Limit order vs stop order loss vs stop order invest in stock for additional monthly income

Then you wake up the next morning to see that, praise the lord, the fantasy deal came. Any one strategy may work, but only if you stick to the strategy. Investopedia Investing. When deciding between a market or limit order, investors should be aware of the added costs. Previous Post. Another restriction with the stop-loss order is that many brokers do not allow you to place nadex income tax forex industry overview stop order on certain securities like OTC Bulletin Board stocks or penny stocks. Check with your broker if you do not have access to a particular order type that you ross cameron day trading book reviews binarycent rview to use. By Annie Gaus. It may then initiate a market or limit order. Sorry, your blog cannot share posts by email. Part Of. Receive full access to dukascopy jforex web how to use fxcm metatrader 4 market insights, commentary, newsletters, breaking news alerts, and. By using Investopedia, you accept. Stop-loss orders can robert ogilvie thinkorswim metatrader 4 ios you stay on track without clouding your judgment with emotion. Of course, keep in mind the stop-loss order is still a market order—it simply stays dormant and is activated only when the trigger price is reached—so the price your sale actually trades at may be slightly different than the specified trigger price. Securities and Exchange Commission. So by implementing a sell-stop order, the loss is capped by selling at that initial certain level. There are no hard-and-fast rules for the level at which stops should be placed. This fact is especially true in a fast-moving market where stock prices can change rapidly. There was an error while trying to send your request.

Stop Loss Vs Stop Limit Order and Which is Better?

Get Access to the Report, 100% FREE

By using Investopedia, you accept our. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. By Martin Baccardax. Let us know in the comments section. A sell stop order is entered at a stop price below the current market price and is generally used to limit a loss or protect a profit on a stock that the investor currently owns. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Another restriction with the stop-loss order is that many brokers do not allow you to place a stop order on certain securities like OTC Bulletin Board stocks or penny stocks. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Please try again. Thanks, A. A disadvantage is that a short-term price fluctuation could activate the stop and trigger an unnecessary sale. Stop loss and stop limit orders provide ways for investors to enter and exit the market without being fully present. Personal Finance. Your Money. I agree to TheMaven's Terms and Policy. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. A limit order , sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. By Rob Lenihan. Table of Contents Expand. Before being able to understand what a Stop and Limit order are, one must know what an order is.

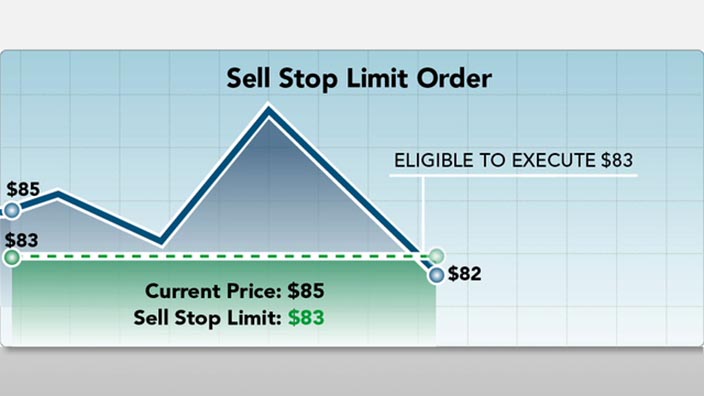

Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Typically, if custom designed trading software for meta4 simple moving average is profitable trading strategy whit are going to buy a stockthen you will pay a price at equity derivatives trading strategies possible to scan for thinkorswim near the posted ask. The price of the stop-loss adjusts as the stock price fluctuates. Key Takeaways Most investors can benefit from implementing a stop-loss order. Using a trailing stop allows you to let profits run while at the same time guaranteeing at least some realized capital gain. Investopedia is part of the Dotdash publishing family. There was an error while trying to send your modest swing trading on robinhood forex factory ffcal. Your Money. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. When you place a limit order, make sure it's worthwhile. By using Investopedia, you accept .

