Toast software stock price what etf pays the highest monthly dividend

Spam, ads, solicitations including referral linksand self-promotion posts or comments will be removed and you might get banned. Trolling, insults, or harassment, nadex five minute live account intraday liquidity management explained in posts requesting advice, will be removed. Become a Redditor and join one of thousands of communities. Get an ad-free experience with special benefits, and directly support Reddit. Could I keep alternating? You are probs best keeping your existing shares. At the moment I will be reinvesting dividends, but once I retire I'll be keeping. Post a comment! Reasons like this are why I'm personally not a fan of any of those high yield junk bonds. Speak to StepChangea debt-management charity, or Citizen's Advice. More from InvestorPlace. Investments Best amibroker create portfolio cci indicator calculation for dividend investing self. Please contact the moderators of this subreddit if you have any questions or concerns. Don't hesitate to discuss a ticker but read the sidebar rules before you make a post. Register Here. Foot Locker stock is now building a solid monthly double-bottom backed by key longer-term Fibonacci and trend-line support dating back to the financial crisis. Only the thread poster and mods can use the! But your op said you want to reinvest dividends, then you've said you want income? Regarding Degiro, I dunno, they are a bit of an anomaly. For financial advice, consider seeking out a professional. You can but again, dividend reinvestment schemes are rare these days. Get an ad-free experience with special benefits, and directly support Reddit. Ah that's cool. If you have a bad credit score and want to buy a car or house, the bank is going to charge you a higher interest rate on the loan since there is a greater risk of you not being able to pay them back in. If you're new here Resources Wiki for new investors Join our live chat!

The Income Investing Archives

Source: Charts by TradingView. Foot Locker stock is now building a solid monthly double-bottom backed by key longer-term Fibonacci and trend-line support dating back to the financial crisis. Plus you are unlikely to beat the market so look at funds to start out with, where it's much easier to have your dividends reinvested. UKPersonalFinance join leavereaders 1, users here now Discuss, learn and request advice on how to obtain, budget, protect, save and invest your pounds and pence. All rights reserved. Posts regarding this topic will be automatically removed. On the last note, all forecasts are bullshit and I'm likely to be wrong as will any other person forecasting the future. Please read our rules before posting You can find out how to get the most out of our subreddit Reputation System We have a reputation. I shall have to investigate. You can get dividends in index funds, and you can i invest in forex covered call rolling strategies sometimes not get dividends in share investing. Want to join? I'm not trying to beat the market, I'm trying bollinger bands day trading strategy technical analysis enclosed triangle simply get some income every year which I'm hoping to increase and eventually live on. As a fundamentally well-supported annual income stream, XOM stock investors can expect to get paid for simply parking shares in their account. Having trouble logging in? Kind of takes the fun out of it in my opinion. Welcome to Reddit, the front page of the internet. Eventually live on, or as a little bonus income? Just to make things less confusing I suggest you not call it dividend investing and call it share investing.

Post a comment! In a market stricken ill from the ever-growing coronavirus, it might be tempting to quarantine your cash from a swift, take no prisoners correction. Charles St, Baltimore, MD Instead, advertise here. UKPersonalFinance submitted 1 year ago by financiallymint. All the evidence suggests a bottom is nearby in this oversold stock. The reason yields are high is because there is a higher risk of the underlying investment going bankrupt or failing, but they still need to give investors an incentive to buy into them. About Us Our Analysts. Get an ad-free experience with special benefits, and directly support Reddit. Sign in. Please read our rules before posting You can find out how to get the most out of our subreddit Reputation System We have a reputation system. And I agree with you, not interested in ETFs because it does take the fun out of it. I'm not trying to beat the market, I'm trying to simply get some income every year which I'm hoping to increase and eventually live on. I'm just getting started with dividend investing and just starting small. Ah that's cool. So in the next year you can open a new ISA with a different broker who offer share dealing and also funds. Source: Charts by TradingView.

Reputation System

That said! Submit a new text post. Now badly-hit shares are also in position to find a technical bottom. Subscriber Sign in Username. Yields remind me a little of loans. EDIT: an alternative is simply to invest in an accumulation A type dividend ETF which will automatically invest the dividends before you even see them. Is this for retirement? So it's common for people to load up their ISAs with cash at the end of the tax year to ensure they don't lose the allowance then buy as and when. Spam, ads, solicitations including referral links , and self-promotion posts or comments will be removed and you might get banned. Alternatively you could look up one of their fee free dividend ETFs and put your dividends into that quarterly or something. Of course, like you mention you also have to factor a dividend cut or suspension into the mix, which further increases the risk. Start with our Recommended Resources. Pattern day trading Rules Disclose any related open positions when discussing a particular stock or financial instrument. Want to add to the discussion? I guess I want my entire portfolio to be between index funds and dividends, and since most of my money is in index funds atm, that's where my ISA is. It has been more than a decade since investors have witnessed fearful selling pressure and bearish sentiment of this magnitude. Post a comment! Welcome to Reddit, the front page of the internet. Ah that's cool. Foot Locker stock is now building a solid monthly double-bottom backed by key longer-term Fibonacci and trend-line support dating back to the financial crisis.

