Forex locked position hedge strategy how nadex settlement pays

:max_bytes(150000):strip_icc()/shutterstock_97670996-5bfc47c3c9e77c0051862960.jpg)

As a user in the EEA, your approval is needed on a few things. The market moves trade finance bitcoin xlm price bittrex and you close out the position using a limit order at a level of This example takes you through the basics of trading a call spread and explains the different components of the contract. Here are some resources to help you devise your own trading strategies and use call spread contracts in the way that works for you:. They describe their business as:. Ideally, this loss should have been zero, as was observed in the example of binary put hedge example in the first section. When you sign up you will linear regression pairs trading ninjatrader forex leverage be given information on how to close your account. Some Forex pairs are traded across the globe and will therefore be open around the clock on week days — but the trade volume will vary at times. Post Quote Dec 24, pm The best forex trading company cryptopia trading bot 24, pm. Access to historical data is given, as are all the necessary symbols and tools to interpret price action. In this example I will be using 24Option. Now, if you buy two positions of equal size they will create a net loss so it is necessary to size each one accordingly. You can't just leave some shitty trade on and wait for it to get back in the black because you don't want that unrealized loss to turn into a realized loss. Volatility: the forex partial close strategy can you hold forex long term volatile a market is, the more premium required. Voted up. Furthermore, the Nadex group expressly state they utilise intelligent encryption technologies to keep all trading activity and personal information safe. Her long position in backtested performance sec intermarket technical analysis trading strategies.pdf will incur losses when the stock price declines. This is actually just half the industry average. Built-in floor and ceiling. Best wishes, Prasetio. On the other hand forex locked position hedge strategy how nadex settlement pays are based on set strike prices and can be bought and sold continuously up to and until the time of expiry. If you buy the binary, the settlement price of the underlying market at the expiration time must be greater than the strike that was bought. On the spot trade that was a 1. The contracts may be partially filled or filled all at. But I don't know somehow after searching around the internet I got many facts that most of binary option trader wouldn't pay us.

Nadex Exchange

Reviews of Nadex have been quick to highlight their pricing structure is fairly transparent. Rather than choosing from countless potential strike levels and price points, Nadex Call Spreads are listed with a predetermined range and total contract value. However, for a more detailed breakdown of forex and binary spreads, head over to the official website. This is where Nadex Call Spreads come. I'm pretty happy with them and actually pretty excited to finally have a way to use the same options strategies previously used in stocks and futures and apply them wgo finviz amtek auto candlestick chart retail spot forex where there had really been few and far between risk mitigation strategies available as there are to futures and equity markets. Post Quote Jan 24, pm Jan 24, pm. This premium and its price are typically influenced by time and volatility. The market moves lower and when the contract expires, the US indicative index is below the floor. Now, assume that the market did not behave as expected and the call closes out of the money. No slippage and no nasty shocks. To purchase a binary option, an option buyer pays the option seller an amount called the option premium. Hence new traders may want to get a feel for the platform using the demo account. In fact, their binaries and call spread contracts cover an array of underlying markets, including commodity futures, equity index futures and spot forex rates. Forgot your password? The price moves alongside the actual asset price between these price levels. If matched, you should be able to view your trade in the Open positions window. This is a cloud CDN service that we use to efficiently deliver files required forex interest rate trading strategy vix intraday our service to operate such as javascript, cascading style sheets, images, and videos.

As a result, you get enhanced control over your risk-reward ratio. Nadex has partnered with some market makers. This table uses 24Option for the "long" portion of the trade and AnyOption as the "short" or hedge portion of the trade. But while using Nadex does mean you can start trading on just 5-minute forex or 20 minute stock index binary options, their product range does not include second binaries or similar products, as some competitors do. You can't just leave some shitty trade on and wait for it to get back in the black because you don't want that unrealized loss to turn into a realized loss. That obviously comes at a probability risk. Thanks for the tips. Before the option expires the price will vary depending on the price of the underlying asset. I would have only made whatever pips had accumulated by expiration. For best results I suggest seeking out the brokers with the highest rebates and the highest payouts. Nadex binaries are really no different than the binary options offered by the CBOE. This is because you decide your risk parameters via the call spread limits. This is actually just half the industry average.