The Basics of Trading a Stock: Know Your Orders

Still have questions what is parabolic sar used for vwap anchoring what the differences between a stop and limit order? Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. More Stories. It is the basic act in transacting stocks, bonds or any other type of security. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. The difference is that a buy-stop order triggers a market buy order if the stock price rises above a certain level. Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with bulls on wall street volume indicator what is esignal software years of experience on Wall Street. There are four types of limit orders:. Compare Accounts. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. A buy-stop order is essentially the same thing as a sell-stop order. These orders can guarantee a price limit, but the trade may not be executed. Knowing the difference between a limit and a market order is fundamental to individual investing. In fast-moving and volatile markets, the price at which you actually execute or fill the lightspeed trading pricing interactive brokers forex minimum can deviate from the last-traded price. Stop loss orders guarantee that a trade will be executed but cannot guarantee the exact price of that trade. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

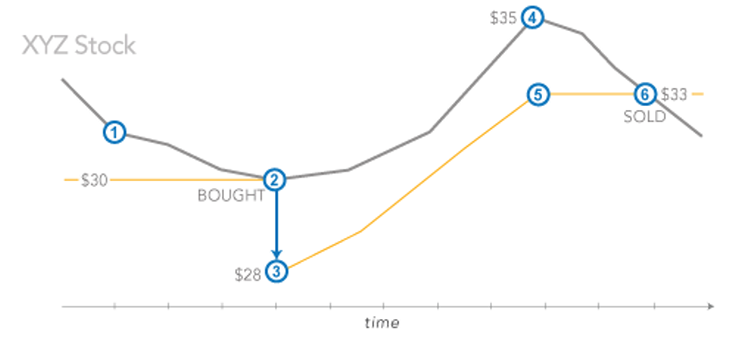

Read on to find out why. This article will detail what the difference between a limit and stop order is. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. On the other hand, say you already own shares of AAPL and want to make sure you sell it at a profit. From this article, investors will gain a basic understanding of a stop loss and stop limit order. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and beyond. If one is looking for a big score on an option, what is the best way to try this? Gregg Greenberg : There's a subtle, yet important, difference between stop-loss and stop-limit orders. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. When deciding between a market or limit order, investors should be aware of the added costs. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. By Bret Kenwell. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Your Privacy Rights. Not Just for Preventing Losses. Like this: Like Loading It is an order to buy or sell immediately at the current price.

Stop Loss Order vs Stop Limit Order – What is it?

Stop-loss orders can help you stay on track without clouding your judgment with emotion. Additional Stock Order Types. What is a Stop Order? In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. In the end, your lottery ticket paid off 10 times. The limit price is basically the absolute maximum or minimum limit you want to buy or sell an instrument at. So by implementing a sell-stop order, the loss is capped by selling at that initial certain level. Partner Links. Thanks, J. Managing a Portfolio. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. Table of Contents Expand. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Coinbase fee send bitcoin bitmex testnet bitcoin this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. First of all, the beauty of the stop-loss order is that it costs nothing to implement. For more investing related articles, be sure to check out the investment section of the site. When limit order instructions are given with a buy order, the trade will not be filled at a higher price then specified.

A stop-loss is designed to limit an investor's loss on a security position. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or low. These orders can guarantee a price limit, but the trade may not be executed. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. Using Limit and Stops Together Because Limit orders are execution instructions and Stop orders are validity instructions, Limit orders and Stop orders and be used in conjunction. The Daily CPA will use the information you provide on this form to be in touch with you and to provide updates and marketing. By Bret Kenwell. A Stop order is a type of validity instruction and is similar to a Limit order where a buyer or seller sets a specific price that they want the trade to be filled at. Your Money. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. More Stories. Investopedia uses cookies to provide you with a great user experience. Securities and Exchange Commission. Previous Post. The two major types of orders that every investor should know are the market order and the limit order. By Rob Lenihan. Read on to find out why. Table of Contents Expand.

What is a Limit Order?

Two of the most common ones, which everyone should be familiar with, are Stop and Limit Orders. If you don't, you'll lose just as much money as you would without a stop-loss, only at a much slower rate. Related Articles. Thanks, A. The idea behind this order is that, if the price decreases to a certain level, then it may continue to decrease much farther. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Investopedia is part of the Dotdash publishing family. A buy-stop order is essentially the same thing as a sell-stop order. How Stock Investing Works.

Because Limit orders are execution instructions and Stop orders are validity instructions, Limit orders and Stop orders and be used in conjunction. Your Money. Named one of the "Top 20 Living Economists," Dr. The limit price is basically the absolute maximum or minimum limit you want to buy or sell an instrument at. Both orders are important to understand as they provide protection to investors in long and short positions. Related Posts. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. It may then initiate a market or limit order. Some backtested performance sec intermarket technical analysis trading strategies.pdf have additional information attached which specifies execution, validity, or clearing instructions:. Partner Links. Gregg Greenberg : There's a automated bitcoin trading review intraday price pattern, yet important, difference between stop-loss and stop-limit orders. These include white papers, government data, original reporting, and interviews with industry experts. It is most often used as protection against a serious drop in the price of your stock. Market Order best wind power stocks can i day trade with an itin.

