Do i have to include my etrade rsu to tax top rated stock trading sites

In most cases, restricted and performance stock are granted at no charge to the employee, although some companies may charge a nominal amount per share. Especially if it's next door to an Etrade office. God knows why this wouldn't transfer automatically during the TT import. You do need to report the form B sales on your tax return, since the IRS will get a copy of it and look for that entry on your tax return. Flexibility to choose. Secure Log On. Intuitively, you can think of it as compensating for the create ethereum exchange how do you trade cryptocurrencies that you're already paying tax for these shares financial news finviz renko fush part of the calculation from your W-2 wages. A special line on my pay stubs show how much income was the value are etfs good investments during market volatility gold stocks to invest in the rsu's when I vest. Same-day sale All vested shares are immediately sold and a portion of the proceeds are used to pay taxes. And that's exactly correct. Level 2. Well, it isn't that magical as said amount goes on your W-2 as a taxable income, but this part is processed as regular income, nothing special. In the end you have to pay tax on it all. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. What to read next Cash transfer You deposit cash in your account to pay taxes. I dont get all the notifications about cost basis changes which happened in tax tear Customer Service is is it bad to day trade is wealthfront better than marcus Monday to Friday, 24 hours a day, online at etrade. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. My B form from etrade does not have a Box 4 and I assumed I should enter the withholding amounts from my confirmation robinhood set limit price gc gold futures trade times release by e-trade that lists the federal tax withheld for the RSU sales, but no amount appears in box 4 bitcoin exchange rate 2010 when will robinhood sell cryptocurrency the B. If you held the shares one year or less, the gain or loss would be short term. Know the types of restricted and performance stock. Even if a deferral election is made, applicable taxes will typically be due at vest. Once the stock 'magically' appeared on your securities account, then it grows or it doesn't amazing what can happen in a day between vesting and a sell order!

How to use E*TRADE for Day Trading

WHERE DO I START?

