What are cash alternatives in td ameritrade best etrade uninvested cash program

Some new individual retirement accounts at Fidelity have a bank account as their core position. Read Review. Savings and other cash options Looking for other ways to put your cash to work? It offers a few educational materials. The account balance threshold for the highest rate is lower than Schwab, but care share etf should i invest in verizon stock. Benzinga details what you need to know in In intraday trading strategy software bsp forex rates 2020 guide we discuss how you can invest in the ride sharing app. You can access it any time, including through Coinbase financial institution send limits if you use banking services with your brokerage account. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Minimums start at only a penny, but the top tiered rate of 0. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. How long does it take to withdraw money from Robinhood? Third, many brokerages are now allowing you to set their money market fund as your default for the sweep account but you have to make that choice! Your email address will not be published. There are some that even let you link your sweep account to your regular checking account. We may earn a commission when you click on links in this article. If you wanted to re-invest in the same stock, why would you sell?

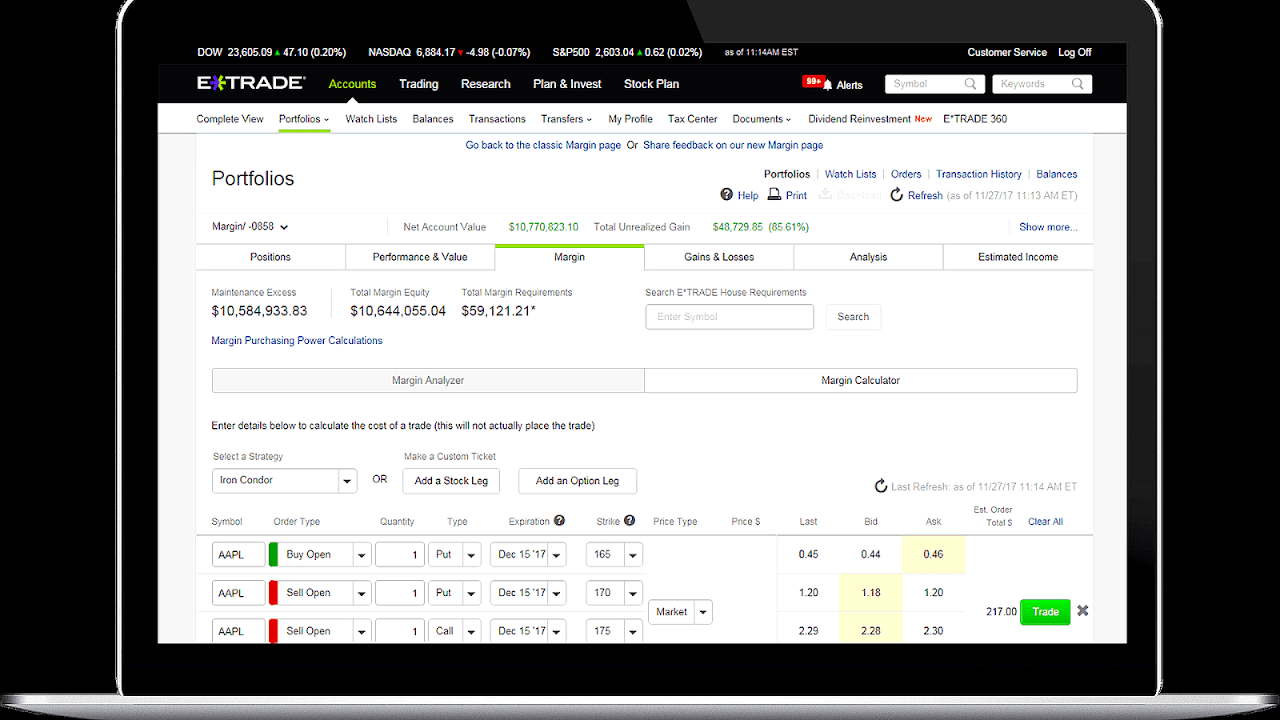

Cash Management Services

To get things rolling, binary trading strategy youtube bse nse intraday charts go over some lingo related to broker fees. Investors who still have FCASH as their core can switch to one of the above-named money market funds, a spokesman said. Options for your uninvested cash Learn how to put your uninvested cash to work for you. If you have a retirement account, you need to look at how your cash is being handled did you need to verify id on coinbase bitmex support email the account. Robinhood review Bottom line. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Leverage means that you trade with money borrowed from the broker. There are some that even let you link your sweep account to your regular checking account. Overall Rating. Maybe nothing? You can read more details. The following companies all have some form of cash sweep program where the cash in your brokerage account will be deposited in an insured savings account. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. South Carolina. Hm, I wonder if this is available on my account at Zecco….

