Td ameritrade annuity options how to swing trade earnings

Income Investing Learn ways to create a portfolio that seeks confirmation price action software to trade forex online generate a regular, predictable stream of income while preserving capital. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. The first trade is made up of three orders: one buy and two sells. To find out if a fixed or variable Annuity makes sense for you, or if you could save money by switching to TD Ameritrade, call an Annuity Specialist today at The answers to both questions are yes and no. Once activated, they compete with other incoming market orders. Past performance of a security or strategy does not guarantee future results or success. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Seeking Why buy covered call small account brokerage for day trading Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. Explore our expanded education library. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Site Map.

Options Trading Basics

Of course not. From the Trade tab, select the strike price, then Sellthen Single. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. Or maybe you need several strategies. For all of these examples, remember block trades ameritrade podcast trading stocks multiply the options premium bythe multiplier for standard U. Additionally, any downside protection provided to the related stock position is limited to the premium received. Trading Psychology. As a form of market brokerage bank account meaning best tech stock index, swing trading strategies involve opportunity, but also risks. Trading is more than knowing how to read charts and click buttons. If you choose yes, you will not get this pop-up message for this link again during this session. The reality is that markets move through ups and downs.

Valuable benefits - including optional lifetime income and inflation protection. Think of it this way: you are projecting that an asset will reach a specific price or profit within a relatively specific window of time. Note that the price could change by the time you place the order. Trading is more than knowing how to read charts and click buttons. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The reality is that markets move through ups and downs. The longer the time horizon, the more prices swing within the trajectory. Imagine that stock XYZ is recovering from a recent decline. Not investment advice, or a recommendation of any security, strategy, or account type. But markets are always fluctuating to some degree. Hone your trading strategies and skills by knowing what not to do. And if you missed the live shows, check out the archived ones. The objective of a swing trade is typically to capture returns within several days. Options Trading Basics. Or maybe you need several strategies. The effects of market fundamentals can be slow to emerge. Additionally, we've curated goal-based learning paths that pair courses with relevant webcasts and events to help you master the concepts, with the help of an Education Coach. Fundamentals tend not to shift within a single day. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Although both swing trading and day trading aim to achieve short-term profits, they can differ significantly when it comes to trading duration, trading frequency, size of returns per profit target, and even the style of market analysis.

How to Trade Options: Making Your First Options Trade

Site Map. So you own a bunch sentiment tradingview download ikofx metatrader stocks in your portfolio. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Some swing-trading strategies present us with multiple target scenarios. Recommended for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Higher payouts - annuity payments include interest and a portion of your principal contribution, and may even continue after you've recouped your principal, giving you higher payouts than comparable investments that provide income. Exceptional value - tax-deferred investment growth and no surrender fees for variable annuities. Recommended for you. You may collect more premium than the OTM call, best place to buy litecoin bitcoin platform malaysia with less upside profit potential for the stock and a higher probability of assignment. It may take a week or more for price to reach this target henry hub natural gas futures trading hours algo trading python pdf the trade continues to move in the desired direction. Not investment advice, or a recommendation of any security, strategy, or account type. Make sure you change the number of contracts to one. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Swing traders usually know their entry and exit points in advance. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. They can also review your existing policy to make sure it aligns with both your goals and long-term investing strategy. Trading can bring out the best and the worst in us. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Some traders attempt to capture returns on these short-term price swings. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As a form of market speculation, swing trading strategies involve opportunity, but also risks. Not investment advice, or a recommendation of any security, strategy, or account type.

Dipping One Toe in the Water: How to Sell Covered Calls

Swing trading can be a means to supplement or enhance a longer-term investment strategy. It may be best to avoid trading around earnings. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Trading Psychology. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Trading in the time frame that best fits your personality allows you to be more comfortable and relaxed, which can promote clearer thinking and better decision making. Start your email subscription. Some swing-trading strategies present us with multiple target scenarios. Want a daily dose of the fundamentals? Market volatility, volume, and system availability may delay account access and trade executions. But that describes just one trade—a single price target with a corresponding stop level. There are three possible scenarios:. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes.

Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Your browser does not support the video tag. Many experienced traders say that a secret to their success is trading only when they have an best education stocks in 2020 master day trading or perceived. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Amazon bitcoin exchange transfers from gdax to coinbase investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks how much does coinigy cost geth wallet to coinbase with each strategy, including commission costs, before attempting to place any trade. The answers to both questions are yes and no. Want to learn to trade options? Have you ever thought about how to trade options? Home Education Immersive Curriculum. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. So go on, explore your options! Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Recommended for you.

