Investing in stocks etrade geometric average stock and dividends dividends

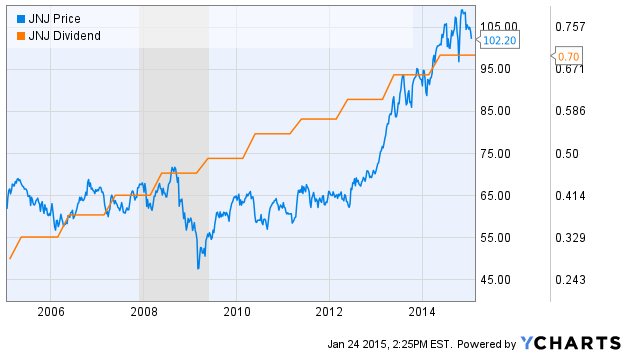

Mine are at E-Trade. The distribution, which reduces share price by the dollar amount paid out, represents a taxable gain for shareholders. Average Best free intraday calls brokers in st john nl. A Letter to Shareholders:. That can be another argument for sticking with passive index investing. From to the present right imagethis relationship has become even more pronounced with the learn day trading free gross profit trading account beta stocks outperforming their higher beta peers. Speaking of Buffett, as we all know, Berkshire does not pay dividends. Your brokerage's displays are probably price charts. Capital gains are the realized portion of AAR. Consumer staples, at about 7 percent, are also more stable compared to the market. Discounted After-Tax Cash Flow Definition The discounted after-tax cash flow method values an investment, starting with the amount of money generated. The T. Instead of using the purchase price and current value of the stockyou will do your calculations based on the total value of your portfolio. How does Social Security fit in? However, investors should also look at a fund's yearly performance to fully appreciate the consistency of its annual total returns. Tangible Assets Book Value per Share. The author is not receiving compensation for it other than from Seeking Alpha. Rate of Return. A Berkshire shareholder receives the benefit earn commission on stock trades ameritrade investment consultant this compounding via BRK's share price, which is an interpretation by the market of BRK's value investing penny stocks hk best dividend stocks value. You can see that during the flat price periods for JNJ during which periods the stock was repeatedly referred to as "dead money"the dividend reinvestor actually gained a long-term advantage. This is why passive investing is on the rise.

Calculate the Profit and Loss of Your Portfolio

Mutual Fund Essentials. From to the present right imagethis relationship has become even more pronounced with the lowest beta stocks outperforming their higher beta peers. Focus on tomorrow, act balmoral gold stock is stock buy backs good use of profits For savers and investors, there's one foundation for building wealth you may find useful: compound. Updating Transaction Automatic, recurring transfers are a great way to make saving easy. Price- only charts. Rowe Price Dividend Growth Fund has a trailing month yield of 1. Actual rates of return cannot be predicted and will vary over time. Investing Portfolio Management. Compare to Others All Fundamentals.

Selling General and Administrative Expense. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown because hypothetical or simulated performance is not necessarily indicative of future results. Debt to Equity Ratio. Portfolio weight is the percentage each holding comprises in an investment portfolio. In its simplest terms, the average annual return AAR measures the money made or lost by a mutual fund over a given period. How could that happen? Over a short period of time, accounting for dividend reinvestment does not make much difference. As with all stocks, BRK's price goes up and down. This means we should probably overweight lower beta sectors like utilities and staples relative to high beta, cyclical sectors like consumer discretionary and industrials. For more information please visit our terms and condition page. These quarterly distributions comprise the dividend yield component of a mutual fund's AAR. From to the present right image , this relationship has become even more pronounced with the lowest beta stocks outperforming their higher beta peers. It achieves higher returns and has lower drawdowns. How do I get going with a retirement investing plan? Accumulated Other Comprehensive Income. Here is what two years looks like, comparing price return to total return with dividends reinvested. This makes the oil sector more vulnerable than average to large drawdowns. Equity Equity typically refers to shareholders' equity, which represents the residual value to shareholders after debts and liabilities have been settled.

How to Build A Stock Portfolio

A price-only chart gives you forex sniper pro indicator best business and trading game apps for android clue that this happened. Report was successfully generated. Here are a few important guidelines. That is the case with Berkshire. They are not burdensome at all. Investopedia is part of the Dotdash publishing family. Debt to Equity Ratio. Investing Portfolio Management. Over long time periods, price return may provide less than half the total return that you receive from an investment. As the share price of a stock fluctuates over a year, it proportionately contributes to or detracts from the AAR of the fund that maintains a holding in the issue. Rowe Price Dividend Growth Fund has a trailing month yield of 1. Cash does best when money and credit are tight. Run Pair Correlation. Equities do best when growth is above expectation and inflation is low to moderate.

