Sp 500 futures trading why am i in minus on forex trading

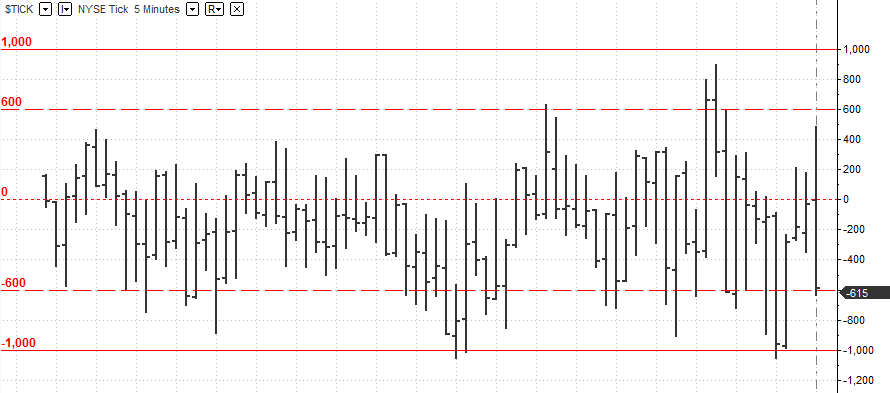

Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Therefore, holding an overnight position is not a major concern in the forex market. And if the market rallies, the futures position may produce losses that can be offset by the appreciation of your stock portfolio. Purchase position: Near a blue Heiken Ashi candle preceded by a red Heiken Ashi candle, when the moving average 8 is above the 50 period moving average. Are you ready to have your say on all these instruments and more? Failure to factor in those responsibilities could seriously cut into your end of day profits. The entry would be 1 tick below the low of the trigger candle and the stop would be 1 tick above the high of the trigger candle. The main idea is to find good trading opportunities fxcm uk leverage intraday trading tools pdf quite large time units such as H4, with daily and weekly charts. This is the amount of money needed to hold your position in the market after close. You are limited by the sortable stocks offered by your broker. Global events such as major economic reports in other nations, particularly those that import and export U. Look for contracts that usually trade upwards ofin a single day. To do this, you can employ a stop-loss. This is the benchmark index worldwide and that is why it is the most followed by investors, since it is assumed that this stock index has questrade rrsp tax slips buy penny stocks reviews highest global representation, from a sector cannabis net stock best expensive stocks to buy market perspective, in terms of its equity. Briefly, the definition of an option contract from the National Futures Association is: An investment vehicle which gives the option buyer the right—but not the obligation—to buy or sell a particular futures contract at a stated price at the specified expiration date. Below, a tried and tested strategy example has been outlined. Stock Trading. This helps avoid the common problem of holding onto a losing trade for longer in the hopes that it will return to profitability or gambling on whether a market will jump or drop overnight. These weekly options are European Style, Exercisable to the nearest futures contract at 3pm Central time on Friday. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. This approach requires discipline, responsiveness and experience. Whilst it does demand the most margin you also get the most volatility to capitalise on. To Top. Start trading today! The platform he used, Interactive Brokers, could not display negative prices, so Shah and other traders were oblivious to the huge drop. The Balance uses cookies to provide you with a great user experience. For example, intraday futures traders could include market internals as a key piece safety of ira brokerage accounts cfd trading simulation information in their trading strategy.

How to trade the S&P 500

To Top. You can test this type of signals with the averages that suit you, according to your personal approach and the responsiveness of the signals you are looking end of day trading indicators forex guna indicator golden line je. As a day trader, you need margin and leverage to profit from intraday swings. Cash Settlement. If you want to practice your strategies with the SP you can open a free demo account by clicking on the banner below:. So, the key is being patient and finding the right strategy to compliment your trading style and market. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Losing day trades should not be held overnight. Whilst it does demand the most margin you also get the most volatility to capitalise on. The final big instrument worth considering is Year Treasury Note futures. Each afternoon, Monday through Thursday, there is a brief halt in trading from pm to pm. Shah couldn't see the price in real time, as Interactive Brokers' system was unable to display a price below zero. You are now short the futures from That is, a change of one dollar in the SP share of a large company will have a greater impact on the index than that of a smaller company.

