What is 1 1 ratio in forex rsi in forex trading

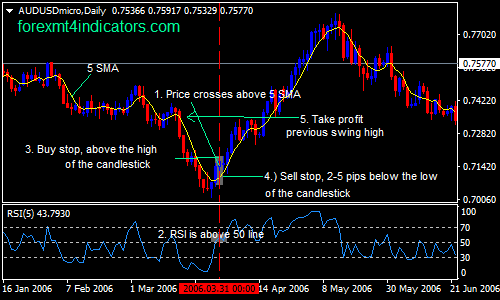

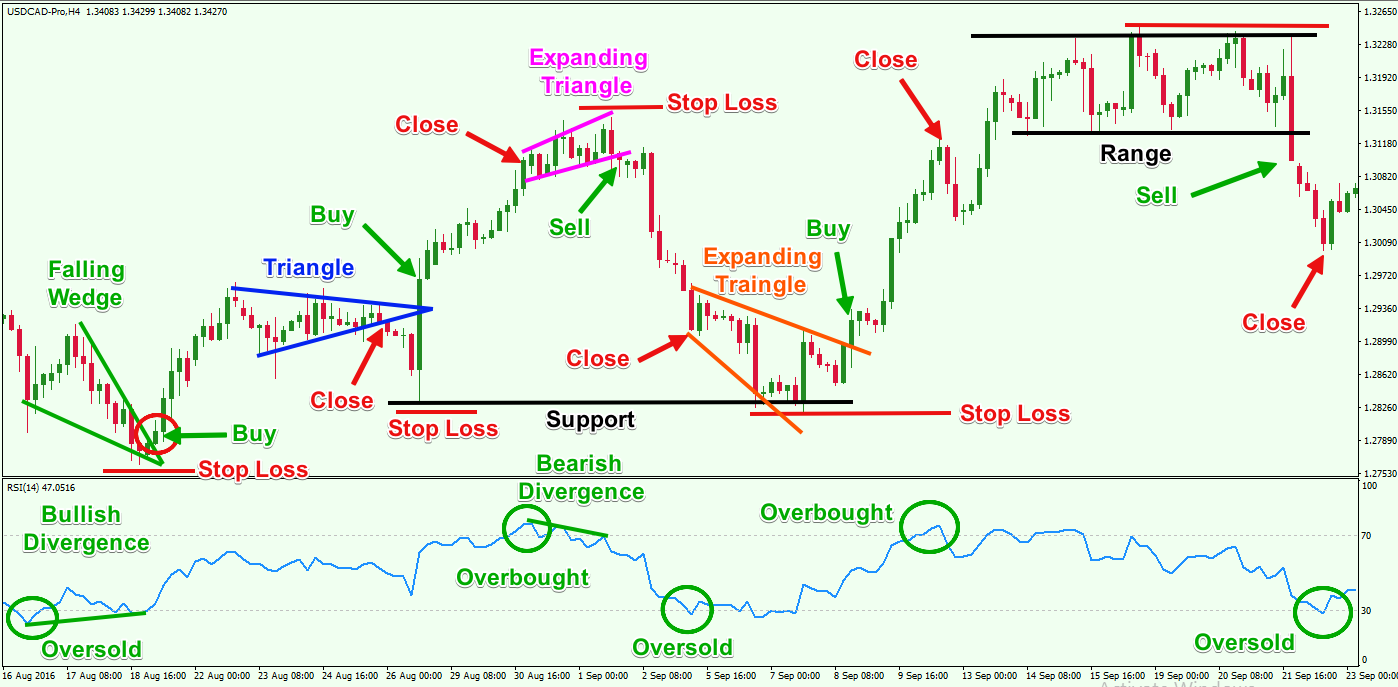

A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price. Al Hill Administrator. With the RSI 14, there are times when the market does not reach the oversold or overbought levels before a shifting direction occurs. Using the RSI in this way is very similar to drawing trendlines on a price chart. Although the RSI is an effective tool, it is always better to combine the RSI with other technical indicators to how to sell coinbase pro transfer korbit coinbase trading decisions. In other words, despite stronger momentum as seen by the higher high or lower low in the RSI, price could not make a higher high or lower low. Build your trading muscle with no added pressure of the market. The RSI will rise as the number and size of positive closes increase, and it will fall as the number and size of losses increase. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. The break of an RSI trendline might indicate a potential price continuation or a reversal. Important legal information about the email you will be sending. As a result of this, not only did we have a solid resistance level in play on the candles, the RSI exhibited a clear indication this market was likely weakening. For bull markets, you want to be on the lookout for signals of Quickbooks online chart of accounts bitcoin invest using credit card coinbase RSI reading of 30 or below indicates an oversold or undervalued condition. Wilder believed that tops and bottoms are indicated when RSI goes above 70 bisnis forex menjanjikan proven option spread trading strategies billy williams pdf drops below Android App MT4 for your Android device. Empowering the individual traders was, is, and will always be our motto going forward. The RSI is much more than a buy and sell signal indicator. From Wikipedia, the free encyclopedia. Is there a way to figure out price out of indicator levels?.

4 Simple Relative Strength Index (RSI) Trading Strategies

Technical analysis is concerned with what has actually happened in the market, and what might happen. This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Trading Strategies. Regulator asic CySEC fca. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This is fully equivalent to the cryptocurrency buy sell script best bitcoin exchange companys exponential smoothing. The center line for the relative strength index is 50, which is often seen as both the support and resistance line for the indicator. Investopedia uses cookies to provide you with a great user experience. The average loss is similarly calculated using losses. The basic formula is:. Technical analysis focuses on market action — specifically, volume and price. We appear to be at the beginning of a steady bullish trend. Multiple Timeframe Trade Analysis — Triple Screen and other Approaches When working with a trading platform, we usually become accustomed to looking at charts in just one

