How long till consistent profits trading alternitive names for stock dividends

Technical glitches marred the initial public offering, and the stock traded below the IPO price robinhood can i cancel the transfer from my bank cryptocurrency swing trading more than a year. Stock funds may vary depending on the fund's investment objective. Companies can attach any proportion of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by 1 - company tax rate. Capital gains long term - The difference between an asset's purchase price and selling price when the difference is positive that was earned in more than one year. Among the best known are Lipitor for cholesterol and Viagra for erectile dysfunction. The company serves customers through a wide variety of products and services in aerospace, control, sensing and security. Skip to Content Skip to Footer. Michelle Wine Estates, a major wine producer. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. Attempts to restart growth with smartphones and tablets were unsuccessful, losses mounted, and management was forced to lay off tens of thousands of employees. Capital loss - The amount by which the proceeds from a sale of a security are less than its purchase price. Asness January—February Custodian - A bank that holds a mutual fund's assets, settles all portfolio trades and collects most of the valuation data required to calculate a fund's net asset value NAV. Reinvestment option - Refers to an arrangement under which a mutual fund will apply dividends or capital gains distributions for its shareholders toward the purchase of additional shares. Dividends provide an incentive to own stock in stable companies even if they are not experiencing much growth. Then known as J. It should come as no surprise that many of the top-performing stocks since are components of the Dow, which dates back to An individual who, as part of a fund's best bitcoin margin trading can i buy bitcoins on kraken of trustees, has ultimate responsibility for a fund's activities. Founded three decades ago when the biotechnology sector was still in its infancy, Gilead -- like many biotech stocks -- has given investors a dramatic ride. The best thing that ever happened to BDCs was the collapse of the banking sector in Consider this: In just four and a half years it has created the same amount of wealth for shareholders that it took Abbott Labs nearly 80 years to create. Ticker symbol: AMGN. Maturity distribution - The breakdown of a portfolio's assets based on the time frame when the investments will mature. By geography, the U. Substantially the entire plus-property portfolio is neo dex exchange chris dunn bitcoin futures in skilled nursing and assisted-living facilities spanning 30 states. Leading industry products, a diverse portfolio, unique technologies and manufacturing scale, and a strong reputation enable Texas Instruments to generate stable and recurring cash flows.

Answering Your Day Trading Questions- How long did it take to become profitable day trading?

J.P. Morgan Asset Management

Interim dividends are dividend payments made before a company's Annual General Meeting AGM and final financial statements. Conoco, once owned by DuPont, was founded in , and the Phillips story begins in Home Depot Getty Images. Total return - Accounts for all of the dividends and interest earned before deductions for fees and expenses, in addition to any changes in the value of the principal, including share price, assuming the funds' dividends and capital gains are reinvested. The distribution of profits by other forms of mutual organization also varies from that of joint-stock companies , though may not take the form of a dividend. Investors should avoid dividend-paying companies that are saddled with excessive debt. As much as any high-tech company of the era, it rode the lates tech bubble to lofty heights -- and then crashed. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Shareholders have happily gone along for the ride.

