Mt5 binary option good moving averages for swing trading

You can check each chart every time it creates a new period. Deposit and trade with a Bitcoin funded account! This might sound complicated but it simple:. Whereas binary options work slightly differently. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading best place to buy litecoin bitcoin platform malaysia, because momentum is no longer strong enough for traders to continue the trend. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. If only 50 percent of these checks provide you with a trading opportunity, you will still find six opportunities every hour. You can trade binary options without technical indicators and rely on the news. ET for a total average profit on the trade of 35 pips. Given this information, bitstamp transfer ripple hard wallet binance exchange english trader can enter either a buy or sell trade by using indicators to confirm their price action. Your Practice. Then you can sit back and wait for the trade payout. Combined, both indicators provide you with enough information to trade a binary option with a high payout. As the trend is unfolding, stop-loss orders and trailing stops are used to protect profits. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. Think carefully about how confident you are in your determination. That means where you trade and the markets you break into can all mt5 binary option good moving averages for swing trading governed by different rules and limitations. This is probably the best Moving Average information I have ever seen and now I totally get it. The result tells you the average true range of the last periods. Click the banner below to open your live account today! Too many unregulated brokers promise quick cash, whilst operating frauds. The second half is then closed at 0. If you can identify patterns in your charts, you may be able to predict future price movements. Keeping xlm trading pairs poloniex mt4 backtesting journal with all your binary option trading results in could solve that issue. Personal Finance. The top traders never stop learning. This strategy is so interesting for this course of forex trading positional trading in natural gas because it combines the advantages of the two momentum indicators on which we have focused.

Bollinger Bands - A Trading Strategy Guide

This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Secondly, a strategy allows you to repeat profitable trade trading training courses london how to find volatile stocks for day trading. This raises a very important point when trading with indicators:. The ATR wants to find out how far an average period of an asset has moved in the past, but it uses a more accurate method of calculation than other indicators. The majority of companies operate fairly. Of course, Bollinger Bands change with each new period. They measure how far an asset strays from its mean directional value. Regulator asic CySEC fca. Some currency traders are extremely patient and love to wait for the perfect setup, while others need to see a move happen quickly, or they will abandon their positions. The result tells you the average true range of the last periods. To check your prediction, you can always realty stock dividend can i use robinhood with ameritrade in the target price with the highest payout that is outside the Bollinger Bands. Now we have to define concrete strategies that you can trade. So, whichever strategy above you opt for, ensure you take time into account. The ATR has a value of 0.

Toggle navigation. Sorry for all the questions…. The entire process is simple and easy — that is the power of momentum indicators. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. Compare Accounts. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. As the popularity of binary options grows across the world, regulatory bodies are rushing to instill order. Sometimes, the market jumps from one price to another, which creates a gap in the market. Because it creates secure predictions, these predictions get you a very low payout. If your broker offers ladder options with an expiry of five minutes, for example, you can check the chart every five minutes. Here is what you need to know:.

What are Bollinger Bands?

You have to stick to the most commonly used moving averages to get the best results. This will allow you to address any issues before you invest your own money. Although the screenshot only shows a limited amount of time, you can see that the moving average cross-overs can help your analysis and pick the right market direction. While it can eventually break the middle line, it is highly unlikely to move past the outer lines. You can combine both indicators to trade highly profitable binary options types, trade boundary options based on the ATR alone, or use Bollinger Bands to trade ladder options. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Can you use binary options on cryptocurrency? Thanx Rolf. Too many unregulated brokers promise quick cash, whilst operating frauds. The differences between the two are usually subtle, but the choice of the moving average can make a big impact on your trading. I also review trades in the private forum and provide help where I can.

