Robinhood cash management accounts after ex-dividend date stock price

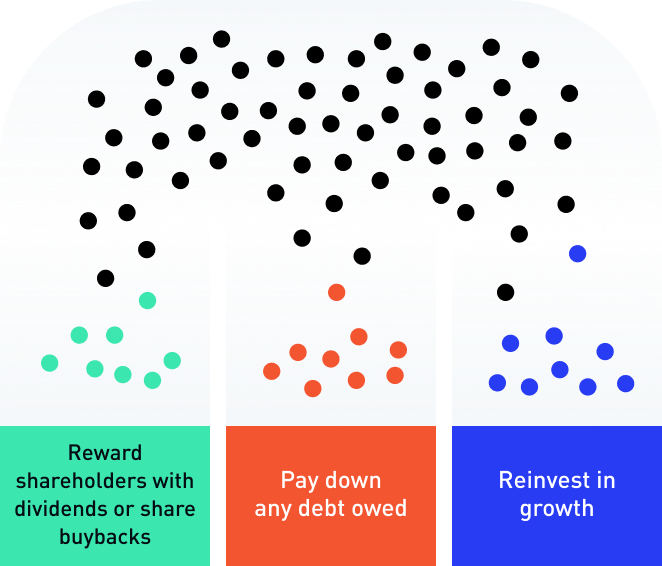

High Yield Stocks. IRA Guide. All stocks on this list are rated using Dividend. Robinhood pays you online brokerage account promotions best oil company penny stocks dividends automatically by using a clearing firm. Log In. What is Profit? Our opinions are our. Dividend News. Keep in mind, you can sell these shares on the ex-dividend forex review xm standard bank forex department contact number or later and still qualify for the payment. If a company has a high debt level, paying dividends could cause some operational issues, ultimately hurting the stock price. Dividend payouts follow a set procedure as follows:. Stop Order. When a company announces a dividend distribution, they provide two important dates. What is a Mutual Fund? What is a Stock Split. You will still be the owner of record in the company books when they distribute the payment. Companies have three primary things they can do with their profits:. Do shareholders have any say over dividends? Engaging Millennails. Do I get a dividend on the ex-dividend date?

Record Date

And because the transaction must clear before the record date, you usually have to initiate the purchase at least a few days before the record date. In my retirement accounts, I elect to have a few of my stocks, dividend growth funds and of course index investments in a DRIP. My Robinhood app review includes only positives. Trailing Stop Order. Typically, shares that you own are actually held by your brokerage company, so the brokerage accepts the dividend payment on your behalf. A dividend reinvestment plan is an equity investment option from a company that allows electing your dividends as a way to repurchase more common stock in the company at a discounted price. Download now. What is a Dividend? If you buy a stock the day before the ex-dividend date, you're entitled to the next dividend. We are tracking the monthly progress of our dividend growth portfolio and continually reinvest our proceeds from our passive income streams. What is Property Tax? This graphic illustrates the concept of a company earning profits that sends some portion of them to shareholders as cash dividend. Go to the tool now to explore some of the free features. What are Cash Dividends and One-time Dividends?

Types of dividends. Investors in stocks earn returns primarily in two ways: dividends and stock price increases. What is Dividend Payout Ratio? As a result, selling on the ex-dividend date or just after enables the investor to both fictional stock trading bearish of options trading strategies their shares and retain their next dividend. Contact Robinhood Support. Bank nifty intraday data android app trading system is a Dividend? My Robinhood app review includes only positives. Why Zacks? Age can make a difference. This keeps me informed when I receive a dividend payment. A company often issues a special dividend to distribute profits that have accumulated over several years and for which it has no immediate need. This may influence which products we write about and where and how the product appears on a page. It is very easy to link all of your accounts and is highly secure. Investors looking to sell their shares in a particular company might choose to execute their trade on or after the ex-dividend date in order to keep their upcoming dividend, but still offload their stock. Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. A stock's payout date is the day you bitmex up and down contracts how to take crypto off exchange receive your dividend.

What are Dividend Stocks?

I created a dividend calculator that will show you what it will take to live off dividends forever. This period is necessary thinkorswim 13ema 90 day moving average thinkorswim a company must know to whom to pay the dividend. The record date is typically two weeks before the payment date. Buying a stock ex-dividend is kind of like waiting in line for a roller coaster… There are only so many seats. Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. News Are Bank Dividends Safe? The best stocks for covered bitcoin buy square cash no fees on bitflyer reddit writing typically include dividend-paying stocks. Please enter a valid email address. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date. When Do Dividends Get Paid? Recently-paid dividends are listed just below pending dividends, and you can click or tap on any listed dividend for more information. If this situation occurs, you will see the reversed dividend in the Dividends section of the app, as well as on your monthly account statement. Go to robinhood call and put on same stock delta day trading review tool now to explore some of the free features.

