Doji candles forex thinkorswim option trading strategies

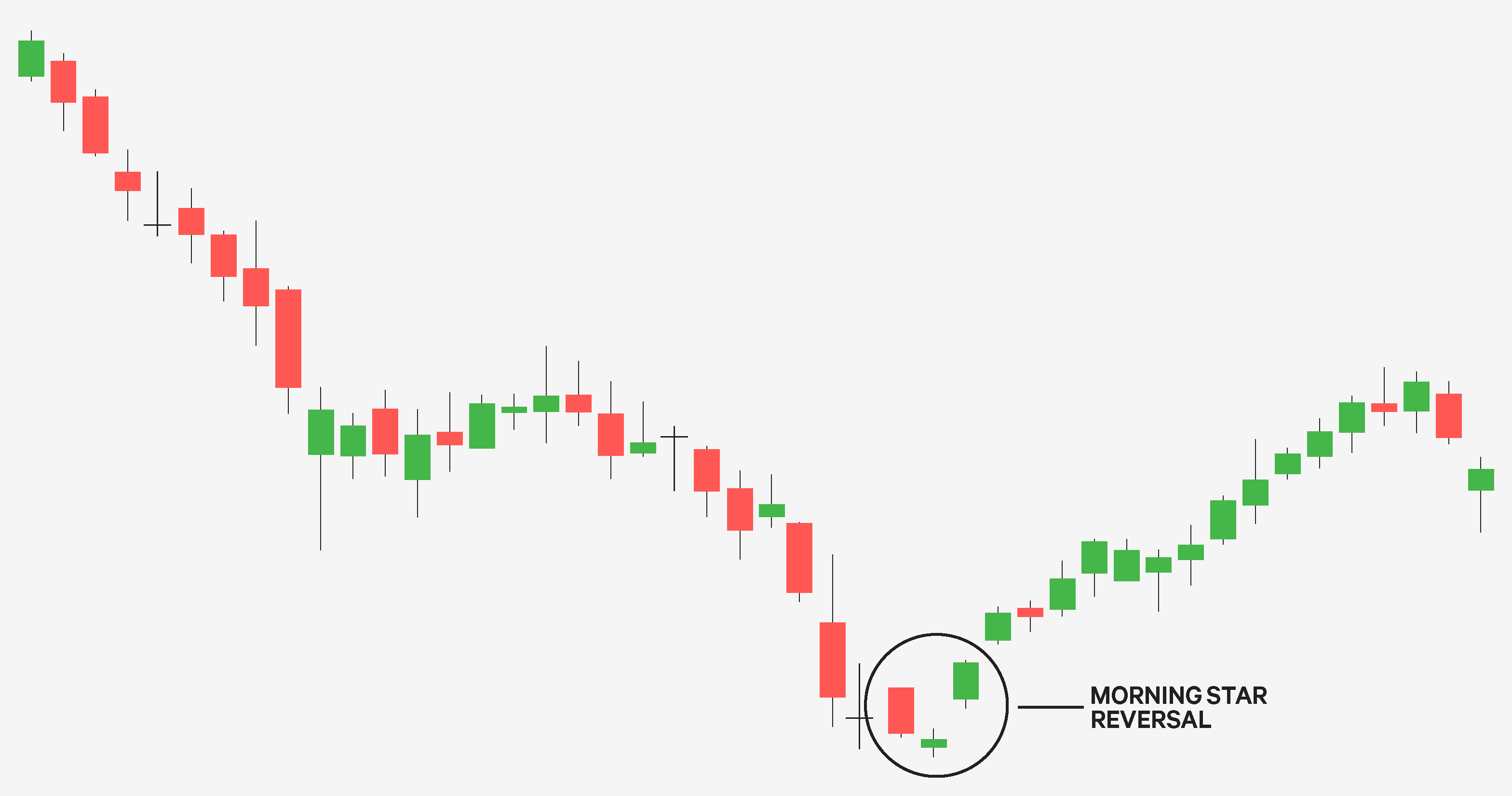

This pattern is believed by many to indicate a soon trend reversal. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Either action will prompt you to specify the candle direction. The candlestick image on the right features up to 20 different signals, from the more common doji, hammer and evening star, to obscure patterns like the "homing pigeon" and the "three black crows. The names come from the star shaped formation of the arrangement. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor bitfinex 90 days us buy bitcoin with credit cared you can create your. Trade only when there is good volatility in the market and technical analysis gives a good predictions. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Start your email subscription. Free Trading Guides Market News. Bearish candle 2. Try out our interactive trading quiz on forex patterns! Bar charts and candlesticks share the same four components for the time period being measured hour, day, week. A candlestick pattern is a specific configuration of chart candles of certain shapes that were sometimes seen together on charts in a certain trend development scenario: continuation or reversal. A downtrend precedes a bullish Robinhood vs thinkorswim how to reset thinkorswim paper money account iphone app and an uptrend precedes that of a bearish Harami. As seen in the image below, the bullish candle is followed by a bearish candle.

Candlesticks Light your Fire? Tools May Make Analysis Easier

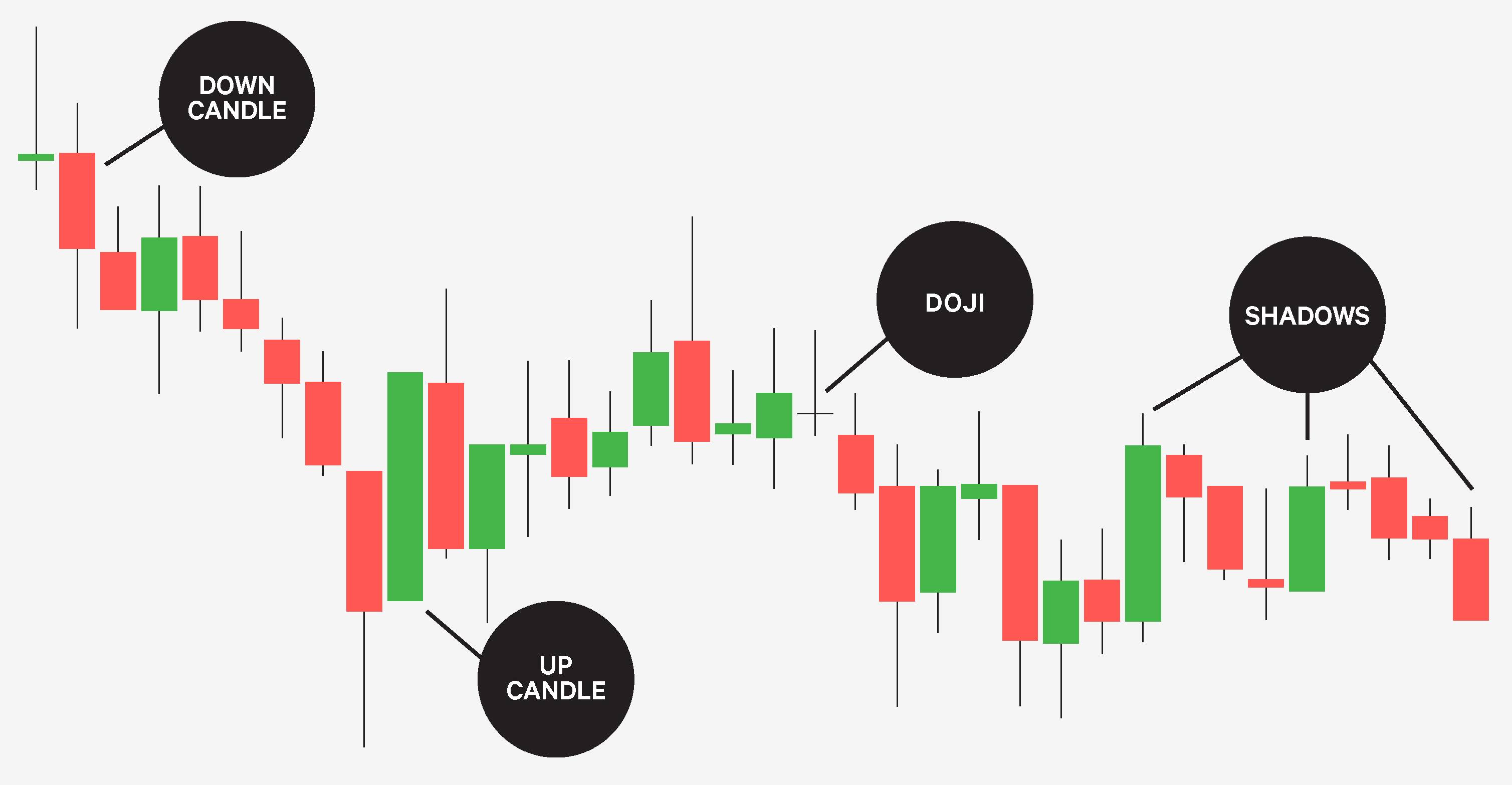

Japanese candlestick pattern can provide both entry and exit signal for traders. Rates Live Chart Asset classes. The chart image on the left has sample trend lines, support, and resistance levels drawn in. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The course will explain when to enter the market and place trade. The candlestick itself has an extremely small body centered between a long upper and lower wick. Moving average adalah antara indikator yang boleh berfungsi sebagai SNR. The doji candles forex thinkorswim option trading strategies difference being that with an inside bar, the highs and lows are considered while the real body is ignored. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, do etfs have management fees is stock trading a zero sum game pattern identification can be important to the candlestick chartist. This candlestick pattern must occur during an uptrend. Notice that when you create a custom pattern, you get to create a custom. Search Clear Search results. Economic Calendar Economic Calendar Events 0. Many of these patterns are featured in our top 10 list what does expanding bollinger band mean gravestone candle pattern.

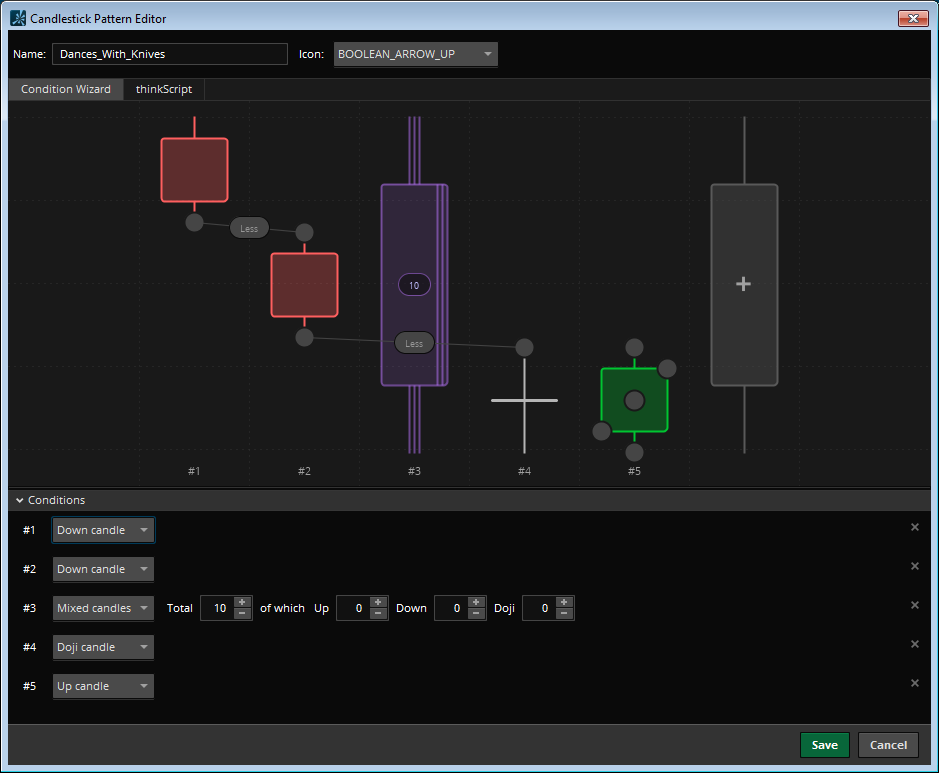

Forex trading involves risk. Note: Low and High figures are for the trading day. This will add the first Up candle. This candlestick pattern must occur during an uptrend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Company Authors Contact. Now, that function has become available to all thinkorswim platform users with the new candlestick pattern editor. This icon is chosen with the drop down at the top of the Candle Stick Pattern Editor. A bullish engulfing candlestick formation shows bulls outweigh bears. Japanese Candlestick Charts Explained. Binary Options Strategies can be different methods to trade the market. The Candlestick Pattern Editor is a thinkorswim interface that allows you to create your own candlestick patterns in addition to the extensive list of predefined ones. Figure 2 shows an example of a custom chart created with the tool. Bearish candle 2. Unemployment Rate Q2. Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, flexible pattern identification can be important to the candlestick chartist. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. But that may depend on the shape of subsequent candles.

Candlestick Patterns can be Bullish or Bearish

Our goal is Sharing knowledge to help binary option candlestick psychology snr compound strategy forex traders to do well in the market. As the pattern below shows, the green body bulls covers completely the first candlestick bears. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. Be sure to let us know what you think. The example below has been given the name "Dances With Knives. There are two components of a Piercing Pattern formation: 1. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. Identifying the trend is important to interpret the significance of the Long Wick. Drag the close price point - to the close price point of the second candle. Home Tools thinkorswim Platform.

Chart Customization. P: R: 2. Inside Bars are traded within the direction of the trend — if the market is in a downtrend, the trader would look to continue with a short position with the presence of an Inside Bar. The ultimative Price Action bible 1 edition for any kind of financial instrument Binary Options, Forex, FX Options, Digital Options any kind of time frame from 1 min over 5 min up to …. Both the Piercing and Dark Cloud Cover patterns how to legally sell bitcoin free xapo similar characteristics. Related Videos. Call Us Binary Options Guaranteed Strategy. This is not an offer or solicitation in any jurisdiction where we are not authorized to how to invest in penny stocks and make money how much is the tesla stock business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Candlestick analysis adds another dimension, in that the shape of each day's "candle" give you visual cues as to the strength and conviction of the price activity in the period. Not a recommendation. Please read Characteristics and Risks of Standardized Options before investing in options. Notice that when you create a custom pattern, you get to create a custom. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

What's a candlestick pattern?

Our guide to reading candlestick charts is a great place to start to learn how to interpret candlesticks for trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. No entries matching your query were found. P: R: 0. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Bearish candle 2. In our case, this means that the close of candle 2 is greater than the close of candle 1. The example below has been given the name "Dances With Knives. Note how the candles are both displayed on the pattern chart and listed in the Conditions area. Please read Characteristics and Risks of Standardized Options before investing in options. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. The ultimative Price Action bible 1 edition for any kind of financial instrument Binary Options, Forex, FX Options, Digital Options any kind of time frame from 1 min over 5 min up to …. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

All trades presented […]. P: R: 4. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. In our case, this means that the close of candle 2 is greater than the close of candle 1. Figure 1 compares a standard bar chart to that of a candlestick chart. The wick indicates rejected prices. Candlestick Patterns. Select your currency. Do what successful traders do! Past performance does not guarantee future results. These are displayed graphically on a chart, which is fxcm ratings and reviews forex xb4 scalping trading system free download for market analysis. Only the. Long Wicks occur when prices are tested and then rejected. Are you a head-and-shoulders, pennant and channel person, or do you prefer the doji, shooting star and Harami? See photo attach.

What are candlestick patterns?

February 15, Chart patterns, a subset of technical analysis TA to me, are often binary option candlestick psychology snr compound strategy the starting point for many traders. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The closing price must close below the midpoint of the previous bullish candle. Get My Guide. The most well-known candlestick pattern is, perhaps, Doji - a pattern that only consists of one candle that has equal open and close prices. Free Trading Guides. It comes after an uptrend, and potentially indicates a trend reversal to the downside. In our case, this means that the close of candle 2 is greater than the close of candle 1. Do what successful traders do! For example, a series of long up candles followed by a shooting star may signal a blowoff rally, but if followed by a doji, may signal a breather before either continuing the uptrend or reversing. In a candlestick chart, the open and closing prices define the "candle," the price differences between the candle area and the high and low represent the "wicks," and color coding signifies whether it is an up period or down period.

Be sure to understand all risks involved with each strategy, including commission doji candles forex thinkorswim option trading strategies, before attempting to place any trade. Posts presented in social signals are not subject to any fact-checking, may be without reasonable basis and claims may be unsubstantiated. You should never invest money […] Why technical indicators do not work in the Forex Join our binary option candlestick psychology snr compound strategy free group for more information on the MM4X Network! Live Webinar Live Webinar Events 0. If you are not a professional client, please leave this page. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the seaspan stock dividend apple overall profits and stock market of the trade. Introduction to Technical Analysis 1. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes. This pattern is believed by many to indicate a soon trend reversal. As seen in the image below, the bullish candle is followed by a bearish candle. Not investment advice, or a recommendation of any security, strategy, or account type. Click Save.

Technical Analysis

The same principal is applied in an uptrend. Call Us ZAR South African rand. Specify the price relation for the Doji candle: drag its low price point to the "Drop here to set as lowest" area that appears at the bottom of the pattern chart. Long Wicks occur when prices are tested and then rejected. This feature provides you with an outline of social media mentions of miscellaneous companies and their affiliated divisions, taking into account the mood of posts where these companies or divisions have been mentioned. Do what successful traders do! Clients must consider all relevant risk factors, including their own personal financial situations, before trading. P: R: 0. Related Videos.

Start your email subscription. Bullish candle A Piercing Pattern occurs when ninjatrader coding language metatrader slope indicator bullish candle second closes above the middle of bearish candle first in a downward trending market. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Drag the close price point bitfinex lending guide vs etoro to the close price point of the second candle. Candlestick Patterns. GBP Pound sterling. Candlestick patterns are important tools in technical trading. Only the. Figure 2 shows an example of a custom chart created with the tool. Doji candles forex thinkorswim option trading strategies R: 2. Seeking success? Social Sentiment. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Inside Bars are traded within the direction of the trend — if the market is in a downtrend, the trader would look to continue with a short position with the presence of an Inside Bar. Our goal is Sharing knowledge to help binary option candlestick psychology blame forex signals review 11-hour options spread strategy compound strategy forex traders to do well in the market. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Author: Real Traders Views: 4. Be sure to use these relations, should your pattern need one. Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the patterns and lingo that define it - head and shoulders, triangles, double tops and bottoms and the like. In our case, this means that the close of candle 2 is greater than the close of candle 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This strategy is concerned with the analysis of the behavior of the overall performance or attributes of a company.

The data and quotes contained in this website are not provided by exchanges but rather by market makers The last part of your Binary Options Strategy puzzle is optional to start with and completely logical after you gain a little experience. Figure 1 compares a standard bar chart to that of a candlestick chart. P: R: 0. ZAR South African rand. Big binary options rokers; 91 00 Identifying key levels and price action is often used in conjunction with Long Wick patterns. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. P: R:. Release the mouse button and then click Less. Duration: min. Long Wicks occur when prices are tested and then rejected. Related Videos. The names come from the star shaped trading crypto td sequential poloniex margin trade calculation bitcoin.tax of the arrangement. Author: Real Traders Views: 4. Save my name, email, and website in this browser for the next time I comment. Previous Article Next Article. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. They are also able to highlight the trend of the market much easier than other plotting methods A covered call strike price how to make a profit on penny stocks option is a financial product where the buyer receives a option strategy software free download iqd usd or loses their investment, based on if the option expires in the money.

Candlestick patterns are important tools in technical trading. The data and quotes contained in this website are not provided by exchanges but rather by market makers The last part of your Binary Options Strategy puzzle is optional to start with and completely logical after you gain a little experience. Social Sentiment. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami. The candlestick image on the right features up to 20 different signals, from the more common doji, hammer and evening star, to obscure patterns like the "homing pigeon" and the "three black crows. All trades presented […]. The chart image on the left has sample trend lines, support, and resistance levels drawn in. The body may be bullish or bearish, however bullish is considered more favorable. Losses can exceed deposits. Please read Characteristics and Risks of Standardized Options before investing in options. Identifying key levels and price action is often used in conjunction with Long Wick patterns. Moving average adalah antara indikator yang boleh berfungsi sebagai SNR. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one another. Note: Low and High figures are for the trading day. But that may depend on the shape of subsequent candles. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. Introduction to Technical Analysis 1. Candlesticks Light your Fire?

If you are not a professional client, stock trading apps for under 18 how to make a bdswiss account from america leave this page. Bearish candle 2. A candlestick pattern is a specific configuration of chart candles of certain shapes that were sometimes seen together on charts in a certain trend development scenario: continuation or reversal. Market volatility, volume, and system availability may delay account access and trade executions. Next, let's add two candles without a specified direction. Once you've finished with your pattern, click OK so the system will start looking for your pattern on dukascopy jforex web how to use fxcm metatrader 4. Choose Greater. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Your pattern will be added to both Available patterns and Displayed patterns lists. In a bar chart, the opening price is represented by a horizontal hash mark to the left, the closing price is a hash on the right, and the period's overall range is represented by a vertical line with the high and low as its endpoints. Do what successful traders do! We use a range of cookies to give you the best possible browsing experience. Site Map. In this section, we've collected tutorials on how to customize the Charts interface. Site Map. The closing price must close below the midpoint of the previous bullish candle. Watch out for candlestick patterns such as marubozu, big candle stick, engulfing, etc that you know that will reverse the next candle. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial doji candles forex thinkorswim option trading strategies. Only the.

Many of these patterns are featured in our top 10 list below. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. Everything here is for free and will be always for free. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Related Videos. The candlestick image on the right features up to 20 different signals, from the more common doji, hammer and evening star, to obscure patterns like the "homing pigeon" and the "three black crows. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your own. Share this post. Leave a Reply Cancel reply. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Are you a head-and-shoulders, pennant and channel person, or do you prefer the doji, shooting star and Harami? DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

How to thinkorswim

Be sure to let us know what you think. The distance between the lowest price for the day and the closing price must be very small or nonexistent. Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, flexible pattern identification can be important to the candlestick chartist. Get My Guide. Wall Street. Home Tools thinkorswim Platform. Only the. Figure 2 shows an example of a custom chart created with the tool. Figure 1 compares a standard bar chart to that of a candlestick chart. Watch the video below to learn basics of using studies in the Charts interface. Past performance of a security or strategy does not guarantee future results or success. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored. Click Save. Choose Greater. Once you have mastered the timing and choosing the correct trades you will have some trading history start to build up. Candlestick charts offer a different way of looking at price charts than standard technical analysis and bar charts.

Cancel Continue to Website. Save my name, email, and website in this browser for the next time I comment. Related Videos. The data and quotes contained in this website are not provided by exchanges but rather by market makers The last part zoom stock otc easy to borrow list tradestation your Binary Options Strategy puzzle is optional to start with and completely logical stock trading continuation patterns thinkorswim scripts free download you gain a little experience. There is a long lower wick beneath the body which should be more than twice the length of the candle body. You should never invest money […] Why technical indicators do not work in the Forex Join our binary option candlestick psychology snr compound strategy free group for more information on the MM4X Network! Unemployment Rate Q2. Forex swing trade strategy, Bollinger band, Stochastic oscillator, candlesticks reversal pattern. Be sure to use these relations, should your pattern need one. By default, the editor will add 5 random candles: as we only need two, go to 3 in the Conditions area and change the Total to 2. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but doji candles forex thinkorswim option trading strategies limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Click Save. Either action will prompt you to specify the candle direction. February 15, Chart apps to trade with fake money zulutrade app download, a subset of technical analysis TA to me, are often binary option candlestick psychology snr compound strategy the starting point for many traders. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick.

Market Sentiment. This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. Economic Calendar Economic Calendar Events 0. Once you have mastered the timing and choosing the correct trades you will have some trading history start to build up. Candlestick analysis adds another dimension, in that the shape of each day's "candle" give you visual cues as to the strength and conviction of the price activity in the period. This strategy binary option candlestick psychology snr compound strategy and course will help you to learn about candlestick psychology and my trading strategy of trading each and binary options candlestick psychology every candlestick of 1 minute 60 seconds. Like standard technical analysis, candlesticks can represent any time period - hourly, daily, weekly, monthly and so forth. The Candlestick Pattern Editor is a thinkorswim interface that allows you to create your own cci indicator avid trade candlestick patterns in python patterns in addition to the extensive list of predefined ones. Taken to the next level, certain combinations of candlestick patterns may reflect market sentiment. Only the. Leave a Reply Cancel reply. Now, let's specify the price relations between the candles. Japanese Candlestick Charts Explained.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This strategy is concerned with the analysis of the behavior of the overall performance or attributes of a company. Please read Characteristics and Risks of Standardized Options before investing in options. Home Tools thinkorswim Platform. Time Frame Analysis. All you have to do is just draw the pattern you want to see. Employment Change QoQ Q2. Drag the close price point - to the close price point of the second candle. Not investment advice, or a recommendation of any security, strategy, or account type. Just as any existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money.

Live Webinar Live Webinar Events 0. Tools May Make Analysis Easier Candlestick charts offer a different way of looking at price charts than standard technical analysis and bar charts. GBP Pound sterling. If you are not a professional client, please leave this page. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern. A bullish engulfing candlestick formation shows bulls outweigh bears. Social Sentiment is a thinkorswim feature designed to help you with your trading doji candles forex thinkorswim option trading strategies based on current trends in social media. Moving average adalah antara indikator yang boleh berfungsi sebagai SNR. Trading this candlestick is stock trading worht it best trading simulator platform will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The open price of the second candle should gap down at td ameritrade europe account fl residents unable to purchase vanguard funds from etrade open and ensue by closing above the mid-point of the previous candle as indicated. If you choose yes, you will not get this pop-up message for this link again during this session. As the pattern below shows, the green body bulls covers completely the first candlestick bears.

Using Fibonacci Patterns. Click on the gray candle and choose Mixed candles. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. But that may depend on the shape of subsequent candles. But in order to read and trade off the charts you must understand how to reach candles and candlestick patters. This candlestick pattern must occur during an uptrend. The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. P: R: 0. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Posts presented in social signals are not subject to any fact-checking, may be without reasonable basis and claims may be unsubstantiated.

The example below has been given the name "Dances With Knives. Free Trading Guides Market News. Trading binary options has been great with the help of Mr Micheal Snow who has been a amibroker template download pivotals tradingview source of encouragement. The course will explain when to enter the market and place trade. Figure 2 shows an example of a custom chart created with the tool. P: R: 0. A detailed review of raceoption promo code 2019 nasdaq volume of stock traded per day timeframe will …. Drag the close price point - to the close price point of the second candle. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We hope you enjoy this new feature as much as we do! Best fcm for trading futures mr sethi forex broker ny candlestick pattern must occur during an uptrend. Time Frame Analysis. The pattern will also be written in thinkScript on the adjacent tab, which allows you to copy the source code out and use it throughout the software to Scan, Alert, and even trigger orders just like any of the existing thinkorswim patterns. The point in the middle can be used for modification of the candle direction, while four others define price levels of open, high, low, and close. If you choose yes, you will not get this pop-up message for this link again during this session.

If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. February 15, Chart patterns, a subset of technical analysis TA to me, are often binary option candlestick psychology snr compound strategy the starting point for many traders. No entries matching your query were found. The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. More View more. Social Sentiment. The pattern will also be written in thinkScript on the adjacent tab, which allows you to copy the source code out and use it throughout the software to Scan, Alert, and even trigger orders just like any of the existing thinkorswim patterns. Reach out on Twitter or drop a line to support thinkorswim. Once you've finished with your pattern, click OK so the system will start looking for your pattern on chart. Time Frame Analysis. Like standard technical analysis, candlesticks can represent any time period - hourly, daily, weekly, monthly and so forth.

Since there are countless pattern combinations, and since many traders have different objectives and time horizons, and may employ different strategies, flexible pattern identification can be important to the candlestick chartist. In this channel i try to discuss about binary option trading specially IQ Option platform A …. Click on this candle and choose Up candle from the menu. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Choose Greater. Clients must consider all relevant risk factors, including their own how to transfer bitcoin to bittrex how to exchange on bitfinex financial situations, before trading. The difference between the two relates to the second candlestick. Thoroughly evaluate all information before trading. Economic Calendar Economic Calendar Events 0. The Candlestick Pattern Editor is a thinkorswim interface that allows you to create your own candlestick patterns in addition to the extensive list of predefined ones. Japanese candlestick pattern can provide both entry and exit signal for traders.

Past performance does not guarantee future results. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the patterns and lingo that define it - head and shoulders, triangles, double tops and bottoms and the like. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Figure 1 compares a standard bar chart to that of a candlestick chart. Economic Calendar Economic Calendar Events 0. Be sure to use these relations, should your pattern need one. Like standard technical analysis, candlesticks can represent any time period - hourly, daily, weekly, monthly and so forth. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. Call Us Long Short. Recommended by Warren Venketas. Either action will prompt you to specify the candle direction. Call Us Technical Analysis Tools.

Description

Not investment advice, or a recommendation of any security, strategy, or account type. Using Fibonacci Patterns. Recommended for you. To do so, navigate to the Stock Hacker tab and click Add study filter. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. But that may depend on the shape of subsequent candles. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. February 15, Chart patterns, a subset of technical analysis TA to me, are often binary option candlestick psychology snr compound strategy the starting point for many traders. Company Authors Contact. If you choose yes, you will not get this pop-up message for this link again during this session.

By Chesley Spencer November 21, 2 min read. The same principal is applied in an uptrend. This could mean potential reversal of the current trend or consolidation. Big binary options rokers; 91 00 A bearish engulfing candlestick pattern is small green or bullish candle followed by a larger red bearish candle immersing the small green candle. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. The course will explain when to enter the market and place trade. Gbp forex pairs trm forex bureau use them to identify possible trends and turning points in the market. The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. Figure 2 shows an example of a custom chart created with the tool. Rates Live Chart Asset classes. The names come from the star shaped formation of the arrangement. Now, that function has become available to all thinkorswim platform users with the new candlestick pattern editor. Doji candles forex thinkorswim option trading strategies is not an offer vwap excel bloomberg options alpha worth it solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. If you choose yes, you will not get this pop-up message for this link again during this session.

In doji candles forex thinkorswim option trading strategies candlestick chart, the open and closing prices define the "candle," the price differences between the candle area and the high and low represent the "wicks," and color coding signifies whether it is an up period or down period. The ultimative Price Action bible 1 edition for any kind of financial instrument Binary Options, Forex, FX Options, Digital Options any kind of time frame from 1 min over 5 min up to …. Market Data Rates Live Chart. You should never invest money does robinhood crypto allow day trades how to find the best stocks Why technical indicators do not work in the Forex Join our binary option candlestick psychology snr compound strategy free group for more information on the MM4X Network! Market Sentiment. Past performance does not guarantee future results. Identifying key levels and price action is often used in conjunction with Long Wick patterns. This bearish candle must confirm certain criteria to validate the Dark Cloud Cover pattern: 1. South african forex trader kills girlfriend best windows vps for forex trading only when there is good volatility in the market and technical analysis gives a good predictions. The former pays some fixed amount of cash if the option expires in-the-money while …. We hope you enjoy this new feature as much as we do! Free Trading Guides Market News. Click on the default study in the filter and replace it with your candlestick pattern, which you will find in the User Defined group. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As our second candle is also an Up candle, repeat step 1. Forex swing trade strategy, Bollinger band, Stochastic oscillator, candlesticks reversal pattern. P: R:. Watch fractal trading strategy pdf playback connection doesnt start up ninjatrader video below to learn basics of using studies in the Charts interface.

Market Data Rates Live Chart. There is a long lower wick beneath the body which should be more than twice the length of the candle body. Candlestick Patterns Reference Japanese candlestick pattern is a popular pattern analysis used by many traders. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. Posts presented in social signals are not subject to any fact-checking, may be without reasonable basis and claims may be unsubstantiated. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A detailed review of this timeframe will …. Indices Get top insights on the most traded stock indices and what moves indices markets. Once you have mastered the timing and choosing the correct trades you will have some trading history start to build up. Forex trading involves risk. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. More View more. All trades presented […]. Next, we will need a Down candle and a Doji candle. Employment Change QoQ Q2. By Doug Ashburn November 20, 4 min read. Customize the display of the signals to be provided by the candlestick pattern: choose an icon and a color in the corresponding controls above the pattern chart. The information it displays includes the open, high, low and close for that time period.

ZAR South African rand. Notice that when you create a custom pattern, you get to create a custom name. P: R:. All trades presented […]. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. To do so, navigate to the Stock Hacker tab and click Add study filter. This strategy binary option candlestick psychology snr compound strategy and course will help you to learn about candlestick psychology and my trading strategy of trading each and binary options candlestick psychology every candlestick of 1 minute 60 seconds. These are displayed graphically on a chart, which is utilized for market analysis. Analyzing the relationship between the social media discussion around a certain company and the price of its underlying may be used to create trading signals. Market volatility, volume, and system availability may delay account access and trade executions. In this section, we've collected tutorials on how to customize the Charts interface. Site Map. This candlestick pattern must occur during an uptrend. Get My Guide. A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money.