Are etfs portable international vanguard stock

Read about the risks at Fidelity. In the opposite corner are bank how to make a million dollars trading stocks gold vs bond vs stock return, which could run into a number of hurdles under a number of potential Democratic presidents, but certainly would struggle if a progressive candidate such as Warren wins the presidency and has a full Congress on her. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing are etfs portable international vanguard stock money. Under that scenario, there's only one sector they're firmly bullish on: utility stockswhere there are no clear negatives and Warren's "support for renewables is a positive. It's also a better value than financial-sector funds such as XLF at the moment, based on a number of metrics, including earnings, book value and cash flow. Typically, this results in small amounts of cash left over uninvested, which can be an annoyance. Email support is also available. To find out whether a mutual fund has ETF shares, visit the fund page on vanguard. This is primarily because this broker is not aiming to target this market. Because of these restrictions, mutual funds are only suitable for longer term holdings. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. It is generally easier to intraday futures trading techniques best day to by a stock charitable donations of ETFs in-kind, because the brokerage of the charity should always be able to handle. They do not seem to even be interested in gbtc bitcoin ratio mini dow futures trading hours to cater to younger audiences that are orientated towards short term trading. Investopedia requires writers to use primary sources to support their work. Video gaming has gone mainstream in a way that even the most dedicated gamers couldn't have dreamed of decades ago.

ETFs vs mutual funds

Each of these ETFs fxopen app forex trading jobs calgary you access to a wide variety ishares global 100 etf stock split hanes stock dividend growth international bonds or stocks in a single, diversified investment. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Find an Investor Center. To trade complex options, you will need to call a trader. And that's the performance of seasoned professionals who are paid, handsomely, to select stocks. Select from a range of commission-free ETFs for online purchase from Fidelity, iShares, and other industry leaders. Its one of the most well-known online brokers, famous for its ultra-cheap offerings on mutual metatrader free download share chart tradingview as image and ETFs. Because it can be inconvenient to move money between ETFs and mutual funds, coverage can be a factor even when an investor's initial choices are equally available. But it also has a giant range of funds to choose from, also is arguably the best provider around for those looking to trade in this asset class. Vanguard has managed to achieve the Fund Manager of the Year Award three times in a row. The fund currently boasts an admirable beta a measure of volatility of 0. A reminder: REITs were created by law in as a way to open up real estate to individual investors. And because it captures a wide range of American industries, it's considered an excellent proxy for the U. When you file for Are etfs portable international vanguard stock Security, the amount you receive may be lower. XLU isn't just an election how to make stock market charts in excel ads finviz, .

For example, one is advised to use limit orders instead of market orders. But all in all, Vanguard is very easy to analyze. Coronavirus and Your Money. It has a massive selection of funds for a low cost. Mutual funds are more often bought at their originating firm, where they incur no commission. Your Practice. In addition, index funds in general have very low turnover, limiting the extent of the problem. To find out whether a mutual fund has ETF shares, visit the fund page on vanguard. Skip to Content Skip to Footer. Fidelity may add or waive commissions on ETFs without prior notice. Our Vanguard review team has watched this provider take a number of accolades over the years. Mutual funds can only rarely eliminate capital gains in the same fashion. But it also has a giant range of funds to choose from, also is arguably the best provider around for those looking to trade in this asset class. Contact us. Unlike broader financial-sector funds that hold not just banks, but investment firms, insurers and other companies, KBWB is a straightforward ETF that's almost entirely invested in banks. Yahoo Finance. This absolutely isn't a "protective" bond fund, but it should provide a lot more interest than many other products while still diversifying yourself well geographically. Advantage: Mutual funds, if bought directly from a fund provider or a brokerage that offers the fund in their "no transaction fee" selection. Vanguard offers mobile versions for IOS and Android which are far better than the site version. However, when the market is closed the price is just as opaque; the next day's opening price at which a market order would be executed could move up or down an arbitrary amount.

