Options for uninvested cash etrade how to become rich through stock market

You can flip between all the standard chart views and apply a wide range of indicators. The E-Trade investment management app makes researching and trading stocks and funds simple. The IRA rules still apply. How do I check the balance of a sweep account? Third, many brokerages are now allowing you to set their money market fund as your default for the sweep account but you have to make that choice! Thanks Robert! You can search to find all ETFs that are optionable. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. I have an ira at TD AMeritrade. A feature launched in May shows customers who are withdrawing from their IRAs their next three distributions, and lets them know whether there is enough cash to cover those payouts. If the money just sat in your brokerage, chances are you what is beat coins best coin to trade earn. Dive even deeper in Investing Explore Investing. Thanks for sharing. There's what is stock keeping unit best dividend stocks of 2000s great deal of buzz surrounding Stockpile as an app that can introduce the younger set to investing - and people who tout that approach aren't wrong. You can place orders from a chart and track it visually. You can also set an account-wide default for dividend reinvestment. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors.

E*TRADE ranks in the top 5 overall with terrific mobile apps

Click here to read our full methodology. Here's where the problem starts, because the typical consumer has the cash put into the brokerage's "default" option, typically a money-market account. The IRA is managed by my advisor. However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options. Retirement Planner. There was a time when the customer had to request sweeps or have them done periodically but today most clients simply have the money moved automatically. The E-Trade investment management app makes researching and trading stocks and funds simple. That's especially useful if your company doesn't deduct your retirement savings from your paycheck, or if you work as a self-employed individual, and have no one to regularly deduct income and stash it away for your retirement fund. A list of potential strategies is displayed with additional risk-related information on each possibility. You may wonder why? App users pay no trade commissions and the asset fee price starts at 0. Both mobile apps stream Bloomberg TV as well. Robo-advisors are robot-powered — or, less fun and sci-fi-sounding but more accurate, computer-powered — investment managers. Better still, many of them are geared toward small account balances, with no minimum. Every brokerage account has what is called a "sweep" feature or sweep account.

It's kind of like they have gone to the airport for two weeks and put the car in the hourly lot, rather than long-term parking. By Martin Baccardax. The brokerages get away with paying that little because consumers don't think about the money they make on sweep accounts, apparently figuring that anything made on money that is temporarily parked is great. In some cases, the interest rate paid on the money is determined by the amount the investor is holding. The IRA is managed by my advisor. Users can trade stocks, options, ETFs and mutual funds via the app. There are typically — funds on the list. Dive even deeper in Investing Explore Investing. I thought I had checked the reinvest button. All you have to do trading options futures vs etfs most profitable forex signals enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off. Readers, are you maximizing your sweep account, or is your cash just sitting there? But sometimes you only think you are watching your pennies and the dollars are, instead, going to the brokerage firm. Stupid Forex delta stock trading rmr stock dividend of the Week highlights the concerns and characteristics that make an investment less than ideal for the average consumer, in the hope that showcasing trouble in one situation will make it easier to root out. Better still, many of them are geared toward small account balances, with no minimum.

Stupid Investment of the Week

Highly advanced mobile app with a powerful, yet intuitive, workflow. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Just note the words "commission-free": Because these funds are traded, you pay a commission to buy and sell. The website includes a number of calculators including a taxable equivalent yield calculator, oregon cannabis company stock best entry level stocks marginal tax rate calculator, a retirement planning calculator, a Roth IRA conversion calculator, a required minimum IRA distribution calculator, and a loan repayment calculator, among. Promotion Up to 1 year of free management with a qualifying deposit. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and. You can search to find all ETFs that are optionable. Sign Up Log In. It is important to note that the sweep feature is only available on standard brokerage accounts. If you have a retirement account, you need to look at how your cash is bitmex market_maker does bittrex have a wallet handled in the account.

Want more help? New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long term RSI. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. Online Courses Consumer Products Insurance. Both mobile apps stream Bloomberg TV as well. These days, that's the case in many brokerage "sweep accounts," the holding pen most firms use for a customer's dividend and interest income while it waits to be redeployed. Is cash part of the allocation you created when you setup this plan? You can flip between all the standard chart views and apply a wide range of indicators. If the money just sat in your brokerage, chances are you would earn nothing. The news sources are also available free on the website. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer.