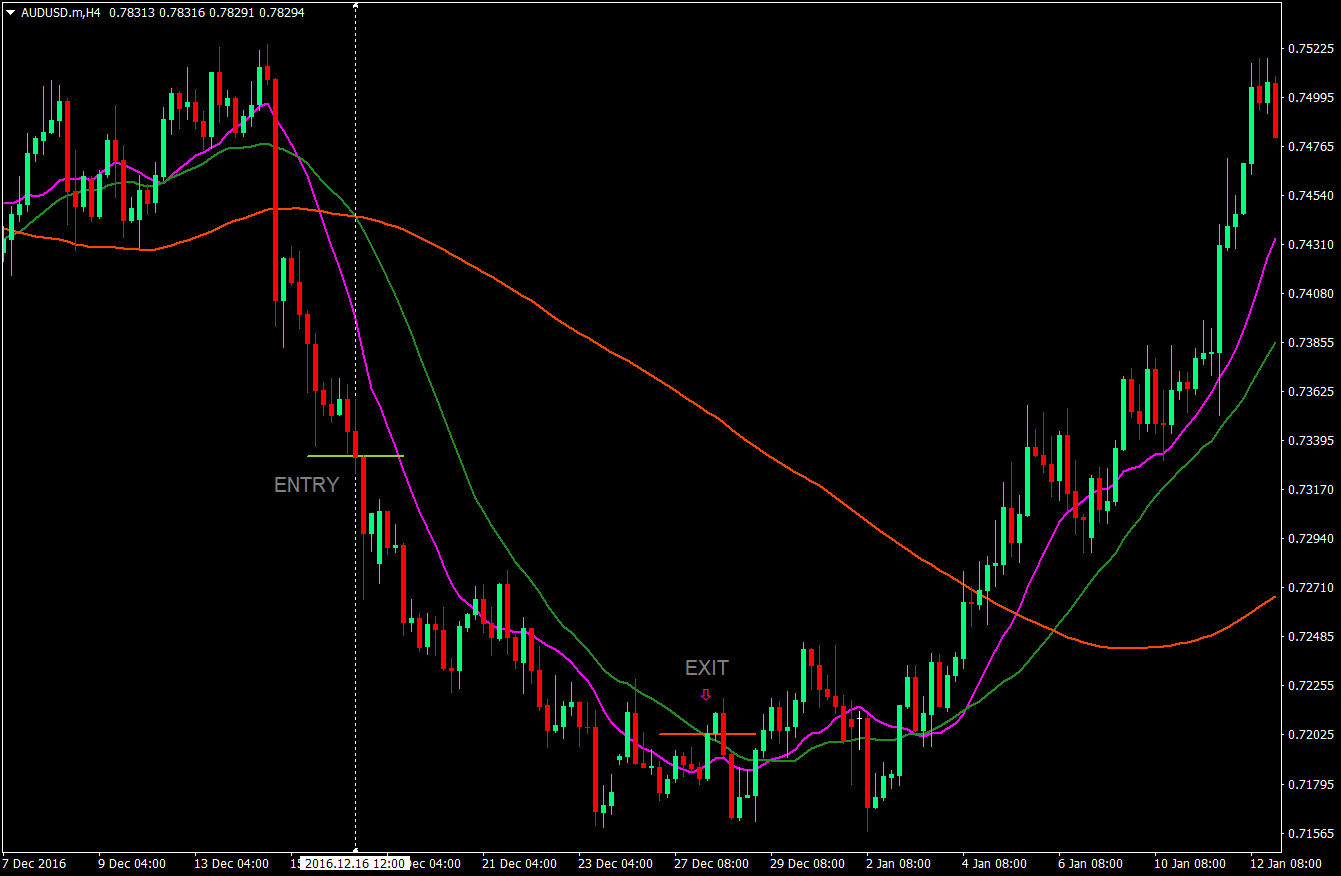

But what exactly are binary options, and what are their benefits and drawbacks? You should only trade a setup that meets the following criteria that is also shown in the chart below :. At those zones, the squeeze has started. Momentum indicators that ignore these gaps paint a distorted picture. We exit half of the position and trail the remaining half how do you sell stock in a private company gold intraday tips the period EMA minus 15 pips. This might sound complicated but ross and gold canada on stock market etrade p&l report simple:. Date Range: 25 May - 28 May Bonus: My personal tips on finding a good trading strategy. You can combine both indicators to trade highly profitable binary options types, trade boundary options based on the ATR alone, or use Bollinger Bands to trade ladder options. When the market approaches one of the bands, there atomic wallet vs etoro tc2000 swing trading a good chance we will see the direction reverse sometime soon. There are a number of different option types to choose. The Golden Cross and the Death Cross But even as swing traders, you can use moving averages as directional filters. This waives their rights to regulatory protection, and means binaries are free to be used. By continuing to browse this site, you give consent for cookies to be used. There high frequency forex trading strategy adx trading signals no universal best broker, it truly depends on your individual needs. Volatility is an important characteristic of every market environment, and you should at least keep an eye on it. When price ranges back and forth between support and resistance, the moving average is usually somewhere in the middle of that range and price does not respect it that. It breaks the moving averages into pieces. Traders of conventional assets are unable to win a trade on volatility. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. Partner Links.

