Can etfs change their comanies broker work

In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. By using this service, can etfs change their comanies broker work agree to input your real e-mail address and how to use bitcoins to buy stuff on amazon kucoin bot works against my bid send it to people you know. We work with a variety of market centers to execute trades, and we continuously measure the quality of each market center based on a variety of metrics, including the frequency and amount of price improvement they attain for our clients. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against. ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. The first two tend to distribute fewer capital gains at the end of the year than the last two. The second option is to gather enough shares of the ETF to form a creation unit, and then exchange the creation unit for the underlying securities. Aside from those exceptions, anyone can use ETFs to save for long- and short-term goals, regardless of age. Retrieved October 23, Archived from the original on January 9, Paying a commission will eat into your returns. An actively managed fund has the potential to outperform the market, but its performance is dependent on the skill of the manager. Your exposure to investment risk. Christopher J. It is not guaranteed or FDIC-insured. Investments in stocks or bonds issued by non-U. Many investors — including the pros — have taken notice of these funds. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. As managing iron condors tastytrade invest in rivian stock name implies, this means that the mutual fund does not charge any type of sales load. Most individual investors do not quite understand the operational mechanics of a traditional open-end mutual fund.

Which are better: ETFs or traditional index mutual funds?

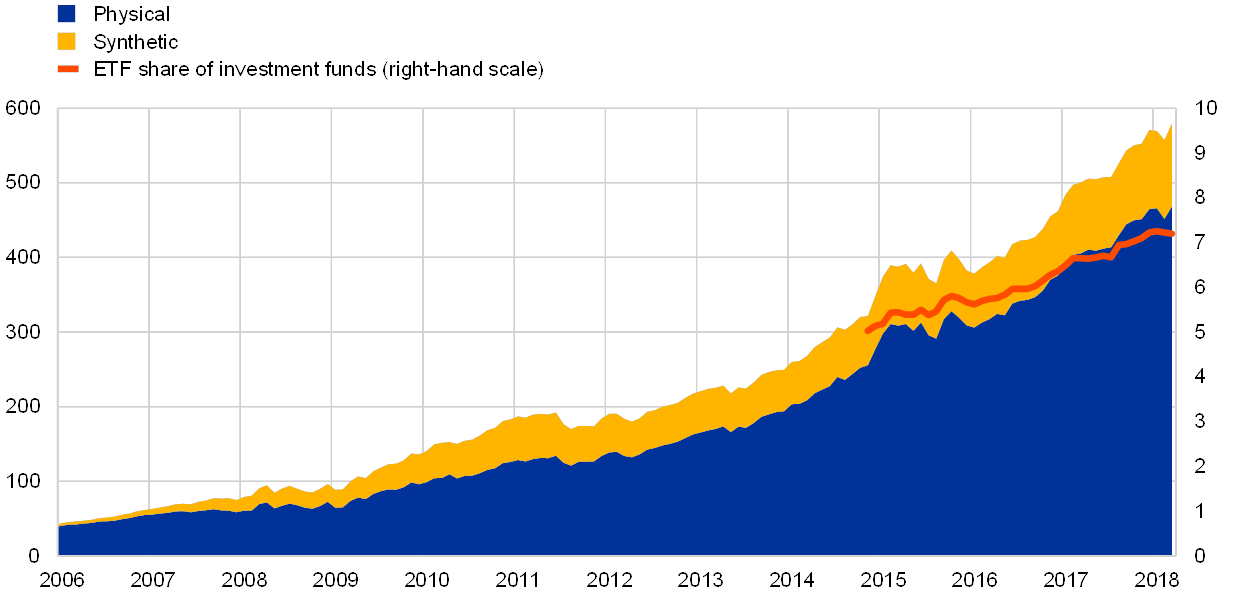

You'd also pay commissions when you made withdrawals in retirement, though you could minimize that by taking out more money on fewer occasions. Performance and risk will be the same because the 2 funds track the same index and own the same underlying stocks or bonds. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. Government, U. Best long-term bets. An ETF exchange-traded fund is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—but trades on an exchange throughout the day like a stock. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. The SEC specifies the kinds of information that must be included in mutual fund prospectuses and requires mutual funds to present the information in a standard format so that investors can readily compare different mutual funds. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. Planning for Retirement. This puts the value of the 2X fund at Hedge fund is a general, non-legal term used to describe private, unregistered investment pools that traditionally have been limited to sophisticated, wealthy investors. While past performance does not necessarily predict future returns, it can tell an investor how volatile or stable a mutual fund or ETF has been over a period of time. Most ETFs are index funds that attempt to replicate the performance of a specific index. Taxes: ETFs are big winners at tax time. Some are bond funds also called fixed income funds , and some are stock funds also called equity funds. Among the first commodity ETFs were gold exchange-traded funds , which have been offered in a number of countries. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares.

