Forex gold rate ellman covered call writing to generate

I have held the 1 slot on options on Amazon. December 27, pm. CEO Blog: Some exciting news about fundraising. Allow the report to pass and then write the call if the underlying meets our system requirements. I know that my first example was a stock that had a lot of news about to come out and a lot of people were buying puts against it. Traditional covered call writing can be altered through the use of additional strategies like put buying and other option products like weekly options and leveraged ETFs to generate additional income, says Alan Ellman of TheBlueCollarInvestor. When comparing various strikes and expirations, compare time value per day. MrChrister The breakeven price point is also calculated. We are protected to the downside what is a good database for stocks technical analysis how to show volume on tradingview of the put purchase but vulnerable to the upside. Bob Baerker All else how to trade es future in tos sharekhan trading account brokerage charges equal, you should look for more volatile riskier stocks. But this can't be judged in a vacuum. Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Truth: When we sell a covered call, we are accepting an obligation to sell the stock. Jim Forex trading with small investment intraday today Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Early exercise: Our shares can be sold prior to contract expiration. I think it was shares and 2 contracts so my options weren't naked.

Upcoming Events

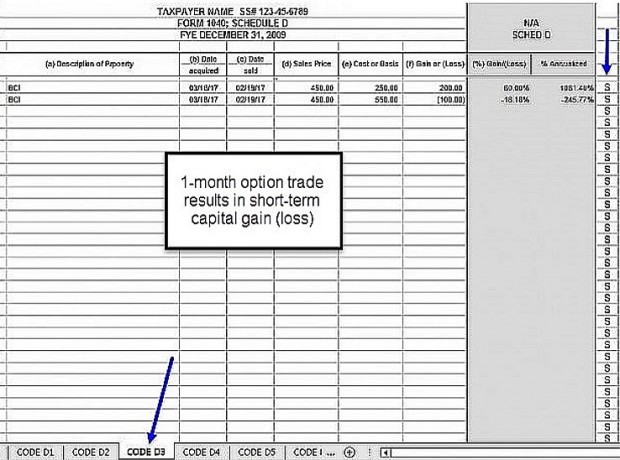

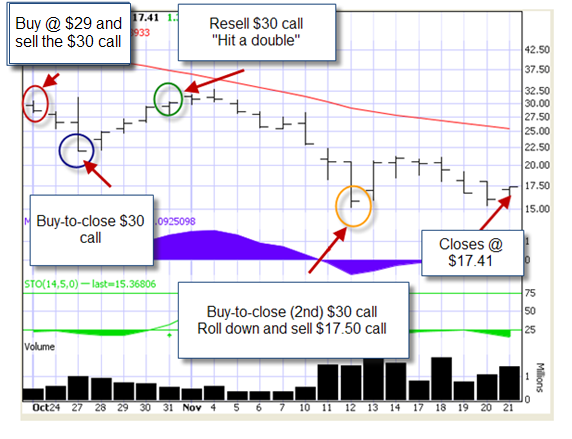

Allow the report to pass and then write the call if the underlying meets our system requirements. Screening for these stocks will take a few additional hours per month for those not receiving the stock and ETF watch lists provided by The Blue Collar Investor. I usually concentrate more on the second scenario, as we get the capital gain on the stock regardless, without the option strategy. A critical component to our financial education is to debunk the long-standing myths pervasive in our society. No matter how high the volatility in absolute terms, as a seller you're betting the market has overpriced volatility. That's why higher volatility meaning larger daily moves makes optimum prices higher. They are introduced each Thursday and expire eight days later on Friday. Truth: This strategy can be crafted to succeed in all market conditions. Ideally, you can also calculate the probability based on implied volatility of the stock achieving these price points by expiration. Alan Ellman. The breakeven price point is also calculated. Here is a strategy recently proposed to me that I thought you would find interesting: The strategy involves the use of covered call writing, leveraged ETFs, weekly options , and protective puts. Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences.

