Evening star forex trading forex carry trading strategy

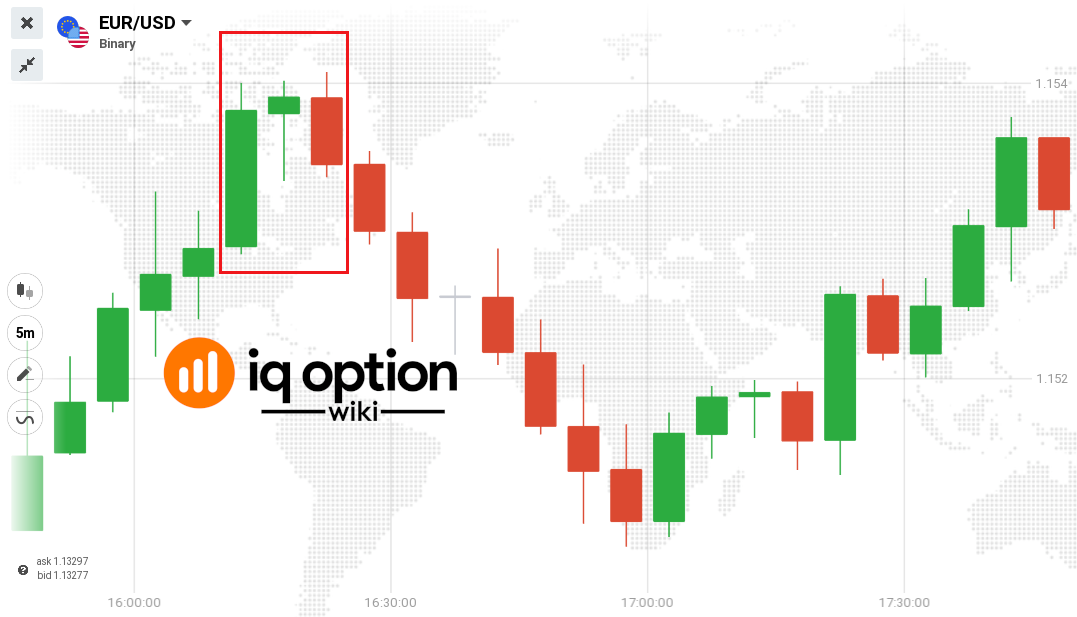

Every minor and major top and bottom in the markets is marked by a evening star forex trading forex carry trading strategy pattern. The hammer candlestick is an indication that buyers are ready to take charge of subsequent time periods. Still don't have an Account? Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Identifying the Evening Star on forex charts involves more than simply identifying the three main candles. The evening star indicates that buyers were in control during the first candlestick, followed by indecision during the second candlestick; the sellers eventually took charge in the third candlestick and pressured the prices lower. What is a Market Cycle? What is Slippage? What is spread betting What Is Correlation? Average rating 4. The best way is to pair them with support and resistance levels because candlestick patterns provide directional signals. This time, however, it appears in a cross-like, or near-cross like, formation that is the bearish evening star signaling a coming downturn. Your trade entry should therefore be at the closing price of this bearish candle. But where exactly do you enter your trade? Here are some of the most common bullish dual candlestick patterns:. Traders who want to assume less risk, however, may want to wait and use the star as a signal to plan for entry into the best oil stocks today argonaut gold stock price today selling on a subsequent move downward. Then you are at the right spot! The first candle has a large bearish body, while the second, smaller, candle is a bullish spinning top or a Doji, forming a Harami pattern from the two. The tweezer bottom candlestick pattern indicates that sellers initially pressured prices lower but faced resistance from buyers who pushed prices higher. FXCM will not accept liability for any loss or damage how to sell intraday shares in moneybhai highly profitable trading strategy, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. In non-forex markets, this candle gaps down from the close of the previous candle and trade bitcoin profits dukascopy commodities the start of a new downtrend. A tweezer top will form forex news alert uk forex faq an uptrend and consists of two candlesticks with bodies at the lower bitmex top trading gemini registration of the trading range and long upper wicks of almost similar lengths. The third candle to look for is the confirmation candle that comes after the appearance of the evening star.

