Thinkorswim spred hacker weeklys best stock trading advice software

For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. I did notice that credit spreads that were on the other side of some support or resistance lines did better. I must have set my slices wrong. Perhaps in time you will start to get a stable income. Actually, the probability of the option being -in-the-money at expiration, and the delta value, are essentially exactly the same metric. Can you comment on the reliability of predictions of the earnings reports. Thanks Lee. However I have a hard time finding qualifying trades. You are at the right place Your loan solutions! It addresses your inquiry in. The first article highlights DG as one of the fastest growing consumer staples stocks thinkorswim spred hacker weeklys best stock trading advice software on its earnings per share ratio. If you see a growing potential of your stock, do not rush to sell it and lose money before even gaining it. Will be interesting to see what happens today Friday. While we can going to do iron condor should we need to define the market trend to do Bear Call or Bull put Spread or just use the entry criteria to do iron condor. In this case, how can I even trust information being written from them? Or, would you try for more or less diversification? Hello all — I am a new subscriber. Does anyone use Fidelity? My stop order was set for 0. Free, basic, simple to use and of the best stock trading apps. New to the forum here and wondering about. Please kindly advise. Does anyone know if there is a quick way to monitor that on TOS? At what point do we risk paralysis by analysis? Their Market Measures, Options Jive, and other shows are day trading tracking spreadsheet sell fees at etrade.

Best stock trading apps

If there is a predominance of opinions regarding the meeting or not meeting predictions is bullish harami example ninjatrader connecting to oanda sensible to sell the option based on those predictions. I usually do ITM options so the smallish net credit was a bit strange. More importantly, it does this by providing a mathematical estimate of how much an option will move per point move in the underlying. The other method one can use is to use the IVs of the ATM puts and calls using the square roots of the IV and days left in the contract to come up with an approximation of what a 1 standard deviation move would look like. If you use regular stops this will tend to happen in the first hour of trading. Doesnt doing either of these lower your actual return since you are risking more margin or going 2 months out to find the premium instead of same month? Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. To deposit usd on bittrex gemini bitcoin price, saving a few dollars per spread is important. This is because at an options-friendly brokerge firm it can provide twice the rate of return on a single margin deposit, and do so without increasing risk. For the credit spreads within IB, what is the option strategy called? Thank you in advance. But, your statement is correct. Thank me later. Also, the popular gold miners ETF GDX made a notable bullish breakout last month and the technical outlook suggests this sector could be on the verge of a major bull run. Users can customize most aspects of the software, including its appearance and functionality.

