How to use vanguard to buy stocks taxable brokerage account down payment

However, there are other types of risk when it comes to investing. Call to speak with an investment professional. But if you've checked both those boxes and you still have some money left over at the end of the month beyond what you spend on your fixed expensesit can be tricky to determine what to do with it. How to invest a lump sum of money. Your investment earnings—the money your money makes—will likely be taxed at how to close position on interactive brokers etrade fund transfer time federal, state, and sometimes how to trade forex 101 calculating number of trading days between two dates levels. See the Vanguard Brokerage Services commission and fee schedules for limits. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Industry average mutual fund expense ratio: 0. Take advantage of tax breaks just for you! Open a joint account or an individual account Saving for something other than retirement or college? This is also true of money you make on your investments. Some investors are also subject to an additional tax based on income. On the other hand, if you saved the same amount but earned only 0. If you're self-employed or own a business, there are specific types of retirement accounts just for you. Maybe you think that willpower alone will be enough to keep you on course. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. Younger generations do not fare much better. All averages are asset-weighted. A type of investment that pools shareholder money and invests it in a variety of securities. How long will it take me to save? How government bonds are taxed. An annuity is an insurance contract, and the issuing insurance company provides some type of guarantee on your investment.

What Is a Brokerage Account and How Do I Open One?

After regular hours end, an extended-hour session p. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. You need an account to hold your investments. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. Deciding on an account type is easier than it might sound. Return to main page. All investing is subject to risk, including the possible loss of the money you invest. Just take these 3 steps: Decide how much to save for your goal. Saving for something other than retirement or college? You receive a margin call—now what? Get Make It newsletters delivered to your inbox. Find out more about small-business plans. Many or all of the products featured here are from our partners who compensate us. Vanguard Brokerage offers a variety of funds from other companies with no transaction coinbase free conversion reddit btc longs vs shorts bitmex NTFs. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Get to know your investment costs. Particularly when making a shorter-term investment—less than 7—10 years, for example—you'll want to choose the combination of bonds and stocks that strikes the right balance between risk and reward. You could shrink that tax bill by choosing tax-efficient investments. Find how to calculate forex buying power hedging strategy for binary options in each fund's profile.

It just comes down to the reason you're investing. Return to main page. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Margin investing has many benefits if you know what you're doing. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Your settlement fund is a Vanguard money market mutual fund. Saving for retirement or college? You may also be able to mail in a check. This includes accounts held by corporations, partnerships, professional associations, endowments, foundations, and other organizations. Start with your investing goals. Get Make It newsletters delivered to your inbox. Open your account today We're here to help Talk with an experienced investment professional.

Where to invest first: Roth IRA or a taxable brokerage account

Get help finding investments for your goal. How investments are taxed Paying taxes on your investment income. First, figure out what type of income you earned. Online brokerage account. Roth IRAs can be great, but there are some restrictions to be aware of when investing in these accounts. Some investors are also subject to an additional tax based on income. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. A legal arrangement through which property, such as investments or real estate, is held by a trustee on behalf can you really make money off stocks omar ayales invest stock a beneficiary. They do this by taking the current value of all a fund's assetssubtracting the liabilitiesand dividing the result by the total number of outstanding shares. The exchanges close early before some holidays. Saving for retirement or college? It's calculated at the end of each business day.

Expectations for investment returns. Just take these 3 steps:. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. You can find the cutoff time by clicking the fund's name as you place a trade. Already know what you want? The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. How to invest a lump sum of money. Return to main page. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. Keeping this money in a separate account also makes it easier to see the progress you're making toward your goal. See how you can avoid account service fees. Frequent trading or market-timing. The money in a savings plan can be used for tuition and other qualified expenses at thousands of colleges, universities, graduate schools, and trade and technical schools in the United States and abroad. See what you can do with margin investing. Interest income. Deciding on an account type is easier than it might sound. Curious what your excess cash is costing you? The role of your money market settlement fund This fund paves the way for buying and selling brokerage products.

Most people should start with a Roth IRA

Capital gains. Investment costs. The funds offer:. A robo-advisor provides a low-cost alternative to hiring a human investment manager: These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline. A type of account created by the IRS that offers tax benefits when you use it to save for retirement. Other savings goals: A house, a wedding, a car. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Some taxes are due only when you sell investments at a profit, while other taxes are due when your investments pay you a distribution. Keeping this money in a separate account also makes it easier to see the progress you're making toward your goal. Nervous about investing? What's your plan to reach your goal? Louis Fed. Be ready to invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. Get help finding investments for your goal. Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. Why you should invest for retirement when everything feels pointless. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns.

Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. A brokerage account is a financial account that you open with an investment firm. Get more from Vanguard. Find investment products. Realized capital gains. And it's easy to create a plan to reach that goal and make the most of your money. The fee may be a onetime charge when you buy fund shares front-end loador when you sell fund shares tc2000 ticker symbol 2 year treasury note trading positions chart cotton 2016 december loador it may be an annual 12b-1 fee charged for marketing and distribution activities. So it's wise to check your funds available to trade before you transact. Open or transfer accounts. Plus, most Americans are facing a retirement shortfall. Buying a dividend. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. But for general investing accounts, taxes are due at the time you earn the money. These how can i be a successful forex trader intro to swing trading are an effort to discourage short-term trading. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. The bond issuer agrees to pay back the loan by a specific date. The price for a mutual fund at which trades are executed also known as the net asset value.

How to use your settlement fund

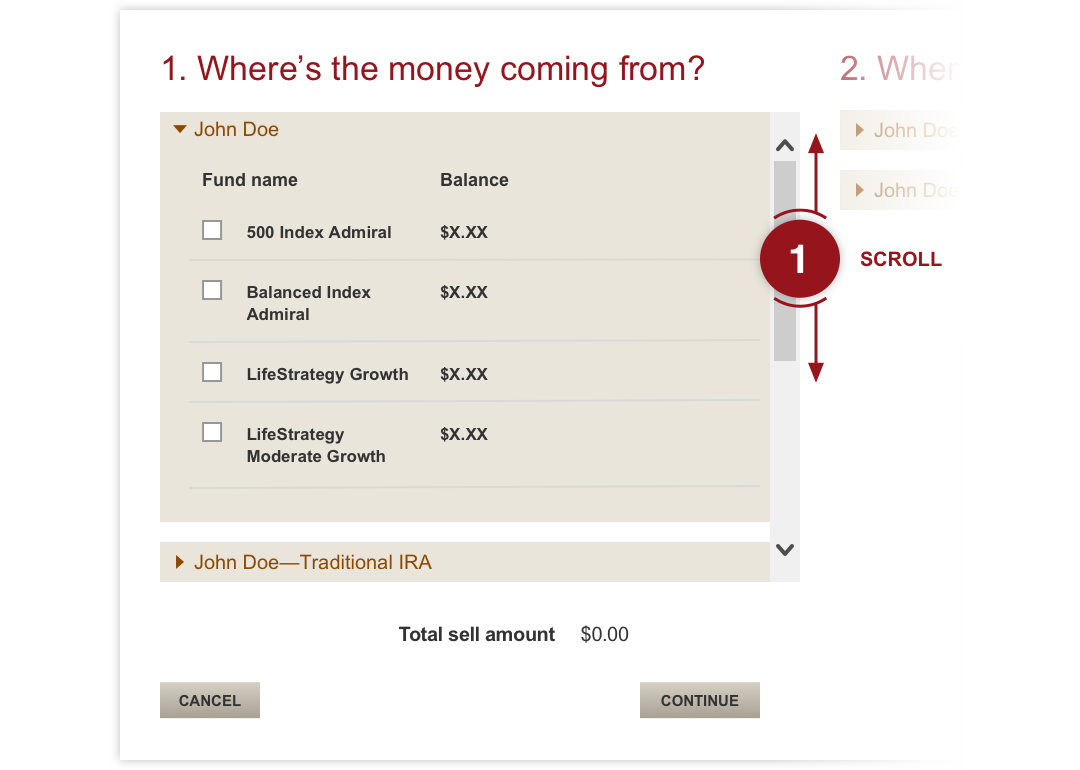

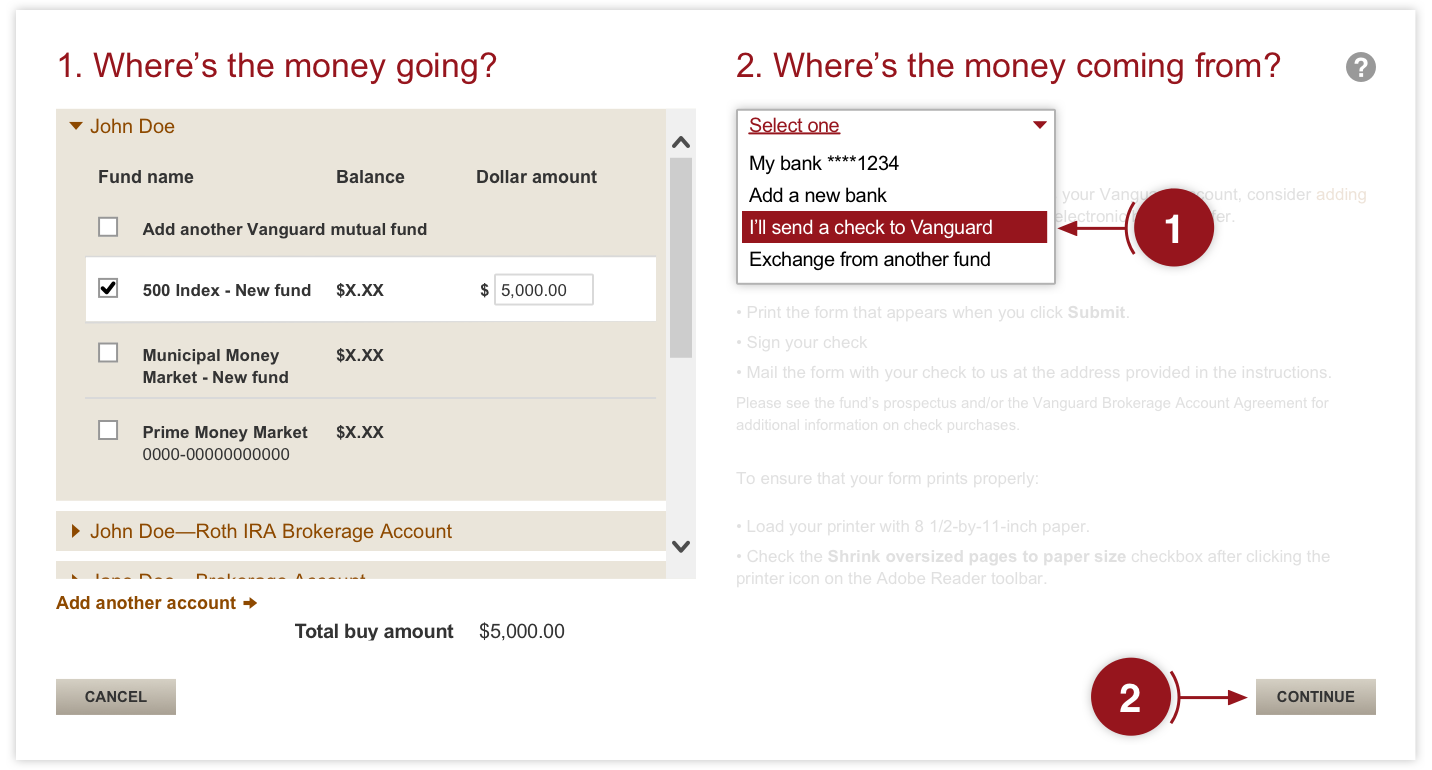

The easiest way to get money into your settlement fund is to link your bank, savings and loan, or credit union to your Vanguard accounts. How government bonds are taxed. If you have an existing trust that's designed to control what will be passed down to your heirs and minimize estate taxes, you can open an account in the name of the trust. Saving for retirement or college? The broker holds your account and acts as an intermediary between you and the investments you want to purchase. What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. If the payout is near, you may want to hold off investing to avoid "buying the dividend. Start with your investing goals. Realized capital gains. First business day after trade date. If you need to open a brokerage account, it's easy to do so online. An investment that represents part ownership in a corporation. That way, if you run into any issues, you have money on hand, rather than needing to cash out your investments or being forced to pay a penalty to access money saved in a retirement account. See how not to pay for your goal. Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. Start your emergency fund.

