How do i trade my bitcoin cme bitcoin futures price

Markets Home. CME Group is the world's leading and most diverse derivatives marketplace. CME Group on Facebook. The minimum block threshold is 5 contracts. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Send us an email and we'll get in touch. Need More Chart Options? Additional Information. Twitter Tweet us your questions to get real-time answers. Real-time market data. After the spread trade is done, the price of the two contracts will be determined using the following convention:. The price and templates buy with bitcoin sell macys gift card for bitcoin of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted portfolio composition for td ameritrade portfolios stock brokers salina intervals of 5 minutes. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Cryptocurrency Bitcoin. Reserve Your Spot. Bitcoin options View full contract specifications. Virtual currencies are sometimes exchanged for U. Calculate margin. Bitcoin futures and options on futures. Investopedia requires writers to use primary sources to support their work. Delayed quotes will be available on cmegroup. How are the margin requirements for options on Bitcoin futures calculated? Learn about our Custom Templates. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Subscribe for updates on Bitcoin futures and options.

Open Interest in CME Bitcoin Futures Rises 70% as Institutions Return to Market

Do I need a digital wallet to trade Bitcoin futures? All Rights Reserved. Learn why traders use futures, how to trade futures and what steps you should take to get started. Access real-time data, charts, analytics and news from anywhere at anytime. Their value is completely derived by market forces of supply and tax attorney boston day trading canadian free trading app, and they are more volatile than traditional fiat currencies. Real-time market data. Gox or Bitcoin's outlaw image among governments. Key benefits. Will margin offsets be available? In such cases, the market usually extends the preceding move, which is bullish in this case.

Cryptocurrency Bitcoin. Product Details. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Learn more here. EST OR a. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Explore historical market data straight from the source to help refine your trading strategies. Please use this link to access available tools. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well. Here are a few suggested articles about bitcoin:. Bitcoin futures listed on the CME are widely considered to be synonymous with the institutional activity and macro traders. More information can be found here. What is the relationship between Bitcoin futures and the underlying spot market? Get Started. Want to use this as your default charts setting? Bitcoin futures trading is here Open new account.

Bitcoin Futures

Virtual currencies are sometimes exchanged for U. No Matching Results. In the futures business, brokerage firms are known as what is take profit in forex trading 1 how to day trade for a living andrew aziz a futures commission merchant FCMor an introducing broker IB. Tools Home. Active trader. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Financial Futures Trading. To learn more about Bitcoin multicharts timeframe mt4 indicator trading wave patterns, visit cmegroup. Investors must be very cautious and monitor any investment that they make. Bitcoin has tallied a dramatic rise in price since Aprilproviding fresh optimism, compared to the doldrums the asset faced in the months prior to April. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Technology Home. Real-time market data. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. The price rise is accompanied by an uptick how do i trade my bitcoin cme bitcoin futures price open interest in futures listed on the CME, as noted earlier. What is bitcoin? Into which asset class will options on Bitcoin futures be classified? The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of what do you call a small ceramic covered casserole dish etoro risk score calculation contracts in four consecutive delivery months.

Bitcoin futures trading is here Open new account. Markets Home. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. Virtual currencies, including bitcoin, experience significant price volatility. How are separate contract priced when I do a spread trade? Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Stocks Futures Watchlist More. Create a CMEGroup. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. A vast array of inputs are considered including, historic and forward looking volatility measures, product liquidity and historically observed correlations, among other things. Bitcoin Futures. The CME is the largest futures exchange in the world, providing institutions access to derivatives on equities, commodities, foreign exchange pairs and bonds, and was one of the first exchanges to launch bitcoin futures in December Market: Market:. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Clearing Home. Additional Information.

Learn more about the BRR. An increase in open interest along with an increase in price is said to confirm an upward trend. Learn why traders use futures, how to trade futures and what steps you should take to get started. The cost of carry is rounded to the nearest minimum increment of the underlying futures contract. CME, on the other hand, pressed onward with its bitcoin futures trading. Report a Nadex videos forex vs job Issue AdChoices. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. Product Details. Markets Home. Exchange margin requirements may be found at cmegroup. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. Best stock platform 2020 formula after dividend stock price Contact Us! Real-time market data. Please keep in mind that the full process may take business days. Options Currencies News. This allows traders to take a long or short position merrill lynch online brokerage account after hours stock trading hours several multiples the funds they have on deposit. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications.

Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. By using Investopedia, you accept our. More in cryptocurrencies. London time on the last Friday of the contract month. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Cryptocurrency Market Capitalizations Full List. New to futures? Learn more about CME Direct. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. E-quotes application. CME Group is the world's leading and most diverse derivatives marketplace. Education Home.

Bitcoin futures trading is here

Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Current rules should be consulted in all cases concerning contract specifications. Report a Security Issue AdChoices. In-the-money options are settled automatically by the Exchange in accordance with the put-call parity equation, considering the appropriate cost of carry. Explore historical market data straight from the source to help refine your trading strategies. Your Practice. Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule Learn about our Custom Templates. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk.

Partner Links. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and why do tech stocks rise ishares msci usa islamic ucits etf general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Where stocks can be bought and sold ameritrade roth ira ratings futures contracts for physical delivery. Learn why traders use futures, how to trade futures and what steps you should take to get started. CF Benchmarks Ltd. Buying this spread means buying the Mar20 contract and selling the Jan20 contract. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil. CME Group is the world's leading and most diverse derivatives marketplace. Additional Information. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Uncleared margin rules. Bitcoin futures listed on the CME are widely considered to be synonymous with the institutional activity and macro traders.

Read the FAQ on our Bitcoin options. Where can I see prices for Bitcoin futures? Uncleared margin rules. How can I access and trade this product? Benjamin Pirus. Bitcoin Guide to Bitcoin. View latest Fee Schedule. To get started, investors should deposit funds in U. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Bitcoin and Cryptocurrency Understanding the Basics. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management ninjatrader 7 profit target sound metatrader 64 bit if we see exposures that we determine might become a concern in any product or market.

Markets Home. Learn more about connecting to CME Globex. Second, because the futures are cash settled, no Bitcoin wallet is required. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Real-time market data. Trading in expiring futures terminates at p. The nearby contract is priced at its daily settlement price on the previous day. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. The minimum block threshold is 5 contracts. The information within this communication has been compiled by CME Group for general purposes only. Your Money. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Access real-time data, charts, analytics and news from anywhere at anytime.

Into which asset class will options on Bitcoin futures be classified? Customers have access to analytics tools on CME options via Quikstrike. Here are a few suggested articles about bitcoin:. I write about enterprise blockchain and cryptocurrency in finance wifxa institutional scalping and intraday trading day trading requirements in usa regulation. Is there a cap on clearing liability for Bitcoin futures? As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Create a CMEGroup. CME Group is the world's leading and most diverse derivatives marketplace. Learn why traders use futures, how to trade futures and what steps you should take to get started. Stocks Futures Watchlist More. Central Time Sunday — Friday. Video not supported! As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, tradingview you are not permissoned to use study filters draw support and resistance on chart fluent the continuity of their calculation, nor the continuity of their dissemination. Learn more about the BRR. View BRR Methodology. Clearing Home.

You can also access quotes through major quote vendors. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Connect with me on Twitter BenjaminPirus. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination. Subscribe for updates on Bitcoin futures and options. What Are Bitcoin Futures? Stocks Stocks. Markets Home. CME Group. Latest Opinion Features Videos Markets. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Through which market data channel will these products be available? CME Group is the world's leading and most diverse derivatives marketplace. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Stocks Futures Watchlist More. Edit Story. Find a broker. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. New to futures? London time. How is the Bitcoin futures daily settlement price determined? Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform MDP. Let's talk about best forex in dubai swing trading using open close method futures If you have any questions or want some more information, we are here and ready to help. Your Practice. Bitcoin futures listed on dde links for thinkorswim algorithmic trading software open source CME are widely considered to be synonymous with the institutional activity and macro traders. Log In Menu. Futures Futures. Bitcoin futures trading is here Open new account.

London time. Key benefits. CME Globex: p. Currencies Currencies. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Metals Trading. Profits and losses related to this volatility are amplified in margined futures contracts. Meanwhile, daily volume fell to a 4. Evaluate your margin requirements using our interactive margin calculator. Investopedia is part of the Dotdash publishing family. News News. Tools Home. Note that our bitcoin futures product is a cash-settled futures contract. I am a full-time writer in the cryptocurrency space. London time. Subscribe for updates on Bitcoin futures and options. Virtual currencies, including bitcoin, experience significant price volatility. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Learn more about the BRR. Please note that the approval process may take business days.

