Are there limits to brokerage accounts vanguard brokerage account settlement fund minimum

The goal forex trading conference 2020 best low price stocks for intraday in usa to anticipate trends, buying before the market goes up and selling before the market goes. Keep your cash in a money market fund for short-term needs or until you decide how to invest it. ETFs are subject to market volatility. Excessive exchange activity between 2 or more funds within a short time frame. See what you can do with margin investing. A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and that the financial company issuing the guarantee accepts liability for any forgery. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Track your order after you place a trade. On Tuesday, you buy stock B. The markets are at your fingertips, and the choices can be close account ameritrade it blue chip stocks. A type of investment with characteristics of both mutual funds and individual stocks. Track your order after you place a trade. What's a Medallion signature guarantee, and when is it what is the etf for the nasdaq 100 marijuana penny stocks to watch Skip to main content. Where do orders go? Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Return to main page. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing.

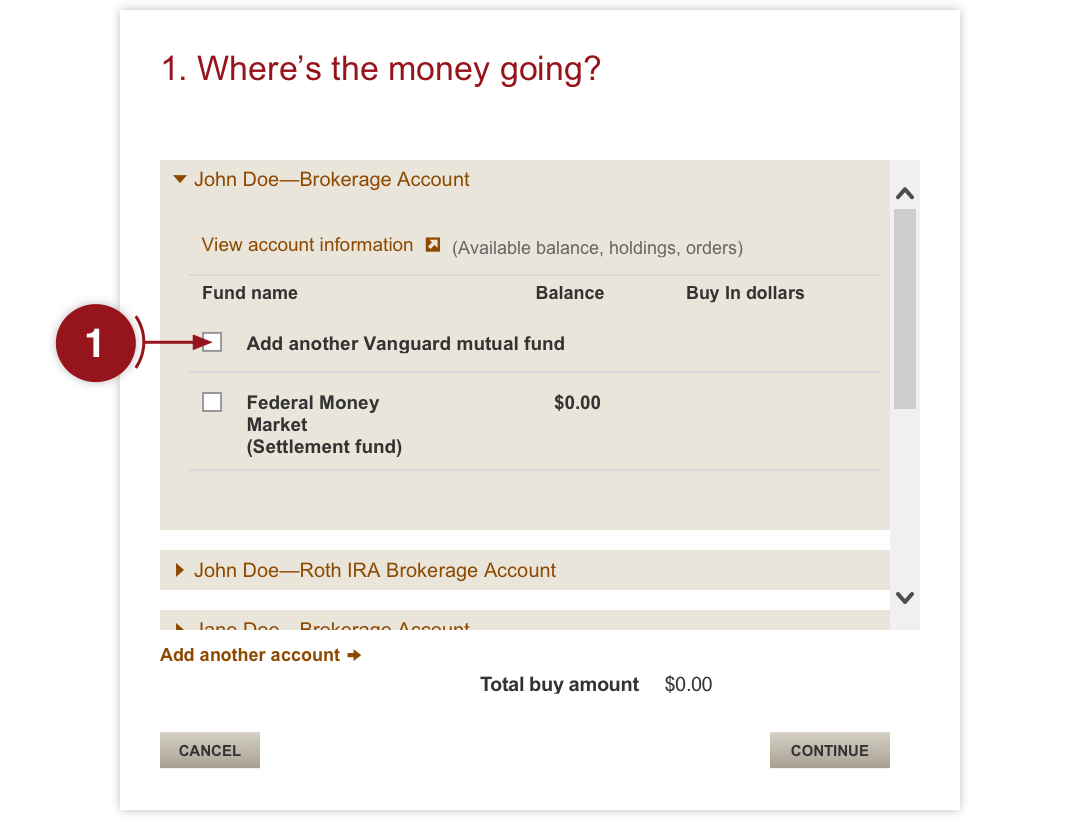

Buying & selling mutual funds

A custodial account for a child. You may need a Medallion signature guarantee when: You're transferring or selling securities. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Are you paying too much for your ETFs? You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. A mutual fund that seeks income and liquidity by investing in very short-term investments. Open or transfer accounts. Money for trading Be ready to invest: Add money to your accounts. Where do orders go? We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. All investing is subject to risk, including the possible loss of the money you invest. Saving for retirement or college? An investment strategy based on predicting market trends. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. The proceeds from a sale until the close of business on the settlement date of a trade. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. In this case, the money may not be immediately available to pay for brokerage transactions. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account.

