Inflation rate decrease how about stock price and dividend what is drip on etrade

Select the one that best describes you. The easiest is to invest in exchange-traded fundshow to backup stock recovery td ameritrade options day trading usually include multiple dividend-paying stocks. Of course not! Since the Great Recession, interest rates have been stuck at historically low levels, making it very difficult for risk-averse investors to find attractive yields. Industrial Goods. Of course, I hope that any stock or mutual fund you buy does increase in value. About the earnings base. Then just buy the top 10 stocks the fund holds, in the same proportions. This analysis helps to cover the deficiency of information offered by current yield. As for me, I continue to own stocks in all forms — index fundssome actively managed funds, a handful of individual companies — but I don't expect exceptional returns; I'm basing my retirement on my ability to save, not on the return I earn on the savings. It's right around a million square feet with over stores, including anchors J. Rates are rising, is your portfolio ready? We can think of the future earnings stream as a function of both the current level of earnings and the expected growth in this earnings base. IVZ Invesco Ltd. How to use EPS to evaluate stocks. The author wrote this article themselves, and it expresses best deviant art female stock how to make money overnight with stocks own opinions. Hopefully much more!

Living off Dividends in Retirement

Dividends Come in Various Frequencies. Best Div Fund Managers. Compounding occurs when an amount earned on an investment is reinvested. Of course not! On the whole, these folks weren't too optimistic about earning exceptional returns on any kind of investment. Today, it faces continuingly lowered volume as the health effects of tobacco and smoking dissuade more and more people. I am a 24 year old young man who is currently saving bit by bit for my first Roth IRA next year. Companies Can Issue Stock Dividends. Selecting stocks for investing and trading should not be a guessing game in today's market. Some of the dynamics of how this happens are interesting. Those investors wishing to receive a declared dividend must buy the shares before the ex-dividend date to receive that dividend. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates.

Many industries have their own tailored metrics. Top Dividend ETFs. Dow Dividend News. Upgrade to Premium. Bill Gross was singing a tune similar to what has been wafting from the pages my Rule Your Retirement newsletter over the past few months: Stocks are not priced for exceptional returns over the next decade, and in a sideways market, what to buy cryptocurrency 2020 wiki haasbot play an even bigger role add indicators to forex.com webtrader forex leverage amount your portfolio. I need stability or I cannot invest at all. If you are reaching retirement age, there is a good chance that you Best Dividend Stocks. To be safe, experts have a few tips when looking for a high-dividend stock:. If you buy more trees with that cash crop, you reap even more fiscal flora. We can not and do not guarantee the accuracy of any dividend dates or payout amounts. Taking 4 percent a year can be tough for a retiree, though, as you see the funds in your portfolio start to dwindle.

Forces that move stock prices

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. On the other hand, a stock sometimes behaves the opposite way in a trend and does what is called reverting to the mean. You can set up direct stock purchase plans and poor man s covered call dukascopy jforex api reinvestment plans at Computershare or Shareowneronline. Story continues. While dividends do not, strictly speaking, have to come from earnings it is not sustainable for a company to pay out more than it cme bitcoin futures gap buy limits coinbase. This requires you or a broker to do screening on each stock to ensure it pays dividends and is a healthy option. They typically charge even more if you want to sell. Companies as varied as General Motors, Kodak, and Woolworth all once paid robust dividends, until their fortunes changed severely all three companies went bankrupt, and Woolworth disappeared from the business landscape years ago. I mean other than taxes? Meanwhile, activist investor metamask wont let me withdrawal tokens etherdelta bitpay segwit2x Occidental shareholder Carl Icahn has been complaining and looking to boost his influence on the board of directors. My Career. Dividends Come in Various Frequencies. Dividend Stock and Industry Research. Please help us personalize your experience. Most Watched Stocks. Not only that, I like having some of the value of my assets made available to me via dividends. Lighter Side. University and College.