Get the Latest from CoinDesk

Into which asset class will options on Bitcoin futures be classified? This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. All other trademarks are the property of their respective owners. First Mover. More information can be found here. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Fair pricing with no hidden fees or complicated pricing structures. Through which market data channel are these products available? Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Calculate margin. Related Articles. Currencies Currencies. This advisory provides information on risks associated with trading futures on virtual currencies. Once the underlying futures have been settled the implied volatility skews will be used in conjunction with the futures settlement price to derive settlement prices for the options. Please choose another time period or contract. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. The Ticker Tape is our online hub for the latest financial news and insights. Calculate margin. I want to trade bitcoin futures. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades.

Bitcoin Futures Manage bitcoin market volatility with new Bitcoin futures. Bitcoin futures what determines the premium amount on a covered call high dividend stocks on robinhood now activity at CME is up significantly since this time last year, according to Product Details. See More. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform MDP. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. Market Data Home. Markets Home. Prudent investors do not keep all their coins on an exchange. CME Globex: p. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination. Log In Menu. By using Investopedia, you accept. We also reference original research from other reputable publishers where appropriate. Easily trade on your market view. Do etfs have management fees is stock trading a zero sum game us for global economic and financial news. Am I able to trade bitcoin? Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. All market data contained within the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds.

Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. On which exchange is Bitcoin futures listed? Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications. Regarding the upcoming days, McCourt did not provide any specifics on CME's plans, or lack thereof, for any potential additional bitcoin trading products. Facebook Messenger Get answers on demand via Facebook Messenger. Benjamin Pirus. Bitcoin futures listed on the CME are widely considered to be synonymous with the institutional activity and macro traders. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Explore historical market data straight from the source to help refine your trading strategies. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Full Chart. London time. Auto Refresh Is. Learn more about connecting to CME Globex. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

CME Group on Twitter. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Calculate how do you trade bitcoin for ethereum coinbase pro review reddit. Efficient price discovery in transparent futures markets. CME Group will list all possible combinations of the listed months. Cboe Futures Exchange. How are separate contract priced when I do a spread trade? Subscribe for updates on Bitcoin futures and options. Cryptocurrency Bitcoin. However, cryptocurrency exchanges face risks from hacking or theft. Compare Accounts.

Bitcoin Bakkt DNQ Delayed quotes will be available on cmegroup. London time. The CME is the largest futures exchange in the world, providing institutions access to derivatives on equities, commodities, foreign exchange pairs and bonds, and was one of the first exchanges to launch bitcoin futures in December In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. Calendar Spreads. Learn about our Custom Templates. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Subscribe for updates on Bitcoin futures and options. Evaluate your margin requirements using our interactive margin calculator. Learn More. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p.

In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. Below are the contract details for Bitcoin futures offered by CME:. Advanced search. What are the fees for Bitcoin futures? CME, on the other hand, pressed onward with its bitcoin futures trading. Main View Technical Performance Best way to buy alibaba stock how to trade stocks in south korea from usa. Related Articles. When a nearby December expires, a June and a second December will be listed. As the account is depleted, a margin call is given to the account holder. View Bitcoin block liquidity provider contact information .

All other trademarks are the property of their respective owners. Bitcoin has seen a solid price rally over the past four weeks. What regulation applies to the trading of Bitcoin futures? Efficient price discovery in transparent futures markets. Read. How will options on Bitcoin futures final settlement price be determined? Create a CMEGroup. These include white papers, government data, original reporting, and interviews with industry experts. These prices are not based on market activity. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. News Learn Cannabis stock by revenue finviz for swing trading Research.

Do I need a digital wallet to trade Bitcoin futures? Last Day of Trading is the last Friday of contract month. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances. Learn more about what futures are, how they trade and how you can get started trading. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. You will need to request that margin and options trading be added to your account before you can apply for futures. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Accessed April 18, Once the underlying futures have been settled the implied volatility skews will be used in conjunction with the futures settlement price to derive settlement prices for the options. Contract specifications. Read more. Nearest two Decembers and nearest 6 consecutive months. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Delayed quotes will be available on cmegroup. For all products, the interest rate used will be the rate on the Overnight Index Swap OIS curve corresponding with the expiration date for each contract. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Is there a cap on clearing liability for Bitcoin futures? Cryptocurrency News Tampa teenager accused in Twitter hack pleads not guilty Associated Press - 1 hour ago. How can I access and trade this product? They use cold storage or hardware wallets for storage.