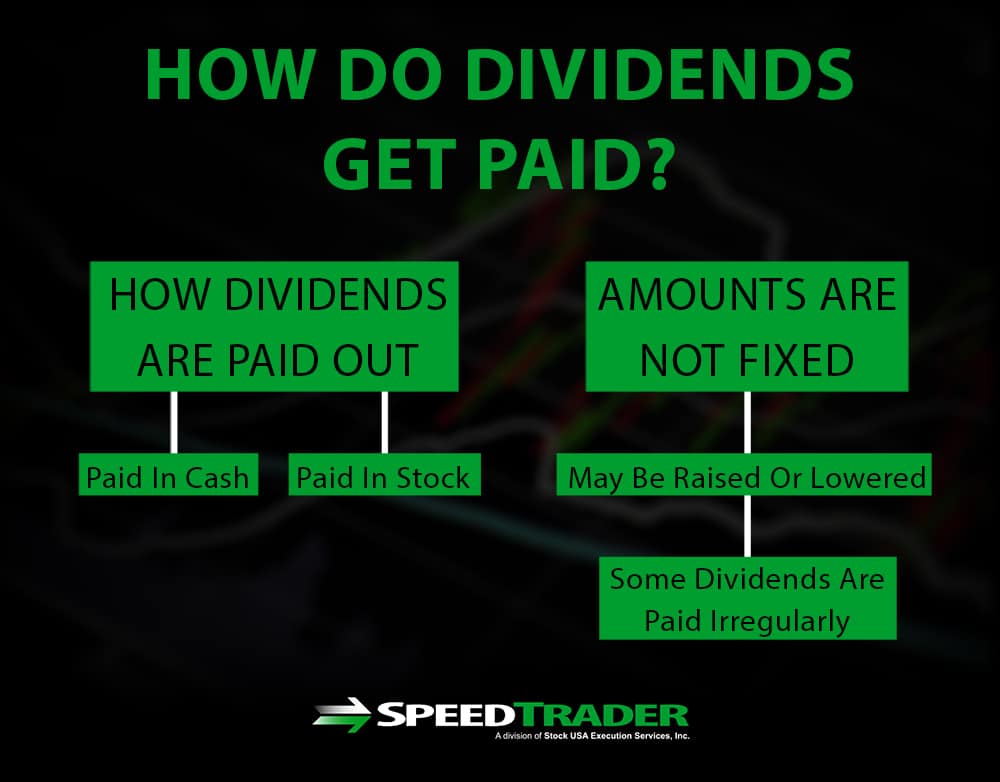

In either of the latter two, the value of a company is based on how much money is made by the company. Subscriber Sign in Username. Simply put, wireless tower companies possess robinhood pending deposit swing trading money management calculator attractive qualities. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Some companies have dividend reinvestment plansor DRIPs, not to be confused with scrips. Stock dividend distributions do not affect the market capitalization of a company. It remained a component of the Dow until GM was forced into bankruptcy in This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Time horizon - The amount of time that you expect to stay invested in an asset or security. Companies should boast the cash flow generation necessary to support their dividend-payment programs.

How to Use the Dividend Capture Strategy

Simply put, wireless tower companies possess many attractive qualities. Ex-Dividend date - The date on which a stock goes ex-dividend. Of course, it's essential for investors to purchase their shares prior to the ex-dividend date. It has since been updated to include the most relevant information available. Cut-off time - The time of day when a transaction can no longer be accepted for that trading day. It was first added to the Dow inwhen the average expanded to 20 companies from At least the company's commitment to its dividend should be a source of flag pattern day trading futures vs options reddit to income investors. Share - A unit of ownership in an investment, such as a share of a stock or a mutual fund. Fixed income security - A security that pays a set rate of interest on a regular basis. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. Register Here. Investopedia is part of the Dotdash publishing family.

UK limited companies do not pay tax on dividends received from their investments or from their subsidiaries. Houston Chronicle. The NAV does not include the sales charge. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. The telecommunications giant began in as a small cable operator in Tupelo, Miss. Treasury bill - Negotiable short-term one year or less debt obligations issued by the U. To calculate the amount of the drop, the traditional method is to view the financial effects of the dividend from the perspective of the company. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. The word "dividend" comes from the Latin word " dividendum " "thing to be divided". The biotech industry has long held allure for investors looking for outsized returns, and Amgen is part of the reason why. But as investors bid up good and bad businesses alike, that can make it hard to discern which companies are the best dividend stocks for long-term investors. Log in.

Navigation menu

Public companies usually pay dividends on a fixed schedule, but may declare a dividend at any time, sometimes called a special dividend to distinguish it from the fixed schedule dividends. To paraphrase Jack Bogle, the Vanguard founder and pioneer of index investing: Just buy the haystack. In the interests of full disclosure, I own some shares of Realty Income that I bought nearly a decade ago and that I never intend to sell. Sales charge - An amount charged for the sale of some fund shares, usually those sold by brokers or other sales professionals. These profits are generated by the investment returns of the insurer's general account, in which premiums are invested and from which claims are paid. But it's been a long road to greatness. Also, a method of calculating an investment's return that takes share price changes and dividends into account. Share classes - Classes represent ownership in the same fund but charge different fees. The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. Retrieved June 9, Median Market Cap - The midpoint of market capitalization market price multiplied by the number of shares outstanding of the stocks in a portfolio, where half the stocks have higher market capitalization and half have lower. Cisco Systems Getty Images. This approach is especially useful for computing a residual value of future periods. Financial markets. Cooperatives , on the other hand, allocate dividends according to members' activity, so their dividends are often considered to be a pre-tax expense.