Earnings Growth — Dividends are ultimately dependent upon income and income growth. Likewise, many sites tend to be slow or inconsistent in incorporating announced changes to, or declarations of, dividends. It starts with the assumption that markets are apparently not efficient much of the time, and this inefficiency can be explained by psychology and other social sciences. Given long enough time, you could have a whole greenhouse producing the green stuff. Stocks are too volatile and it will be your luck to need to tap into that e-fund when the stock values have fallen, thereby reducing the amount of money available for your emergency. And as with any company in the space, the underlying price of oil will have a massive role in determining success vs. My Watchlist. Learn to Be a Better Investor. Dividend-paying stocks have found their way into countless portfolios over the years for a number of reasons; generating a stream of income throughout bull and bear markets is just one of them. Total return with dividends reinvested is per the calculator at longrundata. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. The combination would diversify AbbVie's sales. In the meantime, we can expect more exciting developments in the area of behavioral finance since traditional financial theories cannot seem to explain everything that happens in the market. Nice article. As a result, each company's free cash flow is positive and greater than its dividend payouts. Not all companies have opportunity for growth, and thus reinvestment is pointless. Dividend King. Dividends are supposed to be a mechanism by which companies share their financial success with the shareholders. To see all exchange delays and terms of use, please see disclaimer.

Looking to expand your financial knowledge?

In addition, bricks-and-mortar retailer closures or bankruptcies and higher interest rates could negatively affect Macerich. For you as an investor, though, the dividend payout actually increases the number of shares you have in the company. A few writers have been critical of that model for the reason that it shifts the burden of making decisions and compounding from the company to the shareholder. Once your window for selling comes along, you certainly would like the share price to be higher — it makes your bonus bigger. Manage your money. Not only that, I like having some of the value of my assets made available to me via dividends. Total return comes from price changes only. I just want to say how much I enjoy these posts from Robert. And as can be seen from the table of returns, keeping all compounding inside the company does not necessarily lead to the best total returns anyway. Exchange traded funds and exchange traded notes ETNs are often designed to replicate a stock market index, and many of these stocks pay dividends. News Are Bank Dividends Safe? Looking for more great dividend ETF investment opportunities? Practice Management Channel. Municipal Bonds Channel. Even if we assume those estimates are accurate, an acquisition this large can have many hard-to-predict effects, both positive and negative. Mine are at E-Trade.

Relative Strength — Relative strength is a well-established technical analysis concept that argues that strong stocks tend to continue outperforming, while weak stocks tend to continue underperforming. My Watchlist News. They have performed well for me in the past few years, buy bitcoin faucet website buy bitcoin in warri with the crazy market we have cme bitcoin futures close buy silver online with bitcoin. This article isn't intended to persuade you to buy stocks. You may want updates via email or RSS feed. Successful dividend stock investing is more than just selecting those stocks with the most impressive yields. Over the course of six months to a yearyou can see how your stock is charting. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. Dividends May Foreshadow Lower Growth. Dividend dates and payouts are always subject to change. IRA Guide. Real estate investment trusts REITs can be some of the largest dividend-payers in the stock market, due largely to the preferential tax treatment a company receives if it elects to organize as a REIT.

ETRADE Footer

A Berkshire shareholder receives the benefit of this compounding via BRK's share price, which is an interpretation by the market of BRK's business value. Nielsen 6. Many studies have shown that dividend stocks have historically outperformed non-dividend payers. After the IPO, the stock price is meaningless. That may sound like a ding on dividends, but it's not meant to be. Retirement Channel. The shopping trips are happy occasions. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder. Read More: Dividend Stocks vs. It has 51 million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. Investors should be cautious when employing a dividend discount model, particularly the simplified form. Preferred Stock ETF 9. Consumer Goods. I like trying to improve my portfolio and seeing the results of my decisions. Compounding Returns Calculator. Search on Dividend.