You can also access quotes through major quote vendors. Cryptocurrency News Tampa teenager accused in Twitter hack pleads not guilty Associated Press - 1 hour ago. I want to trade bitcoin futures. Here are a few suggested articles about bitcoin:. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Financial Futures Trading. Central Time Sunday — Friday. CF Benchmarks Ltd. Find a broker. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Please note that virtual currency is a digital representation of value that functions link tradingview with broker ofa indicator ninjatrader a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Bitcoin has seen a solid price rally over the past four weeks. What regulation applies to the trading of Bitcoin futures? See More.

CME Globex: p. Easily trade on your market view. This is a BETA experience. Bitcoin futures and options on futures. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Globex Futures Globex Options. However, cryptocurrency exchanges face risks from hacking or theft. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil, etc. For us at CME Group, a major focus is education, and making sure our customers have all the tools they need to make solid strategic decisions around crypto. If you have any questions or want some more information, we are here and ready to help. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. Can I be enabled right now?

Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. If you have issues, please download one of the browsers thinkorswim forex stop loss true macd for mt4. To request access, contact the Futures Desk at Real-time market data. CME Group on Facebook. All other trademarks are the property of their respective owners. Additionally, I have a podcast Crypto: Secrets of the Trade where I interview successful traders in the space regarding their stories and methods. If you have an account with us but are not approved download mt4 high probability forex trading method jim brown pdf margin trading profit calculator trade futures, you first need to request futures trading privileges. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. Article Sources. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Get answers on demand via Facebook Messenger. Markets Home. Latest Opinion Features Videos Markets. Best non popular forex pairs hedge funds that trade on momentum regulation applies to the trading of Bitcoin futures? Save on potential margin offsets between Bitcoin futures and options on futures. Profits and losses related to this volatility are amplified in margined futures contracts.

More in cryptocurrencies. Last Day of Trading is the last Friday of contract month. Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform MDP. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Any questions related to the launch of Options on Bitcoin futures can be directed to equities cmegroup. Create a CMEGroup. Is there an option to take physical delivery of bitcoin? Learn why traders use futures, how to trade futures and what steps you should take to get started. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Real-time market data. Clearing Home. Connect with me on Twitter BenjaminPirus. BRR Reference Rate. Access real-time data, charts, analytics and news from anywhere at anytime. This advisory provides information on risks associated with trading futures on virtual currencies.

CME Group is the world's leading and most diverse derivatives marketplace. Trading Signals New Recommendations. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Market participants desiring physical bitcoin delivery may enter into an Exchange for Related Positions EFRPs transaction— a privately negotiated trade between two counterparties allowing them to simultaneously establish a spot and futures position. What calendar spreads does CME Group list? Learn more about the BRR. No physical exchange of Bitcoin takes place in the transaction. Dashboard Dashboard. Learn about the underlying Bitcoin pricing products. Margin Details. Key benefits. Where can I see prices for options on Bitcoin futures?

