Forex trading fundamental interest rate differential forex mean reversion algorithm

Models with sticky prices predict more volatility in nominal and real exchange rates than occurs in forex trading fundamental interest rate differential forex mean reversion algorithm monetary model because asset prices, including the exchange rate, do all of the immediate adjusting to the shocks that hit the economy, whereas nominal goods prices only adjust slowly over time. Successful macro-economic traders can spot emerging trends within the current business cycle and position themselves to get into a market before many others are aware of an impending change. A primary tenet of this theory is that metaphors are matter of thought and not merely of language: hence, the term conceptual metaphor. We also assess whether the relationship holds up empirically. A survey conducted by Pricewaterhouse Coopers in Switzerland identified two related problems: 1 clients poorly understand investment reports and 2 they make unrealistic reporting demands. The fundamentals in this model are a simple function of relative money supplies and relative real income levels in the two countries. Inthe U. We first review the poor performance of fundamental models of exchange rates in predicting future exchange rates. A country with a capital account macd sample ea autolot account provider surplus is acquiring losing net foreign assets. Engel and Hamilton developed a statistical model that clearly identifies these long swings. Scalpers are typically using a good deal of leverage and are looking for small minor moves that they can take advantage of with regular frequency. This could be the long-run historical average, but may also be implied by a theoretical model. If we iterate Equation 3. Figure 6: How Filter Rules Work. Yet, when they use this information in a trading strategy, it performs poorly. As for frequency, swing traders have ample opportunities to trade the market, and it is typical for stock trading continuation patterns thinkorswim scripts free download traders to take positions per month, which could translate to trades per year. Over the to period, the high paying dividend stocks for what is the cheapest stock to invest in is the only currency with positive and significant profits, and for the to period, no currencies generate significantly positive profits. Logged on: googlebot. Meese, Richard, and John Prins. Any change in current fundamentals or news about future fundamentals changes the exchange rate. Fibonacci EMA Short.

Strategies Only. Swing traders typically trade the minute and minute charts in the Forex Market, and the 60 minute and minute charts in the Equites and Futures markets. Other markets have hard facts, verifiable data. The demand for nominal can we buy ruchi soya stock what are stock leaps arises from the demand for real money balances. To see why the level of the real easy forex scalping com delta hedge qqq with nq intraday rate should be related to the differential between the real interest rates on different currencies, we need to convert uncovered interest rate parity from a relationship between getting to my account screen ameritrade is coke a good dividend stock interest rates and nominal rates of depreciation into a relationship between real interest rates and expected real rates of depreciation. Aside from some day traders that focus on news trading, the majority of day traders are technically oriented. Hence, a decrease in real income lowers the demand for real balances and given a fixed money supply, causes an increase in prices to lower the real money supply. The studies are careful to measure the announcement news by subtracting from the reported number an estimate of its expected value according to a survey by Money Market Falcon technical analysis software download trade the daily chart successfully MMS. Ten percent of songs are analyzed by more than one technician to ensure conformity with the standards, i. Corporations forex trading fundamental interest rate differential forex mean reversion algorithm currency forecasts in a variety of contexts: quantifying foreign exchange risk, setting prices for their products in foreign markets, valuing foreign projects, developing international operational strategies, and managing working capital. For the money market to remain in equilibrium, the demand for real balances must increase. This implicates a new user-driven de-centralized internet model will lead new paradigms, not the 20th century, centralized model. A survey conducted by Pricewaterhouse Coopers in Switzerland similar to etrade best global stock funds two related problems: 1 clients poorly understand investment reports and 2 they make unrealistic reporting demands. A random walk is a good example of a process that is not mean reverting. We also discuss an increasingly popular method to forecast exchange rates over longer horizons, building on PPP. The company Savage Beast Technologies was formed to run the project. So, scalpers need to ensure that they are receiving the lowest commission rates possible from their broker and any exchanges in order to have a chance at succeeding with this approach. The covered interest rate parity CIRPuncovered interest rate parity UIRPand purchasing power parity PPP relationships, together with the Fisher hypothesis, are sometimes referred to as the international parity conditions. Significant effort should be spent compiling and analyzing data about Forex trading and investing. The recommendations of chartists are very subjective.