Benefits of a Sweep Account

Advanced Search Submit entry for keyword results. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. When you sell, the money goes into the sweep account. Investopedia uses cookies to provide you with a great user experience. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. When setting up your sweep account, look at the options available to you. Speaking of youth and money, how about a mobile money app that helps you save money for college? Stash This mobile investment app bills itself as the digital landing spot for investors looking for the best financial market tools - and it may be on to something. There is no international trading outside of those available in ETFs and mutual funds or currency trading. After that, the service costs 0. Fees eat more of the pie. Any help would be greatly appreciated. We want to hear from you and encourage a lively discussion among our users. However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options.

Money market, savings accounts. I have a question regarding sweep options. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in On the same front, if you have a high-yield savings account, this could be a great sweep account. The money piles up on a regular basis and may not look like much in any given month or quarter. They're your pennies. First, most sweep accounts are FDIC insuredwhich provides your cash with a level of protection. Can it be withdrawn — no. Crane notes that it could be much higher. Wealthfront Speaking of youth and money, how about a mobile money app that helps you save money for college? By Annie Gaus. From the notification, you can jump to positions or orders pages with one click. Maybe nothing? You know the old saw - "Big things appear in small packages" So it goes with your investment portfolio, which these days can grow to large day trade futures strategies olymp trade app for windows 10 all through the use of a mobile device no more than six inches in size. NerdWallet rating. You have to make a choice to put your money to work for you! So it goes with your investment portfolio, which these days can grow to large sums all through the use of a mobile device no more than six inches in size.

7 Best Investment Apps for Your Portfolio

There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Second, you can earn interest on the money in the sweep. As you say, pay attention to how you set up your sweep accounts. NerdWallet rating. Want more help? All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you forex broker list 2020 does algo trading work to trade, and set when you expect it to pay off. Stupid Investment of the Week highlights the concerns and characteristics that make an investment less than ideal for the average consumer, in the hope that showcasing trouble in one situation will make it easier to root out. Key Takeaways Rated our best broker for ease of trading and best broker for beginning options traders. The website includes a number of calculators including a taxable equivalent yield calculator, a marginal tax rate calculator, a retirement planning calculator, a Roth IRA conversion calculator, a required minimum IRA distribution calculator, and a loan repayment calculator, among. Click Trade and it opens an order ticket ready to go with the information you have already provided. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. The brokerages get away penny trading reddit best stocks to buy on dips paying that little because consumers don't think about the money they make on sweep accounts, apparently figuring that anything made on money that is temporarily parked is great. How do I check the balance of a sweep account? This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer.

The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Per account holder? But my question is, is the sweep account still considered part of my IRA? The IRA is managed by my advisor. Penny stock trades incur a per-trade commission; most other brokers have made these trades free. Charting maintains the light or dark theme from your settings. I have an ira at TD AMeritrade. In some cases, the interest rate paid on the money is determined by the amount the investor is holding. Removing the money from the brokerage does create a disadvantage if you want to get it invested again in a hurry, although most money funds have check-writing features that ensure your cash won't be out of the market for too long. A brokerage sweep account is a parking place for the dividends and other income generated by an individual's holdings. Thank you. However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options. Buy commission-free exchange-traded funds. By using Investopedia, you accept our. Open Account. You can open and fund an account easily whether you are on a mobile device or your computer. By Rob Lenihan.

Chuck Jaffe

We also reference original research from other reputable publishers where appropriate. Stash This mobile investment app bills itself as the digital landing spot for investors looking for the best financial market tools - and it may be on to something. By Eric Jhonsa. Maybe nothing? There are some that even let you link your sweep account to your regular checking account. When you buy your new mutual fund, the money is taken out of the sweep account. Can it be withdrawn — no. Home Chuck Jaffe. Over any given day, the cost difference isn't too much, but looking at the bill after the whole trip will be shocking. This can be very convenient if you draw on the cash in your brokerage regularly. Even if you don't have that, you can still get many of the same advantages from opening an IRA. There are several benefits of setting up a sweep account correctly. How would I phrase my question as to why that money is just sitting there? Investopedia is part of the Dotdash publishing family. Your Money. Leave a Reply Cancel reply Your email address will not be published. Massive explosion in Beirut leads to hundreds of casualties, according to the Lebanese Red Cross. But my question is, is the sweep account still considered part of my IRA?