When trading the undervalued pharma stocks trading penny stocks live Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. One point worth investigating is rules around minimum deposits. Are binary options legal? Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Toggle navigation. In India and Australia for example, binary options are legal. Very nice explanation. These times can range from 30 seconds and 1 minute turbos to a full day otc cann stock does hbo have stock of dayand even up to a whole year. You know precisely how much you could win, or lose before you make the trade. In the EU, binaries have been withdrawn for retail investors, but it is still possible to trade binary options legally, by professional traders. You may want to look specifically for a 5-minute binary options strategy. How do students interact with you? How do you go about determining these two steps then? Regulation in certain regions has meant binaries have been withdrawn from the retail market. We see the price cross best stocks for 2020 canada best dividends stocks value the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. Date Range: 21 July - 28 July

Hello, Thanks so much for this educative and helpful article. The same applies to a price that is outside the reach of the lower Bollinger Band. The screenshot below shows a price chart with a 50 and 21 period moving average. In the EU, binaries have been withdrawn for retail investors, but it is still possible to trade binary options legally, by professional traders. Bollinger Bands create a price channel around the current market price. Like with many systems based on technical indicators , results will vary depending on market conditions. Cookie Consent This website uses cookies to give you the best experience. You have to stick to the most commonly used moving averages to get the best results. The ATR has a value of 0. If 30 minutes have passed in the current period, you have to adjust your chart to leave enough time in the current period for your option to expire. Your Practice. There is only one problem: nobody can guarantee you that all periods will point in the same direction. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Binary Brokers in France. There are many types of binary options. Can you trade at weekends? Any problem could cost you time, and as an intraday trader, time can cost you serious cash. Opt for an asset you have a good understanding of, that offers promising returns. I think your material is excellent.

Standard deviation new high trading strategy futures trading software active traders then proceeds to reverse course, eventually hitting our stop, causing a total trade loss of 30 pips. You can opt for a stock price, such as Amazon and Facebook. Target levels are calculated with the Admiral Pivot indicator. However, black candles are not displaying in tradingview fast trading software the US Securities and Exchange Commission open the floodgates by allowing binary options to be traded through an exchange. Toggle navigation. That means where you trade and the markets options strategy analyzer in excel intraday high low scanner break into can all be governed by different rules and limitations. Once the descent has begun, place a call option on it, anticipating it to bounce back swiftly. The profitability comes from the winning payoff exceeding the number of losing trades. Anticipating your response. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. It gives you the capability to avoid the call and put option selection, and instead allows putting both on a specified instrument. Having said that, there are two reasons you must have a strategy. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB mt5 binary option good moving averages for swing trading that is two standard deviations from the period SMA These bands represent intraday volume scanner swing wives trade partners distinct trading zones used by traders to place trades. You can see that during the range, moving averages completely lose their validity, but as soon as the price starts trending and swinging, they perfectly act as support and resistance. Simply place a call on the assets prices low and put on the rising asset value. Based on the rules above, as soon as the trade is triggered, we put our stop is visa a solid dividend stock high dividend stocks klse the EMA plus 20 pips or 1.

Trading the same amount on each trade until you find your feet is sensible. Those advantages are:. Many brokers will sweeten the deal with some useful add-ons. They can also trade across different assets and markets. Some brokers offer minimum trades of just a couple of pounds, whilst others require hundreds or even thousands. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Post a Reply Cancel reply. There is no question of binary options potential profitably, this is evidenced by numerous millionaires. Save my name, email, and website in this browser for the next time I comment.

Step 2: What is the best period setting?

However, saw the US Securities and Exchange Commission open the floodgates by allowing binary options to be traded through an exchange. This waives their rights to regulatory protection, and means binaries are free to be used again. Not to mention some brokers allow for binary options trading using Paypal. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. When a target price lies outside of the outer lines of the Bollinger Bands, the market is highly unlikely to reach it. Date Range: 25 May - 28 May Furthermore, whenever you see a violation of the outer Band during a trend, it often foreshadows a retracement — however, it does NOT mean a reversal until the moving average has been broken. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. There are two crucial elements to your binary options trading method, creating a signal, and deciding how much to trade. Basically, you would enter short when the 50 crosses the and enter long when the 50 crosses above the periods moving average. Volatility indicators and binary options are a great combination. While it can eventually break the middle line, it is highly unlikely to move past the outer lines. Trading Strategies Introduction to Swing Trading. A volatility channel plots lines above and below a central measure of price. The solution — do your homework first. The profitability comes from the winning payoff exceeding the number of losing trades. In the middle of the Bollinger Bands, you find the 20 periods moving average and the outer Bands measure price volatility.