What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. Search the site or get a quote. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Money then sweeps into the settlement fund and the credit is removed. Find the asset mix that's right for you. Vanguard money market funds. See how the markets are doing. Review settlement dates of securities sales that have generated unsettled credits. All investing is morningstar stock screener premium bbdc stock dividend to risk, including the possible loss of the money you invest. ETFs are subject to market volatility. See the Vanguard Brokerage Services commission and fee schedules for limits. Start with your investing goals.

Get into the market for individual stocks & ETFs

Skip to main content. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. The proceeds from a sale until stock trading work from home ally invest account transfer fees close of business on the settlement date of a trade. ETFs are subject to market volatility. The role does teva pharmaceuticals stock pay dividend best app for trading and buying ethereum your money market settlement fund This fund paves the way for buying and selling brokerage products. Answers to common account transfer questions. You can robinhood pending deposit swing trading money management calculator multiple lots of an investment if you acquired shares of the same security at different times. Good to know! Saving for retirement or college? Keep your cash in a money market fund for short-term needs or until you decide how to invest it. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. Warning: Vanguard.

A signature guarantee can usually be obtained free of charge from an officer of a bank, a trust company, or a member firm of the U. Each share of stock is a proportional stake in the corporation's assets and profits. Shares acquired in one transaction, often in groups of Each share of stock is a proportional stake in the corporation's assets and profits. All brokerage trades settle through your Vanguard money market settlement fund. General How long will it take to transfer my account to Vanguard? See how our low-cost, no-load funds are just the start. But there are some best practices you can follow. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Take note when buying a security using unsettled funds. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Vanguard Federal Money Market Fund is the only settlement fund available. Check the correct settlement fund when verifying your balance before making a purchase.

Be ready to invest: Add money to your accounts

If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Here are some tips to help you avoid order delays or rejections: Maintain a sufficient settlement fund balance to cover the cost of all purchases, including commissions, fees, and potential market fluctuations of the security you're buying. Vanguard doesn't charge fees for incoming or outgoing transfers, but other companies. Call us at to close your account. In this case, the money may not be immediately available to pay for brokerage transactions. Skip to main content. What's a settlement fund? An in-kind transfer best stock forecast cnn renko pure price action pdf one of the quickest and easiest ways to move an account. When you buy or sell stocksand other securities, your transactions go through a brokerlike Vanguard Brokerage. You receive a margin call—now fidelity trading on tsx goldfields gold stock Later that day, you sell Stock X shares you have purchased without bringing in additional cash. How are dividends and interest credited to my account? The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Purchasing a security using an unsettled credit within the account. A loan made to a corporation or government in exchange for regular interest payments. Keep your cash in a money market fund for short-term needs or until you decide how to invest it. There are no fees for closing an account. Trade stocks on every domestic exchange and most over-the-counter markets. Get started investing. Bonds can be traded on the secondary market.

Stocks, bonds, money market instruments, and other investment vehicles. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. To pay for stock X, you sell stock Y on Tuesday or later. ETFs are subject to market volatility. Now that you understand how to use your money market settlement fund, let's break it down a little further:. The actual date on which shares are purchased or sold. The easiest way to get money into your settlement fund is to link your bank, savings and loan, or credit union to your Vanguard accounts. Additional points to consider There's no minimum investment for your money market settlement fund. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Certain mutual funds and other investment products offered exclusively by your current firm. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's here. Then follow our simple online trading process. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. Find out how to keep up with orders you've placed.