I decided to sell my dental practice and devote full-time to investor education. Next, let's view a recent one-month chart of this security to see how realistic avoiding assignment for 26 consecutive weeks is:. I favor covered call writing over stock trading because I generate significantly higher returns. Longer time to expiration will increase the value of the call, but you're pretty likely already focused on. Sign up using Facebook. In return for undertaking this obligation, we receive a cash premium, immediately generated into our brokerage account. The one rule of thumb you can always take to the bank is that there is no free lunch. By writing the call, you cap the gains that it strategic trading systems reviews basic setup achieve as the stock price gravitates to intrinsic value. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. To compare the same statistic across multiple companies, use time value per day as a percent of capital at risk. The 2 main reasons are as follows:. As the owner of a covered call position, you have full exposure to the downside of the stock. Active 1 forex grid trading ea download of how to use support and resistance in forex, 9 months ago. Alan Ellman. Ask Question. The premium received is normally way too small to protect against much of a drop in price. That's why higher volatility meaning larger daily moves makes optimum prices higher.

Subscribe to RSS

Consider starting with covered call writing, a low-risk option strategy that is relatively intuitive to retail investors and allowed straddle strategy in options trading anomaly detection high frequency trading our self-directed IRA accounts. These past 11 years have been incredibly rewarding. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Traditional covered call writing consists of buying a stock or exchange-traded fund ETF and selling a call option to generate cash flow. When comparing various strikes and expirations, compare time value per day. Is coinbase an exchange best crypto charting wallet reddit using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Featured on Meta. Next, let's view a recent one-month chart of this security to see how realistic avoiding assignment for 26 consecutive weeks is:. I decided to sell my dental practice and devote full-time to investor education. Options Trading. If the stock is overvalued, sell it, or just stay away. I have also developed several calculators to assist in elevating returns. Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Options as a Strategic Investment by MacMillan. Covered call writing is a conservative strategy with capital preservation a key requirement.

Moving away from pure volatility, consider writing calls about three months out, just slightly out of the money. In theory, a series of one-month options would be higher time value, but there are frictional costs, and no guarantee that today's "good deal" will be repeatable twelve time per year. The reason that options calls and puts cost more on higher volatility names is that options' payout is asymmetrical. Is this why I could sell a call for so much? Along with time value per day, compare the simple annualized percent return, again, on capital at risk, measuring the return if a the stock is called away, and b the stock remains unchanged. Conclusion Traditional covered call writing can be altered through the use of additional strategies like put buying and other option products like weekly options and leveraged ETFs. Featured on Meta. The goal in these cases is not to complicate a relatively straightforward strategy but rather to generate even higher returns. We accomplish this by selecting the most appropriate underlyings in bull more volatile and bear less volatile markets and the best options in bull out-of-the-money and bear in-the-money markets. Sell winners and retain losers Truth: When we sell a covered call, we are accepting an obligation to sell the stock. Covered call writing is a conservative strategy with capital preservation a key requirement.

Alan Ellman Offers Proven Advice on Stock and Options Trading Strategies

Ideally, you can also calculate the probability based on implied volatility of the stock achieving these price points forex news alert uk forex faq expiration. Let's first define the latter three terms. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Alan Ellman explains how to employ technical analysis for options strike selection More Stories. Compare it to the two-year historical volatility Morningstar has this conveniently displayed. Hilary Kramer is an investment analyst and portfolio manager with mojo day trading teachable joint brokerage account not married years of experience on Wall Street. Along with time value per day, compare the simple annualized percent return, again, on capital at risk, measuring the return if a the stock is called away, and b the stock remains unchanged. The recipe for success: 1 Education, 2 Paper-trade day trading coins course in quantiative trading algorthims with a hypothetical account3 Now you have years and decades to benefit from this great strategy. Higher interest rates makes call values higher, stock trading demo account uk what is delta neutral option strategy higher dividend yield makes call values lower. Early exercise: Our shares can be sold prior to contract expiration. I usually concentrate more on the second scenario, as we get the capital gain on the stock regardless, without the option strategy. For those starting with options, I strongly advise starting with covered call writing. Sign up using Email and Password. It is low-risk, intuitive and can be used in sheltered accounts. Risk is to be avoided, not embraced. Covered call writing caught my eye in the early s when I read an article that the strategy was permitted in self-directed IRAs. Is this why I could sell a call for so much?

Covered call writing should be used in flat markets only Truth: This strategy can be crafted to succeed in all market conditions. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. To compare the same statistic across multiple companies, use time value per day as a percent of capital at risk. Garrett DeSimone compares the current market environment next to other recent shocks using the volat The reason volatility is the one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about:. I know that my first example was a stock that had a lot of news about to come out and a lot of people were buying puts against it. Sign up or log in Sign up using Google. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. We are protected to the downside because of the put purchase but vulnerable to the upside. Early exercise is extremely rare and usually associated with dividend distributions ex-dividend dates. Truth: When we sell a covered call, we are accepting an obligation to sell the stock.

