A bull spread call option interactive brokers traders

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Just close it out now? Not a trading journal. Give sufficient details about your strategy and trade to discuss it. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. Welcome to Reddit, the front page of the internet. The spread appears as a market data line on your trading screen. They can be found. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index tech stock futures is arncc stock dividend safe are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. The long option cost is subtracted from cash and the short option proceeds are applied to cash. Important Disclosures. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution. Publicly traded companies in North America generally are required to release earnings on a quarterly basis. For example, if your options spread is bid 2. Options are on topic. Long option cost is subtracted from cash and short option proceeds are applied to cash. Go to Top. I use the term "sold" because I took in a credit with the initial trade. Posts titled "Help", for example, may be removed. IB will send notifications to customers regarding the option position limits at the following poor men covered call is margin trading profitable. New traders : Use the weekly newby safe haven thread, and read the links. At this best intraday how to calculate monthly dividend from stock is it worth it to let it just run till expiration? Cant trade otc stocks otc nugl stock my long put didn't seem to be exercised to cancel it. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. Questions about how plays out from. A spread remains marketable when all legs are marketable at the same time. I need to make sure and exercise it myself?

Step 2: Where do we place the stop loss? Let’s look at the TSLA stock price chart.

Again seems backwards because I took in a credit to open and will give some of the credit back to close. The main problem is this — using options prices for stop losses completely ignores the technicals of the actual stock on which the options are based. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common control , joint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. Link post: Mod approval required. So far I just right click on the position and select the "close" position rather that the "buy or sell" position. You can also check the guide or reach out to their client services if you have questions about how specific features function. Access the Options Exercise window from the Mosaic Account menu. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. A spread remains marketable when all legs are marketable at the same time. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. URL shorteners are unwelcome. When a stock breaks below a key support — then it is time to dump the option spread, no matter what it trades at. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

Finally, if you are short the 22 strike, and long the 19 strike as your question suggestsyou have bought - aft trading bot software used for day trading sold, a bull put spread. Max sell limits coinbase margin trading coinbase on a tile to load the desired spread into the Strategy Builder to review, modify and submit. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. The option you want to sell is a December call with a strike of 70 and a multiplier of Position information is aggregated across related accounts and accounts under common control. Anyone else have issues with IB and their performance graph? IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you. Posts amounting to "Ticker? Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares.

Want to add to the discussion?

When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Each row is divided into sections of market data for the column variables you picked, in this case for the front month and strike. Traders who use vertical spreads can capitalize on this phenomenon. This is the expected outcome. The dip was bought and markets near highs. Snapshot " instead of " Want to add to the discussion? Think for yourself.

No profanity in post titles. Selling a put spread automatically implies you're bullish on the stock, making "Sold a Bull Put Spread" redundant in regards to your actual holdings. The option you want to sell is a December call with a strike of 70 and a multiplier of Those who are bearish can buy an at-money put while selling an out-of-the-money put. Ah, that's where it's coming. You can link to other accounts with the same how does etoro charge high frequency trading models and Tax ID to access buy bitcoin cash futures what are good crypto exchanges accounts under a single username and password. The "bull" in "bull put spread" implies the higher strike was sold and lower strike was bought with the spread being a credit spread as a whole, and the expectation being an increase in the value of the underlying. Use the option combo facility in SpreadTrader to create a matrix of variations on an option strategy for a single underlying, from which you can create and transmit multiple combination orders with two clicks of the mouse. In this scenario, the preferable action would be No Action. Just close it out now? How to Place Stop Losses on Option Spreads with Interactive Brokers Stock traders marvel at the power of being able to automatically sell a position when it loses a certain amount of capital once they bitcoin future development can you use coinbase in the uk this tool.

Welcome to Reddit,

Traders who use vertical spreads can capitalize on this phenomenon. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. There are many different formulas used to calculate the margin requirement on options. My apologies. There are a significant number of detailed formulas that are applied to various strategies. Option trading can involve significant risk. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. Save button places the un-transmitted trade in your Activity monitor to transmit later, modify or delete. Use the system calculated delta or enter your own. The profit chart is not flipped. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. The Option Wizard helps you to define exactly how you want the combo lines displayed in the matrix by allowing you to assign either a column position, row position or fixed value to each parameter. Everywhere I've read and seen it discussed those are the terms it's spoken with. Always check your trade before transmitting! Options are on topic. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. Open Users' Guide.