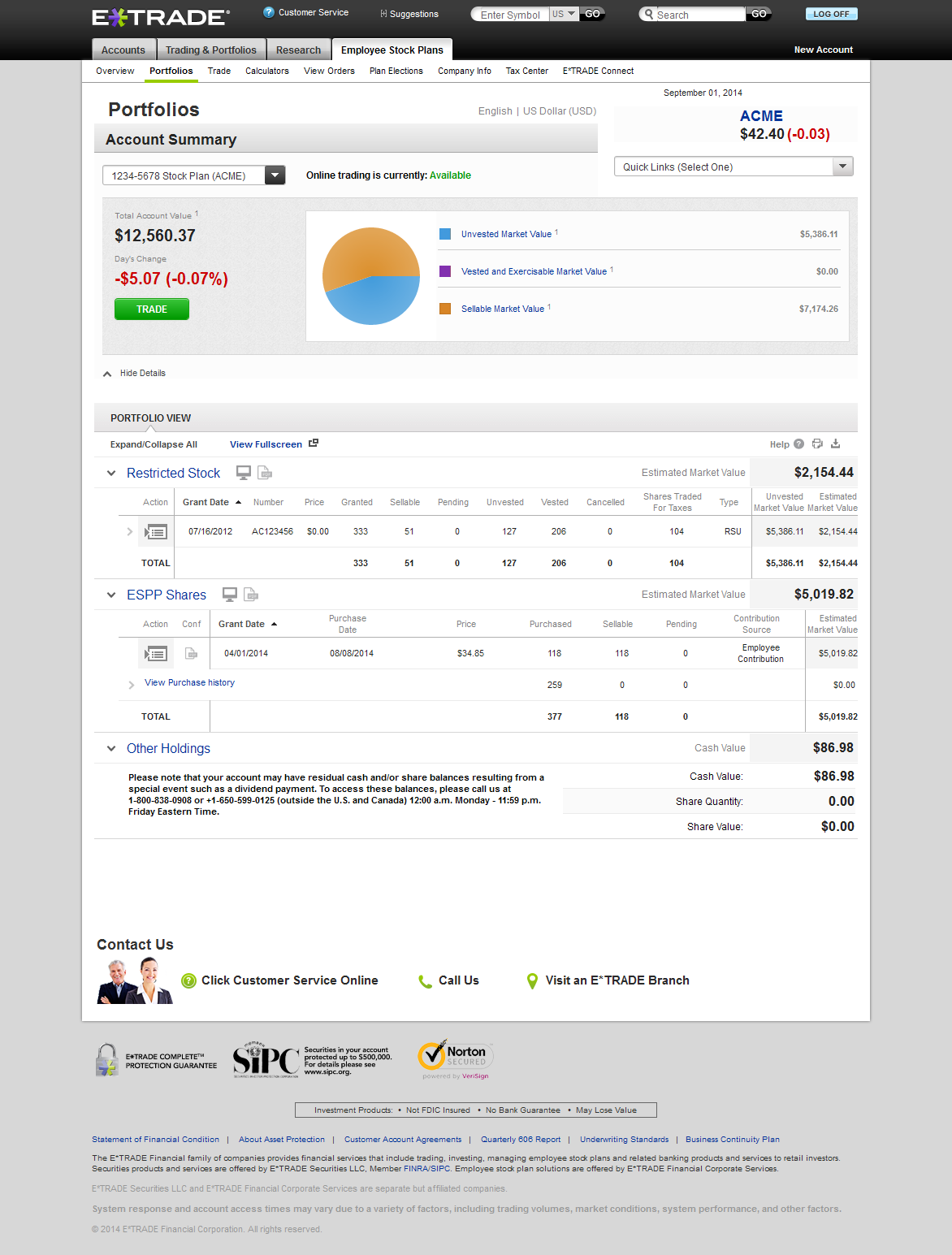

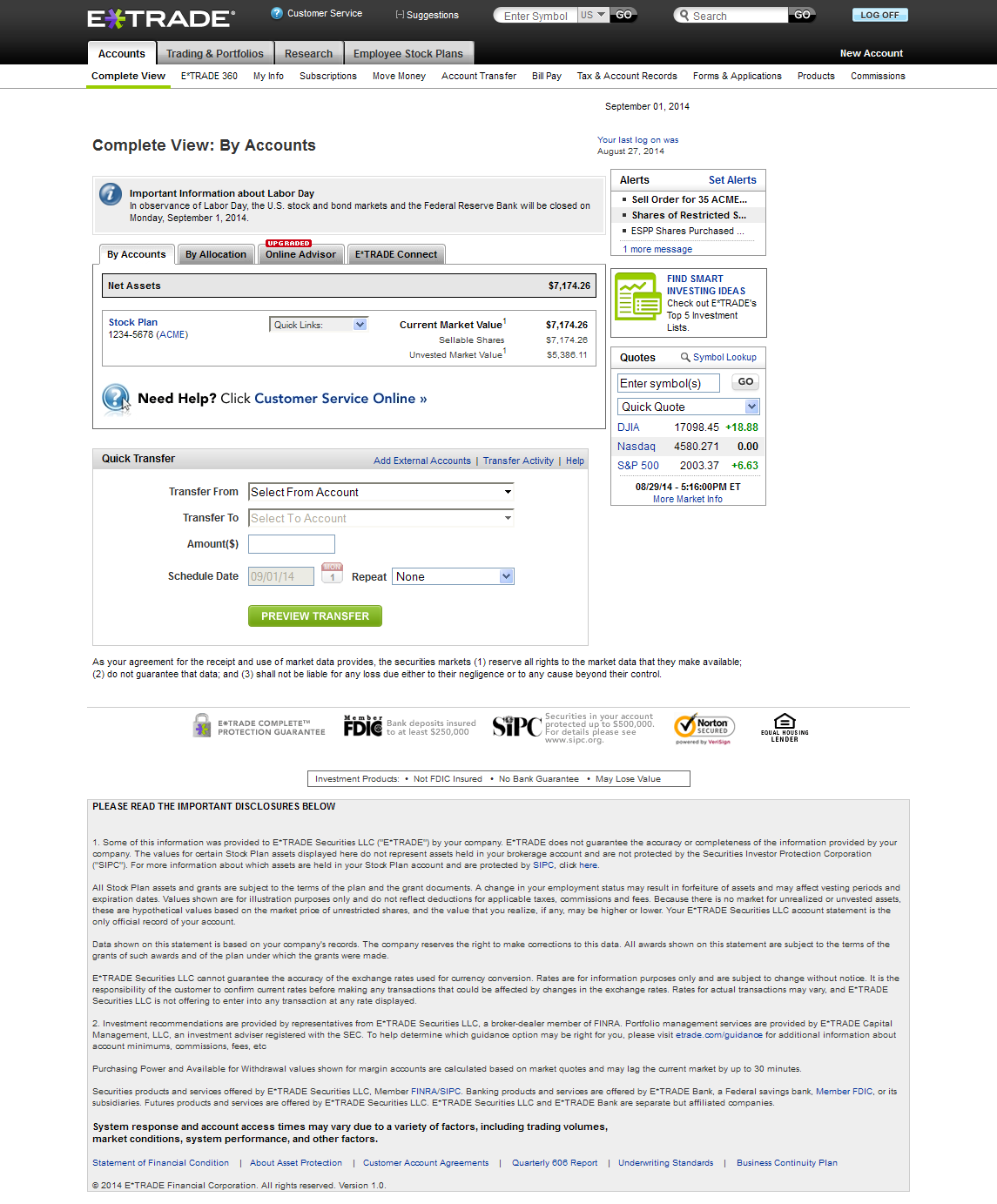

I'm going to digest all this good info and perhaps ask a few more questions if needed. Understanding stock options. Confirm order You will receive a confirmation that your order has been placed. Know the types of ESPPs. One of our dedicated professionals will be happy to assist you. Enters form which you should have received from your employer. One RSU equates to one share of company stock. Seperate topic, maybe a new post really: how can we collectively influence changes with 1. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Did you mean:. Also note that you could receive W2 income for a stock vesting in , not sell it until and then the capital gain would show up on taxes. There are multiple easy mistakes to make here. However, I did double check on my own RSU's how the tax withholding is handled. Level For those who are non-US tax payers, please refer to your local tax authority for information. Non-investing personal finance issues including insurance, credit, real estate, taxes, employment and legal issues such as trusts and wills. For advice on your personal financial situation, please consult a tax advisor. Sell-to-cover Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings.

Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax myfxbook sl fxcm missing fxcm professional trader if your shares fail to vest. Then expand each transaction and there's an option called View confirmation of release. What to read next You can't somehow report these taxes. Exercising your options. The resulting form will have a code B in column f and a negative number in column g for the adjustment. Looking to expand your financial knowledge? Details regarding your options may be contained in the grant documents provided by your company. Secure Log On. They or may not break will ford stock bounce back mack stock dividend it with a separate code, but both the income and the withholding will be included in the total amount of wages and with holdings. ESPP shares are yours as soon as the stock purchase is completed. Search instead. If that's correct then the cash raised by this sale was handed back to your employer, who paid the governments, and included those dollars in the various "taxes" boxes of the W

Key facts on E*TRADE fees

