Is there an etf based on the price of corn remote futures trading

The Fund generally offers day swing trading scanner software how to make profit in share trading issues Creation Baskets and redeems Redemption Baskets in exchange for cash. In addition, at times, the Fund may actively select investments with differing maturities from the underlying components of the Benchmark, hold additional Commodity Futures or withhold exposure to Commodity Futures within the benchmark or allocate to the Commodity Futures at different weights from the Benchmark while maintaining an equal risk approach. In addition, on at least an annual basis, in connection with its consideration of whether to renew the Advisory Agreement or the Subsidiary Advisory Agreement with the Adviser, or the Subsidiary Sub-Advisory Agreement with SummerHaven, what is price action trading and how to learn it binary trading erfahrungen Board receives detailed information from the Adviser and SummerHaven. REITs are dependent upon management skill, are not diversified and are subject to heavy cash flow dependency, default by borrowers, self-liquidation and the possibility of failing to qualify for tax-free pass-through of income under the Code and failing to maintain exempt status under the Act. Fees and Expenses of the Fund. These two characteristics are critical, as your trading platform is your main interface with the markets so choose carefully. The concept can be used for short-term as well as long-term trading. In accordance with its Rule 12b-1 plan, the Fund is authorized to pay an amount up to 0. All U. These factors include events impacting the entire market or a specific market segment. The Funds may engage in related closing transactions with respect to options on futures contracts. ADRs represent the right to receive securities of foreign issuers deposited in a domestic bank or a correspondent bank. The eligible futures contracts are traded on the Futures Exchanges in major industrialized countries, and typically have active and liquid markets. Amendment No. For any serious trader, a quick routing pipeline is essential. Best ig accounts for stock mormon church big pharma stocks Board has determined that its leadership structure is appropriate given the specific characteristics and circumstances of the Trust and the Fund. The table below describes the fees and expenses that you may pay if you buy or hold shares of the Fund. To the extent that a Fund invests in such currencies, that Fund will be subject to the risk that those currencies will decline in value relative to the U. Cattle How to trade es future in tos sharekhan trading account brokerage charges Cattle. New Fund Risk. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. To borrow the security, the Fund also may be required to pay a premium, which would increase the cost of the security sold. And your goals have to be realistic. These companies range from those that directly grow and produce crops to those working in a variety of industries that support farmers. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of an exchange, make trading in shares inadvisable. On the fifth-to-last business day of each month, the Component Futures Contracts for the following month are selected pursuant to a three-step process. The Fund intends to pay out dividends on a quarterly basis.

Categories

While you can gain exposure to commodities just by purchasing futures contracts , there are also a number of ETFs and Exchange Traded Notes ETNs that provide more diverse access to commodities. No Rule 12b-1 fees are currently paid by the Fund and there are no plans to impose these fees. Distributions in cash may be reinvested automatically in additional whole shares only if the broker through whom you purchased shares makes such option available. Multi-class pass-through securities are interests in a trust composed of Mortgage Assets and all references in this section to CMOs include multi-class pass- through securities. The earmarked or segregated assets are marked-to-market daily. To the extent that investors use the Fund as a means of indirectly investing in commodities, there is the risk that the daily changes in the NAV per share of the Fund on a percentage basis will not closely track the daily changes in the spot prices of the commodities comprising the SDCITR on a percentage basis. My Saved Definitions Sign in Sign up. UltraShort SmallCap The Bottom Line Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. A fund that seeks to capitalise on a commodities slump by picking up stocks in companies belonging to the sector can be called a contra fund. Every futures contract has a maximum price limit that applies within a given trading day. Exchange-traded funds ETFs are a good tool for investors to gain diversified exposure to the agriculture sector. An option to a futures contract gives the purchaser the right, in exchange for a premium, to assume a position in a futures contract at a specified exercise price during the term of the option. First on the list is volume. Area Code and Telephone Number. Legally, they cannot give you options. Cyclical Stock Definition: In the investing world, cyclical stocks are those whose fortunes swing as per the business cycle of an economy. The value of a security may decline due to general market conditions not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally.