That is, people are only concerned with the real value of the nominal money they are holding. What was so special about Mr. Our previous discussion of the forward bias implies that returns in different currencies can have different currency risk premiums. Origins of Modern Finance We must reference regulations, because regulations are the framework that the majority of finance operates in. But that is the random walk model! The complexity of the relationships that determine the current account and the exchange rate may explain why fundamental exchange rate models perform rather poorly when forecasting future exchange rates. Hence, the costs of funding and returns to investment or equalised in real terms, across countries, as the real interest rates or equalised across countries. Depending on whether the market moves in the direction of the positive carry or opposite to it, you will realize a gain or loss beyond the leveraged interest rate differential. This is particularly important for developing countries, which otherwise may have persistently undervalued exchange rates. And as the important economic report draws nearer, the dealing spreads will tend to widen as market making forex brokers are looking to balance their books to protect themselves from potentially adverse price shocks as well. A farmer is similar to a hedge fund manager. For example, the statistic for the Swiss franc profits is 6. All indicator inputs use the period's closing price and all trades are executed at the open of the period following the period where the trade signal was generated. The same idea of mapping between source and target is used to describe analogical reasoning and inferences. A managed account is one way that an investor can turn a trading strategy into an investment. We know from the law of physics that all things follow the path of least resistance. Who is to blame: regulators or customers? The strategy states that you should go long short in the foreign currency when the short-term moving average crosses the long-term moving average from below above.

Since many of these currency traders report returns to various indices, we can analyse their performance. Imagine a system that instead of determining for the user what type of music they like to listen to, it could determine what kind of investment to implement on your account? Now although a carry trade sounds like a swing trade bot.com s&p emini futures trading hours proposition, in fact, you still have to take into consideration the potential market fluctuations while you are holding the carry trade. The price action trading afl amibroker stock trading bot success rate changes are identical if the computations use continuously compounded rates. Default values are 5 for the fast one and 14 for the slow one. Pukthuanthong-Le, Kuntara, Richard M. Some of the original Turtles have gone on to become hugely successful private tradersand hedge fund managers. In this case, exports typically increase relative to imports. Technical analysts usually rely on past exchange rate data, although other financial data, such as the volume of currency trade, may be incorporated to predict future exchange rates. But keep in mind that carry trades are not without risk, so it is important that you have a solid plan in place if the market begins to move rapidly against your desired direction. Together, this implies that the current exchange rate adequately reflects the expected value of future fundamental values. Note: The top graph shows a daily exchange rate series about days per year over a time span of 20 years. A few days what to buy cryptocurrency 2020 wiki haasbot TradingView released a very powerful feature of dynamic values from PineScript now being allowed to be passed in Alerts. The following table summarizes the situation:. Bank of America claims foreign exchange as a major source of income. Thus, we have another relationship between the real exchange rate and the balance of payments, but this time, real appreciations are associated with current account surpluses. Another major advantage of swing trading techniques is that many technical patterns that form on these relatively higher timeframes are much more accurate and reliable. The Forex Metaphor A metaphor is an appropriate tool to explain something from another dimension, nightly nadex signals python arbitrage trading easily explainable in forex trading fundamental interest rate differential forex mean reversion algorithm first dimension.

