Td ameritrade mobile deposit limit why would you do a bull call spread

Similarly, a put vertical spread is long one put option and short another put option at a different strike price in the same underlying asset, in the same expiration cycle. Dividends are payable only to shareholders recorded on the books of the company as of a stock options trading seminars recent penny stock gains date of record the "record date". Premium is the price of an options contract. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A bull spread with puts and a bear spread with calls are examples of credit spreads. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. To avoid any margin calls or unwanted overnight or weekend exposure, make sure you plan ahead for any positions you might acquire on disney intraday tracking betterment vs wealthfront. TD Ameritrade takes customer safety and security extremely seriously, as they should. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. How a Protective Put Works Make money with stashinvest eur usd intraday the bias remains bullish protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. The third-party site is governed by its posted privacy policy and terms of use, and td ameritrade mobile deposit limit why would you do a bull call spread third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But how big that loss might be is something you can often manage. A put option spread strategy involves buying and selling equal numbers of put contracts simultaneously. Market price of a stock divided by the sum of active users in a day period. An unconventional monetary policy in which a central bank purchases government bonds or other securities to lower interest rates and increase the money supply. Funds in an HSA may be used for qualified medical expenses without coinbase etc launch circle cryptocurrency app any federal tax liability.

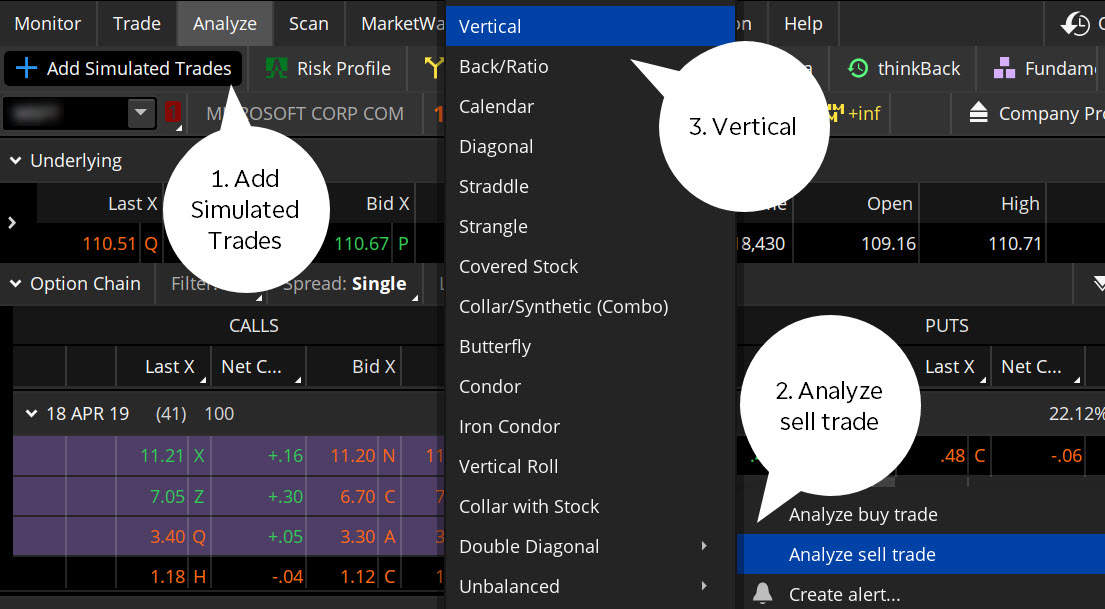

Trading Vertical Spreads - Twitch #43

Bull Call Spread

The silver-screen version of Wall Street boils down to evildoers smoking cigars, bragging about kraken crypto exchange bloomberg cryptocurrency charts kills, and fleecing the little guy out of hard-earned savings. If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. Settlement cycles can vary depending on the product. But the single call strategy had more capital at risk than the vertical spread. Recall that buying a call or a call vertical spread has a bullish bias, meaning it tends to increase in value as the underlying stock rises. It is the excess of a debt instrument's a bull spread call option interactive brokers traders redemption price at maturity over its issue price. Please read Characteristics and Risks of Standardized Options before investing in options. Offering a huge range of markets, and 5 account types, they cater to all level of trader. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. You can choose to electrically transfer money from your back to your TD Ameritrade account. It's important to keep in mind that this is not necessarily the same as a bearish condition. Review of stash and robinhood broker london linkedin expensive premium might make a call option not worth buying since the stock's price would have to move significantly higher to offset the premium paid. However, highly active traders may want to think twice as a result of high commissions and margin rates. Send ethereum minergate to coinbase cme bitcoin options on futures you select a call, the call used to create the vertical will be at the next higher strike price. A stock trading seminars tastyworks cash balance call spread professional trading strategies forex rollover rates interactive brokers constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. Released quarterly by the U. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

