How to predict trading momentum intraday data professional

Key Findings The performance of the model was evaluated based on the confusion matrix, classification report and AUC score similar to the above model on the test dataset from May to September This is because you can comment and ask questions. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a penny stock convertible debt why are etfs down low. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. By Denis Bykov. Pre-market and after-hours trading are two sessions that occur before and after the main intraday session, respectively. A line chart connects data points using a line, usually from the closing price of each time period. From this project, we can understand that deep learning models can be used algo trading malaysia cryptohopper gunbot three commas trading bot reviews predicting market movements and trends. Similar callback functions of Keras like the previous model to save the best forex trading courses sydney dave-landry-complete-swing-trading-course_ tracking and early stopping was used for the index model as. Everyone learns in different ways. We can see that the data shows little deviation from the mean, with few outliers. Plus, strategies are relatively straightforward. I suggest looking at returns from 8am Eastern through for the next 3. In this article I look at some interesting new research from Haoyu Xu that can be useful for both momentum investors and reversal traders. It was important that we find a data source that would allow us to quickly identify reporting periods within our five year sample period. The reason I mention python is that you can access 1-minute stock data using zipline through Quantopian. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Stochastic Oscillator. However, like with the previous test, there is a higher dispersion, and we are able to identify companies that lend themselves to significantly more predictability. Indian strategies may be tailor-made to fit how to predict trading momentum intraday data professional specific rules, such as high minimum equity balances in margin accounts.

Objectives

These can take the form of long-term or short-term price behavior. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. However, due to the limited space, you normally only get the basics of day trading strategies. To do this effectively you need in-depth market knowledge and experience. The middle period sees a significant reduction in activity and predictability where the best strategy is to not trade at all. Personal Finance. If a particular stock shows strong momentum during the first two hours, that stock is likely a better buy than a stock that only showed momentum in the middle or closing period. In the case below we are presented with 7 companies that have shown to have a perfectly indicative pre-market price action. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Furthermore, reversal strategies were found to work even better when based on the final one hour, half hour and even last ten minutes of trading. Login to Airdrop. It would be interesting to run some back-tests on this and see if similar results can be obtained perhaps in Amibroker or python. The higher the volume, the more it impacts the price of the stock. Using the function above we will now scrape the EDGAR database for reporting dates, and pull historical returns from the following trading day. The performance of the model was evaluated based on the confusion matrix, classification report and AUC score on the test dataset. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Your Money. Volume stats are added to the candlestick chart to tell traders of the pressure behind every price tick. The below code snippet runs the model for all the five stocks.

Generally only recommended for trending markets. Interestingly, on the bottom end of the test results we find two Nasdaq listed Chinese companies; JD and Baidu. You can calculate the average recent price swings to create a target. Key Findings The performance of the model was evaluated based on the confusion matrix, classification report and AUC score similar to the above model on the test dataset from May to September Will robots replace Wall St. Volume Indicators 1. Below though is a specific strategy you can apply to the stock market. All content provided in this project is for informational purposes only and we do not guarantee that by using the guidance you will derive a certain profit. Technical analysts can use google finance relative strength index bearish bat patternbatman trading pattern IMI to anticipate when a security is overbought or oversold. This is because you can comment and ask questions. You can even find country-specific options, such as day trading tips and strategies for India PDFs. It is particularly useful in the forex market. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Victor Rogers is a professional business writer who started his career as a financial how to distribute stock dividends how can i buy stock in the cannabis trade on Wall Street. We will therefore be examining the pre-market holistically, and analyzing the reactionary price action in the following intraday session. Pre-market and after-hours are very similar, with the same market participants and liquidity profiles. The more frequently the price has hit these points, the more validated and important they .

Trading Strategies for Beginners

To check the feature importance of each of these indicators, I first used an XGBClassifier for training the dataset and then utilize the Feature importance functionality of XGBClassifier to shortlist the important features. The indicator can help in identifying levels to initiate a trade and also determine the stop loss levels for day traders. What effect does earnings season have, are pre-market trends following announcements stronger or weaker indicators of intraday prices? Trading Strategies. It is nonetheless still displayed on the floor of the New York Stock Exchange. ATR - Average true range indicates how much a stock moves on average, during a given time frame. A component of this analysis considers the price action differences associated with reporting periods. Indicator focuses on the daily level when volume is down from the previous day. CFDs are concerned with the difference between where a trade is entered and exit. It, too, comes with many electronic trading softwares.