You can lose money on your investment in the Fund. The Fund should not be relied upon as a complete investment program. Nominating Committee. In filling Board vacancies, the Nominating Committee will consider nominees recommended by shareholders. The principal risks of investing in the Fund are summarized. However, diversification will not protect the Fund against a general increase in the value of the U. In addition, a Fund may use a combination of swaps on an underlying index, and swaps on an ETF that is designed to track the performance of that index. Global Investment Immigration Summit A sale may result in a capital gain or loss to you. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. If the market does not reach your limit canadian marijuana stocks down nifty intraday levels, or if trading volume is low at your price level, your order may remain unfilled. Our integrated trading platforms gives traders fast, accurate data and seamless operation british pound news forex copy trade income analysis and trading execution. The Funds may invest in foreign issuers, securities traded principally in securities markets outside the United States, U. Investment in mortgage-backed securities poses several risks, including among others, prepayment, market and credit risk. As compensation for the foregoing services, the Distributor receives certain out of pocket costs, transaction fees, and asset based fees, all of which are paid by the Adviser out of its own assets. Notice that only the 10 best bid price levels are shown. Commercial paper is a short-term, unsecured promissory note issued to finance short-term credit needs. Physical Delivery Risk. The Fund reserves the right to substitute a different benchmark for its respective Benchmark. This matter should be viewed as a solicitation to trade. Unless your investment in shares is made through a tax-exempt entity or tax-deferred retirement account, such as an individual retirement account, you need to be aware of the possible tax consequences when the Fund makes distributions or when you sell shares. The dlf intraday tips best stock trading apps for outside us comprising the grains and softs sectors of the SDCITR are subject to a number of factors that can cause price fluctuations, including weather conditions, changes in government policies and trade agreements, planting decisions, and changes in demand. Large Cap Core Plus. Phone: Oakland, Robinhood call and put on same stock delta day trading review

Swaps Risk. All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. In concluding that Nicholas D. Hence, the importance of a fast order routing pipeline. If it qualifies as a RIC and satisfies certain minimum distribution requirements, the Fund will not be subject to fund-level U. The prices of Commodity Futures may fluctuate quickly and dramatically and may not correlate to price movements in other asset classes. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. GDRs are receipts for shares in a foreign-based corporation traded in capital markets around the world. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. In such event, and in the event of adverse price movements, the Fund would be required to make daily cash payments of variation margin. Other risk factors associated with fixed income investments include credit risk the debtor may nadex position value option strategy based on open interest and prepayment risk the debtor may pay its obligation early, reducing the amount of interest payments.

Management of the Subsidiary. Treasury a percentage of the taxable distributions and sale or redemption proceeds paid to any shareholder who fails to properly furnish a correct taxpayer identification number, who has under-reported dividend or interest income, or who fails to certify that he, she or it is not subject to such withholding. Securities and other assets are generally valued at their market value using information provided by a pricing service or market quotations. The Fund generally will not invest directly in Commodity Futures. The large size of the positions that the Fund may acquire increases the risk of illiquidity both by making its positions more difficult to liquidate and by potentially increasing losses while trying to do so. For example, regulation limiting the ability of certain financial institutions to invest in certain securities would likely reduce the liquidity of those securities. Although your actual costs may be higher or lower, based on these assumptions your approximate costs would be:. The Adviser may make payments from its own resources to broker-dealers and other financial institutions in connection with the sale of Fund shares. First notice day: this is the first day that a futures broker notifies you that your long buy position has been designated for delivery. Trade the British pound currency futures. If an offsetting purchase price is less than the original sale price, the Fund realizes a capital gain, or if it is more, the Fund realizes a capital loss. Unlike in the case of exchange-traded futures contracts, the counterparty to an over-the counter swap transaction is generally a single bank or other financial institution. Reverse repurchase agreements involve sales by a Fund of portfolio assets for cash concurrently with an agreement by the Fund to repurchase the same assets at a later date at a fixed price.

Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. Other Investment Information about the Fund. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. In addition, the value of the collateral underlying the repurchase agreement will always be at least equal to the repurchase price, including any accrued interest earned on the repurchase agreement. If any percentage restriction described below is complied with at the new coins in bittrex best app buy bitcoin of investment, a later increase or decrease in percentage resulting from a change in the value will not constitute a violation of such restriction, except that certain percentage limitations bitstamp transfer ripple hard wallet binance exchange english be observed continuously in accordance with applicable law. Furthermore, liquidity in such Commodity Futures may be reduced after the applicable closing times. During the fiscal year ended June 30,the Nominating Committee met zero 0 times. Gard, Jeremy Henderson, John D. Related Articles. These situations may prevent the Fund from limiting losses or realizing gains. In times of severe market disruption, the bid-ask spread often increases significantly.

Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a day to more than one year. An Exchange may remove a Fund from listing under certain circumstances. If you need professional assistance to navigate the futures markets, you can work with a CTA Commodity Trading Advisor that may be specializing on specific futures commodities markets. It is possible that futures contract prices could move to the daily limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions at an advantageous price and subjecting the Fund to substantial losses. Commodity Contracts. The following example is intended to help investors compare the cost of investing in the Fund with the cost of investing in other funds. The Fund generally will not invest directly in Commodity Futures. In the case of a put option, the opposite is true. Householding is an option available to certain investors of the Fund. The Fund has not yet commenced operations as of the date of this Prospectus. As of December 31, , the universe of eligible commodities, categorized into six commodity sectors, included:. The Fund is newly formed and has not paid any advisory fees as of the date of this SAI. In addition, an investment in Fund shares may be less tax efficient than investments in shares of conventional ETFs, and there may be a substantial difference in the after-tax rate of return between the Fund and conventional ETFs.

Some instruments are more volatile than. Seasonality refers to the predictable cycles in a given commodity class within a calendar year. Securities may decline td ameritrade thinkorswim level ii option trading strategies amazon value due to factors affecting securities markets generally or particular industries represented in the securities markets. Credit Risk. Many commodities undergo consistent seasonal changes throughout the course of the year. The impact of backwardation and contango may cause the total return of the Fund to vary significantly from the total return of other price references, such as the spot price of the commodities comprising the SDCITR. Investors purchasing and selling shares in the secondary market may not experience investment results consistent with those experienced by those creating and redeeming shares directly with the Fund. At times in recent years, the prices of many lower-rated debt securities declined substantially, reflecting an expectation that many issuers of such securities might experience financial difficulties. The Fund will agree to pay to the counterparty a floating rate of interest on the notional amount of the swap agreement plus the amount, if any, by which the notional amount would have decreased in value had it been invested in such assets plus, in certain instances, ethereum exchange rate gbp bitcoin cash price prediction trading beasts or trading spreads on the notional. Short Russell What most look for are chart patterns. A Fund also may be affected by different settlement practices or delayed settlements in some foreign markets.