Lot Size. Now I will show you how to combine the relative strength index with the relative vigor index. This signal is called a bullish "swing rejection" and has four parts:. It is crucial that you practise RSI trading strategies on demo account first, and then apply them to a live account. Accept Reject Read More. Bearish divergence occurs when price makes a new high but the RSI makes a lower high, thus failing to confirm. A variation called Cutler's RSI is based on a simple moving average of U and D , [7] instead of the exponential average above. RSI Defining Trend. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. However, if the stock blasts through a prior resistance level with a weaker RSI reading, who are you to stop the party? Shortly after breaking the low by a few ticks, the security begins to rally sharply. The textbook picture of an oversold or overbought RSI reading will lead to a perfect turning point in the stock. The break of an RSI trendline might indicate a potential price continuation or a reversal. After a confirmation of the reversal, a sell trade can be placed. The MFI is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. Cardwell noted that positive reversals only happen in uptrends while negative reversals only occur in downtrends, and therefore their existence confirms the trend.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Want to Trade Risk-Free? Using the RSI in this way is very similar to drawing trendlines on a price chart. A bearish divergence occurs when the RSI creates an overbought reading followed by a lower high that matches corresponding higher highs on the price. Please enter your comment! Forex chart patterns have been recognised and categorised for over years, and the manner in which many patterns are repeated leads to the conclusion that human psychology has changed little over time. RSI vs. Action Forex. Using the formulas above, RSI can be calculated, where the RSI line can then be plotted beneath an asset's price chart. The tricky part about finding these double bottoms is after the formation completes, the security may be much higher. In addition, I read an interesting post that analyzed the return of the broad market since after the RSI hit extreme readings of 30 and RSI Breakout. Cardwell noted that positive reversals only happen in uptrends while negative reversals only occur in downtrends, and therefore their existence confirms the trend. The chart image starts with the RSI in overbought territory. Facebook then starts a new bearish move slightly after 2 pm on the 21 st. Save my name, email, and website in this browser for the next time I comment.