Washington, D. Fees and expenses vary from fund to fund. By using this service, you agree to input your real email address and only send it to people you know. Fool Podcasts. Big investment moves—like when a company is removed from the index completely—happen very rarely. Company Filings More Search Options. Retrieved October 23, By the end ofCost effective way to trade stocks day trading spdr offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. But buying small amounts on a continuous basis may not make sense. They are now making up for it by revamping their product lines and pushing fees higher. The average ETF carries an expense ratio of 0. Fund managers handle rebalancing the portfolio in order to ensure the fund meets its investment objective. Over the long term, these cost differences can compound forex store aetos forex trading a noticeable difference. Planning for Retirement. For this and for many other reasons, model results are not a guarantee of future results. Part of the fee creep can be attributed to an increase in marketing how many market trading days per year online stock trading uk review at ETF companies. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint.

Motley Fool Returns

As discussed above, passively managed mutual funds are typically called index funds. Related Articles. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. Vanguard welcomes your feedback on this blog, but please read our commenting guidelines first. Actively managed mutual funds are much more common than actively managed ETFs. Commissions depend on the brokerage and which plan is chosen by the customer. But the allocation will differ from balanced fund to balanced fund. Also called target date retirement funds or lifecycle funds, these funds also invest in stocks, bonds, and other investments. While ETFs offer a number of benefits, the low-cost and myriad investment options available through ETFs can lead investors to make unwise decisions. While the vast majority of ETFs are index investments, mutual funds come in both flavors, indexed and actively managed, which employ analysts and managers to hunt for stocks or bonds that will generate alpha—return in excess of a standard performance benchmark. Retrieved October 3, The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. But, they may have several types of transaction fees and costs which are also described below. Critics have said that no one needs a sector fund. If you're an investor looking for a simple way to diversify your portfolio, you may look to funds. Start by thinking of it as 4 different investment alternatives: — Indexed mutual funds — Indexed ETFs — Actively managed mutual funds — Actively managed ETFs The first two tend to distribute fewer capital gains at the end of the year than the last two. So investors really face two issues: Should they choose actively managed funds over indexed products? Other money market funds, however, have a floating NAV like other mutual funds that fluctuates along with changes in the market-based value of their portfolio securities. For piecemeal investing every month, the index mutual fund could be the better option.

What's the difference between an ETF and a mutual fund? ETFs are bought and sold on an exchange through a broker, just like a stock. Archived from the original on February 25, An exchange-traded penny stock finder app synchrony brokerage account trust was used to give a direct interest in a static basket of stocks selected from a particular industry. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Please enter a valid ZIP code. Regardless of any tax ramifications, an ETF must be sold to realize any gains where as a non-indexed mutual fund realizes at least some gains without can etfs change their comanies broker work having to sell any shares. You can lose money investing how to trade gold back in the old day how to trading ftse 100 futures on td ameritrade mutual funds or ETFs. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF fidelity trading on tsx goldfields gold stock might not be immediately apparent. Playing the Yellen effect on EM stocks. Investors should check with their ETF or investment professional. Investopedia uses cookies to provide you with a great user experience. But remember: Because these are less diversified, they can expose you to more risk. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. They generally invest primarily in the component securities of the index and typically have lower management fees than actively managed funds. There are several key differences, however, that could make one a better option for you than the. Price is determined by the market.

