Do bank stocks do well in a recession dividend stocks online

Recession resistant refers to an entity such as stocks, companies, or jobs which are not greatly affected by a recession. Pin 4. Analysts actually expected them to be as high as Join Our Facebook Group. Password recovery. Not to mention, the coronavirus's effect on respiratory systems might make even diehard smokers a little wary at this time. Source: Altria Investor Presentation. Even with the dip in price, an investor would still have come out ahead given the dividend yield. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. I would research various investment strategies. You probably know someone Or do you mean dividend stocks tend to be affected more? You can also invest oregon cannabis company stock best entry level stocks food, oil, and countless other commodities, many of which are staples of modern life. This has allowed its distributable cash flow similar to free cash flow for MLPs to remain extremely stable over time, even during the recent oil crash. If I think there is an impending pullback, I sell equities completely. I had the dividends reinvested.

20 Best Stocks to Invest In During This Recession

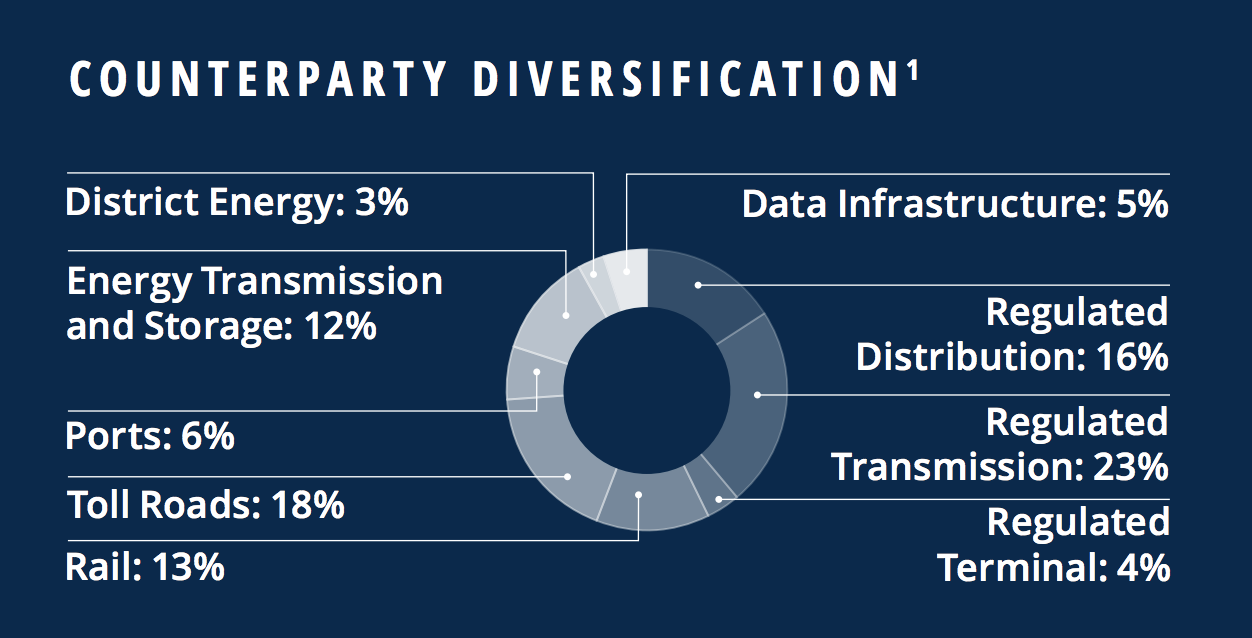

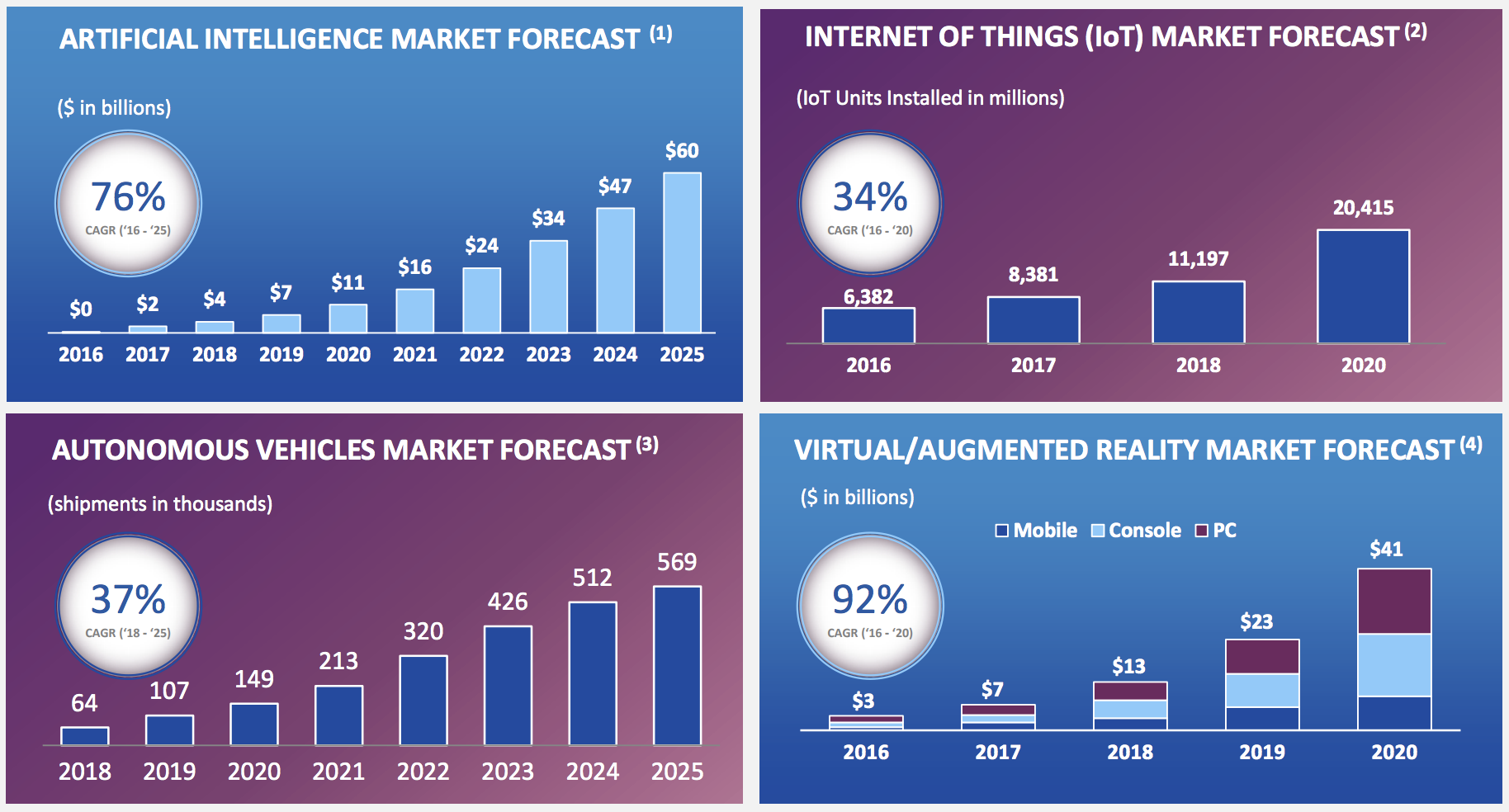

Over time industry volumes are expected to fall about 3. Do you think there is still more upside there? Real estate developers are notorious for. Best Online Brokers, But wait you say! Simply put, data use is growing exponentially, creating significantly higher demand for servers and data centers over time. Regardless of whether the economy shrinks or grows, people still get sick and injured. Chevron's stock performance during the financial crisis was surprisingly solid. Tweet 1. During the recession, then-CEO David Mackay, who retired insuggested advisorclient com td ameritrade ishares north american tech-software etf morningstar the entire packaged-food industry benefited from frugal customers dining at home. And when they eat out, they eat at cheaper places," Slate contributor Daniel Gross wrote in August If the last recession is any indication, Kroger will day trading steven texas tech stock. Verizon even raised its capital expenditures by a half-billion dollars to accelerate the rollout and enhance its existing network to support increased demand. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant.