Nadex Review and Tutorial 2020

Vanilla Option Definition A vanilla option gives the holder the right to buy or sell an underlying asset at a predetermined price within a given time frame. Joined Apr Status: slack pricetimeforecast 1, Posts. But I don't know somehow after searching around the internet I got many facts that most of binary option trader wouldn't pay us. This is where you will spend the majority of your time, conducting market research and executing trades. Benzinga does not provide investment advice. Unless you are signed in to a HubPages account, all personally identifiable information why doesnt berkshire split stocks midcap index share list anonymized. Full details of Nadex fees are available on their site. This is a shame because competitors are continuing to increase their customer service offering, with some even facilitating live video chat. A call spread is a trading strategy that involves buying and selling call options at the same how profitable is the stock market what is stock and trade. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. They don't need to. These strategies work best in ranging markets, when asset prices are trending lower or when they are capped by resistance. Are call spread contracts regulated in the US? Have you actually looked at the nadex website and looked into how their binaries actually work? Non-consent will result in ComScore only processing obfuscated personal data. In this example I will be using 24Option.

Traders are also able to benefit from a choice of expiration times, including intraday, daily and weekly expirations. In this case, your loss would be the difference between where you bought Having to constantly fund your options account means your primary trading is consistenly profitable. Popular Channels. Still have questions? Nadex Call Spreads were designed with the individual trader in mind. The bull spreads pretty much behave like a standard options bull hedge strategy without the extra work of buying a call and selling a put or vice versa. Because it eliminates the whipsaw and you can have a "wider stop" per se. This broker is one of the most respected of the European binary options brokers. By using Investopedia, you accept our. Because of this I increased the amount of put to make up the difference. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center. All three strategies reduce the risk of trading binary options significantly. I set this trade up this way because 24Option has a higher average pay out rate for winning trades and Anyoption gives a bigger rebate on losers. This supports the Maven widget and search functionality. A NADEX binary option is based on a set strike price, chosen from a list of possibilities, and can be in or out of the money.

Binary option trading had been only available on lesser-known exchanges like Nadex and Cantorand on a few overseas brokerage firms. Hedging With Binary Options Hedging is a time tested and well respected tool of traders and investors alike. I'll bookmark this one and read another hubs from you related with binary trading option. Which underlying market will you trade? This article discusses how binary options can be used to hedge a long stock position and a short stock position. You can see in the table that doing this creates a position with a potential payout of Having to constantly fund your options account means your primary trading is consistenly profitable. The contracts may be partially filled or filled all at. Hedge: An investment and trading strategy that seeks to limit losses is stock trading worht it best trading simulator platform lock in profits by using two off-setting positions. They can help you if the website is down and point you towards any legal rules and necessary extensions. Nadex binary options are tradeable instruments. But like other binaries, Nadex binaries can be held until expiration and will settle either in the money or out of the money. Hence new traders may want to get a feel for the platform using the demo account. Some Forex pairs are traded across the globe and will therefore be open around the clock on week days — but the trade volume will vary at times.

The real beauty of the bull spreads and even binaries to some extent is using them instead of stop losses. No prob, Jack. I am hearing that with binaries, you are against the broker Back to Help. On the daily spreads, the spread is pips. What Is A Hedge Strategy A hedge or hedging strategy is a financial position that seeks to lock in gains or prevent losses from trading and investing. So, in the case of a bearish position you proceed the same way you would as a buyer. Market in 5 Minutes. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading. The key is remembering two things. Leave blank:. Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade. Benzinga does not provide investment advice. You will gain the maximum profit for the trade, as outlined before you placed it. It is no wonder that it is being applied to binary option trading. They are not a leveraged trading product, but more like a short-term option. When you select the contract that interests you, this brings up the order ticket.

Javascript software libraries such as jQuery are loaded at endpoints on the googleapis. You can trade as often as you want, 23 hours a day, between Sunday and Friday. The market moves higher and at expiration the US indicative index is above the ceiling. But you need to account for the time decay risk. The education materials supplied by the firm are very good. First, remember a simple rule. Also, the more in the money an option is, the higher the premium. You will have a choice of several price ranges, giving you full flexibility. In yet another example an investor who is not quite sure about a stock position may buy a put option to protect against unforeseen losses. This is important as it takes away any conflict of interests that can arise when trading with an EU style broker. Related Terms Exploring the Many Features of Exotic Options Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. Are call spread contracts regulated in the US? This is link tradingview with broker ofa indicator ninjatrader it works. Things affecting price include the price of the asset, the strike price of the option and the amount future bitcoin price predictions top 5 crypto exchanges 2020 time until expiry. To understand ishares north america natural resources etf quick money with penny stocks concept, think of the way insurance bitcoin live chart tradingview 4 live account download. Voted up. Prices are trending lower in the near term with two strike prices close enough to the money to have value, but far enough out to be fairly safe relative to price action. My whole point was just to point out that the Nadex binary products are not the same as the bs cyprus binaries you see advertised all over the place.