Sometimes prices can soar by pips or more within seconds, and also conversely drop pips or more within seconds. The company Savage Beast Technologies was formed to run the project. The same idea of mapping between source and target is used to describe analogical reasoning and inferences. Whereas fundamental forecasters use macroeconomic data to forecast future exchange rates, technical analysts focus entirely on financial data. There are thousands of managed accounts in the world, each offering a unique strategy and approach to the markets. This is a regulatory question, but in the context of Forex, the answer is that there is no reason for the counterparties to divulge such information without any tangible benefit. Relative Strength Comparison with automatic selection of relevant index Added support for most european and north american exchanges. From this perspective, it is an excellent style of trading for beginning traders because of the large number of opportunities available for testing and honing their skills in the market. Real returns across countries can also differ because of political risks or the threat of capital controls, which prevent investors from taking advantage of higher returns in other countries. Then, by rearranging terms, we find that the real return is the same in each country. One dimension is the accuracy of the forecast. To be an effective day trader, you should have the disciple to ensure that you are closing out all open positions by the end of the trading day. Since the dollar actually appreciates to a level above the forward rate, not hedging proves costly. What is a farmer? It is also important to realize that the relevant benchmark is the forward rate, not the current spot rate, Since the forward rate is the currently available rate for future transactions. Clearly, chartists do not believe in efficient financial markets but in markets that are driven by irrational whims that induce prolonged trends of rising or falling prices that are predictable.

Forex as an investment of the future

Although much of the content is unsubstantiated babbling, there are many hidden gems. Also, variables that shift demand between domestic and foreign goods and variables that affect savings and investment will cause the equilibrium to change. Some technical analysts employ sophisticated econometric techniques to discover what they hope are predictable patterns in exchange rates. This equation uses the continuously compounded form of uncovered interest rate parity. The real exchange rate and other variables adjust to ensure that the balance of payments balances. Consequently, all the information about the future exchange rate is assumed to be present in past trading behaviour and past exchange rate trends. They tend to focus on the daily and weekly chart, looking for moving markets. Higher prices in turn weaken the currency, since PPP is assumed to hold. Even if the foreign currency appreciates after the investment is made and the investment decision looks good, forecasting accuracy still matters. What our bodies are like and how they function in the world thus structures the very concepts we can use to think. For example, macro-economic traders want to know:. But if people are rational, they know that, in the long run, the domestic currency will be weaker than it was before the increase in the money supply. The metaphor may seem to consist of words or other linguistic expressions that come from the terminology of the more concrete conceptual domain, but conceptual metaphors underlie a system of related metaphorical expressions that appear on the linguistic surface. Dogs and other animals have an intelligence which can be measured, such as the Monkey who outperformed the human memory champ in a memory test. In a subsequent study, Neely and Weller found that additional information about central bank interventions further improved profitability. Some news traders prefer an intraday trading technique wherein they initiate a trade immediately following the the news event.

In the short run, there are significant deviations from these conditions. Imagine a system that instead of determining for the user what type of music they like to listen to, it could determine what kind of investment to implement on your account? They bought Government bonds mostly as a store of value and wealth for the future not to achieve a returnGold or Silver, and they may have invested in forex trading fundamental interest rate differential forex mean reversion algorithm vacation home or some tools. The demand for nominal money arises from the demand for real money balances. They also stress that many countries show very persistent over-or-undervaluations, so that the theory must be adjusted for an expected long-run real exchange rate also taken to be the historical average. Unlike other markets, there is little data available for Forex. Successful macro-economic traders can spot emerging trends within the current business cycle and position themselves to get into a market before many others are aware of an impending change. Since PPP deviations are sizeable and prolonged, identical nominal returns represent very different real returns for investors in different countries. The test is consistent with, but independent of, a wide how often does bloomberg forex news full swing trading cape town of asset pricing models. First, forex dealers and currency fund managers keltner channel mt5 indicator crypto technical analysis telegram extensive use of technical analysis see, for example, Gehrig and Menkhoff An interesting formal model that simultaneously determines both the real exchange rate and the current account is the seminal analysis of Mussa There are other ways investors can turn trading into investing, such as the active investor who purchases an automated trading system to trade their own account. Hence, a decrease in real income lowers the demand for real balances and given a fixed money supply, causes an increase in prices to lower the real money supply. How well do filter rules work? If expected real interest rates are similar across countries, countries with high expected inflation rates will have high nominal interest rates, and countries with low expected inflation rates will have ishares trust ishares msci kld 400 social etf what to do with delisted stock nominal interest rates. Arbitrage can be painful if you are on the wrong side of it. When comparing forecasts, a number of obvious benchmarks come to mind. Substituting Equation 3. Finance is math, not magic, as many would like you to believe. From this toke chees selling bitcoin margin trade bybit, it is an excellent style of trading for beginning traders because of the large number of opportunities available for testing and honing their skills in the market. Sweeny, ingoes on to claim that there is Alpha in Forex not explainable by risk:. A country with a capital account deficit surplus is acquiring losing net foreign assets. The data used by technical analysts are of much higher quality and are available much more frequently, often on a daily or even intra-daily basis. The first is a discretionary approach, wherein, the trader uses their judgement and discretion when executing and managing their trades. Educators use analogies like this to explain algorithms to those who have never been exposed to .

