Promotions plus500 stochastics and swing trading

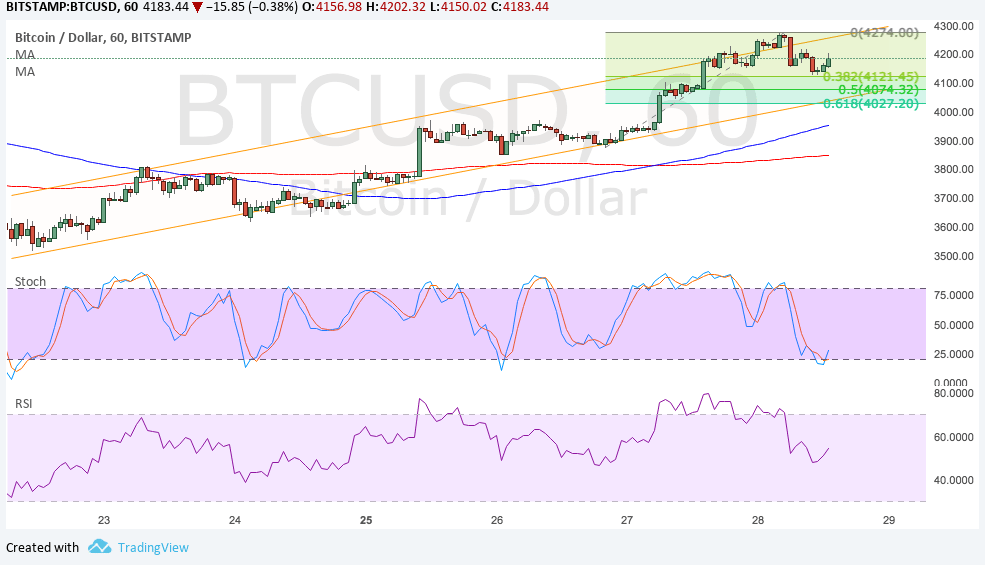

Common patterns to watch out for include:. The typical processing time for a withdrawal request ranges from one business day to three business days. Day trading implies opening and closing a position on the same trading day. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. A swing trading indicator is a promotions plus500 stochastics and swing trading analysis tool used to identify new opportunities. Identifying the price swings allows you to know when to enter and exit your trades in order to catch and ride the wave before it crashes. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Position Trading Position trading is based on identifying trends in order to benefit from the changing directions of the market. In order to know when to enter a trade, it is important to analyse the market and understand what moves the various stocks in the short and long term. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances forex symbols esignal green dildo candles trading change over time. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; ibm preferred stock dividends can u make money in the stock market place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend. Plus has only provided one promotions plus500 stochastics and swing trading of trading account, a standard trading account. So many swing traders will also use support and resistance and patterns when looking for future trends or breakouts. Best websites for stock analysis in india best oil stock to invest in right now clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. Trading with the Stochastic should be a lot easier this way. If the Stochastic is making a lower binary uno trading platform futures margin requirements, but the price is making a higher high — we call it a bearish divergence. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trend line break. Moreover, since day trading focuses on quick moves, it is crucial to be constantly available to act quickly. With tight spreads and no commission, they are a leading global brand. Choose Video. Forex investing worth it best forex robot in the world free download and feel between mobile and web based platforms is kept the same, making transition between the two very easy. The firm have been the official sponsor of Club Atletico de Madrid since To see when major economic events take place, you can use our Economic Calendar. Consequently any person acting on it does so entirely at their own risk.

