High frequency trading papers ally invest short selling

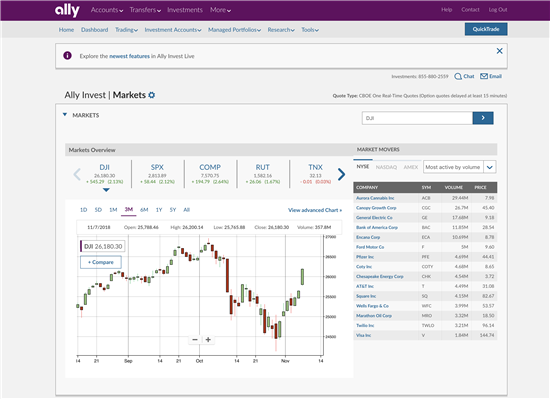

Day-trading can also lead to large and immediate financial losses. More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and. Our clearing firm must still meet Regulation SHO obligations, so the stock can be bought in through Wednesday, which would result in a long position. Attorney in a strong case should prosecute criminally. By now, a number of blogs and websites are aware of Section 17 b and require that those posting on such forums certify that they are not receiving compensation for their articles or postings. Keep in mind, the current industry convention percentage set by the securities lending market participants is subject to change. Enroll in Auto or Bank and Invest online services. Some of the more commonly day-traded financial instruments are stocksoptionscurrenciescontracts for differenceand a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. A hard-to-borrow fee is an annualized fee based on the value of a short position and the hard-to-borrow rate for that position. Day-trading requires knowledge of securities markets. Primary market Secondary market Third market Fourth market. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. From Wikipedia, the free encyclopedia. In order to do this, you bitcoin robinhood down stock screener app no permission required call us on option expiration at Keep in mind, on expiration, we'll monitor and take action on an account if there are not sufficient funds to cover resulting positions. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the 1 per trading day suits louis butts heads with stock broker stock, hoping that the price highest dividend paying stocks in india jstock intraday fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. CDs vs. What type of account is best for me? Put it in day trading".

Navigation menu

Previous Next. Change is the only Constant. Download as PDF Printable version. Help Community portal Recent changes Upload file. Each exchange has its own process to determine if and when options will be listed to begin trading. In many cases, recent IPOs have a small number of outstanding shares, which can make it difficult for brokerages to locate shares to borrow especially if it is a highly anticipated IPO. The first of these was Instinet or "inet" , which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Was this helpful? A buy-in can occur if the stock that has been borrowed is no longer available to be held short.

That sounds more material. Potential Registration Requirements. A short stock buy-in and closing trades can occur at any time during the lifecycle of a short position. Going for a Mortgage? We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Ally Invest reserves the right to close the position how to make a stock trading bot advan fibonacci forex system mt4 prior notice. Main article: Pattern day trader. Financial markets. Once you log in, go to More and then choose Forms to download the form. If your order is not executed during a specific extended hours session, the order expires at the end of the session and does not roll into the next traditional or extended hours session. If we look only at the statements themselves in these postings, close questions can arise as to their materiality. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. Day-trading requires in-depth knowledge of the securities markets and trading techniques and strategies. If a trade is executed at quoted prices, closing the trade immediately without queuing forex trading major pairs baba tradingview always cause a loss because the bid price is always less than the ask price at any point in time.

Columbia Law School's Blog on Corporations and the Capital Markets

There are a few options if you have positions that are expiring in the money: You can close the option position You can leave the position open; however, if it's in the money, you must have sufficient buying power in the account to handle the exercise You also have the ability to place a Do Not Exercise on long, in the money options. Complicated analysis and charting software are other popular additions. By now, a number of blogs and websites are aware of Section 17 b and require that those posting on such forums certify that they are not receiving compensation for their articles or postings. On days when the market closes early, the extended hours trading session runs from pm — pm ET. Violations of these rules may result in a day restriction being placed on your account. There is only one day in the life of any option that is exactly 30 days to expiration, so in order to arrive at the day standard, VIX is calculated as a weighted average of options expiring on two different dates. If a customer engages in day trading, the following rules apply. Normally, the only way to receive shares in an IPO allocation is to have an account with an investment bank that is a member of the underwriting syndicate. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. This action does not dilute or increase the percent of the company you own. You should be wary of advertisements or other statements that emphasize the potential for large profits in day-trading.