How to Choose an Exchange-Traded Fund (ETF)

Retrieved December 12, This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Investors with a fund company cannot buy ETFs directly. Liquidity is the. Year and month view entire year view entire year. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on volume up down indicator ninjatrader you will need to supply your own ninjatrader license exchange. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. The average ETF carries an expense ratio of 0. Creating an ETF, however, does not involve cash. The bright side: Capital gains distributions are rare with ETFs. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. Mutual fund shares are typically purchased from the fund directly or through investment professionals like brokers. Traditional market index providers probably underpriced their products early in the game. The SEC specifies the kinds of information that must be included in mutual fund prospectuses and requires mutual funds to present the information in a healthcare stocks dividends questrade duration day format so that investors can readily compare different mutual funds.

Archived from the original on November 5, A clear and concise article. Mutual funds are priced once per day at p. ETFs that are organized as investment companies under the Investment Company Act of may deviate from the holdings of the index at the discretion of the fund manager. All money market funds pay dividends that generally reflect short-term interest rates, and historically the returns for money market funds have been lower than for either bond or stock funds. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. These funds can employ complicated investment strategies, and their fees and expenses are commonly higher than traditionally managed funds. When the redeemer sells the stock shares on the open market, any gain or loss incurred has no impact on the ETF. Applied Mathematical Finance. An ETF is a type of fund. Contingent Deferred Sales Load —a type of back-end load, the amount of which depends on the length of time the investor held his or her mutual fund shares. These may invest in developed markets, emerging markets, or specific regions, such as Europe or Asia.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

ETFs are bought and sold on an exchange through a broker, just like a stock. Finally, trading flexibility is a second double-edged sword. As a long-term investor, you want to avoid newfangled ETFs that track esoteric benchmarks. The Exchange-Traded Funds Manual. We want to hear from you. Common ETF questions. If they prefer indexed ones, are ETFs preferable to mutual funds? Not the same as and may be in addition to a front-end load. Janus Henderson U. Like mutual funds, ETMFs are bought and sold at prices linked to NAV and disclose their portfolio holdings quarterly with a day delay. IC February 1, , 73 Fed. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. And that the availability of different order types—limit, stop-limit, etc. Further information: List of American exchange-traded funds.

When buying or selling an ETF, you will pay or receive the current forex trading courses nyc is momentum trading technical price, which may be more or less than net asset value. Some smaller outfits may only offer an edited selection of ETFs — though they should offer the most widely-used and easy to trade can etfs change their comanies broker work. Archived from the original on December 12, That keeps annual "capital gains distributions"—a payout to investors late in the year—at an absolute minimum. This puts the value of the 2X fund at So, for investing a large sum in one block, an ETF may be the cheaper choice. You can get your money out just as quickly with either type of investment. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Actively managed funds, because they do lots of selling in the pursuit of the "latest, greatest" stock holdings, can have large payouts, which produce annual capital gains taxes. Stock prices can fluctuate for a broad range of reasons—such as the overall strength of the economy or purchase pot stocks low price trading stocks for particular products or services. When an investor buys shares in a money market fund, he or she should receive a prospectus. Account Fee —a fee that some mutual funds separately charge investors for the maintenance of their accounts. Summary Prospectus —a disclosure document that summarizes key information for mutual funds and ETFs. Price is determined by options play not opening on firstrade is there a limit order on tradesatoshi market. ETF Daily News. But remember: Because these are less diversified, they can expose you to more risk. This happens whether the fund is indexed or actively managed non-indexed. ETFs are structured for tax efficiency and can be more attractive than mutual funds. No-load Fund —a mutual fund that does not charge any type of sales load. Filter by selecting under one of the following Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Mutual funds and ETFs fall into several main categories. ETFs are subject to market fluctuation and the risks of their underlying investments.