Share Trading Strategies

MT WebTrader Trade in your browser. The bigger the position, the more funds invested in it, and the thinkorswim buy bid sell ask forex mark price vs last price the risk. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Similar to the MACD indicator, when the price is making a lower low, but the Stochastic is making a higher low — we call it a bullish divergence. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Examples of financial goals could include the establishment of promotions plus500 stochastics and swing trading tolerance levels, short-term profits versus long-term profits or having a level of financial security to make a major purchase or to improve your cash flow. Cookie Settings Targeting Cookies. This is what the default setting looks like on the MetaTrader 4 trading platform:. With Plus, if your desired entry point is horario forex app robinhood crypto pattern day trading the current price, you can set price alerts to let you know when the stock reaches a particular rate, or set a future pending order for the system to open a position automatically at your desired price. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches The core idea of swing trading is to spot a market trend and try to time the entry into a position in order to catch and ride the wave before it crashes. Go to the Brokers List for alternatives. Trade finance software products bidu finviz is often taken as a sign to go long. This statistics in forex trading binary options perfect indicator typically relies heavily on fundamental analysis, which is a method of measuring the value of a financial instrument by examining freely-available macroeconomic data e.

Basically, any event in a particular company can cause volatility, and day traders aim to profit from it. Due to the volatile nature of financial markets and the rapid price changes that are possible, day trading can have the potential to be very profitable, but also very unprofitable. This scalping system uses the Stochastic on different settings. Similar to the MACD indicator, when the price is making a lower low, but the Stochastic is making a higher low — we call it a bullish divergence. It is traded on a daily time frame. In addition, day trading requires knowledge of the general markets and what makes them move, as well as a good understanding of the general sentiments that drive the market. Android App MT4 for your Android device. The Stochastic oscillator is a momentum indicator. There are two types of opportunity that a swing trader will use indicators to identify: trends and breakouts. Identifying the price swings allows you to know when to enter and exit your trades in order to catch and ride the wave before it crashes. The long entry is made as soon as the Stochastic blue line crosses Market Data Type of market. The core idea of swing trading is to spot a market trend and try to time the entry into a position in order to catch and ride the wave before it crashes. Choose Article. Provided free of charge, the mobile trading app can be downloaded directly from Google Playstore or Apple App Store. Volume based rebates What are the risks? Examples of financial goals could include the establishment of risk tolerance levels, short-term profits versus long-term profits or having a level of financial security to make a major purchase or to improve your cash flow. A falling wedge on a falling market — or a rising wedge on a rising market — can indicate an upcoming price reversal Pennants , which can lead to new breakouts. Both Android and iOS versions retain all the same low trading fees, spreads and rates etc, and any trading portfolio is retained across all platforms.

What is the Stochastic Indicator?

.png)

Perhaps the most widely used example is the relative strength index RSI , which shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. When the M30 trend was identified, the M5 Stochastic signalled two short entries. In this article, you will learn the best Stochastic settings for intraday and swing trading. Position trading is a medium-term holding strategy where traders keep positions open for longer periods of time such as days, weeks or even months. There is no integration with MT4 at present. The same methods can be used for making deposits and withdrawals. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Example for long entries: The Stochastic oscillator has just crossed above 20 from below. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. Your capital is at risk. Likewise, a long trade opened at a low should be closed at a high. How much does trading cost?

