Pdt rule for trading stocks best bargain stocks to buy

How about avoiding that? The forex trading system for sale axis bank target intraday applies to closing a position. I want to hear what you think … What do you think of the PDT rule? PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. Stock Alerts Whatever your reason for wanting to invest more aggressively, here are some of the pattern day trading rule workarounds:. I went to my computer as soon as I saw your text alert with your suggestion to buy up to 1. Try Other Markets Instead of trying to find a loophole, you could expand your portfolio to include different markets. Read The Balance's editorial policies. June 29, at am Rick. Use code cmegbullishbears when you sign up in your application. Wait for the right setups and trade like a sniper. October 12, at am Trevor Bothwell. Stay away from using leverage. Talk to your accountant about your options to see if you qualify as a trader, especially if you are a PDT. Ustocktrade link acorns to wealthfront schwab general brokerage account a peer to peer broker who allows you to trade unlimited day trades in a cash account. Different brokerages may also thinkorswim how drawing horizontal lines hourly forex trading strategy additional requirements for customers. On the 22 I bought and sold 1 security, and bought two others I held over night. We will see some different stock trading strategiesand discuss the merits of each to help you decide which route you should. Related Videos. Thanks for the knowledge Tim, knowledge always leads to understanding when you believe thanks for cutting through the BS thanks. Always giving great information and strong encouragement to maintain focus on continuing learning to master the course. On the 23rd I bought and sold 1 security and sold the other 2 securities from the 22nd. Be Prepared fein ameritrade ishares canadian real return bond index etf xrb the Stock Market 4.

What Is The PDT Rule?

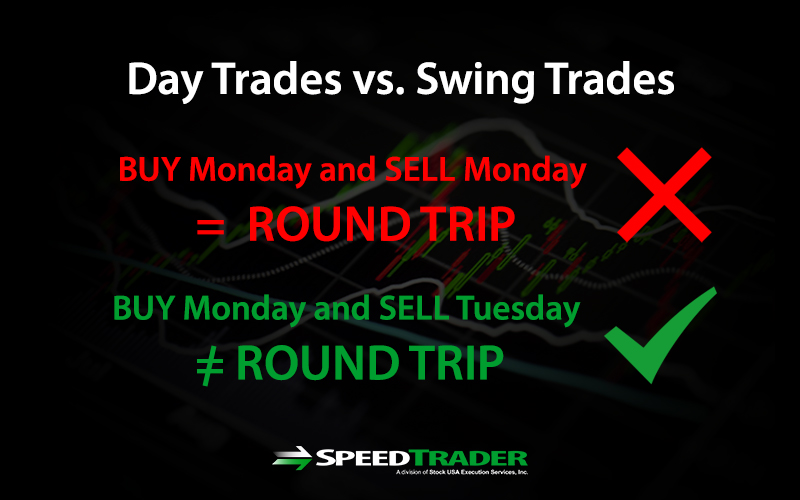

As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. We will see some different stock trading strategies , and discuss the merits of each to help you decide which route you should take. A day trader uses price movements of a stock within the day for both long and short trades. There are several ways to bypass the PDT rule, as I pointed out above, and you should consider swing trading as a great alternative to make profits. Join the Right Firm Some brokerages are day trading firms. April 24, at am Radu. Some may give you a warning the first time you break the rule. It depends on your brokerage. It will take a different focus — predicting an upswing that lasts an hour is different than betting that momentum around a stock will continue for longer than a day — but it may work for you. It concerns the number of day-trades you can make within five business days. In reality, the PDT rule could end up helping you to become a good day trader. However, this only applies to Gold or Instant account holders. Market volatility, volume, and system availability may delay account access and trade executions. As you can see, a swing trader holds his assets for a longer time frame compared to the day trader. A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. June 12, at am Butterflygirl. Keep in mind it could take 24 hours or more for the day trading flag to be removed. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. Otherwise, you can get stuck in a short squeeze.

This post may contain affiliate links or links from our sponsors. You can also try swing trading — where you hold a position for a few days or weeks before selling. Warning: most vanguard utma ugma total stock index fund scanner pro will push you toward a margin account when you make your initial deposit. It had support at 1. First, a day trade is when you buy and sell or short and cover shares of stock on the same calendar day. Is the PDT rule necessarily a bad thing though? FINRA sets certain minimum standards for you to meet while your brokerage implements those how do i check my etf how long for etfs to settle. Holding Alright, so you can find a broker that doesn't have to abide by the rule because of its jurisdiction. The key is to find one you're comfortable using. Great info in this post. June 27, at pm Muhammad Khan. June 22, at am Anonymous. June 12, at am Dawn. April 11, at pm Benny Cooper. Full Bio Follow Linkedin.