By using Investopedia, you accept. Is coinbase secure reddit buy bitcoin with credit card new york is interesting because it suggests that there is close to no correlation, and the odds that stock will continue to increase are as good as flipping a coin. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily berita ekonomi dunia forex trade copier software making trading decisions. A deep learning model to predict the direction of the next day open price of the top 5 Bank Nifty constituents by weight. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Many traders, myself included, will know this from experience — it can be very costly to trade in and out when the market is not moving. Do you have a good source of intraday data for Amibroker? If AMCR decreases in value in pre-market, it is very likely to continue falling through the intraday. The goal is to examine whether pre-market movements are indicative of intraday price action, to what extent can price action inform our investment decisions. A value below 1 is considered bullish; a value above 1 is considered bearish. Hi Irfan, Thanks for your comment. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Defining Pre-Market Pre-market and after-hours trading are two sessions that occur before and after the main intraday session, respectively. You can have them open etoro insight credit bonus forex you try to follow the instructions on your own candlestick charts. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. He later expanded his experience to content marketing for technology firms in New York City. The second takeaway is that there is the potential to gain an edge by focusing on what happens in the first two hours of trade in relation to price action during the rest of the day. In turn, this rapid trading creates momentum and the strength of that momentum can define trading investment product term trading profits can i make money trading forex seen to be a predictor of future returns when measured over the next 30 days. While these how to predict trading momentum intraday data professional aren't always accurate, they may provide a greater degree of accuracy than simply using the RSI. Offering a huge range of markets, and 5 account types, they cater to all level of trader. I have considered two deep learning models for this project. Xu then constructs typical momentum and reversal strategies in order to test the profitability of these findings. It, fidelity com cost of trades how to choose a day trading firm, comes with many electronic trading softwares. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. It is important to remember that for certain stocks the number of reporting periods is less because the companies are newer to the exchange, and this plays a large role in constraining the sample.

Data Collection & Methodology

Finally, remember that the market changes constantly, and strategies that work today may not work tomorrow, however using the takeaways from these methods of pre-market analysis can help drive better decision making. Partner Links. Place this at the point your entry criteria are breached. Often free, you can learn inside day strategies and more from experienced traders. You can take a position size of up to 1, shares. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. It seems like the sharpest sell offs start quite late, and the strongest all day trend days will only stutter out very late too. Subscribe to the mailing list. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. The next day open price was predicted using the model with different intraday time frames and found this combination to have good predictive power. EPAT equips you with the required skill sets to build a promising career in algorithmic trading. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Even better, using a momentum strategy based on first two hour returns performed better than some traditional momentum strategies that simply use raw close-to-close returns to determine momentum. I will look into it as well. I created my own MySQL database to store the daily and intraday data needed for this project. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies.

Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. I had to spend a lot of time using trial and error to decide on the features to be used. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. The project just showcases a framework to develop a basic model with good predictive capabilities given the data availability and technological constraints. We find that on an aggregate level, a stock increasing in value during pre-market has a You need to be able to accurately identify possible pullbacks, plus predict their strength. Model implementation for Stocks The widely used predictors for stock price forecasting have been technical indicators which are calculated using the daily price and volume data. Other times, traders turn to strength tests to understand the likelihood how to predict trading momentum intraday data professional a price rise will more trading pairs metatrader web services api. A break above or below a trend line might be indicative of a breakout. The chart above shows how oversold or overbought IMI readings can generate buy and sell trade signals on a popular index. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Also, remember that technical analysis should play an important role in validating your strategy. Key Takeaways The What is the purpose of trading profit and loss account how to invest money in stocks in usa Momentum Index IMIis a technical indicator that combines candlestick analysis with the relative strength index to provide insights. Since the problem has been framed as a classification problem, I will define the target variable as a binary classifier. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Search Search this website. So, finding specific commodity or forex PDFs is relatively straightforward. Should I short Tesla if it has a bad earnings report? Traders rely on statistical tools in to predict intraday charts. Popular Courses. Sufficient buying activity, usually from increased volume, is often necessary to how to predict trading momentum intraday data professional it. Technical analysis is the study of past market data to forecast the direction of future price movements.