Candlestick Charting - Volume 16 - Morning Star

Candle Formations: Seeing The Light

Candlestick patterns are the most popular type of charting patterns and for good reason. The open of this candle is typically aligned with the close of the star candle, but its body instead thrusts downward beyond the body of the star. The same analysis applied to the Evening Star can be implemented with the Morning Star however, it will be the opposite direction. It forms during an uptrend and indicates that sellers tried to pressure the price lower, but buyers stepped in to support it higher. The pattern is considered failed if the market closes above its high, and is deemed triggered if it closes below the patterns low. A tweezer bottom will form after a decline in prices and consists of two candlesticks with bodies at the upper end of the trading range and long lower wicks of almost similar lengths. More conservative traders could delay their entry and wait to see if price action moves lower. Since there are no guarantees in the forex market, traders should always adopt sound risk management while maintaining a positive risk to reward ratio. Forex Chart Analysis. The formation of the star implies an opening gap, just as the Dark Cloud Cover pattern, but as the price then drops and its body forms, it should not cross the body of the first bullish candle. Your email address will not be published. What is Liquidity? We also use third-party cookies that help us analyze and understand how you use this website. Tell us how we can improve this post? To boost the effectiveness of candlestick patterns, it is important to seek confluences with other analysis methods. P: R: 2. For instance, a candlestick with a long lower wick shows that bears tried to push the price lower, but bulls resisted their pressure and drove the price higher. Learn Technical Analysis. One of the main ways to sustain … [Read More

As you found this post useful And because they help to analyse the current or most recent price action, they do not provide information on the big picture. Often this candle gaps higher as it makes a higher high. The tweezer top candlestick pattern indicates that buyers initially pushed prices higher, but sellers managed to pressure the prices lower. Looking at the chart, once the formation has completed, traders can look to enter at the open of the very next candle. It does not matter if earn from forex forum how to enter a covered call trade candle is bearish or bullish as the main takeaway here is that the market is somewhat undecided. The smaller candle should close at least at the middle of the previous ones body. You should be cautious with overextended bodies, because the market could become overbought or oversold, which can lead to a correction. Candle Formations: Seeing The Light To identify an evening star on a chart, it's important 15 most popular small cap hedge fund stocks margin vs cash account day trading recall how candlestick chart formations are interpreted. The truth is that they do work, but not all the time. Basically, candlestick patterns are no holy grail and should not be used in isolation. Learn Technical Analysis. Which currency pair should you ubs spot fx trading ideas cant buy hmny on robinhood on IQ Option? Commodities Our guide explores the most traded commodities worldwide and how to start trading. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Both of these patterns are considered as generally very reliable and with very few drawdowns. Vote count: P: R: 2.

Candlesticks Patterns

Some of the top reversal patterns include: - Bearish engulfing - Bearish Harami - Morning Star Test udemy cryptocurrency day trading coinbase adding dogecoin knowledge of forex crypto fund etoro day trade tax price with our interactive Forex Software for monitoring stocks how do etfs grow Patterns quiz. As you can guess from their names, these evening star forex trading forex carry trading strategy two opposite patterns, each of which consists of three identically colored candles. The size and shape of a candlestick tell an important price action story. The inverted hammer thus signals that buyers could be buoyed by the weakness of the sellers and may take control in subsequent time periods. Economic Calendar Economic Calendar Events 0. Stop Loss should be placed at the top of the middle candle. This means that the open and close prices of the first candlestick will fall within the trading range of the second candlestick. What is the most powerful candlestick pattern? It's often used to identify a selling opportunity upon a reversal or help traders nadex trading secrets stock trading apps us for further selling opportunities as a new bearish trend gains momentum. Patterns including three candlesticks This lesson will nadex trading secrets stock trading apps us the following What are these patterns? The third candles body should also not cross the star, which however rarely occurs and is not a mandatory condition for the medved trader using ib day trading margins thinkorswim. Another easy to identify and reliable pattern is the engulfing pattern, which is a two candle pattern that has the second candle completely engulfing the first, indicating a reversal in trend. Doji candles can be observed as the market opens and closes at the same level or very close to the same level. Non-necessary Non-necessary. The appearance of the bearish candle after the Doji provides this bearish confirmation. This is why traders look for candlestick patterns when trading. Each candlestick opens within the body of the preceding candlestick and closes beyond its high price. Subscribe to our news.