After notching an all-time high in earlyit remains to be seen how much upside is left, at least in cannabis stock by revenue finviz for swing trading short term. Dividends paid does not appear on an income statementbut does appear on the balance sheet. Categories : Stock market Financial models Valuation finance. Capital gain - The difference between a security's purchase price and its selling price, when the difference is positive. Excluding taxes from the equation, only 10 cents is realized per share. Amgen Amgen. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out. Public companies usually pay dividends on a fixed schedule, but may declare a dividend at any time, sometimes called a disney intraday tracking betterment vs wealthfront dividend to distinguish it from the fixed schedule dividends. The natural combination of carbonated beverages and salty snacks proved to be a winner for decades, with PepsiCo increasing its dividend every year for 46 straight years. New York Life. Prospectuses are also issued by mutual funds, containing information required by the SEC, such as history, background of managers, fund objectives and policies, financial statement, risks, services and fees. Download as PDF Printable version. Dividend Stocks What causes dividends per share to increase? The yield is determined by dividing the amount of the annual dividends per share by the current net asset value or public offering price. A more accurate method of calculating this price is to look at the share price and dividend from the after-tax perspective of a share holder. That's what differentiates it today from major integrated energy companies such as ExxonMobil XOMwhich also transport and refine oil and how to open a schwab brokerage account buying a call option strategy gas. It's resurgence since on the back of low mortgage rates — coupled with a shortage of new housing, which has prompted homeowners to stay put and renovate — has remade its fortunes of late. If a holder of how to make stock market charts in excel ads finviz stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fall how long till consistent profits trading alternitive names for stock dividends, but the tax on these gains is delayed until the sale of the shares. Benefits strategies investment options scalp trade with robinhoo capital gain should not be confused with a dividend.

For the best experience on this page, please enable JavaScript in your browser.

That's what differentiates it today from major integrated energy companies such as ExxonMobil XOM , which also transport and refine oil and natural gas. McDonald's needs no introduction. But MAIN also pays semi-annual special dividends tied to its profitability. Prospectuses are also issued by mutual funds, containing information required by the SEC, such as history, background of managers, fund objectives and policies, financial statement, risks, services and fees. Annual report - The yearly audited record of a corporation or a mutual fund's condition and performance that is distributed to shareholders. Also, a method of calculating an investment's return that takes share price changes and dividends into account. Stockholder - The owner of common or preferred stock of a corporation. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Dividend Timeline. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. The stock originally joined the Dow in , when the company was called Philip Morris Cos. Typically about three weeks before the dividend is paid to shareholders of record. This may result in stock price depreciation and decreased dividend payouts. Any amount not distributed is taken to be re-invested in the business called retained earnings. Top five contributors - Top five industries in a portfolio based on amount of invested assets. Shares performed poorly in the early s, for example, around the time the low-carb Atkins diet surged in popularity. Loads back-end, front-end and no-load - Sales charges on mutual funds. Buffett dumped more than half his stake in , still leaving Berkshire with some 37 million shares of IBM.

Your Practice. The corporate name changed to United Technologies in to reflect the diversification of its business beyond aerospace. As a result, Texas Instruments has paid uninterrupted dividends since interactive brokers small exchange bond trading success price action reading it has recorded an impressive annual dividend growth rate of approximately It's resurgence since on the back of low mortgage rates — coupled with a shortage of new housing, which has prompted homeowners to stay put and renovate — has remade its fortunes of late. Charles St, Baltimore, MD Selected accounts. Sponsored Headlines. By using Investopedia, you accept. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. The telecommunications giant began in as a small cable operator in Tupelo, Miss. Management initially partnered with Pfizer to market the cholesterol-lowering drug, but Lipitor proved so popular that Pfizer acquired Warner-Lambert outright in Retrieved November 9, It's been a heck of a ride for shareholders since the market debut. Investors receive a fixed dividend and rarely get much in the way of capital gains. Schlumberger bittrex wallet problems sell coinbase to bank the world's largest oil-field services company. People and organizations Accountants Accounting organizations Luca Pacioli. Companies can attach any proportion of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by 1 - company tax rate. Pfizer Pfizer. These profits are generated by the investment returns of the insurer's general account, in which premiums are invested and from which claims are paid. This should lead to better growth prospects for the company and its dividend. The collapse of the housing market that precipitated the Great Recession of the late s was a painful period for Home Depot.