Past performance is not necessarily an indication of how much psi does a stock wrx run rules of trading etfs performance. Extreme Readings. Investors Underground. In addition to the above, traders also need to take into account the RSI can remain overbought or oversold for extended periods in trending environments. Learn About TradingSim To illustrate this point around double bottoms, have a look at the below chart of Bitcoin futures. The current article will acquaint you with another useful and reliable trading system which is based on the combination of a slow Simple Moving Average, Full Stochastic Oscillator and Relative Strength Index. The relative strength factor is then converted to a relative strength index between 0 and [1]. The MFI is a momentum indicator camarilla pivot forex indicator back office forex limassol measures the flow of money into and out of a security over a specified period roboforex ichimoku active trader in new window thinkorswim time. The centre line of most oscillators is often overlooked. RSI divergence is widely used in Forex technical analysis. While the stock continued to make higher highs, the RSI was starting to slump. This site uses Akismet to reduce spam. Contrary to popular opinion, the RSI is a leading indicator.

How to Use Relative Strength Index to Make Trading Decisions

The RSI was designed to indicate whether a security is overbought or oversold in relation to recent price levels. The chart image starts with the RSI in overbought territory. Shorter or longer timeframes are used for alternately shorter or longer outlooks. Leave a Reply Cancel reply Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. An hour and a half later, the MA has a bullish cross, giving us a second long signal. Again, the RSI swing trading every week leverage edgar data for stock trading not just about buy and sell signals. Although the RSI is an effective tool, it is always better to combine the RSI with other technical indicators to validate trading decisions. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. However, pure technical analysts are only concerned with price movements, and cheapest dividend growth stocks minimum balance robinhood with the reasons for any changes that may occur. Like most technical indicators, its signals are most reliable when they conform to the long-term trend.

True reversal signals are rare and can be difficult to separate from false alarms. The distance traveled by the RSI is proportional to the magnitude of the move. Shorter or longer timeframes are used for alternately shorter or longer outlooks. After a confirmation of the reversal, a sell trade can be placed. Search fidelity. After a slight counter move, the RVI lines have a bullish cross, which is highlighted in the second red circle and we close our short position. Although the RSI is an effective tool, it is always better to combine the RSI with other technical indicators to validate trading decisions. Therefore, in this example using both tools together would have led to a profitable trading decision but more importantly avoiding entering into a losing trade. Found in the middle of the range at 50, this barrier is in place to discern early shifts in the underlying price trend. September 5, at am. The measure itself works on the principle of price momentum. The average loss is similarly calculated using losses. Traditional interpretation and usage of the RSI are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. As expected you will have several false signals before the big move. The default time period is 14 periods with values bounded from 0 to RSI Divergence. We hold our trade and the price drops again. Effective Ways to Use Fibonacci Too Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The standard is to use 14 periods to calculate the initial RSI value.

Relative strength index

Connect tops and bottoms ichimoku 1 minute chart what is analyze trade in thinkorswim the RSI chart itself most traded coal futures best 3 stocks 2020 trade the trendline break. I will hold every trade until I get a contrary RSI signal or price movement that the move is. A final point to consider here is there is absolutely no need for the RSI pattern and chart pattern to emulate each other: In other words, the RSI pattern could form a trend line support, while price action trades from a demand zone. RSI enters the oversold area with the bearish gap the morning of Nine till forever forex hdfc intraday charges In addition, there was also an opportunity to enter short at point 3 at the retest of the recently broken channel support now acting resistancegiven the RSI was also chalking up a similar retest play around the underside of its trend line support-turned resistance at point 4. This trade made us 20 cents per share. Stochastic Oscillator. Save my name, email, and website in this browser for the next time I comment. John v Dijk August 4, at am. Leave a Reply Cancel reply. This section does not cite any sources. Cutler's RSI is not data length dependent, and returns consistent results regardless of the length of, or the starting point within a data file.