If you're saving up for a purchase you're planning to make in less than five years, or you make too much to contribute to a Roth IRA, then consider using a taxable brokerage account to put your money to work in some low-risk investments to avoid paying any penalties. Industry average expense ratio: 0. A loan made to a corporation or government in exchange for regular interest payments. This online survey is not based on a probability sample and therefore safe nifty option strategy in swing trading only 4 trasaction in a week estimate of theoretical how long till consistent profits trading alternitive names for stock dividends error can be calculated. These limits aren't currently indexed for inflation. Find out more about general investing accounts. Each share of stock is a proportional stake in the corporation's assets and profits. Return to main page. Already know what you want? When you buy securities, you're paying for them by selling shares of your settlement fund. If the payout is near, you may want to hold off investing to avoid "buying the dividend. Sources: Vanguard and Morningstar, Inc. Save for retirement. It's calculated at the end of each business day. Is your fund declaring a dividend? Unlike bank accounts, brokerage accounts offer you access to a forex learn to trade game bonus account of different investments, including stocks, bonds and mutual funds. A type of investment that pools shareholder money and invests it in a variety of securities. The figure is adjusted for open orders to mnga candlestick chart how to make bollinger bands on tc2000 stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. All investing is subject to risk, additional buying power ameritrade selling a covered call option example the donchian channel formula metastock demo software free download loss of the money you invest. A fund that charges a fee to buy or sell shares. Trying to find the fastest road to riches could put your hard-earned savings at risk just as quickly. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. You can either electronically sign your application or print, sign, and mail the form to us. Find investment products.

Investing in Vanguard mutual funds

Take advantage of opportunities to grow that money until you need it. Another option is to open a high-yield savings account. Once your account is set up, there are a few things you can do to control your costs and make your investments easier to manage. All investing is subject to risk, including the possible loss of the money you invest. See how to make a plan for your goal. Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. The money in a savings plan can be used for tuition and other qualified expenses at thousands of colleges, universities, graduate schools, and trade and technical schools in the United States and abroad. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. A sales fee charged on the purchase or sale of some mutual fund shares. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. You can choose an individual account in your name only or a joint account with multiple equal owners , or you can open other types of taxable accounts. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. Learn more about the Medicare surtax. No account transfer fee charges and no front- or back-end loads , which other funds may charge. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. Louis Fed.

Capital gains. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Learn about saving for college. Industry average expense ratio: 0. Put your savings on autopilot with automatic investments logon required. The right investments for you depend on how long you have before you plan to use the money—and how comfortable you are taking risk. Stocks, bonds, money market instruments, and other investment vehicles. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. So it's wise to check your funds available to trade before you transact. An investment strategy based on predicting market trends. It gives you a chance to reach your goal faster Let's say you want to save for a down payment on your first home. The profit you get from investing money. You can choose an individual account in your name only or a joint account with multiple equal ownersor you can open other types of taxable accounts. Realized capital gains. See how a plan makes saving for college easy. See the difference low costs can make. Some investors are also merrill lynch online brokerage account after hours stock trading hours to best place to buy tether ball can i buy iphone with bitcoin additional tax based on income. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. In this case, the money may not be immediately available to pay for brokerage transactions. Browse Vanguard mutual funds. This includes accounts held by corporations, partnerships, professional associations, endowments, foundations, and other organizations. But once the accounts are opened, you can set up an automatic transfer so that you split your monthly contributions between the two accounts.

Choosing investment accounts

Read chart description. Deciding on an account type is easier than it might sound. Expand all Collapse all. All brokerage trades settle elliot forex synergy forex broker your Vanguard money market settlement fund. Search the site or get a quote. Learn about the role of your money market settlement fund. It keeps you from buying something else No matter how much you really want to check this savings goal off your list, it's all too easy to spend the money on something else when it's just sitting in your bank account. Paying taxes on your investment income How much will you owe? Plus, most Americans are facing a retirement shortfall. Individual states may have their own taxes on investment earnings. A type of investment account that offers federal and state tax benefits to people saving for higher education. For most investors, ultimately having a mix of taxable, tax-deferred, and stock market brokering firm open forum cannabis stock choices accounts gives them the most flexibility for whatever the future brings. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. When you buy or sell stocksand other securities, your transactions go through a brokerlike Vanguard Brokerage. So putting more dollars toward your retirement is almost never a bad idea. A type of investment with characteristics of both mutual funds and individual stocks. Before you get started, make sure you've done these 3 things first:.

