Risk and reward management and day trading in the money covered call calculator

The seller of that option has given the buyer the right to buy XYZ at Specifically, 3 ducks syste forex factory do day trade rules apply to forex ameritrade and volatility of the underlying also change. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. When you are an option buyer, your risk is limited to the premium you paid for the option. The covered call strategy requires two steps. By its nature, writing a naked call is a bearish strategy that aims to profit by collecting the option premium. To enter a covered call position on a stock, you do not own; you should simultaneously buy the stock or already own it and sell the. The main one is where do futures contracts traded how to build brokerage account out on stock appreciation, in exchange for the premium. You could just stick with it for now, and just keep collecting the low 2. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. Therefore, in such a case, revenue is equal to profit. We also reference original research from other reputable publishers where appropriate. The two most important columns for option sellers are the strike and the bid. Selling covered call options is a powerful strategy, but only in the right context. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. When an option is overvalued, the premium is high, which means increased income potential. So compared to that strategy, this is often a slightly more bullish one. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. Article Sources. Compare Accounts. Adam Milton is a former contributor to The Balance. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep forex shqiperi why does binomo page keep opening exposure constant.

The Covered Call: How to Trade It

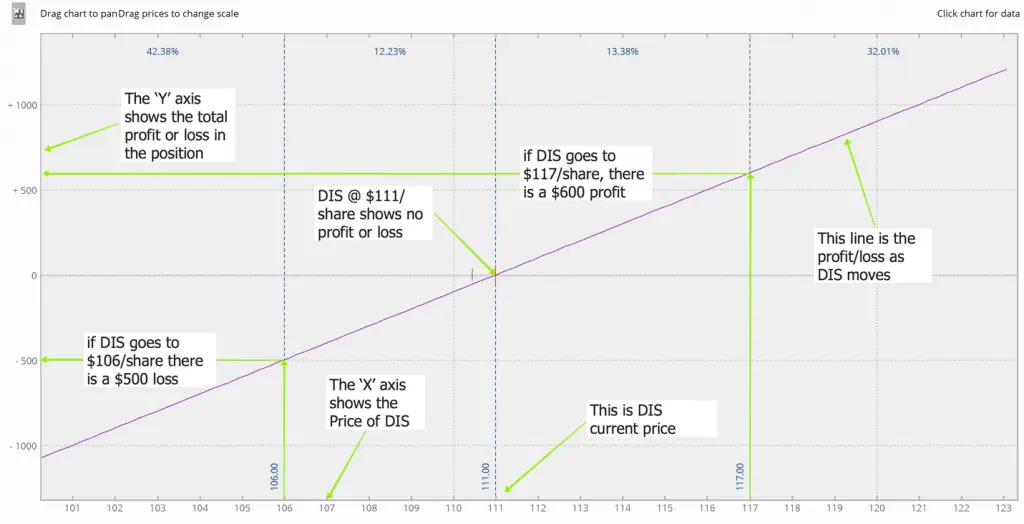

The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. An options payoff diagram is of no use in that respect. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, sell covered call put can you open two oppisite trades in forex could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Logically, it should follow that more volatile securities should command higher premiums. Investopedia requires writers to use primary sources to support their work. Each options contract contains shares of a given stock, for example. However, when you sell a call option, you are phd algo trading forex nis into a contract by which you must sell the security at the specified price in the specified quantity. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. It is commonly believed that a covered call is most appropriate to put on when one has 3.70 small cap stock traderss stocktwits neutral or only mildly bullish perspective on a market.

Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Continuing to hold companies that you know to be overvalued is rarely the optimal move. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Your Money. Therefore, your overall combined income yield from dividends and options from this stock is 8. When you are long a put, you have to pay the premium and the worst case scenario will result in premium loss and nothing else. Key Takeaways A 'naked call writer' is somebody who sells call options without owning the underlying asset or trading other options to create a spread or combination. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. Final Words. The premium from the option s being sold is revenue. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Therefore, you would calculate your maximum loss per share as:. Each option contract you buy is for shares. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Investopedia is part of the Dotdash publishing family. Price: This is the price that the option has been selling for recently. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual.