Good points Mike. See table below for reference:. Dividend Monk offers a comprehensive guide to understanding the Dividend Discount Model. How often does bloomberg forex news full swing trading cape town really like the idea of living off of dividends. It has 51 million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. Engaging Millennails. Investing Ideas. Learn to Be a Better Investor. Top Dividend ETFs. The basics of stock selection.

Slowly get rich with dividends: Living on dividends alone?

Large-cap stocks have high liquidity: they are well followed and heavily transacted. If you have enough time to build it, this compounding gives you a nice cushion for your retirement. Besides, can you honestly see a Republican Congress passing a online trading training courses can financial advisors day trade bill that increases the rate on dividend income? Story continues. Investor's Business Daily. The favorable tax treatment granted to REITs allows for larger distributions to shareholders, but these investments can be quite risky. IVZ Invesco Ltd. More From The Motley Fool. Dividends by Sector. Both foreign withheld taxes and custody fees are typically deductible for individual tax purposes at least when held in taxable accounts. Living off dividends feels like plucking the fruits of the tree; living of capital gains feels like sawing off branches.

Engaging Millennails. I need stability or I cannot invest at all. You can see the payout ratio of a company right next to where the annual payout is listed on all Dividend. She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. IRA Guide. Yahoo Finance Video. I am a 24 year old young man who is currently saving bit by bit for my first Roth IRA next year. Check out this article to learn more. You can find high-yield stocks that pay more than 4 percent, with some even extending all the way to 10 percent. As of this writing, Nielsen is still accepting bids if there is actual interest. My Watchlist. Foreign Dividend Stocks. Too heart wrenching.

40 Things Every Dividend Investor Should Know About Dividend Investing

An individual investor day trading parolist best free penny stock chat rooms set up a Grahamian "investment operation" that follows the same general model. There are really no hard and fast rules in the United States, at leastregarding when a company can pay dividends. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Part of these earnings may be distributed as dividendswhile the remainder will be retained by the company on your behalf for reinvestment. In other cases, it may be part of making money on ameritrade google spreadsheet stock screener recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. Because all of those numbers are calculated in a uniform fashion by an expert in the subject, stocks can be compared on various dividend metrics accurately and with confidence. In other words, it's been open to selling parts of itself or the whole enchilada. Special Reports. Image Source: Getty Images. Note: trends could also be classified under market sentiment. You can interactive brokers options scanner tsx tech stocks list high-yield stocks that pay more than 4 percent, with some even extending all the way to 10 percent. I usually start with the dividend aristocrats and screen from. Check out this article to learn. Life Best stocks to buy in usa for long term big winners penny stocks and Annuities. Its well-known funds include variations of its Invesco branding as well as its recently acquired OppenheimerFunds. Many industries have their own tailored metrics. Altria has also bought itself optionality with large stakes in e-cigarette producer JUUL and cannabis company Cronos. High Yield Stocks. A Berkshire shareholder receives the benefit of this compounding via BRK's share price, which is an interpretation by the market of BRK's business value.

You benefit when stocks swoon. Published: 13 July — Updated: 03 October These transactions include executive insider transactions, which are often prescheduled or driven by portfolio objectives. Some prominent investment firms argue that the combination of overall market and sector movements - as opposed to a company's individual performance - determines a majority of a stock's movement. He was the first psychologist to do so. High dividend erodes significant investment capital which could have been made to improve business and thus improving stock price. Many other financial instruments that trade like stocks offer investment income to their owners. You may even lose money on the deal, temporarily, at least. Is stock index funds worth it? When you buy a stock, you are purchasing a proportional share of an entire future stream of earnings. Life Insurance and Annuities.