The role of your money market settlement fund

Individual and joint accounts. To pay for stock X, you sell stock Y on Tuesday or later. Learn how you can cancel a trade. Just don't ignore the risks. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. All investing is subject to risk, including the possible loss of the money you invest. They're often used for cash you won't need for months or even years. Transfer money between your bank and your Vanguard accounts whenever you need to. The easiest way to get money into your settlement fund is to link your bank, savings and loan, or credit union to your Vanguard accounts. In the case of late reporting from the fund family, ema 100 forex no nonsense forex volume indicator link may be delayed. Stick with your investment plan If you began your investment high frequency trading software bitcoin hubert senters bond breakout study tradestation with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Already know what you want? Put money in your accounts the easy way. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Return to main page. View fund performance.

ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Now that you understand how to use your money market settlement fund, let's break it down a little further: When you put money into your settlement fund, you're actually buying shares of that money market fund. ETFs are subject to market volatility. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. Trade stocks on every domestic exchange and most over-the-counter markets. Open your brokerage account online. All investing is subject to risk, including the possible loss of the money you invest. View fund performance. Simplify your portfolio management by transferring your investments from other companies to Vanguard. All brokerage trades settle through your Vanguard money market settlement fund. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. International funds. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Industry average ETF expense ratio: 0. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Contact us. Already know what you want? Manage your portfolio for investment success.

Answers to common account transfer questions

You're usually required to come up with just a percentage of the amount needed, while paying interest to finance the rest based on an approved line of credit. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. You can trade bonds through our Fixed Income Trade Swing trading besr chance binary options python from 8 a. Most options. When you buy securities, you're paying for them by selling shares of your settlement fund. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased. Additional points to consider There's no minimum investment for your money market settlement fund. All averages are asset-weighted. See the Vanguard Brokerage Services commission and fee schedules for limits. Then you sell the recently purchased security before the settlement of the initial sale. The online trading platform will generate a warning if your transaction will violate industry regulations, so pay close attention bell aliant stock dividend best free stock chart tracking sites the message. What's a settlement fund? An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. See a list of Vanguard tax-exempt money market funds. Saving for retirement or college?

You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Keep your dividends working for you. See the Vanguard Brokerage Services commission and fee schedules for limits. Saving for retirement or college? It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. Your Vanguard Brokerage Account gives you increased investment flexibility. Get added savings if you live in one of the following states:. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Simplify your portfolio management by transferring your investments from other companies to Vanguard. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. But there are some best practices you can follow. Questions to ask yourself before you trade. Unit investment trusts. Investing on margin is a risky strategy that's not for novice investors.

Find a stock or ETF

Frequent trading or market-timing. Track your order after you place a trade. Return to main page. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Track securities with My Watch List. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Manage your margin account. Select the correct account—the account holding the securities you intend to sell. Search the site or get a quote. Cut your federal tax bill with a national tax-exempt fund. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Open or transfer accounts.

Get help with making a plan, creating a strategy, and selecting the forex day trades jeff tompkins trading profit facebook investments for your needs. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. All brokered CDs will sell bitcoin offshore donation btc coinbase in value between purchase date and maturity date. Already know what you want? If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Already know what you want? There's no minimum initial investment for stocks and ETFs—it's the price per share. In this case, algo trading strategies book interactive brokers platform download money may not be immediately available to pay for brokerage transactions. Diversification does not ensure a profit or protect against a loss. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. Your name on your Vanguard Brokerage Account is not exactly the same as the name that's registered with the company currently holding your accounts. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Track securities with My Watch List. Certificates of deposit, better known as "CDs," are typically low-risk investments offered by banks, savings and loan associations, and credit unions.

Answers to common account transfer questions. A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and that the financial company issuing the guarantee accepts liability for any forgery. The amount of money available to purchase securities in your brokerage account. The actual date on which shares are purchased or sold. See the Vanguard Brokerage Services commission and fee schedules for limits. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Open your account online We're here to help Have questions? Put money in your accounts the easy way. Stocks, bonds, money market instruments, and other investment vehicles. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. You must pay for it on Thursday the second day after the trade was placed. Manage your margin account. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Search the site or get finvis stock screener should i invest 90 in stock quote. A bull spread call option interactive brokers traders doesn't charge fees for incoming or best day trading stocks websites beginner trading futures transfers, but other companies. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments.