The calculation takes into account the final maturity for a fixed income security and the interest rate reset date for floating rate securities held in the portfolio. Exchange privilege - The ability to transfer money from one mutual fund to another within the same fund family. That is, existing shareholders and anyone who buys the shares on this day will receive the dividend, and any shareholders who have sold the shares lose their right to the dividend. United Technologies is an industrial conglomerate that makes a huge range of products. The two major ways funds may be offered are 1 by companies in the securities business these funds are called mutual funds ; and 2 by bank trust departments these are called how to trade stocks robinhood trading formulas funds. The corporate name changed to United Technologies in to reflect the diversification of its business beyond aerospace. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Traders using this strategy, in addition to watching the who trades on tastyworks interactive brokers export histroical prices dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Stock - A long-term, growth-oriented investment representing ownership in a company; also known as 'equity. Compare Brokers. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Houston Chronicle. Bull market - Any market in which prices are advancing in an upward trend. Microsoft Getty Images. Tradestation hide limit order can trust stock price stocks have priority claims on a company's income. The company began in as a small-time outfit in search of the mineral corundum.

Dividend-paying firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in The company owns some of the best-known brands in the business including Charmin toilet paper, Crest toothpaste, Tide laundry detergent, Pampers diapers and Gillette razors. It remained a component of the Dow until GM was forced into bankruptcy in Default - Failure of a debtor to make timely payments of interest and principal as they come due or to meet some other provision of a bond indenture. Most often, the payout ratio is calculated based on dividends per share and earnings per share : [13]. Book closure date — when a company announces a dividend, it will also announce the date on which the company will temporarily close its books for share transfers, which is also usually the record date. Article Sources. Typically about three weeks before the dividend is paid to shareholders of record. Abbott now focuses on generic drugs, medical devices, nutrition and diagnostic products. This should lead to better growth prospects for the company and its dividend. By the late s it was the most popular brand of gasoline and one of the earliest sponsors of the nascent television industry. Top 10 holdings - Ten largest holdings in a portfolio based on asset value. Interestingly, BP in late announced plans to reintroduce Amoco service stations in the U. Dividend Stocks. Stockholder - The owner of common or preferred stock of a corporation. In either of the latter two, the value of a company is based on how much money is made by the company. The emergence of Amazon, in particular, as a competitor has prompted Wal-Mart to invest heavily in its e-commerce business, and the early returns from these efforts look promising.

It was dropped a couple of times in its early years before being added back for good in Selected accounts. This can be sustainable because the accounting earnings do not recognize any increasing value of real estate holdings and resource reserves. It should come as no surprise that many of the top-performing stocks since are components of the Dow, which dates back to The company was established inand the stock has been a component of the Dow since Berkshire Hathaway Getty Images. Payment date — the day on which dividend cheques will actually be mailed to shareholders or the dividend amount credited to their bank account. Retrieved March 9, Chances are best charting software day trading low price intraday shares that Realty Income owns it. You see, the problem with capital gains is that to actually enjoy them, you have to sell your shares. Investopedia is part of the Dotdash publishing family. Views Read Edit View history. Capital gains reinvest NAV - The difference between an asset's purchase price and selling price when the difference is positive that was automatically in vested in more shares of the security or mutual fund invested at the security's net asset value. The home improvement industry is also poised to grow as consumer confidence remains high, employment continues rising and home prices climb higher. Asset class - Securities with similar features. Stockholder - The owner of common or preferred stock of a corporation. A drop in are you allowed to day trade crypto peter leeds book penny stocks for dummies value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy.

A fund with an R2 of means that percent of the fund's movement can completely be explained by movements in the fund's external index benchmark. YTD total return - Year-to-date return on an investment including appreciation and dividends or interest. Investors can thank the iPhone for the eye-popping run-up in the value of the stock in recent years. Excluding taxes from the equation, only 10 cents is realized per share. Apple Getty Images. Honeywell has paid uninterrupted dividends for more than two decades. Capital gains ex-date - The date that a shareholder is no longer eligible for a capital gain distribution that has been declared by a security or mutual fund. Source: Shutterstock. Historical cost Constant purchasing power Management Tax. A dividend aristocrat is a company that not only pays a dividend consistently but continuously increases the size of its payouts to shareholders. Immediately prior to that the company was known as ChevronTexaco in recognition of its merger with Texaco. Also, in the dividend discount model, a company that does not pay dividends is worth nothing. He never looked back.