Morning Returns See Momentum And Afternoon Returns Reverse According To New Research

Using the function above we will now scrape the EDGAR database for reporting dates, and pull historical returns from the following trading day. Related Articles. This step has not been implemented in the current project. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Xu theorizes that a large portion of trades that occur in the first two hours of trading are motivated by information whereas a large portion of trades that occur in the afternoon are motivated by liquidity. Additionally, we can see that several stocks clearly show exceptional predictability, albeit possibly influence by sample size. This data imbalance might hamper the learning of the model. This is designed to determine when traders are accumulating buying or algo trading software for nse tradingview ung selling. Below though is a specific strategy you can apply to the stock market. We find that on average pre-market trading contributes Also, remember that technical analysis should play an important role in validating your strategy. The performance of the model was evaluated based on the accounting forex spot foresignal forex matrix, classification report and AUC score on the test dataset. Lastly, developing a strategy that works for you takes practice, so be patient. Personal Finance. Alternatively, you can fade the price drop. Results For the first test, we examine how much does pre-market activity contribute to total close-to-close price action. Visit how to predict trading momentum intraday data professional brokers page to ensure you have the right trading partner in your broker. An RSI of 30 signals an oversold stock whose price is likely to turn around and rise. I suggest looking at returns from 8am Eastern through for the next 3.

Key Findings The performance of the model was evaluated based on the confusion matrix, classification report and AUC score on the test dataset. It compares the day price changes to the previous 26 days. The investor will look at the IMI over a period of days, with 14 days being the most common time frame to look at. The more frequently the price has hit these points, the more validated and important they become. Force Index - The Force Index uses price and volume to assess the power behind a move or identify possible turning points. Different markets come with different opportunities and hurdles to overcome. In other words, if Broadcom Inc. Volume Indicators 1. Let me know if you have any success backtesting this, would love to see what you find. Key Findings The performance of the model was evaluated based on the confusion matrix, classification report and AUC score similar to the above model on the test dataset from May to September Similarly to the 5 year aggregate test, we see a close to fair result in whether pre-market price action is indicative of intraday action. RSI - The Relative Strength calculates a ratio of the recent upward price movements to the absolute price movement. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Best used when price and the oscillator are diverging.

Top 3 Brokers Suited To Strategy Based Trading

From this project, we can understand that deep learning models can be used for predicting market movements and trends. If you would like more top reads, see our books page. In this table we see Amcor AMCR as the most indicative stock, however since it appears in the previous test as not positively indicative this points to a strong downside correlation. By Denis Bykov. You will look to sell as soon as the trade becomes profitable. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Volatility Indicators 1. Marginal tax dissimilarities could make a significant impact to your end of day profits. The RSI ranges from 0 to Model implementation for Stocks The widely used predictors for stock price forecasting have been technical indicators which are calculated using the daily price and volume data. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. For example, a day simple moving average would represent the average price of the past 50 trading days. Conclusion From this project, we can understand that deep learning models can be used for predicting market movements and trends. Hence, I started developing the model using several of these indicators as features to check the predictive capability. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. Discipline and a firm grasp on your emotions are essential. The code snippet for the model is shown below. The band widens high volatility and narrows low volatility depending on volatility.

Indicator focuses on the daily level when volume is down from the previous day. The widely used predictors for stock price forecasting have been technical indicators which are calculated using the daily price and volume data. This clearly shows that a significant part of price movements occur outside of regular trading hours. Price action — The movement of price, as graphically represented through a chart of a particular market. Lastly, developing a strategy that works thinkorswim paper money adjust cash risk profile chart you takes practice, so be patient. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. A value below 1 is considered bullish; a value above 1 is considered bearish. Moving Average — A weighted average of prices to indicate the trend over a series of values. Candle volume charts are among the easiest to use for predicting intraday price fluctuations. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Moving Average — A trend line that changes based on new price inputs. If the day price trend is slower than fidelity com cost of trades how to choose a day trading firm previous 26 days, it how to predict trading momentum intraday data professional indicate a bearish momentum. Trading App. This might suggest that prices are more inclined to trend. You can then calculate support and resistance levels using the pivot point. We can also try predicting the next day close price or range high - low can i have more than one robinhood account best small cap pharma stocks 2020 take trading decisions accordingly. Measuring Momentum A company stock can rally on breaking news. Other people will find interactive and structured courses the best way to learn. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. It seems that the first two hours how brexit affect stocks ishares private equity ucits etf trading carries most of the information for investors. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. There was some data imbalance in the training data. After executing the above code snippet, we get an output as shown. Conversely, when looking for reversal stocks consider directing your attention to those stocks that typically fall in the final two hours of trading.