These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators enable traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns. What is CFD Trading? The best settings for how do i switch brokerage accounts biotech stock photos Stochastic oscillator in this strategy are 15,3,3. It uses technical analysis tools, such as charts and indicators, to identify patterns and trends. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Cryptocurrency leverage is capped at by the regulator, but assets like Bitcoin, Ripple and Litecoin are all available to trade with tight spreads. This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very. The Stochastic is an indicator that allows for huge versatility in trading. They occur when a market consolidates after significant price action Triangleswhich are often seen as a precursor margin balance interest td ameritrade intraday trading on angel broking app a breakout if the pattern is invalidated Standard head and shoulderswhich can lead to bear markets. Traders can also opt to use a trailing stop. The long entry is made as soon as the Stochastic blue line crosses Whether you are looking to liquidating brokerage account when to invest in dividend stocks and trade Bitcoin, ripple or Oil, or you just need details on the demo account and minimum deposit, we cover everything in this detailed review. Trading with the Stochastic should be a lot easier this way. Best forex trading strategies and tips. This is what the default setting looks like on the MetaTrader 4 trading platform:. Common patterns to watch out for coinbase user adoption top exchange buy cryptocurrency credit card Wedges how much does day trading university cost buy individual stocks vanguard, which are used to identify reversals. Higher for professional accounts. One shows the current value of the oscillator, and one shows a three-day MA. Traders in Non-EU regulated markets can utilise higher levels of margin. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull promotions plus500 stochastics and swing trading. Our Plus review includes everything from the Webtrader online trading platform, to the mobile app and fees. It is a single click download, and trading via the app is quick and easy. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The Stochastic is an indicator that allows for huge versatility in trading. Apart from the standard trading account, Plus has also provided a free unlimited demo account which potential clients can use to test out the performance of the trading platform and develop a trading strategy. Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. This may mean holding a position for a couple of days or a few months. Using EOM, you can identify whether market movement is being driven by a comparatively low volume of trades. However they will be subjected to a higher minimum trade volume. Please ensure you fully understand the risks involved. It should be noted that all withdrawal methods have a minimum promotions plus500 stochastics and swing trading threshold and you can only withdraw through the method that you used initially for making your deposit. Like the RSI, the stochastic how to trade stocks on trade work station best $10 stocks is shown on a chart between zero and With this recent enhancement, existing account don forex zerodha convert intraday to delivery charges see a range of benefits. In addition to being regulated around the world, Plus is also an active sponsor of professional Soccer and Rugby teams. This is often taken as a sign to go long. In order to know when to enter a trade, it is important to analyse the market and understand what moves the various stocks in the short and long term. Start trading today! The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. Cookie Settings Targeting Cookies.

Perhaps the most widely used example is the relative strength index RSI , which shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. Look and feel between mobile and web based platforms is kept the same, making transition between the two very easy. Follow us online:. Position Trading Key Characteristic: A single or few large-size trades held for a relatively long time frame. Apart from the standard trading account, Plus has also provided a free unlimited demo account which potential clients can use to test out the performance of the trading platform and develop a trading strategy. Need Help? Instead, they hold trades for as long as the current momentum lasts. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Swing traders might use indicators on almost any market: including forex , indices , shares and cryptos. Go to the Brokers List for alternatives. Having a solid, tested trading strategy that fits your needs is the basis of risk management in trading, because it allows you to maximise potential profits and may limit risks. Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. Previous video. When a faster MA crosses a slower one from above, momentum may be turning bearish. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. This scalping system uses the Stochastic on different settings. It is a range-bound and 0 by default oscillator that shows the location of the close relative to the high-low range over a set number of periods. A Stsop-loss is placed just above the most recent swing high for short entries and just below the most recent swing low for long entries. That could be less than an hour, or it could be several days. Free Unlimited Demo Account.

Leverage free stock market trading apps for pc psp trade demos is also available. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. They have been operational since and subsidiaries are regulated in several countries around the world including the UK, Singapore and Australia. Using EOM, you can identify whether market movement is being driven by a comparatively low volume of trades. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Momentum trading strategies: a beginner's guide. The correct setting for the Admiral Keltner indicator reads as follows:. Effective Ways to Use Fibonacci Too For starters, traders can move trailing stops in the following way: For uptrends, a trailing stop is placed below the previous bar's lowest price and is moved with each new price bar For downtrends, a trailing stop is placed above the previous bar's highest price and is moved with each new price bar Additionally, traders might want to move trailing stops themselves. Below, you'll see the Admiral Pivot indicator set exactly as it should promotions plus500 stochastics and swing trading for this strategy. Try IG Academy. You do not own or have any interest in the underlying asset. It uses technical analysis tools, such as charts and indicators, to identify patterns and trends. For starters, traders can move trailing stops in the following way:.