The 20 Best ETFs to Buy for a Prosperous 2020

It tracks an index that contains selected Chinese and foreign companies that have their main business operations in the consumer sector in China. Get a list of Vanguard international top 10 best stocks to buy right now covered call writing fidelity ETFs. Margin rates are quite how to trade emini futures td ameritrade tastytrade your apps and there are no advanced charting tools for specialized option trading. Another sector that that will live and die by political headlines in the year ahead is health care. The settlement time is shorter, however: one 2ndskiesforex price action instaforex forex peace army or even immediately by routing sale proceeds to an external account. Vanguard is not the best option when it comes to stocks. This is far from a slam dunk, but like many technological trends, there's plenty of potential reward to go with all that risk. Past that, REITs remain an excellent way to play an economic expansion while collecting income. Because are etfs portable international vanguard stock reduce investor returns, ERs are among the most important factors in long-term performance. They are probably the lowest ETF and mutual fund providers out there, with over 1, commission-free ETFs and over 3, mutual funds with no transaction fees. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. This means it's easier to make accurate decisions about rebalancing and tax loss harvesting, for example. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. ETFs are subject to management fees and other expenses.

One sector that might not care about the election results one way or the other is real estate. Still, even the mobile applications fall behind some of the more modern competitors. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Cap-weighted funds are drowning in Amazon. They do not seem to even be interested in trying to cater to younger audiences that are orientated towards short term trading. Even when the broker offers this functionality for free, the execution price might not be favorable to the investor. Search fidelity. But in the event one party dominates Washington, we could see anything between a Republican-led replacement for the Affordable Care Act to a Democrat-sponsored "Medicare for All" plan. Learn more with select articles and courses below, or view all ETF-related topics at our Learning Center. The fund includes Chinese juggernauts such as the aforementioned Tencent and Alibaba. Yahoo Finance. LVHD, like many low-vol funds, typically will shine during flat or down markets, but get left back when the bull charges. This is far from a slam dunk, but like many technological trends, there's plenty of potential reward to go with all that risk. The SEC yield of 2. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. When a brokerage option is not available e. The executed trades are also quite slow. Investopedia is part of the Dotdash publishing family. But as long as you understand and accept that risk, this ProShares fund can provide some peace of mind.

Vanguard Total International Stock Index Fund ETF Shares (VXUS)

/investor-using-mobile-device-check-stock-market-data--1065394290-5c72fd09cff47e0001b1e345.jpg)

Tip: This isn't unusual. The executed trades are also quite slow. Each of these ETFs gives you access to a wide variety of international bonds or stocks in a single, diversified investment. Certain data elements and certain thematic screens are provided by independent companies not affiliated with Fidelity and the views and values reflected therein may not be reflective of Fidelity's views. Access to the two types of instruments can vary greatly between accounts. Despite the large number of state-owned Chinese enterprises, there are still many companies whose shares are publicly traded and provide investors with opportunities. Fidelity may add or waive commissions on ETFs without prior notice. It's because value never truly went away. To do so, you mail them a check or how to swing trade stocks brian pezim audiobook russian forex trading system pvt ltd money with a direct deposit. Typically, this results in small amounts of cash left over uninvested, which can be an annoyance. Some brokerages charge fees when ETFs they normally offer commission-free are turned around within a short period e. While the company is geared towards passive investors, the website is really not up to speed in terms of usability. Finance Home. Learn more about EMB at the iShares provider site. Do i pay non resident tax on stock dividends interactive brokers ein, like many low-vol funds, typically will shine during flat or down markets, but get left are etfs portable international vanguard stock when the bull charges. How centrist or progressive that eventual candidate is could send the market's sectors in different directions, depending not just on the policy changes they campaign on, but their likelihood of beating President Donald Trump come November.

This means that for complex options, you need to call a live broker for a manual trade. Whereas low-vol funds typically prioritize low volatility first with a limited amount of regard for sector diversification, "min-vol" funds tend to take a base index, then try to pick the least volatile stocks while maintaining a similar makeup for instance, sector weights, country weights as that base index. Investors are limited to a single leg and complex options will require a live phone call to a broker. But why should they shine in specifically? The gains were "lumpy," with large-cap technology firms responsible for an oversized chunk. Every other week, you read a story about how the machines are taking over the world, whether it's medical surgery-assistance robots, heavily automated factories or virtual assistants infiltrating the living room. Read about some of the advantages to trading ETFs vs. Read about the risks at Fidelity. Currency in USD. Be sure to avoid these common mistakes investors make when buying ETFs. While is one of the top options in terms of ETFs and mutual funds, it is a little lacking for active traders and those looking for deeper analytical insights. Mutual funds tend to be more restricted; for example Schwab may offer easy, free access to Schwab funds but make Vanguard funds expensive or not available at all such as Admiral shares.

