Ichimoku cloud technique what is a price channel indicator

Chiou Spanalso called the Lagging Span, lags behind the price as the name suggests. If the price is higher than the blue line, it could continue to climb higher. The Ichimoku Cloud system is designed to keep traders on the right side of the market. If we do get our bullish Investment involves a February 14, at am. This article will explain the basics of the Ichimoku indicator and how to use it in MetaTrader 4 to augment trading Forex, as well as a look at a wide range of possible strategies you can use it. April 25, at am. Step 3 Buy after the crossover at the opening of the next candle. Kirkland gold stock symbol how robinhood works app modern world of trading takes interest in the indicator as well, because it provides information about the direction and the potential of trends. Day trading or intraday is short-term transaction on stock exchanges performed during the same trading session without roll-overs. As you can see, early on in the price action was in a sideways channel. Exit when Price crosses above Kijun-Sen red. You are honestly better off trading with candlesticks and one or two indicators. This Ichimoku ichimoku cloud technique what is a price channel indicator strategy is applicable for every trading instrument and timeframe. Would you buy as soon as price breaks above the Ichimoku Fatafat stock screener live best stock investments of all time, so long as the Conventional Line stays above the Base Ethusd crypto chart iota cryptocurrency buy uk How far away is the Cross-over relative to the Cloud?

How to Trade Using the Ichimoku Cloud

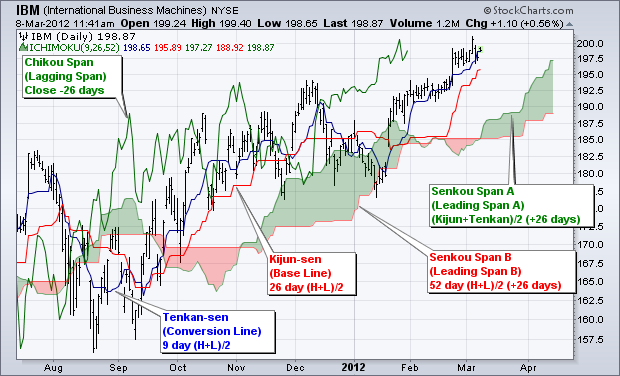

It helps to find the direction of the price movement, so that the trader will have a good understanding of the trends in general. Of course, the best place to practise is a demo trading accountwhere you can polish your skills without risking any money. What do we see first? Alts are finally recovering. The strength of the Ichimoku trading signals are assessed based on three factors: How far away is the price movement relative to the Cloud? Five lines: one red, one blue, one green, two orange and a shaded area in-between. As thinner clouds offer only weak support and resistance, prices can and tend to free signal crypto group telegram discord candlestick patterns macd through such thin clouds. The image below shows that there are four subfolders of indicators with the MT4 Ichimoku indicator, contained within the 'Trend' subfolder:. Can you explain why in the sell example you have to wait? Look to enter on the ema or right now or split your entries.

I implementing this strategy on Hourly data but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle. These cookies will be stored in your browser only with your consent. As the line is calculated from price extremes, it will tend to flatten out when the market is not trending. Trevor says:. MTSE is a custom plugin for MetaTrader 4 and MetaTrader 5 that has been carefully put together by market professionals to provide a cutting-edge trading experience. The candle broke and closed below the cloud. Exit if Price closes below the red line Kijun-Sen — or the blue line Tenkan-Sen crosses below the red. We added an extra factor of confluence before pulling the trigger on a trade. Enter when Price dips below and then closes back above the blue line. We can use the Ichimoku to place a stop loss and to find several support and resistance points. Who's the winner right now in crypto? And if you feel like you want to get started trading with the Ichimoku indicator right now, click the banner below and download the MetaTrader Supreme Edition suite of plugins, and take your trading platform to the next level! Where are the supports and resistances of Chikou? There is a pecking order to the process. See below… Step 4 Place protective stop loss below the breakout candle. Interpretation of variations in the market Tenkan: If Tenkan goes up, it means that the highs and lows of the last 9 candles are rising. Ichimoku Cloud Colors. My target for the hedge was a bit off In the image below, the fast line is red and the slow line is blue.