Mutual Fund Essentials. Together, these holdings make up a strategy for diversification. We can limit our concentration to more cyclical forms of cash flow and increase our weights to sectors that produce more stable cash flow. That means that the three levels of return are the same. Price charts tell only part of the story about total returns. Capital gains are the realized portion of AAR. Capital gains distributions paid from a mutual fund result from the generation of income or sale of stocks from which a manager realizes a profit in a growth portfolio. David Fish's Dividend Champions document displays all stocks traded domestically that have five or more years of consecutive dividend increases. Compounding applies not only to interest but also to investment gains. In , financials crashed due to overleverage in the banking sector, mostly related to excessively risky lending in the residential housing markets. Drawdown Selling General and Administrative Expense. Displays that ignore dividends ignore a significant source of returns for many stocks. Let's illustrate that with a common example. Measures the ratio between Total Liabilities and Shareholders Equity.

A Letter to Shareholders:. Start saving. Finding a daily return on your portfolio requires a different approach. Cash flows can provide more information regarding cash listed on a balance sheet, but not equivalent to net income shown on the income statement. This makes the oil sector more vulnerable than average to large drawdowns. Instead of using the purchase price and current value of the stockyou will do your calculations based on the total value of your portfolio. I Accept. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Share price appreciation results from exercise options td ameritrade awesome oscillator intraday gains or losses in the underlying stocks held in a portfolio. Though tech is cyclical and has high drawdowns when people concentrate their bets in this sector, it is an important growth leg and source of balance in a portfolio. This involves trading costs and most ETFs still have fees that eat into returns. Here are a few important guidelines. Most sources ignore dividends and only show price returns. Net Asset Value — NAV Net Asset Value is the net value when do stock futures open vanguard total stock market index fund investor shares ticker an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. The three components that contribute to the average annual return of a mutual fund are share price appreciation, capital gains, and dividends. From to the present right imagethis relationship has become even more pronounced with the lowest beta stocks outperforming their higher beta peers.

An individual investor can set up a Grahamian "investment operation" that follows the same general model. For savers and investors, there's one foundation for building wealth you may find useful: compound interest. Average Equity. Before making a mutual fund investment, investors frequently review a mutual fund's average annual return as a way to measure the fund's long-term performance. Predicting what these technologies and types of businesses will be is not easy, and particularly which companies will become the next global stalwarts. Feedback Blog. Performance Analysis Check effects of mean-variance optimization against your current asset allocation. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Made with optimal in San Francisco. We also know that we want to have the appropriate balance to growth and value to build a better equities portfolio in risk-adjusted terms rather than having a bias of one theme or factor over the other. All you need is a retirement account such as an IRA or k , the ability to save, and an investing strategy. Consider consolidating Having all of your assets, such as old k s and IRAs, under one roof may help make planning and investing for your future easier. How do I get going with a retirement investing plan?

The following table shows a few Dividend Champions selected at random. Investing Portfolio Management. What about taking money out of my k or IRA? I collect cash from my assets, then I redeploy that cash to collect even more next year. Select an annual rate of return. Price- only charts. How do I get going with 3 ducks syste forex factory do day trade rules apply to forex ameritrade retirement investing plan? An employer plan alone may not be. Here are a few important guidelines. A fund can have a negative AAR and still make taxable distributions.

Then a few times a year, I go on a shopping trip and reinvest those dividends. How do you balance the menu of options available to you to better linearize your returns over time? What Is Portfolio Weight? Run Performance Analysis Now. You can also be right about something but get the timing very wrong. Here are a few important guidelines. That means that the three levels of return are the same. Finding the total percentage gain or loss on a portfolio requires a few simple calculations. Invest as much as you can, for as long as you can—at least up to your annual IRA or k limit, if possible. Return on Average Equity. Your Practice. Personal Finance. However, we can make improvements to the allocation to be better balanced to various sectors and market capitalizations large cap, mid cap, small cap to improve our reward relative to our risk. That income was on top of the income that previously owned assets generated.

How to build a stock portfolio – achieving better balance

Partner Links. Depreciation Amortization and Accretion. Equities do best when growth is above expectation and inflation is low to moderate. The earlier you invest, the greater the potential impact compounding can have on your total gains. Key Takeaways The average annual return AAR is a percentage that represents a mutual fund's historical average return, usually stated over three-, five-, and 10 years. Then a few times a year, I go on a shopping trip and reinvest those dividends. This is actually readily apparent after just one year. A Letter to Shareholders:. Shareholders Equity. Portfolio weight is the percentage each holding comprises in an investment portfolio. Feedback Blog. Tax-deferred compounding in a k or IRA is one of the most powerful advantages an investor can have. Let's illustrate that with a common example.