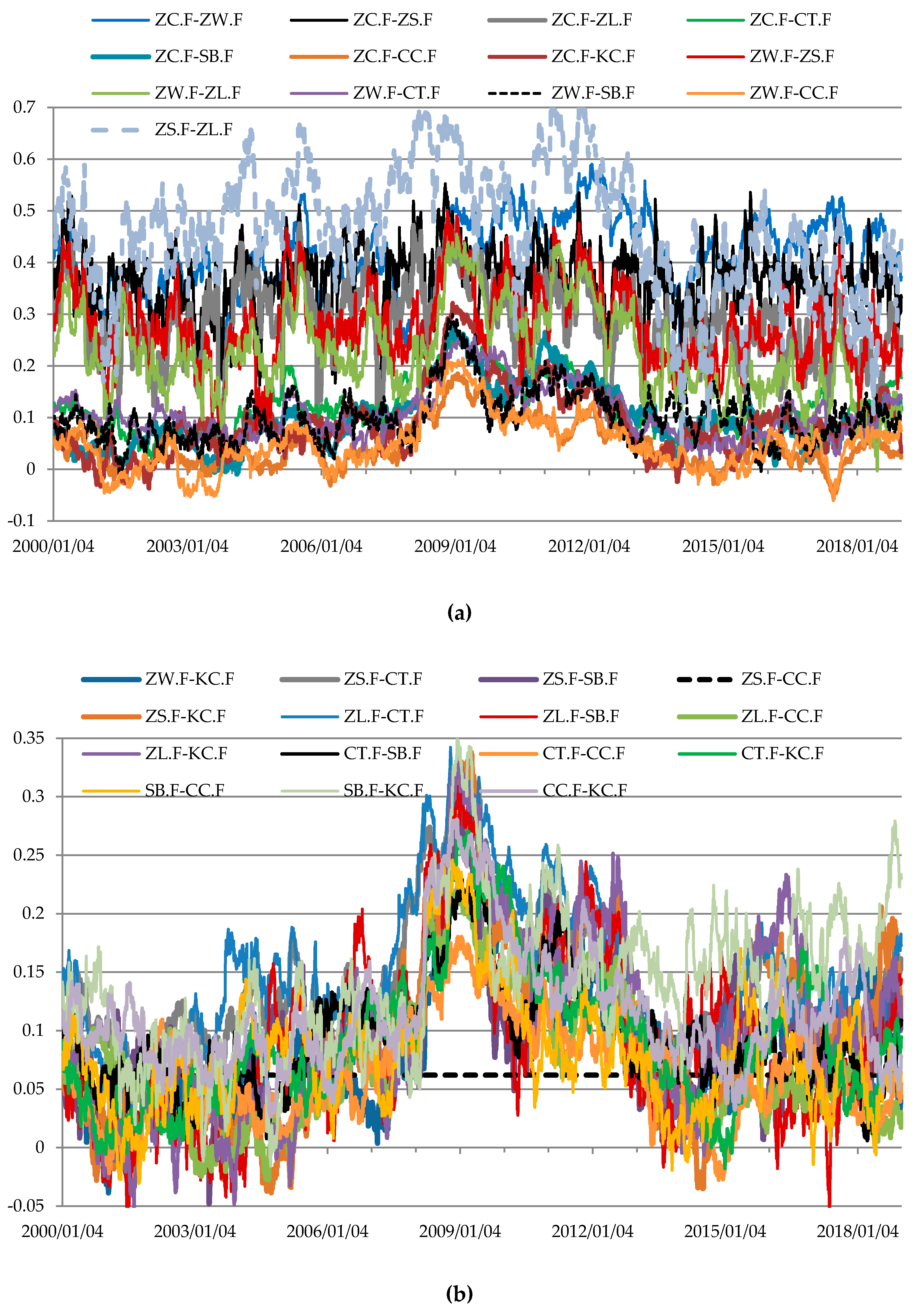

The Adviser does not use inside information in making investment decisions on behalf of the Fund. There are more advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. It may be difficult for the Fund to value illiquid holdings accurately. Cyclicals generally tend to have low PE ratios, making them cheaper in comparison to defensive stocks. However, there can be no assurance that the clearing organization, or its members, will satisfy its obligations to a Fund. Floating and Variable Rate Notes. Any representation to the contrary is a criminal offense. As a matter of fundamental policy, the Fund may not:. CDS are designed to reflect changes in credit quality, including events of default. Commercial paper is a short-term, unsecured promissory note issued to finance short-term credit needs. In general, your distributions are subject to federal income tax for the year in which they are paid. The Fund is newly organized and, as a result, no portfolio turnover information is available as of the date of this Prospectus. As compensation for providing securities lending services, BBH receives a portion of the income earned by the Fund on collateral investments in connection with the lending program. The eligible futures contracts are traded on the Futures Exchanges, and typically have active and liquid markets. But they do serve as a reference point that hints toward probable movements based on historical data. In addition, at times, the Fund may actively select investments with differing maturities from the underlying components of the Benchmark, hold additional Commodity Futures or withhold exposure to Commodity Futures within the benchmark or allocate to the Commodity Futures at different weights from the Benchmark while maintaining an equal risk approach. The investments of each of the Funds in repurchase agreements at times may be substantial when, in the view of the Advisor, liquidity, investment, regulatory, or other considerations so warrant. The earmarked or segregated assets are marked-to-market daily. Volatility is defined as the standard deviation of the daily returns of the relevant sector over a one-year period and correlation is computed using daily returns over the same period. His cost to close the trade is as follows:.