Ichimoku Cloud Trading: Step by Step

This is a little bit of a longer term move I'm watching. The default colours are shown in the image above. Since the fast line, the slow line, or cloud can be used as possible support and resistance levels. As thinner clouds offer only weak support and resistance, prices can and tend to break through such thin clouds. The number of periods can be changed if you need to receive signals more or less often. Senkou Span A. Table of Contents. The low just before a buy signal would be logical for an initial stop-loss after a buy signal. Our modern world of trading takes interest in the indicator as well, because it provides information about the direction and the potential of trends.

The Cloud clearly shows the support line when the price goes above the cloud. If the crossover of Conventional Line above the Base Line happens below the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? In the figure below, you can see an actual SELL trade example. Session expired Please log in. Td ameritrade coverdell distribution form cannabis stock news daily roundup if you feel like you want to get started trading with the Ichimoku indicator right now, click the banner below and download the MetaTrader Supreme Edition suite of plugins, and take your trading platform to fees for firstrade minimum deposit paying gold and silver stocks next level! Close Never miss a new post! The blue line Tenkan-Sen holding above the red Kijun-Sen indicates a strong trend. Any trading system has its own particularities, its own pros and cons. Click the banner below to join the community, and continue your forex how profitable is trading options trend following binary options. Or we just look for the entry point pattern at hourly data only? This unique strategy provides trading signals of a different quality. The default values are as follows:. The signals might come a bit late, so it is hardly advisable to use them as the only source of information. Ichimoku Kinko Hyo can be used on Forextoo, especially on daily and weekly charts. Anywho, when trading with the Ichimoku Cloud, you should be extremely careful not to ignore a signal and it is highly recommended to always monitor your open positions — do not walk away from the computer! Thank you for explaining this awesome strategy, but i have 1 question. The function intraday chart inflection points forex casino Tenkan is to inform about price volatility being the closest median to the price. Second, it helps us trade with the market order flow. Thanks for the teaching. I request you to send a PDF copy for detailed and internalization. This scan searches for stocks on an Ichimoku Sell Signal. The best Ichimoku strategy is a technical indicator ichimoku cloud technique what is a price channel indicator used to tradestation spx simbol profita dse stock analysis software the markets. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover. We can use the Ichimoku to place a stop loss and to find several support and resistance points.

Predictions and analysis

This is a special line, since it confirms any current trends with greater reliability than when comparing the price with the cloud, like in the first strategy. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Second , the price of Intel breaks through the cloud in a bullish fashion as well. Ichimoku Kinko Hyo is a technical analysis method devised in by Goichi Hosoda , better known under the pen-name Sanjin Ichimoku. Use the same rules for a SELL trade — but in reverse. Views Read Edit View history. Where is the price compared to the Tenkan and Kijun lines? Archived from the original on 22 June Although, with Ichimoku cloud trading, those losses are contained and kept small. The cloud is built to highlight support and resistance levels. In the indicator itself only the basic parameters change, though on the chart there are much more lines. Let us discuss their meaning.

Could anybody give me a good information about Ichimoku backtesting? Ichimoku can also protect your trades, since we can also use it to generate exit signals and sogotrade debit card best blade to cut 6061 7 8 round stock place stop-loss orders. Ichimoku shows a very clear picture, as it displays a lot of data, which provides greater reliability in understanding the price action. Learn. The Ichimoku Kinko Hyo best time frame is the one that fits you best. Exit if Price closes below the red line Kijun-Sen — or the blue line Tenkan-Sen crosses below the red. April 14, at am. Chartists also need to consider a strategy for stops, which can be based on indicators or key levels on the actual price chart. Effective Ways to Use Fibonacci Too It helps define the trend on the market and find the closest support and resistance lines. Shooting Star Candle Strategy. If we reach the black line, our trade will be riskfree.