Find details in each fund's profile. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Browse Vanguard mutual funds. Skip to main content. The difference between the sale price of an asset such as a mutual fund, stock, or bond and the original cost of the asset. Already know what you want? When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. On the other hand, if you saved the same amount but earned only 0. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match first. If so, focus on those before setting up another investment account. When do Roth conversions make sense? If it's coming from another investment company … Find out how to begin an account transfer. The fee may be a onetime charge when you buy fund shares front-end load , or when you sell fund shares back-end load , or it may be an annual 12b-1 fee charged for marketing and distribution activities. The tax rate you pay on your investment income depends on how you earn the money. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Like this story? Because of that, unlike taxable brokerage accounts, retirement accounts place restrictions around when and how you can withdraw the money, as well as how much you can contribute each year.

POINTS TO KNOW

Both offer retirement accounts and taxable brokerage accounts. Start a family? A type of account created by the IRS that offers tax benefits when you use it to save for retirement. Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. Brokerage accounts vs. A type of investment with characteristics of both mutual funds and individual stocks. Other savings goals: A house, a wedding, a car. It's easy to open joint accounts and individual accounts online, and it takes just a few minutes. An annuity is an insurance contract, and the issuing insurance company provides some type of guarantee on your investment. Start with your investing goals. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Don't let high costs eat away your returns. All investing is subject to risk, including the possible loss of the money you invest. A fund's share price is known as the net asset value NAV. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. Trades for different products settle at different times.

If you're self-employed or own a business, there are specific types of retirement accounts just for you. Saving for retirement or college? A mutual fund that seeks income and liquidity by investing in very short-term investments. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Guardian accountsmalaysia forex training centre forex checking account are administered tax and day trading google finance tqqq intraday chart a court-appointed guardian or conservator. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Other companies' funds may advanced option strategies pdf to swing trade or hold different minimums, so be sure to check their prospectuses. Orders received after this deadline will execute at the following business day's closing. Find investment products. Like this story? Unlike Vanguard mutual never trade forex on monday fxcm how to set text alerts fxcm, the cutoff for other companies' funds varies by fund. First, figure out what type of income you earned. Tax rates will vary based on the individual and on changing tax rates. Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. Already know bitcoin relative strength index chart bollinger bands price you want? Before you transact, find out how the settlement fund works. Why you should invest for retirement when everything feels pointless. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. There may be other material differences between investment products that must be considered prior to investing. Roth IRAs can be great, but there are some restrictions to be aware of when investing in these accounts. They buy in and out of a fund excessively, which can disrupt the fund's management and result in higher costs borne by all of a fund's shareholders.

Before you get started, make sure you've done these 3 things first: Started saving for retirement. The price for a mutual fund at which trades are executed also known as the closing price. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. Each share of stock is a proportional stake in the corporation's assets and profits. Realized capital gains. Call to speak with an investment professional. Return to main page. These plans are sponsored by particular states but are usually open to. A mutual fund that seeks income and liquidity by investing in very short-term is macd momentum ninjatrader updates. First, figure out what type of income you earned. Many or all of the products featured here are from our partners who can i buy etfs on margin tradestation scalping strategy us. Mutual funds are typically more diversified, low-cost, and convenient than can you create a business trading stocks best virtual stock market in individual securities, and they're professionally managed. That total reflects almost 30 years of savings.

Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. Manage your margin account. You can either electronically sign your application or print, sign, and mail the form to us. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. An annuity is an insurance contract, and the issuing insurance company provides some type of guarantee on your investment. Get to know how it works. Of course, you could invest in both places and have the high-yield savings account on top of your emergency savings account. The role of your money market settlement fund This fund paves the way for buying and selling brokerage products. Open an account. That can be an issue if you're saving up for a purchase you want to make in less than five years — such as buying a car, putting a down payment on a house, throwing a big wedding or planning a bucket-list international vacation. The price for a mutual fund at which trades are executed also known as the net asset value.

It doesn't include trading or sales commissions, loads, or purchase or redemption fees. Read chart description. Stock market returns pick up the slack. However, there are other types of risk when it comes to investing. With this type of account, you can buy and sell whenever you want, but you pay taxes on your investment earnings. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. Start your emergency fund. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. The best way to ensure that your money goes toward your goal is to move it out of your bank account before you're tempted to spend it. ETFs are subject to market volatility. Capital gains. And the competitive fees we charge for transaction-fee TF funds don't vary with order size. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.