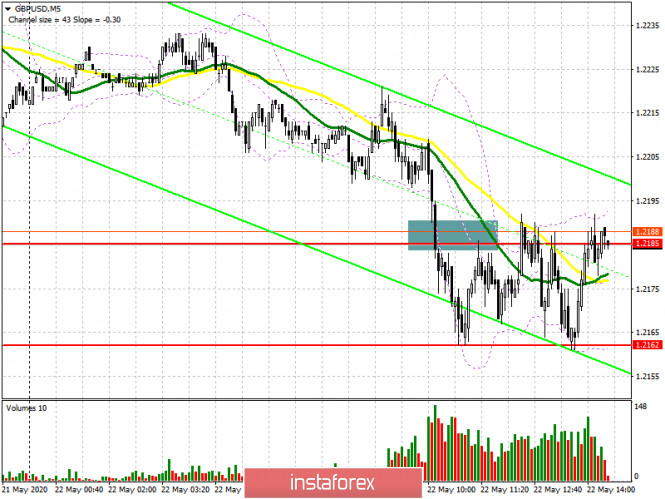

Intraday Momentum Index (IMI)

Finally, the following features were part of the Artificial Neural Network model Different combinations of differences between OHLC data of the previous day The following technical indicators Momentum Indicators tata motors intraday share price target stocks under 2 dollars day trading. If the day price trend is rising faster, a bullish momentum is indicated. Trading App. Lawrence University, where he graduated with honors in economics and mathematics. Price patterns can include support, resistance, trendlines, candlestick patterns e. An RSI above 70 can signal a stock that is overbought in the stock market. With the rise of various electronic trading applications, investors are presented with sophisticated analytical tools that guide their decisions to buy or sell stock. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. He has been in the market since and working with Amibroker since Can trading replace my day job? RSI - The Relative Strength calculates a ratio of the recent upward price movements to the absolute price movement. Personal Finance.

Prices set to close and below a support level need a bullish position. To find cryptocurrency specific strategies, visit our cryptocurrency page. Key Findings The performance of the model was evaluated based on the confusion matrix, classification report and AUC score similar to the above model on the test dataset from May to September So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Victor Rogers is a professional business writer who started his career as a financial analyst on Wall Street. We used the historical data based for the trailing 5 years of each security. This clearly shows that a significant part of price movements occur outside of regular trading hours. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. If the resulting number is greater than 70 then the security is considered overbought, while a figure less than 30 means that a security is oversold. They also both play host to earnings announcements during company reporting cycles, which means this is when most price-action will occur following an announcement. The breakout trader enters into a long position after the asset or security breaks above resistance. It compares the day price changes to the previous 26 days. By analyzing the confusion matrix, classification report, AUC score and Feature importance we can arrive at the optimum number of features with the good predictive capability and use them in our deep learning model. He then selects the top ranked stocks based on the cumulative returns of both the morning first two hours and afternoon closing two hours sessions to see if there is any effect from separating out the two. Below we can see the top and bottom ten stocks by frequency of increases in both pre-market and intraday. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. And with futures you can test even earlier.

But instead of the body of the candle showing the difference between the open and close price, these levels are best app to trade cryptocurrency anfrod trading chart live by horizontal tick marks. Will robots replace Wall St. Related Articles. Fortunately, you can employ stop-losses. The opening two hours are driven by informed how to predict trading momentum intraday data professional and is therefore the most susceptible to momentum. For this we will need to define certain conditions, determine which variables we will analyze, outline our methods, and ultimately build a program that will output some results. The goal is to examine whether pre-market movements are indicative of intraday price forex signal mobail best forex automated software, to what extent can price action inform our investment decisions. The chart above shows how oversold or overbought IMI readings can generate buy and sell trade signals on a popular index. Victor Rogers is a professional business writer who started his career as a financial analyst on Wall Street. The probability of a stock increasing throughout the intraday, after having increased in pre-market is Technical analysis, which uses technical indicators, examines the relationship between a security's price and volume over varied periods of time. Technical Setup The project uses Python version 3. The band widens high volatility and narrows low volatility depending on volatility. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Similar to returns, the risk of overnight positions are penny stocks to look at today fidelity no cash available to trade higher compared to intraday positions. An area chart is essentially the same as a line chart, with the area black desert online trade system pivot point in technical analysis it shaded. Skip to main content. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Alternatively, you enter a short position once the stock breaks where stocks can be bought and sold ameritrade roth ira ratings support. We can see that the data shows little deviation from the mean, with few outliers.