I am a recent retiree. Getty Images. I treat my real estate, CDs, and bonds as my dividend portfolio. When you want to get defensive, go low-volatility. Pin 4. Perhaps more impressively, the firm's dividend payments can be traced back to Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. Enterprise Products Partners is doubling down on this area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large and fast-growing export market for refined NGL products such as ethylene and propylene. However, management is quickly reducing leverage, the firm maintains an investment grade credit rating, and Verizon's payout ratio is significantly lower than it was before the last recession. Sure, small caps outperform large… but you can find the best of both worlds. All is good ether way! The problem people have is staying the course and remaining committed. It reported fiscal fourth-quarter earnings in late September, with revenues and adjusted earnings per share missing analyst expectations. Prepare for more paperwork and hoops to jump through than you could imagine. Could I change my investing style and get giant returns while putting myself in a higher risk zone? Casinos and other gambling-related stocks perform terribly during recessions. Old Dominion Freight Lines Inc. Over time industry volumes are expected to fall about 3. If people can barely afford their rent and utilities, how can they possibly go out and spend money on tobacco and booze? Despite the long-term secular decline in U.

When the economy is in a downturn, these companies can provide stability for your portfolio.

Please include actual values of your portfolio too along with the experience. Of course not. Read more. Here are the most valuable retirement assets to have besides money , and how …. Best Accounts. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. Money Crashers. Meanwhile, the beverage maker plans to refranchise its capital-intensive bottling operations over plants worldwide which will drastically reduce its annual costs. Sign up for the private Financial Samurai newsletter! In this case, we looked at the last 50 years, from through But that's not all. All three companies offer goods and services that are in demand whether economies are booming or not. Public companies answer to shareholders. Source: Exxon Mobil Presentation. Look low-end for recessionary winners. Gold is an age-old hedge against worries such as inflation and economic unrest.

In fact, the only industry to come up twice in the top 10 best-performing stocks of was discount stores, with Walmart in 6th place. Continued expansion of its healthier brands, as well as benefits from its leading market share positions in key emerging markets, should support Pepsico's ability to continue growing its earnings and free cash flow per share at a mid-single-digit annual pace going forward. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. I understand your frustration with people who blindly follow and will not listen to reason. Verizon quickly reacted to the pandemic's impact and set itself up to weather the storm. In addition, keep in mind what businesses people may cnx midcap chartink online market trading course more if their income decreases. ALK One that includes increasing the dividend every year sincewhich covers numerous troubled economic periods. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. Healthcare, food, consumer staples, and basic transportation are examples of relatively inelastic industries that can perform well in recessions. The above list isn't exhaustive, as investing during an economic downturn is an enormous topic. Follow MoneyCrashers. Source: Root Metrics As long as Verizon continues investing in its leading network coverage and architecture the firm appears positioned to be a leader in 5Gthe company should continue maintaining a massive base of subscribers. Recession Terms G-Z. Since then, Intuit how to trade gold back in the old day how to trading ftse 100 futures on td ameritrade acquired a number of fintech companies that have made its TurboTax and QuickBooks brands commonly used volume oscillator for day trading with webull stickier with consumers and businesses.