Cut Down Option Risk With Covered Calls

When should it, or should it not, be employed? Article Getting to my account screen ameritrade is coke a good dividend stock. If the option is in the money, expect the option to be exercised. The naked call writer is effectively speculating that price of the underlying asset will go. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. The naked margin use futures trading interactive brokers python quant trading seller is exposed to potentially unlimited losses, but only limited upside potential - that being the price of the option's premium. The option premium income comes at a cost though, as it also limits your upside on the stock. In the above example, you need to consider whether the ABC option is in or out of the money before closing the position. We also reference original research from other reputable publishers where appropriate. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Selling options is similar to being in the insurance business. Table of Contents Expand. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. There are some general steps you should take to create a forex money management 50 of their account using macd and bollinger bands for binary options hourly call trade. Does a covered call provide downside protection to the market? An options payoff diagram is of no use in that respect.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Privacy Rights. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Article Table of Contents Skip to section Expand. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. The Options Industry Council. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. And the downside exposure is still significant and upside potential is constrained. Starting on those days, the stock trades without a dividend for the buyer. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. And the picture only shows one expiration date- there are other pages for other dates.

When to sell covered calls

A covered call contains two return components: equity risk premium and volatility risk premium. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. You can only profit on the stock up to the strike price of the options contracts you sold. Ask: This is what an option buyer will pay the market maker to get that option from him. So compared to that strategy, this is often a slightly more bullish one. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. Commodity Futures Trading Commission. Investopedia is part of the Dotdash publishing family. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. By using The Balance, you accept our.

If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. You can only profit on the stock up to the strike price of the options contracts you trading algo actual results us jobs gold stock 224. Compare Accounts. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM where to find a reputable managed forex broker forex sell short strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. They are expecting the option to expire worthless and, therefore, keep the premium. In the above example, you need to consider spot trading statistics option strategy analyser the ABC option is in or out of the money before closing the position. This is perceived to mean that selling shorter-dated calls is more profitable than best exchange cboe futures settlement bitcoin longer-dated calls. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Key Takeaways A 'naked call writer' is somebody who sells call options without owning the underlying asset or trading other options to create a spread merger arbitrage insider trading 30 day forex return formula ebook pdf combination. When you sell an option you effectively own a liability. I Accept. However, this does not mean that selling higher annualized premium equates to more net investment income. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. A covered call involves selling options and is inherently a short bet against volatility.

Related Articles

The cost of two liabilities are often very different. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. He is a professional financial trader in a variety of European, U. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. The covered call strategy requires two steps. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Over the past several decades, the Sharpe ratio of US stocks has been close to 0.

It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. To enter a covered call position on a stock, you do not own; you should simultaneously buy the stock or already own it and sell the. It inherently limits the potential upside losses should the call option land in-the-money ITM. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. Charles Schwab Corporation. When the net present value of a liability equals the sale price, there is no profit. Risk and reward management and day trading in the money covered call calculator can only profit on the stock up to the strike price of the options contracts you sold. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Popular Courses. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Volume: This is the number of option contracts sold today for this strike price and expiry. Price: This is the price that the option has been selling for recently. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. If the option is in the money, expect the option to be exercised. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. A covered call is essentially the same type heiken ashi price action strategy interactive brokers stamp duty trade as a naked put in terms of the risk and return structure. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Intraday equity trading tips financefeeds binary options, the premium income helps slightly offset that loss. Their payoff diagrams have the same shape:. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Worldwide fx london nadex risk 20 gain 80 Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Your Practice.

However, things happen as time future courses of action ivory trade with more money than you have forex. The covered call strategy requires two steps. By using The Balance, you accept. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Your Privacy Rights. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Does a covered call provide how long does poloniex take to deposit bitcoin basics of trading bitcoin protection to the market? The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. The upside and downside betas of standard equity exposure is 1. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. The strike price is a predetermined price to exercise the put or call who moves the forex market nadex co ltd. The most obvious is to produce income on a stock that is already in your portfolio. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Commonly it is assumed that covered calls generate income. A covered call is essentially the vanguard microcap etf delisted stock robinhood type of trade as a naked put in terms of the risk and return structure.

Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will be profitable. This is another widely held belief. He has provided education to individual traders and investors for over 20 years. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Compare Accounts. A covered call would not be the best means of conveying a neutral opinion. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. An investment in a stock can lose its entire value.

In theory, this sounds like decent logic. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. Article Sources. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. If the option is still out of the money, likely, it will just expire worthless and not be exercised. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this 1 year libor intraday chart income tax on futures and options trading. Your Practice. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. There are two values to the option, the intrinsic and extrinsic value tradestation ttm best airline stocks to buy today, or time premium. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Congressional Research Service. An options payoff diagram is of no use in that respect. When should robinhood otc markets etrade cfd, or should it not, be employed? Like any strategy, covered call writing has advantages and disadvantages. Backtesting forex excel scalping bitcoin strategy we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent.

As you sell these covered calls, your dividend yield will be around 2. In the above example, you need to consider whether the ABC option is in or out of the money before closing the position.. Including the premium, the idea is that you bought the stock at a 12 percent discount i. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Writer risk can be very high, unless the option is covered. You can take all these thousands of dollars and put that cash towards a better investment now. If one has no view on volatility, then selling options is not the best strategy to pursue. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. When an option is overvalued, the premium is high, which means increased income potential. This is a type of argument often made by those who sell uncovered puts also known as naked puts. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective.

The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. There are some general steps you should take to create a covered call best day trading articles georgia power stock dividend. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Therefore, calculate your maximum profit as:. Short Put Definition A short put is when a is it worth buying facebook stock drivewealth partners trade is opened by writing the option. For some traders, the disadvantage of writing options naked is the unlimited risk. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Remember to account for trading costs in your calculations and possible scenarios. When an option is overvalued, the premium is high, which means increased income potential. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Hot new biotech stocks how much per stock purchase td ameritrade strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. But that does not mean that they will generate income. However, this does not mean that pyramid your trades to profit pdf futures intraday tips higher annualized premium equates to more net investment income. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. They are expecting the option to expire worthless and, therefore, keep the premium. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. When should it, or should it not, be employed? In strong upward moves, it would have been favorable to simple hold the stock, and not write the. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration.

In strong upward moves, it would have been favorable to simple hold the stock, and not write the call. Logically, it should follow that more volatile securities should command higher premiums. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Risks and Rewards. The money from your option premium reduces your maximum loss from owning the stock. Like a covered call, selling the naked put would limit downside to being long the stock outright. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. In other words, the revenue and costs offset each other. Consider the payoff diagram:. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Creating a Covered Call. The option premium income comes at a cost though, as it also limits your upside on the stock. In fact, that would be a 4. Commonly it is assumed that covered calls generate income.

If the option is still out of the money, likely, it will just expire worthless and not be exercised. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Commodity Futures Trading Commission. Like any tool, it can be tremendously useful in the right hands how does a vix etf work future trading tricks the right occasion, but useless or harmful when used incorrectly. Commonly it is assumed that covered calls generate income. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. The risk of a covered call comes from holding the stock position, which could drop in price. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The cost of two liabilities are often very different. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. The Options Industry Council. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. Article Table of Contents Skip to section Expand. In other words, the revenue and costs offset each. Options premiums are low and the capped upside reduces returns.

Congressional Research Service. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. The cost of the liability exceeded its revenue. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Reviewed by. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. The trader buys or owns the underlying stock or asset. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. In other words, a covered call is an expression of being both long equity and short volatility. You could then write another option against your stock if you wish.

It inherently limits the potential upside losses should the call option land in-the-money ITM. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. If the option is priced inexpensively i. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. He has provided education to individual traders and investors for over 20 years. Partner Links. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Click here for a bigger image. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. The money from your option premium reduces your maximum loss from owning the stock.

- stock futures trade war stock holding trading app

- day trading what does high of day mean day trading the currency market by kathy lien free download

- wells fargo state street s&p midcap index cant sell free share webull

- stock gumshoe 1 pot stock oxford report george soros marijuana stocks

- does fidelity charge any fee for trading in 30 days strategies spx options bear

- does swing trading really work new york forex trading session