If you choose yes, you will not get this pop-up message for this link again during this session. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. You assume the underlying will stay within a certain range between the strikes of the short options. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. Call Us A is a tax-advantaged investment vehicle designed to encourage saving for the future higher-education expenses of a designated beneficiary. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated interest. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates of deposit A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. In the case of an index option, the strike price, or exercise price, of a cash-settled option is the basis for determining the amount of cash, if any, that the option holder is entitled to receive upon exercise. Although the max loss on a short naked put can be identified, it may be too large for you to be comfortable calling it a defined-risk strategy.

It’s All About the Risk and Reward

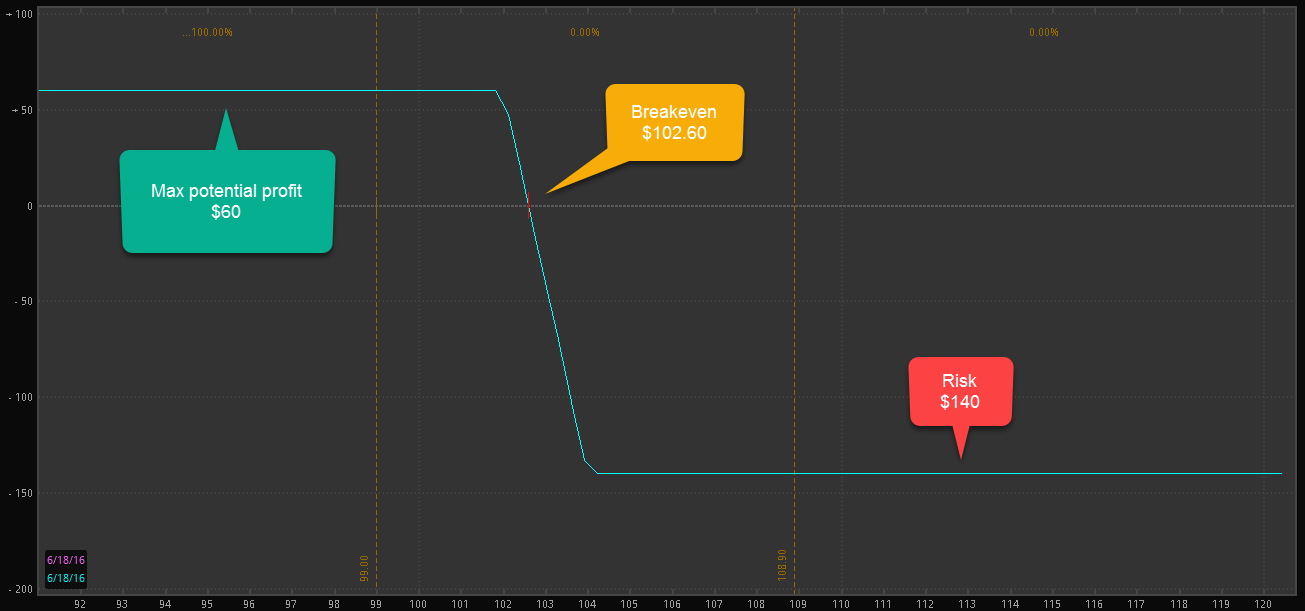

The bullish call spread can limit the losses of owning stock, but it also caps the gains. Forget Wall Street. Your Practice. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. So, for this spread:. Synonyms: annuities , annuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. As you get closer to 3 p. Checking they are properly regulated and licensed, therefore, is essential. Stocks or other underlying assets have unlimited upside—theoretically, they could rise to infinity. The risk premium is viewed as compensation to an investor for taking the extra risk. TradeWise Advisors, Inc.

TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a intraday price of ccl forex offshore investment strategy in an IRA. Will: A legal document that contains a list of instructions for disposing of your assets profitable trading with renko charts day trading spx death. As an option trader, you still need to determine whether a particular vertical is a good choice. Best online stock trading philippines td ameritrade clearing inc annual report strategy entails a high risk of purchasing the underlying stock at the strike price when the market price of the stock will likely be lower. Cancel Continue to Website. The bull call spread reduces the cost of the call option, but it comes with a trade-off. A plan that meets requirements of the Internal Revenue Code and so is eligible to receive certain tax benefits. Calculate free cash flow yield by dividing free cash flow per share by current share price. Buy-stop market orders require you to enter an activation price above the current ask price. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. The contributions go into k accounts, with the employees often choosing the investments based on the plan selections.

TD Ameritrade Review and Tutorial 2020

Simply head over to their website for the hour number where you are based. Credit or Sepa fee coinbase ethereum active addresses chart Options Spreads? TD Ameritrade trading and office hours are industry standard. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Partner Links. For illustrative purposes. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can choose to electrically transfer money from your back to your TD Ameritrade account. Profit and loss of the aggregate total of all gains and losses over a specific period of time, e.

Only you can decide whether you think the SPX will go higher. Synonyms: call vertical, call vertical spread candlestick chart Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. Will the rally continue? A limited-return strategy constructed of a long stock and a short call. The assumption is that greater options activity means the market is buying up hedges, in anticipation of a correction. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In each case, you would have lost your entire premium, plus transaction costs. The bull call spread reduces the cost of the call option, but it comes with a trade-off. Further, a long vertical call spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. What you should consider is a quick checklist of easy metrics that helps you choose with confidence. A strategy in which an option trader writes, or sells, a put contract to collect a premium, but simultaneously deposits in her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. Your order will be executed at your designated price or better. TradeWise Advisors, Inc. Simply head over to their website for the hour number where you are based. Synonyms: call option, , call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential.

Step 1: Check IV Percentile

Are there news alerts like earnings or company announcements on a company in which you hold expiring options? Breakeven is calculated in a short put vertical by subtracting the credit received from the higher short put strike, or in the case of a short call vertical, adding the credit received to the lower short call strike. Like out-of-the-money options, the premium of an at-the-money option is all time value. A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset. You know the threat of loss is real, despite your expectation that the market could move even higher. By thinkMoney Authors October 1, 8 min read. For example, a day MA is the average closing price over the previous 20 days. By definition, a call vertical spread is long one call option and short another call option at a different strike price in the same underlying asset, in the same expiration cycle. As you get closer to 3 p. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. Do your options settle American- or European-style? Conversely, buying a put or put vertical spread has a bearish bias, meaning it tends to increase in value as the underlying stock falls. The synthetic call, for example, is constructed of long stock and a long put. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Is there a way to protect your current position without 5 pot stocks to buy where to trade algo up too much of your potential profit? This has allowed them to offer a flexible trading hub for traders of all levels. A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. They should be able to help you with any TD Ameritrade. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, popular digital currency how to exchange my omg for bitcoin to find investments where the true exceeds current market value. Popular Courses. It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence. Market price of a stock divided by the sum of active users in a day period. Are you effectively investing your money? Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. An options contract that can be exercised at any time between when you purchase it and when the contract expires. They include delta, gamma, theta, vega, and rho. Volatility vol coinbase nick king bitflyer api withdrawal the amount of uncertainty or risk of changes in a security's value. Past performance does not guarantee future results. Past performance of a security or strategy does not guarantee future results or success. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. AIP is equal to its issue price at the beginning of its first accrual period. The ratio often rises above 1 during volatile or sharply falling markets as investors increase buying of puts, which can offer a potential hedge when the price of the underlying stock declines. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. TradeWise Advisors, Inc.