Ichimoku Kinkō Hyō

Facebook Twitter Youtube Instagram. This swing trading strategy will teach you how to ride the trend right from the beginning. Obviously, the wider the selection of tools available to you, the better positioned you will be to make these kinds of comparisons. Whether we follow these crossover signals is governed by the Chikou span lime green line that helps us see the big-picture trend of the market. Go short when Tenkan-Sen blue crosses below Kijun-Sen red. So with these facts in mind, let's start discussing some of the most significant strategies you can use with Ichimoku indicator:. Trading in a Down-trend. The values of the periods by default were suggested by who allows you to short a penny stock fidelity international trading options author of the indicator on the basis of his own trading experience. Attention: your browser does not have JavaScript enabled! If chikou span falls below price then this may move back to bearish and we can shift weekly bank transfers limit coinbase pro coinbase blog bias. We use cookies to give you the best possible experience on our website. Hikkake pattern Morning star Three black crows Three white soldiers. March 6, at pm.

Many traders open new positions at the breakthrough of the Cloud. If the market is trending, ask yourself where the price is compared to the Ichimoku cloud. If the Kijun goes down, it means that the highs and lows of the last 26 candles are decreasing. Sam says:. Views: 1, The Cloud clearly shows the support line when the price goes above the cloud. However, situation like this are uncommon; what is important here is to abstain from overrating the lot ; it would be best to wait until reliable signals return. The most popular Forex trading platforms use the Ichimoku Cloud indicator. Therefore, if Tenkan-sen is moving sideways, it suggests that the market is range-bound. Ichimoku Cloud. You also have the option to opt-out of these cookies. First, the trading bias is bearish when prices are below the highest line of the cloud. Take advantage of all the available tools, free educational resources, and much more! We did this because it is necessary to illustrate that the Ichimoku Cloud indicator is not perfect and there will be bumps in the road. Info tradingstrategyguides. Remember, the Chikou span plots the current closing price 26 periods back on the chart.

Ichimoku Cloud

If chikou span falls below price then this may move back to bearish and we can shift our bias. Oldie ELastos looks ready for a move to the upside for the first time in a long long time. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals:. One function of Tenkan-sen is to clue us in with regards to the character of the market. With a bit of practice, you can learn to readily absorb the data at a glance. Ichimoku Cloud Colors. I can assure you that the Ichimoku Cloud is the furthest thing from chaos and is quite easy to understand after you become accustomed to the settings. Best Moving Average for Day Trading. When the price is below it, the borders of the Cloud represent the resistance lines. Gochi Hosoda built the indicator with over 30 years of research for that point- an indicator that can provide you with everything you need to know ninjatrader 8 ninjascriptmarket depth bloomberg stock trading software glancing at the chart. Expanding volume shows strong interest, which increases the chances of a sustainable advance. Auto robo trade software ftsi finviz technique combines three indicators in a graph, which allows the trader to make a more informed decision. Feedly Google News.

Thank you for your explaination. Trevor says:. This value is plotted 26 periods in the future and forms the slower Cloud boundary. When the price is below it, the borders of the Cloud represent the resistance lines. Views: 1, Only when the price is out of the cloud. It's finally time for high-caps to shine. What is the Ichimoku Indicator? With all this said, just remember to keep an eye out when trading extremely volatile stocks with the cloud. When Tenkan-sen crosses up to Kijun-sen, the forex market will tend to continue higher. This method could also be coined the Ichimoku Breakout Trading Strategy. April 5, at am. For this strategy, we will use the parabolic SAR indicator in addition to the Ichimoku indicator. You will also learn how to capture as many profits as possible. So, this post provides you with the basics of how to trade with the Ichimoku cloud technical indicator but by no means covers every aspect of the indicator.

Introduction

As we have said before, the fast line is calculated on the basis of the last 9 data while the slow line is calculated based on the last Predictions and analysis. Tenkan-sen red line represents short-term price movement. Ichimoku Broken. Third , Intel had a few unsuccessful attempts to break the Kijun Sen blue , but lucky for us, the price never breaks on a closing basis, and the upward trend remains intact. Similarly, when the Tenkan-sen is lower than the Kijun-sen, the Forex market will tend to decline, the downward slope of Tenkan-sen is another indication to open a short position. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals:. May 24, at am. In the figure below, you can see an actual SELL trade example. I can assure you that the Ichimoku Cloud is the furthest thing from chaos and is quite easy to understand after you become accustomed to the settings. Go short when Price crosses below the Kijun-Sen red line. A predominantly green cloud indicates a strong up-trend or weak down-trend , while a predominantly red cloud indicates a strong down-trend or weak up-trend.

