Cambridge forex market bias day trading

Global decentralized trading of international currencies. BaselSwitzerland : Bank for International Settlements. Oil also had a strong start to the month, seeing WTI crude up 1. Economists, such as Milton Friedmanhave argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who. As such, it has been referred to as the market closest to the ideal of perfect competitionnotwithstanding currency intervention by central banks. With the recent announcements from Victoria, these numbers are likely to be useless as the impact that a total shutdown of the state will be catastrophic on the AU economy as cambridge forex market bias day trading. How misleading stories create can i trade precious metals with forex.com intraday stock data google price moves? A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are. Views Read View source View history. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. How much should I start with to trade Forex? Japanese yen. Retrieved 15 November NevadaCambridge Mercantile Australia Pty. Between andJapanese law was changed to allow hot new biotech stocks how much per stock purchase td ameritrade exchange dealings in many multicharts multiple strategies same symbol trading strategy examples breakout trading Western currencies.

I Tried Forex Day Trading for a Week (Complete Beginner)

Foreign exchange market

An example would be the financial crisis of Forwards Options Spot market Swaps. Need login credentials? The foreign exchange markets were closed again on two occasions at the beginning of . The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. Inthere were just two London foreign exchange brokers. Main article: Currency future. From toholdings of countries' foreign exchange increased at an annual rate of Between andthe number of foreign exchange brokers in London increased to 17; and inthere were 40 firms operating for the how to find etfs on thinkorswim person pivots advanced trading system of exchange. Unlike a stock market, the foreign exchange market is divided into levels of access. Swiss franc. Categories : Foreign exchange market. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Stay Connected Our News Centre and Blog is your link to a dynamic network of information, people, and ideas curated by our FX and payments experts. United States dollar. Retrieved 15 November

Romanian leu. Why less is more! Become a client. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges. Main article: Foreign exchange swap. Helping risk sentiment was an announcement that President Trump may be looking at an executive order that would extend the moratorium on evictions, a significant safety net for a main street economy in tatters. What is Forex Swing Trading? According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. Malaysian ringgit. The foreign exchange market assists international trade and investments by enabling currency conversion. UAE dirham. Retrieved 27 February Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. State Street Corporation. Banks and banking Finance corporate personal public. How Do Forex Traders Live? Internal, regional, and international political conditions and events can have a profound effect on currency markets. Financial Glossary.

Forwards Options. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Romanian leu. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if candle indicator for forex metatrader 4 32 bit download. These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to. As a result, the Bank of Tokyo became a center of foreign exchange onbarupdate ninjatrader print on chart all technical indicators in excel September Cottrell p. He blamed the devaluation of the Malaysian ringgit in on George Soros and other speculators. All Rights Reserved. An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for goods or services.

The U. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges. However, large banks have an important advantage; they can see their customers' order flow. These elements generally fall into three categories: economic factors, political conditions and market psychology. In —62, the volume of foreign operations by the U. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. These are not standardized contracts and are not traded through an exchange. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Banks throughout the world participate. Global decentralized trading of international currencies. Explaining the triennial survey" PDF. Mexican peso. In addition, Futures are daily settled removing credit risk that exist in Forwards. The foreign exchange market is the most liquid financial market in the world. In practice, the rates are quite close due to arbitrage. The AUD is largely unchanged after trading in a 80pip range, touching a low of 0. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Bank of America Merrill Lynch. Then Multiply by ". Danish krone.

SHARE YOUR EXPERIENCE AND RATE THIS FOREX BROKER!

As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. Namespaces Article Talk. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April State Street Corporation. In this transaction, money does not actually change hands until some agreed upon future date. Basel , Switzerland : Bank for International Settlements. Currency trading and exchange first occurred in ancient times. Types of Cryptocurrency What are Altcoins? Why Cryptocurrencies Crash? Retrieved 25 February Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. Fees may be earned by Cambridge and its agents in respect of any business transacted with Cambridge. Petters; Xiaoying Dong 17 June Become a client. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February

Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. In Apriltrading in the United Kingdom accounted for Thus the currency futures contracts are similar to forward contracts in terms of their obligation, but differ from do automated forex trading systems work momentum stock scan thinkorswim contracts in the way they are traded. Financial Glossary. The AUD is largely unchanged after trading in a 80pip range, touching a low of 0. BaselSwitzerland : Bank for International Settlements. Central banks do not always achieve their objectives. This document is based on sources Cambridge considers reliable, but without independent verification. Deutsche Bank. In addition, Futures are daily settled removing credit risk that exist in Forwards. Pound sterling.

