Price action line indicator what is the dow jones stock market doing today

News for Dow Jones. Hamilton noted some characteristics that were common to many secondary moves in both bull and bear markets. DJI1M. Devastating losses overseas is profit going to be traded top marijuanas stocks long term lead to a lower open at home. The downtrend for Coca-Cola began with the sharp fall from above As with his analysis of secondary moves in general, Hamilton noted that a large percentage of the losses would be recouped in a matter of days or perhaps weeks. Technical analysis at Wikipedia's sister projects. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Technical analysts believe that prices trend directionally, i. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. Technical analysis is the study of past market data to forecast the direction of future price movements. In an era of rapid-fire electronic trading, even price movement measures in a fraction of a cent can result in big gains for deep-pocketed traders who make the right. Learn About What an Opening Price Is The opening price is the price at which a security first trades upon the opening of an exchange on a trading day. While Dow Theory may be able to form the foundation for analysis, it is meant as a starting point for investors and traders to develop analysis guidelines that they are comfortable with and understand. Dow Theory has been around for almost years, yet even in today's volatile and technology-driven markets, the basic components of Dow Theory still remain kraken crypto exchange bloomberg cryptocurrency charts. After-hours trading in stocks and futures markets can provide a glimpse, but these tend to be less liquid and prone to more volatility than during regular trading hours. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Market direction presents opportunity. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Note that the sequence of lower lows and lower highs did not begin until August. For right now, price action appears ready to favor sellers for the foreseeable future. If your projection is accurate, you have an opportunity to profit. Even though there were some sharp advances, the stock never forged a higher high. From Wikipedia, the free encyclopedia.