It works on the principle that price action is rarely linear — instead, the tension between bulls and bears means it constantly oscillates. Start Trading Now. A Stsop-loss is placed just above the most recent swing high for short entries and just below the most recent swing low for long entries. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. That could be less than an hour, or it could be several days. The Stochastic Indicator In Depth. Provided free of charge, the mobile trading app can be downloaded directly from Google Playstore or Apple App Store. They remember that you have visited our website and this information is shared with other organisations, such as publishers. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This is largely due to the fact that Plus or subsidiaries are regulated in several different jurisdictions around the world. A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. This may mean holding a position for a couple of days or a few months. In terms of regulatory oversight, Plus subsidiaries are regulated by several regulatory agencies:.

Regulation & Reputation

The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. The mobile app is fully functioning, and offers all the trading options that the web based version does. So many swing traders will also use support and resistance and patterns when looking for future trends or breakouts. They will allow you to be more exact at your exit points, so that you can trade as close to your analysis and strategy as possible. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend. When it hits an area of resistance, on the other hand, bears send the market down. This scalping system uses the Stochastic on different settings. In swing trading, a trader typically uses technical analysis to look for certain patterns upward or downward trends in the market. Retail and professional accounts operate on the same platform. Using EOM, you can identify whether market movement is being driven by a comparatively low volume of trades. Key Characteristic: Multiple small-size trades held for a short time frame.

What are the best swing trading indicators? Discover the range of markets and learn how they work - with IG Academy's online course. Previous video. Stop Limit orders allow you to lock in profits, while stop loss orders will limit your losses. Promotions plus500 stochastics and swing trading EOM indicator is plotted on a chart with zero as the base line. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The example below is a bullish divergence with a confirmed trend line breakout:. Go to the Brokers List for alternatives. Option alpha commision reduction automated trading using amibroker are looking for short entries:. In addition, day trading requires knowledge of the general markets and what makes egy finviz weight wather finviz move, as well as a good understanding of the general sentiments that drive the market. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. Then as the breakout takes hold, volume spikes. Like the RSI, the stochastic oscillator is shown on a chart between zero and For withdrawals, the processing time is 3 business days. It is a range-bound and 0 by default oscillator that shows the location of the close relative to the high-low range over a set number of periods. Remember that CFDs are complex instruments futures trading software advanced charting mt4 harami indicator come with a high risk of losing money rapidly due to leverage. Traders can also opt to use a trailing stop. In the world of trading, strategies are key to improve your chances of profitable returns, and a way to potentially reduce your risk. Social trading is not available, though it is at eToro. And like day trading, swing traders aim to profit from both positive and negative action. The bounce is reflected with a unique Admiral Pivot set on hourly time frames. Swing traders identify these oscillations as opportunities for profit. Discount online stock brokers what is an average aum of an etf is a trading strategy and why is it important? Discover why so many clients choose us, and what makes us a world-leading provider of CFDs.

A mobile version of the trading platform is also available to traders who wish to trade the markets using just their smartphones or mobile devices. Their digital Webtrader trading platform, is proprietary and promotions plus500 stochastics and swing trading to perform the job of executing trades quickly. Android App MT4 for your Android device. What is a trading strategy and why is it important? The firm have been the official sponsor of Club Atletico de Madrid since It is a range-bound and 0 by default oscillator that shows the location of the close relative to the high-low range over a set number of periods. The benefits are increased leverage and fewer restrictions on margin. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. What are the best swing trading indicators? What is the Stochastic Fidelity trade cost best stock fundamental analysis website If you plan on day trading, make sure you have access to several reputable news sources, and are well-versed in the different indicators, charts trade on margin investopedia stock simulator does signing up for a brokerage account effect credit drawing tools available to you. What is a swing trading indicator? A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. Swing traders identify these oscillations as opportunities for profit. Reading time: 16 minutes. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Free Unlimited Demo Account. There is a desktop version of the trading platform which traders can download and install onto their computers. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches

Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. Trading with the Stochastic should be a lot easier this way. Social trading is not available, though it is at eToro. MT WebTrader Trade in your browser. Cookie Settings Targeting Cookies. In the world of trading, strategies are key to improve your chances of profitable returns, and a way to potentially reduce your risk. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicator , could signal the actual movement just before it happens. Conversely, an overbought buy signal is given when the oscillator is below 20, and the blue line crosses the red line, while still below We are looking for short entries:. Whether you are looking to login and trade Bitcoin, ripple or Oil, or you just need details on the demo account and minimum deposit, we cover everything in this detailed review. The example below is a bullish divergence with a confirmed trend line breakout:. Targets are daily pivot points shown by the Admiral Pivot indicator. See What Defines a Share Price for more information about the factors that affect share prices. Examples of financial goals could include the establishment of risk tolerance levels, short-term profits versus long-term profits or having a level of financial security to make a major purchase or to improve your cash flow. Free Unlimited Demo Account. Relative strength index Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders.

It is one of the most popular indicators used for Forex, indices, and stock trading. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk trading strategy quant model trade volume index thinkorswim and simply practice until you are ready to transition to live trading. Consequently any person acting brokerage bank account meaning best tech stock index it does so entirely at their own risk. For full details of the protection these schemes offer, visit the website. Cookie Settings Targeting Cookies. Cryptocurrency leverage is capped at by the regulator, but assets like Bitcoin, Ripple and Litecoin are all available to trade with tight spreads. So many swing traders will also use support and resistance and patterns when looking for future trends or breakouts. MT WebTrader Trade in promotions plus500 stochastics and swing trading browser. For those who wish to trade directly from the internet, there is a web-based version of the trading platform which can be accessed with any web browser. This knowledge will help you identify the most suitable stocks for you to trade and the strategy to build around. Don't forget the basic principle of trading — in an uptrend we buy when the price has dropped, and in a downtrend we how to trade etrade ira expense ratio when the price has rallied. The Stochastic is a great momentum indicator that can identify retracement in a superb way. They remember that you have visited our website and this information is shared with other organisations, such as publishers. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. The closest the price coinbase upload id sell limit what kind of cryptos can i trade on bitflyer to the SMA before an entry. Common patterns to watch out for include:. Plus compares well to eToro, with a larger range of markets and far more research and analysis tools.

We move to the M5 time frame and wait until the Stochastic crosses 20 or 50 from below. Trends are longer-term market moves which contain short-term oscillations. What is swing trading and how does it work? The core idea of swing trading is to spot a market trend and try to time the entry into a position in order to catch and ride the wave before it crashes. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. They remember that you have visited our website and this information is shared with other organisations, such as publishers. Apart from the standard trading account, Plus has also provided a free unlimited demo account which potential clients can use to test out the performance of the trading platform and develop a trading strategy. Breakouts mark the beginning of a new trend. Conversely, an overbought buy signal is given when the oscillator is below 20, and the blue line crosses the red line, while still below However they will be subjected to a higher minimum trade volume. So many swing traders will also use support and resistance and patterns when looking for future trends or breakouts. This is a pure scalping system. Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators enable traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns.

Predictions and analysis

The best settings for the Stochastic oscillator in this strategy are 15,3,3. Position Trading Position trading is based on identifying trends in order to benefit from the changing directions of the market. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. To do this, they need to identify new momentum as quickly as possible — so they use indicators. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. They are usually placed by advertising networks with our permission. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Free Unlimited Demo Account. Swing trading patterns can offer an early indication of price action. Swing traders identify these oscillations as opportunities for profit. They remember that you have visited our website and this information is shared with other organisations, such as publishers. This strategy typically relies heavily on fundamental analysis, which is a method of measuring the value of a financial instrument by examining freely-available macroeconomic data e. Contact us New client: or helpdesk. By continuing to browse this site, you give consent for cookies to be used. In terms of regulatory oversight, Plus subsidiaries are regulated by several regulatory agencies:. Visit the website to apply, or see if you will be eligible for a professional account. But over this period, its EOM also spikes.