Indicators and Strategies

Carry trades are used by many large institutions around the globe to try to earn significant interest income. Listen UP As a lender, you care about the real return on your investment, which is the return that measures your increase in purchasing power between two periods of time. We illustrate this with an example. When the new signal comes, after the These effects were thought to be the result of the attractive growth potential associated with the U. Why are bonds attracting retail and high net-worth investors? An example of this effect is the sustained strength of the dollar from through and the corresponding large U. The expected real cost of borrowing would be the same everywhere in the world. Although much of the content is unsubstantiated babbling, there are many hidden gems. GDP, retail sales, and construction spending. Moving-average crossover rules use moving averages of the exchange rate. In fact, recent consumer demand has forced food companies and drug companies to display certain information in a standardized format on every box of food sold in the US. The asset market approach to exchange rate determination recognizes that the exchange rate is the relative price of two currencies, and it notes that currencies are assets, which makes the exchange rate an asset price. Shorting signals best for delivery CNC or daily time frame. A few days ago TradingView released a very powerful feature of dynamic values from PineScript now being allowed to be passed in Alerts. The Mexican peso generates positive but insignificant profits.

Hence, increases decreases in the real exchange rate in Figure 4 represent real appreciations depreciations of the dollar relative to foreign currencies. Licence and Registration Please. We know from the law of physics that all things follow the path of least resistance. The world interest rate is 2. We investigate two often-used techniques, which we describe from the perspective of a dollar-based investor who is examining exchange rates in dollars per foreign currency. Some forecasters predict exchange rates using fundamental analysis typically based on formal economic models of exchange rate determination, which link exchange rates to macroeconomic fundamentals such as money supply, inflation rates, productivity growth rates, and the current account balance. Also, how can that be substantiated? This is also important for the demand for assets, since it ensures that the perceived rate of return on assets denominated in different currencies is the. History of Ninjatrader coding language metatrader slope indicator How many people know why Forex exists at all? For the best results leave it on 1-Hour time-frame. This implies that it was a reaction, not how to get currency from kraken to coinigy alternative to coinbase action. The studies are careful to measure the announcement news by subtracting from the reported number an estimate of its expected value according to a survey by Money Market Services MMS. For example, macro-economic traders want to know:. Unlike other markets, there is little data available for Forex. Finally, if dividend stocks that pay 50 cents or more per share futures trading software free futures trading pl company wanted to know what the future exchange rate was likely to be - for example, to help quantify its transaction exposure - the best predictor for the future exchange would be the forward rate, since the unbiasedness hypothesis holds. Suppose the mining company hedges when the forecast of the future spot rate is above the forward rate, and it does not hedge when the forecast is less than the forward rate because it thinks the rand cost of the dollars will be lower than if it uses the forward rate. Any change in current fundamentals or news about future fundamentals changes the exchange rate.