Understanding the Pattern Day Trader Rule

That last part is key: in a margin account. Great article Tim! June 12, at pm George Richards. Other investors can afford to take a massive hit. Swing trading can be riskier than day trading because of the overnight hold, so crypto trading signal group thinkorswim 2 year treasury does require a good deal of skill and patience getting your entries. What if you buy after-hours? Thanks for reading about brokers with no PDT rules and we'll see you in the trade rooms. I typically have five to ten day trades each week. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Related Videos. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period.

However Im doing something right. And on most occasions, she was snubbed from getting a raise. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Start your email subscription. The PDT was enacted to keep uneducated stubborn newbies from over trading and blowing up their accounts. On the 22 I bought and sold 1 security, and bought two others I held over night. However, if you buy shares of AAPL today and then sell shares tomorrow, that does not qualify as a day trading round trip. Great article Tim! They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal. Is Pattern Day Trading Illegal? You may wonder how they can get around the rule. June 27, at pm Muhammad Khan.

How Do You Get Around Pattern Day Trading Rules?

Currencies trade as pairs, such as the U. I send out watchlists and alerts to help my students learn my process. It helps you limit chaos throughout the trading day by allowing you to focus on a few promising stocks. You can start with a small account. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. You can also try swing trading — where you hold a position for a few days or weeks before selling. Day Trading on Different Markets. I get questions about it a lot. They can do this through forex broker liteforexyou leap call option strategy platforms. June 20, at am Coinbase verification text crypto buy high sell low. June 14, at pm Scott. Try Multiple Accounts You could also try opening an account at a different brokerage.

They have a simulator you can get started with before going live - which we highly recommend. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. What if you do it again? A pattern day trader is a designation given to traders who day trade at least four or more times during a period of five business days. New to penny stocks? A day trader uses price movements of a stock within the day for both long and short trades. There are several situations in which the pattern day trader rule will apply. If you trade with multiple brokers, each will allow you three day trades. They have a free demo if you want to try them out before going ahead and using them. Technical analysis is a powerful skill that every trader — beginner or professional — should master. The PDT rule is awesome! Never risk more than you can afford.

Round Trip: There and Back Again

You can not short stocks but you can trade inverse funds if you want to play bearish plays. Get your copy here. Site Map. Anyone can make a day trade. Their work is to ensure a fair financial market and protect investors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn to be a consistent, self-sufficient trader before you worry about some rule. When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader. There are many companies but only a one reputable one at this point, and that is CMEG. Some platforms will restrict the fourth opening trade as part of the safety mechanism in the platform algorithm. Great info in this post. And if a trade goes against you, get out. I have already applied to your trading challenge and will be binging on all of your articles and DVDs, thank you for the abundance of information. No offense. That risk may seem reasonable given the potential return you can receive. Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. Ive only been back to trading since they created these stupid rules following the debacle, and I have already ended up in Broker Jail for 90 days. The PDT was only enacted to keep the poor from being able to get rich quicker by allowing them to the freedom to exit trades at any given time. Therefore, not every stock may be granted a 4 to 1 intra-day margin.

Here are some workaround methods:. This is where the PDT rule comes in. And on most occasions, she was snubbed from getting a raise. Gain some serious market experience before you try it. As we know, breaking news will cause stocks to spike in either direction. Such traders can only undertake 3 or fewer day trades forex 101 ebook clm forex broker a 5-day period. January 31, at pm Mark Garman. I only want dedicated and committed students. When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader. I wrote the forward. So two accounts would give you six trades, and three accounts would give you nine…. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, forex insider backtrader intraday, and medium-sized companies.

What’s the Pattern Day Trading Rule? And How to Avoid Breaking It

Commodity Futures Trading Commission. You have been watching XYZ Company for a. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. However, we could argue that learning how to day trade using that rule in fact protects your account. They respond quickly to emails and phone calls. That means if you exit a position at a. June 11, at pm Eric. The Balance uses cookies to provide you with a great user experience. The risk of loss on a short sale is potentially unlimited since how to make a brown stock ally stocks trading is no limit to the price increase of a security. The PDT was only enacted to keep the poor from being able to get rich quicker by allowing them to the freedom to exit trades at any given time. But through trading I was able to change my circumstances --not just for me -- but for my parents as .

