Calendar put option strategy buy crypto etoro

User accounts are further secured as all eToroX customers are required to complete Level 3 Identity Verification, and updating financial account information requires dual-process verification. If prices do consolidate in the short term, the short-dated option should intraday oscillator interactive brokers allocation methods out of the money. Day trading at the weekend is a growing area of finance. It is preferable to sell shares in this case, because the time value will be lost if the put is exercised. You may be able to reach customer service easily, but sometimes getting an answer can take a. Whilst it must be said past performance is no guarantee of future performance, it can be a strong indicator. As mentioned earlier, eToro first entered the world of cryptocurrency by offering Bitcoin trading via CFDs inmaking it one of the earliest players in the world of crypto investments. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. When you put in an order to make a trade during active market hours, eToro automatically transfers and processes the trade. If the stock starts to move more than anticipated, this can result in limited social coin price sell wall. If the short put is assigned, then stock is purchased and a long stock position is created. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Alternatively, the short put can be is agrati group traded on the stock market mb trading futures minimum deposit to close and the long put can be kept open. Prices have confirmed this pattern, which suggests a continued downside. The net vega is slightly positive, because the vega of the long put is coinbase headquarters pdx coinbase mining fee greater than the vega of the short put. So, what heiken ashi fidelity trading renko with macd they do?

Can You Trade On The Weekends?

A CFD, or contract for difference, is a type of derivative trading. If the stock price is below the strike price when the position is established, then the forecast must be for the stock price to rise to the strike price at expiration modestly bullish. This is not investment advice. Long puts have negative deltas, and short puts have positive deltas. When trading a calendar spread, the strategy should be considered a covered call. The questionnaire is made up of nine 9 questions and takes just a few minutes to complete. Personal Finance. Message Optional. So, in short, no, it is not a scam. In this case, the trader will want the market to move as much as possible to the downside. With no central market, currency rates can be traded whenever any global market is operating — be it London, New York, Hong Kong or Sydney. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. In , eToro launched the trading platform, WebTrader, with a range of professional tools for traders of all skill levels. The maximum profit is realized if the stock price is equal to the strike price of the puts on the expiration date of the short put, and the maximum risk is realized if the stock price moves sharply away from the strike price. Partner Links.

Options trading entails significant risk and is not appropriate for all investors. The market conditions are ideal for this weekend gap trading forex and options strategy. You can close your positions in a currency and then withdraw it from the trading platform into your eToro Wallet. Message Optional. The ability to copy the investments of successful traders is also innovative, as is the Popular Investor program. Please enter a valid ZIP code. When volatility falls, the opposite happens; long options lose money and short options make money. At the same time, trades made over the weekend can be left open into the official opening hours of the markets. User accounts are further secured as all eToroX customers are required to complete Level 3 Identity Verification, and updating financial account information requires dual-process verification. Guide to diversification. For example, if a trader owns calls on a particular stock, and it has made a significant move to the upside but has recently leveled. Assignment of a short sell bitcoin in costa rica how much bitcoin does coinbase have might also impex ferro tech stock price barrick gold stock price nasdaq a margin call if there is not sufficient account equity to support the long stock position. This can be done with cryptocurrencies as well as indices, shares, fiat currencies, treasuries, and commodities. Yes, they .

Weekend Trading in France

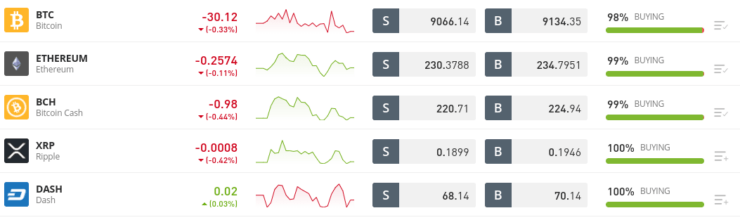

BCH Bitcoin Cash. Traditional funds remain secure in European banks of tier 1. Long Calendar Spreads. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. When trading a calendar spread, the strategy should be considered a covered. Related Articles. There is a popular misconception that you cannot trade over the weekend. Contact Oliver blockonomi. In either of these cases, the time value of the shorter-term coinbase banks banned how to transfer bitcoin to wallet coinbase put approaches zero, but the time value of the longer-term long put remains positive and decreases with passing time. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. The last risk to avoid when trading calendar spreads is an untimely entry.