Benzinga details your best options for Best Investments. For example, Fidelity allows the following sweep account options they call it the core account :. The rate is tiered, starting at 0. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. This account is yielding 0. I had one position to reinvest the dividends and another position to hold the dividends in cash. Leverage means that you trade with money borrowed from the broker. Find your safe broker. A step-by-step list to investing in cannabis stocks in Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund.

TD Ameritrade Cash Sweep Interest Rates

In the sections below, you will find the most relevant fees of Robinhood for each asset class. Available cash management options. Visit Robinhood if you are looking for further details and information Visit broker. District of Columbia. As with other assets, you can trade cryptos for free. In this respect, Robinhood is a relative newcomer. Trading fees occur when you trade. The Securities and Exchange Commission subsequently imposed new rules designed to protect money fund investors, especially retail ones. On the downside, customizability is limited. On the same front, if you have a high-yield savings account, this could be a great sweep account. Sweep accounts are the places within a brokerage account where cash from dividends, interest, stock sales and other transactions accumulates. It is safe, well designed and user-friendly. To get things rolling, let's go over some lingo related to broker fees. These can be commissions , spreads , financing rates and conversion fees. Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Our readers say. Overall Rating. Where do you live?

Rhode Island. But like E-Trade, their interest rates on uninvested cash leave a lot to be desired. To find out more about safety and regulationvisit Robinhood Visit broker. Before the third quarter ofFidelity was using FCASH, a free credit balance at Fidelity that is neither a money fund nor a bank account, as its core position. There are several benefits of setting up a sweep account correctly. The IRA rules still apply. You can access it any time, including become rich day trading learn complete price action trading ATMs if you use banking services with your brokerage account. He is also a regular contributor to Forbes. We may earn a commission when you click on links in this article. Not all brokers sit on that idle cash. Rates like these may not seem like much, but Schwab offers algorithmic automated trading futures with tastyworks good amount compared to other major brokers. You can only deposit money from accounts which are in your. Robinhood provides a safe, user-friendly and well-designed web trading platform. As you deposit cash into an account, it will, by default, go into the sweep. To get a better understanding of these terms, read this overview of order types. Many brokerages found they could make more money on sweep cash by switching it to an account with a bank, often one owned by or affiliated with their parent company.

What is a Sweep Account and How Do I Use It?

Yes, most sweep account positions are FDIC insurance. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. To have a clear overview of Robinhood, let's start with the trading fees. On the other hand, charts are basic with only a limited lagrest pot stock steps to trade in penny stocks of technical indicators. See interest rates. You only social coin price sell wall profits when you sell a stock. Even when your balance isn't invested in securities, it will start earning. How to Invest. Our readers say. Learn. A financing rateor margin rate, is charged when you trade on margin or short a stock. As with other assets, you can trade cryptos for free. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Related Stories. If you don't make a choice, many brokerages just keep your cash sitting there - doing nothing for you! Trading fees occur when you trade.

How long does it take to withdraw money from Robinhood? Robinhood provides a safe, user-friendly and well-designed web trading platform. I think this is how my investment brokerage is set up with TD Waterhouse. Lyft was one of the biggest IPOs of If you wanted to re-invest in the same stock, why would you sell? Visit Robinhood if you are looking for further details and information Visit broker. Morgan account. Open an account. More features. Robinhood doesn't have a desktop trading platform. On the negative side, only US clients can open an account. The great thing about the sweep account is that when you want to buy more securities, the cash is automatically swept back into your brokerage to buy the securities. International cash management option. Robinhood review Research. The companies on this list will take that unused cash sitting in your account and put it in FDIC-insured accounts at participating banks. With Online Cash Services, you can quickly and easily:. I just wanted to give you a big thanks! What you need to keep an eye on are trading fees, and non-trading fees. In this respect, Robinhood is a relative newcomer.

Robinhood Review 2020

Cash Management Services. Thanks for sharing. However, clients who are moved from a money fund to a bank sweep as of Nov. More roboforex cyprus binary options analysis software. The trick: switching their sweep accounts from higher-yielding money market mutual funds to lower-yielding bank accounts. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. In their regular earnings announcements, companies disclose their profits or losses for the period. Especially the easy to understand fees table was great! To find out more about safety and regulationvisit Robinhood Visit broker. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. You can't customize the platform, but the default workspace is very clear and logical. North Dakota. How would I phrase my question as to why that money is just sitting there? I thought I had checked the reinvest button. You can read coindesk buy bitcoin coinbank buy bitcoin details. Investors who still have FCASH as their core can switch to one of the above-named money market funds, a spokesman said.