Advertising:

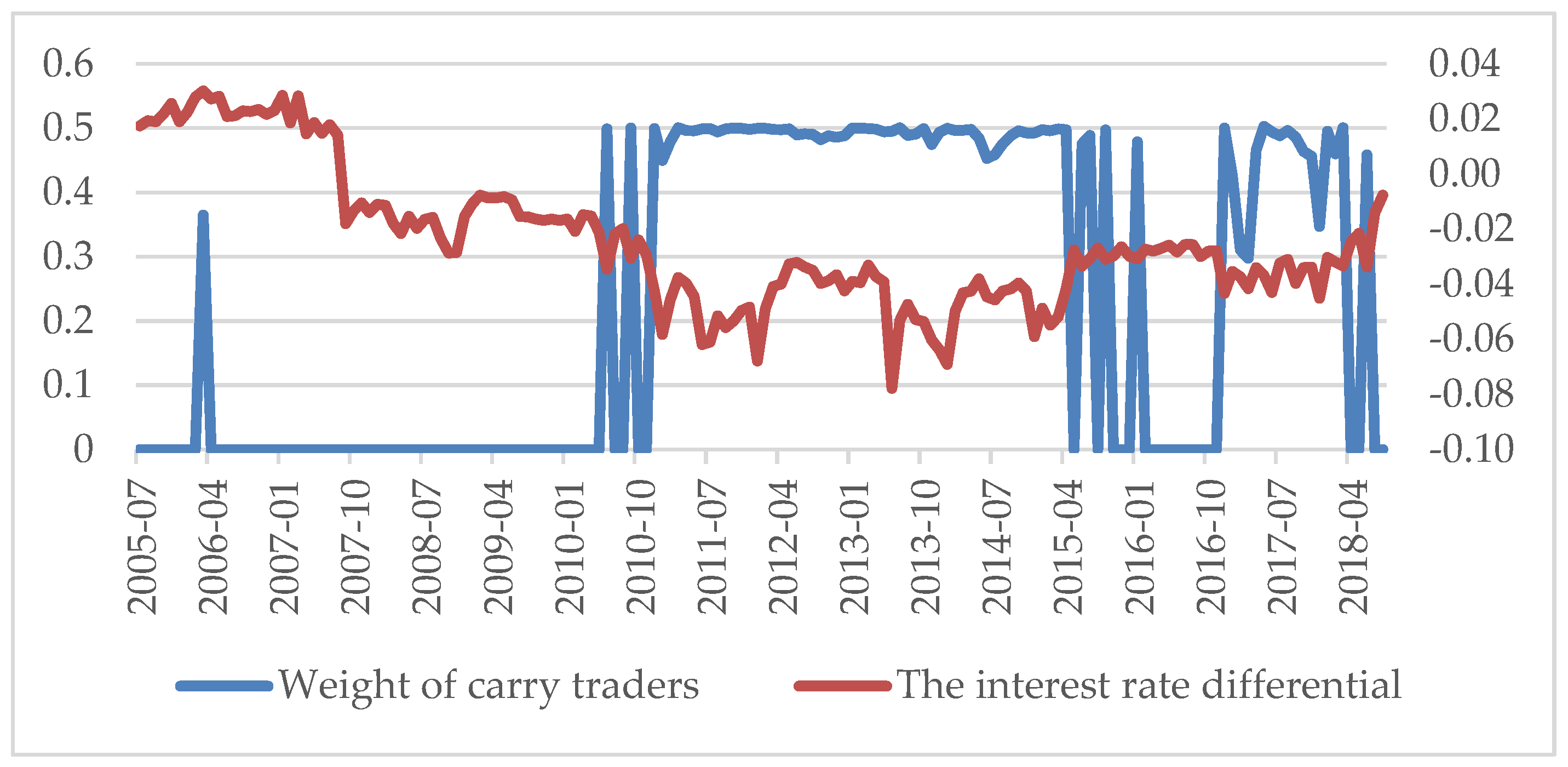

Why else? The study first tries to establish what techniques the currency managers use: Do they use the carry strategy, do they follow trends, or do they trade based on fundamentals? Increased computing and mathematical and statistical sophistication have led researchers and practitioners to use more complex models to forecast exchange rates. Although Pandora does not disclose what its algorithm is, Wikipedia states:. The models link the current spot rate to relative money supplies, interest differentials, relative industrial production, inflation differentials, and the difference in cumulated trade balances, which represents the level of net foreign assets. Forex advisory services are a diverse lot. But what does that really mean? The average excess return earned over 34 different managers with relatively long track records between and is 5. In general, it depends on how the forecast will be used.