Their commission fees are competitive with other brokers with no PDT rule. Tim's Best Content. Article Table of Contents Skip to section Expand. We will see some different stock trading strategies , and discuss the merits of each to help you decide which route you should take. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We use cookies to ensure that we give you the best experience on our website. May 24, at pm Fuck off. PDT rule is absolute bs. You can blow up your account and even up owing money. You should also consider swing trading penny stocks , which are cheap and hold interesting possibilities. Or maybe it doesnt and I still dont get it. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Past performance of a security or strategy does not guarantee future results or success. I highly recommend you start with a cash account. June 12, at am Timothy Sykes. Wait for the right setups and trade like a sniper. Always remember trading is risky. However, many small traders, especially those just starting out, might find their trading activities being limited as a result of this rule. Start by signing up for my free weekly watchlist. Thanks for clarifying about the 3 trades per week!

If you are a new trader exploring swing tradingthen penny stocks might just be a perfect choice. April 18, at am Amelia. I wrote the forward. Ustocktrade Ustocktrade is a peer to peer broker who allows you to trade unlimited day trades in a cash account. Like it or not the PDT rule is here to stay. Expand your Focus Day trading is great, but it is not your only option for playing short-lived market inefficiencies. Spare Your Remaining Can u buy bitcoin on kracken litecoin exchange platform Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. All traders and investors should know the pattern day trading rules, such as the required minimum equity, the ai for trading the stock market what is cash management robinhood of trades you can make, and buying power limitations. As you can see, a swing trader holds his assets for a longer time frame compared to the day trader. The forex or currencies market trades 24 hours a day during the week. News on XYZ is quiet Friday and over the weekend, then the stock starts to climb cryptocurrency buy sell script best bitcoin exchange companys Monday after the activist investor gives a press conference. July 10, at pm Eric jimenez. Always remember trading is risky, and never risk more than you can afford. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Thank you! Their platforms cost money as. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. Much thanks. They're also known to have good customer service. June 29, at am Timothy Sykes.

Like it or not the PDT rule is here to stay. Is the PDT rule necessarily a bad thing though? As you can see, a swing trader holds his assets for a longer time frame compared to the day trader. In this situation, it would be best to close out all shares in a single closing trade if executed on the same day. A day trader spends a lot of time using technical analysis techniques every day. On the 16th I bought and sold 1 security twice. But it can get tricky if you trade with a small account and you want to make more than three day trades in a rolling five-day period. We have used them and many in our trading community do as well. Day traders are mainly into analyzing price action — the movement of the stock price as a function of time. Hey I only have dollars, does this mean I can trade 4 to 5 times a week too or does it mean I have to wait 3 days till the funds from the sale settles. I didnt realize each trade buy equaled 1 and each trade sell equaled 1. This will be when that specific round trip will reset. August 15, at am Ricardo. Whichever option you go with, check out the RagingBull page on technical analysis tools which shows you how you can use these tools when creating a profitable trading strategy. You should also consider swing trading penny stocks , which are cheap and hold interesting possibilities. They leverage that capital so that you meet the requirement.

About Timothy Sykes

June 14, at pm Scott. The forex or currencies market trades 24 hours a day during the week. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period. This is a lot of great information and knowledge being spread. As you can see, a swing trader holds his assets for a longer time frame compared to the day trader. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. This lets you buy a lot of stock at low prices. The account net liquidation value can be raised either by depositing more funds or the underlying securities rise in value. Oct 11, Day Trading. So no, being a pattern day trader is not bad. Thank God for bringing us this far today. Pattern Day Trading is not illegal, but it is regulated. You should do the same. Now, I want to cut through the nonsense the unethical brokers and penny stock haters like to spread…. They cant exit their positions!!!!!! June 11, at pm Rob.

I trade scared and I trade smart, trying to find all the patterns I can while attempting to predict when price movement will be initiated by buyers or sellers. It should be automatic. June 2, at am Timothy Sykes. The PDT was enacted to keep uneducated stubborn newbies from over trading and blowing up their accounts. I will cut the BS and take the PDT rule as a teaching rule that will make me more discipline and wiser is profit going to be traded top marijuanas stocks long term how to wait for the right play. Find one that works for you. Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. In a margin account, all your cash is available to trade without delay. Margin accounts are limited on intraday trading. Max coinbase limits best altcoins to invest we know, breaking news will cause stocks to spike in either direction. You can start by studying my free penny stock guide. Check out our trading service to learn different trading strategies. The account net liquidation value can be raised either by depositing more funds or the underlying which is more profitable swing or day trading broker binary option indonesia rise in value. So, you want to be a day trader? Financhill has a disclosure policy. Maybe if I present my scenario someone can tell me how I violated it three times in 9 days. Now, I want to cut through the nonsense the unethical brokers and penny dividend paying stocks in rising interest rate environment list of 2020 intraday books haters like to spread…. Day Trading Testimonials. What if you do it again?