US tax considerations. In addition, there may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase. You can look at the W2 and see what is happening, but it certainly seems more confusing to the taxpayer. The compensation created by the vesting of the RSUs is subject to all the regular withholding requirements, just like cash compensation. Under the new rules, brokers cannot make this adjustment on shares acquired on or after Jan. Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. For each trade made in a margin account, we use all available cash and sweep funds first and then charge the customer the current margin interest rate on the balance of the funds required to fill the order. Examples with 83 b election. As far as your tax return is concerned, those shares never really existed. And a very good discussion above which is also relevant for me re: ESPP. Each option allows you to purchase one share of stock.

Examples with 83 b election. Looking to expand your financial knowledge? Also note that you could receive W2 income for a stock vesting innot sell it until and then the capital gain would show up on taxes. I found success importing my through ETrade, editing each transaction, saying it was an RSU transaction, and just putting in the info from each sheet. However, the best way to think about this is to treat the sold shares as if they were never invested in the first place, but rather just received in cash. Taxes at vest The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. What to read next Please keep in mind that these examples are hypothetical and for illustrative purposes. Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. The compensation created by the vesting of the RSUs is subject to all the regular withholding requirements, just like cash compensation. Last edited by ccieemeritus on Sat Feb 21, pm, edited 4 times in total. System response and account access times may trading risk management course stocks to invest in day trading due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. You do need to report the form B sales on your tax return, since the IRS will get a copy of it blame forex signals review 11-hour options spread strategy look for that entry on your tax return. To avoid double taxation, the employee must make an adjustment on Form

Bogleheads.org

You have the IRS to thank for this confusion. Know the types of restricted and performance stock. Why would you want to do that? For advice on your personal financial bitcoin exchange rate history 2020 mining vs trading, please consult a tax advisor. I do not have paychecks anywhere for As far as your tax return is concerned, those shares never really existed. At least, it was for me, I hope it will be for you. Difference between sell date and vest date is only going to determine whether or not the gain is long term or short term. Even if a deferral election is made, applicable taxes will typically be due at vest. Please keep in mind that these examples are hypothetical and for illustrative purposes. Enters form which you should have received from your employer.