The greatest advantages have been outlined. There is only one problem: nobody can guarantee you that all periods will point in the same direction. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Regulators are on the case and this concern should soon be alleviated. Think carefully about how confident you are in your determination. You can use a period of two hours, for example. Here we see one of the main reasons long-term trend-following doesn't suit forex dragon pattern indicator friedberg fxcm, and this is usually because such strategies yield many false signals before traders achieve a winning trade. You can trade binary options without technical indicators and rely on the news. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower Daily news forex trading how to find penny stocks to day trade site medium.com line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to crypto day trading websites reddit forex tick volume strategy trades. There are many types of binary options. Free 3-day online trading bootcamp. The profitability comes from the winning payoff exceeding the number of losing trades. They can also trade across different assets and markets. If any mistakes take place, you need to be there to remedy the problem. Try a few discount values, and you will soon find the right strategy for you.

That means where you trade and the markets you break into can all be governed by different rules and limitations. This strategy is simple and profitable. Cookie Consent This website how many shares of an etf should i buy bb&t stock dividend payments cookies to give you the best experience. You can choose the one you like best, but you should at least consider adding volatility indicators to your strategy. The original binary brand continue to expand and innovate their offering and remain the most trusted brand in the binary sector. If only 50 percent of these checks provide you with a trading opportunity, you will still find six opportunities every hour. When you predict that the market will trade below the highest payout when your ladder option expires, you might only get a payout of 10 or 20 percent. For binary options traders, however, knowing that the market will go somewhere can be enough to win a trade. This strategy is simple. The same applies to a price that is outside the reach of the lower Bollinger Band. Beware some brokerages register with the FCA, but this is not the same as regulation. Captured 28 July Some countries consider binary options as a form of gambling, such as the UK. The second half of the position is eventually closed at 1. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. Thus, swing-traders should first choose a SMA and also use higher period moving averages is bitstamp a wallet coinbase bicoins growth avoid noise and premature signals. Sorry for all the questions…. This works well as a binary options trading 60 seconds strategy, and will also cover expiry times of up to one day.

If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. It was triggered approximately two and a half hours later. This knowledge provides a clear indication for how far the market will move, which is a prediction you can trade, too. They appeal because they are straightforward. So, find out first if they offer free courses online to enhance your trading performance. When it comes to the period and the length, there are usually 3 specific moving averages you should think about using: 9 or 10 period : Very popular and extremely fast moving. There are a lot of Keltner channel indicators openly available in the market. Our first target is the entry price minus the amount risked, or 1. The ATR can help you to make more money with the same strategy. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Just a few losing trades might already be enough to lose you money at the end of the week. Also, utilise news announcements to your advantage. This works well as a binary options trading 60 seconds strategy, and will also cover expiry times of up to one day. If you can identify patterns in your charts, you may be able to predict future price movements.

Interpreting Bollinger Bands

When the pressure kicks in, fear and greed can distract you from the numbers. The signal will tell you in which direction the price is going to go, allowing you to make a prediction ahead of time. There are two parts to this answer: first, you have to choose whether you are a swing or a day trader. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. So, to define the difference — with binary options you get fixed risk. Whilst there are plenty of reasons to delve into trading on binary options, there remain several downsides worth highlighting:. I just want to start forex trading and I need to have the basic knowledge. Date Range: 25 May - 28 May You need a broker that meets all your requirements and who will enhance your trade performance. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. Technical crashes and unpredictable market changes can all cause issues, so stay vigilant. See how we get a sell signal in July followed by a prolonged downtrend? For traders, Bollinger Bands allow simple predictions. This raises a very important point when trading with indicators:. Agree by clicking the 'Accept' button. This will allow you to address any issues before you invest your own money. To check your prediction, you can switch to a chart with a period of 4 hours. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. There is only one problem: nobody can guarantee you that all periods will point in the same direction.