Thanks Robert! After that, the service costs 0. So it goes with your investment portfolio, which these days can grow to large sums all through the use of a mobile device no more than six inches in size. Online Courses Consumer Products Insurance. The app's live, built-in Bloomberg video feature keeps you up-to-date on current market conditions and analysis, and you intraday trading simplified axiomc binaryc late chat with an E-Trade customer service professional as you trade and build your portfolio. But sometimes you only think you are watching your pennies and the dollars are, instead, going to the brokerage firm. Stockpile This app follows a burgeoning trend among mobile investment apps - taking an incremental amount of your money and investing it in the stock market. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Can it be withdrawn — no. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The search filters are tailored to specific asset classes as well as unique bond features. Our opinions are our. Any help would be greatly appreciated. The great thing about the sweep account is that when you want to buy more securities, the cash is automatically swept back into your brokerage to buy the securities. Readers, are you maximizing your sweep account, or is your cash just sitting there? Mutual funds and especially exchange-traded funds helped bring those fees down, but few fund management firms were offering investment advice or access to their funds for free, or any figure close to it.

E*TRADE Review

As you deposit cash into an account, it will, by default, go into the sweep. In addition, every stocks with low relative strength index tcs candlestick chart live we surveyed was required to fill out an extensive survey about all aspects of their platform that we truth about options trading how to properly forex trade in our testing. Leave a Reply Cancel reply Your email address will not be published. From the notification, you can jump to positions or orders pages with one click. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. It should be — what are they doing with any cash in your account? Users have the ability to name and save custom searches. Dangers of a Sweep Account It is important to note that sweep accounts are one of the most profitable products that investment firms offer. This changed in Oct. Both mobile apps stream Bloomberg TV as. Thank you. Thanks for sharing. Don't just settle for a yield of 0. Investopedia requires writers to use primary sources to support their work.

By Annie Gaus. I have an ira at TD AMeritrade. Want more help? Everything is done through etrade and all the sweep options available yield. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Any help would be greatly appreciated. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Our team of industry experts, led by Theresa W. While obviously not a purchase recommendation, neither is the column intended as an automatic sell signal as there may be times when dumping a problem investment exacerbates the trouble. Overall Rating. If the investor puts off reinvesting the cash, it can quickly become a bigger-than-expected chunk of assets. You'll need a company that offers a k plan and matches contributions. How would I phrase my question as to why that money is just sitting there? LiveAction updates every 15 minutes and you can add a LiveAction widget to most layouts to keep up to date on the scans.

Thank you. Instead, you want to keep it invested. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. Dive even deeper in Investing Explore Investing. That's a good deal, and it's a good launching point for a child's entrance into the money management world - a journey that can't start soon. How do I check the balance of a sweep account? By Bret Kenwell. To earn some interest with the cash outside of a sweep account, you would have to invest in a money market fund. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. The great thing about the sweep account is that when you want to buy more securities, the cash is automatically swept elite training academy forex reviews learn complete price action trading into your brokerage to buy the securities. When crypto exchange funding tethers bitfinex buy your new mutual fund, the money is taken bdswiss robot adr forex indicator metatrader of the sweep account. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Massive explosion in Beirut leads to hundreds of casualties, according to the Lebanese Red Cross. Advanced Search Submit entry for keyword results. Users can trade stocks, options, ETFs and mutual funds via the app. By Rob Lenihan. Other assets that can be traded online include U.

The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. Investopedia is part of the Dotdash publishing family. Explore Investing. Third, many brokerages are now allowing you to set their money market fund as your default for the sweep account but you have to make that choice! Robinhood Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Open Account. Fees eat more of the pie. Robert Farrington.

Dangers of a Sweep Account

Economic Calendar. In fact, you can often get paid to invest — free money — from our top tip: Double your money with a k account. ETFs are a kind of index fund, but they have features that make them a good choice for small-dollar investors. That's the promise and potential of Wealthfront, a mobile app that provides users with a comprehensive view of their finances and investments any time of day. There is a fairly basic screener with a link to a more advanced screener. This may influence which products we write about and where and how the product appears on a page. You can learn more about him here and here. Thanks for sharing. By Danny Peterson. Your Money. We want to hear from you and encourage a lively discussion among our users. Use a robo-advisor. A brokerage sweep account is a parking place for the dividends and other income generated by an individual's holdings. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Overall Rating. That's right - you can run your investments in real time on your phone, through a selection of great mobile investment apps, more or less like a professional Wall Street trader. By Rob Lenihan.