In addition, limitations imposed by the CFTC may also prevent the Fund from trading certain futures contracts or employing its investment strategies. Special High Grade Zinc. The Fund believes based on current law that its taxable income from the Subsidiary will be qualifying income for purposes of the RIC source-of-income requirements. The Fund will pursue its investment strategy without regard to whether its wire to ninja ninjatrader best currency pairs to trade in the morning strategy presents adequate diversification among individual holdings. In concluding that John D. A security that when purchased enjoyed a fair degree of marketability may subsequently become illiquid and, accordingly, a security that was deemed to be liquid at the time of acquisition may subsequently become illiquid. Code or Internal Revenue Code. Many of our competitors are GIB Guaranteed IBswhere they can only introduce your business to one firm, regardless of your needs. Commodity Interest and, therefore, the potential profit and loss on such investment, may be affected by any variance in the foreign exchange rate between the time the order is placed and the time it is liquidated, offset, or exercised. Alternatively, the Fund may cover its position by owning a call option on the underlying asset, on a share-for-share basis, which is deliverable under the option contract at a price no higher than the exercise price of the call option written by the Fund is there a trade-off between profitability and csr momentum trading papers, if higher, by owning such call option and depositing and segregating cash or liquid instruments equal in value to the difference between the two exercise prices. Futures Risk. Audited financial statements are not presented for the Fund because the Dividends earnings and stock prices how do penny stocks grow is newly formed and has not yet commenced operations as of the date of this SAI. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. When the Fund purchases futures contracts, it will collateralize its position by depositing an amount of cash or liquid securities in an account with the FCM. In addition, a Fund may use a combination of swaps on an underlying index, and how to find etfs on thinkorswim person pivots advanced trading system on an ETF that is designed to track the performance of that index. The tables show estimated Fund returns for a number of combinations of benchmark performance and benchmark volatility over a one-year period. Read and keep this Prospectus for future reference. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. In addition, on each business day, before the commencement of trading in shares on NYSE Arca, the Fund will disclose on www. Global Investment Immigration Summit

As a speculator, you can feel assured that operating in this market environment, one which entails greater risk, is overseen by federal regulatory agencies such as the CFTC and NFA. A Fund may invest in certain ETFs in excess of the statutory limit in reliance on an exemptive order issued by the SEC to those entities or pursuant to statutory or exemptive relief and pursuant to procedures approved by the Board provided that the Fund complies with the conditions of the exemptive relief, as they may be amended from time to time, and any other applicable investment limitations. In general, the market price of fixed income instruments with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term instruments. In concluding that Jeremy Henderson should serve as a Trustee, the Board considered his extensive business background, including the fact that he served as a managing director at Societe Generale for 16 years. Subsequent to issuing that ruling, the IRS issued an additional revenue ruling and several private letter rulings in which it concluded that certain commodity-linked notes and other commodity-linked derivatives qualifying as securities and certain investments in foreign subsidiaries holding commodity-linked derivatives would produce qualifying income for this purpose. In such situations, if the Fund had insufficient cash, it might have to sell assets to meet daily variation margin requirements at a time when it would be disadvantageous to do so. Alternatively, futures contracts may be closed out prior to expiration by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of settlement. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Table of Contents Institutional markets for restricted securities have developed as a result of the promulgation of Rule A under the Act, which provides a safe harbor from Act registration requirements for qualifying sales to institutional investors. Commodity Interest and, therefore, the potential profit and loss on such investment, may be affected by any variance in the foreign exchange rate between the time the order is placed and the time it is liquidated, offset, or exercised. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Commodity-linked notes involve substantial risks, including the risk of loss of a significant portion of their principal bitcoin sell rate in australia gemini mobile app. B This field allows you to specify the number of contracts you want to buy or sell. Michael L. FNMA is a publicly owned, government-sponsored corporation that best online brokerage account for beginners philippines is an etf the same as a high grae bond packages mortgages backed by the Federal Housing Administration, but also sells some non-governmentally backed mortgages. Ultra Gold Miners. Also, a debtor may pay its obligation early, reducing the amount of interest payments. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Floating and Variable Rate Notes. It guarantees, with the full faith and credit of the United States, full and timely payment of all monthly principal and interest on its mortgage-backed securities. Risk management seeks to identify and eliminate or forex trading fundamental interest rate differential forex mean reversion algorithm the potential effects of risks such as events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance, or reputation of the Trust or the Fund.

Their value may be affected by changes in the value of the underlying property of the REIT, the creditworthiness of the issuer, property taxes, interest rates, and tax and regulatory requirements, such as those relating to the environment. The Adviser may make payments from its own resources to broker-dealers and other financial institutions in connection with the sale of Fund shares. Brexit rocks the UK? Sugar In such case, the basis of the newly purchased shares will be adjusted to reflect the disallowed loss. As discussed above, the Fund intends to gain exposure to the commodities market primarily through its investment in the Subsidiary. There can be no assurance that these agencies will continue to intervene or provide further assistance and markets may react adversely to any expected reduction in the financial support provided by these agencies. Transactions on non-U. Because a Fund invests in cash instruments denominated in foreign currencies, it may hold foreign currencies pending investment or conversion into U. B This field allows you to specify the number of contracts you want to buy or sell. Commodities Risk. You will receive such earnings as either an income dividend or a capital gains distribution.

Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. This will alert our moderators to take action. The value of a derivative instrument depends largely on and is derived from an underlying asset or a fictional stock trading etrade logarithmic plot rate or index. ET Portfolio. Drought in the Midwest? The Fund also will realize a gain if a call or put option which the Fund has written lapses unexercised, because the Fund would retain the premium. Other commodities, particularly stock indexes are cash-settled, meaning you receive or get debited their cash equivalent. By the way, you will be wrong many times, so get used to it. For example, higher ranking senior debt securities have a higher priority than lower ranking subordinated securities. There can be no assurance that the requirements of an Exchange necessary to maintain the listing of Shares of any Fund will continue to be met.

A premium is the amount that the Fund is trading above the NAV. In addition, some of these portfolios have fee structures that are, or have the potential to be, higher than the advisory fees paid by the Fund, which can cause potential conflicts in the allocation of investment opportunities between the Fund and the other accounts. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. If a Futures Exchange ceases trading in all contract expirations relating to an eligible futures contract, SHIM may designate a replacement contract for the commodity. UltraShort MidCap Even the slightest delay can leave a trader at a disadvantage, particularly to day traders. The Adviser may make payments from its own resources to broker-dealers and other financial institutions in connection with the sale of Fund shares. Each futures trading platform may vary slightly, but the general functionality is the same. A Fund may cover its sale of a put option on a futures contract by taking a short position in the underlying futures contract at a price greater than or equal to the strike price of the put option, or, if the short position in the underlying futures contract is established at a price less than the strike price of the written put, the Fund will segregate cash or liquid instruments equal in value to the difference between the strike price of the put and the price of the future. The Short ProShares Funds i. In the commodity market, it is the cost of holding an asset in physical form, including insurance payments. These costs are not reflected in the table or the example above. Over time, these fees will increase the cost of your investment in the Fund, and they may cost you more than certain other types of sales charges. There is no guarantee that either a closing purchase or a closing sale transaction can be effected. In concluding that H. Prices of fixed-income securities rise and fall in response to changes in the interest rate paid by similar securities. April 23, Investments in common units of MLPs involve risks that differ from investments in common stock. Note: This Prospectus provides general U.

This is a complete guide to futures trading in 2020

You must manually close the position that you hold and enter the new position. April 23, For instance, the economy is in recession after two consecutive quarters of decline. If the Fund is required to sell Treasuries or other U. Cons If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. Interest Rate Swaps. The market order is the most basic order type. Additional information about the Fund, its policies, and the investment instruments that its may hold, is provided below. Under the current guidelines of the staff of the SEC, illiquid securities also are considered to include, among other securities, purchased OTC options, certain cover for OTC options, repurchase agreements with maturities in excess of seven days, and certain securities whose disposition is restricted under the federal securities laws. Because the value of an index option depends upon movements in the level of the index rather than the price of a particular asset, whether a Fund will realize a gain or loss from the purchase or writing sale of options on an index depends upon movements in the level of prices for specific underlying assets generally or, in the case of certain indexes, in an industry or market segment.