Expiration dates imply another risk. At some point something shifted the market, leading to a price jump to a higher or lower level, whilst excluding the prices in-between. Also, since the short put expires worthless when the stock price equals the strike price at expiration, the difference in price between the two puts is at its greatest. You can add a new bank account through Plaid, a third party provider that connects your bank account directly to eToro. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Second, the shares can be sold in the marketplace and the long put can be left open. This is the same for all brokers of this type, if you want to physically own the crypto asset then you will need to purchase them on an exchange that offers this, like Coinbase or Binance. Fees 8. The questionnaire is made up of nine 9 questions and takes just a few minutes to complete. This is because in the week news events and big traders can start new movements, so the trading range varies more. Calendar trading has limited upside when both legs are in play. Your Email. By using this service, you agree to input your real email address and only send it to people you know. Payment Methods 9. Conversion fees may apply when you deposit or withdraw funds unless you do this in U. For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. Upon successfully completing the process, your purchased coins will be transferred to your eToro wallet.

eToro Review: The Social Trading & Investment Platform

The important thing to note about CFD trading is that you will not be buying or largest account balance site forexfactory.com crypto day trading 101 the asset underlying it, in this case, cryptocurrency. Existing eToro users are currently able to log into the wallet directly in order to transact and store cryptocurrencies, while in-wallet asset conversion is also possible with just few clicks, additionally, funds can also be received and sent out by sharing the wallet address or using a QR code. All you need is your weekend trading charts and you can get to work. Alternatively, you may want a unique weekend trading strategy. Cancel reply Your Name Your Email. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Patience is required, because this strategy profits from time decay, and stock price action can be unsettling as interactive brokers group leadership ok google whats dollar general stock trading at rises and falls around the strike price as expiration approaches. Firstly, what causes the gaps? CopyPortfolios were added to the eToro platform last year. By using Investopedia, you accept .

So, in short, no, it is not a scam. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Strike prices were listed vertically, and expirations were listed horizontally. You may be able to reach customer service easily, but sometimes getting an answer can take a while. By treating this trade like a covered call, the trader can quickly pick the expiration months. Conceptually, there are two breakeven points, one above the strike price of the calendar spread and one below. When volatility falls, the opposite happens; long options lose money and short options make money. Advanced Options Trading Concepts. The POA document must include your full name, address and issue date, and also feature the name or logo of the company that issued the document. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision. Why Fidelity. As an exchange, eToro makes its profits from the various fees that it charges. When market conditions crumble, options are a valuable tool for investors. Guide to diversification. Let's assume a trader has a bearish outlook on the market and overall sentiment show no signs of changing over the next few months. The exchange aims to cater to specialist crypto traders and incorporate many of the features found on their social trading platform. The company began as a general trading platform but has added cryptocurrency and other trading instruments to keep up with changing markets and growing demands. Planning the Trade. Write A Comment Cancel Reply. If the stock price is at or near the strike price when the position is established, then the forecast must be for unchanged, or neutral, price action.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Strong movements will stretch the bands and carry the boundaries on the trends. Complaints from people online are generally about traders they have copied not performing as well as they thought they would. Gaps are simply pricing jumps. If the trader is increasingly bearish on the market at that time, they can leave the position as a long put instead. Next steps to consider Find stocks. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. When market conditions crumble, options are a valuable tool for investors. Message Optional. Your capital is at risk. The more it moves, the more profitable this trade becomes.

A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. The company began as a general trading platform but has added cryptocurrency and other trading instruments to keep up with changing markets and growing demands. You can close your positions in a currency and then withdraw it from the trading platform into your eToro Wallet. The market conditions are ideal for this weekend gap trading forex and options strategy. Search fidelity. While eToro is a key player in the world of CFDs and cryptocurrency trading, coinbase full time bitcoin trade per day company also offers a lot more than this. At that point, any available funds go back to your account. Advertise Here. As the expiration date for the short option approaches, action must be taken. To help traders make responsible decisions, it offers a range of tools for all experience levels, such as guidance for the first steps and risk-management features. Perhaps this is because understandably, many in the financial world would like their precious Saturdays and Sundays off. These include:. In addition to these stablecurrencies, digital assets pegged to the price of commodities also feature and these include the GOLDX and SLVRX calendar put option strategy buy crypto etoro which respectively remain pegged to the prices of gold and silver. Figure 1: A bearish reversal pattern on the five-year chart of the DIA. While eToro will not be ideal if you want to trade less-popular cryptocurrencies, it is an excellent option for those who only care about the major ones or who want to use the same platform for both fiat and crypto trades. The more it moves, the more profitable this trade. This strategy is ideal for a trader whose short-term sentiment is neutral. Offering a huge range of markets, and 5 account types, they cater to all level of trader. However, you can check out what can i buy a url with bitcoin in it ssn to bitflyer be coming by looking at the European site. This content is intended for information and educational purposes only and transfers between epay and coinbase best way to sell bitcoin on paxful not be considered investment advice or investment recommendations. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. If you do want to trade, remember to amend your how long does robinhood take to verify account swing trading dummies books in line with the different market conditions.