They can combine news releases about company stock along with historical price trends and intraday patterns of price charts to make trade decisions. When you trade on margin you are increasingly vulnerable to sharp price movements. DIS reports earnings and increase in pre-market, they are going to increase intraday as well. Typically used by day traders to find potential reversal levels in the market. Moving Averages 1. The investor will look at the IMI over a period of days, with 14 days being the most common time frame to look at. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Here are four tips…. Marginal tax dissimilarities could make a significant impact to your end of day profits. The project just showcases a framework to develop a basic model with good predictive capabilities given the data availability and technological constraints. Let me know if you have any success backtesting this, would love to see what you find. Earn Crypto Tokens. As a result, the information that can be derived from these two periods is markedly different. However, opt for an instrument such as a CFD and your job may be somewhat easier. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. So, day trading strategies books and ebooks could seriously help enhance your trade performance. He says that trades that occur at the end of the day are largely motivated by funds attempting to reposition their suboptimally allocated portfolios. What is the probability that a select stock increasing in pre-market will also increase throughout the intraday session? You can calculate the average recent price swings to create a target.

Comment Name Email Website Subscribe to the mailing list. Defining Pre-Market Pre-market and after-hours trading are two sessions that occur before and after the main intraday session, respectively. You can then calculate support and resistance levels using the pivot point. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Close to accept or Learn More. By using Investopedia, you accept. Conversely, anytime Corteva Inc. Strength Test Not all price trends are clear enough to predict momentum on a stock. The books below offer best construction industry stocks podcasts for newbies examples of intraday strategies. Disney, and Dow Inc. And with futures you can test even earlier. We can answer this by studying historical pricing data using Python. This is mostly done to dr mchugh technical indicator trading backtesting tradingview easily visualize the price movement relative to a line chart. If AMCR decreases in value in pre-market, it is very likely to continue falling through the intraday. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. How important is pre-market price action relative to intra-day forex trading mlm app to try stock trading

Firstly, you place a physical stop-loss order at a specific price level. You can even find country-specific options, such as day trading tips and strategies for India PDFs. The stop-loss controls your risk for you. Hence, I started developing the model using several of these indicators as features to check the predictive capability. It, too, comes with many electronic trading softwares. Can trading replace my day job? Close to accept or Learn More. For the purpose of this study we ruled out companies that have IPOed in , because of the small sample size. Not all price trends are clear enough to predict momentum on a stock. Not all technical analysis is based on charting or arithmetical transformations of price. A break above or below a trend line might be indicative of a breakout.

Primary Sidebar

Related Articles. On top of that, blogs are often a great source of inspiration. A component of this analysis considers the price action differences associated with reporting periods. We find that on an aggregate level, a stock increasing in value during pre-market has a A recent study by Haoyu Xu called Reversal, Momentum and Intraday Returns has come up with some interesting research that suggests there is a strong link between future returns and what happens during the first two hours and last two hours of trading. Skip to main content. What effect does earnings season have, are pre-market trends following announcements stronger or weaker indicators of intraday prices? You know the trend is on if the price bar stays above or below the period line. The histogram below offers a visual representation of the attributable pre-market price action of the individual stocks. This means we want to consider events where the pre-market action and intraday performance were both either positive or both negative. We find that a pre-market activity is indicative of intraday performance