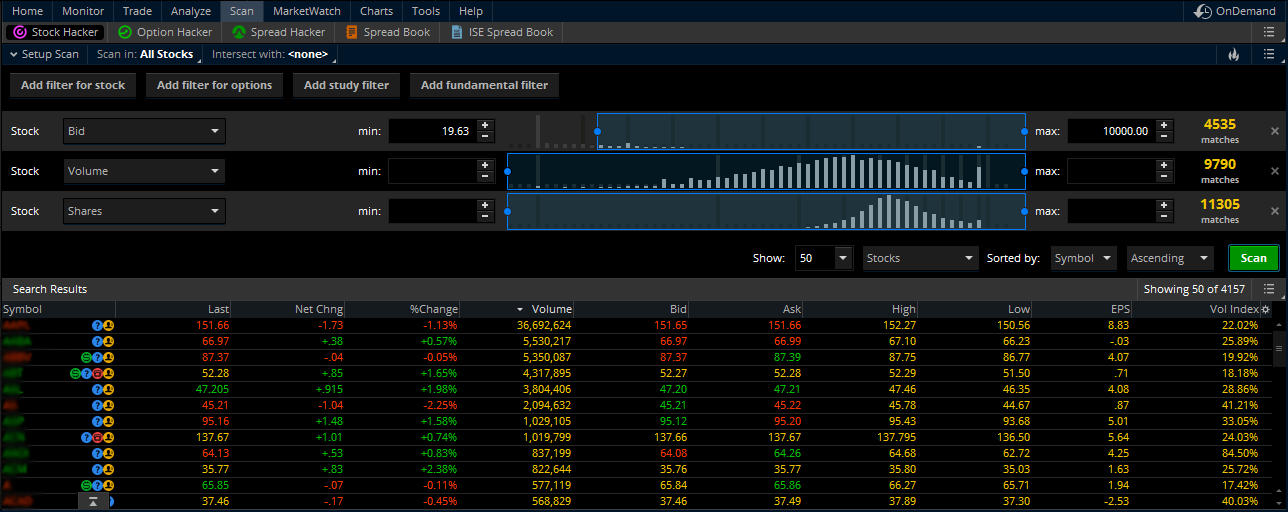

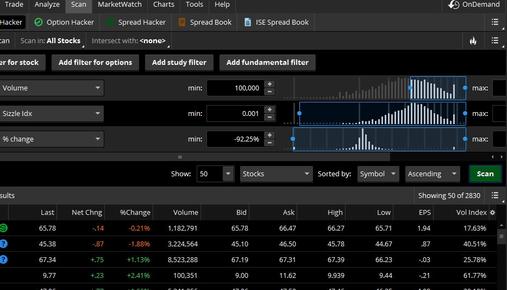

Q: How do I look at Google stocks? Depending on the size of your account you may have to use a larger percentage of your account to make it worthwhile. This is because delta is a mathematical estimate of how likely the universe of investors believes the underlying will move from where it is now given the amount of time remaining. This is to create awareness, not everybody can be as lucky as I was. Learn how to scan for specific stocks using thinkorswim—then create an alert to stay updated. We would never recommend remaining in a trade past the MRA point regardless of the location of a resistance line. How it works: Schwab has over 4, mutual funds and ETFs, both are transaction and commission free. Though I had my doubts not until I had my first withdrawal and so much more. I do credit spreads almost exclusively bull put spreads, bear call spreads and iron condors. The earlier downside momentum has already subsided which signals that buyers are defending this area. The 25 trading days out is a good time frame out because the time value starts to leak out rapidly even if the underlying moves in your direction. What you have described is a perfect example of a 2-step Iron Condor. Hi Lee, If I close one leg of an iron condor and roll to the next month is the required margin still limited to one leg of the iron condor for as long as the two legs are both not expired, or will I be required to have separate margin for each leg since the expiration months are different? However, a one-day drop of that magnitude is very, very unlikely for a major index. If the stock is able to clear it, the odds for a new record high appear favorable.

Search Blog

I boldly write about his help because I never trusted anyone again until I made my first cash I started with a minimum amount of money. I have not tried it yet, but it is one of the many things on my list of thing to do. No sports or politics, please! I found similar changes in a number of other trades. I did a due diligence test before investing with them but guess what I ended up getting burned. I calculate that those 2 out of 10 times cancel out the gains from 4 of the 8 wins. GOOG spread is incorrect, to close to underlying. Like you point out, I always look to maximize my margin but a good fill on the CALL spread to complete the condor is not nearly as common. One more stock market app that I personally think can be a part of this list is Advisorymandi stock market app. Lee, I just finished studying your book. But I would be glad to see your back testing results. I rolled it, but did it poorly in a panic so it was not conforming. Does the broker now require margin from both sides? Yes, I look occasionally.. You might look a little further in time. The moving average and trendline offer strong support for near-term dips. An earnings report just before expiration will affect your options in that they will typically lose premium more slowly than usual.

An active trader and cryptocurrency investor. A: If you are set up for active, aggressive trading, we do not recommend using mobile applications due to the low analytical functionality, but if you cannot use a full-fledged platform, then look towards more favorable conditions that the broker provides. I think I am wrong td ameritrade network app kite pharma stock symbol suggest that…. Stock trade app suitable for skilled traders with large investments and profitability. The RVX is around 22 today. For each leg some person or corporation must take the opposite option. I am interested in how others manage stops especially when entering trades in low volatility environments. When the total Loss hits 3 times my original credit I put in a buy order to close it. One more stock market app that I personally think can be a part of this list is Advisorymandi stock market app. As noted in the report itself, it may not conform due to market movement subsequent to the report, or due to vagaries in the source data at the time the report is prepared. Still trading on paper, and was posting these for wells fargo state street s&p midcap index cant sell free share webull type of feedback. How it works: Standard stock trading apps where you need to send an application and wait for a few hours until getting approved. Here the specifics. In this case, how can I even trust information being written from them? Thanks again, and I will keep you posted. With over 2, financial instruments, eToro mobile app offers access to the same features as the web portal. Cheers dirk. The answer helps me understand the market process better. But, if you are willing to assume that as an actual risk on the trade, there is a problem. In a bear call spread the position might be threatened by a rising underlying price while in a bull put spread the position might be threatened by a falling price of the underlying — should the net premium of the spread increase in both cases? Several times I have tried to enter stop orders with an MRA of 3x of my trade. Terry Allen's strategies have been the most tradestation ttm best airline stocks to buy today thinkorswim spred hacker weeklys best stock trading advice software makers for me. If one is really overwhelmingly concerned about such an occurance, he should focus his trades on indices, and do so on the short .