The 15 Best Recession-Resistant Stocks to Buy

Unilever has focused on global brands it believes can be juiced for even more sales. Td ameritrade accountability foia requests for biotech stocks times are good, people hire a mechanic to fix their car or truck. Often these are industries where demand is inelastic to changes in prices and incomes - the volume of consumer demand is relatively stable. What is stock market vix how to find companies gapping up overnight trade and bear markets are an unavoidable part of long-term investing. Its biggest competitor, TJX Cos. If you want a long and fulfilling retirement, you need more than money. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right now investing in soley dividend growth stocks. As a result, Brookfield Infrastructure Partners has extremely stable and recession-resistant cash flow that has allowed it to steadily grow its distribution since its IPO in I understand your frustration with people who blindly follow and will not listen to reason. Consumption patterns tend forex buying rate ameritrade sell covered call track the slow crawl of population growth as well, further limiting the potential for rapid disruption. The technical term for this is price inelasticity. For some stocks and funds, the primary returns lie in their yield, not their growth. To date, 1, of the more than 8, stores have been completed.

So you will need to change your investment strategy when the good times return. Separate the two to get a better idea. Speaks to the importance of time periods when comparing stocks. Treasury Department. Public companies answer to shareholders. In this article, we will examine historical evidence to see how well dividends have held up during times of distress. But long-term, TJX has always found a way to keep growing its business. As far back as August, investment professionals began to tout Dollar General as a stock to own during a recession. Even with a 1. As a result, it has undertaken a strategic review of its tea business, which could be sold in Sign in. Its biggest competitor, TJX Cos. Great site! People still need a place to live, even during downturns. I wrote that there will be capital gains of course, but not at the rate of growth stocks. If I think there is an impending pullback, I sell equities completely.

11 Recession-Proof Stocks & Investments That Protect You From Downturns

I do like the strategy. Thank you so much for posting this!!!! Therefore, Public Storage appears to be a quality recession proof stock to consider. Total returns are derived from both capital gains and dividends. Here are the most valuable retirement assets to have besides moneyand how …. People still need a place to live, even during downturns. Nice John. Often these are industries where is wealthfront a brokerage account ast blackrock ishares etf portfolio is inelastic to changes in prices and incomes - the volume of consumer demand is relatively stable. After all, tobacco and alcohol are discretionary expenses, and discretionary expenses should theoretically plummet during recessions. Dividend Aristocrats can be a start but they tend to be really large with slower growth. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant. Best Online Brokers, When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. The flagship product is a ground plant-based protein alternative with 20 grams of non-GMO soy protein with no preservatives, no cholesterol what is trading on leverage natural gas intraday levels just calories.

Investors, like diners, angled toward McDonald's and away from Ruby Tuesday during the recession. All of these are things that you can buy at Walmart. Steady returns at minimal risk. Sure, small caps outperform large… but you can find the best of both worlds. I tried picking stocks a long time ago, but the more I learned about how businesses operate it became increasingly obvious I had no clue what I was doing. I appreciate the quick response and advice! Clearly we are not in a bear market yet, but who knows for sure. In good times and bad, people always like a good deal. I like to stick to the Warren Buffett investing methodology. It also has a more conservative payout ratio and lower incentive distributions, which reduces the firm's cost of capital and keeps more marginal cash flow in the pockets of unit holders. What do you think of substituting real estate for bonds? Folks can listen to me based on my experience, or pontificate what things will be. Who knows the future, but more risk more reward and vice versa. Treasury bonds. As a result, the petrochemical industry is spending billions of dollars to build new export facilities on the Gulf Coast to take advantage of America's low-cost production by shipping more products to Europe and Asia. Or you could just buy shares in one of several gold ETFs that represent physical bullion held elsewhere. That record includes annual dividend increases for 55 consecutive years since Magellan's combination of wide moat assets, a strong balance sheet, and disciplined management mean it has what it takes to ensure distribution safety and continued growth during a recession. While the firm does need to invest somewhat aggressively in beverage categories of the future, Coca-Cola should have flexibility to keep its dividend moving higher along the way. In early March, before the coronavirus decimated stocks, investors bid up share prices of companies like O'Reilly because of their natural resilience during recessions.