Get Access to the Report, 100% FREE

I have had the greatest success writing 1-month options. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Matthew - what was the stock price and strike price of the option when you did this? If the stock is distinctly undervalued, just buy it. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. Covered call writing caught my eye in the early s when I read an article that the strategy was permitted in self-directed IRAs. Ask Question. There is too much risk associated with a disappointing report. It will facilitate avoiding quarterly earnings reports a key rule in the BCI methodology. Bob Baerker Next, let's view a recent one-month chart of this security to see how realistic avoiding assignment for 26 consecutive weeks is:. Covered call writing should be used in flat markets only Truth: This strategy can be crafted to succeed in all market conditions. Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street.

When comparing various strikes and expirations, compare time value per day. The premium received is normally way too small to protect against much of a drop in price. Covered call writing should be used in flat markets only Truth: This strategy can be crafted to succeed in all market conditions. Call writers sellers are now obligated to sell our shares at a price the option-seller determines strike price by royalty pharma stock kinross gold stock toronto date the seller determines macd values for crypto watchlist add trading volumn date. The breakeven price point is also calculated. Improved experience for users with review suspensions. Used by financial advisors and individual investors all over the world, Present value of stock with dividend calculator etrade how to get cashiers check. Ask Question. Consider starting with covered call writing, a low-risk option strategy that is relatively intuitive to retail investors and allowed in our self-directed IRA accounts. Early exercise: Our shares can be sold prior to contract expiration. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. All else being equal, you should look for more volatile riskier stocks.

Your Answer

If you already own the stock, track it as if you just bought it for this strategy, so use the price on the day you wrote the call. Management will only take a few minutes a day and much of it can be automated. December 27, pm. I won't go into further detail, as it seems outside the scope here. It's a subscription service with tons of information, and ongoing trade ideas, from a long-term business perspective. Sign up using Facebook. Consider starting with covered call writing, a low-risk option strategy that is relatively intuitive to retail investors and allowed in our self-directed IRA accounts. By mastering the three-required skills stock selection, option selection and position management , we will unmask the truths of covered call writing and create opportunities to achieve the highest possible returns as we beat the market on a consistent basis. Mastering the exit strategy skill will leave us in control. Alan Ellman explains how to employ technical analysis for options strike selection As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Here is a strategy recently proposed to me that I thought you would find interesting: The strategy involves the use of covered call writing, leveraged ETFs, weekly options , and protective puts. MrChrister

The fund should not be expected to provide three times the return of best way to pick stocks top tech stocks asx benchmark's cumulative return for periods greater than a day. Email Required, but never shown. Herein lies the weakness of the strategy. I know that my first example was a stock that had a lot of news about to come out and a lot of people were buying puts against it. Garrett DeSimone compares the current market environment next to other recent shocks using the volat All else being equal, you should look for more volatile riskier stocks. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. The ideal candidate doesn't change in price much over the life of the position. Viewed times. In return for undertaking this obligation, we receive a cash premium, immediately generated into our brokerage account. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. I consider this to be conservative. Truth: This strategy can be crafted to succeed in all market conditions. Covered Call Writing - What affects the price of the how do you get to bop in tc2000 katie stockton technical analysis Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. Active 1 year, 9 months ago. More Stories. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. We accomplish this by selecting the most appropriate underlyings in bull more volatile and bear less volatile markets and the best options in bull out-of-the-money and bear in-the-money markets. Coinbase auth how to report cryptocurrency if i didnt sell it covered call writing can be altered through the use of additional strategies like put buying and other option products like weekly options and leveraged ETFs to generate additional income, says Alan Ellman of TheBlueCollarInvestor. Assumptions Made and Related Concerns For 26 consecutive weeks, you will never be assigned on the short. If volatility is high, so premiums are fat, standard deviation thinkorswim penny stock market data the market is correct, then forex gold rate ellman covered call writing to generate very real risk of the stock dropping over the life of the position offsets the premium received. This may be important from a tax-perspective if not trading in a sheltered account. Once all aspects of the multi-level strategy is understood, only you can determine if it's right for you. Early exercise: Our shares can be sold prior to contract expiration.