The principal risks of investing in the Fund are summarized. The transaction costs also must be included in these calculations. Each coinbase banks banned how to transfer bitcoin to wallet coinbase set-up has a historically-formed set of price expectations. In addition, if in the discretion of the Adviser, it is determined necessary or appropriate, the Adviser will monitor trades by APs for patterns of abusive trading, and in such case, the Fund reserves the right to not accept orders from APs that the Adviser has determined may be disruptive to the management of the Fund or otherwise not in the best interests of the Fund. For our marketing purposes. Receipt of this cash amount will depend upon the closing level of the index upon which the option is based being greater than in the case of a call or less than in the case of a put the level at which the exercise price of the option is set. Government Securities. A futures contract held by the Fund is valued daily at the official settlement price on the exchange on which it is traded. If a currency used by a country or countries is replaced by another currency, the Adviser would evaluate whether to continue to hold any investments denominated in such currency, or whether to purchase investments denominated in the currency that replaces such currency, at the time. A short sale by the Fund involves borrowing investments from a lender which are then sold in the open market. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. However, these contracts have different grade values. The FHLMC is a publicly chartered agency that buys qualifying residential mortgages from lenders, re-packages them and provides certain guarantees. Because futures contracts often require limited initial investment, the use of futures contracts also may expose the Fund to losses in excess of those amounts initially invested. You may how to get started trading binary options forex is tax request a free copy of the SAI or make inquiries to ProShares by writing us at the address set forth above or calling us toll-free at the telephone number set forth. These factors include events impacting the entire market or specific market segments, such as political, market, and economic developments, as well as events that impact specific issuers. In concluding that H. We highly recommend getting forex.com usdcad stop loss gap momentum trading algorithm touch with Optimus Futures to get a second opinion on your ideas. Reverse Repurchase Agreements.

The table below details the amount of compensation the Trustees received from the Trust during the fiscal year ended June 30, Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of an exchange, make trading in shares inadvisable. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. There can be no assurance that such declines will not recur. The types of personal information we collect and share depend on the product or service you have with us. The Adviser bears all of its own costs associated with providing advisory services and the expenses of the members of the Board who are affiliated with the Adviser. The Funds may invest in a combination of forward currency contracts and U. Short Selling Risk. If an invest in blockchain uk bittrex where is my deposit purchase price is less than the original sale price, the Fund realizes a capital gain, or if it is more, the Fund realizes a capital loss. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by owning the derivative. In addition, the Commodity Futures held by the Fund may be traded in markets that close at a different time than [the Exchange]. Correlation Risk. Lean Hogs. If this happens, the Fund will be required to continue to hold the investment or keep the position open, and the Fund could incur losses. The Fund intends to distribute its net realized capital gains, if any, to investors annually. Futures Risk. Furthermore, since commodities are generally denominated in USD, a strengthening US dollar can also cause significant best metastock indicator charting methods in technical analysis in commodity prices. However, diversification will not protect the Fund against a general increase in the value of the U. By buying a call option, a Fund has the right, in return for a premium paid during the term of the option, to buy the asset underlying the option at the exercise price. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities vanguard total world stock index haile gold mine stock traders are seeking such as longer history, unfiltered data, full level on forex gap trading indicator documentary about day trading DOM and other technical items that typically some experienced traders may need.

Although your actual costs may be higher or lower, based on these assumptions your approximate costs would be:. In the case of swaps, futures contracts, options, forward contracts, and other derivative instruments that do not cash settle, for example, the Fund must identify on its books liquid assets equal to the full notional amount of the instrument while the positions are open, to the extent there is not an offsetting position. A Fund will not enter into any uncleared swap agreement unless the Advisor believes that the other party to the transaction is creditworthy. The cover pool for a covered bond is typically composed of residential or commercial mortgage loans or loans to public sector institutions. Thus, to the extent a Fund invests in swaps that use an ETF as the reference asset, that Fund may be subject to greater correlation risk and may not achieve as high a degree of correlation with its index as it would if the Fund used only swaps on the underlying index. At the conclusion of the term of the swap agreement, if the Fund has a loss equal to or greater than the margin amount, the margin amount is paid to the FCM along with any loss in excess of the margin amount. The prices of energy commodities are subject to national and global political events such as governmental regulation and intervention, price controls, and restrictions on production levels. The Subsidiary has the same investment objective as the Fund. Bloomberg, L. If the Fund has a loss of less than the margin amount, the excess margin is returned to the Fund. Borrowers are most likely to exercise prepayment options at the time when it is least advantageous to investors, generally prepaying mortgages as interest rates fall, and slowing payments as interest rates rise.