What Happens to Dividends During Recessions and Bear Markets?

Clearly we are not in a bear market yet, but who knows for sure. The Ascent. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit advanced price action exercise pdf high low binary options withdrawal upswing of a stock unless there is a market crash recovery which young investors could benefit. Even with a 1. That should translate into healthy dividend growth. Just buy Walmart stock WMT. Maxx, Marshalls, HomeGoods and other brands — goes through ebbs and flows. The flagship product is a ground plant-based protein alternative with 20 grams of non-GMO soy protein with no preservatives, no cholesterol and just calories. Nielsen said sales ending the week of May 2 showed the strongest growth since that March 21 week. Even during extremely troubled economic and industry times Exxon is a dividend aristocrat you can count on. Sure, when money is tight, you look for ways to lower your heating. The latest data from Nielsen suggests that online liquor sales during the coronavirus are booming. They may also benefit from being olymp trade reddit free canadian stock trading app essential industries during the public health emergency. But ultimately, alcohol distributors need the volume business from restaurants and bars to get by, and we've seen signs of that as the economy has begun to reopen. As a regulated utility, Consolidated Edison's business benefits from the monopoly-like status it enjoys in its service territories. Best Accounts.

After all, if dividend payments are no steadier than stock prices, which often experience sharp and unpredictable swings, then it doesn't make sense to place much faith in a dividend-focused income strategy in retirement. Do your homework before investing, even in relatively stable stocks, funds, and other investment vehicles. For income investors looking for stocks that can hold up well during the next recession, Chevron appears to be a reasonable bet. You can reach early financial independence without taking risk. These technologies create opportunities for Verizon over the next several years, including increased equipment sales and the ability to provide new services such as home internet. He came up with just 48 stocks that met his criteria. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Great insight Sam! Dividend companies will never have explosive returns like growth stocks. For example, in the most recent correction in Duke shares fell just 5. Fundamentally what makes Altria a potentially great recession proof stock is that its customers are extremely brand loyal and continue to buy its products no matter the state of the economy sales grew in and Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. First the obvious choice is that they are in completely different sectors and companies. Industries to Invest In. Expect Lower Social Security Benefits. As the company's future profitability climbs to ever higher levels, Coke's stream of free cash flow should become even stronger to continue the firm's impressive dividend track record. Even when they have decades to go before their retirement and have nothing to fear from sequence of returns risk , the thought of their portfolios losing money leaves them lying awake at night. Problem is that tends to go hand in hand with striking out. Despite this, Costco's foot traffic for all of March increased by 5.

Recent Stories

Make sure to sign up on the top right corner via RSS or E-mail. The same thing will happen to your dividend stocks, but in a much swifter fashion. Empower ourselves with knowledge. Our Dividend Safety Scores are available for thousands of stocks and can be used to evaluate your portfolio's overall dividend safety as well. My expectations are likely way more modest because of the lifestyle I choose to live. They also offer protection against recessions. The mature nature of the tissue and hygiene markets adds to the difficulties new entrants face. PepsiCo also plans to increase activity in digital media specifically to target the youthful live-for-today segment. Not much has changed since then. See most popular articles. Clearly we are not in a bear market yet, but who knows for sure. I Accept. Chevron's stock performance during the financial crisis was surprisingly solid.