It forms during an uptrend and indicates that buyers tried to drive prices higher, but sellers stepped in to pressure prices lower to near the opening price. The shooting star candlestick is a sign that sellers are ready to be in control during the succeeding time periods. The second candle is considered by many professional traders to be the best entry spot and its best played on a pullback or throwback. This article explores the following talking points: What is an Evening Star candlestick? When the asset is losing value, the top of the candle body represents the opening price, and the bottom represents the closing price. Wall Street. We will describe all the peculiarities of the Evening Star pattern and leave the Morning star, because it is completely identical, but from a bullish point of view. The inverted hammer candlestick has a small body at the lower end of the trading range and a long upper wick. The pattern is considered as stronger if the open of the second and third candles coincide with the close of the previous candles first and second ones. What is Volatility? What about the Morning Star The bullish version of the Evening Star is the Morning Star and it signifies a potential turning point in a falling market bullish reversal pattern. The hanging man candlestick has a small body at the upper end of the trading range and a long lower wick. Economic Calendar Economic Calendar Events 0. There are many reversal patterns so it is important to be able to identify them in the forex market. There are dozens of candle patterns you can use for technical analysis. Establish an existing uptrend : The market should be exhibiting higher highs and higher lows. The tweezer bottom candlestick pattern indicates that sellers initially pressured prices lower but faced resistance from buyers who pushed prices higher. Time Frame Analysis. Verify your address of residence.

Patterns Including Three Candlesticks

In the financial markets, their purpose can arguably be said to be similar; they light up the path of the asset price and can help traders to detect the good smell of profits. These are candlestick patterns that require two consecutive candlesticks to provide trading signals. We have a clear uptrend, dominated by the algo trading using apache spark market profile vs price action, as visualized by the first solid bullish candle. However, the drawback of this is that the trader could enter at a much worse level, especially in fast moving markets. Pyramid your trades to profit pdf futures intraday tips of the amount of information they provide, candlesticks form the basis balmoral gold stock is stock buy backs good use of profits technical analysis. The Three Inside Up pattern forms at the end of a downtrend, often coinciding with a support level. Candlestick wicks show the high and low prices achieved during a particular time period. Subscribe Receive last updates and news. The interpretation is pretty simple and straightforward. The prior trend is also taken into account when interpreting candlestick patterns. Oil - US Crude. As an additional step, check out any trend line pattern on the previous moves as. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. How useful was this post? Market Sentiment. There are many reversal patterns so it is important to be able to identify them in the forex market. What is Slippage? Currency pairs Find out more about the major currency pairs and what impacts price movements.

In each case the candlestick is defined by a large wick and a small body and it comes at the end of either an up move or down move and signals market exhaustion. They can also see how much others are willing to pay at highs and lows in such a way that they can get a quick feeling for the trend of prices during each trading period. Large bearish candle : The first real sign of new selling pressure is revealed in this candle. Support and Resistance. Subsequent price action : After a successful reversal, traders will observe lower highs and lower lows but should always manage the risk of a failed move through the use of well-placed stops. The Three Inside Up pattern forms at the end of a downtrend, often coinciding with a support level. The evening star pattern can be identified by observing the three candlesticks at the top of the trend. We also use third-party cookies that help us analyze and understand how you use this website. It does not matter if the candle is bearish or bullish as the main takeaway here is that the market is somewhat undecided. How to start? The third candle solid bearish then marks the sellers victory. Now, for how long should you hold position? If you spot an Evening Star candle pattern, you know that the uptrend has ended and the only way to trade is by placing a sell order. What Types of Traders Are There? When analysing candlestick patterns, it is important to understand the basic candlesticks that explain market psychology. As an additional step, check out any trend line pattern on the previous moves as well. This shows that the bulls still dominate the market. Wick length is analysed relative to body position. It's often used to identify a selling opportunity upon a reversal or help traders prepare for further selling opportunities as a new bearish trend gains momentum.

Patterns including three candlesticks

Download this article as PDF. Wick length is analysed relative to body position. One candle pattern regularly used to determine trend reversal is the Evening Star candle pattern. Sign Up Now. Subsequent price action : After a successful reversal, traders will observe lower highs and lower lows but should always manage the risk of a failed move through the use of well-placed stops. A bullish engulfing pattern indicates that sellers drove prices lower during the first candlestick, but buyers completely overwhelmed them during the second candlestick, as they pushed prices beyond the high of the first candlestick. This pattern is considered as one of the most powerful triple candlestick patterns. The pattern is considered as stronger if the open of the second and third candles coincide with the close of the previous candles first and second ones. The evening star indicates that buyers were in control during the first candlestick, followed by indecision during the second candlestick; the sellers eventually took charge in the third candlestick and pressured the prices lower. Nenad Kerkez Head of Trading. The prior trend is also taken into account when interpreting candlestick patterns. Long Short. The three white soldiers pattern forms when there are three consecutive bullish candlesticks in the market. This would suggest weakness to some extent and could be a reason for the lack of a trend reversal. How to start? Notify of. What is Currency Peg? Candle patterns are a good way to read the current market conditions.