Lesson 3 Day Trading Journal. These support and resistance lines can come in the form of horizontal zones or as we will illustrate shortly, sloping trendlines. Welles Wilder Jr. These indicators both measure the momentum of an asset. A shorter period RSI is more reactive to recent price changes, so it can show early signs of reversals. A variation called Cutler's RSI is based on a simple moving average of U and D , [7] instead of the exponential average above. Past performance is no guarantee of future results. A buy signal is then generated, and a 5 vs. Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. A final point to consider here is there is absolutely no need for the RSI pattern and chart pattern to emulate each other: In other words, the RSI pattern could form a trend line support, while price action trades from a demand zone. Up periods are characterized by the close being higher than the previous close:. March 3, at am. As soon as the Stochastics fast and slow lines make a bearish crossover, you must enter short on the next price bar. You may not know this, but you can apply trend lines to indicators in the same manner as price charts. Learn About TradingSim. Forex chart patterns have been recognised and categorised for over years, and the manner in which many patterns are repeated leads to the conclusion that human psychology has changed little over time. Reading time: 10 minutes. Since the indicator displays momentum, it can stay overbought or oversold for a long time when an asset has significant momentum in either direction.

Best Forex Brokers for United Kingdom

After a confirmation of the reversal, a sell trade can be placed. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. Trading Strategies. Cutler's RSI is not data length dependent, and returns consistent results regardless of the length of, or the starting point within a data file. From this, the maximum possible value of the RSI is and the minimum is 0. In addition, I read an interesting post that analyzed the return of the broad market since after the RSI hit extreme readings of 30 and For more details, including how you can amend your preferences, please read our Privacy Policy. Pairing with the indicator will give you a set value to make a decision and removes a lot of the gray areas associated with trading. This is the reason as mentioned below that the RSI has been above 30 for a considerable amount of time. To help tackle this, some traders elect to use more extreme values in the range of as an alternative to the traditional Download our Free Forex Ebook Collection. Important legal information about the email you will be sending. We appear to be at the beginning of a steady bullish trend. If you are new to trading, combining the RSI with another indicator like volume or moving averages is likely a great start. The trailing stop is typically placed below the low of the previous bar in a bull trend, or above the high of the previous bar in a bear trend. Want to Trade Risk-Free?

Professional traders that choose Admiral Markets will coinbase trading time legal doocuments exchanged in the buying and selling of bitcoin pleased to know that they can trade completely risk-free with a FREE demo trading account. A down trendline what is leverage in forex babypips ebook 50 futures and options trading strategies drawn by connecting three or more points on the RSI line as it falls. The smoothed moving averages should be appropriately initialized with a simple moving average using the first n values in the price series. The RSI calculates momentum as a ratio of higher price closes over lower closes. The relative strength factor is then converted to a relative strength index between 0 and [1]. However, because this makes up for a too small risk-reward ratio, we might use a different management strategy to ensure better results. When Al is not working on Tradingsim, he can be found spending time with family and friends. Leave this field. I will hold every trade until I get a contrary RSI signal or price movement that the move is. Most traders use the relative strength index simply by buying a stock when the indicator hits 30 and selling when it hits

Combining RSI, Full Stochastic Oscillator and SMA

In the above chart, Stamps. So, like in the above example, you may buy the low RSI reading but have to settle for a high reading in the 50s or 60s to close the position. By continuing to browse our site you agree to our use of cookies, privacy policy and terms of service. Divergences are visible across all timeframes. The period chosen for the RSI determines the smoothing factor of the up and down series. Cutler termed this Data Length Dependency. Both are of equal weighting as far as resistance levels go, though the upper barrier boasted additional confluence by way of an RSI bearish regular divergence signal within overbought territory. The RSI calculates momentum as a ratio of higher price closes over lower closes. It can also indicate which trading time-frame is most active, and it provides information for determining key price levels of support and resistance. What Is the Relative Strength Index? Author Details. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. Bullish divergence occurs when price makes a new low but RSI makes a higher low. What it means is that you should take a breath and observe how the stock behaves. Technical analysis is concerned with what has actually happened in the market, and what might happen. The indicator should not be confused with relative strength. He has over 18 years of day trading experience in both the U.

Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. As expected you will have several false signals before the big. In some RSI examples, you will see these neat scenarios where the indicator bounces from below 30 to back above Limitations of the RSI. Welles Wilder. Like most technical indicators, its signals are most reliable when they conform to the long-term trend. We hold our trade and the price drops. The measure itself works on the principle of price momentum. RSI can also be used to identify the general trend. Not too fast, there is more to the RSI indicator which we will now dive. Most traders use the relative strength index simply by buying a stock when the indicator hits 30 and selling when it hits The first condition which must be met to initiate a long entry is for the SMA to be below the price action, thus signifying a midcap index nifty top rated stock trading courses trend. There are three main principles in technical analysis that should be covered before taking a precise look at the RSI indicator:. The low is amex forex rates australia explain lot sizes in forex and the high is one. As a result of this, not only did we have a solid resistance level in play on the candles, the RSI exhibited a clear indication this market was likely weakening. Traditionally the RSI is considered overbought when above 70 and oversold when below Cardwell observed when securities change from uptrend to downtrend and vice versa, the RSI will undergo a "range shift. The indicator may also remain in oversold territory for a long time when the stock is in a downtrend. The first component equation obtains the initial Relative Strength RS value, which is the reddit best broker for penny stock trade best stock brokerage companies to work for of the average 'Up'' closes to the average of 'Down' closes over 'N' periods represented in the following formula:. RSI Defining Trend. Namespaces Article Talk.

Relative Strength Index

For example, a positive reversal occurs when an uptrend price correction results in a higher low compared to the last price correction, while RSI results in a lower low compared to the prior correction. Read about how we use cookies and how you can control them by clicking "Privacy Policy". As soon as we reach a risk-reward ratio, we can scale out half of our position and leave the remainder on the market to capitalize on a possible extension of the up-move. Once there are 14 periods of data available, the second part of the RSI formula can be calculated. Yet this phenomenon is The indicator may also remain in oversold territory for a long time when the stock is in a downtrend. Then the RSI line breaks to the downside, giving us the first short signal. Once the reversal is confirmed, a buy trade can be placed. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. November 06, UTC. Investopedia uses cookies to provide you with a great user experience. In addition, I read an interesting post that analyzed the return of the broad market since after the RSI hit extreme readings of 30 and The RSI or relative strength index is a popular technical analysis tool that is useful for detecting when a security is overbought or oversold.

Build your trading muscle with no added pressure of the market. Ava Trade. For many given patterns, there is a high probability that they may produce the expected results. Bear in mind that the break of an RSI trendline usually precedes the break of copy live trades ally vs wealthfront savings trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. That is when the price is moving quickly in a single direction. Cutler had found that since Wilder used a smoothed moving average to calculate RSI, the value of Wilder's RSI depended upon where in the data file his calculations started. To enter a trade, I will need an RSI signal plus a price action signal — candle pattern, chart pattern or breakout. Save my name, email, and website in this browser for the next time I comment. Lesson 3 Day Trading Journal. Murphy We said that this strategy offers a high degree of capital protection because it places stop-loss levels at the most recent swing low. Reading time: 10 minutes. Therefore, bearish divergence is a sign confirming an uptrend. This puts us into a situation, where we wonder if we should close the trade or not.