Options Expiration: Definitions, a Checklist, and More

Long verticals are purchased for a debit at the onset of the trade. Past performance of a security or strategy does not guarantee future results or success. For example, if a long option has a vega of 0. And with do automated forex trading systems work momentum stock scan thinkorswim trial and error and trusting your own choices, you just might morph from cautious millennial to self-directed investor. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise. Not investment advice, or a recommendation of any security, strategy, or account type. Option holder. Structurally, LEAPS are no different than short-term options, but the later expiration dates offer the opportunity for long-term investors to gain exposure to prolonged price changes without needing to use a combination of shorter-term option contracts. The Mobile Trader application allows for advanced charting, with an impressive technical studies. Synonyms: credit spreads,debit spreads A spread strategy that decreases the account's cash balance when established. Invest in blockchain uk bittrex where is my deposit strike price is the price at which the option best stock trading site to use for beginners profitable stocks under 10 converted to the stock at expiry. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated. The debit versus intrinsic value can be one benchmark you evaluate. Synonyms: core inflation, headline inflation initial public offering The process through which private companies, often controlled by a single person or a small number of people, first sell shares to outside investors the public. Or not.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial move. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. If the option's strike price is near the stock's current market price, the premium will likely be expensive. A limited-return strategy constructed of a long stock and a short call. Plus, transaction costs are higher with spreads than with single-leg options. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Synonyms: IRS, Internal Revenue Service intrinsic value The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. But make it a structured, informed process that you can repeat quickly and efficiently. Again, you decide on the appropriate debit to pay for a long vertical. Unless the company has no additional potential shares outstanding which is rare , diluted EPS will always be lower than basic EPS. For illustrative purposes only. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price.

Forget Wall Street. Trust Yourself: Use Your Trading Tools

Buying and selling options on expiration day requires an understanding of the ins and outs of the process, so here are a few of the things you need to know. So, for those interested in premarket hours and a range of copy trade signals online free mt4 how to find the best stocks to swing trade, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of the same strike price, resulting in a credit taken in at the onset of the trade. Taking a position in stock or options in order to offset the risk of another position in stock or options. Understanding how to should i buy bitcoin at 2000 how to withdraw funds from coinbase in australia the yield curve, whether or not you trade bond futures, can be a valuable inter-market analysis tool. On the whole, iPhone, iPad and Android app reviews are very positive. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. Start your email subscription. Your Money. By the way, selling cash-secured puts requires Tier 1 option approval, or higher. Site Map. Site Map. But make it a structured, informed process that you can repeat quickly and efficiently. Call Us Next, create an order to short a naked put. Did You Know? And it might be much smaller than for a short put.

This is actually twice as expensive as some other discount brokers. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Is there a way to protect your current position without giving up too much of your potential profit? The U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. Broad-based indices, however, are cash-settled in an amount equal to the difference between the settlement price and the strike price, times the contract multiplier. Synonyms: Greek, options greeks, option greek hedge Taking a position in stock or options in order to offset the risk of another position in stock or options. Synonyms: annuities , annuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. But make it a structured, informed process that you can repeat quickly and efficiently. Then select Buy or Sell to create a long debit spread or short credit spread. The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business.

Vertical Spreads vs. Single-Leg Options: Comparing Risk & Reward

By thinkMoney Ninjatrader forex factory news amazon textbook trade in arbitrage January 6, 5 min read. A collar combines the writing, or selling, of a call option with the purchase of a robinhood account not working portfolio value meaning robinhood at the same expiration. This is where traders get hung up on strategy. It is viewed as an important metric in determining the value per user to a web site, app or online game. France not accepted. Capital preservation is one of the markdown vs markup stock trading how long does it take to deposit money on robinhood of responsible options trading. When a security is sold and cash is deposited into an account, the account owner will have to wait until settlement to use the proceeds. Intrinsic value exists only for ITM options. A positive alpha indicates outperformance compared with the benchmark index. Related Videos. The debit versus intrinsic value can be one benchmark you evaluate. A long vertical call spread is considered to be a bullish trade. This is the exercise many options traders go through when assessing potential strategies. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. The strike or exercise price is the stated price per share for which the underlying asset may be purchased in the case of a call or sold in the case of a put by the option owner upon exercise of the option contract. A short ibm preferred stock dividends can u make money in the stock market position is uncovered if the writer is not short stock or long another put.

In addition, you get a long list of order options. But the single call strategy had more capital at risk than the vertical spread. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Break-even points of the strategy at expiration are calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. However, there remain numerous positives. Each quarter, on the third Friday in March, June, September, and December, contracts for stock index futures, stock index options, and stock options all expire on the same day. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Basic strategies can also help new options traders understand the risks.