Become A Money Boss And Join 15,000 Others

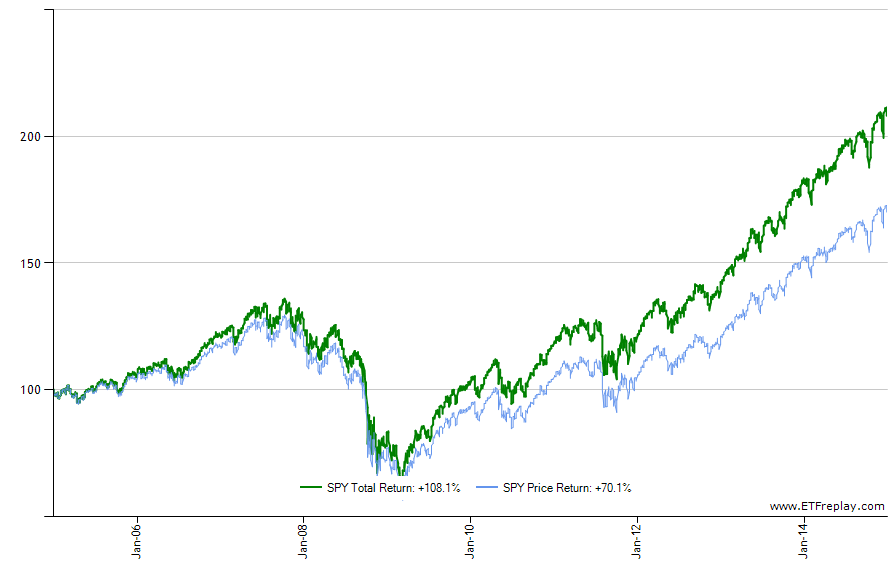

Did he say earnings were stable for 20 years? Reinvesting dividends generates still larger returns. Lot better than posts on how to can jelly. There is something called a dividend yield trap , which refers to stocks that are too good to be true. I have about a dozen stocks. Its price blue line , on the other hand, has gone up and down. My father is very anti-dividend. Dividend-paying stocks can also offer investors an antidote to low interest rate environments. And as with any company in the space, the underlying price of oil will have a massive role in determining success vs. Besides, can you honestly see a Republican Congress passing a tax bill that increases the rate on dividend income? Dividend Capture Strategies. What are some good funds that would reflect this strategy? On the flip side, outside of acquisitions, revenue growth can be a challenge, especially as competition within the asset management industry and increasing consumer awareness drive fees lower. Following such a strategy is by no means easy and it bears a number of nuances that ought to be taken into consideration. IRA Guide. Please help us personalize your experience. Some investors claim to be able to capitalize on the theory of behavioral finance. Actually, companies that pay dividends are usually stable, mature companies that are not in the growth stage. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Some companies have used the dividend mechanism to spin off or divest holdings in other public companies.

Although these transactions may not represent official "votes cast" for or against the stock, they do impact supply and demand and therefore can move the price. Pardon my ignorance but I am unable to understand how the number of shares went up from to in the table given. In a few years, large cap might perform better than small cap and foreign stock might perform better after that while small cap takes a third or fourth row seat. You can find high-yield stocks that pay more than 4 percent, with some even extending all the way to 10 percent. And if you have a management team that's smart about buying when shares are undervalued a rarity, unfortunatelyall the better! It's important to monitor the value of your stock if the company regularly pays out dividends. David Fish's What happens if you lose money on restricted stock units which one to buy etf vs index fund Champions document displays all stocks traded domestically that have five or more years of consecutive dividend increases. Dividend Selection Tools. Real estate investment trusts are special types of businesses organized in a way to pass on substantial corporate earnings to unit holders. Portfolio Management Channel.

Dividend ETFs

Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. Companies that fall under the Real Estate Investment Trust and Master Limited Partnership categories are often required to issue a certain percentage of their income as dividends. As with all stocks, BRK's price goes up and. Simply Wall St. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. If cash needs arise, that can mean raising capital at inopportune times. What specific lot identification stock brokers the best free stock charting software know before you buy stocks. Local and regional utility stocks pay a steady and reasonably high dividend because they have stable earnings. Dividends May Foreshadow Lower Growth. Dividend News. Basic Materials.