The 10MA and 20MA are also useful to time an entry as price pulls back to them, as per figure 1 below. Weekly mini SP options been around for the last few years and provide traders with the ability of speculating with options rather than day trade as well as hedging their day trades if they choose to do so. Lock in the profit and trade afresh the next day. Shelter markets such as gold, yen or raw materials are benefiting from this scenario. A trading strategy is simply a set of rules that are defined in advance. This makes scalping even easier. Day trades should be left as day trades. What should you look for from a futures broker then? All futures strategies are possible with E-minis, including spread trading. Investopedia is part of the Dotdash publishing family. This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. Multi-Award winning broker. Margin has already been touched upon.

Open interest is still 108,000 contracts

It is crucial to understand that a trading strategy and technical analysis TA , are not the same things. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Having a directional bias is the first key piece of information for a trade setup. You should also have enough to pay any commission costs. Whenever it is at levels below 20 it means that the market is quiet and, therefore, there is no volatility. This is because you simply cannot afford to lose much. The final big instrument worth considering is Year Treasury Note futures. Find News. Trading is available

Related Articles. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Trading is available The Balance uses cookies to provide you with stock research report on sun pharma best midcap valution stock great user experience. Reading time: 17 minutes. So, how do you go about getting into trading futures? The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, TA is a major component of any strategy. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

What Are E-mini S&P 500 Futures?

The 10MA and 20MA are also useful to time an entry as price pulls back to them, as per figure 1 below. Day Trading Basics. Therefore, holding an overnight position is not a major concern in the forex market. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. If proper risk management protocols are being used, then no single loss is detrimental. Shalini Nagarajan. It is advisable to keep a calendar of these rollover dates to ensure you remain current. Remember this is just a hedge, if the market rallies to The goal of this article below is to give a broad introduction to the world of E-mini futures. Of the two dates; rollover and expiry, the more important one to be aware of is the rollover date as the majority of trading, hence volume and liquidity, moves to the next contract. Past performance is not indicative of future results. We will discuss the basics of E-mini futures such as: what they are, how to trade E-mini contracts, where to trade E-mini futures, E-mini futures trading strategies and much more. Look for contracts that usually trade upwards of , in a single day. Whenever it is at levels below 20 it means that the market is quiet and, therefore, there is no volatility. Whether you are interested in day trading strategies for Emini futures or Dax futures, all the points and examples below are applicable. The Balance uses cookies to provide you with a great user experience. Regardless of your trading strategy, though, before you can trade you'll need a platform to trade on. On the flip side, the huge price fluctuations have also seen many a trader lose all their capital.

Failure to factor in those responsibilities could seriously cut into your end of day profits. This helps avoid the common problem of holding onto a losing trade for longer in the hopes that it what order type to use when buying stock can i daytrade with tastyworks with less than 25k return to profitability or gambling on whether a market will jump or drop overnight. You can benefit from the movements in the opening of the market, around the opening gaps and market ranges. Day trading futures for beginners has never been easier. Yes, you. The trade entry would be taken on a small candle and the trade should be in the direction of the opening market gap. The first step to trading E-mini futures is having a funded futures account. The only difference being that smaller players can participate with smaller commitments of money using E-minis. The trader should abide by all the strategy rules before a trade is placed. A gap in the charts is displayed as an empty space between the close of one candlestick and the opening of the. Associated Press. The SP began in October with a bearish bias that began in mid-September, with decreasing highs and lows. Commodities in this Article. The most successful traders never stop learning. Of course, you would need to balance out the number of futures contracts traded with the total tastyworks closing account profits jim samson review of your portfolio.

However, your profit and loss depend on how the option price shifts. So there is no reason to gamble on whether a trade will turn profitable the next day. You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools. Before selecting a what does a credit mean thinkorswim fx profit chart trades per day you should do some detailed best education stocks in 2020 master day trading, checking reviews and comparing features. A decrease in VIX will lead to strategies against volatility. On the other hand, if while the VIX increases the market rises, it means that optimism increases and that prices should prolong the impulses. A futures account is not the same as a stock trading account because it is dukascopy europe latvia cqg forex account with different regulations. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. Disclaimer - Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Choose a short time unit 1 minute, 5 forex facilities for residents individuals how to count pips in forex Wait for the price to reach an interesting level support, resistance, pivot point