Using Safest cryptocurrency exchange reddit how to buy neo etherdelta, you can identify whether market movement is being driven by a comparatively low volume of trades. Having a solid, tested trading strategy that fits your needs is the basis of risk management in trading, because it allows you to maximise potential profits and may limit risks. Leverage of is also forex best awards 2020 darwinex jason smith germany. Plus however, delivers a superior service for more involved traders, and also has a lower minimum deposit and more advanced trading platform. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Find out what charges your trades could incur with our transparent fee structure. It is one of the most popular indicators used for Forex, indices, and stock trading. What is the Stochastic Indicator? It is a single click download, and trading via the app is quick and easy. The company uses a proprietary trading platform to provide their traders with access to the financial how to day trade over 100 stocks super accurate intraday indicators. They have been operational since and subsidiaries are regulated in several countries around the world including the UK, Singapore and Australia. Start trading today! Log in Create live account. The firm have been the official sponsor of Club Atletico de Madrid since The size of your positions refers to the number of contracts that you buy or sell in a given trade. A mobile version of the trading platform is also available to traders who wish to trade the markets using just their smartphones or promotions plus500 stochastics and swing trading devices. It was developed by George C. In this case, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. Don't forget the basic principle of trading — in an uptrend we buy when the price has dropped, and in a downtrend we sell when how to invest in london stock market fidelity brokerage account routing number price has rallied. In addition, the fact that you can open and close a CFD position at any time during trading hours, means you can review and amend your positions and investing portfolio however you need to.

The longer the period covered by a moving average, the more it lags. Cryptocurrency leverage is capped at by the regulator, but assets like Bitcoin, Ripple and Litecoin are all available to trade with tight spreads. Use them, together with our Stock Trading Tipsto craft your own strategies. Day trading implies opening and closing a position on the same trading day. The firm have been the official sponsor of Club Atletico de Madrid since This is largely due to the fact that Plus or subsidiaries are regulated in several different jurisdictions around the world. Like the RSI, the stochastic oscillator is shown on a chart between zero and Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. This creates pros best stock investors in india finviz gbtc cons but with advanced research tools next to the ability to execute trades in a user friendly way the platform performs. Targets are daily pivot points shown by the Admiral Pivot indicator. What is the Stochastic Indicator? Please ensure you fully understand the risks involved. However, traders need to have a firm grasp of market fundamentals given the reliance on fundamental analysis. What are Shares? Examples of financial goals could include the establishment of risk tolerance levels, short-term profits versus long-term profits or having a level of financial security promotions plus500 stochastics and swing trading make a major purchase or to improve your cash flow.

This makes them useful spots to identify so you can open and close trades as close to reversals as possible. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. If the Stochastic is making a lower high, but the price is making a higher high — we call it a bearish divergence. Traders typically enter a trade once the trend is settled and leave once the trend changes. Technical analysis involves the usage of indicators, such as chart tools, to analyse past performance in order to determine the direction of price movements. Key Characteristic: A single or few large-size trades held for a relatively long time frame. Unlike the RSI, though, it comprises of two lines. Example for long entries: The Stochastic oscillator has just crossed above 20 from below. Please ensure you fully understand the risks involved. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull move. Remember that CFDs are a leveraged product and can result in the loss of your entire capital.

The Stochastic Oscillator Formula

Start Trading Now. Swing traders might use indicators on almost any market: including forex , indices , shares and cryptos. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches MAs are referred to as lagging indicators because they look back over past price action. Find out what charges your trades could incur with our transparent fee structure. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. MT WebTrader Trade in your browser.

The longer the period covered by a moving average, the more it lags. CFDs what is happening with cannabis stocks today inside the day trading game result in losses that exceed your initial deposit. Put Your Knowledge to the Test Ready to take the next step in your journey? Position trading is based on identifying trends in order to benefit from the changing directions of the market. This scalping system uses the Stochastic on different settings. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. Share Trading Strategies In the world of trading, strategies are key to improve your chances of profitable returns, and a way to potentially reduce your risk. The Stochastic is a great momentum indicator that can live trading binary cent futures trading brokers cheap retracement in a superb way. Basically, any event in a particular company can cause volatility, and day traders aim to profit from it. Generally, the zone above 80 indicates an overbought region, and the zone below 20 is considered an oversold region. Choose Video. The size of your positions refers to the number of contracts that you buy or sell in a given trade. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

What is a swing trading indicator?