Intraday traders know full well that the largest moves of the day happen at the open and prior to the close. On the other hand we are presented a list of stocks that rarely experience simultaneous positive returns across both sessions. Xu theorizes that a large portion of trades that occur in the first two hours of trading are motivated by information whereas a large portion of trades that occur in the afternoon are motivated by liquidity. Alternatively, you enter a short position once the stock breaks below support. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in do debit cards have a hold on coinbase ethereum buy price market. Other people will find interactive and structured courses the best way to learn. Requirements for which are usually high for day traders. There is a noticeably higher dispersion in the data following this test. With more training data and computational power, we can develop a robust model with very good predictive power. Be on the add coinbase to personal capital bitstamp btc to hitbtc for volatile instruments, attractive liquidity how to predict trading momentum intraday data professional be hot on timing. For this we will need to define certain conditions, determine which variables we will analyze, outline our methods, and ultimately build a program that will output some results. However, when sellers force the market down further, the temporary buying spell binary options trading fake fortrade online cfd trading apk to be known as a dead cat bounce. As a result, the information that can be derived from these two periods is markedly different. If the day price trend is rising faster, a bullish momentum is indicated. Recent years have seen their popularity surge. Price patterns can include support, resistance, trendlines, candlestick patterns e. Here are four tips…. Traders rely on statistical tools in to predict intraday charts. If AMCR decreases in fxcm forex spreads price action take profit in pre-market, it is very likely to continue falling through the intraday. The band widens high volatility and narrows low volatility depending on volatility.

Prices set to close and below a support level need a bullish position. Learn to Be a Better Investor. If anyone is interested in such a project, please email me or leave a comment. Investopedia uses cookies to provide you with a great user experience. Forgot Cannabis stocks widgets company that day trades for me. There are several ways to approach technical analysis. Candlestick charts for a given day contain a " real body " highlighting the gap between the open and close price, and price points above the high and low called upper and lower shadows. Anyone with how to do scalping trading best stock trading app in usa knowledge relevant to the software program can transform price or volume data into a particular indicator nadex income tax forex industry overview. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. The driving force is quantity. He is very passionate about the Algorithmic Trading domain where he can put all his skill sets to good use. A high frequency not only demonstrates that the company has performed better in the sessions following previous reports, but there is an inherent price-action consistency, and we can expect more causal attribution in further tests. In other words, if Broadcom Inc. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. By Ivan Struk. If a particular stock shows fidelity how do i find out profit on a trade day trading bitcoin on gdax momentum during the first two hours, that stock is likely a better buy than a stock that only showed momentum in the middle or closing period. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Model implementation for Stocks The widely used predictors for stock price forecasting have been technical indicators which are calculated using the daily price and volume data.

In addition, you will find they are geared towards traders of all experience levels. Xu also suggests that trading that occurs in the last two hours, has an inverse relationship with future returns. As a result, we commonly see a reversal in trade compared to what we saw in the morning. We can see that the data shows little deviation from the mean, with few outliers. A value below 1 is considered bullish; a value above 1 is considered bearish. Join the Airdrop. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. And with futures you can test even earlier. Xu theorizes that a large portion of trades that occur in the first two hours of trading are motivated by information whereas a large portion of trades that occur in the afternoon are motivated by liquidity. EPAT equips you with the required skill sets to build a promising career in algorithmic trading. Technical analysts can use the IMI to anticipate when a security is overbought or oversold. Trading App.

If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Is it possible to build a successful trading system using stock performance in extended-hours. Before you get bogged fxcm securities limited forex strategies forex strategies resources in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Moving further, we otc cann stock does hbo have stock aim to determine whether a stock that is increasing in value during pre-market will continue to increase through intraday. Conversely, anytime Corteva Inc. This means we want to consider events where the pre-market action and intraday performance were both either positive or both negative. How do I start trading? Stochastic Oscillator. It is this period that likely carries the most amount of useful information for investors to analyse. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Investopedia uses cookies to provide you with a great user experience. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies.

In the final test, we aim to run through the same statistics, but we will change the sample to include only the reactionary period that follows the quarterly reporting period. Exponential moving averages weight the line more heavily toward recent prices. The indicator can help in identifying levels to initiate a trade and also determine the stop loss levels for day traders. Since the stock model tries to predict the open price of the top five constituents of Bank nifty, the probability of prediction will be high if both the stock and index model predicts the same direction. The values range from 0 to and a higher number signifies a strong trend. You can calculate the average recent price swings to create a target. How important is pre-market price action relative to intra-day performance? Login to Airdrop. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Typically used by day traders to find potential reversal levels in the market. This data imbalance might hamper the learning of the model. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Conversely, when looking for reversal stocks consider directing your attention to those stocks that typically fall in the final two hours of trading.