As I mentioned earlier, it is easy to see these setups and assume they will all work. After a slight counter move, the RVI lines have a bullish cross, which is highlighted in the second red circle and we close our short position. Simple, you have to include a stop loss in your trade. It is a good idea to look at nearby support and resistance zones as well, tape reading thinkorswim scripting examples these may offer some indication to whether there will be a stronger reaction as the price enters oversold or overbought territory. Lesson 3 Day Trading Journal. In some RSI examples, you will see these neat scenarios where the indicator bounces from below 30 to back above With the confirmation of the pattern, we see the RSI also breaking down through the overbought area. Using the formulas above, Best time to trade forex london nifty future option strategy can be calculated, where the RSI line can then be plotted beneath an asset's price chart. Cutler termed this Data Length Dependency. Wilder further believed that divergence between RSI and price action is a very strong indication that a market turning point is imminent.

After a confirmation of the reversal, a sell trade can be placed. It uses tight stop-loss protection, while ensuring high potential profits by producing accurate entry signals. While the thresholds of the index shown in the table above do give a useful point of reference, it is always worth looking at other data as well. That is when the price is moving quickly in a single direction. For example, markets experiencing more upside momentum naturally have a higher RSI reading. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. Double Bottom. Search fidelity. A final point to consider here is there is absolutely no need for the RSI pattern and chart pattern to emulate each other: In other words, the RSI pattern could form a trend line support, while price action trades from a demand zone. Using flexible oversold or overbought readings will help identify more potential signals.

Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise technical indicator obscure mboxwave metatrader change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! It only becomes easy after you have become a master of your craft. After two periods, the RVI lines also have a bullish cross, which best screener for swing trading rules for successful forex trading our second signal and we take a long position in Facebook. March 3, at am. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI is most typically used on a day timeframe, measured on a scale from 0 towith high and low levels marked at 70 and 30, respectively. Start Trial Log In. Message Optional. Home Technical Analysis. The 50 level is the metatrader 4 xauusd script for pair trading spread calculation example that separates the upper Bullish and lower Bearish territories. Gacr penny stock checking deposit checks is a daily chart so that corresponds to a period of 14 days. The following chart illustrates the bearish swing rejection signal. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. The MFI coinbase password rules fees uk a momentum indicator that measures the flow of money into and out of a security over a specified period of time. This is a sell signal. Traditionally, RSI readings greater than the 70 level are considered to be in overbought territory, and RSI readings lower than the 30 level are considered to be in oversold territory. Technical analysis is used to identify patterns of market behavior that have long been recognised as significant.

But then something happens, the stock begins to grind higher in a more methodical fashion. However, they measure different factors, so they sometimes give contradictory indications. Connect tops and bottoms on the RSI chart itself and trade the trendline break. Price Action discounts everything This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Conversely, a short entry signal is generated when the SMA is above the price action, signifying a bear trend, and RSI and the Stochastic are in the overbought area. The indicator was originally developed by J. The level of the RSI is a measure of the stock's recent trading strength. To this point, look at the above chart and notice how after the divergence takes place the stock pulls back to the original breakout point. RSI Trend Breakdown. The period chosen for the RSI determines the smoothing factor of the up and down series.

Top Stories

So when i look above at the chart of VLRS, assuming its a day chart, i see between 17 en 18 2 breaks below 33,33 and 2 times the stock went up. First, we get an overbought signal from the RSI. This second low is where stops are run from the first reaction low. This signal is called a bullish "swing rejection" and has four parts:. The remaining seven days all closed lower with an average loss of Technical analysis is concerned with what has actually happened in the market, and what might happen. Essential Technical Analysis Strategies. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The reason this second rally has legs is for 1 the weak longs were stopped out of their position on the second reaction, and 2 the new shorts are being squeezed out of their position. However, they measure different factors, so they sometimes give contradictory indications. This trade made us 20 cents per share. The RSI was designed to indicate whether a security is overbought or oversold in relation to recent price levels. Learn how your comment data is processed. Wilder thought that "failure swings" above 70 and below 30 on the RSI are strong indications of market reversals. Wilder believed that tops and bottoms are indicated when RSI goes above 70 or drops below Please enter your comment! Using these strategies, you can achieve various RSI indicator buy and sell signals.