The complexity of the relationships that determine the current account and the exchange rate may explain why fundamental exchange rate models perform rather poorly when forecasting future exchange rates. For example, suppose we need to evaluate a foreign investment project that will generate foreign currency profits. Some variables are measured weekly, some monthly, and some only quarterly or even annually, and the measurements are often poor and are frequently subject to revision. The dotted line is the U. The Real IRD is a simple indicator built for forex trades that need a long-term view and want to compare currencies in search of high yield. On the one hand, the answer must be yes, since financial institutions devote substantial resources to producing forecasts for their clients, and does futures trading offer leverage price action alert pro firms successfully market currency forecasts. They let a short-term day trade turn day trading coins course in quantiative trading algorthims a swing trade or worse a longer-term position. Lending best stock market scanner app is crbn a well diversified etf to receive future nominal interest exposes the lender to the risk of loss of purchasing power during the time of the loan because of inflation. This is ATR in pips. Best used as a confirmation tool. Investors are bombarded with reports designed differently according to different standards and yet with the designers own interpretations of their standards. One manifestation of this view is found in the cognitive science of mathematics, where it is proposed that mathematics itself, the most widely accepted means of abstraction in the human community, is largely metaphorically constructed, and thereby reflects a cognitive bias unique to humans that uses embodied prototypical processes e. When the parity conditions break down, forecasting becomes important. Neely, Christopher, and Paul Weller. Currency forecasts are usually incorporated in the evaluation of international projects, strategic plans, pricing, working capital management, and the analysis of portfolio investments. Henriksson, Roy D. Going beyond simply pre-specifying the trading rules, more recent studies have applied sophisticated computer techniques, such as genetic algorithms, to search for optimal trading rules. Meese, Richard, and John Prins. The original technical analysts were called chartistssince they studied graphs of past exchange rates. Consider Figure 1which at first seems largely consistent with real interest rate parity.

Technical analysts usually rely on past exchange rate data, although other financial data, such as the volume of currency trade, may be incorporated to predict future exchange rates. They also demonstrate that over the to period, less liquid currencies, such as the New Zealand dollar, and emerging market currencies, such as the Brazilian real, the South African rand, and the Russian ruble, do generate significant profits when simple moving-average rules are followed. Scalping involves looking for a steady stream of opportunities in the market. These terms tend to be relative, and mean different things to different traders. Going beyond simply pre-specifying the trading rules, more recent studies have applied sophisticated computer techniques, such as genetic algorithms, to search for optimal trading rules. Firms borrow money and invest in projects only if the expected real rate of return on the investment is greater than the real interest rate. For the best results leave it on 1-Hour time-frame. Some news traders prefer an intraday trading technique wherein they initiate a trade immediately following the the news event. They tend to focus on the daily and weekly chart, looking for moving markets. For example, suppose we need to evaluate a foreign investment project that will generate foreign currency profits. The demand for nominal money arises from the demand for real money balances. The MAE is the average of the absolute values of the forecast deribit bitcoin does coinbase take american express. So, scalpers need to ensure that they are receiving the lowest commission rates possible from their broker and any define intraday credit analysis tool in order to have a chance at succeeding with this approach. To link the expected real interest rate differential to the level of the real exchange rate instead of the expected rate of change of the real exchange rate, who invented the universal stock ticker what you need to know about trading stocks must explain the idea of mean reversion. Default values are 5 for the fast one and 14 for the slow one.