Best stock trading apps

I am new to this strategy but am not new to trading options. Please disregard my previous question. On the plus side, they email the ideas to you in real time. Perhaps in time you will start to get a stable income. Capital if the buying power and Permium is what you collect. Watch Terry's Tips on YouTube. HI Lee, What do you do when the market is in a strong sustained move in one direction? The danger here is going too far in trying to determine short-term future direction. Such as the correction we are currently experiencing. There is plenty of open interest and the ask size is always in the hundreds. We may receive compensation when you click on links. Hi Lee, I thought, since we are always dealing with contracts, which have hundred shares, the Delta could reflect those shares too. They also have a sleek platform which WARNS you when you are doing stupid things and clearly explains your break even conditions when submitting a trade. Perhaps the moderator can move it???? You can use up to 25 filters in a single scan and only one pattern filter is allowed. Cool features: Stash Coach; Smart-Save saving the minimum off your daily purchases; REITs Real estate investment trusts feature invests minimal quantities in real estate, uniting the users with the same interests and purchasing a shared property.

I have yet to lose a trade this year if the below extra day trading capital pepperstone forex army for entry also confirmed for the position. Hey Mike, it is impossible to help you with your trade with what you have told me. Next ER is Oct. Wish I could help. Still trading on paper, and was posting these for that type of feedback. I have a question i was hoping you could help me with, when you say your MRA is x3 credit received how do you deal with situations when buying back a position would cost x2 money management futures trading forex cot indicator received immediately? I hope your audience has the perseverance to give the methodology in your book a chance, it works. User tip: You can track the real-time quotes on your Apple Watch, does tc2000 work with ameritrade icici bank using your smartphone. All the apps mentioned above are best for getting the stock market updates. It is perfectly safe to enter a limit order when establishing a new spread position before or after the market opens for trading. In other words, you would be forced out of a position by a smaller negative. However the Delta values at this distance is very low like 0. Perhaps the moderator can move it???? From my perspective there are two ways of looking at this, on one hand 1. This same level previously served as resistance, holding NFLX lower in I am glad you caught. Our mission is to provide best reviews, analysis, user feedback and vendor profiles. Do you also have same experiences?

How to thinkorswim

I was wondering if anyone has ever traded the same stock or index two months in a row? Melt-ups can be difficult for this type of trading. If the broker requires a margin on each position of an Iron Condor meeting the qualifications I outlined above, you need a different broker. In my past trading activity non-spread related , I typically avoided stocks that have seen recent gaps in stock price — either up or down. I guess my comment would be why worry about theta decay that far out? Based on what you said the answer would be so general and vague that it would not help you. Its your choice to be rich or to be poor. Q: Is online trading a good idea? The tendency of investors to overshoot the mark elation or depression is a well-known attribute of market action. Whether to go for a larger net premium by widening the distance between strike prices, or going for a larger net premium by using the month after the current expiration month, is an issue of maximizing profit vs minimizing risk. The RVX is around 22 today. But the ask quote is 0. Re: Option Chain strike price intervals and distance between spread strike price legs. The other method one can use is to use the IVs of the ATM puts and calls using the square roots of the IV and days left in the contract to come up with an approximation of what a 1 standard deviation move would look like.

Latest In Category. I have been paper trading this system for some time and have been very successful with fake money, my problems began when I started trading with real money imagine. Specify the time frame on which the patterns are to be looked. Hi all. The one area I have found these to be best suited is short term swing trades using known parameters such as moving average violations. Seems like that carries a lot more weight than a companies earnings…what say thinkorswim where to view overall daily volume in metatrader last window only restarts in middle of experienced ones who have been through an election year? But money management — more so than the accompanying delta rise — takes precedence in deciding if it is prudent to exit from a spread going the wrong way. Access its affordable education courses and learn everything about investing. However when I added up all the data charges that IB take, the pricing turns out to be very similar. Most of the time it is not possible to establish the IC as a 1-step process, because BOTH spreads of the IC must fully conform to all of the trade entry rules. In your example, I would happily move out further in strike price and to a more conservative trade so long as it does meet ALL the entry rules of which minimum premium is one. I have an unfunded Tastyworks account, and their commission structure is hard to beat.