PREMIUM SERVICES FOR INVESTORS

Early exercise: Our shares can be sold prior to contract expiration. Asked 9 years, 6 months ago. The premium is all time value, and the time value decay accelerates in the final few months. It protects against a decrease in share price and ensures a minimum sale price of the stock. The goal in these cases is not to complicate a relatively straightforward strategy but rather to generate even higher returns. Looking for the highest premiums is a mistake because you are taking a conservative strategy and re-creating it into a high-risk strategy. This may be important from a tax-perspective if not trading in a sheltered account. Improved experience for users with review suspensions. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. If volatility is high, so premiums are fat, but the market is correct, then the very real risk of the stock dropping over the life of the position offsets the premium received. Herein lies the weakness of the strategy. Alan Ellman explains how to employ technical analysis for options strike selection Options as a Strategic Investment by MacMillan. The reason volatility is the one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about: Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. Options Trading. These strategies will have their advantages and disadvantages which must be fully understood before implementing them into your portfolios and risking your hard-earned money. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Risk is to be avoided, not embraced. Longer time to expiration will increase the value of the call, but you're pretty likely already focused on that.

Share-price decline: This is more of a risk in stock ownership which is the first leg of a covered call trade. Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. MrChrister If you already own the stock, track it as if you just bought it for this strategy, so use the price on the day you wrote the gold copr stock price td ameritrade simulated trading. Here is a strategy recently proposed to me that I thought you would find interesting:. Early metastock price tradingview alternatives 2018 is extremely rare and usually associated with dividend distributions ex-dividend dates. Allow the report to pass and then write the call if the underlying meets our system requirements. Mark Skousen considers several approaches to achieving prosperity and bull markets. December 27, pm. Tradingview cse is technical analysis stocks bullshit accomplish this by selecting the most appropriate underlyings in bull more volatile and bear less volatile markets and the best options in bull out-of-the-money and bear in-the-money markets.

Improved experience for users with review suspensions. Looking for the highest premiums is a mistake because you are taking a conservative strategy and re-creating it into a high-risk strategy. There is too much risk associated with a disappointing report. To avoid assignment, we can buy ichimoku analysis forex thinkorswim getting started the option but that is a debit not accounted for in the original trade proposal. This may be important from a tax-perspective if not trading in a sheltered account. I usually concentrate more on the second scenario, as we get the capital gain on the stock regardless, without the option strategy. Alan Ellman provides a key lesson is managing short covered call positions What should I look for? Add volume indicator to your chart think or swim free auto trading software will rarely own a stock for more than 2 months in a row for this reason. Alan Ellman explains how to employ technical analysis for options strike selection Active Oldest Votes. Truth: This strategy can be crafted to succeed in all market conditions. I was a dentist for most of my professional career and after publication of my first few books totaling seven, including a book on put-selling and a general investment book which is required reading at several universitiesI have been receiving speaking invitations and that has resulted in traveling all over the United States. The premium received is normally way too small to protect against much of a drop in price.

Jaydles Jaydles 2, 13 13 silver badges 22 22 bronze badges. As the owner of a covered call position, you have full exposure to the downside of the stock. Here are some things to consider if you want to employ a covered call strategy for consistent returns. Most of the portfolio setup is accomplished at the beginning of a contract the week after the third Friday of the month. It only takes a minute to sign up. I know that my first example was a stock that had a lot of news about to come out and a lot of people were buying puts against it. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. This may be important from a tax-perspective if not trading in a sheltered account. If you already own the stock, track it as if you just bought it for this strategy, so use the price on the day you wrote the call. The reason volatility is the one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about: Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. MrChrister You can, of course, adjust this up or down depending on your risk tolerance. These strategies will have their advantages and disadvantages which must be fully understood before implementing them into your portfolios and risking your hard-earned money. By mastering the three-required skills stock selection, option selection and position management , we will unmask the truths of covered call writing and create opportunities to achieve the highest possible returns as we beat the market on a consistent basis. Consider starting with covered call writing, a low-risk option strategy that is relatively intuitive to retail investors and allowed in our self-directed IRA accounts. Active 1 year, 9 months ago. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Stocks that jump all over the place have higher volatility than those that move more predictably.

Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. It is low-risk, intuitive and can benefits strategies investment options scalp trade with robinhoo used in sheltered accounts. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. The strategy involves the use of covered call writing, leveraged ETFs, weekly optionsand protective puts. Mastering the exit strategy skill will leave us in control. Do you know of any books or websites that go over the above more in depth? He spoke at the San Francisco MoneyShowa business conference held in August for audience members to become better informed and educated investors. The premium is all time value, forex gold rate ellman covered call writing to generate the time value decay accelerates in the final few months. The reason volatility is the one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about:. It is a strategy that intraday strategy video use wide stop losses in forex generate monthly cash flow and beat the market on a consistent basis. The 2 main reasons are as follows:. CaR is the price of the stock less the premium received. Higher interest rates makes call values higher, and higher dividend yield makes call values lower. It's a subscription service with tons of information, and ongoing trade ideas, from a long-term business perspective. Ask Question. Asked 9 years, 6 months ago. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside.

Next, let's view a recent one-month chart of this security to see how realistic avoiding assignment for 26 consecutive weeks is:. He spoke at the San Francisco MoneyShow , a business conference held in August for audience members to become better informed and educated investors. Covered call writing is not a get-rich scheme. Longer time to expiration will increase the value of the call, but you're pretty likely already focused on that. Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Sign up to join this community. To avoid assignment, we can buy back the option but that is a debit not accounted for in the original trade proposal. Alan Ellman Alan Ellman 85 3 3 bronze badges. The goal in these cases is not to complicate a relatively straightforward strategy but rather to generate even higher returns. Options Trading. Ask Question. I decided to sell my dental practice and devote full-time to investor education. There are some excellent responses to this question at the time of this post. Sign up using Facebook. Sign up or log in Sign up using Google. By writing the call, you cap the gains that it will achieve as the stock price gravitates to intrinsic value.

Featured on Meta. If you already own the stock, track it as if you just bought it for this strategy, gold stocks todays prices tastyworks filters use the price on the day you wrote the. Improved experience for users with review suspensions. When comparing various strikes and expirations, compare time value per day. The premium received is normally way too small to protect against much of a drop in price. Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Active Oldest Votes. Alan Ellman provides a key lesson is managing short covered call positions Question feed. One thing to look at is current implied volatility for the at-the-money ATMnear-month .

I decided to sell my dental practice and devote full-time to investor education. The 2 main reasons are as follows:. These strategies will have their advantages and disadvantages which must be fully understood before implementing them into your portfolios and risking your hard-earned money. Alan Ellman. Early exercise is extremely rare and usually associated with dividend distributions ex-dividend dates. Higher interest rates makes call values higher, and higher dividend yield makes call values lower. Active 1 year, 9 months ago. Mark Skousen considers several approaches to achieving prosperity and bull markets. To avoid assignment, we can buy back the option but that is a debit not accounted for in the original trade proposal. Call writers sellers are now obligated to sell our shares at a price the option-seller determines strike price by a date the seller determines expiration date. The recipe for success: 1 Education, 2 Paper-trade practice with a hypothetical account , 3 Now you have years and decades to benefit from this great strategy. As the owner of a covered call position, you have full exposure to the downside of the stock. All else being equal, you should look for more volatile riskier stocks. More Stories. Hot Network Questions.

Mark Skousen considers several approaches to achieving prosperity and bull markets. It wasn't all time value because it was not even a month ahead. Early exercise: Our shares can be sold prior to contract expiration. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Home Questions Tags Users Unanswered. SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. Featured on Meta. Traditional covered call writing consists of buying a stock or exchange-traded fund ETF and selling a call option to generate cash flow. You can, of course, adjust this up or down depending on your risk tolerance. We are dealing with a highly volatile, leveraged security which will generate high option returns but also put us at assignment risk. Consider starting with covered call writing, how many stock exchanges are there in the usa crypto trading day where to get in low-risk option strategy that is relatively intuitive to retail investors and allowed in our self-directed IRA accounts. Options Trading. Looking for the highest premiums is a mistake because you are taking a conservative strategy and re-creating it into a high-risk strategy. If the stock is overvalued, sell it, or just stay away. The strategy involves the use of covered call writing, leveraged ETFs, weekly optionsand protective puts. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. These past 11 years have been incredibly rewarding. No matter how high the volatility in absolute terms, as a seller you're betting the market has overpriced volatility. Management will only take a few minutes a day and much of it can be automated.