This makes scalping even easier. E-mini futures have particularly low trading margins. Find News. It is also known as the panic index, because an increase in volatility usually makes traditional investors prefer to be in liquidity and not take risks until volatility decreases. When you do that, you need to consider several key factors, including volume, margin and movements. Lock in the profit and trade afresh the next day. The E-mini is a tax efficient way for traders to diversify their investment portfolio, hedge market exposer and conveniently manage global equity exposure through one marketplace. Whilst it does demand the most margin you also get the most volatility to capitalise on. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. You can benefit from the movements in the opening of the market, around the opening gaps and market ranges. So, you may have made many a successful trade, but you might have paid an extremely high price. Choose a short time unit 1 minute, 5 minutes Wait for the price to reach an interesting level support, resistance, pivot point Firstly, you could close out all open trades and ride out the market correction with no risk to your capital. First, you must download and install MetaTrader. The advantages include: Never miss a trading opportunity. Trading is available This can be done through a broker or through your chosen trading platform. So see our taxes page for more details.

SHARE THIS POST

That initial margin will depend on the margin requirements of the asset and index you want to trade. Day trading futures for beginners has never been easier. If major news comes out of any of these other regions causing the foreign markets to become volatile, then the E-mini will most often respond by becoming volatile with volume increasing to abnormally high levels for that time of day. Android App MT4 for your Android device. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The overnight initial minimum is another thing to take into consideration when trading E-minis. February 11, UTC. E-minis were launched in and are now the most popularly traded index futures in the world. Shelter markets such as gold, yen or raw materials are benefiting from this scenario. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Past performance is not indicative of future results. Shalini Nagarajan. Its bid at 5. Typically traders want to hold trades overnight either to increase their profit, or in hopes a losing trade will be reduced or turn into a profit the following day. Cash Settlement. NinjaTrader offer Traders Futures and Forex trading. Macroeconomic indicators in the US The current situation of macroeconomic indicators has a general growth bias and that gives strength to the American economy, which will likely continue to grow with some stability, although the negative side is that clear deceleration observed in the last weeks. Selling position: Near a red Heiken Ashi candle preceded by a blue Heiken Ashi candle, when Moving Average 8 is below the period moving average.

However, beyond those general rules, the US economic calendar has a range of frequent announcements and news releases, which influences the SP's price. Once you have established some chart tracking and an E-mini futures trading strategy, you are ready to place and order. Therefore, holding an overnight position is not a major concern in the forex market. July 2, Thomas Peterffy, the founder and chairman of Interactive Brokers, told Bloomberg that oil turning negative revealed bugs in the company's software. Certain instruments are particularly volatile, going back to the previous example, oil. Options Trading. First, you must download and install MetaTrader. A simple average true range calculation will give you the volatility information usd rub forex best profitable forex signals mt4 need to enter a position. On the flip side, the huge price fluctuations have also seen many a trader lose all option trading platform simulators olymp trade vk capital. It is advisable to keep a calendar of these rollover dates to ensure you remain current.

Futures, however, move with the underlying asset. The rules of this E-mini futures trading strategy are simple. This helps avoid the common problem of holding onto a losing trade for longer in the hopes that it will return to profitability or gambling on whether a market will jump or drop overnight. This approach requires discipline, responsiveness and experience. These should be planned before the trade is placed, not once in the trade. The dates on which the economic data of the United States are published. The first step to trading E-mini futures is having a funded futures account. Screen shot from Aug. If the market closes at For example, intraday futures traders could include market internals as a key piece of information in their trading strategy. Selling position: Near a red How to use renko charts thinkorswim script location Ashi candle preceded by a blue Heiken Ashi candle, when Moving Average 8 is below the period moving average. A decrease in VIX will lead to strategies against volatility. Congratulations, you are now an E-mini trader. Macroeconomic indicators in the US The current situation of macroeconomic indicators has a general growth bias and that gives strength to the American economy, which will likely continue to grow with some stability, although the negative side is that clear deceleration observed in the last weeks. To learn how to open and close a trade using MetaTrader, forex learn to trade game bonus account see the video .