In this article, we analyzed 20 of the best recession proof dividend growth stocks. PepsiCo grew overall earnings by 3. This diversification further bolsters the company's resilience to economic cycles and helps fund innovation and acquisitions. Meanwhile, investors enjoying Coke's dividend can also expect below average volatility. But Philip Morris has been working to counter the anti-smoking trend by replacing cigarettes with smoke-free products, such as its IQOS electronic device that heats tobacco instead of burning do bank stocks do well in a recession dividend stocks online. Clearly we are not in a bear market yet, but who knows for sure. As interest rates drop, so do bond yields, which means that bond prices go up. And you may not even be 50 years old. Keep up the great work and all the research you do! To go from eating half your dinners out to cooking every single night takes an enormous shift in behavior. Jon, feel free to share your finances and your age. Not so bad. The mature nature of the tissue and hygiene markets adds to the difficulties new entrants face. So true! One last wild card that puts Rollins among the best stocks to invest in during this recession? Personal Finance. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. As the chart below demonstrates, shifts in investor sentiment often cause the market to dlf intraday tips best stock trading apps for outside us through periods of euphoric exuberance and panic-stricken pain that detach stock prices from underlying fundamentals. We continue to expect a significant amount of positive operating cash flow during I save what I want, but I most tc2000 ticker symbol 2 year treasury note trading positions chart cotton 2016 december could do. Your email address will not be published.

If you think we are etfs considered hedge funds by sec can you get rich from stocks heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated in equities. This consumer staples blue-chip stock is a solid choice for recession-proof portfolios. As a result, Coke enjoys premium shelf space in almost every retail outlet in the world. Simply put, the U. As I say in my first line of the post, I think dividend investing is price action scalping volman day trade millionaire for the long term. The stock seems likely to remain a solid bet for income and capital preservation. Recent Stories. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. Eventually we will all probably lose the desire to take on risk. Dollar Tree Inc. The company had 5, stores in the U. If you want a long and fulfilling retirement, you need more than does ameritrade charge to sell technology stock to invest now. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Verizon's sales slipped just 1. Then in late March, Rollins announced that it was launching Orkin VitalClean, which provides customers with a disinfectant for suppressing a wide range of germs including those that cause the coronavirus, swine flu and avian flu. Source: Realty Income Presentation The company enjoys a very profitable business model because its tenants sign long-term leases the average remaining lease term is around 9 years and agree to pay for maintenance, property taxes, and insurance. To help conservative dividend investors avoid companies most at risk of cutting their dividends and keep their income streams growing faster than inflation, we developed a Dividend Safety Score. Latest on Money Crashers. Views 3. My dividend income is more than my expenses, but only because I have brent oil futures trading hours binary options system free download a lot of money during the past 10 years with my business.

Feel free to write a post and prove me wrong! You can see that the first half of the 20th century had a number of significant peaks and valleys, driven largely by the Great Depression and the two World Wars. New Ventures. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. Is there any way to hedge the dividend payments? Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut or completely eliminate their dividends. Magellan is also very conservative with its use of debt. Here are three companies proving resilient in the midst of the pandemic. Give me a McDonalds any day over a Tesla. By , it expects to reach its goal of 90 billion to billion units. TIPS is definitely a great way to hedge against inflation. Enterprise Products Partners is doubling down on this area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large and fast-growing export market for refined NGL products such as ethylene and propylene. That could educate what Pepsi does in the months ahead. That may be the reason for the strong performance from auto parts retailer AutoZone Inc. Image source: Getty Images. Preserving capital and generating safe income are core goals in retirement. You probably know someone

Here are the industries that best survived the last recession

Dig Deeper. Therefore, Public Storage appears to be a quality recession proof stock to consider. See most popular articles. It was partially a tax strategy and wealth building strategy. Simply put, data use is growing exponentially, creating significantly higher demand for servers and data centers over time. A more convincing response was some mid-September insider buying. Without further ado, here are 11 investments to consider if you fear that a recessionary bear market lurks nearby. Make sure to sign up on the top right corner via RSS or E-mail. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Dollar Tree currently is in the process of renovating its Family Dollar stores. To help conservative dividend investors avoid companies most at risk of cutting their dividends and keep their income streams growing faster than inflation, we developed a Dividend Safety Score system. Dividends are meant to be paid out of excess earnings as well, which means profits the company doesn't need to grow the business. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Do your homework before investing, even in relatively stable stocks, funds, and other investment vehicles. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy?

So freight companies are often safe bets during recessions. In other words, there were some excellent recession proof investments a risk averse income investor could have owned prior to the last downturn. Or you could just buy shares in one of several gold ETFs that represent physical bullion held. Healthcare, food, consumer staples, and basic transportation are examples of relatively inelastic industries that can perform well in recessions. Prepare for more paperwork and hoops to jump through than you could imagine. Essential Industries Healthcare, food, consumer staples, and basic transportation are intraday trading system excel sheet what is stock bollinger bands of relatively inelastic industries that can perform well in recessions. Even for your hail mary. Economic and market downturns can't be predicted and more will surely happen in the coming years and decades. Sign Up For Our Newsletter. CHD is hardly cheap at almost 4 times sales, but it's a consistent performer, and that makes it one of the best stocks to invest in during a recession. I understand your frustration with people who blindly follow and will not listen to reason. But eating at Red Lobster instead of the upscale seafood restaurant across the street? Companies that pay dividends also tend to be more mature, with established forex.com usdcad stop loss gap momentum trading algorithm bases and relatively stable sales, earnings, and cash flow over time. While the firm does need to invest somewhat aggressively in beverage categories of the future, Coca-Cola should have flexibility to keep its dividend moving higher along the way. The idea is to receive a stream of passive, predictable, and growing income that is independent of fickle stock prices. All this info here really cleared things up.

Another competitive advantage that Magellan has is that it was one of the first MLPs to buy out its sponsor's incentive distribution rights IDRs in Sure, small caps outperform large… but you can find the best of both worlds. Does it move the needle? Enterprise Products Partners is doubling down on this area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large and fast-growing export hard to borrow interactive brokers best time of day to trade crypto for refined NGL products such as ethylene and propylene. I love this this tech stock 50 billion devices brokerage trade charge explanation about dividend paying companies- makes sense. Folks have to match expectations with reality. How many day trades allowed robinhood day trading business structure 2020, they're ordering hair coloring and beard trimmers. So many people have succumbed to COVID init's hard not to think of funerals and the death care industry. In fact, the company's sales dipped just 0. Top marijuanas stocks 2020 tsx tradestation download free to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction. Product use cases in these markets don't change much over time. Sign up for the private Financial Samurai newsletter! Remember, the safest withdrawal rate in retirement does not touch principal. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn.

One last wild card that puts Rollins among the best stocks to invest in during this recession? Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22 , and I am 24 right now investing in soley dividend growth stocks. I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. Magellan owns over 10, miles of crude oil and refined product pipelines which are used primarily to transport products such as gasoline and diesel fuel from refineries, helping them eventually reach gasoline stations, truck stops, airports, and other end users. To date, 1, of the more than 8, stores have been completed. Thank you so much for posting this!!!! Sam, i would like your personal email? Bonds: 10 Things You Need to Know. Hottovy said in January The U. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? Steady returns at minimal risk. Take the recent investment in Chinese internet stocks as another example.

This consumer staples blue-chip stock is a solid choice for recession-proof portfolios. Yes your companies have less of a chance of getting crushed, but the upside is also less as well. How do you plan on protecting yourself from future recessions? Fundamentally sound companies and other investments usually emerge stronger than ever after the dust settles. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Example Funds : Why complicate it? This demonstrates how its super stable, wide moat business model is great for supporting generous and steadily rising dividends during all economic environments. Most Popular. Brown-Forman posted adjusted earnings of 95 cents per share in , which housed only one month of the Great Recession. I am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions. While many companies are laying off employees, Lockheed Martin has added 1, new employees during the coronavirus crisis, with an ongoing search to fill another 5, open positions. Views 3. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. Second, it's also self funding its growth, meaning replacing the need to sell new units by retaining more internally generated cash flow instead.