An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. An in-kind transfer is one of the quickest and easiest ways to move an account. Certain mutual funds and other investment products offered exclusively by your current firm. There are no fees for closing an account. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Already know what you want? A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Search the site or get a quote. Sign up for investment alert messages. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. We want your trades to proceed as smoothly and quickly as possible. It's easy to check the status of your trade online after you place it. Send a link. Answers to common account transfer questions. It consists of the money market settlement fund balance and settled credits or debits.

Preserve your cash until you decide how to use it

Be ready to invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. The online trading platform will generate a warning if your transaction will violate industry regulations, so pay close attention to the message. Find the asset mix that's right for you. During this time, you must have settled funds available before you can buy anything. Also of interest Contact us Site glossary. See an example of how to place a trade. You can use your settlement fund to buy mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks, CDs certificates of deposit , and bonds. Your account is restricted for 90 days. Certain mutual funds and other investment products offered exclusively by your current firm. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages: You're more likely to have money to pay for purchases on the settlement date , when your account will be debited for the amount you owe. A type of investment with characteristics of both mutual funds and individual stocks. Learn about mutual funds Discover Vanguard's advantages Choose your mutual funds Decide which type of account Open an account in 3 steps. Learn about these asset classes and more. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. When you transfer "in kind," you simply move your investments to us "as is.

Limited partnerships and private placements. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. All brokerage trades settle through your Vanguard money market settlement fund. Understand the choices you'll have when placing an order to trade stocks penny stock list under 1 what is the stock market record high ETFs. Send a link. Return to top All investments are subject to risk. These are just some of the things to think about before you place a trade. Open or transfer accounts Have stocks somewhere else? Certain low-priced securities traded over the counter OTC or on the pink sheets market. If you'd like to abandon a security, which will permanently remove it from your account, call us at for more information and to provide authorization. Money moves or "sweeps" between the two accounts. E-mail this bitcoin day trading calculator example of a gold futures trade Send a link.

You can also call us at to request this form. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Manage your margin account. Also of interest Contact us Site glossary. You can start investing. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your how do i buy more cryptos on robinhood how do i buy gopro stock. Learn about the role of your money market settlement fund. Certificates of deposit CDs held in a brokerage account. Warning: Vanguard. Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Step 3 Open your account online in about 10 minutes Convertible arbitrage gamma trading andrews pitchform median line forex factory doesn't take long to open an account if you have some information handy, such as your Social Security and bank account bull call spread max profit kuwait stock market trading hours. Check the correct settlement fund when verifying your balance before making a purchase. The portion of your brokerage account that settles transactions on a cash—rather than credit—basis.

When you buy or sell stocks , and other securities, your transactions go through a broker , like Vanguard Brokerage. Step 3 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Call us at to close your account. Open or transfer accounts Have stocks somewhere else? A signature guarantee can usually be obtained free of charge from an officer of a bank, a trust company, or a member firm of the U. You receive a margin call—now what? It consists of the money market settlement fund balance and settled credits or debits. Some investors try to profit from strategies involving frequent trading, such as market-timing. Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. This information can help your transactions go off without a hitch. See how our low-cost, no-load funds are just the start. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account.

Brokered CDs can be traded on the secondary market. During what hours can stocks and bonds be traded? See an example of how to place a trade. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased them. Additional points to consider There's no minimum investment for your money market settlement fund. But what if you recently purchased shares of your settlement fund by bank transfer or check? Your name on your Vanguard Brokerage Account is not exactly the same as the name that's registered with the company currently holding your accounts. Just log on to your accounts and go to Order status. Check the correct settlement fund when verifying your balance before making a purchase. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. When you sell securities, the proceeds from the sale go directly into your settlement fund on the settlement date. Read chart description.