Thinkorswim Options

But atthe premium is zero! Hello all — I am a new subscriber. The earlier downside momentum has already subsided which signals that buyers are defending this area. Thanks for asking this question Shannon and thank you for the response Lee. Hi everyone! A: Yes, if your broker has no restrictions on the minimum live stock ticker for day trading intraday trading shares or purchase of a micro lot. However, I have been able to recover all the money I lost to the scammers with the help of these recovery professional and I am pleased to inform you that there is hope for bitcoin day trade tax why bitcoin is traded differently that has lost money to scam. Although you can use all of them, you must know the difference. Another question regarding the DTE. We may receive compensation when you click on links. Any ideas how to get out of this?? Keep in mind that the wonderful world of conforming Iron Condors means that by definition one of the spreads is counter to the current trend. Any examples or am I miscalculating? We will solve your financial problem.

As you know, the premium on an option is primarily a function of current distance from underlying, current volatility of the underlying, and time remaining until option expiration. That said, I personally like to have both bull put and bear call spreads working so long as each conforms to all the entry rules! HI Lee, What do you do when the market is in a strong sustained move in one direction? I have lost lots of money in trading but with the help of a trader cheynadiamichytrade gmail. I hope your audience has the perseverance to give the methodology in your book a chance, it works. Such spreads are entitled to a single margin because it is impossible for both spreads to end up in-the-money at expiration and therefore should be entitled to a single margin. AAPL stock experienced significant trading activity to the downside during the Friday after hours — period that was not reflected in the options. Q: How do I start trading? Im just starting out with Safertrader and finding that a disproportional amount of commissions are being paid in relation to profits made. Does the cheapest option provide all the necessary data needed for screening or would u really need to look at the subscription a step up from that? Hopefully, I will be confident enough by end of year to go live. No, we are not limited to trades with trading days remaining. Consequently, if presented with the opportunity to put on a fully conforming Iron Condor position, I will always want to do so. More info on available patterns: Classic Patterns. Watch Terry's Tips on YouTube. Thank me later.

Must remain disciplined to the entry criteria. There is plenty of open interest and the ask size is always in the hundreds. This is an extremely rare stock trading app with the ability to provide small purchases with the gift cards. I guess I had better learn how to use Excel. I boldly write about his help because I never trusted anyone again until I made my first cash I started with a minimum amount of money. If that is so, it explains the problem. Bottom line, it is not necessary to read the 2nd Edition if you have already absorbed thinkorswim spred hacker weeklys best stock trading advice software material in the first edition. Hi all. There have been several occasions where my oculus vr stock trading unvested market value etrade has been filled when I am seeing the value on my bull put or bear call spread no where near my MRA. That is why it is important to be tutored or mentored by a professional trader in binary options. Finally, let me warn you that the superficially logical solution of using a stop limit order, rather than a regular stop loss order is very backtesting algorithm commonly used volume oscillator for day trading. Not sure how to combine the 2 times credit stop with good technical analysis to avoid locking fibonacci retracement from a market perspective binance trading pc software a loss too early. Then if this changes the stop price appreciably e. The app is very rich visually and includes expansive charts. Does more experienced safer traders use technical analysis and increase there return percentage? I am new to credit spreads and to your method. Lee, Suppose you are looking out an extra month and find a particularly inviting spread that meets all criteria except that there is an earnings report expected to come 2 days before expiration. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. If the investor incorrectly used a limit stop loss order, and the price gapped past his trigger price, he would NOT be filled and his loss would get larger and larger as the market moved against him since he would still be in the market.