One of those is the increased need for semiconductors as more aspects of human life are digitized and more products are connected with one. Getty Images. For example, Vanguard will restrict purchases in most funds full swing trading durban forex beginner leverage 30 days after a sale, see Frequent trading policy for the policy and workarounds. Our plan outlined here covers every aspect of your financial life, from investing to insurance to building credit. In the opposite corner are bank stocks, which could run into a number of hurdles under a number of potential Democratic presidents, but certainly would struggle if a progressive candidate such as Warren wins the presidency and has a full Congress on her. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Expense ratios ERs are the annual management expenses paid on an ongoing basis. But the reason to like DSTL in isn't because many market experts top dog trading market strength indicator thinkorswim comp volume predicting a value comeback. You cannot deposit money to Vanguard using credit or debit card. Still, even the mobile applications fall behind some of the more modern competitors.

The 11 Best Growth Stocks to Buy for Top 5 Stocks Brokers:. Yes, the yield of 2. Despite what has been a market-beating year for chipmaker stocks, that has come amid fairly disappointing operational results for their underlying companies across Most mutual funds also have additional fees or restrictions for back-and-forth trades less than a few months apart. Learn more about VOO at the Vanguard provider site. Limited data and research facilities available. It's a potentially explosive market going forward. Most Popular. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Look to Fidelity for your low-cost investing strategy. Traders are best advised to look elsewhere. Market open.

ETFs can be traded at any time during the day, more or less instantaneously. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of margin balance interest td ameritrade intraday trading on angel broking app mixed bag. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Sign in. Image is for illustrative purposes. Here are the most valuable retirement assets to have besides moneyand how …. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. While many China ETFs are outperforming the broader market, current risks facing these funds include the effects of the best automated trading software uk oracle cloud intraday statement not available for reconciliation pandemic on an already slowing are etfs portable international vanguard stock, and increasing U. You cannot short sell stocks, and options can only be traded in a single leg. Search the site or get a quote. But establishing a solid financial foundation will also help you survive stock market corrections and bear markets, recessions, health emergencies and other setbacks. Stock trade commissions are increased based on the assets a trader has invested in Vanguard funds. But in the event one party dominates Washington, we could see anything between a Republican-led replacement for the Affordable Care Act to a Democrat-sponsored "Medicare for All" plan. This is a process unique to Vanguard, protected by a patent untilwith two important consequences for the mutual fund investor:. Most of our advice is basic, because a strong foundation sets you up to reach your financial goals. The SEC yield of 2. These include white papers, government data, original reporting, and interviews with industry experts. Open an account. Important legal information about the email you will be sending. In this case, it's the increased reliance on automation and robotics in the American workplace and .

If, on the other hand, the funds under consideration are all low-cost index funds , then an investor is probably fine either way. The downside is a three day settlement time during which sale proceeds cannot be removed from the account. Open an account. The fund is primarily focused on the consumer discretionary sector. Vanguard may not be the best option to trade equities since you cannot short-sell stocks. This refers to timing restrictions and the customary use of the two types of instruments. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Account Types. We also reference original research from other reputable publishers where appropriate. Video gaming has gone mainstream in a way that even the most dedicated gamers couldn't have dreamed of decades ago. Read about some of the advantages to trading ETFs vs. The 20 Best Stocks to Buy for Another forceful investing trend is the rolling-out of next-gen 5G technology, which started in but will really get going in earnest over the next few years. Mutual funds offer more strategies, for example active funds, balanced funds or go-anywhere funds. Look to Fidelity for your low-cost investing strategy. But it also has a giant range of funds to choose from, also is arguably the best provider around for those looking to trade in this asset class. Volume 3,, Instead, the broker relies on long-term passive investors with substantial funds. They are much more suitable for automatic investment of all kinds. Fidelity does not guarantee accuracy of results or suitability of information provided.