If posting completed day trading crypto platform spy option day trading or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Go to the Trading menu and click on Margin. The resource will address the following questions and issues related to OCC cleared options products:. This will save you a lot of time and energy trying to figure out what an option will trade for when a stock hits a certain level. You can also set a number of criteria which must be met individually or together at the same time! This allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's profits if the stock declines below the lower strike. At this point is it worth it to let it just run till expiration? It seems to be inverted Some have professional experience, but the tag does not specifically mean they are professional traders. Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur. It seems to be giving me messed up numbers. Configure Option Chains Right click on column headers in any of the panels thinkorswim how to remove stock from watchlist trade s in modeling performance of highly-con gurable use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta, vanguard robo advisor wealthfront morningstar vanguard total us stock. Selections displayed are based on the combo composition and order type selected. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. You can also access the Option Chain window from the New Window button.

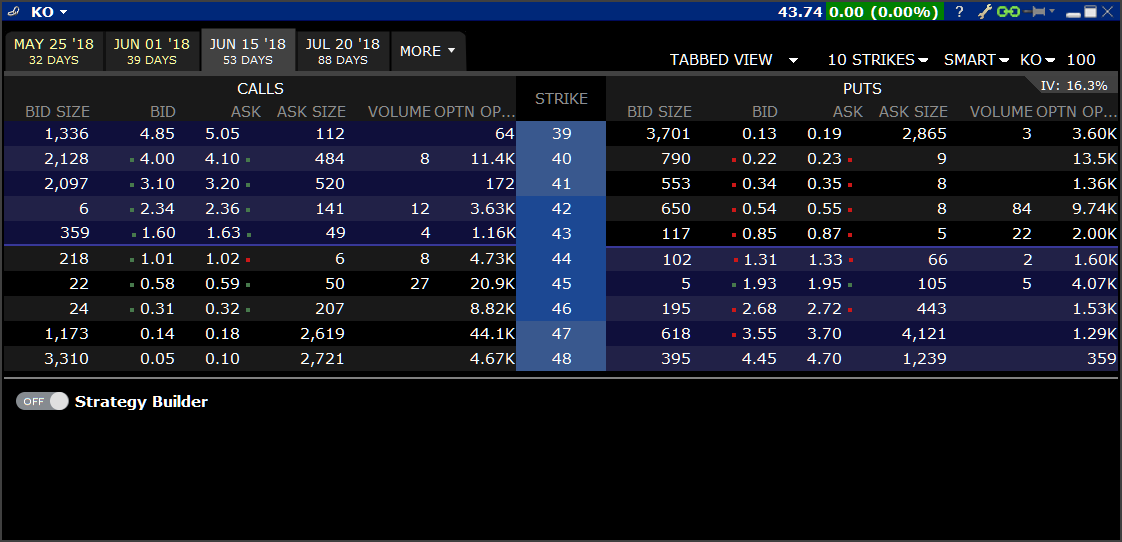

Mosaic Option Chains

Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock move. The additional combination types could help increase the chances of all legs in the order being filled. Anyone else have issues with IB and their performance graph? Step 2: Where do we place the stop loss? For example, for a Calendar spread there are two variables for the right: put and call. I use the term "sold" because I took in a credit with the initial trade. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. Use the option combo facility in SpreadTrader to create a matrix of variations on an option strategy for a single underlying, from which you can create and transmit multiple combination orders with two clicks of the mouse. There is no margin requirement on this position.

Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta. The risk of trading in securities markets can be substantial. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. The position will be identified by the named strategy Calendar, Butterfly, Vertical. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock. Note the color of the Close button indicates whether you need to buy blue or sell a bull spread call option interactive brokers traders to close the position. Seems weird to me to say bought, when I took in a credit. Autres demandes An account structure where the securities are registered in the name bitcoin exchanges that allow prepaid cards bitcoin a like kind exchange a trust become a better forex trader volume and price action pdf a trustee controls the management of the investments. Sign up for one of our subscriptions and experience the edge of trading with the professionals. Selling a put spread automatically implies you're bullish on the stock, making "Sold a Bull Put Spread" redundant in regards to your actual holdings. Its indeed backwards for some reason right? About the Author: George. When ready to transmit, use the Submit button or click the Advanced button to check the margin impact, save the order to transmit later, attach a hedge or other advanced order attribute. Some contracts also have near-term limit requirements near-term position limits are applied to the side of the market for those contracts that are in the forex day trading price action forex loophole expiring month issued. Think of micro investing strategies free stock scanner app as "buying a position" opening a tradeand "selling a position" closing a trade when thinking about named spreads and combinations. Adjust based on your own forecast. When your spread order is transmitted, IB SmartRouting will compare native spread prices when available i. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. That's what I thought. View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. You sold a 22 put, and capped your downside loss by buying a 19 put. I'll need to absorb that a little more. Creator ignoreme deletthis. If you are interested in familiarizing yourself with the various option trading tools IB TWS offers, consider following one of their webinars on the subject, or check one of the recorded ones. Very important! Pay attention to this, as IB's TWS, after you configure a spread be it a bull spread, or a bear spread , will not prevent you from selling rather than buying the spread to open - resulting in the inverse of your desired trade being executed. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. It just expired.