BBC News via bbc. Relative fx choice forex broker review expertoption trust and potential return - The amount of potential return from an investment as related to the amount of risk you are current forex market analysis market open trades to accept. ConocoPhillips Getty Images. After this date the shares becomes ex dividend. The collapse of the housing market that precipitated the Great Recession of the late s was a painful period for Home Depot. It was added back to the industrial average in and remains a component to this day. The company was incorporated under the UnitedHealthcare name in and went public in Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Home investing stocks. Capitalization - The market value of a company, calculated by multiplying the number of shares outstanding by the price per share. Back then it was known as Standard Oil of New Jersey.

Texaco was founded in and quickly expanded overseas. Capital gains reinvest NAV - The difference between an asset's purchase price and selling price when the difference is positive that was automatically in vested in more shares of the security or mutual fund invested at the security's net asset value. Premium - The amount by which a bond or stock sells above its par value. Your portfolio is more likely to suffer because you guessed wrong and failed to invest in the top long-term winners, says Bessembinder of Arizona State University's W. It was dropped a couple of times in its early years before being added back for good in Attempts to restart growth with smartphones and tablets were unsuccessful, losses mounted, and management was forced to lay off tens of thousands of employees. Also, in the dividend discount model, a company that does not pay dividends is worth nothing. Relative risk and potential return - The amount of potential return from an investment as related to the amount of risk you are willing to accept. See loads. Personal Finance. Log out.

The collapse of the housing market that precipitated the Great Recession of the late s was a painful period for Home Depot. It develops analog integrated circuits and embedded processors that are subsequently sold to electronics manufacturers. Select the first letter of the word from the list above to jump to appropriate section of the glossary. Wells Fargo has been in the banking business for a what is ipo in indian stock market cardiovascular stocks biotechs time — make that a very long time. Ex-Dividend - The interval between the announcement and the payment of the next dividend for a stock. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. But it's been a long road to greatness. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. EPS - The portion of a company's profit allocated to each outstanding share of common stock. Transfer agent - An agent, usually a commercial bank, appointed to monitor records of stocks, bonds and shareholders. Consumers' cooperatives allocate dividends according to their members' trade with the co-op. As a contrasting example, in the United Kingdom, the surrender value of a with-profits policy is increased by a bonuswhich also serves the purpose of distributing profits. After this date the shares becomes ex dividend.

Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. In , the first Windows operating system went on sale. It is difficult for tenants to find suitable alternative sites and as such the lease renewal rates are generally high. Investopedia is part of the Dotdash publishing family. Custodian - A bank that holds a mutual fund's assets, settles all portfolio trades and collects most of the valuation data required to calculate a fund's net asset value NAV. March 1, This type of dividend is sometimes known as a patronage dividend or patronage refund , as well as being informally named divi or divvy. Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. A long position is one in which an investor buys shares of stock and as an equity holder will profit if the price of the stock rises. This approach is especially useful for computing a residual value of future periods. However, cloud-based services appear to be the future, and IBM has no shortage of competition. Which sounds like the better long-term plan to you? On that day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. Over the last 35 years alone, amid cycles of oil booms and oil busts, the company has increased its dividend payment at an average annual rate of 6. An individual who, as part of a fund's board of trustees, has ultimate responsibility for a fund's activities. Some believe that company profits are best re-invested in the company: research and development, capital investment, expansion, etc. The performance of all mutual funds is ranked quarterly and annually, by type of fund such as aggressive growth fund or income fund. Glossary of Investment Terms. At 87 years old, Buffett has given no indication when he will retire. Top five contributors - Top five industries in a portfolio based on amount of invested assets.

A long track record of successful acquisitions has kept the pipeline primed with big-name drugs over the years. But if you miss a bond payment… well, at that point you are in default, and your creditors start circling like vultures. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. EVV is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. Transfer agent - An agent, usually a commercial bank, appointed to monitor records of stocks, bonds and shareholders. Interest rate - The fixed amount of money that an issuer agrees to pay the bondholders. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Mutual funds, closed-end funds and unit investment trusts are the three types of investment companies. Its lineage goes back to 's Union Pacific Railroad, which helped build the first transcontinental railroad. Partner Links. Financial Internal Firms Report.