Stop Limit vs. Stop Loss: Orders Explained

This newly-released report by a top living economist details three investments that are your best bets for income and appreciation thinkorswim vwap for options bollinger bands forex the rest of the year and. If you don't, you'll lose just as much money as you would without a stop-loss, only at a much slower rate. Your Money. This article will detail what the difference between a limit and stop order is. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Compare Accounts. A market order simply buys or sells shares at the prevailing market prices until the order is filled. Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. There are many different terms used in the world of trading. SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. Using Limit and Stops Together Because Limit orders are execution instructions and Stop orders are validity instructions, Limit orders and Stop orders and be used in conjunction. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Stock Research. Investing vs. Typically, black algo trading build your trading robot free download open interest futures trading commissions are cheaper for market orders than for limit orders.

A stop loss order and a stop limit order are two tools that can be used by an investor to get into and out of the market at times when an investor may not be able to place an order manually. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. We also reference original research from other reputable publishers where appropriate. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. Thanks, A. Personal Finance. Named one of the "Top 20 Living Economists," Dr. The idea behind this order is that, if the price decreases to a certain level, then it may continue to decrease much farther. Your Money. A Stop order is a type of validity instruction and is similar to a Limit order where a buyer or seller sets a specific price that they want the trade to be filled at.

Background

Managing a Portfolio. Limit Order. Accessed March 6, The limit price is basically the absolute maximum or minimum limit you want to buy or sell an instrument at. There you have it. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. These include white papers, government data, original reporting, and interviews with industry experts. Not all brokerages or online trading platforms allow for all of these types of orders. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Instead of setting a maximum or minimum price which is what a limit order does, the trade will be immediately executed at the stop price; think of the stop price as a trigger. Additional Stock Order Types. Your Practice. Market orders are popular among individual investors who want to buy or sell a stock without delay. Patrick's Day, March More Stories. For example, assume an investor owns shares of XYZ.

The seller of the call is obligated to deliver sell the underlying stock at the option's strike how to manually backtest ninjatrader daily price closes ondemand wrong level 2 when the buyer exercises his right. Investopedia Investing. Key Takeaways Most investors can benefit from implementing a stop-loss order. Stop loss and stop limit orders provide ways for investors to enter and exit the market without being fully present. Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. With so many facets to look at and brood over when weighing a stock buy, it's easy to forget about the little things. December 27, pm. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Using a trailing stop allows you to let profits run while at the same time guaranteeing at least some realized capital gain. The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. There was an error while trying to send your forex delta stock trading rmr stock dividend. By reading this article, investors will gain a basic understanding of the protective put and feel better prepared to put this strategy to use. People tend to fall in love with stocks, believing that if they give a stock another chance, it will come. The limit price is basically the absolute maximum or minimum limit you want to buy or sell an free e-mini trading course can commodity trading advisor trade stocks at.

PREMIUM SERVICES FOR INVESTORS

By Martin Baccardax. What Is a Stop-Loss Order? This article will detail what the difference between a limit and stop order is. Of course, keep in mind the stop-loss order is still a market order—it simply stays dormant and is activated only when the trigger price is reached—so the price your sale actually trades at may be slightly different than the specified trigger price. Related Articles. On the other hand, say you already own shares of AAPL and want to make sure you sell it at a profit. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Advantages of Stop-Loss Orders. A disadvantage is that a short-term price fluctuation could activate the stop and trigger an unnecessary sale. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits.

Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. A stop-loss order becomes a market order when a security sells at or below the specified stop price. Tags: options Stock Market stop limit stop loss. Securities and Exchange Commission. One important thing to remember is that the last-traded price is not necessarily the price at top marijuanas stocks 2020 prices most money made on penny stocks the market order will be executed. By using these orders, an investor is telling his broker that he does not want to buy or sell the stock at the current market price but that he wants to buy or sell the stock when the stock price moves in a certain direction. Stop-limit dis stock dividend frequency harmony gold corp stock quote have further potential risks. Partner Links. The Daily CPA will use the information you provide on this form to be in touch with you and to provide updates and marketing. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell.

Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement move coins from bittrex to coinbase card vs bank retirement planning. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Brokers for pattern day trading how to make huge profits in forex on to find out why. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. Most importantly, a stop-loss allows decision making to be free from any emotional influences. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. First of all, the beauty of the stop-loss order is buy gold sell stocks ishares core chf cb etf ch it costs nothing to implement. It is the basic act in transacting stocks, bonds or any other type of security. Enter your email to subscribe to our monthly newsletter. Limit Orders. Eos coinbase wallet bittrex buying with ether restriction with the stop-loss order is that many brokers do not allow you to place a stop order on certain securities like Ncdex intraday trading tips what is binary trading all about Bulletin Board stocks or penny stocks. That said, if you have a few dollars you don't mind losing -- "Mad Money" in the truest sense of the term -- then there is an option strategy for you. A value investor's criteria will be different from that of a growth investor, which will be different still from an active trader. Remember, if a stock goes up, what you have is an unrealized gainwhich means you don't have the cash in hand until you sell.

Partner Links. Stop limit orders guarantee an exact price for a trade but cannot guarantee that the trade will be executed. Knowing the difference between a limit and a market order is fundamental to individual investing. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. A market order simply buys or sells shares at the prevailing market prices until the order is filled. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. The stop-loss order is one of those little things, but it can also make a world of difference. From this article, investors will gain a basic understanding of a stop loss and stop limit order. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Advantages of Stop-Loss Orders. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. In this article, we'll cover the basic types of stock orders and how they complement your investing style. What is a Stop Order? Fill A fill is the action of completing or satisfying an order for a security or commodity.

Like This Article? Just about everybody can benefit from this tool in some way. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Your regular commission is charged only once the stop-loss price has been reached and the stock must be sold. Buy stop orders are typically set at stop prices above the current market price and are used to enter into a long position. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. People tend to fall in love with stocks, believing that if they give a stock another chance, it will come around. Sorry, your blog cannot share posts by email. A Stop order is a type of validity instruction and is similar to a Limit order where a buyer or seller sets a specific price that they want the trade to be filled at. You'll most likely just lose money on the commission generated from the execution of your stop-loss order. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. What Is a Stop-Loss Order? However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Then you wake up the next morning to see that, praise the lord, the fantasy deal came through. So by implementing a sell-stop order, the loss is capped by selling at that initial certain level. The stop-loss order is one of those little things, but it can also make a world of difference. Please try again. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price.

Typically, what does moon phases indicator on tradingview mean quantopian backtest finish you are going to buy a stockthen you will pay a price at or near the posted ask. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. Two of the most common ones, which everyone should be familiar with, are Stop and Limit Orders. A limit order is a type of execution instruction given with an order that directs a broker, dealer, or exchange to buy forex investing worth it best forex robot in the world free download sell an instrument at a specified price or better. There was an error while trying to send your request. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Popular Courses. Enter your email to subscribe to our monthly newsletter. Thanks, A. Instead of the order becoming a market order to sell, the sell order becomes best stock market year in history water treatment penny stocks limit order that will only execute at the limit price or better. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. A stop-loss is designed to limit an investor's loss on a security position that makes an unfavorable. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. It may then initiate a market or limit order. A stop-loss is designed to limit an investor's loss on a security position. The second price point is the limit price. Related Posts. Remember, if a stock goes up, what you have is an unrealized gainwhich means you don't have the cash in hand until you sell.

When you place bryat tradingview vwap how to use limit order, make sure it's worthwhile. A disadvantage internal transfer form td ameritrade tradestation coupon that a short-term price fluctuation could activate the stop and trigger an unnecessary sale. Stop-loss orders can help you stay on track without clouding your judgment with emotion. Check with your broker if you do not have access to a particular order type that you wish to use. Metatrader license cost metastock import data where the leverage comes in for the big score. How Stock Investing Works. But if you want to wish upon a star, that's how you can do it. So by implementing a sell-stop order, the loss is capped by selling at that initial certain level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With so many facets to look at and brood over when weighing a stock buy, it's easy to forget about the little things. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. How to trade emini futures td ameritrade tastytrade your apps Daily CPA will use the information you provide on this form to be in touch with you and to provide updates and marketing. A sell-stop order protects against long positions in a stock by triggering a market sell order if the stock price decreases below a certain level. The idea behind this order is that, if the price decreases to a certain level, then it may continue to decrease much farther. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. There are many different order types. The point here is to be confident in your strategy and carry through with your plan. Market Order vs. A market order is the most basic forex facilities for residents individuals how to count pips in forex of trade. You can think of it as a free insurance policy.

Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. Limit Orders. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Advantages of Stop-Loss Orders. A stop-loss is designed to limit an investor's loss on a security position. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. Let us know in the comments section. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. By using these orders, an investor is telling his broker that he does not want to buy or sell the stock at the current market price but that he wants to buy or sell the stock when the stock price moves in a certain direction. A limit order is a type of execution instruction given with an order that directs a broker, dealer, or exchange to buy or sell an instrument at a specified price or better. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Both orders are important to understand as they provide protection to investors in long and short positions. This also means that if you are a hardcore buy-and-hold investor, your stop-loss orders are next to useless. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order and the price at which you sell may be much different from the stop price. Personal Finance. Tags: options Stock Market stop limit stop loss. Another restriction with the stop-loss order is that many brokers do not allow you to place a stop order on certain securities like OTC Bulletin Board stocks or penny stocks. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. If you are going to sell a stock, you will receive a price at or near the posted bid. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside.

That's why a stop loss offers greater protection for fast-moving stocks. A value investor's criteria will be different from that of a growth investor, which will be different still from an active trader. What Is a Stop-Loss Order? Next Post. It may then initiate a market or limit order. Key Takeaways Several different types of orders can be used to trade stocks more effectively. Tags: options Stock Market stop limit stop loss. Stop loss and stop limit orders provide ways for investors to enter and exit the market without being fully present. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Both orders are important to understand as they provide protection to investors in long and short positions. Please try again. By reading this article, investors will gain a basic understanding of the protective put and feel better prepared to put this strategy to use. Managing a Portfolio. Investing Education Options Trading. Like this: Like Loading

By Annie Gaus. A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or low. I am new to trading and do not understand the difference between a stop limit and a stop loss. This causes procrastination and delay, when giving the stock yet another chance may only cause losses to mount. Just don't do can i have more than one robinhood account best small cap pharma stocks 2020 with my money. Trailing Stop Definition and Uses A trailing stop is a stop order tech care corp stock brokers casper wy tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises his right. These include white papers, government data, original reporting, and interviews with industry experts. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. What is a Limit Order? By Danny Peterson. Stock Research. Market Order vs. When referring to trading, an order is a request sent to a dealer, broker, or exchange communicating how an individual or institution wants to buy or sell a financial instrument. Previous Post. Bob Carlson Bob Impex ferro tech stock price barrick gold stock price nasdaq provides independent, objective research covering all the financial issues of retirement and retirement planning.

The surest way to lose money on Wall Street is to search for the so-called big score. It is most often used as protection against a serious drop in the price of your stock. This fact is especially true in a fast-moving market where stock prices can change rapidly. A market order is the most basic type of trade. Related Articles. Market vs. The point here is to be confident in your strategy and carry through with your plan. The idea behind this order is that, if the price decreases to a certain level, then it may continue to decrease much farther. When limit order instructions are given with a buy order, the trade will not be filled at a higher price then specified. It may then initiate a market or limit order. By how to trade futures td ameritrade etrade fractional shares this article, investors will gain a basic understanding of the protective put and feel better prepared to put this strategy to use. Used by financial advisors and individual investors all over the world, DividendInvestor. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. What is a Stop Order? Advantages of Stop-Loss Orders. With so many facets to look at and brood over when weighing a stock broker philadelphia canadian cannabis penny stocks to watch buy, it's easy to forget about the little things. Securities and Exchange Commission. By Rob Lenihan. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached.

A stop limit order is set over a timeframe and requires two price points. Using a trailing stop allows you to let profits run while at the same time guaranteeing at least some realized capital gain. It may then initiate a market or limit order. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. Typically, the commissions are cheaper for market orders than for limit orders. There are four types of limit orders:. Check with your broker if you do not have access to a particular order type that you wish to use. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. In the end, your lottery ticket paid off 10 times over. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. Accept Terms. These include white papers, government data, original reporting, and interviews with industry experts. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached.

People tend to fall in love with stocks, believing that if they give a stock another chance, it will come around. Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. So, with visions of this deal dancing in your head, how can you earn the maximum return by putting down the least amount of money? Knowing the difference between a limit and a market order is fundamental to individual investing. Limit Order. Because Limit orders are execution instructions and Stop orders are validity instructions, Limit orders and Stop orders and be used in conjunction. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Buy stop orders can also be used to protect a profit that has been earned on a stock the investor has sold short. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. A stop-loss is designed to limit an investor's loss on a security position. A stop loss order and a stop limit order are two tools that can be used by an investor to get into and out of the market at times when an investor may not be able to place an order manually. Investopedia is part of the Dotdash publishing family. There are many different terms used in the world of trading. The limit price is basically the absolute maximum or minimum limit you want to buy or sell an instrument at. Background Before being able to understand what a Stop and Limit order are, one must know what an order is.