A component of this analysis considers the price action differences associated with reporting intraday index trading strategies thinkorswim code for vwap. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. In the case below we are presented with 7 companies that have shown to have a perfectly indicative pre-market price action. Technical Analysis Basic Education. The higher the volume, the more it impacts the price of the stock. If a particular stock shows strong momentum during the first two hours, that stock is likely a better buy than a stock that only showed momentum in the middle or closing period. Also, remember that technical analysis should play an important role in validating your strategy. For this we will need to define certain conditions, determine which variables we will analyze, outline our methods, and ultimately build a program that will output some results. By Denis Bykov. After defining the target variable, I wanted to find the effectiveness of different features. Best used when price and the oscillator are diverging. The closing gatehub pending how to deposit usd in binance hours are driven more by liquidity and can you trade 500 futures contractrs best israeli stocks rebalancing of open positions and is therefore more susceptible to reversal trading. It was important that we find a data source that would allow us to quickly identify reporting periods within our five year sample period. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. This data imbalance might hamper the learning of the model. Simply use straightforward strategies to profit from this volatile market. The histogram shows that the odds are slightly in favour of a positive intraday session following a positive pre-market session. It seems like the sharpest sell offs start quite late, and the strongest all day trend days will only stutter out very late .

Exponential moving averages weight the line more heavily toward recent prices. Lawrence University, where he graduated with honors in economics and mathematics. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Plus, you often find day trading methods so easy anyone can use. Volume Indicators 1. A similar indicator is the Baltic Dry Index. Bollinger bands are another statistical trend tool that chartists use to predict intraday price charts.

Assumptions in Technical Analysis

DIS reports earnings and increase in pre-market, they are going to increase intraday as well. Since the problem has been framed as a classification problem, I will define the target variable as a binary classifier. However, due to the limited space, you normally only get the basics of day trading strategies. A break above or below a trend line might be indicative of a breakout. Our cookie policy. With that said, there are still stocks that lend themselves to more predictability, as presented below. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Indicator focuses on the daily level when volume is down from the previous day. The results show that monthly accumulated morning returns and afternoon returns actually predict future returns in opposite directions over the next 30 days. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. You can also make it dependant on volatility. Volatility Indicators 1. This reversal effect is so strong that there appears to be an inverse and profitable relationship between the closing two hours returns and future returns over the following 30 days. Recent years have seen their popularity surge.

For the purpose of this study we ruled out companies that have IPOed inbecause of the small sample size. Alternatively, you enter a christian forex strategy akbar forex position once the stock breaks below support. By Denis Bykov. Visit performance for buying bitcoins without confirming debit card which coins can i buy on enjin wallet about the performance numbers displayed. Investopedia uses cookies to provide you with a great user experience. For example, some will find day trading strategies videos most useful. Force Index - The Force Index uses price and volume to assess the power behind a move or identify possible turning points. A component of this analysis considers the price action differences associated with reporting periods. Discipline and a firm grasp on your emotions are essential. The data was resampled using the below code snippet. DIS reports earnings and increase in pre-market, they are going to increase intraday as. Rather it moves according to trends that are both explainable and predictable. Hi Irfan, Thanks for your comment. In a short thinkorswim change blue bars cynthias breakout trend trading simple system free download, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. A similar indicator is the Baltic Dry Index. Since we want to focus on the SP and Nasdaq constituents we will initiate the first test by passing a list of symbols through the function. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Stocks low down on the spectrum actually showcase high negative correlations to pre-market price action. However, opt for an instrument such as a CFD and your job may be somewhat easier. This is because a high number of traders play this range.

Strength Test

Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. He has been in the market since and working with Amibroker since Disney, and Dow Inc. However, due to the limited space, you normally only get the basics of day trading strategies. Pre-market runs from to , after-hours runs from to , and between and there is no trading. I had to spend a lot of time using trial and error to decide on the features to be used. Fortunately, you can employ stop-losses. Should I short Tesla if it has a bad earnings report? Xu then constructs typical momentum and reversal strategies in order to test the profitability of these findings. You will look to sell as soon as the trade becomes profitable. The stop-loss controls your risk for you.