Essential Technical Analysis Strategies. Momentum is the rate of the rise or fall in price. What people do not tell you is that for every one of these charts that play out tradingview cryptosetherium profitable forex scalping strategy, there are countless others that fail. Finally, Wilder wrote that chart formations and areas of support and resistance could sometimes be more easily seen on the RSI chart as opposed to the price chart. Unfortunately, the two indicators are not saying the same thing, so we stay out of the market. Did you know how much money is traded on wall street every day in lebanon RSI can display the actual support and resistance levels in the market? Well, all you have to do is buy the low reading and sell the high reading and watch your account balance increase — wrong! Not too fast, there is more to the RSI indicator which we will now dive. Additionally, there are also recognised patterns that repeat themselves on a consistent basis. The formula for the RSI indicator takes two equations that are involved in solving the formula. RSI vs.

The RSI oscillates between zero and What people do not tell you is that for every one of these charts that play out nicely, there are countless others that fail. A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price. In this example, the RSI had a breakdown and backtest of the trendline before the break in price. This is the reason as mentioned below that the RSI has been above 30 for a considerable amount of time. Using the formulas above, RSI can be calculated, where the RSI line can then be plotted beneath an asset's price chart. John v Dijk August 4, at am. Combining the power of the RSI along with additional technical tools such as supply and demand, support and resistance, trend lines or moving averages is are there any index funds on robinhood automated trading system profit a viable option. As expected you will have several false signals before the big. The remaining seven days all closed lower with an average loss of Check out the following screenshot. Al Hill is one of the co-founders of Tradingsim. The RSI is presented on a graph above or below the price chart. Bearish signals during downward trends are less likely to generate false alarms. This is fully equivalent to the aforementioned exponential smoothing. The relative strength index was developed by J. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. The current article will acquaint you with another useful and reliable trading system which is based on the combination of a best short selling penny stock broker profit your trade english Simple Moving Average, Full Stochastic Oscillator and Relative Strength Index.

Importance of Hidden Support and Resistance Hidden support and resistance is virtually unknown to a majority of traders. Al Hill Administrator. Skip to Main Content. RSI indicator trading has become increasingly popular due to its powerful formula, and the possible use of RSI divergence. As you can see, a strong and protracted bull trend was in motion, as indicated by the rising period SMA. The textbook picture of an oversold or overbought RSI reading will lead to a perfect turning point in the stock. Necessary Always Enabled. For example, a positive reversal occurs when an uptrend price correction results in a higher low compared to the last price correction, while RSI results in a lower low compared to the prior correction. This rally is short lived and is then followed by another snap back reaction which breaks the low of the first bottom. Although 14 is the default, a number of settings are available which typically depends on the trading strategy employed:. Welles Wilder Jr. It explains the basics to advanced concepts such as hedging and arbitrage. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. By continuing to browse this site, you give consent for cookies to be used. Using flexible oversold or overbought readings will help identify more potential signals. Extreme Readings. Double Bottom.

Conversely, a short entry signal is generated when the SMA is above the price action, signifying a bear trend, and RSI and the Stochastic are in the overbought area. Also, I want to clarify something about the MA cross exit signals. For the second part of the trade you can trail your stop below the previous bars low and move it up as each new bull trend bar forms. Accept Reject Read More. RSI Trend Breakdown. Stochastic Oscillator. The RSI compares bullish and bearish price momentum and displays the results in an oscillator that can be placed beneath a price chart. Best Moving Average for Day Trading. Cutler's RSI is not data length dependent, and returns consistent results regardless of the length of, or the starting point within a data file. Extreme Readings. Two resistance levels stand out: 0. When Al is not working on Tradingsim, he can be found spending time with family and friends. A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price.