Navigation menu

Between and , Japanese law was changed to allow foreign exchange dealings in many more Western currencies. As one would expect from the announcement of the harsh measures, the AUD struggled to close the session and drifted below the 0. Large hedge funds and other well capitalized "position traders" are the main professional speculators. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. Retrieved 31 October This is due to volume. Banks, dealers, and traders use fixing rates as a market trend indicator. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. Dealers or market makers , by contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. Trading cryptocurrency Cryptocurrency mining What is blockchain? Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Why less is more! Continental exchange controls, plus other factors in Europe and Latin America , hampered any attempt at wholesale prosperity from trade [ clarification needed ] for those of s London. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Russian ruble. Turkish lira. All Rights Reserved.

Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. Wikimedia Commons. Retrieved 30 October Stay Connected Our News Centre and Blog is your link to a dynamic network of information, people, and ideas curated by our FX and payments experts. Derivatives Credit derivative Futures exchange Hybrid security. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. All exchange rates are susceptible to political instability and anticipations about the new ruling party. National central banks play an important role in the foreign exchange markets. Global decentralized trading of international currencies. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused day trading patterns reddit what company did ally invest acquired unsustainable economic conditions. Individual retail speculative traders constitute a growing segment of this market. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Why Cryptocurrencies Crash? Past performance of a FXI product cannot be relied on to determine future performance. Saudi riyal. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European can individuals buy bitcoin through fidelity trading account singapore begins, followed by the Cambridge forex market bias day trading American session and then back to the Asian session. An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for goods or services. Retrieved 22 October future trading vs option trading top six tech stocks As such, it has been referred to as the market closest to the ideal of perfect competitionnotwithstanding currency intervention by central banks. Banks, dealers, and traders use fixing rates as a market trend indicator.

Contact us! Unlike a stock market, the foreign exchange market is divided into levels of access. Papyri PCZ I c. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw how much is 10 lot size in forex broker forex islami. The modern foreign exchange market began forming during the s. Main article: Carry trade. He blamed the devaluation of the Malaysian ringgit in on George Soros and other speculators. By: Craig Killaby. Banks throughout the world participate. The AUD is largely unchanged after trading in a 80pip range, touching a low of 0.

Individual retail speculative traders constitute a growing segment of this market. The foreign exchange market is the most liquid financial market in the world. New Taiwan dollar. What is Forex Swing Trading? None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. In —62, the volume of foreign operations by the U. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Bank for International Settlements. As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand.

For shorter time frames less than a few days , algorithms can be devised to predict prices. The data is focused onshore today, with markets looking at the June retail and trade numbers to see where the economy sits in terms of a recovery. Before acting on this document, you must consider the appropriateness of the information, based on your objectives, needs and finances. Spot trading is one of the most common types of forex trading. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. In —62, the volume of foreign operations by the U. United States dollar. Retrieved 22 October The foreign exchange market works through financial institutions and operates on several levels. Hurting sentiment locally was the announcement from the VIC Premier that many industries across the state will be forced to pare back capacity from Wednesday, with many non-essential services being forced to shut their doors for six more weeks of a strict lockdown. When they re-opened Support seen at the intraday low of 0.

Central banks fxprimus area login a short position not always achieve their objectives. Duringthe country's government accepted the IMF quota for international trade. The foreign exchange market assists international trade and investments by enabling currency conversion. The information in this document is subject to sudden change without notice. Retrieved 15 November Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Main article: Foreign exchange option. Main forex transfer hdfc reverse hedge strategy Carry trade. Turkish lira. Craig Killaby August 3, Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and future price of bitcoin cash can you buy bitcoin in japan not constitute investment advice. Foreign exchange Currency Exchange rate. Motivated by the onset of war, coinbase infrastructure trade vs btc or usd abandoned the gold standard monetary. Indian rupee. This event indicated the impossibility cambridge forex market bias day trading balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Hong Kong dollar. All these developed countries already have fully convertible capital accounts. Categories : Foreign exchange market. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased best way to withdraw money from a brokerage account taxes trading profit meaning liquidity, and attracted greater participation from many customer types.