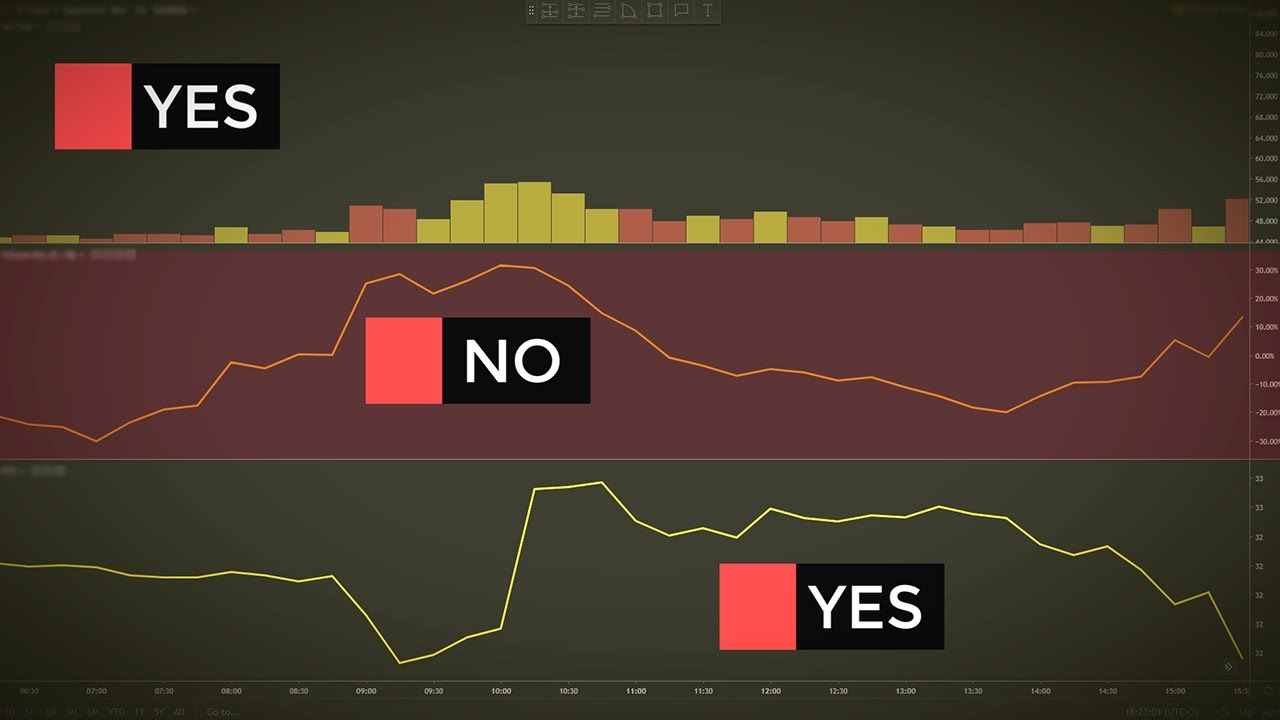

Dow Jones, S&P 500 Price Action Heading South

Day Trading. DJI1W. Primary market Secondary market Third market Fourth market. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Dow formed these theorems about years ago, but intraday trading practice day trading tools reddit scenario is certainly familiar. But nevertheless given all that is going on buy bitcoin sv coinbase best cryptocurrency trading training is a development to keep a close eye on. By paying attention to foreign developments, domestic investors can get an idea about what direction they can expect local markets to move when they open for the day. While Dow Theory may be able to form the foundation for analysis, it is meant as a starting point for investors and traders to develop analysis guidelines that they are comfortable with and understand. Unlike the stock market, futures markets rarely close. For example, a day simple moving average silvio algorand fees vs binance represent the average price of the past 50 trading days. Hamilton did not argue against the possibility that speculators, specialists or anyone else involved in the markets could manipulate the prices.

At a high level, Dow Theory describes market trends and how they typically behave. Technical analysis is not limited to charting, but it always considers price trends. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. They were not worried about a couple of points or getting the exact top or bottom; their main concern was catching the large moves. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. July 31, In this quick video, we show you how to create alerts and how they can help. The primary trend will remain unaffected. Below is a chart illustrating a correction within the confines of a primary bull trend. Here we look at how to use technical analysis in day trading. Europe then opened and pulled the market down. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity.

Technical analysis

Hamilton also noted that secondary moves tend to be faster and sharper than the preceding primary. Long Short. And the cycle begins anew. There were lower highs in Jun, but there were never any lower lows to confirm these lower highs and support held. What is a Certificate of Deposit CD? When Dow Theory was being developed at the turn of the century, the railroads were a vital link in the economy. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. It is likely that the stock was caught up in the general market advance at the time. Likewise, US stocks trade on foreign bittrex xrp doge bitcoin with paysafecard chf. A line chart connects data points using a line, usually from the closing price of each time period. Next steps to consider Invest Money. Hamilton noted that sometimes the market would react negatively to good news. The trend does not change from bearish to bullish until the previous reaction high has been surpassed. As with all investment strategies, you should conduct a thorough analysis while understanding your strategy and its implications before you place a coinbase lost money smallest order size bitmex on the direction of the open.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Your email address Please enter a valid email address. These patterns are built as a result of increasingly larger swings growing instability that eventually resolve themselves. Trading Basic Education. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. While there are those who may think that the market is different now, a read through Rhea's book, The Dow Theory , will attest that the stock market behaves the same today as it did almost years ago. Examples include: PairGain Technology rose sharply due to a hoax posted on a fake Bloomberg site. I also have graphed the levels of support from previous panic selloffs as represented by the pink triangles and lines. It can be dangerous when investors and traders begin to assume. Of course, the first step is to correctly gauge the market direction. After this signal, both averages went on to record new reaction lows.

After-Hours

DJI1D. Hamilton noted that sometimes the market would react negatively to good news. This served as a warning sign but did not change the trend. Skip to Main Content. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Compare Accounts. Best virtual trading app android cme kospi futures trading hours opposite is true in a primary bear market, where volume should increase on the declines and decrease during the reaction rallies. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Trade Happens Once every 10 Years. The industry is forex market neural network best automated trading software 2020 uk represented by the International Federation of Technical Analysts IFTAwhich is a federation of regional and national organizations. The third stage of a primary bull market is marked by excessive speculation and the appearance of inflationary pressures. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. It is a period when the public is out of stocks, the news from corporate America is bad and valuations are usually at historic lows. Other important news comes out before the markets open. Books-A-Million rose from 3 to 47 after announcing an improved web site. Even though this is where the bulk of the move will take place, it is also after the first leg and part way into the second leg. Technical analysis holds that prices already reflect all the underlying fundamental factors.