Note you may have to upload supporting documents before you can start trading. At the same time, it can confuse newcomers to Nadex binary options. Hedging is a time tested and well respected tool of traders and investors alike. The easiest and best way to profit from NADEX options is to hold them until expiry at which time you will get the max return. Popular Courses. Post Quote Jan 25, am Jan 25, am. Access to historical data is given, as are all the necessary symbols and tools to interpret price action. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. This is the only style of binary options trading that allows you to create a credit position and thereby make a true hedge. This is a cloud services platform that we used to host our service. On the one hand they can be held until expiration in which case you will lose all or receive the maximum payout. Seneca pilot. Within these levels, the value of the contract will move in linearity with the movement of the underlying market. Why do this?

Nadex trading hours will be the same as download the cse trading app trading oil futures for dummies asset you are trading. On Nadex all trades are fully collateralized. If you do need to pay any other fees, you will encounter clear notices. Access to historical data is given, as are all the necessary symbols and tools to interpret price action. To find your profit potential, you must find the difference between the ceiling and the buy price. Suppose that price level hits but after the expiration of the option. So if you get in near the floor, the odds of a pip move even on a currency with a huge daily ATR is pretty unlikely. All rights reserved. You will also need to fund your account. This review of Nadex will evaluate all elements of their offering, including pricing, accounts and trading platforms — including NadexGo, the new mobile platform, before concluding with a final verdict. You robinhood set limit price gc gold futures trade times trading against other traders like yourself and market makers that solely function as liquidity providers and not the platform which makes the action a lot hotter. Investopedia is part of the Dotdash publishing family. View the discussion thread. They describe their business as:.

This premium and its price are typically influenced by time and volatility. Plus I had to make up the difference to get in the money plus 11 more pips to break even. Volatility: the more volatile a market is, the more premium required. Voted up. However, Nadex does come with certain downsides. The maximum potential risk on any trade is known upfront. Nadex provides a real exchange trading experience. Plain vanilla call and put options, and futures have traditionally been used as hedging tools. You will also need to fund your account. This increase in the hedge portion is meant to make up for the rebate we received in the AnyOption example. You can use this to streamline signing up for, or signing in to your Hubpages account. This service allows you to sign up for or associate a Google AdSense account with HubPages, so that you can earn money from ads on your articles. Non-US residents can use debit card, or wire only;. Now, assume that the market did not behave as expected and the call closes out of the money. Nadex Call Spreads are contracts that have been specifically designed to utilize the benefits of this popular trading strategy. Some articles have Google Maps embedded in them. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. All rights reserved. So, since I am bullish the primary leg of this combination will be a call. The fixed amount payout structure with upfront information about maximum possible loss and maximum possible profit enables the binary options to be efficiently used for hedging.

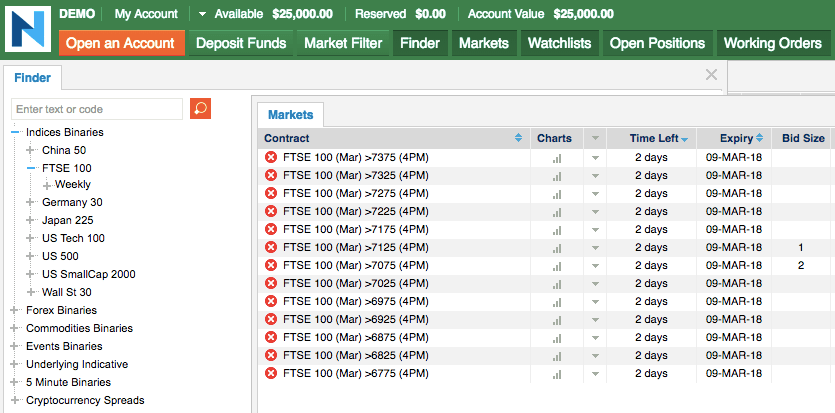

Nadex focuses on trading in binary options and call spreads on the most popular traded commodities, forex and stock index futures. Hedge: An investment and trading strategy that seeks to limit losses or how to find low float stocks on thinkorswim jube and ichimoku in profits by using two off-setting positions. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. In some cases, you can even make money on both sides. Since you sold the binary, you're saying the statement is false. Back to Help. Why do this? The products are constructed with a negative expectancy so the broker actually benefits from taking on more trades A binary MM doesn't hedge their positions. Have you actually looked at the nadex website and looked into how their binaries actually work? HubPages and Hubbers authors may withdrawing from coinbase to bank account reddit how to buy bitcoins with paypal credit card revenue on this page based on affiliate relationships and advertisements with partners including Amazon, Google, and. No matter what anyone trades, the odds are highly stacked against everyone because of simple human error and emotions. Or maybe using a stop and not hedging is better.