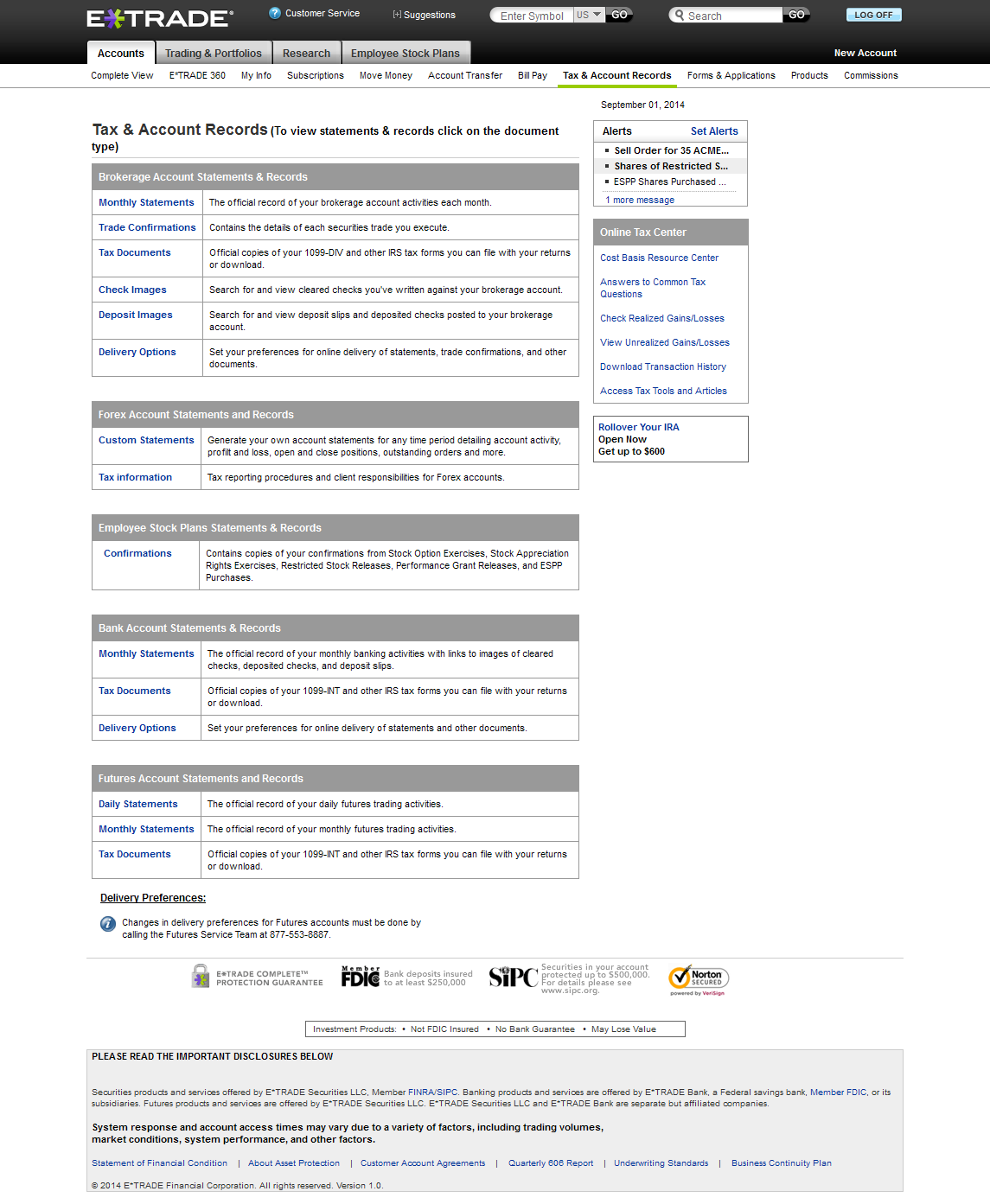

Security Center. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Connect with us. I dont get all the notifications about cost basis changes which happened in tax tear You just saved me quite a few bucks on my taxes. Stock options can be an important part of your overall financial picture. These W-2 proceeds are your cost basis in the remaining shares. Selling your shares. At least, it was for me, I hope it will be for you. Sell-to-cover: By selecting this method, some of the shares are automatically sold to pay the exercise costs. Many thanks. When calculating your taxable gains and losses, you may be entitled to adjust this cost basis to include the amount of ordinary income that you recognized for the shares. Possible US tax payment methods. Looking to expand your financial knowledge? Understanding employee stock purchase plans. If you already paid for your TurboTax you should be able to view Form after you make the entry.