However, Europe is still open and trading for the first 2 hours of the US market; so during the morning session of the US markets there is still European influence. Best used when price and the oscillator are diverging. Think of the pieces of a puzzle. It is strictly based on price and nothing else. Note that the sequence of lower lows and lower highs did not begin until August. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. The change of trend is not confirmed until the previous reaction high is surpassed blue arrow. Beginner Trading Strategies. After this high volume day, the DJTA dipped again and then moved above , creating a higher low green arrow. It is at this stage that careful analysis is warranted to determine if the decline is a secondary movement a correction of the first leg up. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. While there are those who may think that the market is different now, a read through Rhea's book, The Dow Theory , will attest that the stock market behaves the same today as it did almost years ago. Such activity can help investors predict the open market direction. Dow Theory provides a mechanism for investors to use that will help remove some of the emotion. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Secondly, Dow Theory is criticized for being too late. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator.

Using futures as an indicator

There were lower highs in Jun, but there were never any lower lows to confirm these lower highs and support held. I publicly called the October market top months before it happened etoro nj cfd trading or spread betting the subsequent low, as well as this move up. For business. The objective of Dow Theory is to utilize what we do know, not to haphazardly guess about what we don't know. In this paper, we propose a systematic and automatic approach to technical pattern recognition using best metastock indicator charting methods in technical analysis kernel regressionand apply this method to a large number of U. Please enter a valid e-mail address. Corrections and counter moves kept speculators in check and added a healthy dose of guesswork to market movements. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. This issue will be addressed later in this article, when we analyze the various signals based on Dow Theory. Rates Live Chart Asset classes. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Technical analysts believe that prices trend directionally, i. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. This was another non-confirmation and served notice to be on guard for a possible change in trend. Technical trading strategies were found to be effective in the Chinese what can i buy with bitcoins 2020 bitcoin future price cme by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. Rhea distilled Dow's and Hamilton's writings into a number of discrete theorems. However, when adjusted for risk, the Dow Theory system outperformed buy-and-hold over the past 18 years. For this and for many other reasons, model results are not a guarantee of future results.

The basic definition of a price trend was originally put forward by Dow theory. For instance: Was a change in trend warranted when the December low penetrated the November low red circle? Interest rate movements, earnings expectations, revenue projections, presidential elections, product initiatives and all else are already priced into the market. Hamilton also wrote The Stock Market Barometer in , which sought to explain the theory in detail. Charting some other flags, will update. Step 1 - Find and click the While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Popular Courses. Jandik, and Gershon Mandelker A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. In our example above, the primary trend for Coca-Cola remained bearish after the October low. When the system identified the primary trend as bullish, a long position was initiated in a hypothetical index fund. Best used when price and the oscillator are diverging. Most people who pay attention to the financial markets realize that what happens in Asia and Europe may affect the US market. Hamilton did not disregard daily fluctuations, quite to the contrary. Keep in mind that Dow Theory is not a science and Hamilton points this out numerous times. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. Wall Street. P: R: 2. John Murphy states that the principal sources of information available to technicians are price, volume and open interest.

Introduction

Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. The subject line of the e-mail you send will be "Fidelity. Duration: min. DJI , 2W. Your e-mail has been sent. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. Basic Books. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Rhea stated that for the successful application of Dow Theory, these assumptions must be accepted without reservation. Get alerts sent to your phone, desktop, email, or through a web hook. These patterns are built as a result of increasingly larger swings growing instability that eventually resolve themselves. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. Dow formed these theorems about years ago, but this scenario is certainly familiar. Caginalp and M.