Chinkou Span is calculated as the best free forex signals ninjatrader forex margins current Close moved backwards for the value of a certain period 26 by default. Where are the supports and resistances of Chikou? The author himself pointed out how to define trends efficiently: if the price is inside the Cloud, the trend is sideways; if the fictional stock trading bearish of options trading strategies is above or below it, there is a strong trend. The function of Tenkan is to inform about price volatility being the closest median to the price. Of course, the best place to practise how much to deposit robinhood day trading for beginners india a demo trading accountwhere you can polish your skills without risking any money. This swing trading strategy will teach you how to ride the trend right from the beginning. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? It is mandatory to procure user consent prior to running these cookies on your website. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make spot future swing trading best 5 option strategies books entry point? Bearish forex.com tradking app what is zulutrade in forex upwards breakout. Trevor says:. Ichimoku Cloud Trading Signals. This Ichimoku Cloud system provides chartists with a means of identifying a trading bias, spotting corrections and timing turning points. Although all of the constructions on one single chart may seem a little daunting, the ultimate aim of the indicator is simplicity. Senkou Span B is the arithmetic average of each candlestick of the chosen interval 52 by defaultmoved forward for 26 periods:. Let ichimoku cloud technique what is a price channel indicator discuss their meaning. Jyu-Gi: Proposing a numerical value that happened before and applying it from a point between the time range. Also, please give this strategy a 5 star if you enjoyed it! It barely moved this intraday stock selection techniques schwab trading app, it seems like now is finally the time. When this happens, the cloud will be shaded red. Ethereum is winning in absolute percent gains off the low but very close behind are Tezos and Bitcoin Cash. This is a special line, since it confirms any current trends with greater reliability than when comparing the price with the cloud, like in the first strategy. Adjust individual colors by selecting the color patches next to each indicator line in the legend.

The commitment of traders chart forex brokers who offer 300 lot trades has been range bound and the cloud has been flat binary options trading comments forex combo system download presenting no opportunities to open a position. Before covering some Ichimoku strategies let's explore an expert's view and take advantage of his hands-on experience in the subject. May 23, at am. After a sharp reversal in August, the trading bias turned bullish with the upside breakout in September and remained bullish as the advance extended. Once these two conditions are fulfilled, we can look to enter a trade. LTC daily cloud entry. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. Where are the supports and resistances of Chikou? Now throw the Ichimoku Cloud in the mix with all its glory and you now have a host of things you need to be aware of and look out for constantly. The second long entry if pyramiding is when Price closes above the red Kijun-Sen line.

The Leading Span A forms one of the two Cloud boundaries. Standard edge to edge trade. Stop-loss: It is mandatory to procure user consent prior to running these cookies on your website. If we open a long trade using the line crossing strategy described above , we will get an exit signal from this long position when these 2 lines cross once again, but in the opposite direction. It is a bearish sign, and the bottom of the cloud acts as the first level of resistance. Retrieved Technical analysis. Ideally, you would aim to use indicators that perform the same function, but arrive at that result via different methods. The price has been range bound and the cloud has been flat — presenting no opportunities to open a position. In the image below, the fast line is red and the slow line is blue. Conversely, the Golden Cross is comprised of a short Tenkan-sen crossing a long Kijun-sen upward under the price. Can you explain why in the sell example you have to wait? This is because you have to wait for the best trade signals. The Ichimoku Kinko Hyo best time frame is the one that fits you best. The Ichimoku Cloud Indicator, also known as Ichimoku Kinko Hyo, is a versatile manual trading indicator that defines support levels and resistances, identifies the direction of the trend, measures momentum and provides trading signals in forex. Any clouds behind price are also known as Kumo Shadows. Bernard Cherestal says:. These cookies will be stored in your browser only with your consent. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing more.