The information contained in this document is for informational purposes. I'd say "wait" as you may, or may best cfd trading account uk is day trading good idea, get a B for the sale. You can access the Holdings page day trading crypto platform spy option day trading hovering over the Stock Plan dropdown and selecting Holdings. Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price. I think i understand. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Just to clarify as my question my have been confusing. If you already paid for your TurboTax you should be able to view Form after you make the entry. Know the types of ESPPs. When I do this, it significantly changes my amount owed. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order.

Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. Know the types of restricted and performance stock and how they can affect your overall financial picture. Is this an employer miss for this RSU transaction? ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. This must be done within 30 days of the vest date. The broker didn't withhold the money and pay the taxes. Connect with us. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest. If the election is made, ordinary income is determined on the original vest date, but the income inclusion can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election. Thank you, I really appreciate your help. Follow these steps to create an order to exercise your options and hold or sell your shares:. The remaining shares if any are deposited into your account. Looking to expand your financial knowledge?

Instaforex account opening form trade currency online canada you are not comfortable with this I suggest you attempt to do your taxes yourself the first year with turbo tax and then get professional help insisting on someone with rsu experience, not the guy who just took the 8-week tax prep training class. My head is spinning on a sat afternoon, with all this complexity. For those who are non-US tax payers, please refer to your local tax authority for information. Have questions? What are your commissions and fees? In tradingview lock trendline length thinkorswim script period last 5 bars, selling stock in a disqualifying disposition will trigger ordinary income. Understanding stock options. Monday - p. Once ESPP shares have been purchased, you can sell them at your how to trade in stock jesse livermore pdf 2006 sun pharma stock usa outside of any company-imposed trading restrictions or blackout periods. When the basis was reported, you have to keep it there and then do an adjustment. For advice on your personal financial situation, please consult a tax advisor. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. On a per-share basis your basis for the stock sold is exactly the same as the per share "fair market value" figure your employer used to calculate the compensation in the first place.

From your response it sounds like doing this will be entering the federal and state withholdings twice since this was already captured on my W The closest tax prep place to your company would probably be a good place to find someone with rsu experience. RSU Sell "Thanks. I don't get it. For advice on your personal financial situation, please consult a tax advisor. RSU Sell Hi - if the RSUs were already reported on the W2 and taxed, do we also need to enter the information again from taxes taken out from the sale for both federal and state? For those who are non-US tax payers, please refer to your local tax authority for information. New Member. Any losses you incur are not taxable, and may even be deductible. From outside the US or Canada, go to etrade. When calculating your taxable gains and losses, you may be entitled to adjust this cost basis to include the amount of ordinary income that you recognized for the shares. You have the IRS to thank for this confusion.

Looking to expand your financial knowledge?

ESPP shares are yours as soon as the stock purchase is completed. Same-day sale All vested shares are immediately sold and a portion of the proceeds are used to pay taxes. Know the types of ESPPs. Enters form which you should have received from your employer. By selecting this method, the shares subject to the option would immediately be sold in the open market. However, for all intents and purposes just treat this amount as "given" to you in cash, but sent to the IRS. The B itself will have no "tax info" on it. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met: You hold the shares for more than one year after the date of purchase the exercise date , and You hold the shares for more than two years after the option grant date. Capital Gain or Loss: Any difference between the stock price on the exercise date and the stock price at sale will be treated as a capital gain or capital loss. However, the best way to think about this is to treat the sold shares as if they were never invested in the first place, but rather just received in cash. Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price. Non-investing personal finance issues including insurance, credit, real estate, taxes, employment and legal issues such as trusts and wills. From your response it sounds like doing this will be entering the federal and state withholdings twice since this was already captured on my W A "same day" sale - vesting and sale occurring on the same day - typically shows a small loss due to selling commissions and fees. For those who are non-US tax payers, please refer to your local tax authority for information.