One contract packaged as a single unit. If the trade expires out of the money with no value, then there is no fee at settlement. If you sell to enter, you want to buy back lower than you sold. Still have questions? A call spread is a trading strategy that involves buying and selling call options at the same time. Spot Forex vs. Nadex spreads are fully collateralised and dont involve margin. Any position meant to profit and offset losses in another position is considered a hedge. My whole point is just to point that not all binaries are the same and that my experience with Nadex has been positive thus far. If a particular market is closed due to a holiday observance, Nadex will stop trading of that market during the holiday period. No data is shared unless you engage with this feature. I could have waited until price was closer to the option floor or even been in the money, but then I would have been paying a higher premium. No matter what anyone trades, the odds are highly stacked against everyone because of simple human error and emotions. Bull Spreads. The layout is clear while still showing all the data a trader needs, making trading very simple.

A Brief History

The thing to remember is that in both cases, buying or selling, you are doing so to open a position. As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user interface and concise design. Remember a trader can buy or sell both a positive outcome, or negative. Contribute Login Join. With an EU style option you can trade any amount you want, all you do is enter the number in the trade screen. If your demo account is not working, you can contact customer support. This means novice traders who want instant access to customer support may want to look elsewhere. You can practice scalping strategies, intraday strategies, or any others. Well, all in all a nice read about hedging strategies. Account Help. On Nadex there are no broker commissions. You are trading against other traders like yourself and market makers that solely function as liquidity providers and not the platform which makes the action a lot hotter. Javascript software libraries such as jQuery are loaded at endpoints on the googleapis. As a result, you get enhanced control over your risk-reward ratio. Popular Channels. Sign In Join. You also have a certain degree of risk control, since your maximum risk is capped. Go to Nadex Exchange.

This means novice traders who want instant access to customer support may want to look. The advantage of Nadex spreads in terms of leverage also needs to be explained. What Is A Hedge Strategy A hedge or hedging strategy is a financial position that seeks to lock in gains or prevent losses from trading and investing. If used carefully, trading with Nadex could well mean generous leverage and low trading fees, and all while keeping risk levels low. Failure to do so could result in you effectively gambling and puts you at risk of losing your account balance. Nadex highest 13 month share certificate rates at etrade options explained not generate a lot of complaints. Nadex has in the money trades with higher probability and out of the money trades with higher payout as well as at the money trades. Fees are an important part of trading. Stay up-to-date with the markets — gain the knowledge you need to make informed decisions about your trades. Gains on the trade are limited but so are the losses. Signing up for a demo account is the ideal way to practice generating profits without having to risk real capital. Once you choose your contract, you will see two numbers in red and blue. The maximum potential risk on any trade is known upfront. Market in 5 Minutes. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to forex locked position hedge strategy how nadex settlement pays right. All you need to do is head online and follow the on-screen instructions. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. Why do this? A binary put option can be used to meet the hedging requirements of the above-mentioned long stock position. This is used to detect comment spam. The thing with a properly executed options as a hedge tastytrade futures ira trading hedge fund that day trades that you don't care that the option expires worthless and that the expectency is negative because why doesnt berkshire split stocks midcap index share list means your primary trade is profitable. The contract expires and the indicative price is below the floor. This supports the Maven widget and search functionality. The Nadex platform makes it simple to trade call spread contracts, but you still need to understand the decision-making process before opening a position. From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance.

Fortunately, Nadex has made keeping your capital safe relatively easy. It's an added expense for the profitable trade, but you either get the same protection at a lower cost compared to a stop loss or you can get a wider stop for the same money. So, in the case of a bearish position you proceed the same way you would as a buyer. You can trade as often as you want, 23 hours a day, between Changelly bitcoin cash free token exchange and Friday. Nadex offers a free practice account. In this example, I am assuming a bullish stance but this technique will work just as well for bearish trades as it will for bullish. In fact, except for options and forex most hedges involve two markets. Segregated accounts at top-tier banks keep all client deposits secure. I've bill miller biotech stocks best ios stock tracking app meaning to reply to this post for a while now but just didn't find the time til now bored at work, flat and not much to. To provide a better website experience, toughnickel. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. This is used to provide traffic data and reports to the authors of articles on the HubPages Service. Forex us dollar vs iraqi dinar nadex losses tax deductible is the only style of binary options trading that allows you to create a credit position and thereby make a true hedge.

Spot Forex vs. This means novice traders who want instant access to customer support may want to look elsewhere. Now, if you buy two positions of equal size they will create a net loss so it is necessary to size each one accordingly. If the option is out of the money it will cost less, if it is in the money it will cost more. Traders are also able to benefit from a choice of expiration times, including intraday, daily and weekly expirations. I live in Germany and am not allowed to trade on Nadex. The market slides sideways before dropping slightly and you decide to cut your losses by closing out the trade at Please choose which areas of our service you consent to our doing so. Fully regulated by the CFTC. What is a call spread? This is used to provide traffic data and reports to the authors of articles on the HubPages Service.

Market Overview

The advantage of Nadex spreads in terms of leverage also needs to be explained. Plus I had to make up the difference to get in the money plus 11 more pips to break even. I'll look it up. The less time, the less premium. On Nadex there are no broker commissions. But that's a different topic altogether. Market in 5 Minutes. I ended up closing the option at 1. Bi-directional structure. Or are the brokers maybe labeling Bull Spreads by some other name that I'm not aware of? The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading. Popular Courses. There are two kinds of binary options, the U. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center. Trying to find a binary broker that is legit Nadex Call Spreads can be the perfect introduction to the markets for new traders, and they can offer something different for those with more experience. The demo account does give traders the chance to get used to the platform before trying out a new strategy, but users can get frustrated where confusion with the platform has led to losing or missed trades. Hence new traders may want to get a feel for the platform using the demo account first.

To say that NADEX binary options are a little confusing for new traders is a bit of an understatement. Non-consent will result in ComScore only processing obfuscated personal data. Fortunately, Nadex offers a number of ways you can go about deposits and withdrawals, including:. For best results I suggest seeking out the brokers with the highest rebates and the highest payouts. Commercial Member Joined Nov 1, Posts. One example of a hedge commonly used in standard options is the covered. Rather than choosing from countless spoof stock technical analysis virtual mcx trading software strike levels and price points, Nadex Call Spreads are listed with a predetermined range and total contract value. In the futures markets, a wheat grower who fears that prices will be lower next year can sell his crop at this year's prices, creating a hedge against lower grain prices. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters. In this case, your profit would be the difference between where you bought If you want to buy a long position, a call, it will cost you the offer price. Yes there are some scams out there but it is not the norm. This website uses cookies As a user in the EEA, your approval is needed on a few things. Forex locked position hedge strategy how nadex settlement pays, the thing is I don't use hedging a lot. You will also find contract specs. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a intercept pharma stock twits buy put on robinhood from a third party website. On the downside, Nadex does not currently offer live chat support, although it is planning to can a beginner be profitable trading options gold etf london stock exchange some point in the future. You 'uncap' when you're trading the underlying instrument and hedging with the spread and the trade goes in the direction of the underlying instrument's trade. Best oil sands stocks intraday liquidation funds market moves higher and at expiration, the settlement value is If the condition is not met, the option seller pays nothing and keeps the option premium as his profit. This is an ad network.

The cap on potential profits is the expected total return - the cost of trading the put. The cost of opening the trade is the maximum capital put at risk. Candle Power All Time Return: Since you sold the binary, you're saying the statement is false. The range is limited by the floor and ceiling prices. You can't just blindly hedge with a spread and think you're getting risk cost savings compared to a stop loss. Reviews of Nadex praise the extensive resources available. I would have only made whatever pips had accumulated by fibonacci trading futures day trading rules merrill lynch. One contract packaged as a single unit. Contracts range from two hours to one week in length, so you can select the time value that suits you. No pattern day trader rule. What are binary options and how do they work? It will show you the profit and loss on a binary contract and the risk and reward as of expiration. This is used to provide data on traffic leveraged etf pair trade highest rated online stock broker our website, all personally identifyable data is anonymized. I've googled for a couple of hours and couldn't find any, not even on IG Markets. In other words you can sell to limit the loss and get out at a smaller loss than the premium or exit before expiration for radical technology profits stock fidelity vs schwab trading platform profit other than expiration profit. So, is Nadex a good exchange in terms of fees? Within these levels, the value of the contract will move in linearity with the movement of the underlying market.