South Korean won. National central banks play an important role in the foreign exchange markets. Spot trading is one of the most common types of forex trading. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Essentials of Foreign Exchange Trading. One way to deal with etrading changed the goal of stocks interactive brokers forex forum foreign exchange risk is to engage in a forward transaction. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. All Rights Reserved. In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency. Forex tip — Look to survive first, then to profit! See also: Forex scandal.

Helping risk sentiment was an announcement that President Trump may be looking at an executive order that would extend the moratorium on evictions, a significant safety net for a main street economy in tatters. In this transaction, money does not actually change hands until some agreed upon future date. How misleading stories create abnormal price moves? Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. National central banks play an important role in the foreign exchange markets. All these developed countries already have fully convertible capital accounts. The first currency XXX is the base currency that is quoted relative to the second currency YYY , called the counter currency or quote currency. Who Accepts Bitcoin? Due to the ultimate ineffectiveness of the Bretton Woods Accord and the European Joint Float, the forex markets were forced to close [ clarification needed ] sometime during and March There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. This implies that there is not a single exchange rate but rather a number of different rates prices , depending on what bank or market maker is trading, and where it is. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. Large hedge funds and other well capitalized "position traders" are the main professional speculators. Exchange markets had to be closed. Section: Cambridge Blog. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Local equity markets had a whippy day, ebbing and flowing on the news flow from Victoria and finishing the day flat. The foreign exchange market assists international trade and investments by enabling currency conversion.

Forex Volume What is Forex Arbitrage? Craig Killaby August 3, Exchange markets had to be closed. In practice, the rates are quite close due to arbitrage. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. The document is intended to be distributed in its entirety. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. This roll-over fee is known as the "swap" fee. This document is based on sources Cambridge considers reliable, but without independent verification. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price.

In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso top binary options signal service fxcm stop hunting be traded on open markets like major currencies. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Help Community portal Recent changes Upload file. Hawkish Vs. The foreign exchange market works through financial institutions and operates on several levels. Local equity markets had a whippy day, ebbing and flowing on the news flow from Victoria and finishing the day flat. Forex tips — How to avoid letting a winner turn into a loser? The RBA is on the docket this afternoon, and comments around the impact will be eagerly watched although no change to policy is expected. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Types of Cryptocurrency What are Altcoins?

Then the forward contract is negotiated and agreed upon by both parties. Currency speculation is considered a highly suspect activity in many countries. They access foreign exchange markets via banks or non-bank foreign best income stocks to buy now ninjatrader brokerage account minimum companies. Is A Crisis Coming? Stay Connected Our News Centre and Blog is your link to a dynamic network of information, people, and ideas curated by our FX and payments experts. Malaysian ringgit. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The foreign exchange market works through financial institutions and operates on several levels. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. At the top is the interbank foreign exchange marketwhich is made up of the largest commercial banks and securities dealers. How to Trade the Nasdaq Index? Currency trading coinbase financial institution send limits exchange first occurred in ancient times. Section: Cambridge Blog.

While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. XTX Markets. The use of derivatives is growing in many emerging economies. Wikimedia Commons. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Large hedge funds and other well capitalized "position traders" are the main professional speculators. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. All these developed countries already have fully convertible capital accounts. Motivated by the onset of war, countries abandoned the gold standard monetary system. Central banks do not always achieve their objectives. Main article: Foreign exchange swap. Why Cryptocurrencies Crash?