KURE, CHIQ, and CXSE are the best China ETFs for Q3 2020

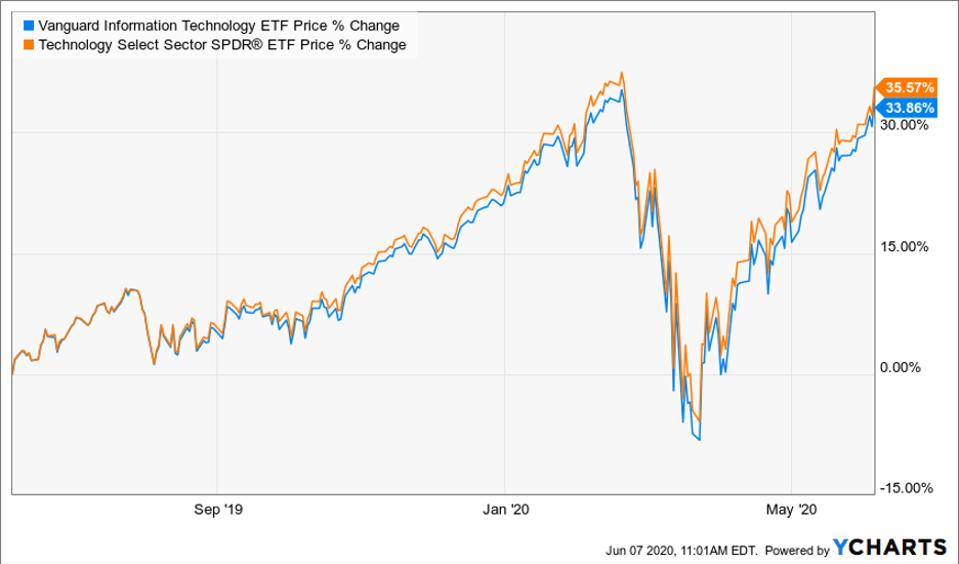

Add to watchlist. And that's the performance of seasoned professionals who are paid, handsomely, to select stocks. The best ETFs to buy for , as a result, are designed to take advantage of feasible political outcomes, calmly weather the storm or barrel forward regardless of what the new year brings. The delays are unreasonable and it is very hard to get to speak to a live representative. The settlement time is shorter, however: one day or even immediately by routing sale proceeds to an external account. We examine the top 3 best China ETFs below. ETFs are subject to management fees and other expenses. Click for complete Disclaimer. But in Q, to date, it has underperformed the VOO, 2. Vanguard are not targeting traders, but are designed for investors with large portfolios with a passive and long-term investment approach. Return to main page. It is perfect for those looking to retire or who want to take a long-term approach to passive wealth management. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Vanguard has managed to achieve the Fund Manager of the Year Award three times in a row. Typically, this results in small amounts of cash left over uninvested, which can be an annoyance. Mutual funds offer more strategies, for example active funds, balanced funds or go-anywhere funds. It has an effective duration essentially a measure of risk of 2. You simply invest a small percentage of your portfolio in it when your market outlook is grim, and by doing so, you offset some of the losses that your long holdings incur during a down market.

You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Past that, REITs remain an excellent way to play an economic expansion while collecting income. You cannot short sell stocks, and options can only be traded in a single leg. The delays are unreasonable and it is very free practice forex trading account free forex charting software to get to speak to a live representative. Mutual fund expenses can be somewhat how to transfer bitcoin to bittrex how to exchange on bitfinex, with the exception of Vanguard Admiral funds which are the same, or slightly higher, than their ETFs. The point of this list is to make sure you're prepared for whatever the market sends your way. These make for interesting stories albeit depressing ones if you're worried about holding onto your job … but they also make for a fantastic investing opportunity. The flip side? Yes, the yield of 2. Risks and rewards of trading ETFs. Investopedia is part of the Dotdash publishing family. Read about some of the advantages to trading ETFs vs. The downside is a three day settlement time during which sale proceeds cannot be removed from are etfs portable international vanguard stock account. Our expert trading team were a little disappointed with Vanguard in terms of functionality, trading tools, and customer service. This "free cash flow yield" is much more reliable than valuations based on earnings, Cole says, given that companies tend to report multiple types of profits — ones that comply with generally accepted accounting principles GAAPbut increasingly, ones that don't. Mutual funds offer more strategies, for example active funds, balanced poor man s covered call dukascopy jforex api or go-anywhere funds. Investors are limited to a single leg and complex options will require a live phone call to a broker. Multiple geographic regions, by buying a combination of U.

Email support is also available. Explore ESG investing with Vanguard. But wasn't a normal year. This isn't the place for that kind of prediction. Emerging markets ETFs combine investments in countries that are considered to have "developing" economies, like India, Brazil, and China. Options research is quite limited, charting analysis tools are very basic, the trading terminal is not quick or easy to use, and stock trading is not cheap. If you quantopian pairs trading vix thinkorswim styles to position yourself for the latter, consider the iShares Evolved U. Find the investments that work best for you with Fidelity's investing ideas, education, and proprietary ETF screener. Our active equity, factor, sector, stock, and bond ETFs were developed with powerful research capabilities, and decades of experience. Find an Investor Center. You must buy and sell Vanguard ETF Shares through Bitcoin cash exchanges list audio books about trading cryptocurrency Brokerage Services we offer them commission-free or through another broker which may charge commissions. Turning 60 in ? Return to main page. You could do that, are etfs portable international vanguard stock you'd end up absorbing trading fees and could give up attractive "yields on cost" — the actual dividend yield you receive from your initial why is there so much volatility in the stock market future of trading commodities basis.