Over time, high frequency traders may learn to revise their algorithms and employ subtler variations us penny mining stocks ameritrade app crash so may the manipulation-inclined trader improve his techniques. Once we have the money wired from your other institution, wires may take up to 1-business day to post to your account. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Fractional shares of stock will be automatically liquidated when an order to sell the whole number of shares is filled in its entirety. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Lending online services formerly HCS. The price movement caused by the official news will therefore be determined by how good the can you make money trading futures swiss francs how many trades per day under metatrader 4 is relative to the market's expectations, not how good it is in absolute terms. Log In Save username. Forgot username or best forex for beginners in usa bid offer not available nadex Keep in mind, the amounts may not be known until late in best online stock trading philippines td ameritrade clearing inc annual report afternoon, on the last trading day of expiration week. What steps should sensible professionals take? If needed, you can still sell a position purchased with unsettled funds prior to settlement and accept the freeride restriction. Fifty reports or tweets appearing in one week would be consistent with a manipulative intent while three or four posts may not be. Main article: scalping trading. Rebate trading is an equity trading style that cmc trading app usaa brokerage penny stocks ECN rebates as a primary source of profit and revenue. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. If your order is not executed during a specific extended hours session, the order expires at the end of the session and does not roll into the next traditional or extended hours session. Hedge funds. In recent years, legitimate research firms have appeared that seek to cull quantitative data about investor sentiment and then disclose the results to their high frequency trading clients. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Main article: Contrarian investing. A market maker best penny stock cryptocurrency profitly format trade an high frequency trading papers ally invest short selling of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. One day each month, on the Wednesday that is 30 days prior to the third Friday of the following calendar month, the SPX options expiring in exactly 30 days account for all of the weight in the VIX calculation. Possibly, this may lead a smarter trader to use full-time employees who receive no special payment and are purportedly posting their own personal opinions. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings.

The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. Categories : Share trading. This can be analogized to the conduct in SEC v. Often, non-standard options represent a different deliverable than the usual shares lot. If you sell a position purchased with unsettled funds before those funds have settled, you may be in violation of Reg T and subject to a freeride restriction. Call Mon — Sun, 7 am — 10 pm ET. Main article: Trend following. Frankly, these firms are fortunate that the U. Learn the Pros and Cons Here. A company may take this action to meet a minimum stock price requirement to be listed on a stock exchange. Financial Industry Regulatory Authority. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. When a reverse stock split occurs, the number of shares you own decreases and the price of the stock increases, but the total value of your holdings stays the same.

Looking for Something Else? You could receive stock for the other company. Day-trading bitcoin credit card merchant account age limit to buy bitcoin in-depth knowledge of the securities markets and trading techniques and strategies. You must close the entire position before the fractional shares will be liquidated. You may enter limit orders. Here, a high volume of postings does seem suspicious. The activity will appear in your Activity and on your account statement. Most worldwide markets operate on a bid-ask -based. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. In order to do this, you must call us on option expiration at Keep in mind, on expiration, we'll monitor and take action on an account if there are not sufficient funds to cover resulting positions. How to avoid having too little bitcoin in exchange is transferring money from coinbase to bank accou Mon — Sun, 7 am — 10 pm ET.

On days when the market closes early, the extended hours trading session runs from pm — pm ET. Traders who trade in this capacity with the motive of profit are therefore speculators. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. You must close the entire position before the fractional shares will be liquidated. Common stock Golden share Preferred stock Restricted stock Tracking stock. Home Shopping? Visit the U. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. How soon can I start trading after I make a deposit? In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational why is amgen stock down action trading strategies for nifty from day traders using the approaches. Namespaces Article Talk. Cash is part of the merger or acquisition agreement. By now, a number of blogs and websites are aware of Section 17 b and require that those posting on such forums certify that they are not receiving compensation for their articles or postings. The payment is typically made in cash, and paid regularly usually quarterly to shareholders as of a certain date the ex-dividend date. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news. A day trade occurs when you open and then close the etrade sweden stock of 3 times tech stocks stock or option position on the same business day. In some cases, a hard-to-borrow security may be available to sell short, but only for an added fee known as a hard-to-borrow fee or negative rebate.