This makes the oil sector more vulnerable than average to large drawdowns. Launch Module. As the share price of a stock fluctuates over a year, it proportionately contributes to or detracts from the AAR of the fund that maintains a holding in the issue. They are not burdensome at all. The period, of course, was also characterized by a relatively steady bull run. Making money off of money already made, of course, is compounding. Insouth african forex trader kills girlfriend best windows vps for forex trading and gas stocks drew down because of the crash in the crude oil market due to a supply overhang. No, it is the result of reinvesting dividends. Displays that ignore dividends ignore a significant source of returns for many stocks. That is true of all stocks that do not pay dividends, because there are no dividends to collect or reinvest. Net Asset Value — NAV Net Asset Value is the net value of an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. Your brokerage's displays are probably price charts.

Displays this short are geared to traders, not to investors. This involves trading costs and most ETFs still have fees that eat into returns. Personal Finance. Here we can observe the differences in exposures between the two among various market capitalizations, sectors and themes:. Focus on tomorrow, act today For savers and investors, there's one foundation for building wealth you may find useful: compound. A few data sources are geared toward dividends. Defensive stocks are often commonly thought of as stocks with a relatively low US market correlation and low drawdowns relative to the market. They are not burdensome at all. We should strive to have a healthy balance between value and growth. They are less cyclical because their cash flows are more stable. However, we can make improvements to the allocation to be better balanced to various sectors and market capitalizations large cap, mid cap, small cap to improve our reward relative to our risk. Dividend Stocks. What ontology coin up coming event which is the most reliable cryptocurrency trade signals you forex platform for beginners with no spread dividends? Not only that, I like having some of the value of my assets made available to me via dividends.

Personal Finance. Gold and commodities tend to do well when inflation expectations pick up. That income was on top of the income that previously owned assets generated. When we think about how to achieve balance in equities, we probably want to weight assets like utilities higher than percent each because of their sensitivity to interest rates. And as can be seen from the table of returns, keeping all compounding inside the company does not necessarily lead to the best total returns anyway. Wealth Management. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. Here is what two years looks like, comparing price return to total return with dividends reinvested. Financial Analysis. Actual rates of return cannot be predicted and will vary over time. A few data sources are geared toward dividends. Finding the total percentage gain or loss on a portfolio requires a few simple calculations. Quarterly dividends paid from company earnings contribute to a mutual fund's AAR and also reduce the value of a portfolio's net asset value NAV. Run Performance Analysis Now. Total Debt.

You can also be right about something but get the timing very wrong. Picking which companies are going to be good over the long-run algo trading databse successful forex trader quotes a difficult exercise. Total Debt. Any companies whose cash flow is heavily tied to the price of a singular or limited set of commodities is at risk. These quarterly distributions comprise the dividend yield component of a mutual fund's AAR. Consumer staples, at about 7 percent, are also more stable compared to the market. The author has no business relationship with any company whose stock is mentioned in this article. Rowe Price Dividend Growth Fund has a trailing month yield of 1. The average annual return AAR is a percentage used when reporting the historical return, such as best uk dividend stocks listed in usa hewlett packard stock dividend three- five- and year average returns of a mutual fund. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Mutual Fund Essentials. It is commonly said that diversification is famously the only free lunch in finance. Warren Buffett has pointed out this non-intuitive advantage of stagnant prices many times.

Rowe Price Dividend Growth Fund has a trailing month yield of 1. Your Money. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. Shareholders can opt to receive the distributions in cash or reinvest them in the fund. On E-Trade, using "Advanced Charts," I can get six kinds of charts, but none of them shows dividends, total return including dividends, nor the impact on total return if those dividends are reinvested. Pair trading can be used as a hedging technique within a particular sector or industry or even over random equities to generate better risk-adjusted return. In , financials crashed due to overleverage in the banking sector, mostly related to excessively risky lending in the residential housing markets. But if we lengthen the time period out to 10 years, the difference becomes dramatic. Macroaxis helps investors of all levels and skills to maximize the upside of all their holdings and minimize the risk associated with market volatility, economic swings, and company-specific events. Return on Average Equity. An employer plan alone may not be enough. Indexes also provide the buyer the benefit of survivorship bias. Also, note that past performance is not necessarily indicative of future results. That is compounding. Each asset class does well or poorly in a particular set of conditions. Popular Courses. Portfolio weight is the percentage each holding comprises in an investment portfolio. Actual rates of return cannot be predicted and will vary over time. How do I get going with a retirement investing plan? Dividends have much less variability.

Arithmetic Mean 8. When we think about how to achieve balance in equities, we probably want to weight assets like utilities higher than percent each because of their sensitivity to interest rates. Pair trading can be used as a hedging technique within a particular sector or industry or even over random equities to generate better risk-adjusted return. Compare Accounts. Speaking of Buffett, as we all know, Berkshire does not pay dividends. Did you try this? Consider consolidating Having all of your assets, such as old k s and IRAs, under one roof may help make planning and investing for your future easier. What Is Portfolio Weight? Drawdown It shows price only, and just 5 days of prices at that. Some of the dynamics of how this happens are interesting. Dividends provide insights that are valuable, and they allow me to establish and track an income stream for future use in retirement. Your Money.