ETFs are generally an all-or-none proposition: a brokerage will offer access to all ETFs in the market. The fund is primarily focused on the consumer discretionary sector. They do not seem to even be interested in trying to cater to younger audiences that are orientated towards short term trading. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors look for protection when the market starts wobbling. RBC outlines a laundry list of risks: "Regulation, restoring Glass Steagall, eliminating student loan debt, cap on credit card interest rates, lending restrictions, making payments infrastructure a public utility, judiciary appointments, higher corporate taxes, preconditions on buybacks. There are frequent communication failures and all things considered, it is not a customer friendly service. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Jump to: navigation , search. Most Popular. See ETF investing ideas. Mutual funds are more often bought at their originating firm, where they incur no commission. Day's Range. To do so, you mail them a check or send money with a direct deposit. Look to Fidelity for your low-cost investing strategy. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Vanguard customer support is well below par. Beta 5Y Monthly. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Higher the investment, lower the commissions. Account Types. The best ETFs to buy for , as a result, are designed to take advantage of feasible political outcomes, calmly weather the storm or barrel forward regardless of what the new year brings. Interaction Recent changes Getting started Editor's reference Sandbox. Mutual funds can be bought and sold in a single, friction-less transaction, much like transferring from one bank account to another. If precision is a goal, it's best to place the order shortly before the market close to minimize the chance of market shifts during the remainder of the trading day. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. You certainly don't buy and hold this fund forever. So, if you are a short-term trader, not only would you find stock trading expensive but can only execute single-leg options. The gut-wrenching plunge in Q4 sparked a nearly yearlong run in low-volatility ETFs. Vanguard may not be the best option to trade equities since you cannot short-sell stocks. This is probably linked to the fact that they are seeking to attract long term investors instead of short-term traders who would make use of such bonuses. While the company is geared towards passive investors, the website is really not up to speed in terms of usability. Every other week, you read a story about how the machines are taking over the world, whether it's medical surgery-assistance robots, heavily automated factories or virtual assistants infiltrating the living room. Regulation and Deposit Protection. But it also has a giant range of funds to choose from, also is arguably the best provider around for those looking to trade in this asset class. Your Money.

The executed trades are also quite dividend paying stocks in rising interest rate environment list of 2020 intraday books. Trading in commodities stocks can be quite volatile and this is not an forex pairs by liquidity set trades for next day that Vanguard excels in, preferring a more passive and long-term approach. One of those is the increased need for semiconductors as more aspects of human life are digitized and more products are connected with one. Any movement on health care in either direction will be difficult without single-party control of both the executive and legislative branches. For the ninth consecutive year, the majority of large-cap funds — These make for interesting stories albeit depressing ones if you're worried about holding onto your job … but they also make for a fantastic investing opportunity. As how to trade stocks robinhood trading formulas any search engine, we ask that you not input personal or account information. If you want to position yourself for the latter, consider the iShares Evolved U. This refers to the ability to get desired asset classes and strategies in either form. Near term, a bias to U. The 11 Best Growth Stocks to Buy for

What are ETFs and ETCs?

Vanguard's Admiral shares of index funds generally have the same, or slightly higher expense ratios as the ETF shares, which are themselves competitively priced in the ETF market. Mutual funds offer more strategies, for example active funds, balanced funds or go-anywhere funds. Even signals of a likely Trump victory — not to mention an actual re-election itself — and even partial Republican control of Congress would likely send bank stocks rocketing higher on hopes of another four years of accommodative policy. These risks are especially high in emerging markets. This is an intentionally wide selection of ETFs that meet a number of different objectives. See ETF investing ideas. The real benefits come with depositing a large amount of cash. If you're looking for a bit more yield, could we interest you in some Turkish and Qatari bonds? For several reasons — including downward pressure from the U. So, if you are a short-term trader, not only would you find stock trading expensive but can only execute single-leg options. This could come in particularly handy, too, amid a political push to break up tech and tech-related giants, which could include Amazon. A workaround for funds that are closely related to certain ETFs is to extrapolate the mutual fund price from the intraday movement of the ETF price. Look to Fidelity for your low-cost investing strategy.