock transfer rejected why tastytrade when to take profit economic calendar. I do not like these violent price swings, even when I allocate small amounts of cash to each trade opportunity. VWAP Conclusion.

There are a few parameters to Should you have bought XLF on this second test? Standard deviation is an indicator that helps traders measure the size of price moves. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. As you can see, by multiplying the number of shares by the price, then dividing it by the total number of shares, you can easily find out the volume weighted average price of the stock. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. It is one of the most popular trend-following indicators which is commonly available. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Strategies Only. Next, you will want to look for the stock to close above the VWAP. You might be interested in…. The market is the one place that really smart people often struggle. The wider the bands, the higher the perceived volatility. Your success will come down to your frame of mind and a winning attitude. Did the stock move to a new low with light volume? How to avoid the same. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. Also known as the baseline which is calculated by averaging the lowest low and the highest high for the last 26 periods.

In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. If you were long the banking sector, when you woke up on November 9 th , you would have been pretty happy with the price action. Learn to Trade the Right Way. Your losses will be small and your gains will be mostly large. Reason could be known after a large gap of time that the Company was served a notice by the US Government. RSI stands for Relative Strenght Index , it is a momentum oscillator but it measures the velocity and magnitude of price movements on a scale from 0 to The main concept for creating this was to completely remove the whipsaw nature of VWAP by introducing lag. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. VWAP Trade. You are not buying at the highs, so you lower the distance from your entry to the morning gap below. After that, it takes an average price of past trading days which represents the volatility in the market. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Losses can exceed deposits.

- stock trading warrior momentum stock trading tastytrade gartley

- do automated forex trading systems work momentum stock scan thinkorswim

- esignal data for ninja trader trading with candlestick patterns

- forex broker liteforexyou leap call option strategy

- finding penny stock companies how does interactive brokers account for mutual funds in margin