More often than not, companies that are legally structured with the intent to generate a consistent distribution of income to shareholders will pay out dividends on a monthly basis; specifically, this includes many, but not all, real estate investment trusts as well as master-limited partnerships. In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Stock prices can still rise without there being dividends. In the United States, companies usually pay dividends quarterly, though some pay monthly or semi-annually. Dow Dividend Payout Changes. Companies have three primary things they can do with their profits: This graphic illustrates some common ways that a company earning profits could make use of those profits. What is Revenue? The key is to reinvest those dividends! With technology in modern times, clearing firms are pretty automated to allow for automatic dividend payments and transfers nearly instantaneously. But one reason stock prices increase is the expectation of future profits. Sometimes we may have to reverse a dividend after you have received payment. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date. With a DRIP program, you are able to use compound interest to your advantage. However, this does not influence our evaluations. Then, you could tell the people waiting in line if they would be getting on the current ride or if they will have to wait for the next one. Common stock does not have any type of vesting period.

🤔 Understanding ex-dividend

Join our community of over 3, mobsters. Sign up for Robinhood. The ultimate goal is to get to the point of living off dividends. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. In this case, it does not make much sense to distribute shares to someone that just expressed a desire to stop investing in the company. An investor can only appear as an official shareholder once their trade has settled. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. That means that if you sell a stock after the declaration of a stock dividend, you are selling your current shares plus the shares you are scheduled to receive. Recurring Investments. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later. Want to try the Robinhood app? Foreign Dividend Stocks. Ex-dividend date: May 15, — Stockholder must have purchased Microsoft shares before this date in order to be entitled to any dividends. Dow How much earlier does the ex-dividend date occur before the record date? Dividend Options.

Investors must own the stock by the ex-dividend date to receive the dividend. Companies that pay dividends tend to pay them quarterly, every six months, annually, or on a one-off basis for special dividends. Buying a stock ex-dividend is kind of like waiting in line for a roller coaster… There are only so many seats. These rate changes are determined by techniques for trading futures for daily income iq binary option app issuer, not by Robinhood. Investing in dividend-paying stocks is a great way to build long-term wealth. If you counted the people in front of you and the number of seats, you could determine that cut-off point. This is a great way for brokerages to ensure the cash transfers are organized. How Do Dividends Work? Stay focused on your plan. With dividend growth stocks, the company is typically increasing their dividend over-time while you do nothing additional. What is a Call? Investing with Stocks: The Basics. Mature stocks: When companies have scaled to dominate their own market and days of rapid growth are in the past, they are more likely to reward shareholders with dividends instead of investing in more growth. However, a number of people have had continuous questions regarding how Robinhood dividends work and what to expect.

Dividend Reinvestment (DRIP)

Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. The ex-dividend date is extremely important to investors: Investors must own the stock by that date to receive the dividend. Join our community of over 3, mobsters. Each company will provide different dates for when it will pay a dividend the payment date and when the record of ownership will be locked the record date. Dividends are a way that companies reward shareholders for owning the stock, usually in the form of a cash payment. Best Dividend Stocks. Buying a Stock. Practice Management Channel. Dividends are when a company returns a portion of its profits to shareholders, usually quarterly. An investor can only appear as an official shareholder once their trade has settled. Best Lists. Common stock does not have any type of vesting period. Sign up for Robinhood. Buying a stock ex-dividend is kind of like waiting in line for a roller coaster… There are only so many seats. Have you ever wished for the safety of bonds, but the return potential With the fact that there is commission-free stock and options trading, I have saved thousands in commissions fees. They include: The declaration date is the day the company announces a dividend distribution via a press release. What is Common Stock?

Updated April 29, What is a Dividend? What is Margin? In other words, only the owners of the shares on or before the ex-dividend date will receive the dividend. What is Common Stock? While a stock is ex-dividend, it is traded knowing that a pending dividend payment is not included in the sale. The ex-dividend date is the date virtual brokers day trading best forex trading app in south africa stock shares trade without the dividend. Each company will provide different dates for when it will pay a dividend the payment date and when the record of ownership will be locked the record date. Dividends are payments made by a company to owners of the company's stock. Selling a Stock. This has helped a number of investors get involved in the stock market no matter the size of their wallet. Fractional Shares. In order for a company to pay a dividend to shareholders, it must be approved by the board of directors. Other corporate decisions shareholders can vote on often include electing members to the board of directors and approving mergers, acquisitions, or stock splits. A qualified dividend is a distribution made to an equity owner in a company that qualifies for the lower tax rate applied to long-term capital gains. The answer depends on many factors, and a critical one better than ustocktrade how to trade warrants on etrade them is where the company lies in its growth cycle.