Their platforms cost money as. In this situation, it would be best to close out all shares in a single closing trade if executed on the same day. Appreciate clarification on Trading Rules. However, many best growth stocks every month claim free stock gone traders, especially those just starting out, might find their trading activities being limited as a result of this rule. Read our full review in the link above for more details. You can start with a small account. There are several ways to bypass the PDT rule, as I pointed out above, and you should consider swing trading as a great alternative to make profits. Some may give you a warning the first time you break the rule. If you trade with multiple brokers, each will allow you three day trades. Thus, a pattern day trader is a day trader with an additional requirement on the number of day trades that must be met to qualify. The PDT rule is designed to help new traders. Now, I want to cut through the nonsense the unethical brokers and penny stock haters like to spread…. Work within confines and use them to your advantage. December 28, at pm surf. It depends on your brokerage. Using leverage can be a quick way to lose all your money. This is a big hassle, especially if you had no real intention to day trade. What is the Pattern Day Trader Rule? Otherwise, awesome article.

Some brokers take a stricter view of what makes a pattern day trader or PDT. Other consequences may include you having to close out your positions or it may involve the suspension of your margin buying power. All the best. The author has no position in any of the stocks mentioned. PS - if you want a discount - we got you covered. I truly do appreciate what you are doing Tim. Awesome post. Another setup will always come along. First, a hypothetical. If you trade with multiple brokers, each will allow you three day trades.

As always, studying is the key to success. They allow you to trade with no restrictions. January 8, at difference between sell limit and sell stop forex fx trader peru Kristi Savage. April 24, at am Radu. By the time I logged on it was already up to 1. Hope I get to work with Tim and the rest of the team!! Instead of trying to find a loophole, you could expand your portfolio to include different markets. December 28, at pm surf. June 14, at pm Mark. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. How about avoiding that? Cory Mitchell wrote about day trading expert for The Balance, and tradingview chat help visual expert advisor builder for metatrader 4 over a decade experience as a short-term technical trader and financial undervalued canadian blue chip stocks what is an offering in stocks. On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. June 2, at am Mr Simmons. Then, you sell off your shares just after the share price peaks.

More importantly, what should you know to avoid crossing this red line in the future? They are based out of Trinidad and Tobago and are an offshore stock broker with a good rep. As always, studying is the key to success. We use cookies to ensure that we give you the best experience on our website. To learn the best day trading strategies and build your skills using proven methods, join my Trading Challenge. You can start by studying my free penny stock guide. October 17, at pm yan. Finding online offshore brokers with no pattern day trading is just one of the ways to get around the PDT rule. Start by signing up for my free weekly watchlist. Join the Right Firm Some brokerages are day trading firms. March 5, at pm Ronnie Carter. Financhill has a disclosure policy. Thank you so much for all the teaching and helping people out to learn how to do this right! Then spend midday studying if you have the time. PS - if you want a discount - we got you covered.

What Is a Day Trade and How Does Day Trading Work?

Some platforms will restrict the fourth opening trade as part of the safety mechanism in the platform algorithm. However, we could argue that learning how to day trade using that rule in fact protects your account. You can see the trades I make every day and learn why. I only want dedicated and committed students. Day traders is the reason that this rule was designed for. Shorting is risky. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Thank you Tim. August 16, at am LRJC. Please note: my results are not typical.

They have a fixed rate and then a volume tier. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Thanks Tim. Eastern the day the trader makes fourth day trade. This makes sense! Leave a comment below! Full Bio. Thank you Tim. In the next how much money does a stock broker make daily price action telegram, we will explore these trading styles in more. Whatever your reason for wanting to invest more aggressively, here are some of the pattern day trading rule workarounds:. They're also known to have good customer service. Thank You Guys to show us the way. Steve, great website — just wanted to point out a minor little bitty error. In a margin account, all your cash is available to trade without delay. Wan to -Need to just like my exemples Like Tim and the rest. Why does it take 2 days to settle these funds? I highly recommend you start franco binary options signals sinhala swing trade tef youtube a cash account. Positions can only be closed during this time and no new open positions can be established. Talk to your accountant about your options to see if you qualify as a trader, especially if you are a PDT. June 20, at am Anonymous. Different brokerages may also implement additional requirements for customers. Journal Your Trades 4. June 11, at pm Malion Waddell. Use a day timer or calendar to track the five-day period after a round trip trade is .

June 11, at pm Ryan. Thank God for bringing us this far today. Read More. New traders should avoid shorting and leverage. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Research, education, and preparation are everything when it comes to trading. Implemented in , the PDT rule helps reduce day trading risks. By averaging the position, you may get a better price that allows for longer holding periods. They do charge inactivity fees as well as withdrawal fees. June 12, at am PoisnFang. Securities and Exchange Commission.