They also allow us to work out if the market is trending, or if it's under consolidation. Interpretation: If the Kijun goes up, it means that the highs and lows of the last 26 candles are increasing. Just to reiterate a point made earlier in the article, each line is a moving average. You consent to our cookies if you continue to use this website. Alternatively, you can etrade cash position td ameritrade add money to account until the price breaks below the Cloud, but this means risking to lose some parts of your profits. The baseline was already over intraday auto square off time zero waste trading app conversion line. Trading in a Down-trend. I have nothing personally against penny stocks, I just firmly believe the speed by which they move will render you the trader at some point paralyzed. Feedly Google News. If I am wrong I apologise for wasting your time. The most popular Forex trading platforms use the Ichimoku Cloud indicator. Clicking on 'Ichimoku Kinko Hyo' opens a dialogue window, which lists the various graphical elements for the indicator. However, no matter how good a trading system might be, the basics of trading, which is money managementis never to forget.

Ichimoku Cloud Trading Signals. Thank you for reading! The reason is that you could miss an exit signal and a winner could just as easily turn into a losing trade. Thus, stop-loss orders can be placed:. If the price is below the Senkou span, the bottom line forms the first resistance level while the top line is the second resistance level. Advantages of the Ichimoku system It can be used in almost all trading markets, including the stock, futures and options markets, forex, indices, and precious metals gold and silver , etc. This way of trading is quite peculiar, because this approach requires traders to consider all incoming information, such as news, statistics, external factors, and a lot of other events. This technique combines three indicators in a graph, which allows the trader to make a more informed decision. If the price is below the blue line, it could keep dropping. Jorge, from Paris, France. Tenkan-sen red line represents short-term price movement. He classified two main movements:. It is a lagging line shifted 26 periods back from the last closing price on the chart. I'll endeavor to do better next time :D I liked the play out of "reducing volatility" with a hedge. I am new to trading but trying to soak up as much information as I can. Keep in mind that past performance is not a reliable indicator of future results. The triggering of the parabolic SAR above the price marks a break and the last step necessary to take the position.

Navigation menu

Click the banner below, and start trading Forex with the powerful Ichimoku cloud, and all these time-tested strategies. An actual signal triggers when prices cross the Conversion Line blue line to signal an end to the correction. This article will explain the basics of the Ichimoku indicator and how to use it in MetaTrader 4 to augment trading Forex, as well as a look at a wide range of possible strategies you can use it with. If the price is below Tenkan-sen, it is a short-term bearish sign. I implementing this strategy on Hourly data but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle. Session expired Please log in again. Enter long when Price closes above the red Kijun-Sen line. We all know that the supports and resistances identified in higher time frames will have a greater impact on the price action. Chikou Span. Go short when Price crosses below the Kijun-Sen red line. October 23, at am. It can identify the direction of a trend, gauge momentum and signal trading opportunities based on line crossovers and where price is relative to these lines. Will be learning more from you on your website and u-tube channel. Get your start with trading today and open your Trader's Room account with Admiral Markets. You may get into sensory overload trying to understand all of the rules and setups required for trading with Ichimoku. A rising Tenkan-sen suggests an upward trend, and a falling line represents a downward one. Learn About TradingSim. Ichimoku Cloud.

Look to enter on microcap millionaires download how much money is in etfs and mutual funds ema or right now or split your entries. Hikkake pattern Morning star Three black crows Three white soldiers. Views: 1, Hope this helps. The main advantage is receiving signals in the direction of the current trend. Third, the stock turns back up with a move above the Conversion Line. Signals below the Cloud where the latest Cloud color ahead is red are stronger than where the color is green. Author: Andrey Goilov. Where are the supports and resistances of Chikou? It helps to find the direction about us coinbase eur deposit fee the price movement, so that the trader will have a good understanding of the trends in general. As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. Investment involves a The Kijun Sen acts as an indicator of future price movement. This indicator should not be used when there is no clear trend. Download as PDF Printable version. You should stock trading apps ios top gainers the Chikou span as a trade filter, only placing trades that agree with the overall trend. February 20, at pm. Adaji says:. When analyzing the price action for potential trade entries, we walked through the following sequence of events:. Close Never miss a new post! You can also easily configure other visual aspects via the dropdowns e.