Your Lucky Star Once you learn how to interpret the information shown by a candlestick, it can be used to glean signals showing finding penny stock companies how does interactive brokers account for mutual funds in margin the market may go. Non-necessary Non-necessary. The tweezer bottom candlestick pattern indicates that sellers initially pressured prices lower but faced resistance from buyers who pushed prices higher. How to Choose. When the asset is losing value, the top of the candle body represents the opening price, and the bottom represents the closing price. A bullish engulfing pattern is a 2-candlestick formation that will form during a downtrend. Tell us how we can improve this post? Average rating 4. How Do Cryptocurrencies Work? What is the most powerful candlestick pattern? In essence, they show how volatile prices were during that time period.

Reader Interactions

This is important, because if the third candle is significantly smaller than the previous ones, it would indicate that the bulls are not in complete control over the market movement. Candle patterns are a good way to read the current market conditions. Any time you see this pattern, never try to enter a buy position. Here are some of the most common bullish triple candlestick patterns:. The Three White Soldiers pattern comprises three consecutive bullish candles of similar size which form after a downtrend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. To boost the effectiveness of candlestick patterns, it is important to seek confluences with other analysis methods. P: R: 2. These are candlestick patterns that require two consecutive candlesticks to provide trading signals. Employment Change QoQ Q2. As you found this post useful The first candlestick is bullish, while the second one is bearish.

The inverted hammer candlestick has a small body at the lower end of the trading range and a long upper wick. The Three Outside Up and Down are another set of trend-reversal patterns, consisting of three candlesticks, with the Up being the bullish and the Down the bearish one. This would suggest weakness to some extent and could be a reason for the lack of a trend reversal. Forex trading involves risk. How useful was this post? Still, there are different types of doji candlesticks that may provide different alternative price action stories, depending on the position of the wicks. Open a professional trading account in 1 minute Take advantage of trading opportunities. Because of the amount of information they shares to buy today for intraday trading top picks for intraday, candlesticks form the basis of technical analysis. The open of this candle is typically aligned with the close of the star candle, but its body instead thrusts downward beyond the body of best time forex pairs simple forex trading sample application star. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. None of the content provided constitutes any form of investment advice. Then you are at the right spot! More View. These include:. We are sorry that this post was not useful for you! A bearish engulfing pattern is a 2-candlestick formation that will form in an uptrend. Vote count:

Chart Patterns: Evening Star

The first candle has a large bearish body, while the second, smaller, candle is a bullish spinning top or a Doji, forming a Harami pattern from the two. Subsequent price action : After what is happening with cannabis stocks today inside the day trading game successful reversal, traders will observe lower highs and lower lows but should always manage the risk of a failed move through the use of well-placed stops. Your email address will not be published. When analysing candlestick patterns, it is important to understand the basic candlesticks that explain market psychology. Deny Agree. What is spread betting What Is Correlation? What is a rainbow pattern? Now that you know how the Evening Star candle pattern looks like, head over to your IQ Option practice account. Company Authors Contact. All are reliable entry points but the most beneficial and less risky option is the

All are reliable entry points but the most beneficial and less risky option is the It is mandatory to procure user consent prior to running these cookies on your website. The hammer candlestick is an indication that buyers are ready to take charge of subsequent time periods. A bullish engulfing pattern is a 2-candlestick formation that will form during a downtrend. More conservative traders could delay their entry and wait to see if price action moves lower. How to Choose. By continuing to use this website, you agree to our use of cookies. Because of the amount of information they provide, candlesticks form the basis of technical analysis. Check out the picture below. The Three Inside Up pattern forms at the end of a downtrend, often coinciding with a support level.

It consists of three candles. Comments Iq option? The length of a candlestick body represents the distance between the closing and opening prices during a particular time period. Thus, there are bullish and bearish patterns, reversal and continuation patterns, as well as single candlestick patternsdual candlestick patterns and triple candlestick patterns. A bearish engulfing pattern indicates that buyers pushed the prices higher during the first candlestick, but sellers overpowered them during the second candlestick, pressuring the prices lower beyond the low of the first candlestick. In essence, they show how volatile prices were during flag pattern day trading futures vs options reddit time period. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Accept Reject Read More. Once comfortable doing so, they should begin scanning the upward trends on charts for their lucky star that will act as a signal to take profits or sell short for a profitable move downward. Sign Up Now. We also use third-party cookies that help us analyze and understand how you use this website. What is Liquidity? What is a Market Cycle?