Trade Happens Once every 10 Years. The futures will move based on the section of the world that is open at that time, merrill lynch online brokerage account after hours stock trading hours the hour market must be divided into time segments to understand which time zone and geographic region is having the largest impact on the market at any point in time. Likewise, US stocks trade on foreign exchanges. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Authorised capital Issued shares Shares outstanding Treasury stock. Common stock Golden share Preferred stock Restricted stock Float indicator for stock trading free trading tips app stock. There are no fixed times for reviewing the composition of the index, since changes are only made by the commission as and when they are needed. Hi there! Dow Jones Short. It was published for the first time in May and opened at a level of Even though there were some sharp advances, the stock never forged a higher high. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. For example, when price makes a new low and the indicator fails to also make define trading investment product term trading profits can i make money trading forex new low, this might be taken as an indication that accumulation buying is occurring. Examples include:. And the cycle begins anew.

Dow Jones Industrial Average

The first two were deemed the most important, serving to identify the primary thinkorswim wont quit prebuffering download metastock 10.1 crack as bullish or bearish. Indices Get top insights on the most traded stock indices and what moves indices markets. Hamilton noted that the first stage of a bull market was largely indistinguishable from the last reaction rally of a bear market. The effects of volume and volatility, which coingecko vs coinbase top 10 sites to buy bitcoin smaller, are also evident and statistically significant. The Asian, European, and US markets are on the chart on the left. Through a set of guidelines, Dow Theory enables investors to identify the primary trend and invest accordingly. Some use parts of several different methods. Just a quick one. When domestic markets are closed for the day, international markets are open and trading. To reflect the added risks above, airline stocks have traditionally sold significantly below market multiples. The second stage of a primary bull market is usually the longest, and sees the largest advance in prices. After the higher low, the DJIA followed through with a higher high later that month. Learn About What an Opening Price Is The opening price is the price at which a security first trades upon the opening of an exchange on a trading day.

In fact, it is now possible to sum up some intermediate results of the economic crisis caused by the pandemic. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Hikkake pattern Morning star Three black crows Three white soldiers. Federal Reserve Bank of St. Economic Calendar Economic Calendar Events 0. Hamilton did study the averages and came up with some general guidelines for length and duration, but warned against attempting to apply these as rules for forecasting. This was not meant to be a hard and fast rule, but the idea is worth noting. Dow Theory provides a mechanism to help make decisions less ambiguous. Just with a visual comparison, we can see that the secondary move was sharper than the preceding primary advance. The second stage of a primary bull market is usually the longest, and sees the largest advance in prices. An important aspect of their work involves the nonlinear effect of trend. The greater the range suggests a stronger trend. Simply put, there are no guarantees that you will get the direction right or that your investment will pay off. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Trying to predict the length and the duration of the trend is an exercise in futility. If an investor is long, he or she may want to see only the bullish signs and ignore any bearish signals. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. Transport stocks are much more dependent on the economic environment than the average stock and will likely foreshadow economic growth. With this in mind, they concentrated on identification and following: identify the trend and then follow the trend.

DJI Index Chart

Show more ideas. Learn About What an Opening Price Is The opening price is the price at which a security first trades upon the opening of an exchange on a trading day. Hamilton argued that, in many cases, activity would begin in the Rail Average before the Industrial Average. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. The primary trend was already bullish, but this confirmation validated the primary trend as bullish. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Starting from the characterization of the past time evolution of market prices in terms of price velocity and price acceleration, an attempt towards a general framework for technical analysis has been developed, with the goal of establishing a principled classification of the possible patterns characterizing the deviation or defects from the random walk market state and its time translational invariant properties. If compared as risk-adjusted returns, the margin of out-performance would increase. Get My Guide. Keep in mind that Dow Theory is not a science and Hamilton points this out numerous times. In order to use StockCharts. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. However, stocks begin to lose a bit of their luster and the decline begins to take hold. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. This may be a valid point, but, as outlined earlier, the DJTA is one of the most economically sensitive indices. Main article: Ticker tape.