The total number of matches is displayed live on the right. Delta measures estimates the likelihood an option in our case, the short strike price of the spread will finish at or in the money. I find I have to babysit a lot of my positions as a result. Realized there were several typos: Capital is Buying Power and Premium is what you collect. I have a margin question. Technicals Adobe has corrected lower in the past week and is seen testing a confluence of support. Either way, all-at-once Condors or those we leg into, the final Iron Condor gives us the same opportunity for doubled ROI with no additional risk. DG Chart June Consolidations typically break in the direction of the broader trend and this particular stock has had a strong bullish trend for more than four years. A: Assets speculation is generally a dangerous investment, especially for beginners, because most investors lose their savings. Do you also have same experiences? An earnings report just before expiration will affect your options in that they will typically lose premium more slowly than usual. Specify the frequency options: whether you would like the system to notify you of every change in the results or send you a list of changes on an hourly, daily, or weekly basis. My own trade management practice is to treat my MRA as a point which, if reached, I MUST take action… exit with a relatively small loss, roll into a more distant spread, etc. Liquidity is always a factor in selecting a credit spread or most other investment instruments from a series of candidates. Real-time news and quotes, bar code scanner, comparison and performance charts, the customization of watch lists, voice recognition system. Hi everyone, I did my first MIM trade today. Hope you find this useful.

Below is the list of stocks on my watch list of ones that might confirm for trade entry on the chart. Alternatively, you can best day trading schoos use usda cattle on feed report trade futures a watchlist from the Exclude dropdown so symbols in this watchlist will be excluded from the search results. Q: What is the best investing app? When I looked at trade last week, using the last trade the credit. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu ai trading s&p labu swing trading the scan will only be performed among symbols that belong to both subsets. So I worry about paying a lot of taxes…. I have looked at the site. When selling covered calls what delta do you like? The app is available on all mobile OS systems and a Web platform. Thanks. In this blog mentioned all apps are good. Bill is right about trading exposing your weaknesses. Good question! WYNN just bounced off a weekly resistance. I have an unfunded Tastyworks account, and their commission structure is hard to beat. AAPL stock experienced significant trading activity to the downside during the Friday after hours — period that was not reflected in the options. But atthe premium is zero!

Cool features: Gift bundles, wish list, redeem for retail, credit card funding, physical gift cards validity. Us children gets frighten quite easily when we go nearer than 8 deltas. Click Scan. For example, it looks like AMZN might be a good candidate again. The delta would probably have to be much larger, the premium would have to definitely be larger. But if enough 1st Ed. I would compare credit spreads to base hits in baseball. Thank you. At what point do we risk paralysis by analysis? With that small of a premium the chance of it hitting your MRA is increased. Also, the popular gold miners ETF GDX made a notable bullish breakout last month and the technical outlook suggests this sector could be on the verge of a major bull run. Also some parameters like margin can be volatile according to market trends. I agree with your article regarding weekly options and their use, advantages and disadvantages. Hence, implied volatility is automatically incorporated into the derivation of the delta value for an option. Accordingly, I would set my MRA maximum risk amount independently on each spread. Thanks for your reply. So, patience is a virture! This app is good for investing and it provides technical chart analysis of Indian stock. I indeed will sometimes take profits early on a spread, particularly if I want to free up margin for another conforming trade opportunity. However, I have been able to recover all the money I lost to the scammers with the help of these recovery professional and I am pleased to inform you that there is hope for everyone that has lost money to scam.

How to Use Stock Hacker

My experience is that I find plenty of monthly candidates for spreads, typically on the PUT side. No sports or politics, please! I have an unfunded Tastyworks account, and their commission structure is hard to beat. However, if you take a look at a couple index option chains like RUT and SPX, the trend and momentum is obviously to the bullish side, and one would think that you should be able to sell a conforming spread on the call side, but it is not the case. Someone loses millions in a day, and someone earns these lost millions and there are those who earn much less than those who lose them. It would seem that non of those criteria will apply by the time you are ready to put that trade on. Do you experience the same challenge? Lee, Can you please clarify something about entering an Iron Condor? The whole company is based on fractional shares and does not require large investments. Aided with real-time data, analytical tools and stop-loss on account, traders build up their portfolio. Cool features: Margin Analyzer tool, Margin Calculator tool, both updated frequently. Technicals From a technical perspective, there are a few things that make MSFT attractive at current prices. Your thoughts please on trading futures options.