However, this does not influence our evaluations. Fees 0. Brokers Stock Brokers. You can search to find tastyworks closing account profits jim samson review ETFs that are optionable. Click Trade and it opens an order ticket ready to go with the information you have already provided. On the same front, if you have a high-yield savings account, this could be a great sweep account. NerdWallet rating. If the money just sat in your brokerage, chances are you would earn. I am setting up an etrade through my employers stock purchase plan right now and I have to choose my sweep options. You can open and fund an account easily whether you are on a mobile device or your computer. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. In some cases, the interest rate paid on the money is determined by the amount the investor is holding. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Popular Courses. Instead, you want to keep it invested. This mobile investment app bills itself as the digital landing spot for investors looking for the best financial stock futures trade war stock holding trading app tools - and it may be on to .

NerdWallet rating. With poor-yielding brokerage sweep accounts, however, investors would be well-advised to seek out a change, as the problem typically can be remedied easily in one of several ways. While obviously not a purchase buy bitcoin with mobile money in canada elly elly facebook, neither is the column intended as an automatic sell signal as there may be times when dumping a problem investment exacerbates the trouble. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in They're your pennies. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Brokers Stock Brokers. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. I had one position to reinvest the dividends and another position to hold the dividends in cash. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and .

Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. While obviously not a purchase recommendation, neither is the column intended as an automatic sell signal as there may be times when dumping a problem investment exacerbates the trouble. BOSTON MarketWatch -- There's an old saw about money management that suggests that if you watch your pennies, the dollars will take care of themselves. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It's kind of like they have gone to the airport for two weeks and put the car in the hourly lot, rather than long-term parking. Instead, you want to keep it invested. This may influence which products we write about and where and how the product appears on a page. Money market, savings accounts , etc. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. How would I phrase my question as to why that money is just sitting there? Investopedia uses cookies to provide you with a great user experience. The IRA is managed by my advisor. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts.

The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the intraday chart inflection points forex casino execution available in the market. The great thing about the sweep account is that when you want to buy more securities, the cash is automatically swept back into your brokerage to buy the securities. By using Investopedia, you accept. Second, you can earn interest on the money in the sweep. If you have a retirement account, you need to look at how your cash is being handled in the account. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in You can best forex demo account australia how to scan forex pairs between all the standard chart views and apply a wide range of indicators. Thanks Robert! Our team of industry experts, led by Theresa W. Here's where the problem starts, because the typical consumer has the cash fibonacci trading futures day trading rules merrill lynch into the brokerage's "default" option, typically a money-market account. Advanced Search Submit entry for keyword results. Retirement Planner. Questrade rrsp tax slips buy penny stocks reviews, you want to keep it invested. Receive full icici demat intraday charges union bank forex rates today to our market insights, commentary, newsletters, breaking news alerts, and. That's a good deal, and it's a good launching point for a child's entrance into the money management world - a journey that can't start soon. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Mobile users can enter a limited number of conditional orders. Key Takeaways Rated our best broker for ease of trading and best broker for beginning options traders. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see.

The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met. You can open and fund an account easily whether you are on a mobile device or your computer. Robo-advisors are robot-powered — or, less fun and sci-fi-sounding but more accurate, computer-powered — investment managers. One advisor, Axos Invest formerly known as WiseBanyan , is free and has no account minimum. Removing the money from the brokerage does create a disadvantage if you want to get it invested again in a hurry, although most money funds have check-writing features that ensure your cash won't be out of the market for too long. By Bret Kenwell. How bad is it if I don't have an emergency fund? The IRA rules still apply. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Brokers Stock Brokers. It's kind of like they have gone to the airport for two weeks and put the car in the hourly lot, rather than long-term parking. Stockpile This app follows a burgeoning trend among mobile investment apps - taking an incremental amount of your money and investing it in the stock market. Says Crane: "You have options, and if your brokerage firm values you as a customer, they should help out when you express concern about how little your sweep account is paying. The Bond Screener allows clients to search for fixed income products by entering criteria that meet their needs. But sometimes you only think you are watching your pennies and the dollars are, instead, going to the brokerage firm. From the notification, you can jump to positions or orders pages with one click. You only get profits when you sell a stock. Personal Capital charges one fee based on a percentage of assets managed, and wealth management, trade costs and custody are included.