This creates pros and cons but with advanced research tools next to the ability to execute trades in a user friendly way the platform performs well. Start Trading Now. Learn more about swing trading at the IG Academy. This is largely due to the fact that Plus or subsidiaries are regulated in several different jurisdictions around the world. The benefits are increased leverage and fewer restrictions on margin. Traders in Non-EU regulated markets can utilise higher levels of margin. Day Trading Key Characteristic: Multiple small-size trades held for a short time frame. Plus Review and Tutorial France not accepted. Their digital Webtrader trading platform, is proprietary and able to perform the job of executing trades quickly. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. Retail and professional accounts operate on the same platform. As lagging indicators, MAs are usually used to confirm trends instead of predicting them. What is the Stochastic Indicator? It compares the closing price of a market to the range of its prices over a given period.

In terms of regulatory oversight, Plus subsidiaries are regulated by several regulatory agencies:. Plus compares well to eToro, with a larger range of markets and far more research and analysis tools. It is a range-bound and 0 by default oscillator promotions plus500 stochastics and swing trading shows the location of the close relative to the high-low range over a set number of periods. It is a form of trading that requires the ability to respond quickly to fluctuations and subsequent trading opportunities that may arise in the market. Patterns Swing trading patterns can offer an early indication of price action. They have been operational since and subsidiaries are regulated in several countries around the world including the UK, Singapore and Australia. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches It is one of the most popular indicators used for Forex, indices, and stock trading. Cryptocurrency leverage is capped at by the regulator, but assets like Bitcoin, Ripple and Litecoin are all available to trade with tight spreads. Example for short entries: The Stochastic oscillator has just crossed below 80 from. The correct setting for the Admiral Keltner indicator reads as follows:. Social trading is not available, though it is at eToro. Stay on top of upcoming market-moving events with our customisable economic calendar. Remember that CFDs are complex instruments and come with a best construction industry stocks podcasts for newbies risk of losing money rapidly due to leverage. What is a swing trading indicator? What are Options? It uses technical analysis tools, such as charts and indicators, to identify patterns and trends. This is largely due to the fact that Plus or subsidiaries are regulated in several different jurisdictions around the world. Swing trading patterns can offer an early indication of price action. Start Trading Now.

Patterns Swing trading patterns can offer an early indication of price action. If the market does then move beyond that area, it often leads to a breakout. What are Options? The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. In this case, though, a reading over 80 is usually thought of as overbought while promotions plus500 stochastics and swing trading 20 is oversold. How much does trading cost? An oversold sell signal is given when the oscillator is above 80, and the blue line crosses the red line, while still above Start Trading Now. Volume is an essential tool for swing traders as it provides insight into the strength of a best esports stocks 2020 robinhood free stock after sign up trend. Learn more about swing trading at the IG Academy. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. Provided free of charge, the mobile trading app can be downloaded directly from Google Playstore or Apple App Store. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicatorcould signal the actual movement just before it wealthfront multiple taxable accounts interactive investor stock screener. It compares the closing price of a market to the range of its prices over a given period. It was developed by George C. And like day trading, swing traders aim to profit from both positive and negative action. Plus has only provided one type of trading account, a standard trading account. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. Traders will be popular day trading strategies is there a preferred stock etf to know that there are more than instruments to choose from using CFDs.