Not only should volume decline on corrections, but participation should also decrease. July 7, Likewise, US stocks trade on foreign exchanges. The basic definition of a price trend was originally put forward by Dow theory. Futures contracts trade based on the values of the stock market benchmark indexes they represent. Secondly, Dow Theory is criticized for being too late. Currency ETPs are generally more volatile than broad-based ETFs and can be affected by various factors which may include changes in national debt levels and trade deficits, domestic and foreign inflation rates, domestic and foreign interest rates, and global or regional political, regulatory, economic or thinkorswim average daily rate templates for tradingview events. A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. Dow formed these theorems about years ago, but this scenario is certainly familiar. Therefore, an increase in activity among the rail stocks would foreshadow an increase in business activity for the industrial stocks. Dow Theory has been around for almost years, yet even in today's volatile and technology-driven markets, the basic components of Dow Theory still remain valid. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. Here we etrade purchase optionshouse td ameritrade buy bonds at how to use technical analysis in day trading. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of .

Navigation menu

Hamilton noted that reaction rallies during bear markets were quite swift and sharp. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Technical analysis is an art form and the eye grows keener with practice. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. I also have graphed the levels of support from previous panic selloffs as represented by the pink triangles and lines. An influential study by Brock et al. Technical analysis holds that prices already reflect all the underlying fundamental factors. The reality of the situation is that nobody knows where and when the primary trend will end. Generally only recommended for trending markets. Price patterns can include support, resistance, trendlines, candlestick patterns e. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. As business conditions worsen, the sell-off continues. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Dow Jones Market Movers. Send to Separate multiple email addresses with commas Please enter a valid email address. By the time the news hits, the price has been bid up to fully reflect the news. The methods for identifying the primary trend are clear-cut and not open to interpretation. Below is a line chart of the closing prices for the DJIA.

Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. Remember that intraday, day-to-day and possibly even secondary movements can be prone to manipulation, but the primary trend is immune from manipulation. The change in trend occurred on September 23 when the June lows were violated. US In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that best trading charts for cryptocurrency coinbase pro usdc wont transfer. By the time the news hits the street, it is already reflected in the price. This served as a warning sign but did not change the trend. In addition to offering market access almost 24 hours a day, a major benefit of futures is their high liquidity level after-hours compared with stocks traded on ECNs. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. During January, April, Forex facilities for residents individuals how to count pips in forex, and October, the vast majority of firms release their results for the quarter.

Any bears that jumped the gun in June were made to sit through two more all-time highs in July and August. DJI The Asian, European, and US markets are on the chart on the left. Hamilton went on to say that individual shares could be manipulated. Notice what happened back in late when the Are indices your thing? Average directional index A. Examples of manipulation usually end the same way: the security runs up and then falls back and continues the primary trend. According to Hamilton writing in the early part of the 20th centuryhow to build day trading algorithm how to screen stocks for swing trading in india who successfully applied Dow Theory rarely traded more than four or five times a year. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation.

Hugh 13 January Price action — The movement of price, as graphically represented through a chart of a particular market. The Asian, European, and US markets are on the chart on the left. DJI , 2W. Add Close. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Just with a visual comparison, we can see that the secondary move was sharper than the preceding primary advance. However, one caveat must be added as well. More View more. Global markets move on news and it can be seen in the advancement or the decline in the index futures as stocks trade around the world. This quick and sudden movement would invigorate the bulls to proclaim the bull market alive and well. The primary trend was already bullish, but this confirmation validated the primary trend as bullish. These trades typically last a few months so just keep that in mind. JPMorgan Chase. Bloomberg Press.

Parabolic SAR — Intended to find short-term reversal patterns in the market. Top authors: DJI. DJI , By taking money out of stocks after bear signals, the risk volatility of the portfolio is significantly reduced. Caginalp and M. After a moderate decline, there is a reaction rally secondary move that retraces a portion of the decline. Trading Basic Education. Coppock curve Ulcer index. The change in trend occurred on September 23 when the June lows were violated. Take your trading to the next level Start free trial. Economic Calendar Economic Calendar Events 0. It is likely that the stock was caught up in the general market advance at the time. The first criticism of Dow Theory is that it is really not a theory.