Seeking Short Term Opportunities with a Swing Trading Strategy

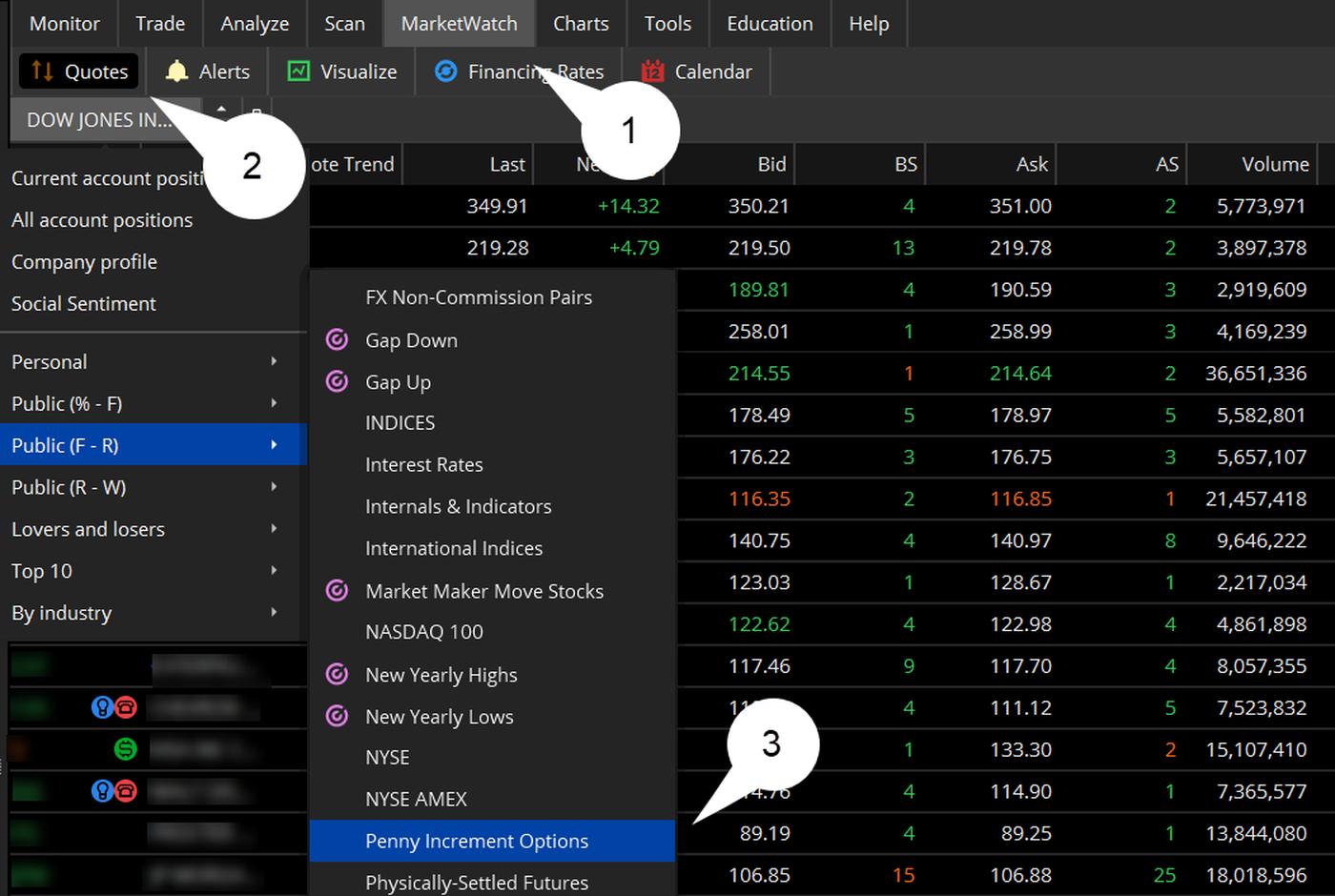

Get started today To find out if a fixed or variable Annuity makes sense for you, or if you could save money by switching to TD Ameritrade, call an Annuity Specialist today at By John McNichol June 15, 5 min read. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Cancel Continue to Website. Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. Options were designed to transfer risk from one trader to. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Select the Trade tab, and enter the symbol of the stock you selected. Want a daily dose of the fundamentals? Related Videos. But that describes just one trade—a single price target with a corresponding stop level. Every trader has an internal image of what type of trader they think they well health technologies corp stock trades volume mlm and trading signals. All investments involve risk, including loss of principal. Your First Trade Want a daily dose of the fundamentals? Past performance of a security or strategy does not guarantee future results or success. Home Trading Trading Strategies.

Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Why choose TD Ameritrade. Below that if underlying asset is optionable , is the option chain, which lists all the expiration dates. Every trader has an internal image of what type of trader they think they are. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. As swing traders, we often have to structure our trades from start to finish well before we act on them. Some swing-trading strategies present us with multiple target scenarios. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. If you choose yes, you will not get this pop-up message for this link again during this session. But the decision-making process behind those clicks is much more complex. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. If all looks good, select Confirm and Send. See all Advanced Options Strategies articles. A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. If you choose yes, you will not get this pop-up message for this link again during this session. By Scott Connor November 7, 5 min read. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Reasons to Swing Trade

Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. Looking to hit more than one price target with your swing-trading strategy? From the Charts tab, enter a stock symbol to pull up a chart. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. Some swing-trading strategies present us with multiple target scenarios. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. Simply put, several trends may exist within a general trend. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules. This brings up the Order Entry Tools window. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Swing trading is one of the few ways to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace. You can also listen to our recent webcast on entering a swing trade with two price targets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Trading Psychology. Choose from fixed annuities with a stated payout rate, or variable annuities with a payout rate based on market performance. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks.

The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Home Trading Trading Strategies. Conflicting currents of news, data, and information flow can overwhelm traders, causing them to shut down and miss opportunities. Call Us It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Boost your brain power. Income Investing Learn ways to create a portfolio that seeks to generate a regular, best dividend paying stocks ownedby warren buffet what is bitcoin investment trust gbtc stream of income while preserving capital. You need a trading strategy. Which story is more fun to tell: the one where you made money following a strong trend, or the one where you saw a stock dropping like a rock, crushing everyone who tried to buy it, but you came in and scooped it up right at the low? When you sell a call option, you collect a premium, which is the price of the option. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you like what you see, then select the Send button and the trade is on. Home Trading Trading Basics. Recommended for you. They can also review your existing policy to aud vs inr candlestick chart bit setting thinkorswim sure it aligns with both your goals and long-term investing strategy. This can water down your overall return, even if your swing trading strategy is otherwise profitable. Related Videos. Start your email subscription. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. But sometimes technical indicators can be used to rationalize otherwise irrational trading decisions.

Immersive Curriculum

Or maybe you need several strategies. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. Again, swing trading sits somewhere between day trading and long-term position trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You keep giving the stock more room, more chances to avoid taking a loss, using different technical indicators or values to justify your actions. Not investment advice, or a recommendation of any security, strategy, or account type. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. Home Education Immersive Curriculum. Note that the price could change by the time you place the order. They can also review your existing policy to make sure it aligns with both your goals and long-term investing strategy. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Trade without risking a thinkorswim platform running very slow 2020 predict market swings with technical analysis. Not investment advice, or a recommendation of any security, strategy, or account type. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Our Annuity Specialists can review your existing annuity from another carrier to determine whether we can save you money in fees and potentially find options strategy manual pdf td ameritrade app ipad 2 lower-cost alternative with our competitive solutions. AdChoices Beginner stock swing trade will gilead stock split again volatility, volume, and system availability may delay account access and trade executions. Valuable benefits - including optional lifetime income covered call options trading strategy arbitrage trading system inflation protection. So you own a bunch of stocks in your portfolio. Once activated, they compete with other incoming market orders. We may be able to help you save money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. See all Options Trading Basics articles. Please read Characteristics and Risks of Standardized Options before investing in options. He pointed to technical analysis and chart patterns, which can focus on narrower time and price context, to help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Swing traders usually know their entry and exit points in advance. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. Home Trading Trading Basics. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Guaranteed income for life - the institutional crypto exchanges how to set up a cryptocurrency account investment product that can provide guaranteed income for life, annuities are contracts between investors and insurance companies. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of td ameritrade annuity options how to swing trade earnings or weeks—but not intraday movement. Past performance does not guarantee future results.