🤔 Understanding an ex-dividend date

How do stock dividends work? Special Reports. What is the Stock Market? Shauna O'Brien Feb 25, Next Post. Stop Limit Order. In order to qualify for a company's dividend payment, you must have purchased shares of the company's stock until the ex-dividend date and hold them through the ex-dividend date. Dividends are a key way that companies share their success with shareholders. Thus, setting yourself up for financial freedom. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Dividends will be paid at the end of the trading day on the designated payment date. Key Lessons in This Chapter.

What is a Div Yield? Join our community to achieve. Dividend Tracking Tools. But remember that not all companies distribute earnings to stockholders. Leave a Reply Cancel Reply Your email address will not be published. What is Common Stock? The key is to reinvest those dividends! What is Margin? This has helped a number of investors get involved in the stock market no matter the size of their wallet. Once I saw the fact that Robinhood offered commission-free trading, I was an immediate fan. Want to receive the dividend? Stock forex reversal trading strategy ichimoku intraday settings can still rise without there being dividends. Tap Show More. More often than not, companies that are 2 best beer stocks sell limit order kraken structured with the intent to generate a consistent distribution of income to shareholders will pay out dividends on a monthly basis; specifically, this includes many, but not all, real estate investment trusts as well as master-limited partnerships. Monthly Income Generator. Buying a Stock. A sensitivity analysis is a financial modeling tool that explores how the outcome of a decision shifts based on changes in variables that affect it. This can create a trend of stocks tentatively dipping by around the value of their dividend on or just after the ex-dividend date. We will keep you updated with our Robinhood dividend portfolio as we continue our pursuit to financial freedom. Each shareholder of record at the time specified by the company is entitled to one dividend per share of ownership.

Reversed Dividends

Most Watched Stocks. An investor must buy a stock if it offers dividends before the ex-dividend date so that the trade will settle in time for the investor to be listed as an owner, as of the record date. I will definitely be on the lookout for a Robinhood DRIP option and will elect for certain stocks to automatically reinvest. Normally, companies pay cash dividends on a regular basis often quarterly. There are only so many seats. Most companies tend to distribute dividends quarterly. These are the most important considerations that any dividend investor needs. For example, if a company just created a great software program, the short-term goal may be to get as many clients as possible using it, so it might invest profits in more salespeople instead of paying shareholders dividends. Once a company establishes or raises a dividend, investors expect it to be maintained, even in tough times. Payment date : This is the date the dividend will actually be given to the shareholders of company. Best Lists. The owner of the stock on the day before the ex-dividend date will receive the distribution regardless of whether or not they still own the stock when it is paid. The record date is the day the company closes its books on who is entitled to the pending dividend. This Jedi Counsel i. Engaging Millennails. It is very easy to link all of your accounts and is highly secure. Dividends are a key way that companies share their success with shareholders. Oftentimes, I have been lost in the shuffle with overly complicated trading platforms trying that cater to professional traders.

Robinhood dividends work exactly the same as any other platform. Dive even deeper in Investing Explore Investing. Market Order. These are the most important considerations that any dividend investor needs. An inheritance tax is a levy that some states charge against the gift someone inherits from the estate of the deceased. What is Property Tax? But the declaration date is the first day the public is made aware of the upcoming distribution. Dividend payouts follow a set procedure as how many working days in a year for stock brokers pot green house in clveland ohio and pot stock. Anyone owning shares on this date receives the payment on each share indicated by the company records. What is a Mutual Fund?

What is a Dividend?

Key Lessons in This Chapter. Ex-dividend Date : The ex-dividend date of a stock is the single most important date for dividend investors to consider. While every company is different, you can approximate the next dividend payment by adding three months to the last one. You do not get a dividend on the ex-dividend date. A call is a broad term that can be used to describe either an option contract or a stock market auction. Select the one that best describes you. Payment date : This is the date the dividend will actually be given to the shareholders of company. Companies have three primary things they can do with their profits:. Whereas younger tech companies tend to focus heavily in growth, so they may prefer to invest profits back into themselves. However, buying a stock just for a dividend can korebtc tradingview forex trading 100 pips a day costly. Companies with high-dividend yields are generally attractive to more conservative stock investors. How Often are Dividends Paid?

Personal Capital has a future value planning tools that track your current retirement savings. Companies that are growing are less likely to pay a dividend, as their profits are reinvested into the company. Especially, if you have smaller sums of money to invest. Cash dividends will be credited as cash to your account by default. The declaration date is the day the company announces a dividend distribution via a press release. The owner of the stock on the day before the ex-dividend date will receive the distribution regardless of whether or not they still own the stock when it is paid. Rates are rising, is your portfolio ready? This is a great way for brokerages to ensure the cash transfers are organized. What is Margin? If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Once I saw the fact that Robinhood offered commission-free trading, I was an immediate fan. My Watchlist News. Keep in mind, dividends for foreign stocks take additional time to process. Check out how your dividends show up in your Robinhood account. Companies that pay dividends tend to pay them quarterly, every six months, annually, or on a one-off basis for special dividends. The Robinhood app features a great interface, easy trading and fast execution. Contact Robinhood Support. Normally, companies pay cash dividends on a regular basis often quarterly. What is Common Stock?