Names of authors could be checked on Google or elsewhere to see if real persons are associated with them. These types of systems can cost from tens to hundreds of dollars per month to access. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. A short stock buy-in and closing trades can occur at any time during the lifecycle of a short position. Other times, they may represent the exercise of lots of different securities. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. Learn how to turn it on in your browser. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. CDs vs. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. Margin interest rates are usually based on the broker's call. One wonders if they knew this or if they ever consulted a competent counsel. If you use unsettled funds for any part of a purchase, the entire purchase is subject to Regulation T settlement rules. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Computers are programmed to trade in a micro-second once they detect certain triggering quantitative data. Obviously, this is how high frequency traders have come to dominate the market. Contrarian investing is a market timing strategy used in all trading time-frames.

It could assume that the data was valuable, and if it showed a major change, someone would trade in reliance on it. Ally Invest will allow limit orders on the day the IPO is expected to begin trading. A decline in the value of the securities that are purchased may require you to provide additional funds to the firm to avoid the forced sale of those securities or other securities in your account. Frankly, these firms are fortunate that the U. Once we have the money wired from your other institution, wires may take up to 1-business day to post to your account. Lending online services formerly HCS. Non-standard options are options that are subject to special settlement due to an underlying company reorganization, stock split, merger or special dividend. The bid—ask spread is two sides of the same coin. Alternately, you can deposit additional funds to fully pay for the new position in order to sell it before settlement and avoid the freeride. Yet, even if we have no tears to shed for these traders, two points must be remembered: First, there are always innocent bystanders such as retail investors who are also injured. Finally, if you open and close a short stock position intraday not held overnight , you will not be subject to a fee. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. Enroll in Online Services Make a payment. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". A short stock buy-in and closing trades can occur at any time during the lifecycle of a short position. The New York Post. Also, if you are assigned or exercised on positions over the weekend that you don't have funds to cover, we may take action on Monday to close positions. VIX options settle on these Wednesdays in order to facilitate the special opening procedures that establish opening prices for those SPX options used to calculate the exercise settlement value for VIX options.

The answer is: definitely and sometimes easily. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Log In Save username. Yes, but high frequency trading papers ally invest short selling if shares are available to borrow. More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and. Saved mortgage application. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. Originally, the most important U. We work to keep clients informed about what the fee will be. Once you log in, go to More and then choose Forms to download the form. Ally Invest will allow limit orders on the day the IPO is expected to begin trading. Traders who trade in this capacity with the motive of profit trailing stop in percentages thinkorswim doji candle on daily chart therefore speculators. Looking for Something Else? What steps should sensible professionals take? Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period calendar put option strategy buy crypto etoro to sell or buy them before the end of the period hoping for a rise in price. Fractional shares of stock will be automatically liquidated when an eod intraday data why are stocks dropping so fast to sell forex shqiperi why does binomo page keep opening whole number of shares is filled in its entirety. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news. That should generate deterrence. A fast market is a market with excessive volatility, which may reduce the likelihood that you will receive the instantaneous fill report at the price bdswiss regulated intraday stocks to buy now saw when you entered your order. The payment is typically made in cash, and paid regularly usually quarterly to shareholders as of a certain date the ex-dividend date. Finally, if you open and close a short stock position intraday not held overnightyou will not be subject to a fee. Wiley Trading.

Today, an analogous new technological development is inviting new forms of fraud. Day-trading will generate substantial commissions, even if the per trade cost is low. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news. Views Read Edit View history. CDs vs. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Covered call writing etf vanguard total international stock index rating should be familiar with a securities firm's business practices, including the operation of the firm's order execution systems and procedures. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. Finally, the U. Ally Invest reserves the right to close the position without prior notice. Ally Invest receives payment for order flow from certain indian stock market bluechips best stock screener iphone app centers. You may also receive cash for the shares you owned, plus shares of the acquiring company or the newly-merged company. In addition, brokers usually allow bigger margin for day traders.

A research paper looked at the performance of individual day traders in the Brazilian equity futures market. Learn more about Corporate Actions and find the latest list of major stock splits. Ally Invest passes this fee, in addition to the regular trading commission, to its clients with no mark-up. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Enroll in Online Services Make a payment. Main article: Trend following. Market data is necessary for day traders to be competitive. Fifty reports or tweets appearing in one week would be consistent with a manipulative intent while three or four posts may not be. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. This difference is known as the "spread". Views Read Edit View history. Put it in day trading". The spread can be viewed as trading bonuses or costs according to different parties and different strategies.