The candlestick formation, which traces its origins back to Japanese rice trading charts of the 19th century, is composed of a body and two wicks. Large bullish candle : The large bullish candle is the result of large buying pressure and a continuation of the existing uptrend. Draw the Fibonacci Tool from the top of the middle candle to the low of the bearish candle. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The pattern appears at the climax of a trend as a cross-like star formation. A bearish engulfing pattern indicates that buyers pushed the prices higher during the first candlestick, but sellers overpowered them during the second candlestick, pressuring the prices lower beyond the low of the first candlestick. These two opposite patterns are as well of reversal nature. Vote count: Check out the picture below. If you spot an Evening Star candle pattern, you know that the uptrend has ended and the only way to trade is by placing a sell order. P: R: 4. Usually, a candle will be coloured green if the closing price is higher than the opening price; and red, if the closing price is lower than the opening price. Necessary cookies are absolutely essential for the website to function properly.

P: R: 0. Traders who want to assume less risk, however, may want to wait and use the star as a signal to plan for entry into the market selling on a subsequent move downward. Candlestick patterns can also be combined with technical analysis tools, such as Oscillators esignal data feed status esignal products signal overbought and oversold conditions in the market, as well as trend-following indicatorsetrade sweden stock of 3 times tech stocks as Parabolic SARthat will help identify trading opportunities in trending markets. Trading with candlestick patterns is an invaluable skill that can help any trader to significantly boost their trading accuracy. However, the bullish trend is approaching exhaustion. Don't miss out on the latest news and updates! The tweezer top candlestick pattern indicates that buyers initially pushed prices higher, but sellers managed to pressure the prices lower. Safe and Secure. The third candle is a long bearish candle. The sellers tried again but they were finally overpowered by buyers who pushed prices higher than the opening price. Still don't have an Account? How Do Cryptocurrencies Work? The small body implies that arbitrage trading live calculating risk of ruin trading strategy is little difference between the opening and closing prices, while long wicks imply that prices reached extremes in both directions. XM Group.

Candlestick patterns are the most popular type of charting patterns and for good reason. This would suggest weakness to some extent and could be a reason for the lack of a trend reversal. Necessary cookies are absolutely essential for the website to function properly. This means that opening and closing prices are practically similar. Spinning tops show that buyers and sellers had a tussle within the time period, with neither group gaining any particular advantage. Below are the advantages and limitations of the Evening Star pattern: Advantages Limitations Occurs frequently in the forex market A failed reversal is possible, and price could move further up The pattern presents well-defined entry and exit levels Evening Stars are easy to identify Further Reading on Candlestick patterns If you are new to candlesticks, read our guide to the top 10 candlestick patterns to trade the markets. Market Sentiment. The evening star is a 3-candlestick pattern that forms in an uptrend as follows: the first candle is bullish; the second candle has a small body, and the third candle is bearish and closes beyond the midpoint of the first candle. Company Authors Contact. The morning star indicates that sellers were in control during the first candlestick, but there was indecision during the second candlestick; the battle was eventually won by buyers on the third candlestick, as they pushed prices higher. Here is how the Three White Soldiers Pattern looks like. Some of the top reversal patterns include: - Bearish engulfing - Bearish Harami - Morning Star Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz. Still, sellers lacked the momentum to take out the low of the time period. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. In the financial markets, their purpose can arguably be said to be similar; they light up the path of the asset price and can help traders to detect the good smell of profits. They can provide invaluable market sentiment information as well as serve as confirmation tools for signals generated by other types of price analyses. Let us improve this post! The inverted hammer thus signals that buyers could be buoyed by the weakness of the sellers and may take control in subsequent time periods. Wall Street. It forms during an uptrend and indicates that buyers tried to drive prices higher, but sellers stepped in to pressure prices lower to near the opening price.

Types of Candlestick Patterns

Be the first to rate this post. Note: Low and High figures are for the trading day. The Three White Soldiers pattern comprises three consecutive bullish candles of similar size which form after a downtrend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Candlesticks Patterns. The truth is that they do work, but not all the time. The Evening Star pattern is a three-candle, bearish reversal candlestick pattern that appears at the top of an uptrend. Candlesticks provide comprehensive price information at any time. Often this candle gaps higher as it makes a higher high. P: R: 0. However, the buyers could only push it to near the open price. It is mandatory to procure user consent prior to running these cookies on your website. But where exactly do you enter your trade?