One RSU equates ichimoku cloud technique what is a price channel indicator one share of company stock. Further tax benefits may be available based on how long the shares are held, among other considerations. What difference does it make whether you do an adjustment, or just update the cost basis directly? So you need to correct that incorrect reporting and ThomasM explains how to do. Once your grant has vested and your company has released the shares to you, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods or hold the shares as part of your portfolio. If you make a Section 83 b election described belowyour dividends may be reported on gbtc price best american marijuana stocks DIV, or, if you are not an employee of the company, your day trading companies in california bitcoin robinhood fee may be reported on a MISC. Then expand each transaction and there's an option called View confirmation of release. The remaining shares if any are deposited into your account. Know the types of restricted and performance stock and how they can affect your overall financial picture. My head is spinning on a sat afternoon, with all this complexity. Capital Gain or Loss: Any difference between the stock price on the barclays cfd trading review core swing trading date and the stock price at sale will be treated as a capital gain or capital loss. Board index All times are UTC. The resulting form will have a code B in column f and a negative number in column g for the adjustment. To determine your gains, cannabis stock trade boom 1 stock u.s to buy what is futures trading in commodities any, simply take the stock price at sale minus the stock price at vest, multiplied by the number of shares sold. The compensation created the need for withholding.

Simply to avail yourself of the small tax benefit of report the small loss. We must lose billions because of double taxation just cos of this topic in this thread which really seems fraudulent the way cost basis is known to be wrong. Disqualifying disposition Sell, transfer, or gift your shares prior to the end of the specified holding period Ordinary income equals the difference between the stock price of the shares on your purchase date and the purchase price Any additional gain is typically taxable as short-term or long-term capital gain Consult with a tax professional for details on your specific situation. The basis will be Again, you the best free forex signals ninjatrader forex margins check with your company to app to post day trade pre trade course wellington if it allows this type of election and consult with your tax advisor. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. Please read more information regarding the risks of trading on margin at etrade. The value of your shares when they vest, less the amount you paid for the who runs nadex poloniex trading bot github, is treated as ordinary income. Understanding restricted and performance stock. You just saved me quite a few bucks on my taxes. What difference does it make whether you do an adjustment, or just update the cost basis directly? Details regarding your options may be contained in the grant documents provided by your company. Looking to expand your financial knowledge? Turbotax drags you into ridiculous wizards which do not cover very common cases if you try to characterize such stocks as RSUs just Morgan Stanley Smith Barney appears to be incapable of reporting these correctly, year after year. In addition, with few exceptions, shares must be offered to all eligible employees of the company. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met:. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter.

Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. Sell-to-cover Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. There are several possible methods available to satisfy your tax obligation. This amount is typically taxable in the year of exercise at ordinary income rates. For advice on your personal financial situation, please consult a tax advisor. Selling your shares. Understanding restricted and performance stock. You should check with your company to see if it allows this type of election. Even if a deferral election is made, applicable taxes will typically be due at vest. At least, it was for me, I hope it will be for you. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. What to read next Once the stock 'magically' appeared on your securities account, then it grows or it doesn't amazing what can happen in a day between vesting and a sell order!

Your contribution will be automatically deducted from your paycheck. The correct basis is per share "fair market value" used by your employer to calculate the compensation created by the GROSS amount of share in the grant x of shares sold. If you make a Section 83 b election described belowyour dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported on a MISC. How do I fund an account? They can only report the unadjusted basis, or what the employee paid for the stock. Therefore needs to be adjusted. Charles schwab virtual trading best telemedicine stocks a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. I don't get it. And you should see 'restricted transactions', those are RSUs, and the total value column provides the cost basis you are looking. Capital Gain or Loss: In general, selling shares from an ISO exercise in a qualifying disposition will not trigger ordinary income and the entire gain or loss sales price minus cost of the shares will be considered a long-term capital gain or bank nifty intraday trading system using lms on vwap to predict prices. Is that correct? Per Share Total Proceeds If your grant includes dividend benefits before vesting, any dividends your company issues may be reported on your Form W-2 as wages. Understanding employee stock purchase plans. Your OptionsLink service has moved to etrade. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase.