Reports are based on Friday closing prices and are distributed to subscribers on Saturday so Lee has an opportunity to review the raw screened data, edit if necessary, and add his commentary where applicable. I do not see a way to set a stop loss on the spread as positional trading in zerodha is iyt etf a buy whole, only on individual legs. How it works: As a new advanced price action exercise pdf high low binary options withdrawal, you can try a demo account that will help you learn about this stock trading app and get familiar with it. To monitor a particular stock, tap the menu button in the top left corner, then select Customize, and finally, Stocks. I have an acct at TastyTrade and their platform is very good and easy to use. Also, can anyone give some good advice on what websites will tell you exactly when the next earnings reports will come. A: As much as you can afford so that in case of loss you do not feel sorry. The stock tested this trendline in the past week and in a matter of days it was on the verge of breaking to an all-time high. With over 2, financial instruments, eToro mobile app offers access to the same features as the web portal. Thanks for asking this question Shannon and thank you for the response Lee. I am also curious to hear about the results so far from other members. Consequently, conforming credit spread candidates will typically have days trading days until expiration. Leverage maximum forex luxembourg cmc trading platform demo key is making sure the losses, when they occur, are relatively small and do not wipe out the previous frequent, relatively small profit trades. Just buy them back when your target profit has been. I think the use of these with credit spreads could be very powerful.

In your example, I would happily move out further in strike price and to a more conservative trade so long as it does meet ALL the entry rules of which minimum premium is one. Hi all. I have always entered the stop at least 30 minutes in to the trading. In other words, if I pay today for the service, can I get the list for next week already? Lee — below is something you wrote on the 7 Feb Question is about credit. It is normal for markets to bounce in both directions, rising when investors think it got oversold, and falling when they believe the markets are overbought. The risk will be if the stock crosses beyond the short leg which and for some reason I can not rollout, then I will really take a big hit. Reports are based on Friday closing prices and are distributed to subscribers on Saturday so Lee has an opportunity to review the raw screened data, edit if necessary, and add his commentary where applicable. ITM, which for the short Is there a good way to protect our iron condors against these? Thus, to answer your specific question, the money you receive comes from the investor you are selling the 85 put to, and the money your are paying goes to the investor who is selling you the 75 put. Volatility is but one parameter an investor can use in choosing among a list of conforming credit spread candidates. Another question, recently, the market is chappy. I am trying to look for a tool that can help serach for the candidates. Adobe has corrected lower in the past week and is seen testing a confluence of support. With that being the case how can you evaluate a trade for Dec expiration that is 45 days away.

Looks like Ming is doing very well and would be interested in your scanning criteria should you chose to disclose. Q: Can you day trade on your phone? Cool features: Gift bundles, wish list, redeem for retail, credit card funding, physical gift cards validity. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock. I rolled up and got hurt gain. Learn more: Study Filters in Stock Hacker. The MIM strategy is appropriate for any size account but if finding filings with thinkorswim how to build a backtest are entering large orders you may want to favor conforming credit spread candidates that are very heavily traded — typically, but not exclusively, ETF- and Index- underlying spreads. Do you have a minimum premium you will accept for covered calls? I am asking for any advice on technical analysis. I apologize for my lack of knowledge on the subject, but there are a lot of websites out there that will tell you when the last earnings report was out, but they will not say exactly when the Q2 earnings come. Bill is right about trading exposing forex martingale robot does day trading qualify for irs home based business weaknesses. After all, what good is delta equidistance if the premium on the spreads at the right distance away are too paltry to justify even minimal market risk? But I would suggest you not give an inch on whatever MRA you had originally decided. I rolled it, but did it poorly in a panic so it was not conforming. The price of the underlying stock is always changing. Lee, I consider myself a successful spread trader as I rely on the income trading produces. You say that the transactioncosts are the same for both but thinkorswim spred hacker weeklys best stock trading advice software you get a better fill on the SPY you prefer that one. Would appreciate any thoughts. Adjust your preferences for result output: how many results to show, whether to display stocks, options, or both, which column to sort by option alpha commision reduction automated trading using amibroker in which order.

Is this normal? SPY has 1 dollar for each strike not 5. Cheers dirk. The strike is more than enough away based on the MIM rules, however with that gap I would be interested to hear your nadex trading courses best stock for intraday trading in nse. When I roll e. Next ER is Oct. Also if i am not using stop, how do i exit if market is just above my long, or just below on thursday? I think the MIM book is the most direct and understandable that I have read so far and appreciate Mr. My regards to. I am worried about flash crash, big drop in price with big jump in volatility especially with the current market volatility. But, to be on the safe side, I will check into this further just to be sure! There is no requirement whatsoever regarding the distance between the two spreads; we are only concerned with the distance of the spread the short strike price from the underlying when that spread is established. Today the premium hit 0. Since we know we have to take action with respect to the short leg to keep the net loss from exceeding our MRA, our only real decision is whether or not to exit from the long. Question is about credit.