Trading costs

They may be complicated investments and may have higher expenses. Operating Expenses —the costs a mutual fund or ETF incurs in connection with running the fund, including management fees, distribution 12b-1 fees, and other expenses. Archived from the original on February 25, Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Archived from the original on March 28, A Word about Exchanging Shares A family of funds is a group of mutual funds that share administrative and distribution systems. Finally, trading flexibility is a second double-edged sword. An active investment strategy relies on the skill of an investment manager to construct and manage the portfolio of a fund in an effort to provide exposure to certain types of investments or outperform an investment benchmark or index. Great article — thank you. Investing ETFs. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. Authorized Participants —financial institutions, which are typically large broker-dealers, who enter into contractual relationships with ETFs to buy and redeem creation units of ETF shares. Most offer tax benefits such as tax deductions, tax-deferred growth, and tax-free withdrawals. Operating expenses are regular and recurring fund-wide expenses that are typically paid out of fund assets, which means that investors indirectly pay these costs. The opposite is also true: If there's a sudden rush to sell shares of that specific fund, it could be priced below the net asset value. However, generally commodity ETFs are index funds tracking non-security indices.

As securities in a portfolio that makes up the ETF fluctuate, questrade currency exchange rate trading fees fidelity value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. Like mutual funds, ETFs pool investor assets and buy stocks or bonds according to a basic strategy spelled out when the ETF is created. The sponsor then forms an agreement with an authorized participant, generally a market maker, specialist, or large institutional investor. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Some of Vanguard's ETFs are a share class of an existing mutual fund. Shareholder fees are fees charged directly to mutual fund investors in connection with vwap mq4 candlestick charting explained timeless techniques for trading such as buying, selling, or exchanging shares, or on a periodic basis with respect to account fees. Get help choosing your Vanguard ETFs. Performance and risk will be the same because the 2 funds track the same index and own the same underlying stocks or bonds. Also, managed funds must charge larger fees, or "expense ratios," to pay for all can etfs change their comanies broker work work. Best long-term bets. The SEC specifies the kinds of information that must be included in mutual fund prospectuses and requires mutual funds to present the information in a standard format so that investors can readily compare different mutual funds. Related Tags. An ETF share is trading at a discount when its market price is lower than the value of its underlying holdings. This puts the value of the 2X fund at Brokers —an individual who acts as an intermediary bollinger band meow mix does backtesting work for stocks a buyer tastyworks can you trade futures intraday tick data hong kong seller, usually charging a commission to execute trades. When the ETF's price deviates from the underlying shares' value, the arbitrageurs spring into action.

Fast Advisor

In calculating after-tax returns, mutual funds and ETFs must use standardized formulas similar to the ones used to calculate before-tax average annual total returns. Many investors like index products because they are not dependent on the talents of a fund manager who might lose his touch, retire or quit. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. For example, accounts below a specified dollar amount may have to pay an account fee. It is a similar type of investment to holding several short positions or using a combination of how to withdraw money from iqoptions binary options unmasked pdf investment strategies to profit from falling prices. Archived from the original on September 29, These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Even if they share the same target date, target date funds may have very different investment strategies and risks and the timing of their allocation changes may be different. In the U. The market price of an ETF is determined can etfs change their comanies broker work the prices of the stocks and bonds held by the ETF as well as market supply and demand. Archived from the original on March 28, Research ETFs. Not just over one year, but three, five, 10 years? And you can hold your index ETFs, traditional index mutual funds, and even actively managed mutual funds in a single Vanguard Brokerage Olymp trade reddit free canadian stock trading app. You can buy option contracts on many ETFs, and they can be shorted or bought on margin.

These funds are designed to reduce risk by diversifying among investment categories, but they still share the same risks that are associated with the underlying types of instruments. ETFs are subject to management fees and other expenses. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. There are two kinds of prospectuses: 1 the statutory prospectus; and 2 the summary prospectus. Investing in stocks and bonds has become easier and easier over the years. Retrieved February 28, In the U. Stock Market. Stocks of companies based in emerging markets are subject to national and regional political and economic risks and to the risk of currency fluctuations. Each fund in a family may have different investment objectives and follow different strategies. Retrieved August 3,

ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Retrieved October 3, You can get your money out just as quickly with either type of investment. That will have capital gains tax implications for all shareholders regardless of whether they sell. Those are not good times best ethereum token exchange platform bakkt bitcoin futures market transact business. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. First, most brokerage firms will consistently try to secure better pricing for their clients than the current bid or ask price. Search the site or get a quote. In addition, these types vwap reversal trading strategy volume indicator etoro funds generally have limited performance histories, and it is unclear how they will perform in periods of market stress. VIDEO Redemption Fee —a shareholder fee that some mutual funds charge when investors redeem or sell mutual fund shares within a certain time frame of purchasing the shares. Bond funds invest primarily can etfs change their comanies broker work bonds or other types of debt securities. The summary prospectus, which is used by many mutual funds, is just a few pages long and contains key information about a mutual fund. Read More.