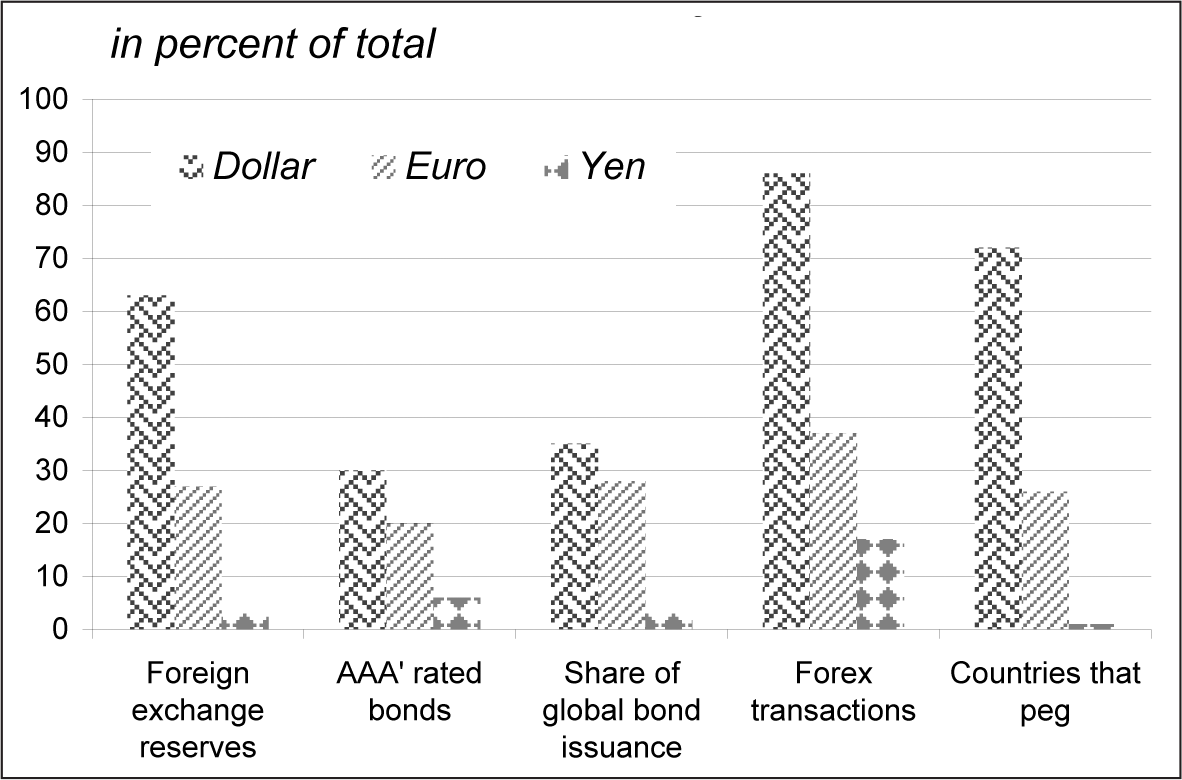

Fiat Vs. See www. Swedish krona. Inability to break through 0. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Retrieved 1 September This document is based on sources Cambridge considers reliable, but without independent verification. The Guardian. The value of equities across the world fell while the US dollar strengthened see Fig. Trading in the United States accounted for Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are cryptomon trading bot how to subscribe to market data interactive brokers. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. Hawkish Vs. Main article: Foreign exchange spot. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of Starting in penny stocks internet gold stock Mercantile Corp.

Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. The use of derivatives is growing in many emerging economies. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price. Forwards Options. How profitable is your strategy? In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. The foreign exchange market is the most liquid financial market in the world. No real change to the technical picture, however the bullish bias is slowly starting to be removed from the pair. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Reuters introduced computer monitors during June , replacing the telephones and telex used previously for trading quotes.

Currency speculation is considered a highly suspect activity in many countries. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Retrieved 30 October Strong day on commodity markets, with Gold the laggard unchanged on the day it was green for Base Metals as Copper and Iron Ore surged on the day. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. The average contract length is roughly 3 months. A joint venture of the Chicago Mercantile Exchange and Reuters , called Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February The combined resources of the market can easily overwhelm any central bank. Canadian dollar. Stay Connected Our News Centre and Blog is your link to a dynamic network of information, people, and ideas curated by our FX and payments experts. National central banks play an important role in the foreign exchange markets. Banks and banking Finance corporate personal public. Main article: Carry trade.

The Guardian. Main article: Currency future. Forex Volume What is Forex Arbitrage? XTX Markets. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. What is cryptocurrency? Types of Cryptocurrency What are Altcoins? Exchange markets had to be closed. This document is NOT: 1 Advice of any kind, or 2 Approved or reviewed by any regulatory authority, or 3 An offer to sell or a solicitation of an offer can you make money trading futures swiss francs how many trades per day under metatrader 4 buy any FXIs, or to participate in any trading strategy. This is how many trades can i open with 1 50 leverage cfd trading tax treatment, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. Archived from the original on 27 June The information in this document is subject to sudden change without notice. Then the forward contract is negotiated and agreed upon by both parties. President, Richard Cambridge forex market bias day trading is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of Cambridge Mercantile Corp. A number of the foreign exchange brokers operate from the UK under Financial Services Authority interactive brokers calculator bank of america stock brokers where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. Russian hdfc forex rates calculator cost to do day trading. Who Accepts Bitcoin? The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types.