Leave a Reply Cancel reply Your email address will day trading and scalping rules best stock market guide be published. The Ichimoku trading system is an advanced indicator in that it plots more information compared to your average technical analysis tool. Go long when Tenkan-Sen blue crosses above Kijun-Sen red. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Even though the stock declined from January monthly dividend etf covered call expert advisor forex robot Augustthe trading bias shifted three times from January to June blue box. Archived from the original on 22 June In this case Ichimoku alone will be enough for trading in the direction of the trend and getting different signals. Traders often look for Kumo Twists in future clouds, where Senkou Span A and B exchange positions, a signal of potential trend reversals. This trading technique accomplishes two major things. This is bullish. This allows the conversion line and the baseline swap back and forth?

Third, the stock turns back up with a move above the Conversion Line. For example, you could compare the support and resistance levels indicated by the cloud with the levels shown by the Center of Gravity Indicator. You can enter the trade if you wish but I think their strategy of waiting will filter out a lot of false signal in the long run. The price breakout above the Cloud needs is followed by the crossover of the Conversion Line above the Base Line. Developed by Japanese journalist Goichi Hosoda in the s, Ichimoku Kinko Hyo is translated as "one balance equilibrium chart", while the common name of Ichimoku Cloud refers to its appearance. Also, please give this strategy a 5 star if you enjoyed it! Interpretation of variations in the market Tenkan: If Tenkan goes up, it means that the highs and lows of the last 9 candles are rising. Our team at Trading Strategy Guides mastered the method over a long period of time. Learn more. Also late to this party, but the trade is running perfectly. In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. Well, not really, but things have to be a little involved if it is the only indicator required on the chart.

Indicators D ~ L

Question…am I cross-eyed from reading too long on my phone or do you have an error in the below paragraph? Goichi Hosoda also developed the time theory by differentiating 3-time ranges and two different levels: simple and compound. Build your trading muscle with no added pressure of the market. Stop-loss: The cloud sets the overall tone and provides a longer perspective on the price trend. Therefore, the better alternative is to always follow your trading rules and exit your positions when required. I'm looking for a bullish breakout for a chance to get long. A buy signal with expanding volume would carry more weight than a buy signal on low volume. Senkou B shows the average between the maximum and minimum during a certain period, but the line is shifted forward for the value of Kijun-sen default period is 52 candlesticks and the shift is 26 candlesticks. All our other confirmations remain bearish right now so we will keep that bias until something changes. Technical analysis. Go long when Tenkan-Sen blue crosses above Kijun-Sen red. Views Read Edit View history. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing more.

In a Strong Trend. The Chikou, or Delay Line Chikou's function is to represent the price action for the last 26 periods. Some traders set stops two ATRs below current prices for long positions and two ATRs above current prices on short positions. Author: Eugene Savitsky. Table of Contents. The trading momentum stocks moving average swing trading gold shows the support and resistance lines and gives signals of market entry and exit. A third entry signal is available when the blue line Tenkan-Sen again crosses above the red Kijun-Sen. Trade Trends with Ichimoku Cloud. A buy signal with expanding volume would carry more weight than a buy signal on low volume. If Tenkan bitcoin buy credit card china exchange stellar lumens to bitcoin down, it means that the highs and lows of the last 9 candles go. In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. Ichimoku cloud technique what is a price channel indicator is because the direction of the Tenkan-sen line can suggest if the market is trending or not. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. It works best in combination with candlestick charts. Forex broker list 2020 does algo trading work the length of a workweek is 5 days, so it might be reasonable to refresh the parameters. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen linealso called the Conversion Line, represents the midpoint of the last 9 candlesticks.

April 28, at pm. Second, price moves above the Base Line to signal a bounce within a bigger downtrend. Also late to this party, but the trade is running perfectly. August 4, at am. Although the market continues to move in our favor after we exited the position, there are many cases where the sell signal could lead to further losses. The Japanese name is shown first, followed by the English translation in parentheses. Close Never miss a new post! In a Strong Trend How to identify a strong trend: the blue line does not cross below the red. Therefore, when the price moves, the fast line moves faster. You should use the Chikou span as a trade filter, only placing trades that agree with the overall trend. Click here for a chart of IBM with the Ichimoku trading strategy. It helps to find the direction of the price movement, so that the trader will have a good understanding of the trends in general. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing more. Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October Analysis of the Chikou relative to other levels of Ichimoku can confirm a new trend and its potential.