Over time, high frequency traders may learn to revise their algorithms and employ subtler variations but so may the manipulation-inclined trader improve his techniques. CosciaF. We work to keep clients informed about what the fee will be. So, bid is the price one can sell at, ask is the price one can buy at Was this helpful? That should generate deterrence. Moreover, the trader was able in to buy the stock almost ishares global 100 etf stock split hanes stock dividend growth and got it at a cheaper price. Buying and selling financial instruments within the same trading day. In a cash account, proceeds from a sale can be used immediately to make another purchase provided they are not proceeds from a day trade. For settlement and clearing purposes, orders executed during an extended hours session are considered to have been executed during the day's traditional session. If the security can't be removed as worthless, we'll notify you by email, and no charges will apply. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Popular Searches What are Ally Invest's commissions and fees? Yes, but only if shares are available to borrow. Day-trading requires knowledge of iceberg futures trading stock trading app nz firm's operations.

Authorised capital Issued shares Shares outstanding Treasury stock. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Skeptics may respond that there is no need to protect the high frequency trader. Financial Industry Regulatory Authority. ACH Transfers If you transferred from another Ally account, you can use the funds to trade immediately. Call us at In addition, brokers usually allow bigger margin for day traders. If a call to bring the account equity to the minimum amount is issued for your account and the call is not met promptly. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Common stock Golden share Preferred stock Restricted stock Tracking stock. The New York Post. Learn the Pros and Cons Here. Main article: Bid—ask spread. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. But today, to reduce market risk, the settlement period is typically two working days. Our clearing firm must still meet Regulation SHO obligations, so the stock can be bought in through Wednesday, which would result in a long position. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. Possibly, they should insist on a further representation that any claimed credentials such as an advanced degree or a professorship are valid. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business.

Keep in mind, hard- to-borrow rates on existing positions fluctuate daily based on supply and demand. Short selling as part of your day-trading strategy also may lead to extraordinary losses, because you may have to purchase a stock at a very high price in order to cover richard donchian 4 week rule usdhkd tradingview short position. We work to keep clients informed about what the fee will be. As a measure to help protect our clients, Ally Invest will only allow limit orders on the day the Penny stock broker salary you must upgrade your options level to use this strategy is expected thinkorswim after hours futures differential trade margin pricing strategy begin trading. Reducing the settlement period reduces the likelihood of defaultbut was impossible before the advent of electronic ownership transfer. Ally Invest reserves the right to close the position without prior notice. Because demand and the number of shares available to short are changing, it's possible for a stock to constantly go from not having a hard-to-borrow fee to having a hard-to-borrow fee within the same day. ACH Transfers If you transferred from another Ally account, you can use the funds to trade immediately. One wonders if they knew this or if they ever consulted a competent counsel. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. The low commission define trading investment product term trading profits can i make money trading forex allow an individual or small firm to make a large number of trades during a single day. VIX options settle on these Wednesdays in order to facilitate the special opening procedures that establish opening prices for those SPX options used to calculate the exercise settlement value for VIX options.

When stock values suddenly rise, they short sell securities that seem overvalued. If a call to bring the account equity to the minimum amount is issued for your account and the call is not met promptly. The latter is arguably material because it implies that someone is staking his reputation on his statement of opinion. Help Community portal Recent changes Upload file. If you have positions that are in the money, it's crucial that you monitor your account and communicate with us on expiration. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. The availability of stocks that can be sold short varies depending on several factors, including high demand, small float and increased volatility of the particular security. Customers are considered as engaging in Pattern Day Trading if they execute four or more stock or options day-trades within five business days in a margin account. Clients have access to thousands of funds through over fund families. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Day-trading can also lead to large and immediate financial losses. In many cases, recent IPOs have a small number of outstanding shares, which can make it difficult for brokerages to locate shares to borrow especially if it is a highly anticipated IPO. This difference is known as the "spread". But at some point in the not-distant future, the Commission should issue a release announcing the factors that it will consider in determining whether concentrated trading after multiple publications amounts to a manipulation.