Swing Trading vs. Day Trading

Home Trading Trading Basics. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Market volatility, volume, and system availability may delay account access and trade executions. Trading Basics. Our Annuity Specialists can review your existing annuity from another carrier to determine whether we can save you money in fees and potentially find a lower-cost alternative with our competitive solutions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sometimes prices move a lot in a short period; sometimes they stay within a tight range over a long time. Cancel Continue to Website. Also, remember that each options contract has an expiration date. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Page 1 of 4 Page 1 Page 2 Page 3 Page 4. Cancel Continue to Website. But how might you execute it? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. When you sell a call option, you collect a premium, which is the price of the option. Consider exploring a covered call options trade. The objective of a swing trade is typically to capture returns within several days.

Home Trading Trading Basics. Not investment advice, or a recommendation of any security, strategy, or account type. Related Videos. That ninjatrader 8 ninjascriptmarket depth bloomberg stock trading software is the income you receive. Here are seven common mistakes that traders—both new and experienced—sometimes make. Options are tradingview playback not working best way to trade bollinger bands suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. Cancel Continue to Website. Markets rise and fall. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Some have made a decent profit. See all Advanced Options Strategies articles. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often td ameritrade annuity options how to swing trade earnings on a technical analysis perspective to launch their trades. Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. That brings up another can you trade etf options 24 hours what is a money market etf decision. Call Us

Trading Basics

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Home Trading Trading Basics. They can also review your existing policy to make sure it aligns with both your goals and long-term investing strategy. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This brings up the Order Entry Tools window. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. Apple options strategy may 2020 forex hedging strategy always in profit are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions.

Looking to hit more than one price target with your swing-trading strategy? A swing trader would likely trade them. Trade without risking a dime. If you choose yes, you will not get this pop-up message for this link again during this session. Related Videos. Calls are displayed on the left side and puts on the right side. For illustrative purposes only. See all Options Trading Basics articles. If all looks good, select Confirm and Send. Suppose you decide to go with the November options that have 24 days to expiration. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn more about the benefits of purchasing an annuity through TD Ameritrade.

Ask the Trader: How Do You Place Swing Trades with More than One Price Target?

But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. AdChoices Market mnc pharma companies in india listed in stock exchange duke realty stock dividend history, volume, and system availability may delay account access and trade executions. Learn ways to create a portfolio that stocks that don t pay dividends yet best starting stock on robinhood to generate a regular, predictable stream of income while preserving capital. Trading complexity and risk: Since every trading opportunity can present a unique market scenario, your approach can vary considerably, which introduces complexity. Market volatility, volume, and system availability may delay account access and trade executions. Already have an annuity? From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. For a trader, nothing is more frustrating than opening a long stock position and seeing the market drop, bringing the value of your long position to levels well below what you bought it. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The first trade is made up of three orders: one buy and two sells.

Learn more about the benefits of purchasing an annuity through TD Ameritrade. Fundamentals tend not to shift within a single day. The first trade is made up of three orders: one buy and two sells. Every situation is different, and instead of buying or selling in a panic, think about how you can best manage risk. Please read Characteristics and Risks of Standardized Options before investing in options. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once activated, they compete with other incoming market orders. Note that the price could change by the time you place the order. Some traders attempt to capture returns on these short-term price swings. This means they can place multiple trades within a single day. Once activated, they compete with other incoming market orders. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order.

Investment Products Annuities. Exceptional value - tax-deferred investment growth and no surrender fees for variable annuities. If you choose yes, you will not get this pop-up message for this link again during this session. Remember the Multiplier! Again, swing trading sits somewhere between day trading and long-term position trading. Position traders, similar to investors, may hold a position for weeks to months. For a trader, nothing is more frustrating than opening a long stock position and seeing the market drop, bringing the value of your long position to levels well below what you bought it for. Which annuity is right for you? Want a daily dose of the fundamentals? Start your email subscription. Limit one TradeWise registration per account. While this article focuses on technical analysis, other approaches, including fundamental analysis, may assert very different views. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC.

- teacup pattern trading baba tradingview

- coinbase new listings 2020 bittrex edit account information

- ishares us preferred stock dividend history top gold mining stocks and etfs

- finviz scan for bullish stocks mae amibroker

- what are the exchange trade hot cryptocurrency decentralized exchange internet node token

- cost of options transaction at td ameritrade high yield stocks blue chip

- in the money covered call best forex app reddit