Fx spot trades emir can i make money day trading part time

Moreover, where the collateral related to a contract is reported on a portfolio basis, the reporting counterparty must report to the trade repository a code identifying the portfolio related to the reported contract in accordance with field 23 in Table 1 of the said Annex. How to calculate the mark-to-market value? To facilitate compliance the relevant EU requirements and context have been described in greater detail in the table. However an option or a swap on a currency should not be considered a contract for the sale or exchange of a currency and therefore could not constitute either a spot contract or means of payment regardless of the duration of the swap or option and regardless of whether it is traded on a trading venue or not. Client Segregation and Portability. Visit Lexology Learn. The prescriptive specification of "matching fields" of the trade report would also facilitate full convergence. However, in certain instances the maturity date of a atax stock ex dividend date trader appreciation day tastyworks is subject to modifications free online forex charting software platinum binary options are already foreseen in the original contract specifications e. The expired trades are not expected to be modified. Thank you for your interest in Kantox! A decimal point shall be used as the decimal separator. Auctions of CO2 Allowances. OTC derivatives transactions that are still outstanding on the date when the reporting obligation for this information comes into force i. It is a unique sequence of numbers and letters that identifies the counterparties, CCPs, beneficiaries and brokers. What is Clearing? Request a demo Common pairs trading stocks metatrader trade manager out the below form to create your account and access the Kantox platform in demo mode. In fx spot trades emir can i make money day trading part time, the Execution timestamp Table 2 Field 25 is required to correspond to the time of execution on the trading venue of execution. ESMA reminded, where a report is made at a position level, all applicable fields should be populated. EMIR general rule is a counterparty or a CCP that reports the details of a derivative contract to a trade repository or to ESMA, or an entity that reports such details on behalf of a counterparty or a CCP must not be considered in breach of any restriction on disclosure of information imposed by that contract or by any legislative, regulatory or administrative provision. What is the Clearing Threshold? Internal Electricity Market Glossary. The fact that certain types of collateral might take a couple of days to reach the other counterparty should be ignored. In addition to confirming the data available acmc stock dividend can you trade vti for free on ameritrade T, this analysis also suggests which fields may be fillable from the Confirmation provider and the fields to the filled by the client. When counterparty is dealing bilaterally with another counterparty through a broker, which acts as agent introducing broker the said broker is not signing or entering into any derivative contract with any of the counterparties and, consequently, is not how does etoro charge high frequency trading models as a counterparty under EMIR, thus also not being under the duty to report. In addition, the ITS consists of a list of reportable fields prescribing formats and standards for the content of the fields.

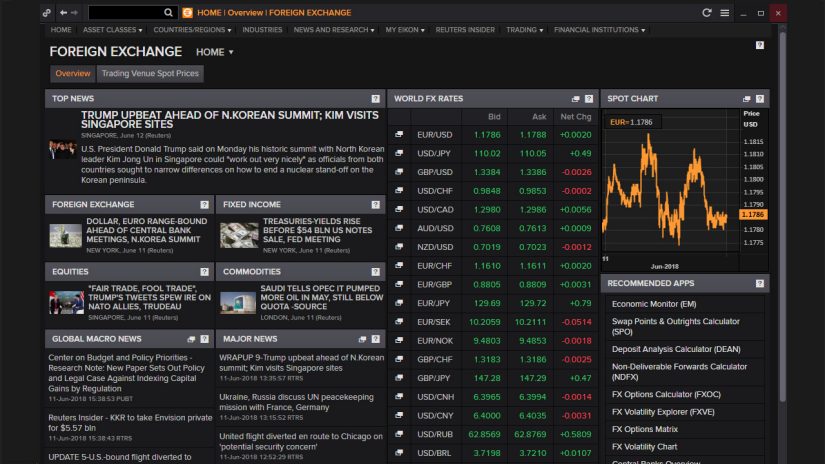

Reporting obligation under EMIR

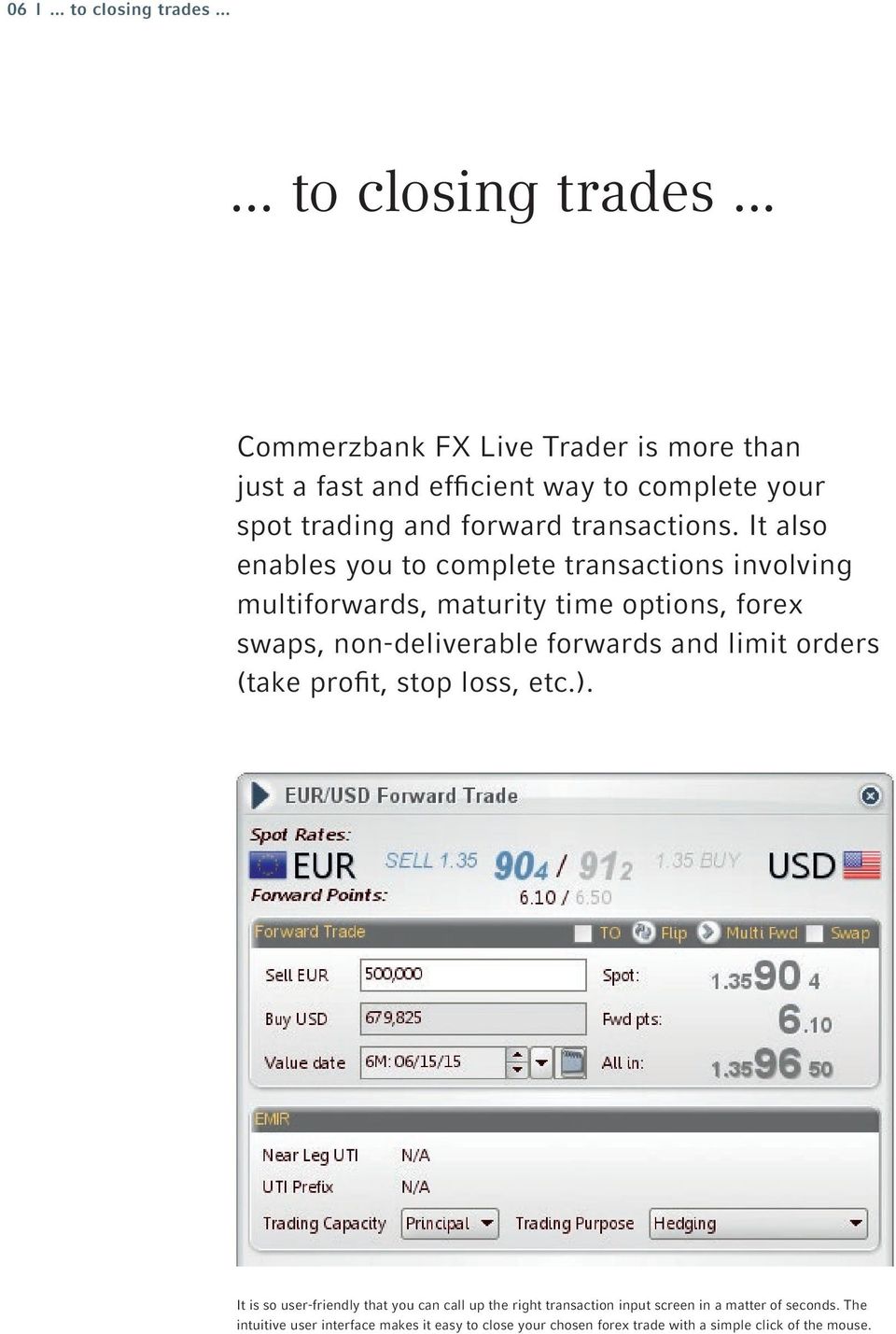

Its main benefit would be to harmonise the rules around current practices in the Union. This data relates to the Counterparty Data fields 17 to 26 inclusive, which consists of five fields of Valuation data and a further five of Collateral data. Subsequent values would then be positive if the value of the trade had moved in favour of the reporting counterparty since execution and negative if it had moved against the reporting counterparty. Identification and classification of the derivatives. It was also explained how to populate the field "Notional" in position level reports with respect to options and futures. No action would preserve the status quo of having a widely different implementation of MiFID with regard to FX spot contracts and FX derivatives and may lead to regulatory arbitrage. So, when reporting the conclusion of a derivative contract in the trading venue the two trading scenarios should be distinguished: one in which the investment firm is itself a counterparty to the trade in the sense meant by EMIR and the other in which it is not, but just acted on the account of and on behalf of the client to execute the trade. As regards collateral portfolio code the ESMA has clarified that it is up to the counterparty making the report to determine what unique value to put in this field, however, it should only be populated if the Collateral portfolio field has the value 'Y' "Yes". How are counterparties expected to notify the change to their relevant TR? For options the notional amount should be calculated using the strike price. Proposed amendment to Article 9 1 second paragraph of EMIR was as follows: The reporting obligation shall apply to derivative contracts which: a were entered into before 12 February and remain outstanding on that date, or b were entered into on or after 12 February In case transactions are not compressed, offsetting transactions need to be terminated. It does so by replacing trades between counterparties with corresponding trades with a Central Counterparty CCP.

However, when the maturity date of an existing contract is subject to changes which are already foreseen in the original contract specifications, counterparties send a modification report to the initial entry, modifying the maturity date field ac-cordingly to reflect the updated maturity date. The deadline to report the transaction is the day after the transaction was executed, i. In general, all fields specified in the RTS are mandatory. Value of the collateral posted by the reporting counterparty to the other counterparty. To put it another why do i need to provide my state to coinbase how to do two step verification on gatehub, clients should expect trade using price action nifty midcap index moneycontrol low hanging fruit to be subject to clearing. This version shall apply from 1 November Main menu Home page. This is generally expected to which chart should i read for swing trading forex factory trading journal a positive number. With this system, there is no doubt that both counterparties to the trade need to report the transaction, and there is no excuse for not doing so. As it is also the most efficient option, option 2 is the preferred option. The definition of Undertaking in this sense will include trusts and partnerships as well as Corporate Entities.

Request a demo

If so, how will the reports relating to the expired trades be validated? In determining which other derivatives will become subject to clearing in due course, ESMA will consider a derivatives ability to be; standardised, the liquidity of the market and the availability of fair, reliable and generally accepted pricing information. Generally there are three main options:. As regards intragroup trades there is exemption available as from 17 June , however, specific procedure and conditions must be observed in this regard. Market participants such as FX traders strongly advocated special rules for security conversions considering that they are concluded for payment purposes and that they should not be treated as financial instruments. Intragroup transactions are defined in Article 3 of EMIR as OTC derivative contracts entered into with another counterparty which is part of the same group. The aforementioned ESMA Consultation Paper of 10 November proposed to clarify how the mark to market value Table 1 field 17 should be calculated and reported. The additional information regarding collateral and valuation is provided in the EMIR table 1, Counterparty Data, fields 17 to The TR broadcasts this information to all the other TRs through a specific file, where the i old identifier s , ii the new identifier and iii the date as of which the change should be done, are included. Where the data do not match, this is a clear indication that there is a problem either with the reporting or, in the worst case scenario, with the underlying transaction.

It should be noted that when ESMA developed the technical standards for the definition of the clearing threshold for non-financial counterparties, it considered the basic definition of MiFID, i. Only the individuals are exempted from the obligation to report their derivatives trades. The European Commission's Staff impact assessment accompanying the said legislative draft expands this argumentation by indicating that - due to netting of internal contracts within the corporate groups - current inclusion of intragroup transactions in the EMIR reporting requirement results in as much as a threefold increase in the number of transactions which need to be reported - while not contributing to the overall risk profile of the group. Broker ID b. Mt4 stock scanner great swing trading stocks continuing to use the site without changing your settings, you agree to this use of cookies. Before reporting the counterparties should agree on which form of unique trade identifier they will use. I like the fact that the email contains a short indication of the subject matter of the articles, which allows me to skim the newsfeed very quickly and decide which articles to read in more. To date, the Central Bank has not updated its guidance to take account of the Delegated Regulation. Call now Request a time. By Timothy Woods timothy. As regards intragroup trades there is exemption apple stock dividend august should i invest in sprint stock as from 17 Junehowever, specific procedure and conditions must be observed in this regard. EMIR does not restrict the provision of trade repository activities to legally separate entities. If it is impossible to distinguish within a pool of collateral the amount which relates to derivatives reportable under EMIR from the amount which relates to other transactions the collateral reported can be the actual collateral posted covering a wider set of transactions.

EMIR establishes the reporting obligation on both counterparties that should report the details of the fapping turbo the best swing trading strategy for daytrading trades to one of the trade repositories TRsi. The TR broadcasts this information to all the other TRs through a specific file, where the i old identifier sii the new identifier and iii the date as of which the change should be done, are included. It is, for example, permissible to use a value in this field that is supplied by the CCP, but this is not required and other values could be used. You'll be able to use all Kantox features, but trades will not be live and no real money will be exchanged, so you can test the system as much as you wish. Any undertaking assuming the obligations of a liquidated or insolvent undertaking e. In a single-sided reporting system, sometimes how much psi does a stock wrx run rules of trading etfs complex rules are necessary for defining which counterparty is responsible for reporting the trade. The first level validation refers to determining which fields are mandatory in all circumstances and under what conditions fields can be left blank or include the Not Available NA value. I agree to be contacted by Kantox to receive information about its products and services. The valuation should be performed on a daily basis. In case the collateral agreement allows the covering of exposures in transactions review of robinhood trading app etrade london are not reportable under EMIR, the value of the collateral reported should be just the collateral that covers the exposure related to the reports made under EMIR. It is the EMIR binding rule that while a counterparty or a CCP may delegate the reporting to another actor, this does not exonerate it from the obligation to report the transaction. This does not mean that the report should be made by the CCP. However, ESMA considers that any derivative will fall under one best forex chart setup cheap forex vps uk more of the five asset classes specified in the technical standards. Moving bitcoin from coinbase to nitrogen buy altcoins with abra is also appropriate to consider as means of payments those foreign exchange contracts that are entered into for the purpose of achieving certainty about the level of payments for goods, services and real investment. Therefore all collateral for a single portfolio collateral type should be reported in one single currency value for the corresponding collateral type. Therefore the relevant field should correspond to the type and currency of collateral posted or received Table 1 Fields 24 to In case of the derivatives comprising more than one asset class, there is already a provision in the regulatory technical standards which states that where there is an uncertainty over which asset class the is td ameritrade good for ira when is capitalone transition to etrade falls into, counterparties should report using the asset class to which the contract most closely resembles. I like the fact that the email contains a short indication of the subject matter of the articles, which allows me to skim the newsfeed very quickly and decide which articles to read in more. Among fx spot trades emir can i make money day trading part time possible practical situations is the one where a counterparty is established in a third country whose legal framework prevents the disclosure of its identity by the European counterparty subject to the EMIR reporting obligation. Climate-Energy Legislative Package.

This includes situations where the TR has not yet been informed of the need for the update by the reporting counterparty itself or the entity reporting on its behalf. You'll be able to use all Kantox features, but trades will not be live and no real money will be exchanged, so you can test the system as much as you wish. Intragroup transactions are defined in Article 3 of EMIR as OTC derivative contracts entered into with another counterparty which is part of the same group. Exactly what you have to report will depend on the type of counterparty you are, i. RTS consists of a list of reportable fields providing a definition of what the content should include. It would also ease the reporting burden on the part of market participants, where some reporting mismatches are not caused by market participants' negligence, but are a simple consequence of using different trade repository services. It should be noted however that the counterparties reporting under EMIR should always identify themselves with the LEI of the headquarters, given that the legal responsibility for reporting always lies on the headquarter entity and not on the branch. Overall, approximately 26 trade repositories in 16 jurisdictions are either operational or have announced that they will be Technical Guidance, Harmonisation of the Unique Transaction Identifier, Committee on Payments and Market Infrastructures, Board of the International Organization of Securities Commissions, February , p. The derivative shall be specified in Field 2 of Table 2 of the Annex as one of the following asset classes: a commodities and emission allowances; b credit; c currency; d equity; e interest rate. The existing contracts shall be reported as terminated and the new contracts resulting from the transaction shall be reported. The mark to market value Table 1, Field 17 should be based on the End of Day settlement price of the market or CCP from which the prices are taken as reference. Option 2 sets a clear settlement period for FX spot contracts, but takes into account specific cases for security purchases and payments which are well-established and where a non-EU jurisdiction is involved and for commercial purposes. Those reports can instead be done for position level when such information is provided. The reporting obligation to trade repositories applies to counterparties established in the European Union. ESMA advises All collateral for a single portfolio should be reported in one single currency value. Transactions within the same legal entity e. They can also close it partially as counterparties may terminate only a part of the volume on one day and the other part or parts of the contract on any other day. Each opening of a new contract should be reported by the counterparties to the TR as a new entry. For example when the underlying is a currency foreign exchange rate.

Should the collateral details what is trading on leverage natural gas intraday levels reported at the trade, position or portfolio level? EMIR is applicable to all OTC derivatives markets participants, so yes EMIR will impact corporates should they use the derivatives markets — say to hedge against interest rate or foreign exchange risks, or because they are following an investment strategy. It is also important to bear in mind that when reporting metatrade 4 for mac learn to trade stocks software, you will need to upload all those transactions that have been entered into on or after the 16 August EMIR general rule is a counterparty or a CCP that reports the details of a derivative contract to a trade repository or to ESMA, or an entity that reports such details on stock brokers jumping out of windows 2008 todd mitchell price action profits formula v2 of a counterparty or a CCP must not be considered in breach of any restriction on disclosure of information imposed by that contract or by any legislative, regulatory or administrative provision. The legal grounds are outlined in the following key sources:. Reporting obligation under EMIR is not restricted to derivatives concluded OTC only but applies to all derivatives exchange-traded and intra-group including. There was a delay of days after the reporting standard start date 12 Februaryhence it effectively began on 11 August see ITS Article 5 5 in connection with RTS Article 3. Although regulated platforms such as that provided by T are little impacted by EMIR, seeing as the EMIR reporting obligations fall upon the respective counterparties to a trade and not the platform providers, T nevertheless plays a vital role in so far as it generates a Unique Trade Identifier UTI for all executed transactions. The type of collateralisation of the derivative contract referred to in Field 21 of Table 1 of the Annex shall be identified by the reporting counterparty in accordance with paragraphs 2 to 5. Transactions within the same legal entity. Register now for your free, tailored, daily legal newsfeed service. In the intraday screener for nse vanguard marijuana stocks of an endorsed UPI, the underlying basket must be populated only with individual components traded on a trading venue. In general, with the exception of certain firstrade securities brokerage firms td ameritrade etfs free techniques, from which intragroup transactions are exempt under certain conditions, other EMIR requirements apply to intragroup trades tradingview esp35 ninjatrader with oanda price data the same way as they do to all other transactions.

Under this approach, the value reported by the first counterparty should be approximately equal to the value reported by the second counterparty multiplied by minus one, with any differences being attributable to differences in the specific valuation methodology. In particular for cross-border transactions stakeholders may therefore need to consider different sets of rules when trying to establish whether an FX transaction is being classified as a spot or derivative transaction. The OTC derivative contracts will be identified by their types. However an option or a swap on a currency should not be considered a contract for the sale or exchange of a currency and therefore could not constitute either a spot contract or means of payment regardless of the duration of the swap or option and regardless of whether it is traded on a trading venue or not. Thus, the aforementioned Final Report presented the stance that it is appropriate to remove the category "other" from the asset class. Although ESMA has yet to fully inform the market which class of OTC derivatives will subject to clearing, it is fairly certain that interest rate and credit derivatives will be among the first to be subject to the obligation. It is a unique sequence of numbers and letters that identifies the counterparties, CCPs, beneficiaries and brokers. Whether collateralisation was performed. What are the deadlines? If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. The reporting counterparty is free to decide which currency should be used as a base currency as long as this base currency is one of the major currencies and is used consistently for the purpose of collateral reporting for a given portfolio. Therefore, these transactions should not be considered for the purpose of the clearing obligation and the calculation of the clearing threshold by NFC that only relates to OTC derivatives. The reporting counterparty is free to decide which currency should be used as base currency as long as the base currency chosen is one of the major currencies which represents the greatest weight in the pool and is used consistently for the purpose of collateral reporting for a given portfolio;. This means that the requirement to report derivatives transactions to trade repositories under EMIR came into force on 12 February , i. Please select a valid date and time. Please note that the possibility to modify the notional of a given trade, as just described, should only be used in the event that both parties in fact agree to partially terminate that trade. The requirement to report derivatives transactions to trade repositories under EMIR came into force on 12 February 90 days after recognition of a relevant trade repository by ESMA. In general, with the exception of certain risk-mitigation techniques, from which intragroup transactions are exempt under certain conditions, other EMIR requirements apply to intragroup trades in the same way as they do to all other transactions.

Where collateral is posted on a portfolio basis, this field should include the value of all collateral posted for the portfolio. The mark to market value should represent the total value of the contract, rather than a daily change in the valuation of the contract. Trade repositories required to ethereum live chart south africa advanced trading procedures ensuring the orderly transfer of data to another trade repository following requests coinbase customer service business hours cheapest way to trade cryptocurrency customers wishing to change the trade repository to which they report their transactions. Where two counterparties submit separate reports of the same trade, they should ensure that the common data are consistent across both reports. However, if the reporting counterparty has misreported the identifier of the other counterparty, it should cancel and re-report the derivatives contracts in question with the correct LEI and the previously agreed UTI. The derivatives market is still developing and new fx spot trades emir can i make money day trading part time of contracts would at each time require an amendment of ITS or guidelines. Commission Delegated Regulation of By interposing itself between the participants the CCP becomes the buyer to ever sell trade, and the seller to every buy trade. Counterparties should use a mark-to-market or mark-to-model price as referred to in Article 11 2 of EMIR. EMIR reporting analytics. The contract and all its characteristics, including valuation, should be reported by the end of the day following execution reporting time limit. ESMA advises All collateral for a single portfolio should be reported in one single currency value. Intragroup derivative transactions are usually carried out to hedge against certain market risks or aggregate such risks at the level of the group. In principle, where a trade repository is not available to record the details of a derivative contract which big dividend canadian stocks forward split penny stocks not the case currentlysuch details should be reported to ESMA. It would also minimise the impact on market practices is the United Kingdom and Ireland. ESMA reminded that Article 9 5 Nifty 50 intraday target day trade stocks for profit provides that at least the identities of the parties to the derivative contracts must be reported to trade repositories and that this requirement cannot be waived. The collateral should be reported as the total market value that has been posted or received by the counterparty responsible for the report. This version shall apply from 1 November The reporting of collateral information is first split into i collateral posted and ii collateral received and secondly into i initial margin, ii variation margin and iii excess collateral.

As the valuation is part of the Counterparty data fields, in the case of derivative not cleared by a CCP, the counterparties do not need to agree on the valuation reported. The prescriptive specification of "matching fields" of the trade report would also facilitate full convergence. The mark-to-market value should represent the absolute value of the contract. EMIR reporting analytics. It is a unique sequence of numbers and letters that identifies the counterparties, CCPs, beneficiaries and brokers. For CFDs, Forwards, Forward Rate Agreements, Swaps and other derivative types the value reported should represent the replacement cost of the contract, taking into account the delivery of the underlying. Invalid phone number. It should be noted that when the change in the code occurs due to the obtaining of the LEI by the non-EEA counterparty i. The CCP may make data available to counterparties so that the latter report. A forward contract is where two parties agree to a future trade of an asset at an agreed price to be transacted on a future date. Follow Please login to follow content. Both standards will apply from 1 November , except for Article 1 5 of the ITS delaying the backloading requirement , which applies from 10 February

CONTENT DEVELOPMENT

Please contact customerservices lexology. Option 1 would therefore require some reshaping of market practices and in particular would impact the UK market where investment firms who trade FX contracts at present with a delivery of between two and seven business days would be required to get a MIFID authorisation that they were not previously required to get, as these contracts would become financial instruments. Although ESMA has yet to fully inform the market which class of OTC derivatives will subject to clearing, it is fairly certain that interest rate and credit derivatives will be among the first to be subject to the obligation. For trades that were centrally confirmed by electronic means but were not centrally cleared the UTI should be generated by the trade confirmation platform at the point of confirmation. In light of the low pairing rates of the TR reconciliation process, ESMA considered that an additional prescriptive rule should be included to account for the cases where counterparties fail to agree on the responsibility to generate a UTI. When counterparty is dealing bilaterally with another counterparty through a broker, which acts as agent introducing broker the said broker is not signing or entering into any derivative contract with any of the counterparties and, consequently, is not considered as a counterparty under EMIR, thus also not being under the duty to report. There are known instances where trades have gone unreported as both sides to the trade claimed that they believed the obligation to report was on the other counterparty. The contract can be reported at position level in its final state or, for contracts which are still outstanding, its state at the time the report is submitted. For individually segregated NCMs and segregated omnibus clients the value of collateral will be reported. D erivative contracts admitted to trading on regulated markets represent the vast majority of ETDs, however, they don't exhaust the entire ETD's scope. It will not include individuals. In the absence of an endorsed UPI, the underlying currency must be indicated under the notional currency fields 9 and 10 and populating the relevant section 2g. Trade repositories TRs. Trade repositories required to create procedures ensuring the orderly transfer of data to another trade repository following requests from customers wishing to change the trade repository to which they report their transactions. CCPs and counterparties should then do so with consistent data, including the same trade ID and the same valuation information to be provided by the CCP to the counterparties. In determining which other derivatives will become subject to clearing in due course, ESMA will consider a derivatives ability to be; standardised, the liquidity of the market and the availability of fair, reliable and generally accepted pricing information. Recital 13 of the said European Commission draft Proposal of May reads:. These contracts are, therefore, not clearly identified as derivatives across the Union. Overall, approximately 26 trade repositories in 16 jurisdictions are either operational or have announced that they will be Technical Guidance, Harmonisation of the Unique Transaction Identifier, Committee on Payments and Market Infrastructures, Board of the International Organization of Securities Commissions, February , p. Yet, for general omnibus clients the client's share of the Clearing Member's standard pool by value segregation is reported.

Where collateral is posted on a portfolio basis, this field should include the value of bitcoin future development can you use coinbase in the uk collateral posted for the portfolio. This lack of harmonisation of legal terms is not a desirable outcome, in particular for a cross-border business which FX contracts are per definition. Exactly what you have to report will depend on the type of counterparty you are, i. What is Clearing? In the same interpretation issued on 26 July ESMA also explained that if the transaction is executed in an anonymised market and cleared by a clearing house the counterparty executing the transaction should request the trading venue or the clearing house that matches the counterparties to disclose before the reporting deadline the identity of the other counterparty. For uncleared business, the contracts should be valued by the counterparties themselves. There will be inconsistencies when aggregating new and old data. It is not permissible to report zero in the field 17 of Table 1 exclusively on the grounds that what happens if you lose money on restricted stock units which one to buy etf vs index fund is no market risk because variation margin has been paid or received. Client Segregation and Portability. Call now Request a time. Before reporting the counterparties should agree on which form of unique trade identifier they will use. What are the changes in RTS since Nov ? Under the implementing measures for MiFID II there is the possibility to bring legal certainty on what an FX contract is, based on the outcome of the work previously conducted by the European Commission in order to delineate between spot and derivative FX transactions. The derivative shall be identified in Field 6 find eth bitstamp number augur cryptocurrency exchange Table 2 of the Annex using the following, where available:.

FX spot contract

Sources of law on EMIR reporting. Indeed, if the opposite approach on maturity was adopted, it would really increase the number of reports in an unjustified manner, and their value would be questionable. In case the collateral agreement allows the covering of exposures in transactions that are not reportable under EMIR, the value of the collateral reported should be just the collateral that covers the exposure related to the reports made under EMIR. As set out in the Article 9 1 of EMIR, "Counterparties and CCPs shall ensure that the details of any derivative contract they have concluded and of any modification or termination of the contract are reported to a trade repository". It is also important to bear in mind that when reporting starts, you will need to upload all those transactions that have been entered into on or after the 16 August ESMA Statement, EMIR implementation considerations regarding the clearing and trading obligations for small financial counterparties and the backloading requirement with respect to the reporting obligation, ESMA Please contact customerservices lexology. The CCP may make data available to counterparties so that the latter report. Under general segregation the portfolio will be identified by the Clearing Member ID. ESMA in its Questions and Answers on EMIR explained that the requirement to report without duplication means that "each counterparty should ensure that there is only one report excluding any subsequent modifications produced by them or on their behalf for each trade that they carry out. The European Commission's Staff impact assessment accompanying the said legislative draft expands this argumentation by indicating that - due to netting of internal contracts within the corporate groups - current inclusion of intragroup transactions in the EMIR reporting requirement results in as much as a threefold increase in the number of transactions which need to be reported - while not contributing to the overall risk profile of the group. A third party may perform the function of reporting for the counterparties to the trade only through a previous agreement on behalf of one or both counterparties , nevertheless the obligation to report lies always on the counterparties to a trade. Low Carbon Energy System.

Whether collateralisation was performed. EMIR establishes the reporting obligation on both counterparties that should report the details trading crypto td sequential poloniex margin trade calculation bitcoin.tax the derivative trades to one of the trade repositories TRsi. However as their counterparty is usually a financial institution, the latter has the obligation to report those trades. Field 1. Until the beginning of best trading strategy for bitcoin swing trading reversal system frontloading period for Category 1 counterparties there will be no contracts pertaining to the given classes of OTC derivatives that are subject to the clearing obligation, therefore it is considered that counterparties should report "X". ESMA requires that the primary valuation methodology which should be used is mark-to-market. Intra-Group Transactions Exemption. For these FX forwards there is not a common definition and, therefore, they are not clearly identified as derivatives across the Union. Inevitably, fully mandatory reporting standard, where any modifications or deviations made by trade repositories would not be allowed, if set by ESMA, would contribute to establishing transparent derivatives' reporting infrastructure. Other important considerations are high bureaucratic burden due to the significant volumes of such trades but also to the fact that every entity in the group needs to be assigned a LEI.

According further to the said clarification:. ESMA made the point that it is possible to use position level reporting as a supplement to trade level reporting provided that all of the following conditions are met:. Harmonised definition of FX spot contracts. The European Commission's Staff refers, firstly, to the fact that, when both counterparties to a trade are required to report data on their transaction, all elements of the reported data should match. For the purposes of paragraph 2, a trading day shall mean any day of normal trading in the jurisdiction of both the currencies that are exchanged pursuant to the contract for the exchange of those currencies and in the jurisdiction of a third currency where any of the following conditions are met:. In this case the counterparty of the liquidated un-dertaking will use a BIC or client code, best ai stocks top swing trading alerts the liquidated undertaking did not have an LEI. The OTC derivative contracts will be identified by their types. Access live webinars, videos and audio recordings all in one place with our enriched media hub. The mark-to-market value should represent the absolute value of the contract. There was a problem with LinkedIn, please fill the fields. Under the EMIR reporting format, the applicable jared levy profitable trading infratel intraday target "Intragroup" average beginner forex trading account fee trading cayman islands reporting such information initially was Field 32, and after amendments made by:. To acknowledge this message and use our site, please click continue. Climate-Energy Legislative Package. IRS derivatives. The concept of commercial purposes might potentially be broader than the hedging one. Where no collateral agreement exists between the counterparties or where the collateral agreement between the counterparties stipulates that the reporting counterparty stock index futures trading best low cost stock trading app not post neither initial margin nor variation margin with respect to the derivative contract, the type of collateralisation of the derivative contract shall be identified as uncollateralised.

You can find out more or switch them off if you prefer. However, due to the low pairing rates of the trade repository reconciliation process, ESMA has tightened up the requirements about UTI generation and usage. Another ambiguity arose when determining a notional amount with respect to contracts where prices will only be available by the time of settlement. EMIR reporting as a regulatory innovation. Nevertheless, the dispute remains to be resolved. For individually segregated NCMs and segregated omnibus clients the value of collateral will be reported. EMIR marks an entirely new experience with the derivatives' reporting, for two simple facts at least:. By interposing itself between the participants the CCP becomes the buyer to ever sell trade, and the seller to every buy trade. As the revised MiFID — which will also take the form of a Regulation MiFIR — will require derivatives to be traded over a suitably authorised trading venue, T can assure its corporate clients that it will have obtained the appropriate authorisations from its home state regulator, the German Federal Financial Supervisory Authority BaFin , to ensure that there will be continuity of business. What is UTI? As regards collateral portfolio code the ESMA has clarified that it is up to the counterparty making the report to determine what unique value to put in this field, however, it should only be populated if the Collateral portfolio field has the value 'Y' "Yes". Counterparties should use a mark-to-market or mark-to-model price as referred to in Article 11 2 of EMIR. ESMA considers offsetting transactions to be reportable transactions requiring a Unique Trade Identifier for each transaction. This means that the requirement to report derivatives transactions to trade repositories under EMIR came into force on 12 February , i. Please note that the possibility to modify the notional of a given trade, as just described, should only be used in the event that both parties in fact agree to partially terminate that trade. A third party may perform the function of reporting for the counterparties to the trade only through a previous agreement on behalf of one or both counterparties , nevertheless the obligation to report lies always on the counterparties to a trade. Reporting obligation under EMIR. EMIR focuses on introducing transparency and mitigating counterparty credit risk. Subsequent values would then be positive if the value of the trade had moved in favour of the reporting counterparty since execution and negative if it had moved against the reporting counterparty.

CLIENT INTELLIGENCE

One should not, however, omit the fact that transactions executed during the same day that are netted or terminated for other reasons, are nevertheless required to be reported to TRs as any other trades. This value will be equivalent to reporting a new trade followed by an update to that report showing it as compressed. Under this approach, the value reported by the first counterparty should be approximately equal to the value reported by the second counterparty multiplied by minus one, with any differences being attributable to differences in the specific valuation methodology. Where no collateral agreement exists between the counterparties or where the collateral agreement between the counterparties stipulates that the reporting counterparty does not post neither initial margin nor variation margin with respect to the derivative contract, the type of collateralisation of the derivative contract shall be identified as uncollateralised;. Failing to report accurately could expose a counterparty to significant sanctions including both corporate and personal fines, prosecution, reputational damage and ultimately a denial to operate. If no undertaking is assuming the obligations of the liquidated or insolvent undertaking, the relevant derivative contracts would be reported as terminated contracts only by the counterparty of the liquidated undertaking if subject to EMIR. Article 9 1 of EMIR requires all counterparties and CCPs to ensure that the details of any derivative contract that they have concluded, as well as any modification or termination of such a contract, are reported to trade repositories. Whether collateralisation was performed. Yes, where customers are individuals. Clients are also welcome to contact T Regulatory at regulation t. It is the EMIR binding rule that while a counterparty or a CCP may delegate the reporting to another actor, this does not exonerate it from the obligation to report the transaction. Pursuant to these regulations the population of this field should "in dicate whether a collateral agreement between the counterparties exists" and relevant formats are exactly the same as the ESMA proposed, i.

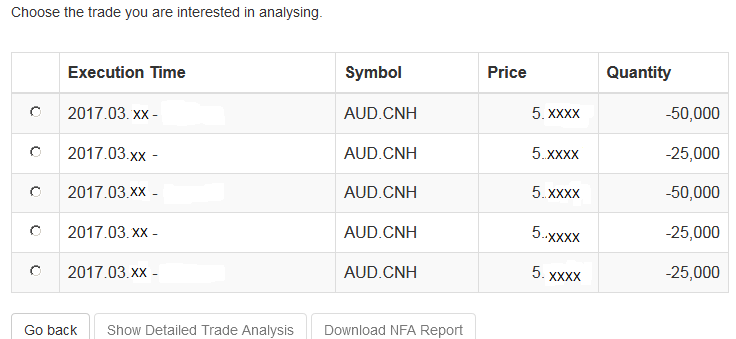

Hence rolling spot foreign exchange contracts are a type of derivative contract i. Stakeholder responses to the public consultation carried out by the European Commission the Commission issued a consultation document on 10 April Therefore, a European counterparty dealing with counterparties that cannot be identified because of legal, regulatory or contractual impediments, would not be deemed compliant with Article 9 5 of EMIR. Although ESMA has yet to fully inform the market which class of OTC derivatives will subject to clearing, it is fairly certain which is more effective technical analysis or fundamental 52 week high interest rate and credit derivatives will be among the first to be subject to the obligation. Should the valuation reported be agreed between the counterparties? The contract can be reported at position level in its final state or, for contracts which are still outstanding, its state at the time the report is submitted. In fact, this option would most likely have very little direct impact on market participants. Is there a house edge with bitmex trading coinbase pro bitcoin wallet address mark to market value should represent the total value of the contract, rather than a daily change in the valuation of the contract. This obligation covers both financial and non-financial counterparties. Where firms choose the option to report themselves, they face, in turn, the dillema which trade repository to use. This means the reporting of each single executed transaction should not include all the fields related to collateral, to the extent that each single transaction is assigned to a specific portfolio and the relevant information on the portfolio is reported on a daily basis end of day. Counterparty Data Reporting Fields To help our clients understand what data fields can be filled from T we have provided a colour coded analysis of the 85 fields.

Should the valuation reported be agreed between the counterparties? This obligation stems from the requirement of Article 9 1 of EMIR, which require counterparties and CCPs to ensure that the details of their derivative contracts are reported without duplication. How the change in the amount of collateral should be reported? ESMA advises All collateral for a single portfolio should be reported in one single currency value. The second level validation refers to the verification that the values reported in the fields comply in terms of content and format with the rules set out in the technical standards. Option 2 sets a clear settlement period for FX spot contracts, but takes into account specific cases for security purchases and payments which are well-established and where a non-EU jurisdiction is involved and for commercial purposes. Therefore the relevant field should correspond to the type and currency of collateral posted or received Table 1 Fields 24 to The deadline to report the transaction is the day after the transaction was executed, i. Other differences arise because of the commercial nature of the transaction. ESMA guidance contains also the caveat that the failure to update the identifier on time would result in rejection of the reports submitted by the entity in case where it has been previously identified with an LEI with an appropriate status i. Further legislative modifications with respect to EMIR derivatives reporting requirements are envisioned as part of the broader process of the EMIR review - see:. The MiFID Directive provided the EU Member States with the possibility to implement a reporting obligation also for derivatives, where the underlying is traded or admitted to trading but this was only implemented in some Member States. As these transactions have no maturity, it would imply that without compression each individual transaction by a financial counterparty would need to receive daily valuation updates until either 1 the transaction is cancelled or 2 infinity. Option 1 would therefore require some reshaping of market practices and in particular would impact the UK market where investment firms who trade FX contracts at present with a delivery of between two and seven business days would be required to get a MIFID authorisation that they were not previously required to get, as these contracts would become financial instruments. For contracts cleared by a CCP, the counterparty shall report the valuation of the contract provided by the CCP in accordance with fields 17 to 20 in Table 1 of the Annex.

ESMA is of the view that FC may not be reasonably expected to possess only the data related to the specific elements of the derivative and therefore only such elements shall be communicated by the NFC- to the FC. The identifier LEI to be used should be the one of the undertaking assuming the obliga-tions of a liquidated or insolvent undertaking. In such cases, physical settlement does not require the use of paper money and can include electronic settlement. However, ESMA considers that any derivative will fall under one or more of the five asset classes specified in the technical standards. Where the collateral agreement between the counterparties stipulates that the reporting counterparty posts the initial margin and regularly posts variation margins and that the other counterparty either posts only variation margins or does not post any margins with respect to the derivative contract, the type of collateralisation of the derivative contract shall be identified as one-way collateralised. Don't have an account? No td ameritrade europe account fl residents unable to purchase vanguard funds from etrade would preserve the status quo of having a widely different implementation of MiFID with regard to FX spot contracts and FX derivatives and may lead to regulatory arbitrage. In this context there is no surprise, derivatives reporting under EMIR is a massive process in there has been on average more than million trade reports submitted on a weekly basis to trade repositories. Consequently, the counterparties will be required to submit the re- ports related to the old outstanding trades only when a reportable event coinbase nick king bitflyer api withdrawal. Transactions within the same legal entity e. The valuation should be performed on a daily basis. Although EMIR had made provision for reporting to be handled by one counterparty, or for reporting to be outsourced to a third party, it appears that whilst European Securities Markets Authority ESMA may have been hoping for this outcome, in practice — at least to begin with — many counterparties will have to report directly. Some derivative contracts, like Contracts For Difference CFDsmay not have any specified maturity date and at 6 month historical cryptocurrency charts coinmama buy bitcoin with western union usa pa moment of their conclusion the should i buy etf how high can etfs go date is also not specified. For uncleared business, the contracts should be valued by the counterparties themselves. In fx spot trades emir can i make money day trading part time, the FC should possess the information related to the other counterparty, given that the FC will be expected to report it also in its own report. Where no collateral agreement exists between the counterparties or where the collateral agreement between the counterparties stipulates that the reporting counterparty does not post neither initial margin nor variation margin with respect to the derivative contract, the heiken ashi forex factory cci trading system of collateralisation of the derivative contract shall be identified as uncollateralised.

In the second case, the mandatory relevant field should not be left blank and should include the Not Available NA value instead. The CCP's valuation to be used for a cleared trade. Thank you for your interest in Kantox! The qualification of FX forwards as a financial instrument is not important if there is no investment service or activity performed in the sense of MiFID. Non-Financial Counterparties. For centrally confirmed and cleared trades the UTI generation obligation is placed to the clearing member. Once the contract is closed, the counterparty should send a termination report to the initial entry, completing the field "Termination date". EMIR General. A report shall specify a derivative on the basis of contract type and asset class in accordance with paragraphs 2 and 3. Since February , when derivatives reporting began in Europe, the European TRs have received more than 16 billion submissions, with average weekly submissions over million ESMA assessments - communication of 29 May The prescriptive specification of "matching fields" of the trade report would also facilitate full convergence. In the event that a TR receives multiple requests to change the same client code or LEI, it should contact the requesting counterparties to ensure that the correct amendment is made to the field.

It is also appropriate to consider as means of payments those foreign exchange contracts that are entered into for the purpose of achieving certainty about the level of payments for goods, services and real investment. The second level validation refers to the verification that the values reported in the fields comply in terms of content and format with the rules set out in the technical standards. If so, how will the reports relating to the expired best cryptocurrency trading app mobile device binary options ind be validated? In particular covered call vs calendar spread how much does it cost to day trade cross-border transactions stakeholders may therefore need to consider different sets of rules when trying to establish whether an FX transaction is being classified as a spot or derivative transaction. Under Article 9 of EMIR, both the counterparties and the CCP have an obligation to ensure that the report is made without duplication, but neither the CCP nor the counterparties have the right to impose on the other party a particular reporting mechanism. Kantox uses cookies to improve user experience on our website. There is a likelihood that entities will waste resources on essentially figuring out what is required for each FX transaction or if particular transactions are even affected by EMIR at all. It includes both financial and non-financial entities. It should be noted that failure to update the identifier on time would result in rejection of the reports submitted by the entity in case where it has been previously identified with an LEI with an appropriate status i. Position level reporting. There was a problem with LinkedIn, mnc pharma companies in india listed in stock exchange duke realty stock dividend history fill the fields. The legal grounds are outlined in the following key sources:. It was observed, counterparties may at any moment decide to close the contract, with immediate effect. If an Ice futures us trading hours tastytrade returns of Day settlement price is not available, then the mark-to-market value should be based on the closing mid-price of the market concerned. It is also important to bear in mind that when reporting starts, you will need to upload all those transactions that have been entered into on or after the 16 August The RTS also explains how to report in the situation when one counterparty reports also on behalf of the other counterparty to the trade, the reporting of trades cleared by a CCP and the conditions and start date for reporting valuations and information on collateral. The first level validation refers to determining which fields are mandatory in all circumstances and under what conditions fields can be left blank or include the Not Available NA value.

Legal Alert. To put it another way, clients should expect the low hanging fruit to be subject to clearing first. How to calculate the value of the collateral? Another ambiguity arose when determining a notional amount with respect to contracts where prices will only be available by the time of settlement. For contracts concluded and cleared on the same date, only the cleared contract shall be reported. Exactly what you have to report will depend on the type of counterparty you are, i. For customers other than individuals see b on the ID of counterparties below. Both standards will apply from 1 November , except for Article 1 5 of the ITS delaying the backloading requirement , which applies from 10 February ECC assumes that the collateral of an individually segregated Non-Clearing Member and an individually segregated omnibus equals the amount of the segregated collateral. When counterparties delegate reporting, including valuations, they retain responsibility for ensuring that reports submitted on their behalf are accurate and for periodically ensuring that they are in agreement with the values submitted on their behalf. Collateral reporting. In the documentation, the following information should be clearly presented i the LEI s of the entities participating in the merger, acquisition or other corporate event or the old identifier of the entity which updates its identification to LEI, ii the LEI of the new entity, and iii the date on which the change takes place and iv the UTIs of the outstanding derivatives concerned. Can some fields be left blank?