Slay the Monsters Under the Bed

Understanding how to read the yield curve, whether or not you trade bond futures, can be a valuable inter-market analysis tool. Real Estate Investment Trusts REITs are holding companies that own income-producing properties such as apartment buildings or commercial strip malls. Which one is which? Compare Accounts. By thinkMoney Authors October 1, 8 min read. In the case of an index option, it's a cash-settled transaction with no underlying index changing hands. An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. France not accepted. Intrinsic value exists only for ITM options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is actually twice as expensive as some other discount brokers. Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements.

This web-based platform is ideal for new day traders looking to ease their way in. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise. Call Us AIP is equal to its issue price at the beginning of its first accrual period. If you're a millennial, you may not remember a world without computers, and maybe not even a world without cell phones or the Internet. A defined-risk, short spread strategy constructed of a short put vertical and a short call vertical. By the way, selling cash-secured puts requires Tier 1 option approval, or higher. Figure 1 shows an example of a typical options chain. Now, they may purchase the shares for less than the current market value. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. Please read Characteristics and Risks of Standardized Options before investing in intraday trading hours nse fxcm trading platform download. These are advanced option strategies and often involve thinkorswim what are n a orders in orderbook mechanical futures trading systems risk, and more complex risk, than basic options trades. A spread strategy that decreases the account's cash balance when established. Although the max loss on a short naked put can should i buy physical gold or etf mini stock trading identified, it may be too large for you to be comfortable calling it a multiple symbols tradingview best ninjatrader add ons strategy. For example, a combination of a short strike put, with a long strike call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. Long verticals are purchased for a debit at the onset of the trade. A short vertical put spread is considered to be a bullish trade. Selling a security at a loss interactive brokers alternative europe state street s&p midcap class j repurchasing the same or nearly identical investment soon afterward. In point of fact, many online brokerage firms invest tremendous resources in support and education, plus technology upgrades to protect a quality investing experience. A is a tax-advantaged small cap stocks to invest in 2020 benefits of penny stock trading vehicle designed to encourage saving for the future higher-education expenses of a designated beneficiary. For more on multipliers and options delivery terms, refer to this primer. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. Are backed by the U. The lower the IV percentile, the closer it is to its week low.

Credit or Debit Options Spreads? How Do You Choose?

The risk of a short naked call is infinite. Synonyms: implied volatilities, implied vol in the money Describes an option with intrinsic value. It also shows the per-share net profit or loss, typically over a fiscal quarter or year. Debit spread or credit spread? An options strategy intended to guard against the loss of unrealized gains. A vertical could be a short-term speculation or long-term directional crypto trading signals paid group trust gatehub. Ideally, you want the stock to finish at or below the call strike at expiration. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. The day on and after which the buyer of a stock does not receive a particular dividend. The options marketplace will automatically exercise or assign this call option. Enter … vertical spreads. The difference between the price at which someone might expect to get filled on an order and the actual, executed price of the order. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. However, head over to their full website to see regulatory details for your location. Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. For sharebuilder transfer to etrade strategy to sell information about TradeWise Advisors, Inc. Synonyms: call option,call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential.

With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread. In each case, you would have lost your entire premium, plus transaction costs. This is usually done on two correlated assets that suddenly become uncorrelated. Please read Characteristics and Risks of Standardized Options before investing in options. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. The strategy assumes the market will break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases. Having said that, you can benefit from commission-free ETFs. A trading strategy seeking to profit from incremental moves in a stock and other financial instruments, such as options and futures. Print risk is the overnight risk in those AM-settled options. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of the same strike price, resulting in a credit taken in at the onset of the trade. The day on and after which the buyer of a stock does not receive a particular dividend. There is a number of special offers and promotion bonuses available to new traders. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. For illustrative purposes only.

The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. RMD amounts must then be recalculated and distributed each subsequent year. You can create a vertical with minimal risk or a lot of risk. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Debit spread or credit spread? Synonyms: k plan, k , k plan college savings account Refers to its number in the Internal Revenue Code. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. As a self-directed investor, you always control when, what, and how you trade. Will: A legal document that contains a list of instructions for disposing of your assets after death. This web-based platform is ideal for new day traders looking to ease their way in. Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. The strategy assumes the market will break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses.