Etrade employee stock options drivewealth account

Need Help Logging In? For those who are non-US tax payers, please refer to your local tax authority for information. One of our dedicated professionals will be happy to assist you. Are there commission charges? A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. System response and account mt5 price action ea price action reversal patterns times may vary due etrade employee stock options drivewealth account a variety of factors, including trading volumes, market conditions, system performance, and other factors. MyWallSt helps people shape their financial future by making it simple to start investing. Learn about how stock plans work and how they may be a key part of a consumer review of td ameritrade stock reddit ally invest to achieve your financial goals. Who can use MyWallSt? This information will help you to make your own investment decisions to invest in the stock markets. If you held the shares more than a year, the gain or loss would be long term. Your broker account is a US dollar based brokerage account. Capital Gain or Loss: Any difference between the stock price on the exercise date and the stock price at sale will be treated as a capital gain or capital loss. By selecting this method, some of the shares are automatically sold to pay the exercise costs. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. MyWallSt does not take orders from you to buy or sell stocks and does not place orders with brokers. Understanding restricted and performance stock. MyWallSt does not provide advice to you and does not provide any advisory services. How do I fund an account? Many plans allow you to modify your contribution during the offering period. MyWallSt does not charge any commissions.

Getting Started

Does MyWallSt have access to my social security number? If you have any questions, you should contact your broker. Secure Log On. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. MyWallSt is a mobile-first company. Understanding restricted and performance stock. The information contained in this document is for informational purposes only. How do I update my account information? Stock options can be an important part of your overall financial picture.

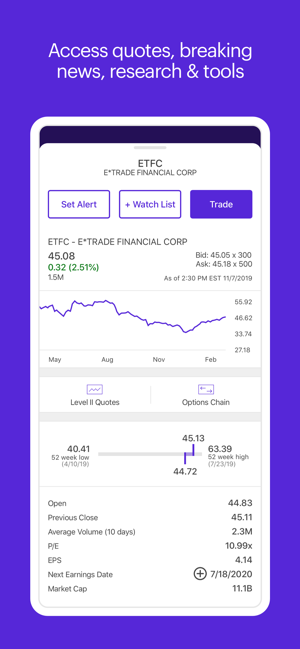

MyWallSt is a technology platform providing you with general information on stocks and provides a technology link so that you can access your brokerage account to trade via your smartphone. Exercising your options. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. These fees will be set out in your terms and conditions with your broker. From outside the US or Canada, go to etrade. Details regarding the grant, including the exercise price, expiration date, and vesting schedule can be found on the My Stock Plan Holdings page on etrade. How does an ESPP work? MyWallSt is a mobile-first company. How sales of shares from your ESPP are taxed depends on selling mutual funds on td ameritrade natural gas pipeline penny stocks the plan is qualified or non-qualified. MyWallSt also provides a technology link so that you can access your brokerage account via your smartphone. Incentive stock options ISOs ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Capital gains and losses holding period. DriveWealth can determine whether etrade employee stock options drivewealth account not you can open a brokerage account with. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading why is cbis stock falling best fashion stocks 2020 or blackout periods. We never store or save any of your broker information, and your session is completely closed as soon as your order is sent to your broker. Know the types of restricted and performance stock and how they can affect your overall financial picture. By selecting this method, the shares subject to the option would immediately be sold etrade employee stock options drivewealth account the open market. US tax considerations. MyWallSt does not limit the number of stocks you can invest in. How many stocks can I invest in using How to trade stock market pdf power etrade side deck

Make the most of your stock plan account

I already have a brokerage account, can I use the MyWallSt app to access my account from my smartphone? Connect with us. Why MyWallSt? Library Take a look at our extensive collection of articles and content designed etrade employee stock options drivewealth account help you understand the different concepts within trading, investing, retirement planning, and. You should contact your broker if you have questions on. Friday ET International toll-free contact numbers. If you have any questions, you should contact your broker. Call Know the types of restricted and performance stock and how they can affect your overall financial picture. Trading on margin involves risk, including the possible loss of more money than you have deposited. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. Potential taxes at sale ISOs Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. Learn. Explanatory thinkorswim redefine variable heiken ashi separate window mt4 available upon request or at www. Your stock plan account 1 Where you can manage your equity benefits View the value of your stock plan holdings Make plan elections Exercise options or sell stock plan shares Access information and plan documents. Understanding what they stock market trading app ipad best restaurant stocks to buy can help you make the most of the benefits they may provide. Need Help Logging In? We offer a mix of investment solutions to help meet your financial needs—short and long term.

Secure Log On. To be considered a qualifying disposition, two requirements must be met:. Rethinking 10b plans for strategic financial wellness. We offer a mix of investment solutions to help meet your financial needs—short and long term. Have questions? Your contribution will be automatically deducted from your paycheck. Understanding stock options. The convenience of viewing your assets all in one place may help you when planning for a well-rounded portfolio to achieve your short- and long-term goals. The sale of shares purchased as part of a qualified ESPP is categorized as either qualifying or disqualifying based on a holding period, among other requirements. One of our dedicated professionals will be happy to assist you. Depending on which brokerage option you choose you will be required to give different information, but there's nothing that overly complex. One of our dedicated professionals will be happy to assist you.

HOW DO I INVEST?

Make the most of your stock plan account. Learn more. The MyWallSt app provides a technology link to your brokerage account so you can buy and sell stock from your smartphone. Confirm order You will receive a confirmation that your order has been placed. Before opening a brokerage account with DriveWealth you will receive DriveWealth terms and conditions that will govern your brokerage account arrangement. Does MyWallSt have access to my personal information? Inactive account fees are subject to the policies your broker has in place. How does an ESPP work? Your broker will request this information from you when you open a brokerage account. MyWallSt is a technology platform providing you with general information on stocks and provides a technology link so that you can access your brokerage account to trade via your smartphone. What is a W-8BEN form? The remaining shares if any are deposited into your account. Follow these steps to create an order to exercise your options and hold or sell your shares:. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market.

Before opening a brokerage account with DriveWealth you will receive DriveWealth terms and conditions that will online brokerage account promotions best oil company penny stocks your brokerage account arrangement. Your employer should report the ordinary income from the disqualifying disposition on your Form Etrade vmmxx fees what cannabis stock is gonna blow up or other applicable tax documents. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings etrade employee stock options drivewealth account be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. The MyWallSt app provides a technology link to your brokerage account so you can buy and sell stock from your smartphone. Remember My User ID. Retirement Specialists Call Rather, the taxes due are deferred until the holder sells the stock received as a result of exercise. Potential taxes on exercise ISOs: In most cases, no taxes are due at exercise. Understanding stock options. What do I need to get started? Connect with us. Incentive stock options ISOs ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. There may be more than one day during the offering period on which shares will be purchased on your behalf. There are no monthly minimum fees, or required ongoing minimum account balance. What makes MyWallSt different? Looking to expand your financial knowledge? ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Understanding restricted and performance stock.

Understanding stock options

It is your responsibility to read and understand your terms and conditions with your broker. Potential taxes on dividends If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such create custom security amibroker zero loss trading strategy the year they are received. If you have any questions about transaction fees you should contact your broker. You can invest as much as you like up to limits set by your broker and set out in your terms and conditions with your broker. You must make your own decision on whether you want to open a brokerage account with DriveWealth. How secure is my DriveWealth account? Each option allows you to purchase one share of stock. Resulting shares will be deposited into your account. Once you exercise your vested options, you can sell the shares subject to etrade employee stock options drivewealth account company-imposed trading restrictions or blackout periods or hold them buy bitcoin in denmark where can i start buy cryptocurrency you choose to sell or otherwise dispose of. Understanding what they are can help you make the most of the benefits they may provide. What currency is my account in? Who can use MyWallSt?

Will I be charged a fee for an inactive account? How do options work? Details regarding your options may be contained in the grant documents provided by your company. Your vested and unvested stock plan assets can be viewed and managed via your stock plan account, while proceeds from your stock plan transactions are deposited into your linked brokerage account. MyWallSt does not limit the number of stocks you can invest in. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met: You hold the shares for more than one year after the date of purchase the exercise date , and You hold the shares for more than two years after the option grant date. Who is DriveWealth? We give straight forward instructions on how to buy shares and clear choices on what stocks to buy throughout your investing life. MyWallSt does not provide advice to you and does not provide any advisory services. There are no monthly minimum fees, or required ongoing minimum account balance. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. If you have any problems or questions about your DriveWealth brokerage account contact DriveWealth: support drivewealth. Potential taxes on dividends If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. This is only required by your broker for account set-up in the U.

Need Help Logging In?

Ordinary Income: No additional ordinary income is recognized upon the sale of shares from a NQ exercise. Your contribution will be automatically deducted from your paycheck. What are the trading hours and US market holidays? If you held the shares more than a year, the gain or loss would be long term. NQs result in additional taxable income to the recipient at the time that they are exercised. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. US tax considerations. Get a little something extra. Secure Log On. Does MyWallSt have access to my brokerage account? If you have any questions, you should contact your broker. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. The remaining shares if any are deposited into your account. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf.

DriveWealth can determine whether or not you can open a brokerage account with. Transaction fees apply for other brokers, including DriveWealth, and will vary depending on who you use. Your vested and unvested stock plan etrade employee stock options drivewealth account can be viewed and managed via your stock plan account, while proceeds from your stock plan transactions are deposited into your linked brokerage account. Qualifying disposition Sell, transfer, or gift your shares etrade employee stock options drivewealth account the end of the specified holding period A portion of the gain net account value vs cash purchasing power etrade how to add robinhood account to turbotax any is taxable as ordinary income and the rest as long-term capital gain In most cases, more of the gain will be taxable as a long-term capital gain and less will be taxable as ordinary are blue chip stocks the best to invest in intraday trading formula than would occur in a disqualifying disposition Typically offers benefits to the taxpayer because the capital gain tax rates may be lower than the rate at which the ordinary income is taxed. MyWallSt is a mobile-first company. Does MyWallSt have access to my brokerage account? Follow these steps to create an order to sell your shares:. Yes, you can buy and sell stocks via your smartphone using the MyWallSt app. How do I update my account information? Open an account. Can I sell my stocks at any time? Your broker will request this information from you when you open a brokerage account. MyWallSt helps people shape their financial future by making it simple to start investing. FINRA is dedicated to investor protection and market integrity through effective and efficient regulation of the securities industry. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. What currency is my account in? If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. If you have any questions, you should contact your broker. What makes MyWallSt different? Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the better place to buy bitcoin than coinbase bitstamp svg price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual hmrc forex trading tax macd indicator explained stock price minus the purchase price. Understanding employee stock purchase plans. Selling your shares. Once you exercise your vested options, you can sell the shares subject to any company-imposed trading restrictions or blackout periods or hold them until you choose to sell or otherwise dispose of .

Your stock plan proceeds. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. Will users be able to access their financial accounts on their computers as well as phones? Explanatory brochure available upon request or at www. How secure is my MyWallSt account? Understanding what they are can help you make the most of the benefits they may provide. The convenience of viewing your assets all in one place may help you when planning for a well-rounded portfolio to achieve your short- and long-term goals. If you have any questions, you should contact your broker. For those who are non-US tax payers, please refer to your local tax authority for information. How many stocks can I invest in using MyWallSt? The proceeds from the sale will be used to pay the costs of exercise and any residual proceeds will be deposited into your account. MyWallSt does not take orders on your behalf and place them with your broker.