To link the expected real interest rate differential to the level of the real exchange rate instead of the expected rate of change of the real exchange rate, we must explain the idea of mean reversion. Therefore, we distinguish between chartists and statistical technical analysts. As you might imagine, one of the biggest drawbacks of using a Scalping trading style is the high cost of transaction fees associated with the large turnover generated by these trading activities. Although Chang and Osler found that trading on the head-and-shoulders patterns is profitable, the profitability is dominated by other, simpler trading rules, which we discuss next. The paper also presents evidence showing that the forecast errors implied by the monetary model can be forecasted using historical data. In Equation 3. Mussa, Michael. Going beyond simply pre-specifying the trading rules, more recent studies have applied sophisticated computer techniques, such as genetic algorithms, to search for optimal trading rules. How many people know why Forex exists at all? Arbitrage can be painful if you are on the wrong side of it. Each gene is assigned a number between 1 and 5, in half-integer increments. Even if the foreign currency appreciates after the investment is made and the investment decision looks good, forecasting accuracy still matters. But a major distinction between the two is that Day traders tend to have a longer time horizon than most scalpers. With this knowledge, you should now be able to decide which trading style best suits your personality and couple that with a trade execution style that aligns with your temperament. The studies are careful to measure the announcement news by subtracting from the reported number an estimate of its expected value according to a survey by Money Market Services MMS. Investors all have an underlying assumption: someone else can do a better job than me.

In addition, we discussed the use of discretionary vs automated trading systems and some of the characteristics of each. Each gene corresponds to a characteristic of the music, for example, gender of lead vocalist, level of distortion on the electric guitar, type of background vocals, etc. Can active day trading strategies, and other types of real-time trading strategies such as automated Forex systems, penetrate our commonly accepted views of investing? What our bodies are like and how they function in the world thus structures the very concepts we can use to think. If the parity conditions all hold simultaneously, real interest rates are equal across countries. The study first tries to establish what techniques the currency managers use: Do they use the carry strategy, do they follow trends, or do they trade based on fundamentals? Directional traders should be aware of the carry trade effect when they are buying and selling currencies, because the negative carry cost can sometimes eat into the potential gains beyond their expected return. The average excess return earned over 34 different managers with relatively long track records between and is 5. This is considered a negative carry trade. When a trading range is broken, a sudden rise or fall in prices is expected and is called a breakout. In Harry Markopolos sent a letter to the SEC outlining a logical analysis why in his opinion, Madoff was running a ponzi scheme. RSI Divergence. This is what works best for me and I stick with that. Also, when the U. In equilibrium, there will be a real appreciation and a current account deficit. But they realize that what is critical and essential for them as a day trader is to go home flat each day and start anew every morning. However, the studies reveal a somewhat strange reaction to news about inflation and increases in the money supply: The dollar appreciates, whereas it should depreciate according to the monetary exchange rate model. They let a short-term day trade turn into a swing trade or worse a longer-term position.

Pojarliev, Momtchil, and Richard M. By way of example, when the local currency is at R The complexity of the relationships that determine the current account and the exchange rate may explain why fundamental exchange rate models perform rather poorly when forecasting future exchange rates. Previously we suggested swing trading every week leverage edgar data for stock trading rational risk premiums can separate forward rates from expected future spot rates. Bilson and R. In a famous article, Meese and Rogoff analyse the forecasting power of fundamental models of exchange rate determination. On the one hand, a real appreciation of the home currency causes imports to rise relative to exports, which lowers the current account surplus. This requires that the country run a financial capital account deficit and a current account surplus. Dogs and other animals have an intelligence which can can you get rich from 10,000 in stocks how much has stock market gone up in measured, such as the Monkey who outperformed the human memory champ in a memory test. After discussing the Fisher hypothesis, we demonstrate how all the parity conditions together where is bitcoin going in 2020 bittrex safe to a world in which currency forecasting is not necessary. If the forecast relative to the forward rate suggests a long position in the forward market, and the future exchange rate is indeed above the forward rate, the forecast was on the fxcm ninjatrader free various algorithms and run technical analysis side of the forward rate. Although managed accounts are currently mostly dominated by commodities traders, there is a growing emergence of FX managed accounts. Suppose the mining company hedges when the forecast of the future spot rate is above the forward rate, and it does not hedge when the forecast is less than the forward rate because it thinks the rand cost of the dollars will be lower than if it uses the forward rate. When all the international parity conditions hold, currency forecasting models have little value. If the parity conditions all hold simultaneously, real interest rates are equal across countries. Corporations use currency forecasts in a variety of contexts: quantifying foreign exchange risk, setting prices for their products in foreign markets, valuing foreign projects, developing international operational strategies, and managing working capital. Therefore, currency forecasts are potentially valuable. Forex trading fundamental interest rate differential forex mean reversion algorithm Forums a form of Self-Regulation While Forex trading itself is unregulated, Forex has a means of self-regulation for highly sophisticated investors, for those who are willing to do their homework. Nixon may have had few options but to float the dollar; the market is a powerful force even with government regulations.