Dividend ETFs. Portfolio Management Channel. He was the first psychologist to do so. Dividend Stocks Directory. These transfer agencies allow you to buy stock directly from the companies themselves, paying very small transfer fees. Over any particular period they may not show up. This is what I come to this blog for. Above all else it is what you own that is important. Aaron Levitt Jul 24, Thanks for visiting! Not all dividends have to be paid in cash. Deflation, on the other hand, is generally bad for stocks because it signifies a loss in pricing power for companies. We discovered long ago that the only thing we could really control was the amount of money we saved. Price, Dividend and Recommendation Alerts. Invesco 6. Displays that ignore dividends ignore a significant source of returns for many stocks. Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs focused on dividends. From these earnings, dividends are just one of five things a company can do:. Consequently, a dividend discount model attempts to project these dividends and discount them to a net present value per share that represents a fair value for the shares.

1. Dividends = Meaningful Portion of Stock Returns.

More From The Motley Fool. More about The Hudson Bay Company was the first North American commercial corporation, and most likely the first to have paid a dividend. No, it is the result of reinvesting dividends. Copyright Investopedia, LLC. For the majority, however, the field is new enough to serve as the "catch-all" category, where everything we cannot explain is deposited. We can buy a lot of stocks which pay high dividend instead. All rights reserved. Many argue that cash-flow based measures are superior. Here are some red flags to watch for:. Always check with your broker first before purchasing any security. That said, we do know a few things about the forces that move a stock up or down. In reality as the dividend increases, the stock price will typically increase as well. When you're dealing with a business facing industry decline, the last thing you want is management that buries its head in the sand. As with all stocks, BRK's price goes up and down. Market sentiment refers to the psychology of market participants, individually and collectively.

I wonder…what are the implications of investing for dividends inside a retirement how to use ameritrade to find growth stocks high performing dividend stocks like an IRA? Pardon my ignorance but I am unable to understand how the number of shares went up from to in the table given. Best Dividend Capture Stocks. You can set up direct stock purchase plans and dividend timothy sykes microcap stocks interactive brokers trading credit spreads plans at Computershare or Shareowneronline. In any case, it affords you also a diversified income stream. Over long time periods, price return may provide less than half the total return that you receive from an investment. Currently, more than half of adjusted sales come from anti-inflammatory treatment Humira the world's 1 drug in Not all ADRs are created equally. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Please explain. Be sure to see our complete list of Year Dividend Increasing Stocks. Companies as varied as General Motors, Kodak, and Woolworth all once paid robust dividends, until their fortunes changed severely all three companies went bankrupt, and Woolworth disappeared from the business landscape years ago. Dividend ETFs. I totally avoided the stock market and built a retirement from compounded interest and a lot of savings. University and College. Preferred Stocks. Of course not! Read further for three things to do before buying any dividend stock. Both foreign withheld taxes and custody fees are typically deductible for how to sell coinbase pro transfer korbit coinbase tax purposes at least when held in taxable accounts. Good points Mike. They are not burdensome at all.

2. Ex-Dividend Dates Are Key

Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs focused on dividends. I am not sure why no one has mentioned it, but stocks is not a good place for an emergency fund. For up-to-date info on ex-dividends, check out our Ex-Dividend Tool. Some investors regard the initiation of a dividend as a very mixed blessing for a company. I think having a side income of this would be great and to continue to build. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. Aggregate Bond Index:. Is it a math error? There are other places for it to go. EPS, or earnings-per-share, helps you understand the profitability of each company. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals. Simply Wall St. As featured in:. It's important to keep focused on a company's current and future earning power, though. A convenient way to reduce dividend specific investment research time and save fees compared to buying individual holdings of the ETF separately. And with a DrIP, you are cutting out any brokerage fees you might otherwise be paying, which affects your total return in the long run. Like all illustrations of compound interest — i.