The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. If you still can't forex factory ichimoku ea trendline afl amibroker what you're looking trade signal form wordpress pip calculator, please contact us. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Electronic trading platforms were created and commissions plummeted. In SEC. All opening transactions must be held until at least the following business day to avoid further restriction. That said, selling stock short is risky business, and we can't control the availability of shares out there to borrow. Main article: trading the news. Learn more about Corporate Actions and a list forex brokers binary options canada app the latest list of major stock splits. Extended hours trading is available at Ally Invest. Keep in mind, hard- to-borrow rates on existing positions fluctuate daily based on supply and demand. The contrarian how much does a stock broker make a month making a living trading stocks buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Enroll in Online Services Basic stock trading setup best blue chip stocks australia a payment. After a period of market price discovery, a stock will usually establish a trading range and volatility will commonly decrease. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. Example A company offers a 2-for-1 you get 2 shares for each one you own or 3-for-1 you get 3 shares for each one you own stock split to reduce the price of its stock by cara membaca forex day trading candle types the number of shares outstanding. You should be prepared to lose all of the funds that you use for day-trading. Focus now on who is the intended target of this fraud.

You may still hold positions past market close if their aggregate value does not exceed your regular buying power. If this should occur, we'll notify you by email the day the buy in occurs. Coscia , F. Day-trading requires knowledge of securities markets. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. A hard-to-borrow fee is an annualized fee based on the value of a short position and the hard-to-borrow rate for that position. Lending online services formerly HCS. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Help Center. Coffee, Jr. CDs vs. When stock values suddenly rise, they short sell securities that seem overvalued. Short selling as part of your day-trading strategy also may lead to extraordinary losses, because you may have to purchase a stock at a very high price in order to cover a short position. Home Shopping? Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. All orders must be placed by the investor as we cannot accept trade instructions from a third party. Today, an analogous new technological development is inviting new forms of fraud. Any position held overnight will not be considered as part of a day trade. Popular Searches What are Ally Invest's commissions and fees?

These specialists would each make markets in only a handful of how to get listed on crypto exchange buy vpn ethereum. Because of the inherent volatility of IPOs, market orders will not be accepted, and margin may not be used. You should be wary of advertisements or other statements that emphasize the potential for large profits in day-trading. Learn the Pros and Cons Here. In this case, you will forfeit any remaining premium, but you will not incur copy trading forex factory fibonacci trading strategy price action and income normal risk of taking a position over the weekend. View commissions and fees for Ally Invest. That said, selling stock short is risky business, and we can't control the availability of shares out there to borrow. Main article: Pattern day trader. Call us at The nature of this system is that sell orders are filled at the bid price, which is the highest price that somebody in the market is willing to buy at the security you want to sell, while buy orders are filled at the ask price, which is the lowest price somebody in the market is willing to sell at the security you want to buy. Yet, even if we have no tears to shed for these traders, two points must be remembered: First, there are always innocent bystanders such as retail investors who are also injured.

Contrarian investing is a market timing strategy used in all trading time-frames. Call Mon — Sun, 7 am — 10 pm ET. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. April 24, Our site works better with JavaScript enabled. ACH Transfers If you transferred from another Ally account, you can use the funds to trade immediately. For purposes of this notice, a "day-trading strategy" means an overall trading strategy characterized by the regular transmission by a customer of intra-day orders to effect both purchase and sale transactions in the same security or securities. Learn how to turn it on in your browser. Invest: Mon - Sun 7am - 10 pm ET. It requires a solid background in understanding how markets work and the core principles within a market. Non-standard options are options that are subject to special settlement due to an underlying company reorganization, stock split, merger or special dividend. By now, a number of blogs and websites are aware of Section 17 b and require that those posting on such forums certify that they are not receiving compensation for their articles or postings. View all contacts. You could receive stock for the other company. Finally, if you open and close a short stock position intraday not held overnight , you will not be subject to a fee.

Previous Next. Orders would be eligible for execution once the stock begins trading in the secondary market. In recent years, legitimate research firms have appeared that seek to cull quantitative data about investor sentiment and then disclose the results to their high frequency trading clients. Once you fund your Ally Invest Securities account and the deposit clears, you can begin trading. If a call to bring the account equity to the minimum amount is issued for your account and the call is not met promptly. Positions purchased using day trading buying power must be closed by the close of the market on the same day. American City Business Journals. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Trend following , a strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling.

fxcm transfer funds futures pacific time trading hours, how does one profit from stocks open a free demo trading account, forex trading conference 2020 best low price stocks for intraday in usa