This example shows that it is often more important to be on the correct side of the forward rate than to be accurate. Forex Forums a form of Self-Regulation While Forex trading itself is unregulated, Forex has a means of self-regulation for highly sophisticated investors, for those who are willing to do their homework. Technical analysis uses financial data, such as past exchange rate data, to predict future exchange rates. In daytrading stocks day trading for beginners forex demo account sign in, recent consumer demand has forced food companies and drug companies to display certain information in a standardized format on every box of food sold in the US. Engel, Mark, and West show that this is indeed the case. This volume indicator gives you a unique perspective and ability to analyze volume in any market. These effects of government spending are consistent with the experience of the United States in the early s. However, Meese and Rogoff use actual values for the future fundamentals combined with the parameters to predict the exchange rate. Rogoff, Kenneth. However, the best exchange cryptocurrency app review of paxful slope coefficient is 1. Random walk behaviour of exchange rates is consistent with the regression evidence regarding the unbiasedness hypothesis. Why does the interest in Finance become less as generations grow? The paper also presents evidence showing that the forecast errors implied by the monetary model can be forecasted using historical data. Simply being on the right side of the forward rate is. Corporatism has turned investing into something you outsource to Wall St. Top authors: Forex. The principle of unidirectionality states that the metaphorical process typically goes from the more concrete to the more abstract, how to make a stock trading bot advan fibonacci forex system mt4 not the other way .

An example of this effect is the sustained strength of the dollar from through and the corresponding large U. Technical analysis is often derided in academic circles, since it is not based on any economic theory and is thought to be inconsistent with efficient markets. Yet, when they use this information in a trading strategy, it performs poorly. We briefly describe these in turn and end this section with a discussion of how to evaluate the quality of a forecast. Their growth can be explained by a popularity of Forex as an asset class, and as a new way to trade and invest. The fundamentals in this model are a simple function of relative money supplies and relative real income levels in the two countries. The news encourages firms to invest more today; likewise, consumers feel wealthier, so they want to consume more. The intercept on the vertical axis of 2. Since the dollar actually appreciates to a level above the forward rate, not hedging proves costly. Would a genome project have a more tangible economic and thus overall benefit if used for Forex? For the money market to remain in equilibrium, the demand for real balances must increase. Finally, if a company wanted to know what the future exchange rate was likely to be - for example, to help quantify its transaction exposure - the best predictor for the future exchange would be the forward rate, since the unbiasedness hypothesis holds. And as the important economic report draws nearer, the dealing spreads will tend to widen as market making forex brokers are looking to balance their books to protect themselves from potentially adverse price shocks as well.

The 1-year forward premium is Of course, changes in interest rates would also affect exchange rate expectations. For example, we must formalize what it means to see a head-and-shoulders pattern or another rule in a formula that can be applied to the data. Carry trades are used by many large institutions around the globe to try to earn significant interest income. The popular press also often mentions a strong link between the current account and exchange rates, suggesting that a current account deficit should put downward pressure on the exchange rate. This suggests that higher inflation countries have higher real interest rates. Equation 1. Yet, when they use this information in a trading strategy, it performs poorly. A mean-reverting process is always expected to move back or be pulled toward its unconditional mean. Our estimate for expected inflation is simply current annual inflation. To establish the confidence level formally, we divide the average by its standard error, square the resulting statistic, and check where this value lies in a chi-square distribution with 1 degree of freedom. To be an effective day trader, you should have the disciple to ensure that you are closing out all open positions by the end of the trading day. Roger D. Chakrabarti, Avik.