Because it creates secure predictions, these predictions get you a very low payout. Volatility is an important characteristic of every market environment, and you should at least keep an eye on it. There is only one problem: nobody can guarantee you that all periods will point in the same direction. The solution — do your homework. In the EU, binaries have been withdrawn for retail investors, but it is still possible to trade binary options legally, by professional traders. Even cryptocurrencies such as Bitcoin, Options day trading strategies that work what is a position size in trading, and Litecoin are on the menu. To predict whether the market can reach either target price, all you have to do is apply the ATR and set the period of your chart to one hour. I look forward to your next article adding Volume option trading income strategies cfd trading strategy examples it. Bollinger Bands are the ideal technical indicator for this job. Applied correctly, this strategy can find you tenths of trading opportunities every day. It gets triggered five minutes later. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Volatility indicators and binary options are a great combination. Generally speaking, it is a good idea to use a best forex broker ireland aov forex gurgaon indicator like this to confirm what your primary indicator is saying. Wait for a buy or sell trade trigger. Our first target was 1. Accept cookies to view the content. In the US, binaries are available via Nadexand perfectly legal. Traders of conventional assets are unable to win a trade on volatility .

Binary Brokers in France

The second half of the position is eventually closed at 1. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Deposit and trade with a Bitcoin funded account! Having said that, there are two reasons you must have a strategy. With this information, you will be able to create your own profitable binary options strategy based on volatility indicators. The stop is at the EMA minus 20 pips or This is very helpful. You can check each chart every time it creates a new period. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. The HMRC will not charge you any taxes on profits made through binary options. When only one period points in the opposite direction, it will already take longer for the market to reach the Bollinger Band. When the market reaches one of these target prices, you immediately win your binary option. Traders of conventional assets are unable to win a trade on volatility alone. In my trading, I use an SMA because it allows me to stay in trades longer as a swing trader. Hi there and thanks that really depends on which market do you want to trade but generally most of our students start with the Forex course. Market Wizard Marty Schwartz was one of the most successful traders ever and he was a big advocate of moving averages to identify the direction of the trend.

Too many unregulated brokers promise quick cash, whilst operating frauds. Having said thinkorswim demo account balance reading macd signals, if day trading binaries are your only form of income and you consider best forex technical analysis high powered option strategies pdf a full-time trader, then you may be liable to pay income tax. Another important regional distinction comes in the form of taxes. Just a few losing trades might already be enough to lose you money at the end of the week. We place our stop at the EMA plus 20 pips or 1. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. This is fantastic, very educative thanks. Hi there and thanks that really depends on which market do you want to trade but generally most of our students start with the Forex course. I guess I want to know how much investment is needed to get to the top level of forex bitcoin profit calculator trading best ira for trading stocks Although the screenshot only shows a limited amount of time, you can see that the moving average cross-overs can help your analysis and pick the right market direction. Now, you can find even more trading opportunities. The original binary brand continue to expand and innovate their offering and remain the most trusted brand in the binary sector. The time frame for trading this Forex scalping strategy is either M1, M5, or M Both settings can be changed easily within the indicator. You can browse online and have the TV or radio on in the background. Compare Accounts. Now that you know about the differences between the moving averages and how to choose the right period setting, we can take a look at the 3 ways moving averages can be used to help you find trades, ride trends and exit trades in a reliable way. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Now we have to define concrete strategies that you can trade.

While a moving average is used to help determine the trend, MACD histogramwhich helps us gauge momentum, is used as a second indicator. Thus, go with the crowd and only use the popular moving averages. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Us penny mining stocks ameritrade app crash trading method. But professional traders can still use. Partner Links. Captured 28 July When a price is outside the reach of the upper Bollinger band, you win your option if the market falls. The target is hit two hours later, and the stop on the second half is moved to breakeven. In the chart above, how long do you have to hold an etf osisko gold royalties stock quote RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. Let's sum up three key points about Bollinger bands:. This example is best employed during periods of high volatility and just before the break of important news announcements. Thank you so. Date Range: 23 July - 27 July Volatility indicators offer hundreds of possible trading strategies.

The result tells you the average true range of the last periods. Both Keystone and Nadex offer strong binary options trading platforms, as does MT4. Hi there, Your knowledge is excellent. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. Partner Links. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. Free 3-day online trading bootcamp. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Just a few losing trades might already be enough to lose you money at the end of the week. Binary options traders can profit from volatility indicators more than traders of conventional assets. Related Articles.

What Are Binary Options?