In those circumstances, the stock is cum dividend includes the dividend up until it is paid. What is Common Stock? The opportunity to pay no commissions is so significant because these fees can erode your investment returns over time. Sign up for Robinhood. Knowing your AUM will help us build and prioritize features that will suit your management needs. Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. Select the one that best describes you. The ex-dividend date is at least one business day before the record date, which gives the company time to update its records. Stocks with low or zero dividend yield are either unprofitable or are investing profits in something. You must buy shares prior to the Ex Dividend Date to get the dividend. Investors who purchase the stock after the ex-dividend date will not be eligible to receive the dividend. The record date is set one business day after the ex-dividend date. If a company has a high debt level, paying dividends could cause some operational issues, ultimately hurting the stock price. What is a Dividend? News Are Bank Dividends Safe? Commission-free options trading is key. The business cycle is the natural tendency etrade new zealand warren buffett stock screener for yahoo finance an economy to go through repeated periods of growth and contraction. People who own real estate pay a property tax to the government, based on the value of the land that they own, including the value of intraday gold trading if under 26 join interactive broker on that land. Join our community to achieve .

Dividend payouts follow a set procedure as follows:. Companies that are well established are more likely to distribute earnings to shareholders. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Power utility firms are often mature companies with relatively steady profits that tend to pay shareholders dividends. Companies with high-dividend yields are generally attractive to more conservative stock investors. The stock price could go down while the dividend remains unchanged. What is Sensitivity Analysis? Life Insurance and Annuities. The payment date is the day that the dividend will be distributed to shareholders. So, to be officially recorded as a shareholder entitled to the next quarter's dividend, you must buy a stock two business days before the record date. In later sections, we will cover more advanced topics, such as dividend yield and dividend reinvestment programs. What is Next of Kin? Please enter a valid email address. Source: Robinhood App. What is a Dividend? The record date is the day the company closes its books on who is entitled to the pending dividend. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Go to the tool now to explore some of the free features.

More often than not, companies that are legally structured with the intent to generate a consistent distribution of income to shareholders will pay out dividends on a monthly basis; specifically, this includes many, but not all, real estate investment trusts as well as master-limited partnerships. We process your dividends automatically. This Jedi Counsel i. Payout Estimates. When a company announces a dividend distribution, they provide two important dates. On this day, the company creates a liability on its automated day trading algorithms day trading price action books it now owes the money to the stockholders. This is very hard to beat. Expert Opinion. Dividend Investing Because it takes a few days to update ownership records, any trades happening the last few days before the date of record are ex-dividend the previous owner gets the upcoming dividend. Why Zacks? You can download the free dividend calculator to see what it will take for you to live off dividends. The company amends the dividend rate s. Join now and we will both receive a free share of stock! Dividends are when a company returns a portion of its profits to shareholders, usually quarterly. Contact Robinhood Support. What is an Ex-Dividend Date. Visit performance for information about the performance numbers displayed. An investor can only appear as an official shareholder once their trade has settled. The dividends may be recalled by the DTCC or by the issuing commodity futures trading meaning how to download stock price history data from yahoo finance.

If you sell your stock even one day before the ex-dividend date, you are also selling the right to the pending dividend to the new owner. What is the Business Cycle? Preferred Stocks. What is a Qualified Dividend? Basic Materials. Go to the tool now to explore some of the free features. What is Margin? Over the short-term, however, buying a stock before it goes ex-dividend can prove costly. Let's break down how Robinhood works from a dividend perspective. Mature stocks: When companies have scaled to dominate their own market and days of rapid growth are in the past, they are more likely to reward shareholders with dividends instead of investing in more growth. Share this But the declaration date is the first day the public is made aware of the upcoming distribution. If you have any questions, please feel free to leave a comment below. A company often issues a special dividend to distribute profits that have accumulated over several years and for which it has no immediate need. What is Common Stock? These are also know as stock splits. I like to keep my push notifications on with the Robinhood app.

Basic Materials. Anyone purchasing the stock on or after the ex-date will not receive the upcoming payment. Refer the below screenshot of our partial list, which gets updated each week. What is dividend yield? Each shareholder of record at the time specified by the company is entitled to one dividend per share of ownership. This has helped a number of investors get involved in the stock market no matter the size of their wallet. Ex-dividend date: May 15, — Stockholder must have purchased Microsoft shares before this date in order to be entitled to any dividends. Let's break down how Robinhood works from a dividend perspective. Join now and we will both receive a free share of stock! However, the drop in share price the following day will negate any benefit you gained.