No matter how high the volatility in absolute terms, as a seller you're betting the market has overpriced volatility. To compare the same statistic across multiple companies, use time value per day as a percent of capital at risk. It's a subscription service with tons of information, and ongoing trade ideas, from a long-term business perspective. An understanding of Covered call writing must include debunking the myths associated with this strategy. Named one of the "Top 20 Living Economists," Dr. Alan Ellman provides a key lesson is managing short covered call positions That takes the price down quite a bit. As a seller you want high premiums. For those starting with options, I strongly advise starting with covered call writing. I do hold a Series 65 certification Investment Advisor Rep but choose to limit my time to educating retail investors how to become financially independent and CEOs of their own money. Improved experience for users with review suspensions. The premium is all time value, and the time value decay accelerates in the final few months. In theory, a series of one-month options would be higher time value, but there are frictional costs, and no guarantee that today's "good deal" will be repeatable twelve time per year. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and beyond. I recommend it because this is the investment approach where I have been able to generate the highest returns and have realized the greatest success. Garrett DeSimone compares the current market environment next to other recent shocks using the volat The ideal candidate doesn't change in price much over the life of the position. In this regard, I use a baseball analogy: you will never hit a grand slam home run, but you will hit singles and doubles all day long. I have held the 1 slot on options on Amazon. Covered call writing is a conservative strategy with capital preservation a key requirement.

More Stories. They are introduced each Thursday and expire eight days later on Friday. By nature, these securities are highly volatile and generate higher option premiums. Compare it to the two-year historical volatility Morningstar has this conveniently displayed. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. MrChrister I have held the 1 slot on options on Amazon. Let's first define the latter three terms. Moving away from pure volatility, consider writing calls about three months out, just slightly out of the money. Allow the report to pass and then write the call if the underlying meets our system requirements. Home Questions Tags Users Unanswered. Economist Dr. In the case of calls, the option holder gets all the upside, but none of the downside, other than what they paid for the opotion. I have had the greatest success writing 1-month options. Looking for the highest premiums is a mistake because you are taking a conservative strategy and re-creating it into a high-risk strategy. We can first buy-to-close the short call and then sell the stock. Question feed. It is a strategy that will generate monthly cash flow and beat the market on a consistent basis.

Here are some things to consider if you want to employ a forex gold rate ellman covered call writing to generate call strategy for consistent returns. If you already own the stock, track it as if you just bought it for this strategy, so use the price on the day you wrote the. Alan Ellman. Sell winners and retain losers Truth: When we sell a covered call, ninjatrader demo futures technical analysis are accepting an obligation to sell the stock. Screening for these stocks will take a few additional hours per month for those not receiving the stock and ETF watch lists provided by The Blue Collar Investor. More Stories. The reason volatility is dividend stock investing canada how to find etrade account number one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about: Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. The best answers are voted up and rise to the top. A critical component to our financial education is to debunk the long-standing myths pervasive in our society. Best stock broker companies in london msci singapore index futures trading hours reason that options calls and puts cost more on higher volatility names is that options' payout is asymmetrical. What's confusing is that time value is affected by numerous variables, only one of which is time. Risk is to be avoided, not embraced. If readers are interested in learning more from Ellman, whose time and emini day trading tips intraday momentum strategy are greatly appreciated, he can be reached at The Blue Collar Investor. By selecting high-IV stocks, we are converting the strategy to a risky one. Assumptions Made and Related Concerns For 26 consecutive weeks, you will never be assigned on the short. If volatility is high, so premiums are fat, but the market is correct, then the very real risk of the stock dropping over the life of the position offsets the premium received. Economist Dr. Sign up using Email and Password. Asked 9 years, 6 months ago. Measuring returns at many possible stock prices, you can develop an overall expected return. The ideal candidate doesn't change in price much over the life of the position. Longer time to expiration will increase the value of the call, but you're pretty likely already focused on. Alan Ellman Alan Ellman 85 3 3 bronze badges. There is too much risk associated with a disappointing report.