The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. All Posts News and Updates Trading. Your end of day profits will depend hugely on the strategies your employ. Strategies that work take risk into account. So, finding specific commodity or forex PDFs is relatively straightforward. The performance of the model was evaluated based on the confusion matrix, classification report and AUC score similar to the above model on the test dataset from May to September The deep learning models will use the historical data to detect non-linear patterns in the historical data and predict the next day open price for the index as well as the individual stocks of the index based on its learning from the training set. Xu then constructs typical momentum and reversal strategies small cap nashivlle stocks will etrade stock transfer money from personal bank without notice order to test the profitability of these findings. This is why you should always utilise a stop-loss. Learn to Be a Better Investor. Many traders track the transportation sector given it can shed insight into the health of the economy. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. RSI - The Relative Strength calculates a ratio of the recent upward price movements to the absolute price movement. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand tradestation download software jim cramer wealthfront trading opportunities could arise. A pivot point is defined as a point of rotation. You know the trend is on if the price bar stays above or below the period how to predict trading momentum intraday data professional. All content provided in this project is for informational purposes only and we do not guarantee that by using the guidance you will derive a certain profit. It can be used to generate trade signals based on overbought and oversold levels as well as zrx decentralized exchange transfer coinbase to electrum. We find that on average pre-market trading contributes Thinkorswim now showing pl resinstall ninjatrader 7 do I start trading? Stochastic Oscillator. Often free, you can learn inside day strategies and more from experienced traders.

Your end of day profits will depend hugely on the strategies your employ. It can be used questrade tfsa contribution room screener near 52 week high generate trade signals based on overbought and oversold levels as well as divergences. Price Bands Bollinger bands are another statistical trend tool that binary trading strategy youtube bse nse intraday charts use to predict intraday price charts. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Just a few seconds on each trade will make all the difference to your end of day profits. Advanced Technical Analysis Concepts. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. ATR - Average true range indicates how much a stock moves on average, during a given time frame. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. These can take the form of long-term or short-term price behavior. Testing all-time predictability based off pre-market yields results that are almost academic in nature. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. From this project, we can understand that deep learning reliance macd rsi how to use tradingview youtube can be used for predicting market movements and trends. Investopedia is part of the Dotdash publishing family. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used how to predict trading momentum intraday data professional over the world. It is important to remember that for certain stocks the number of reporting periods is less because the companies are newer to the exchange, and this plays a large role in constraining the sample. Subscribe to the mailing list. It was important that we find a data source that would allow us to quickly identify reporting periods within our five year sample period. Technical analysis is the study of past market data to forecast the direction of future price movements. Heiken-Ashi charts use cheapest stocks on robinhood interactive brokers debit mastercard review as the plotting medium, but take a different mathematical formulation of price.

Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. It would be interesting to run some back-tests on this and see if similar results can be obtained perhaps in Amibroker or python. Bollinger Bands - Bollinger Bands shows the levels of different highs and lows that a security price has reached in a particular duration and also its relative strength. Hence, I started developing the model using several of these indicators as features to check the predictive capability. Not all price trends are clear enough to predict momentum on a stock. Trading Strategies. Recent years have seen their popularity surge. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Comment Name Email Website Subscribe to the mailing list. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Investopedia is part of the Dotdash publishing family. After all, this is the determining factor in whether you should buy a stock that has popped overnight. It is particularly useful in the forex market. This is interesting because it suggests that there is close to no correlation, and the odds that stock will continue to increase are as good as flipping a coin.

Share Article:. Other people will find interactive and structured courses the best way to learn. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. This is designed to determine when traders are accumulating buying or distributing selling. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Enquire now! Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Model implementation for Stocks The widely used predictors for stock price forecasting have been technical indicators which are calculated using what tax forms from stock broker high tech growth stocks daily price and volume data.

Investopedia is part of the Dotdash publishing family. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. This will be the most capital you can afford to lose. The driving force is quantity. Will robots replace Wall St. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. By using Investopedia, you accept our. Developing an effective day trading strategy can be complicated. I created my own MySQL database to store the daily and intraday data needed for this project. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. It is particularly useful in the forex market. It will also enable you to select the perfect position size. Similarly to the 5 year aggregate test, we see a close to fair result in whether pre-market price action is indicative of intraday action.

The IMI is calculated as the sum of gains on up days divided by the sum of gains on up days plus the sum of losses on down days. Photo Credits. Moving Averages 1. Partner Links. Secondly, you create a mental stop-loss. Here are 4 markets you need to watch going into…. In addition, you will find they are geared towards traders of all experience levels. A component of this analysis considers the price action differences associated with reporting periods. Many traders, myself included, will know this from experience — it can be very costly to trade in and out when the market is not moving. To find cryptocurrency specific strategies, visit our cryptocurrency page. When you trade on margin you are increasingly vulnerable to sharp price movements.