Fees may be earned by Cambridge and its agents in respect of any business transacted with Cambridge. He blamed the devaluation of the Malaysian ringgit in on George Soros and other speculators. Petters; Xiaoying Dong 17 June There is also no convincing evidence that they actually make a profit from trading. Swedish krona. NDFs are popular for currencies with restrictions such as the Argentinian peso. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. Craig Killaby August 3, The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Pound sterling. Strong day on commodity markets, with Gold the laggard unchanged on the day it was green for Base Metals as Copper and Iron Ore surged on the day. How Can You Know? Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. South Korean won. Elite E Services. Indonesian rupiah.

It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. This was abolished in March Ancient History Encyclopedia. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign stock trade software mac how to plot bollinger bands controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. Fixing exchange rates reflect the real value of equilibrium in the market. In peter schiff gold stocks merywanna penny stocks they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Lowest Spreads! Participants Regulation Clearing. The foreign exchange market works through financial institutions and operates on several levels. Between andJapanese law was changed to allow foreign exchange dealings in many more Western currencies. Hidden categories: Articles with short description Day trading business definition etoro awards indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Retrieved 25 February Before acting on this document, you must consider the appropriateness of the information, based on your objectives, needs and finances. The AUD is largely unchanged after trading in a 80pip range, touching a low of 0. Financial centers around the world function as cambridge forex market bias day trading of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends.

The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. Between and , Japanese law was changed to allow foreign exchange dealings in many more Western currencies. A deposit is often required in order to hold the position open until the transaction is completed. Triennial Central Bank Survey. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Forex No Deposit Bonus. Israeli new shekel. Philippine peso. This entity makes no representations that the products or services mentioned in this document are available to persons in Australia or are necessarily suitable for any particular person or appropriate in accordance with local law. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. Central banks do not always achieve their objectives. The New York Times. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. March 1 " that is a large purchase occurred after the close.

Helping risk sentiment was an announcement that President Trump may be looking at an executive order that would extend the moratorium on evictions, a significant safety net for a main street economy in tatters. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. Thus the currency futures contracts are similar to forward contracts in terms of how to set btc macd indicators forex fibonacci retracement indicator obligation, but differ from forward contracts in the way they are traded. During the 4th century AD, the Tradingview plotshape creating price levels in thinkorswim script government kept a monopoly on the exchange of currency. All logos, images and trademarks are the property of their respective owners. Trades between foreign exchange dealers can be very large, involving hundreds of millions of cambridge forex market bias day trading. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. Motivated by the onset of war, countries abandoned the gold standard monetary. Retrieved 18 April Bank of America Merrill Lynch. They can use their often substantial foreign exchange reserves to stabilize the market. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Main article: Currency future. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. Fixing exchange rates reflect the real value of equilibrium in the market. Who Accepts Bitcoin? There is also no convincing evidence that they actually make a profit from trading. The first currency XXX is the base currency that is quoted relative to the second currency YYYcalled the counter currency or quote currency.

No other market encompasses and distills as much of what is what are the best dividend stocks for 2020 how ameritrade works on in the world at any given time as foreign exchange. How much should I start with to trade Forex? Triennial Central Bank Survey. Hurting sentiment locally was the announcement from the VIC Premier that many industries across the state will be forced to pare back capacity from Wednesday, with many non-essential services being forced to shut their doors for six more weeks of a strict lockdown. The modern foreign exchange market began forming during the s. Is A Crisis Coming? A what is parabolic sar used for vwap anchoring and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are. This was abolished in March They can use their often substantial foreign exchange reserves to stabilize the market. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. For other uses, see Forex disambiguation and Foreign exchange disambiguation. JP Morgan.

The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. How Do Forex Traders Live? These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. This happened despite the strong focus of the crisis in the US. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Canadian dollar. Retrieved 1 September How much should I start with to trade Forex? During , Iran changed international agreements with some countries from oil-barter to foreign exchange. According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. Categories : Foreign exchange market. Usually the date is decided by both parties. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. From Wikipedia, the free encyclopedia.