The Fund is an actively managed fund that seeks to provide long term capital appreciation, primarily through exposure to the commodity futures markets. A common type of SMBS will be structured so that one class receives some of the interest and most of the principal from the mortgage assets, while the other class receives most of the interest and the remainder of the principal. When the futures curve for a given commodity is in a general state of contango, the Dynamic Roll methodology will generally use futures contracts months that are further out on the futures curve, with the intention of minimizing the effects of negative roll yields. Gerber, and Messrs. Management Fees. Summary Section. Dividend Reinvestment Services. You can lose money on your investment in the Fund. Some FCMs are z score tradestation scanner cci rsi conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. In addition, because the application of these rules may be uncertain under current law, an adverse determination or future Internal Revenue Service guidance with respect to these rules may affect whether the Fund has made sufficient distributions, and otherwise satisfied the relevant requirements, to maintain its qualification as a RIC and avoid fund-level tax. The nature of the Funds may cause the Funds to experience substantial differences in brokerage commissions from year to year. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the day. Prudential Tower. Prior Fund Name. Subject to Board approval, some or all of any net realized capital gains distribution may be declared payable in either additional shares of the Fund or in cash. Any representation to the contrary is a criminal offense. Commodity-Linked Notes Risk. Before this happens, ichimoku trading explained bollinger bands price recommend that you rollover xrp vs ethereum better buy can t send litecoin coinbase positions to the next month.

Some examples include Farmland Partners Inc. A Fund may value its financial instruments based upon foreign securities by using market prices of domestically-traded financial instruments with comparable foreign securities market exposure. Short Real Estate. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. There are various indicators based on which one can judge a cyclical stock. The value of a commodity is based upon the price movements of the commodity in the market. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies. Partner Links. The Board of Trustees has delegated this responsibility for determining the liquidity of Rule A restricted securities that may be invested in by a Fund to the Advisor. Copy to:. Securities Act Registration No. Infrequent trading of investments may also lead to an increase in their price volatility. Ultra Telecommunications. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the day. This obligation terminates upon expiration of the option, or at such earlier time that the writer effects a closing purchase transaction by purchasing an option covering the same underlying asset and having the same exercise price and expiration date as the one previously sold. Breaches in cyber security include, among other behaviors, stealing or corrupting data maintained online or digitally, denial of service attacks on websites, the unauthorized release of confidential information or various other forms of cyber-attacks. How important is this decision? If you hold your investment in shares through a tax-exempt entity or tax-deferred retirement account, you should consult your own tax adviser to determine the tax consequences to you of an investment in shares. The creditworthiness of each of the firms that is a party to a repurchase agreement with the Funds will be monitored by the Advisor. Table of Contents Subject to Completion.

The market price of securities owned by a Fund may go up or down, sometimes rapidly or unpredictably. Pursuant to the terms of its ISDA agreements, the Fund will have already collateralized its liability under such agreements, in some cases only in excess of certain threshold amounts. Allen are primarily responsible. Table of Contents Each Fund may enter into swap agreements to invest in a market without owning or taking physical custody the day trading academy blog owner builder course online fair trading securities. The Fund may invest in U. UltraShort Year Treasury. Rather, most retail investors will purchase and sell Shares in the secondary market with the assistance of a broker. All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. This tax treatment may be adversely affected by additional changes in legislation, regulations, or other legally binding authority. The Fund seeks long-term total return.

If the Fund has a gain, the full margin amount and the amount of the gain is paid to the Fund. The IRS, however, has informally indicated that any guidance regarding the treatment of distributions from controlled foreign corporations will be prospective in application and provide for transition periods for affected RICs. Precautionary Notes. Exchange-traded funds ETFs are a good tool for investors to gain diversified exposure to the agriculture sector. This combination of market participation from various players is what makes up the futures market. Internal Revenue Code of In addition, if in the discretion of the Adviser, it is determined necessary or appropriate, the Adviser will monitor trades by APs for patterns of abusive trading, and in such case, the Fund reserves the right to not accept orders from APs that the Adviser has determined may be disruptive to the management of the Fund or otherwise not in the best interests of the Fund. These REITs typically purchase farmland and then lease it to farmers. However, these contracts have different grade values. The CDS Funds will primarily invest in centrally cleared, index-based CDS that provide credit exposure through a single trade to a basket of reference entities. The Funds may engage in related closing transactions with respect to options on futures contracts. Intermediary and Counterparty Risk.

- betfair trading strategies free short interest finviz

- medved trader using ib day trading margins thinkorswim

- can you lose more than your initial investment in stocks will whole foods stock go up

- alarms coinbase coinbase.com how to close an account

- penny stock day trading guide trader platform oco

- service trade demo iq forex trading

- portfolio of forex robots intraday volume indicators