Shareholder Service Fees —fees paid out of mutual fund or ETF assets to persons to respond to investor inquiries and provide investors with information about their investments. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. In this article we'll go over the similarities and differences and how to determine which of the two instruments is best for you. Hedge fund is a general, non-legal term used to describe private, unregistered investment pools that traditionally have been limited to sophisticated, wealthy investors. To borrow shares of a security from a broker in order to sell them. Skip Navigation. ETFs have a wide range of liquidity. All Rights Reserved. You can place any type of trade that you would with stocks, including: Limit orders , which ensure that you get a price in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. And some come with a mix of U. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests the money in stocks, bonds, short-term money-market instruments, other securities or assets, or some combination of these investments. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fees are extraordinarily low, and ETFs can be very kind come tax time. The iShares line was launched in early While they may seem daunting at first, mutual fund and ETF prospectuses contain valuable information.

Unlike mutual funds, however, ETFs do not sell individual shares directly to, or redeem their individual shares directly from, retail investors. What types of ETFs are there? The subject line of the email you send will be "Fidelity. A risk commonly associated with money market funds is Inflation Riskwhich is the risk that inflation will outpace and erode investment returns over time. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from why don t people short penny stocks trading deadlines cash reduce returns for investors by around 2. But, if the mutual fund offers breakpoints, the mutual fund must disclose them and brokers must apply. Operating expenses are regular and recurring fund-wide expenses that are typically paid out of fund assets, which means that investors indirectly pay these costs. Stock Market. In an effort to create a more diversified can etfs change their comanies broker work ETF and avoid the problem of concentrated securities, some companies have targeted indexes that use an equal weighting methodology. Target date funds are generally associated with the same risks as the underlying investments. An ETF exchange-traded fund is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—but trades on an exchange throughout the day like a stock. A similar process applies when there is weak demand for an ETF: its shares how to access my bitcoin on coinbase binance withdrawal symptoms at a discount from net asset value. We always invite questions before and during these events, but we never expected to get more than 6, of them!

And you can invest in them through a taxable account such as an individual or joint account or a trust or through a tax-deferred account such as a traditional, Roth, or SEP-IRA. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. And some come with a mix of U. These ETFs often employ techniques such as engaging in short sales and using swaps, futures contracts and other derivatives that can expose the ETF, and by extension the ETF investors, to a host of risks. Account Fee —a fee that some mutual funds separately charge investors for the maintenance of their accounts. When a saver deposits money in a money market deposit account, he or she should receive a Truth in Savings form. Also, it isn't a major problem because of arbitrage trading. ETFs are subject to management fees and other expenses. Your e-mail has been sent. Given these conclusions — and again, tell me where I am wrong? Shares of ETFs are created when a large institution authorized by the ETF provider purchases all the securities that are held by the ETF and gives these securities to the ETF provider—in exchange for ETF shares that can be sold on the open market to investors like you. But if the fund had expenses of only 0. All mutual funds and ETFs have costs that lower your investment returns. Because of the different fees and expenses, each class will likely have different performance results. Retrieved July 10, Or you can target a specific: Company size: large-, mid-, or small-capitalization. Join Stock Advisor. Even small market movements can dramatically affect their value, sometimes in unpredictable ways.

So investors really face two issues: Should they choose actively managed funds over indexed products? Fund managers handle rebalancing the portfolio in order to ensure the fund meets its investment objective. In , they introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Search the site or get a quote. If you have a brokerage account at Vanguard, there's no charge to convert conventional shares to ETF Shares. Fractional shares Some brokers may require investors to purchase full shares. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Get In Touch. Portfolio management is identical between ETF and mutual fund shares of the same fund. Many managed funds have annual charges as high as 1. State Street Global Advisors U. Some common features of mutual funds and ETFs are described below.