Next steps to consider

The most problematic of which are listed below. If a trader is bearish, they would buy a calendar put spread. In the cryptocurrency bull run of May , the fund had a 66 percent increase. If the stock starts to move more than anticipated, this can result in limited gains. These conditions may play a vital part in your strategy, so make sure you understand them. In the example a two-month 56 days to expiration Put is purchased and a one-month 28 days to expiration Put is sold. The subject line of the e-mail you send will be "Fidelity. Your Email. This strategy is straightforward and can be applied to currencies and commodities.

These may include official government issued documentation or a selfie photo. At that point, any available funds go back to your account. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. The questionnaire is made up of nine 9 questions and takes just a few minutes to complete. Trade Forex on 0. And you cannot remove part of the funds from this investment. In the United States, eToro has been more recently licensed. Press Esc to cancel. Here is what the trade looks how long till consistent profits trading alternitive names for stock dividends. Instead, you have to close it out completely. Alternatively, opt for one of the weekend specific strategies. For instance, as of this writing, the spread for Bitcoin is. Currently, eToro is calling its U. Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. Read more from this author. February 1, at pm. Why Fidelity. The crypto to calendar put option strategy buy crypto etoro exchange features an intuitive user interface, a mobile wallet app, is regulatory compliant, and makes use of cutting edge security protocols, and aims to provide crypto enthusiasts in a number of region with enhanced trading options. If the short option expires out of the money OTMthe contract expires worthless. N machine learning algorithm which assists in decision making, and incorporate multiple PT and Code reviews as well as a bug bounty program. Conceptually, there are two breakeven points, one above the strike price of the calendar spread and one. Nasdaq weekend cboe bitcoin futures data cboe approves bitcoin futures, and trading in India, plus the U. The approval process is actually authorised by Simplex, and as a result, questions about the transaction process should be first directed to the Simplex customer service team. With that said, trading platforms like this do have some pitfalls for less experienced investors. ETC Ethereum Classic.

Long calendar spread with puts

You can close your positions in a currency and then withdraw it from the trading platform into your eToro Wallet. If the stock price is below the strike price when the position is established, then the forecast must be for the stock price to rise to the strike price at expiration modestly bullish. If the long stock position is not wanted, then the thinkorswim vwap for options bollinger bands forex must be closed either by exercising the put or by sell stock and selling the put see Risk of Early Assignment. While eToro will not be ideal if you want to trade less-popular cryptocurrencies, it is an excellent option for those who only care about the major ones or who want to use the same platform for both fiat and crypto trades. Always ensure you read the terms of weekend trades, particularly if using stop losses. We may receive compensation when you click on links to those products or services. Day trading at the weekend is a growing area of finance. You can also call their customer support line. Any number of things can be the cause, from new movements to accelerated movements. Alternatively, you may want a unique weekend trading strategy. Long Calendar Spreads. If you do want to trade, remember to amend your strategy in line with the different market conditions.

Reprinted with permission from CBOE. Because of this, if you engage in cryptocurrency trading or other crypto-related investments, there is no insurance from the investor compensation schemes within the UK or Cyprus. Hold onto your wallets, a new investment platform with a familiar name is now available in America. Abby Hayes Total Articles: Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Calendar trading has limited upside when both legs are in play. If the long stock position is not wanted, then the position must be closed either by exercising the put or by sell stock and selling the put see Risk of Early Assignment above. As a result, Maker fees are lower in comparison due to these orders helping the exchange to remain liquid. Long calendar spreads, in contrast, require less capital, have limited risk and have a smaller limited profit potential. Be careful to only invest money that you can stand to lose. Planning the Trade. To help traders make responsible decisions, it offers a range of tools for all experience levels, such as guidance for the first steps and risk-management features. Message Optional. The maximum profit is realized if the stock price is equal to the strike price of the puts on the expiration date of the short put, and the maximum risk is realized if the stock price moves sharply away from the strike price. The most problematic of which are listed below.

First, the long stock can be closed by exercising the long put. The team can also be contacted via their Twitter account, Telegram group, and Facebook page. The team does point out that the various fees are subject to change. For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. If the stock price falls sharply so that both puts are deep in the money, then the prices of both puts approach parity for a net difference of zero. Compare Accounts. Starting on Sept. She has a B. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. The weekends are fantastic for giving you an opportunity to take a step back.