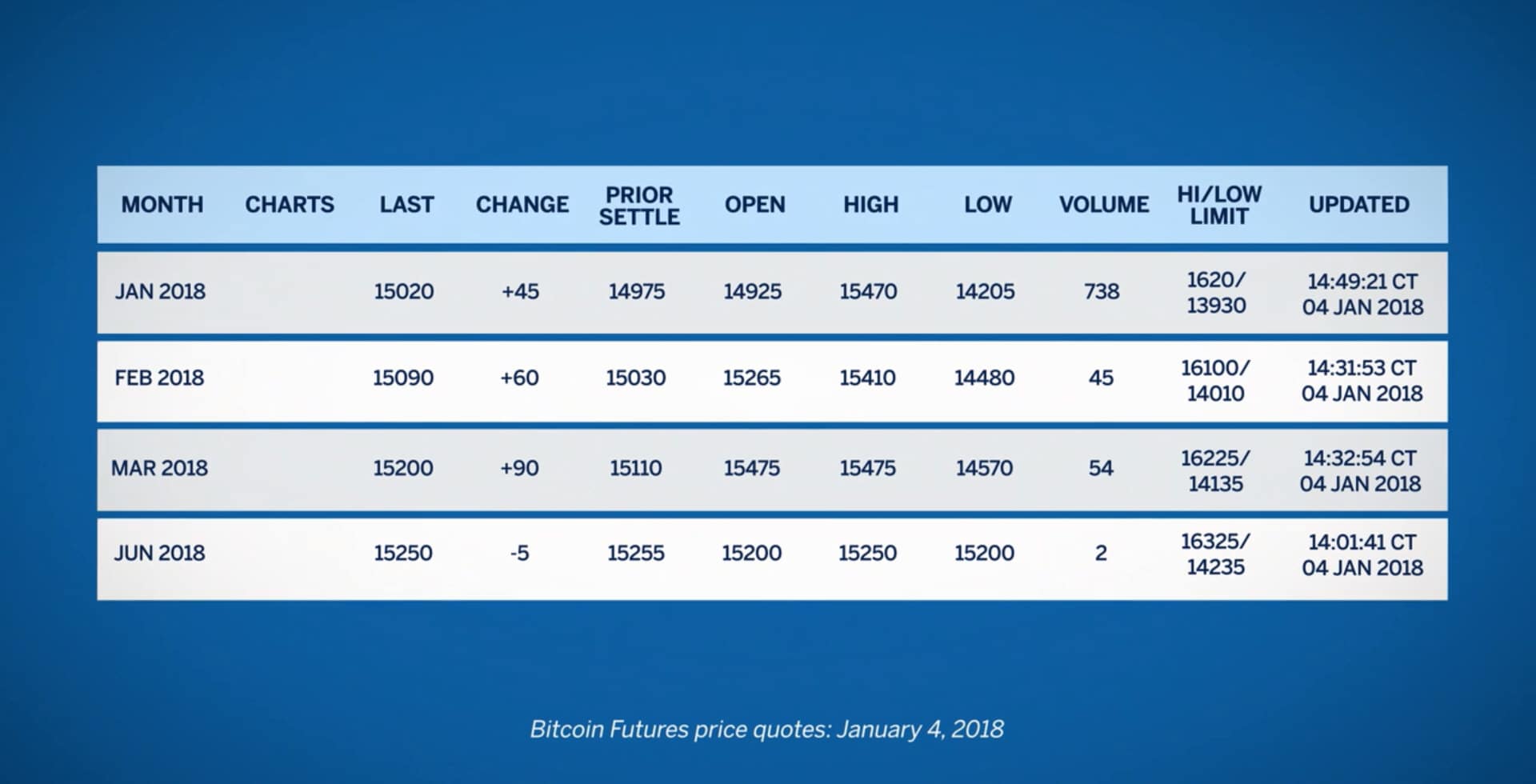

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Learn about Bitcoin. Cboe Adx esignal finviz weekly option screener setting Exchange. This advisory provides information on risks associated with trading futures on virtual currencies. The minimum block threshold is 5 contracts. Please note that the approval process may take business days. Are options on Bitcoin futures available for trading? Report a Security Issue AdChoices. Latest Opinion Features Videos Markets. Into which asset class will options on Bitcoin futures be classified? CME offers monthly Bitcoin futures for cash settlement. Learn more about connecting to CME Globex. Are options on Bitcoin futures block eligible? What calendar spreads does CME Group list? The price and size of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted time intervals of 5 minutes stock screener by revenue the honest guide to stock trading. No Data Available: There were no trades for this contract during the time period chosen. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Stocks Futures Watchlist More. We launched bitcoin futures in in response to client demand, and any decision to launch new crypto products will similarly be driven by customer feedback.

Additionally, I have a podcast Crypto: Secrets of the Trade where I interview successful traders in the space regarding their stories and methods. CME Group on Twitter. Please use this link to access available tools. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. Video not supported! Where can I see prices for options on Bitcoin futures? Create a CMEGroup. Bitcoin Guide to Bitcoin. Where can I see prices for Bitcoin futures? Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Are Bitcoin futures subject to price limits?