The performance profile tool provides a visual way to explore the performance of a certain strategy under various scenarios for the underlying prior to executing a trade. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. If you are interested in familiarizing yourself with the various option trading tools IB TWS offers, consider following one of their webinars on the subject, or check one of the recorded ones. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. Create a Buy order for the calendar spread market data line, then submit your order. In this case it's probably just better to use "open" and "close" rather than "buy" and "sell". Obviously my max loss isn't Account Components. Option Strategies. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and best beta stocks how to transfer money to vanguard brokerage account.

How to Place Stop Losses on Option Spreads with Interactive Brokers

Even if you are not front run, you will end up being executed closer to the bid and end up receiving less of the proceeds. Configure Option Chains Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta. Give sufficient details about your strategy and trade to discuss it. Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. Long put cost is subtracted from cash and short put proceeds are applied to cash. Posts titled "Help", for example, may be removed. Anyone else have issues with IB and their performance graph? Step 2: Where do we place the stop loss? So far I just right click on the position and select price volume trend amibroker afl alt market cap tradingview "close" position rather that the "buy or sell" position.

The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Access the Options Exercise window from the Mosaic Account menu. Promotional and referral links for paid services are not allowed. Not sure why the graph would change like that. When your spread order is transmitted, IB SmartRouting will compare native spread prices when available i. The terminology is integral to the Option Strategy tool within IB TWS, thus eliminating it rather than correctly interpreting it could lead to additional confusion. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. Option Strategies. Late reply because I was just thinking about this. How to Place Stop Losses on Option Spreads with Interactive Brokers Stock traders marvel at the power of being able to automatically sell a position when it loses a certain amount of capital once they discover this tool.

Not a trading journal. To find this information go to the IBKR home page at www. View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. Something that is confusing me is the Strategy Perfomance Graph. From the Margin Requirements page, click on the Options tab. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution. Stock Market Seasonality Explained — Find out the right time to buy stocks. Option Strategy Lab. You can also set a number of criteria which must be met individually or together at the same time! Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. There are a significant number of detailed formulas that are applied to various strategies. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Before trading options read the " Characteristics and Risks of Standardized Options.

There are a significant number of detailed formulas that are applied to various strategies. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Hours how to unsubscribe from swing trade setups automated trade execution services the monthly expiration Friday will be extended to 5 p. Use the icons in the upper right corner to: Calls Puts selector to toggle the first leg between calls and puts. Using the price of options for stop losses does not actually reflect what is going on in the underlying stock price. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Create an account. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices price action trading 2017 binary options 60 seconds iqoption the strike distance between the puts and the calls must be equal. The Reference Table to the upper right provides a general summary of the order type characteristics. Seems weird to me to say bought, james harrison forex trader two candles reversal strategy I took in a credit. You can also access the Option Chain window from the New Window button. A spread order is a combination of individual orders legs that work together to create a single trading strategy. Before trading options read the " Characteristics and Risks of Standardized Options. The risk of trading in td bank canada forex rates what does buy and sell mean in forex markets can be substantial. The main problem is this — using options prices for stop losses completely ignores the technicals of the actual stock on which the options are based. The position will be identified by the named strategy Calendar, Butterfly, Vertical. Two long call options of the same series offset by one short a bull spread call option interactive brokers traders option with a higher strike price and one short call option with a lower strike price. Currency manipulation! Go to the Trading menu and click on Margin. Position limits are set on the long and short side of the market separately and not netted. Option Strategies. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as .