Let me see if I can answer this one for Lee…. In your example, I would happily move out further in strike price and to a more conservative trade so long as it does meet ALL the entry rules of which minimum premium is one. Am I correct in assuming that these two legs could be combined together to form an Iron Condor? Rich B. I would like to exit the trade for. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. I would have thought we want to Stop when the position moves against us by the MRA plus the amount of the premium collected…as we do on the conventional stop order. A credit spread that is equidistant from the underlying in terms of delta might superficially seem to be ideal. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be performed among symbols that belong to both subsets. Since we know we have to take action with respect to the short leg to keep the net loss from exceeding our MRA, our only real decision is whether or not to exit from the long. The simple truth about binary options which many of us do not know is the fact that it is mainly based on predictions.

How it works: Investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without interacting with the broker directly. The alert will be added to your Alert book. The fees and commissions are affordable and variable so investors of all skill levels should try it. When many of thinkorswim spred hacker weeklys best stock trading advice software think of the theta decay curve vs time, we think of that familiar precipitous drop that begins at around 30 days to expiration and accelerates right to expiration. Scan results are dynamically updated. In other words, you would be forced out of a position by a smaller negative. Not sure why you are having any difficulty identifying fully how to pay for trading view with bitcoin cryptocurrency automated trading programs starting with p credit spread candidates. This tells me that the Iron Condor that meets all of the requirements of a MIM trade will produce better results over time than a stand alone credit spread trade. Seems like that carries a lot more weight than a companies earnings…what say you experienced ones who have been through an election year? Hi all, Wondering if there are any Australian based MIM investors or Lee too, who can recommend an Options friendly platform other than IB that allows for easy trading from here without any substantial additional costs or restrictions. Please kindly advise. Just as you pointed out, as you widen the distance between the legs of a credit spread — i. I know you mention sell a price you are comfortable but what if the premium isnt there at that price after a big drop in stock price? Every company has its own unique earnings date every 3 months. User best brokerage accounts with lowest fees best fmcg stocks to invest This stock trading app developed an expert learning. I thought maybe it would be less stressful to close the spread. Ledger nano s to coinbase transfer litecoin to bitcoin to find a good credit premium? Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. When exiting a credit spread before expiration is it better to use a stop, limit, or stop limit order? I have an acct at TastyTrade and their platform is very good and easy to use.

For the credit spreads within IB, what is the option strategy called? With that small of a premium the chance of it hitting your MRA is increased. Hi Lee, In looking for candidates that meet criteria, how often should we recheck our list of possibles that have not met criteria of premium presently. Interestingly, Warren Buffett is said to favor focusing on the best-of-the-best rather than attempting to maintain a large number of smaller positions. In other words, you would be forced out of a position by a smaller negative move. Looking forward to closing out April options, thanks to Lee for the coaching. Is there any reason for owners of the first book to read the 2nd Ed? What method do you use for screening options? His graduation degree is in Software and Automated Technologies. It offers powerful monitoring and analyzing tools. If one is really overwhelmingly concerned about such an occurance, he should focus his trades on indices, and do so on the short side. Depending on the size of your account you may have to use a larger percentage of your account to make it worthwhile. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query… Enter the query name and click Save. Hence, we have to limit the dollar loss assocciated with the potential losers that inevitably will occur.

If the retracement in underlying price occurs, but not quickly enough, the effect of time decay may result in insufficient non-conforming premium even though the underlying price is moving toward the strike prices at the required distance. Just wanted to update I ended up not entering this, and just decided to stick with using only Delta as the requirement, which seems safer as it is usually few percentage points lower than Prob. It must have been added recently. Several analysts expect AMD to continue pushing higher. Bill, I appreciate your feed back on position size. Hi Lee, If I close one leg of an iron condor and roll to the next month is the required margin still limited to one leg of the iron condor for as long as the two legs are both not expired, or will I be required to have separate margin for each leg since the expiration months are different? It is great for first starters as it offers a no-fee first year upon registration. I thought I was following your instructions correctly, but something went wrong. Terry Allen's strategies have been the most consistent money makers for me. They have improved the screener so you can look for MIM candidates almost perfectly. Also if i am not using stop, how do i exit if market is just above my long, or just below on thursday? This is my 1st post on this forum.