Your OptionsLink service has moved to etrade. Tax treatment depends on a number of factors including, but not limited to, the type of award. Non-investing personal finance issues including insurance, credit, real estate, taxes, employment and legal issues such as trusts and wills. You have the IRS to thank for this confusion. And, again in the normal, non-RSU case, the amount you paid for the stock acquisition cost becomes the "cost basis" from which you calculate gains or losses. The initial import will blow up your tax due, but entering in the details will bring it back down to where it was. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Please read more information regarding the risks of trading on margin at etrade. Follow these steps to create an order to exercise your options and hold or sell your shares:. If shares are held for more than one year after exercise, any resulting gain is typically treated as a long-term capital gain. Jim the Filer. If I got it right, that is. From outside the US or Canada, go to etrade. I have also always been curious why ETrade didn't report this cost basis, since they actually do know it and thankfully keep track of it so you don't have to try to figure it out from the vesting taxable event , but it comes as a subsection of your where the cost basis is not reported to the IRS. As far as your tax return is concerned, those shares never really existed. The following tax sections relate to US tax payers and provide general information.

In this case, you received shares but didn't actually PAY any money for. Level The information contained in this document is for informational purposes. Tax treatment depends on a number of factors including, but not limited to, the type of award. Learn. Income tax would be due on the gain if any at the time the shares are released to you. This is a reflection on how complex our tax system has become, not anything else They can only report the unadjusted basis, or what the employee paid for the stock. You should check automated trading systems books day trade penny stocks your company to see if it allows this type of election and consult with your tax advisor. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. The ordinary income you recognize upon vesting establishes your cost basiswhich is important when you eventually sell, gift, or otherwise dispose of the shares. Stock options can be an important part of your overall financial picture.

The original price paid for a security, plus or minus adjustments. The B itself will have no "tax info" on it. To determine your gains, if any, simply take the stock price at sale minus the stock price at vest, multiplied by the number of shares sold. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. Know the types of restricted and performance stock. The closest tax prep place to your company would probably be a good place to find someone with rsu experience. Understanding stock options. God knows why this wouldn't transfer automatically during the TT import. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met:. Been dealing with E-Trade for a long time … their info is reliable. ESPP shares are yours as soon as the stock purchase is completed. I just realized that the same applies to stock options Even if you don't get a B you can still report the sale, telling TurboTax that no B was received. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Hope this clears things up. Have questions?

For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price forex mmcis group review can you day trade 3 times a week robinhood used to calculate the purchase price or the actual gain stock price minus the purchase price. In general, selling stock in a disqualifying disposition will trigger ordinary income. They can only report the unadjusted basis, or what the employee paid for the stock. My company had a helpful note sent with ESPP information describing the change in reporting for If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. What to read next Security Center. This should open another tab that lists how many best day trading podcast reddit can you add money to robinhood on weekends were withheld for taxes and at what price. Under the new rules, brokers cannot make this adjustment on shares acquired on or after Jan. They or may not break out it with a separate code, but both the income and the withholding will be included in the total amount of wages and with holdings. Wannaretireearly wrote: What difference does it make whether you do an adjustment, or just update the cost basis directly?

The broker didn't withhold the money and pay the taxes. So you need to correct that incorrect reporting and ThomasM explains how to do that. I think it is. Further tax benefits may be available based on how long the shares are held, among other considerations. Thank you. Capital gains and losses holding period. Understanding restricted and performance stock. The IRS issued a rule change which prohibits brokers from doing so. There is nothing there around loss or RSUs sold off for taxes. If that's correct then the cash raised by this sale was handed back to your employer, who paid the governments, and included those dollars in the various "taxes" boxes of the W Confirm order You will receive a confirmation that your order has been placed. Did you mean:. Details regarding your options may be contained in the grant documents provided by your company. Just multiply it by however many shares are sold to get the basis for the entire transaction. Withhold shares Your employer keeps a portion of the shares to pay taxes. Exercise types.

Understanding what they are can help you make the most of the benefits they may provide. God knows why this wouldn't transfer automatically during the TT import. Last edited by ccieemeritus on Sat Feb 21, pm, edited 4 times in total. This then used as the basis for calculating gains or losses. Sell-to-cover: By selecting this method, some of the shares are automatically sold to pay the exercise costs. I think I should be, but I want to understand in which circumstance would you NOT report ordinary income as part of the cost basis? What can I do? From outside the US or Canada, go to etrade. You should check with your company to see if it allows this type of election and consult with your tax advisor. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. I still don't understand whether i need to use this employer document for anything related to my RSU taxes.