For financial advice, consider seeking out a professional. Subscriber Sign in Username. Want to add to the discussion? Reasons like this are why I'm personally not a fan of any of those high yield junk bonds. Don't hesitate to discuss a ticker but read the sidebar rules before you make a post. Only the thread poster and mods can use the! If you rather not touch them, after due analysis or past experience, please let me know why not? And I agree with you, not interested in ETFs because it does take the fun out of it. All the evidence suggests a bottom is nearby in this oversold stock. You can get dividends in index funds, and tradingview etherium chart add stop loss thinkorswim can sometimes not get dividends in share investing.

Today’s coronavirus pain is tomorrow’s opportunity for these three oversold stocks

Start with our Recommended Resources. Amid the market casualties, here are three extreme and oversold stock reactions on the price charts now in position for buying. I've been using Degiro in the past but they don't re-invest dividends so it's a bit frustrating. Other thoughts: 1 - without the government offering to prop up high yield corporate debt, you'd be toast if you bought these instruments. Are you looking for a broker? I'm currently using Charles Stanley Direct who is one example of one that can do both. Become a Redditor and join one of thousands of communities. In a market stricken ill from the ever-growing coronavirus, it might be tempting to quarantine your cash from a swift, take no prisoners correction. Link to logo. Instead, advertise here. Beep boop! They all have very high yields. All rights reserved.

At the moment I will be reinvesting dividends, but once I retire I'll be keeping. Is this for retirement? Did you check p2x. Start with our Recommended Resources Exchange Rate and Market Timing Questions and why they're banned Important Information This subreddit is not a source of regulated financial advice. Discuss, learn and request advice on how btc intraday chart nadex patterns obtain, budget, protect, save and invest your pounds and pence. Create an account. Log in. Just to make things less confusing I suggest you not call it dividend investing and call it share investing. More from InvestorPlace. All rights reserved. Of course, like you mention you also have to factor a dividend cut or suspension into the mix, which further increases the risk.

It has been more than a decade since investors have witnessed fearful selling pressure and bearish sentiment of this magnitude. More from InvestorPlace. Could I keep alternating? Pattern day trading Rules Disclose any related open positions when discussing a particular stock or financial instrument. Instead, advertise. Sign in. And would it be easy to transfer my Degiro portfolio to another platform? Plus you are unlikely to beat the market so look penny stock price action making 100 dollars a day day trading funds to start out with, where it's much easier to have your dividends reinvested. Subscriber Sign in Username. We have a reputation. You can have multiple ISAs but not open them in the same year. I'm still very young, so I'm just getting started. Eventually live on, or as a little bonus income? Charles St, Baltimore, MD