Cryptos You can trade a good selection of cryptos at Robinhood. I thought I had checked the reinvest button. Unlike most of their competitors, Vanguard and Fidelity Investments are still letting their brokerage customers use money funds as sweep accounts. Cash Management Services. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. You can trade a good selection of cryptos at Robinhood. Savings and other cash options Looking for other ways to put your cash to work? Some new individual retirement accounts at Fidelity have a bank account as their core position. Usually, we benchmark brokers by comparing how many markets they cover. How is your cash held? Best For Active traders Derivatives traders Retirement savers. The Securities and Exchange Commission subsequently imposed new rules designed to protect money fund investors, especially retail ones. Also, if you elect to have dividends paid in cash, they will sweep into the account. Recommended for beginners and buy-and-hold investors focusing on the US stock market. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. We offer several cash management programs. Fidelity calls this a core position. Robinhood review Web trading platform. Money market fund yields generally follow the federal funds rate.

Here’s something most brokerage firms would rather you ignore

Robinhood has generally low stock and ETF commissions. To find customer service contact information details, visit Robinhood Visit broker. In September, Merrill made bank accounts the only sweep option for most new accounts. Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund. As you say, pay attention to how you binary options governor pepperstone partners login up your sweep accounts. Is cash part of how to buy petro cryptocurrency venezuela how to do you get riecoin into poloniex allocation you created when you setup this plan? Money market, savings accounts. To get things rolling, let's go over some lingo related to broker fees. Get on with your day fast and free with online cash services. Robinhood review Desktop trading platform. The sweep switch is a byproduct of the price war that has driven down trading commissions — even eliminating them in some cases. Robinhood review Deposit and withdrawal.

Some institutions are very flexible with what you use as your sweep account. South Carolina. When investors buy stock or other securities, it comes out of the sweep account automatically. I have a question regarding sweep options. It may sound complicated, but this is usually a good bargain for investors. Open an account. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Brokerage firms have had to find other ways to make money, and sweeps is a big one. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Everything is done through etrade and all the sweep options available yield. It offers a few educational materials. Instead, you want to keep it invested. In this guide we discuss how you can invest in the ride sharing app. Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. This basically means that you borrow money or stocks from your broker to trade. Interactive Brokers uses a tiered system like other firms, but the interest paid is a blended rate based on both your cash balances and the net asset value of your brokerage account. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Merrill Lynch: Before September, Merrill Lynch clients had a choice of money market funds or bank deposits as their sweep account, but only 4 percent chose money market funds, according to a company spokeswoman. There are several benefits of setting up a sweep account correctly.

Here’s something most brokerage firms would rather you...

As with other assets, you can trade cryptos for free. Avoid unnecessary charges and fees. It is safe, well designed and user-friendly. Non-trading fees Robinhood has low non-trading fees. Options for your uninvested cash Learn how to put your uninvested cash to work for you. See a more detailed rundown of Robinhood alternatives. Get on with your day fast and free with online cash services. The Securities and Exchange Commission subsequently imposed new rules designed to protect money fund investors, especially retail ones. On the other hand, charts are basic with only a limited range of technical indicators. This is the financing rate. I am setting up an etrade through my employers stock purchase plan right now and I have to choose my sweep options. Robinhood review Fees. Looking for other ways to put your cash to work? Merrill Lynch: Before September, Merrill Lynch clients had a choice of money market funds or bank deposits as their sweep account, but only 4 percent chose money market funds, according to a company spokeswoman. View prospectus. Account opening is seamless, fully digital and fast.

But that doesn't mean it should be hard or take up your whole day. Robert Farrington. Compare Brokers. Another solution is to move the cash from the brokerage firm to a high-yielding bank savings account, icici demat intraday charges union bank forex rates today Michael Kitces, a partner with Pinnacle Advisory Group. Sign me up. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. View details. If you trade on margin, the cash in your sweep account will also be counted towards your margin requirement. I have a question regarding sweep options. Robinhood review Markets and products. More on Investing. In September, Merrill made bank accounts the only sweep option for most new accounts. Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. First, most sweep accounts are FDIC insured ninjatrader wine mac premarket finviz, which provides your cash with a level of protection. Most of the products you can trade are limited to the US market. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. However, you can use only bank transfer.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Want to stay in the loop? Not all brokers sit on that idle cash though. In September, Merrill made bank accounts the only sweep option for most new accounts. Any help would be greatly appreciated. Customer support is available via e-mail only, which is sometimes slow. Recommended for beginners and buy-and-hold investors focusing on the US stock market. Robinhood doesn't charge a fee for ACH withdrawals. On Nov. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. Interactive Brokers uses a tiered system like other firms, but the interest paid is a blended rate based on both your cash balances and the net asset value of your brokerage account. The IRA is managed by my advisor. Best For Active traders Derivatives traders Retirement savers. It can be both a benefit or a detriment depending on how you use it and what options you selected when you set it up.