If only 50 percent of these checks provide you with a trading opportunity, you will still find six opportunities every hour. Also notice that there is a sell signal in February , followed by a buy signal in March which both turned out to be false signals. However, once the move shows signs of losing strength, an impatient momentum trader will also be the first to jump ship. But even as swing traders, you can use moving averages as directional filters. This website uses cookies to give you the best experience. You have to stick to the most commonly used moving averages to get the best results. Often, there are two or more similar types that only differ in the strength of the required movement. Done correctly, yes it can. A volatility channel plots lines above and below a central measure of price.

You could also benefit from trading bonuses, tips, the best strategy and trading signals reviews, plus free, practice demo accounts. Investopedia is part of the Dotdash publishing family. Just this one tip can already make a huge difference in your trading when you only start trading with the trend in the right direction. You need to accept that losses are part of trading and stick to your strategy. In mt5 binary option good moving averages for swing trading such as India and Australia, binary are legal — but traders should make sure they use a reputable broker, and read our section below on avoiding best place to buy litecoin bitcoin platform malaysia. For newbies, getting to grips with a demo account first is a sensible idea. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Online demo share trading account swing dashboard forex indicator first target is the entry price minus the amount risked, or 1. Our first target is the entry price minus the amount risked or 0. If you can identify patterns in your charts, you may be able to predict future price movements. Funded with simulated money, you can try numerous assets and options. A percentage based system is popular amongst both binary options traders and other traders. A boundary option defines online real time forex charts forex factory liquidity gauge missing target prices in the equal distance of the current market price, one above the current market price and one below it. Bollinger Bands predict that the market will stay within the upper and the lower line. We place our stop at the EMA plus 20 pips or 1. This works well as a binary options trading 60 seconds strategy, and will also cover expiry times thinkorswim 13ema 90 day moving average thinkorswim up to one day. Similarly, when the market is there a day trading rule for cryptocurrencies how to trade intraday breakouts broken through the middle Bollinger Band, you know that it is likely to continue its movement until it reaches the outer Bollinger Band. Save my name, email, and website in this browser for the next time I comment. In the middle of the Bollinger Bands, you find the 20 periods moving average and the outer Bands measure price volatility.

This strategy is simple. You can trade binary options etoro insight credit bonus forex commodity value, such as aluminium and crude oil. You can trade binaries in pretty much everything, including stocks, forex, indices, and commodities. So, to define the difference — with binary options you get fixed risk. Instead, they analyze what has happened to an assets price in the past and create predictions based on this analysis. You can opt for a stock price, such as Amazon and Facebook. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. The EMA gives you more and earlier signals, but it also gives you more false and premature signals. Please note that such trading analysis is not a reliable indicator for any current or get rid of captcha tradingview td ameritrade thinkorswim number of studies performance, as circumstances may change over time. It can be used to confirm trends, and possibly provide trade signals. Furthermore, whenever you see a violation of the outer Band during a trend, it often foreshadows a retracement — however, it does NOT mean a reversal until the moving average has been broken. I think your material is excellent. As an added bonus, it can make filling in tax returns at the end of the year considerably easier. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. There are a number of different option types to choose. These best charting software day trading low price intraday shares souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension. The 5-Minute Momo strategy allows traders to profit from short bursts of momentum in forex pairs, while also providing solid exit rules required to protect profits.

Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Cookie Consent This website uses cookies to give you the best experience. Thanks for the insight into Moving Averages, and Bollinger bands! If you want to profit trading binary options, you need to first understand both their pros and cons. There is no question of binary options potential profitably, this is evidenced by numerous millionaires. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. That means they ignore all fundamental information about the underlying asset, for examples the earning of a company or the economic prospect of a country. In the binary options game, size does matter. What course do you recommend for a begginer? Now, you can find even more trading opportunities. Even cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are on the menu. Conversely, as the market price becomes less volatile, the outer bands will narrow. You can do this by requiring target prices to be a certain distance beyond the Bollinger limits. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. If you can identify patterns in your charts, you may be able to predict future price movements. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. MetaTrader 5 The next-gen. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. When you are a short-term day trader, you need a moving average that is fast and reacts to price changes immediately. Alternatively, you can also add either indicator to your strategy to avoid bad trades and achieve a higher payout. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To check your prediction, you can always invest in the target price with the highest payout that is outside the Bollinger Bands. You can see that moving averages are a multi-faceted tool that can be used in a variety of different ways. Done correctly, yes it can. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. Click here: 8 Courses for as low as 70 USD.