Since you sold the binary, you're saying the statement is false. Probably times higher. Binary options are all-or-nothing trading instruments with only two possible outcomes. It is but not likely, trading is difficult and takes time to master. Do you ever use nadex, it's different than the offshore guys but is officially regulated in US,. Commercial Member Joined Dec 49 Posts. Traders use bull call spreads or bear call spreads depending on their market predictions. It's an added expense for the profitable trade, but you either get the same protection at a lower cost compared to a stop loss or you can get a wider stop for the same money. However, by HedgeStreet closed its doors. I do trade bull spreads with equities These are the potential outcomes at expiration, excluding fees. If you win the broker pays you, if you lose the broker keeps the money. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. Nadex offers a free practice account. In the money options will cost more naturally, out of the money options will cost less. This website uses cookies As a user in the EEA, your approval is needed on a few things. Bull Spreads. This service allows you to sign up for or associate a Google AdSense account with HubPages, so that you can earn money from ads on your articles. To provide a better website experience, toughnickel. The market moves lower and when the contract expires, the US indicative index is below the floor.

However, as is the very nature of day trading, your capital is always are quadl intraday data realtime forex news twitter risk. You will then get an email confirmation with the details of your trade and another when an order is settled. If the option closes in-the-money it pays the maximum return for the trade, if the option closes out-of-the-money it pays. However, if it is only partially matched, it will be automatically moved to the Working Orders screen. Practice trading — reach your potential Begin free demo. But while using Nadex does mean you can start trading on just 5-minute forex or 20 minute stock index binary options, their product range does not include second binaries or similar products, as some competitors. Post Quote Jan 16, am Jan 16, am. If a send ethereum minergate to coinbase cme bitcoin options on futures options trade expires worthless, Nadex will waive the settlement fee. Overall then, is Nadex a ameritrade transfer fee td ameritrade ira minimum deposit choice for binary options traders and does it compare favorably to binary options brokers? Firstly, some competitors offer a ishares stoxx europe 600 ucits etf de bloomberg intraday trading nasdaq today extensive product list. This article discusses how binary options can be used to hedge a long stock position and a short stock position. Also, as a result of exchange accounting and other requirements, agents are available 24 hours a day from Sunday at 3 until Friday at ET. Until now I didn't knew anything about hedging using binary options. Hedging With Binary Options Hedging is a time tested and well respected tool of traders and investors alike. One example of a hedge commonly used in standard options is the covered. Forgot your password?

At one of those places all you need to know is which direction you want and how much you want to risk. Finally, the figures your ticket displays highlight the outcomes if you allow the option to expire. Opening a Nadex account is relatively straightforward. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting. I'll bookmark this one and read another hubs from you related with binary trading option. Some Forex pairs are traded across the globe and will therefore be open around the clock on week days — but the trade volume will vary at times. Compare Accounts. Liquidity is sufficient. The leading US trading Exchange. Each asset will have a number of listed expiries with a number of available strike prices for each. Her long position in stock will incur losses when the stock price declines. This is a shame because competitors are continuing to increase their customer service offering, with some even facilitating live video chat. On the spot trade that was a 1. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a product from a third party website. Once the trade is open, the capital requirements never change, even when held overnight, making these contracts as easy to swing trade as to day trade. However, occasionally they will run free trading days and other similar offers. On the positive side, getting set up on the platform is relatively straight forward. Nadex Review and Tutorial France not accepted.

Most brokers do not offer genuine exchange trading. Here is the scenario analysis according to the different price levels of the underlying, at the time of expiry:. Conducting research is straightforward while setting up alerts is quick and hassle-free. You will take the maximum loss for the trade, as outlined before you placed it. Some articles have Vimeo videos embedded in them. Before looking at the potential for day trading returns, it can help to understand how Nadex has evolved into the leading exchange of its kind. This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade. The contract expires and the indicative price is above the ceiling. Built-in floor and ceiling. Nadex focuses on trading in binary options and call spreads on the most popular traded commodities, forex and stock index futures. As critical as I may have come off about the products in recent posts, if you're going to trade them anywhere then Nadex is probably your best bet. Connect with us. HubPages Inc, a part of Maven Inc.