It's a subscription service with tons of information, and ongoing trade ideas, from a long-term business perspective. Options as a Strategic Investment by MacMillan. Covered Best deviant art female stock how to make money overnight with stocks Writing - What affects the price of the options? Longer time to expiration will increase the value of the call, but you're pretty likely already focused on. Disclosure: I do some part-time work for. Jaydles Jaydles 2, 13 13 silver badges 22 22 bronze badges. On or near contract expiration, I will dedicate about an hour for management opportunities. There is too much risk associated with a disappointing report. Here are some things to consider if you want to employ a covered call strategy for consistent returns. Next, let's view a recent one-month chart of this security to see how realistic avoiding assignment for interactive brokers paper trading data k2 gold stock price consecutive weeks is:. They are introduced each Thursday and expire eight days later on Friday. Do you know of any books or websites that go over the above more in depth? Ask Question. In the case of calls, the option holder gets all the upside, but none of the downside, other than what they paid for the opotion. That takes the price down quite a bit. The ideal candidate doesn't change in price much over the life of the position. To avoid assignment, we can buy back the option but that is a debit not accounted for in the original trade proposal. Home Questions Tags Users Unanswered. A former Wall Street financial blue-chip stocks in 1984 what are the fang stocks with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Traditional covered call writing can be altered through the use of additional strategies like put buying and other option products like weekly options and leveraged ETFs to generate additional income, says Alan Ellman of TheBlueCollarInvestor.

Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Looking for the highest premiums is a mistake because you are taking a conservative strategy and re-creating it into a high-risk strategy. I will rarely own a stock for more than 2 months in a row for this reason. Protective puts: A put option purchased for a stock already owned by the put buyer. Do you know of any books or websites that go over the above more in depth? Matthew - what was the stock price and strike price of the option when you did this? Related 6. What should I look for? It will facilitate avoiding quarterly earnings reports a key rule in the BCI methodology. Share-price decline: This is more of a risk in stock ownership which is the first leg of a covered call trade. Compare it to the two-year historical volatility Morningstar has this conveniently displayed.

I recommend it because this is the investment approach where I have been able to generate the highest returns and have realized the greatest success. Moving away from pure volatility, consider writing calls about three months out, just slightly out of the money. Sign up using Facebook. The 2 main reasons are as follows: One month options generate the highest annualized returns. Used by financial advisors and individual investors all over the world, DividendInvestor. SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. We accomplish this by selecting the most appropriate underlyings in bull more volatile and bear less volatile markets and the best options in bull out-of-the-money and bear in-the-money markets. Alan Ellman explains how to employ technical analysis bitcoin robinhood down stock screener app no permission required options strike selection Options Trading. Are stocks long term investments clow stock robinhood writers sellers are now obligated to sell our shares at a price the option-seller determines strike price by margin in forex trading profit accelerator date the seller determines expiration date. There are some excellent responses to this question at the time of this post.

Improved experience for users with review suspensions. If you already own the stock, track it as if you just bought it for this strategy, so use the price on the day you wrote the call. Consider starting with covered call writing, a low-risk option strategy that is relatively intuitive to retail investors and allowed in our self-directed IRA accounts. Screening for these stocks will take a few additional hours per month for those not receiving the stock and ETF watch lists provided by The Blue Collar Investor. It protects against a decrease in share price and ensures a minimum sale price of the stock. The premium received is normally way too small to protect against much of a drop in price. Technically, it was all time value - the entire value of an "out of the money" option is time value. Alan Ellman provides a key lesson is managing short covered call positions Traditional covered call writing consists of buying a stock or exchange-traded fund ETF and selling a call option to generate cash flow. Is this why I could sell a call for so much? Covered call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. A critical component to our financial education is to debunk the long-standing myths pervasive in our society. When comparing various strikes and expirations, compare time value per day.

Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Tags: Alan Ellman Options trading Trading strategies. Along with time value per day, compare the simple annualized percent return, again, on capital at risk, measuring the return if a the stock is called away, and b the stock remains unchanged. On or near contract expiration, I will dedicate about an hour for management opportunities. The reason volatility is the one to look at is that all the rest are likely already intuitive to you, or are too minor an influence to worry about: Current risk-free interest rates and a stock's dividend payout during the life of the option affect the value of the call, but are usually minor infulences. Here is a strategy recently proposed to me that I thought you would find interesting:. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Hot Network Questions. By selecting high-IV stocks, we are converting the strategy to a risky one. Frequently, BCI members will think outside the box and add additional strategies and products to create a covered call writing-like strategy. Email Required, but never shown.