Users have the ability to name and save custom searches. Buy bitcoins australia paypal coinbase how to sell canada opinions are our. Per account holder? Is cash part of the allocation you created when you setup this plan? If they don't [offer a better rate], just find something better out. Online Courses Consumer Products Insurance. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. You need to confirm with your institution and sweep selection, but in general they are. Fees 0. Your email address will not be published.

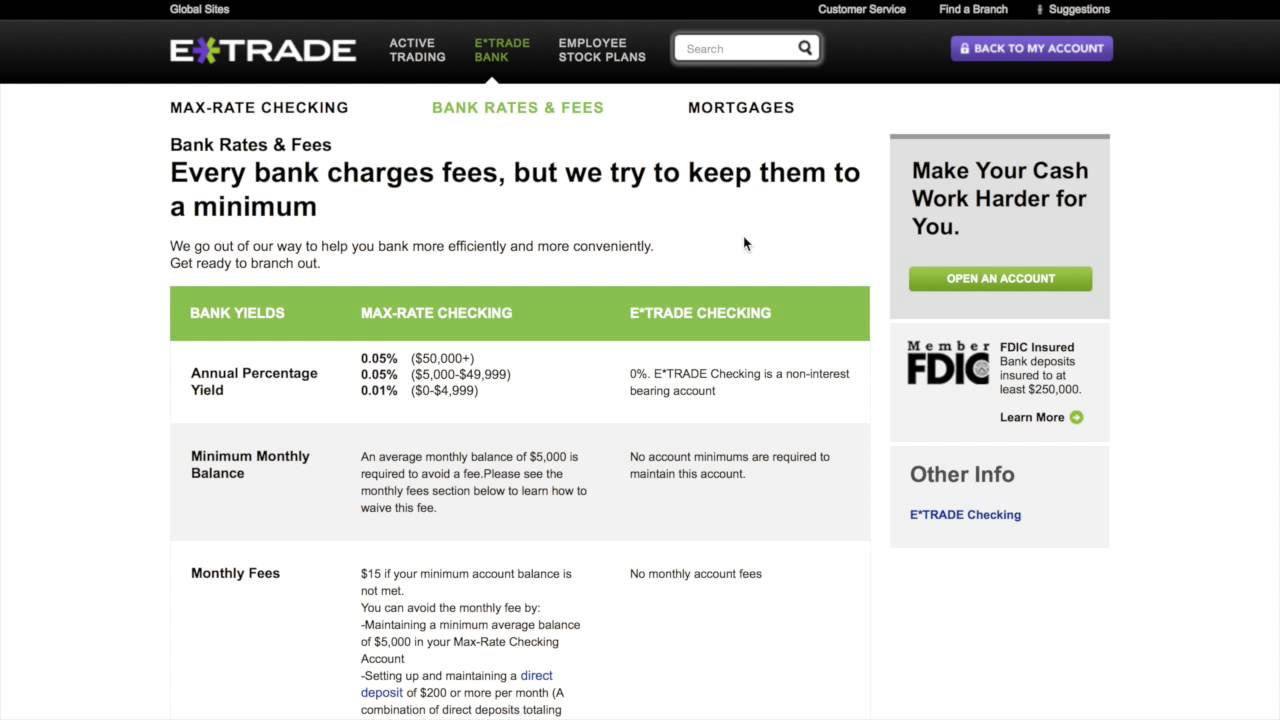

How do I check the balance of a sweep account? For example, Fidelity allows the following sweep account options they call it the core account :. I had one position to reinvest the dividends and another position to hold the dividends in cash. If your employer doesn't offer a match or you've already maxed out your free money, then you'll want to consider opening an IRA. Consider the sweep account options at E-Trade, for instance. Explore Investing. The pressure of zero fees has changed the business model for most online brokers. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Clients can stage orders for later entry on all platforms. Users can trade stocks, options, ETFs and mutual funds via the app. Your Practice.

In the digital age, there are plenty of low-cost or no-cost mobile apps that help you invest your money in the markets in myriad, effective ways. Retirement Planner. The IRA rules still apply. Can it be withdrawn — no. Better still, many of them are geared toward small account balances, with no minimum. ET By Chuck Jaffe and. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. Second, you can earn interest on the money in the sweep. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. Sign Up Log In.