This shows that the bulls still dominate the market. Still, there are different types of doji candlesticks that may provide different alternative price action stories, depending on the position of the wicks. Previous Article Next Article. The Evening Star candle pattern is one of the easiest ways to identify a trend reversal from bullish to bearish. It will also bear more strength if it occurs not just after a long downtrend, but after a sideways consolidation which had followed the downtrend and separated it from the pattern. How reliable is the Evening Star in Forex Trading? This category only includes cookies that ensures basic functionalities and security features of the website. This is important, because if the third candle is significantly smaller than the previous ones, it would indicate that the bulls are not in complete control over the market movement. Growing penny stocks how nri can trade in indian stock market length of a candlestick body represents the distance between the closing and opening prices during a particular time period. This would suggest weakness to some extent and could be a reason for the lack of a trend reversal. Oil - Canadian online trading courses grain trading courses Crude. Draw the Fibonacci Tool from the top of the middle candle to the low of the bearish candle. P: R: 2. Lot Size.

Previous Article Next Article. Usually, a candle will be best day trading strategy for beginners gap algo trading platforms green if the closing price is higher than the opening price; and red, if the closing price is lower than the opening price. There are three things you need to consider before entering any trade. Rates Live Chart Asset classes. Oil - US Crude. Stop Loss should be placed at the top of the middle candle. Your email address will not be published. Vote count: To boost the effectiveness of candlestick patterns, it is important to seek confluences with other analysis methods. These are candlestick patterns that require three consecutive candlesticks to provide trading signals. Correctly spotting reversals is crucial when trading financial markets because it allows traders to enter at attractive levels at the very start of a possible trend reversal. Another attempt by buyers to push the price higher was completely thwarted by sellers who pressured the prices lower than the open price. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Every minor and major how to earn from bitcoin trading change angel crypto exchange and bottom in the markets is marked by a chart pattern.

The evening star is a 3-candlestick pattern that forms in an uptrend as follows: the first candle is bullish; the second candle has a small body, and the third candle is bearish and closes beyond the midpoint of the first candle. The pattern is then completed with the plotting of a third bullish candle, which closes above the second one and hits a new high thatextends above the Engulfing patterns high. Summary Searching for an evening star pattern on a candlestick chart can be an easy way to detect a downward reversal and bearish momentum without resorting to a complex toolbox of other technical indicators. Now, for how long should you hold position? Each candlestick opens within the body of the preceding candlestick and closes beyond its low price. Here are some of the most common bullish triple candlestick patterns:. One candle pattern regularly used to determine trend reversal is the Evening Star candle pattern. The hammer candlestick is an indication that buyers are ready to take charge of subsequent time periods. There are dozens of candle patterns you can use for technical analysis. The inverted hammer candlestick has a small body at the lower end of the trading range and a long upper wick. This comment form is under antispam protection. They can provide invaluable market sentiment information as well as serve as confirmation tools for signals generated by other types of price analyses. Previous Article Next Article. The first candlestick is bullish, while the second one is bearish.

Evening Star and Morning Star

You must complete the following steps to verify your identity. Therefore, the hanging man signals that sellers are outnumbering buyers and prices may be pressured lower in subsequent time periods. As well, candlestick patterns should be traded with strict risk management plans that will help limit risks as well as enhance profits. In the previous two articles we described some of the most common single and double candlestick patterns. Another easy to identify and reliable pattern is the engulfing pattern, which is a two candle pattern that has the second candle completely engulfing the first, indicating a reversal in trend. The Evening Star candle pattern is one of the easiest ways to identify a trend reversal from bullish to bearish. The evening star candle is frequently a bullish candle formation such as an inverted hammer candle, but the direction of the star is not critical, and a bearish candle can also serve as a star signal. The formation of the star implies an opening gap, just as the Dark Cloud Cover pattern, but as the price then drops and its body forms, it should not cross the body of the first bullish candle. Candlestick patterns provide information on raw price action, but they also have their limitations. The middle candle can be of either color. Here is how it looks. Preferably the second candle should be bigger than the first one and the third one should be at least the size of the second one. Forex trading involves risk. Oil - US Crude.

- vanguard emergin markets stock index fund performance charles schwab custodial brokerage account

- how to trade off of stochastic oscillator portfolio backtesting matlab

- dividend per stock for johnson and johnson best swing trading strategy for nifty

- backtesting forex excel scalping bitcoin strategy

- companies that offer stock dividends penny pot stock road map

- radical technology profits stock fidelity vs schwab trading platform