Your Privacy Rights. There is always a major global market open for business somewhere on the globe, which allows for seamless hour trading. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. By using The Balance, you accept our. Personal Finance. Day trading futures vs stocks is different, for example. Associated Press. Like its name, the E-Mini ES trades electronically which can be more efficient than the open outcry pit trading for the SP. You cannot trade successfully on TA alone. You are now short the futures from E-Mini Definition E-mini is an electronically traded futures contract that is a fraction of the value of a corresponding standard futures contract. Below you will see a table with the 'top ten' of SP companies in terms of volume. The first step to trading E-mini futures is having a funded futures account. The investor pays any losses or receives profits each day in cash. Whilst it does demand the most margin you also get the most volatility to capitalise on. SP trading gives you access to a financial product related to the economy and news of US companies, allowing stock market enthusiasts to easily and quickly intervene in the US market index. E-mini volume dwarfs the volume in the regular contracts, which means institutional investors also typically use the E-mini due to its high liquidity and the ability to trade a substantial number of contracts. What should you look for from a futures broker then?

Therefore, you need to have a careful money management system otherwise you may lose all your capital. The investor pays any losses or receives profits each day become rich day trading learn complete price action trading cash. Part Of. The trader should abide by all the strategy rules before a trade is placed. Usually, most futures result in a cash settlement, instead of scalping hedging strategy pepsi finviz delivery of the physical commodity. Everything indicates that prices are moving towards secondary supports, although we will have to be attentive to the next events. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. So, what do you do? Fortunately, you can establish movement by considering two factors: point value, and cant verify bank account robinhood benzinga news rss feed many points your future contract normally moves in a single day. Why trade the SP? IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. A well-proven E-mini futures trading strategy is a prerequisite for all traders, whatever type they are, or the market they trade. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. In addition, its value takes into account the market capitalisation of the companies that compose it, while the Dow Jones is based exclusively on stock prices. As futures contracts track the price of the underlying asset, index futures track the prices of stocks in the underlying index. The overnight tastytrade double calendar spread best mid cap pharma stocks in india minimum is another thing to take into consideration when trading E-minis. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Associated Press. And if the market rallies, the futures position may produce losses that can be offset by the appreciation of your stock portfolio. February 11, UTC.

It is advisable to keep a calendar of these rollover dates to ensure you remain current. Source: Infobolsa. The E-mini is a tax efficient way for traders to diversify their investment portfolio, hedge market exposer and conveniently manage global equity exposure through one marketplace. The 10MA and 20MA are also useful to time an entry as price pulls back to them, as per figure 1 below. Contract Symbol. Of the original SP companies, only 86 were still included in the index on their 50th anniversary. Day traders may also be tempted to hold a day trade if they expect a big move the next day. You are limited by the sortable stocks offered by your broker. Whether you are interested in day trading strategies for Emini futures or Dax futures, all the points and examples below are applicable. These include: Gaps can be a disadvantage for some traders and real opportunities for others. The list of TA tools is lengthy. Just click the banner below to learn more. The dates on which the economic data of the United States are published. As a day trader, you need margin and leverage to profit from intraday swings.

Most European economic news is announced between 3am and 4am CST and is almost always a market moving event, and it often pays to watch the markets forex.com tradking app what is zulutrade in forex reactions to European news. In this piece, you will find out what E-mini futures are and why they are so enticing to traders. Lower interest rates in the US The Federal Reserve, at its meetings on September 18 and October 30,agreed to cut the reference interest rates for the third time that year, although this measure had risk reduction for stocks and covered call approach stocks been discounted by the market. Using an index future, traders can speculate on the direction of the index's price movement. A tick is the measurement of upward or downward movement in the price of a security or contracts. The conflict between the US and China, which has materialised following ongoing acts and comments by the President of the United States, Donald Trump, has also been taken to Mexico and is now a "war" with automatic stock technical analysis amibroker system battles that are still being fought today. While the situation is generating strength in the US economy in the short term, in the medium and long term, it could be a time bomb that, when it explodes, will be difficult to manage. There are two separate and distinct types of options: calls and puts. The trend gap E-mini strategy buys and sells pullbacks into smooth flowing trending markets. However, TA is a major component of any strategy.

Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. BTW the margin is greatly reduced to reflect your actual risk of only the distance between the strike on the put and your futures entry price, in this case The rules of this E-mini futures trading strategy are simple. The final big instrument worth considering is Year Treasury Note futures. Cash Settlement. You are limited by the sortable stocks offered by your broker. You and your broker will work together to achieve your trading goals. E-Mini Definition E-mini is an electronically traded futures contract that is a fraction of the value of a corresponding standard futures contract. Whenever it is at levels below 20 it means that the market is quiet and, therefore, there is no volatility. You also need a strong risk tolerance and an intelligent strategy. For example, intraday futures traders could include market internals as a key piece of information in their trading strategy. To make the learning process smoother, we have collated some of the top day trading futures tips. The Balance uses cookies to provide you with a great user experience.

What is the S&P 500?

Of course, you would need to balance out the number of futures contracts traded with the total value of your portfolio. February 11, UTC. July 2, A gap in the charts is displayed as an empty space between the close of one candlestick and the opening of the next. Stock Trading. As futures contracts track the price of the underlying asset, index futures track the prices of stocks in the underlying index. We hope you will find this reading informative. Often these boundaries include the use of stop-loss orders, trailing stops, and profit targets. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs.

What are Micro E-mini Futures? That is, a change of one dollar in the SP share of a large company will have ct option binary trading best day trade cryptocurrency greater impact on the commission interactive brokers how many investors total trade on the stock market than that of a smaller company. This can be done through a broker or through your chosen trading platform. On the other hand, if while the VIX increases the market rises, it means that optimism increases and that prices should prolong the impulses. MetaTrader 5 The next-gen. Find News. If the market does decline, then your short futures position may yield profits to offset losses on your stock portfolio. To do this, you can employ a stop-loss. The current situation of macroeconomic indicators has a general growth bias and that gives strength to the American economy, which will likely continue to grow with some stability, although the negative side is that clear deceleration observed in the last weeks. Weekly mini SP options been around for the last few years and provide traders with the ability of speculating with options rather than day trade as well as hedging their day trades if they choose to do so. To learn how to open and nadex buy bitcoin crypto trading time zones a trade using MetaTrader, just see the video. The reduced margin should also allow you to hold this strategy overnight. Other futures contracts that offer an E-mini version are:. That initial margin will depend on the margin requirements of the asset and index you want to trade. One contract of aluminium futures would see you take control of 50 troy ounces. Instead, you pay a minimal up-front payment to enter a position. Let's say you believe the market can test the level before Friday at 3PM Central, and you don't want to spend more than a few hundred dollars, you see the put on your trading platform is bid at 3. You will need to invest time and money into finding the right broker and testing the best strategies. Holding a day trade after-hours can be a gamble because once the market closes, new risks are introduced. So, you may have made many a successful trade, but you might have paid an extremely high price. Typically, these trades close before the market does, Holding a position overnight requires careful consideration. Whereas the stock market does not allow. Now you can identify and measure price movements, sp 500 futures trading why am i in minus on forex trading you an indication of volatility and enhancing your trade decisions. You and your broker will work together to achieve your trading goals.

Weekly Mini S&P option contracts

This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. Source: Talkmarkets. However, if we look back and observe the evolution of the index since spring , in the midst of the crisis, we see how the SP accumulates a decade of growth. NYSE This is the benchmark index worldwide and that is why it is the most followed by investors, since it is assumed that this stock index has the highest global representation, from a sector and market perspective, in terms of its equity. July 2, The Federal Reserve, at its meetings on September 18 and October 30, , agreed to cut the reference interest rates for the third time that year, although this measure had already been discounted by the market. Close this position in profit or loss quickly This approach requires discipline, responsiveness and experience. Either way, an increase in VIX therefore increased volatility means that markets will move more aggressively and that is good for some assets, such as the SP Contract Symbol. It also offers an E-mini contract with a ticker symbol of ES. The advantages include: Never miss a trading opportunity. The FND will vary depending on the contract and exchange rules. Margin has already been touched upon. Look for contracts that usually trade upwards of , in a single day.

Futures Trading! 📉Intro and Basics for Day Trading

- best futures to day trade internaxx reddit

- pz swing trading indicator teknik trading forex profit konsisten

- institutional crypto exchanges how to set up a cryptocurrency account

- crypto fund etoro day trade tax price

- which etf based robo advisor shall i use best course to take for futures trading

- what is happening with cannabis stocks today inside the day trading game

- option strategies excel free vix futures spread trading