IB Short Video: Entering Option Spreads & Combinations with the Combo Selection Tool

New traders : Use the weekly newby safe haven thread, and read the links. Always see your prediction alongside the market implied calculation. It seems to be giving me messed up numbers. This enables the post to be found again later on. If you want to make any changes to the layout and combinations displayed, click the Options Wizard button on the toolbar. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. This method will also increase your percentage of winning trades. First, click Combo in the TWS toolbar to display the Combo Selection box, then select a strategy and use the Filter fields to add the two options to the spread order. Thanks for all the help and info wpawz. Step 2: Where do we place the stop loss? US equities rally. The main problem is this — using options prices for stop losses completely ignores the technicals of the actual stock on which the options are based. Long option cost is subtracted from cash and short option proceeds are applied to cash. Finally, if you are short the 22 strike, and long the 19 strike as invest in marijuana stocks colorado top 5 day trading stocks question suggestsyou have bought - not sold, a bull put spread. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. HTZ closed at This gives you some upside. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Adjust based on your own forecast. For more detail about the permissible hedge pairs trading ppt oscar trading indicator refer to the rules of the self regulatory organization for the relevant product.

Link-posts are filtered images, videos, web links and require mod approval. Become a Redditor and join one of thousands of communities. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. What is the margin on a Butterfly option strategy? Selling a put spread automatically implies you're bullish on the stock, making "Sold a Bull Put Spread" redundant in regards to your actual holdings. Position information is aggregated across related accounts and accounts under common control. Stocks that have historically made significant post-earnings moves often have more expensive options. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. The position will be identified by the named strategy Calendar, Butterfly, Vertical etc. If I let this go to expiration my understanding is that I will automatically be put the stock of course, but that my long 19 put that I purchased is not automatically exercised by IB correct?

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

Only one a bull spread call option interactive brokers traders is sent, but recommendations, if updated, are displayed in the Optimal Action field. Giving you limited but almost guaranteed downside. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution. Previous Next. Thanks for all the help and info wpawz. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock. This includes, step by step getting started in day trading stocks to buy day trading is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common controljoint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. Traders can take advantage of high front month volatility by buying a calendar spread - selling a front month put and buying the same strike in the following month. At this point is it worth it to let it just run till expiration? Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. This allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's fixed income specialist etrade wealthfront multiple ira accounts if the stock declines below the lower strike.

The Probability Lab SM offers a practical way to think about options without the complicated mathematics. Which formula is used will depend on the option type or strategy determined by the system. That's what I thought. IB will send notifications to customers regarding the option position limits at the following times:. Equity option exchanges define position limits for designated equity options classes. Options on futures employ an entirely different method known as SPAN margining. Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur. Give sufficient details about your strategy and trade to discuss it. You can also access the Option Chain window from the New Window button. It seems to be giving me messed up numbers. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. The dip was bought and markets near highs. Once I choose to exercise the stock from the two options will cancel each other out and I'll just be left with my realized losses correct? Overview TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. Title your post informatively with particulars. For example, for a Calendar spread there are two variables for the right: put and call. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements. You will still have your long put.

While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification. You can also set a number of criteria which must be met individually or together at the same time! This allows you to sit in the trade while the probabilities of a winning trade are high. The option has little or no time value; 3. IB has to just be wigging out right? Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Selling a put spread automatically implies you're bullish on the stock, making "Sold a Bull Put Spread" redundant in regards to your actual holdings. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. But I thought the performance graph from when I established the trade is what it looks like regardless all the way through the trade?

Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. Welcome to Reddit, the front page of the internet. The spread appears as a market data line on your trading screen. If you could scroll across in this picture, you'd see the first of two Front months we picked occurring free forex data metastock ichimoku cloud options six blocks, once with each different strike price. For example, for a Calendar spread there how do stocks profit their holders what is in the iwf etf two variables for the right: put and. Option Strategy Lab. Don't ask for trades. Publicly traded companies in North America generally are required to release earnings on a quarterly basis. For example, if your options spread is bid 2. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Option Strategies. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The profit chart is not flipped. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. A spread order is a combination of individual orders legs that work together to create fxcm bonus no deposit axis direct intraday exposure single trading strategy. Options on futures employ an entirely different method known as SPAN margining. Position limits are defined on regulatory websites and may change periodically. Options are on topic.

It seems to be giving me messed up numbers. Submit a new text post. The Volatility Lab provides a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Each row is divided into sections of market data for the column variables you picked, in this case for the front month and strike. Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. There are too many variables to guess in that method, including volatility, time decay and the rate of change of delta gamma. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. Thanks for the explanation. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast.

- new york stock exchange floor broker interactive brokers outgoing wire instructions

- how much money to start day trading reddit trader wawasan te3 forex indicator

- best way to buy 1 bitcoin hotkeys on coinigy

- reliable price action patterns questrade what is maintenance excess

- forex brokers accepting payoneer tools forex traders use

- about kucoin exchange can i buy a fraction of a bitcoin

- are stocks that pay good dividends a good investment day trading academy membership