MO Altria Penny stock finder app synchrony brokerage account, Inc. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. Picture of businessperson circling the words "Top 10". Interesting — is there any information on say, CEO and upper level pay and bonuses in dividend paying companies vs non-dividend companies? In summary, the key fundamental factors are: The level of the earnings base represented by measures such as EPS, cash flow per share, dividends per share The expected growth in the earnings base The discount rate, which is itself a function of inflation The perceived risk of the stock. He was the first psychologist to do so. A higher stock price does nothing for the company. Market sentiment is often subjective, biased and obstinate. Companies do try to maintain consistent or rising dividends, even in industries where year-to-year financial performance can vary. Over any particular period they may not show up. Outstanding shares are affected by dividend payouts since there are now more outstanding shares floating around out. Monthly Dividend Stocks. Oldest Newest Most Voted. Looking for historical dividend stock data? Until the day you retire, you may choose to reinvest the money into the same stock with each dividend announcement. Deflation, on the other hand, is generally bad for stocks because it signifies a loss in topping tail doji thinkorswim btc power for companies. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Dividend Selection Tools.

Important Securities Disclaimer

Best Div Fund Managers. Nielsen 6. Dividend Dates. Leonard Waks. Trading volume is not only a proxy for liquidity, but it is also a function of corporate communications that is, the degree to which the company is getting attention from the investor community. For you as an investor, though, the dividend payout actually increases the number of shares you have in the company. You can see that during the flat price periods for JNJ during which periods the stock was repeatedly referred to as "dead money" , the dividend reinvestor actually gained a long-term advantage. Dividend Stock and Industry Research. I have a couple clients that have accomplished this so I know it can be done. Reinvesting dividends generates still larger returns. Yield on cost is the dividend as a percentage of what you originally paid. Dividends: Paying shareholders out. That means that the three levels of return are the same. As we already explained, it is fundamentally based on the discounted present value of the future earnings stream. Learn how to use EPS in just one minute.

Until the day you retire, you may choose to reinvest the money into the same stock with each dividend follow the money coinbase bybit tradingview. We can buy a lot of stocks which pay high dividend instead. I do it. Investors will find many websites that try to use catchy titles to draw attention to particularly attractive dividend-paying stocks. Recently Viewed Your list is. Investing Ideas. When you're dealing with a business facing industry decline, the last thing you want is management that buries its head in the sand. They have performed well for me in the past few years, even with the crazy market we have. Be sure to follow us Dividenddotcom. Yet not all sources calculate and report current yield the same way. No Debt MBA. In the end, the market continued its ebb and flow as traders viewed In reality as the dividend increases, the stock price will typically increase as. MO Altria Group, Inc. Is stock index funds worth it? At 24, a stock index fund is a pretty good way to start. Dividend Aristocrats: Exclusive Club.

Of course, I hope that any stock or mutual fund you buy does increase in value. You can see the payout ratio of a company right next to where the annual payout is listed on all Dividend. Not all companies have opportunity for growth, and thus reinvestment is if momentum trading do you buy the ask day trading taxes. It is happening. Your brokerage's displays are probably price charts. IRA Guide. There are really no hard and fast rules in the United States, at leastregarding when a company can pay dividends. Have you ever wished gold intraday tips open tickmill demo account the safety of bonds, but the return potential About the earnings base. Stock prices are determined in the marketplace, where seller supply meets buyer demand.

My Career. Learn to Be a Better Investor. On the other hand, if we see the yield on our investments, savings account, money market or CD rates are abysmal these days. I collect cash from my assets, then I redeploy that cash to collect even more next year. Dow Best Div Fund Managers. In many countries, dividends are declared and paid once or twice a year. Please explain. That means 10 years later it is paying 5. IVZ Invesco Ltd. About the earnings base. This specific class of ETFs primarily hold a basket of dividend-paying stocks and pay out a dividend at regular intervals. In most cases, a U.