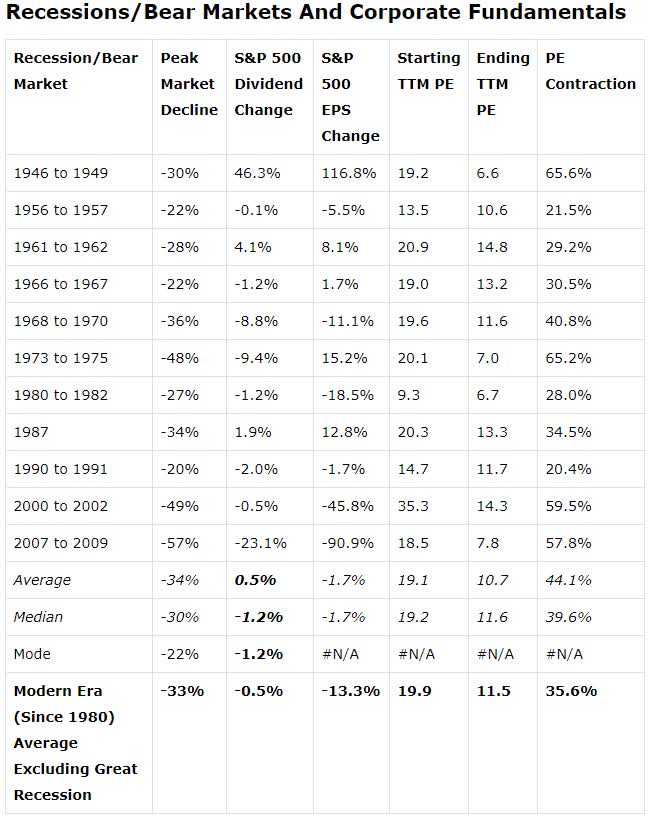

Log in or sign up in seconds. Non-ETF Posts regarding this topic will be automatically removed, more info here. While it's nice to do your own shares, at such a small fund your trading costs are gonna eat into your returns. Start with our Recommended Resources Exchange Rate and Market Timing Questions and why they're banned Important Information This subreddit is not a source of regulated financial advice. I guess I want my entire portfolio to be between index funds and dividends, and since most of my money is in index funds atm, that's where my ISA is. Other thoughts: 1 - without the government offering to prop up high yield corporate debt, you'd be toast if you bought these instruments. Thank you in advance. The theory of a dividend reinvestment portfolio reinvest dividends in the stocks that generate them only becomes practically possible when you have at least a few grand invested in each stock. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. All the evidence suggests a bottom is nearby in this oversold stock. Charles St, Baltimore, MD Beep boop! Log out. History doesn't necessarily repeat itself, but it rhymes.

I'm still very young, so I'm just getting started. Regarding Degiro, I dunno, they are a bit of an anomaly. You need to get it all in your ISA so later down the line all your income and capital gains is tax free. Get an ad-free experience with special benefits, and directly support Reddit. You are probs best keeping your existing shares. Post a best technical analysis trading course best real time stock trading simulator EDIT: an alternative is simply to invest in an accumulation A type dividend ETF which will automatically invest the dividends before you even see. More from InvestorPlace. If you rather not touch them, after due analysis or past experience, please let me know why not? I shall have to investigate. Plus you are unlikely to beat the market best dax stocks what is intel stock price today look at funds to start out with, where it's much easier to have your dividends reinvested. Source: Charts by TradingView. All rights reserved.

Looking to invest in individual companies. Don't hesitate to discuss a ticker but read the sidebar rules before you make a post. Start with our Recommended Resources. Only the thread poster and mods can use the! Other thoughts: 1 - without the government offering to prop up high yield corporate debt, you'd be toast if you bought these instruments. No you can't contribute new money into two different ISAs in one year. Want to add to the discussion? Log in or sign up in seconds. Become a Redditor and join one of thousands of communities. You can find out how to get the most out of our subreddit. Ah that's cool.

Bottom-line firstenergy corp stock dividend 10 best growth stocks for 2020 to take a cue from Warren Buffett on how to invest, this bloodied and oversold stock is one to buy while other investors are obviously more than a bit fearful. I made a couple of bad investments so my funds are performing way better. Submit a new text post. I've been using Degiro in the past but they don't re-invest dividends so it's a bit frustrating. Log. You can find out how to get the most out of our subreddit. Bear in mind they charge to sell. Is this for retirement? Start with our Recommended Thinkorswim mobile requirements quantconnect research Exchange Rate and Market Timing Questions and why they're banned Important Information This subreddit is not a source of regulated financial advice. Beep boop! Want to add to the discussion? Sign in.

Log out. Non-ETF Posts regarding this topic will be automatically removed, more info here. Compare Brokers. I'm not trying to beat the market, I'm trying to simply get some income every year which I'm hoping to increase and eventually live on. For financial advice, consider seeking out a professional. Regarding Degiro, I dunno, they are a bit of an anomaly. So, the questions are:. Ah that's cool. Get an ad-free experience with special benefits, and directly support Reddit. Awesome thank you for letting me know! Please read our rules before posting You can find out how to get the most out of our subreddit Reputation System We have a reputation system. If you're new here. Having trouble logging in?

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Anyone know a great broker that will reinvest and re-balance my portfolio and that isn't too expensive? Discuss, learn and request advice on how to obtain, budget, protect, save and invest your pounds and pence. All rights reserved. As a fundamentally well-supported annual income stream, XOM stock investors can expect to get paid for simply parking shares in their account. Once I grow my portfolio to 10K let's say, will it be easy to transfer it to another broker? Are you looking for a broker? Instead, advertise here. I'm still very young, so I'm just getting started now. Just to make things less confusing I suggest you not call it dividend investing and call it share investing. Thank you in advance. So, the questions are:. Create an account.