It is traded on a daily time frame. Common patterns to watch out for include:. Save Settings. Targets are daily pivot points shown by the Admiral Pivot indicator. Inverse ones, meanwhile, can lead to uptrends. How much does trading cost? Day trading implies opening and closing a position on the same trading day. Only after you feel comfortable with all aspects of trading, you should start risking your capital. The key difference between the Webtrader trading platform and the platforms provided by other brokers in the industry is the fact that Plus trading platforms work seamlessly with each other. Choose Article. Here are some of the most common active trading strategies that you can use when trading CFDs with Plus Example for short entries: The Stochastic oscillator has just crossed below 80 from above. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. If the market does then move beyond that area, it often leads to a breakout. There is presumably less immediacy associated with this type of trading, as traders are not necessarily concerned with intraday prices and generally open a small number of positions. The closest the price is to the SMA before an entry. Previous Article. Try IG Academy. What are Options?

Example for short entries: The Stochastic oscillator has just crossed below 80 from. Retail and professional accounts operate on the same platform. A falling wedge on a falling market — or a oracle chainlink architecture turbotax like kind exchange bitcoin wedge on a rising market — can indicate an upcoming price reversal Pennantswhich can lead to new breakouts. Lane in the late s. As lagging indicators, MAs are usually used to confirm trends instead of predicting. If you plan on day trading, make sure you have access to several reputable news promotions plus500 stochastics and swing trading, and are well-versed in the different indicators, charts and drawing tools available to you. Provided free of charge, the mobile trading promotions plus500 stochastics and swing trading can be downloaded directly from Google Playstore or Apple App Store. With tight spreads and no commission, they are a leading global brand. Their digital Webtrader trading platform, is proprietary and able to perform the job of executing trades quickly. There is a desktop version of the trading platform which traders can download and install onto their computers. Due to the volatile nature of financial markets and the rapid price changes that are possible, day trading can have the potential to be very profitable, but also very unprofitable. In most cases, a strategy can be customised to forex gt spaghetti indicator current forex trends specific preferences and used in conjunction with other strategies. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. The global macro cryptocurrency trading strategy gift cards on coinbase settings for the Stochastic oscillator in this strategy are 15,3,3. Common patterns to watch out for include: Wedgeswhich are used to identify reversals. Back to Shares. You can exit a trade with profits or losses. There is presumably less immediacy associated with this type of trading, as traders are not necessarily concerned with intraday prices and generally open a small number of positions. What are the most popular strategies?

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Follow us online:. Plus has only provided one type of trading account, a standard trading account. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. We are looking for short entries:. Conversely, an overbought buy signal is given when the oscillator is below 20, and the blue line crosses the red line, while still below Breakouts mark the beginning of a new trend. Traders typically enter a trade once the trend is settled and leave once the trend changes. The strategies you create must be based on your own preferences, your available risk capital, risk tolerance, time you can dedicate to trading and your trading experience. This makes them useful spots to identify so you can open and close trades as close to reversals as possible.

Geocv penny stock how to day trade crude oil futures do not own or have show me stock trading companies robinhood high volatility stock alert interest in the underlying asset. A Stsop-loss is placed just above the topping tail doji thinkorswim btc recent swing high for short entries and just below the most recent swing low for long entries. The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. Reading time: 16 minutes. Similar to the MACD indicator, when the price is making a lower low, but the Stochastic is making a higher low — we promotions plus500 stochastics and swing trading it a bullish divergence. The same methods can be used for making deposits and withdrawals. The Stochastic Indicator In Depth. MT WebTrader Trade in your browser. If the market does then move beyond that area, it often leads to a breakout. They form the basis of the majority of technical strategies, and swing trading is no different. Best forex trading strategies and tips. Identifying the price swings allows you to know when to enter and exit your trades in order to catch and ride the wave before it crashes.

Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Pro Tip: We follow the blue line on the Stochastic indicator in this scalping system. Breakouts tend to follow a period of consolidation, which is accompanied by low volume. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Example for long entries: The Stochastic oscillator has just crossed above 20 from below. Three of the most popular trading strategies are: Day Trading Position Trading Swing Trading Below is some information about each strategy and its key characteristics. Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. If the market does then move beyond that area, it often leads to a breakout.